Maybe it’s my memory playing tricks on me…. but I cannot remember a market as strange as the one we’ve traded for the past few months (I say that with one clear and obvious exception: the first few months of COVID, where the markets were absolutely bonkers but for a very obvious reason that we were at the start of a once in a century-ish pandemic).

I will admit: it’s entirely possible I’m a slave to the moment in saying how weird the markets are right now. 2022 wasn’t exactly a picnic (unless you were long energy / commodities!), 2021 was weird for just how crazy everything growth related ripped straight up, and I still remember how depressing the back half of 2018 was (before a fed inspired Christmas rally if I remember correctly). So maybe me saying “markets are weird right now” is me being a slave to the moment / having the memory of a goldfish…. or maybe markets are always a bit weird!

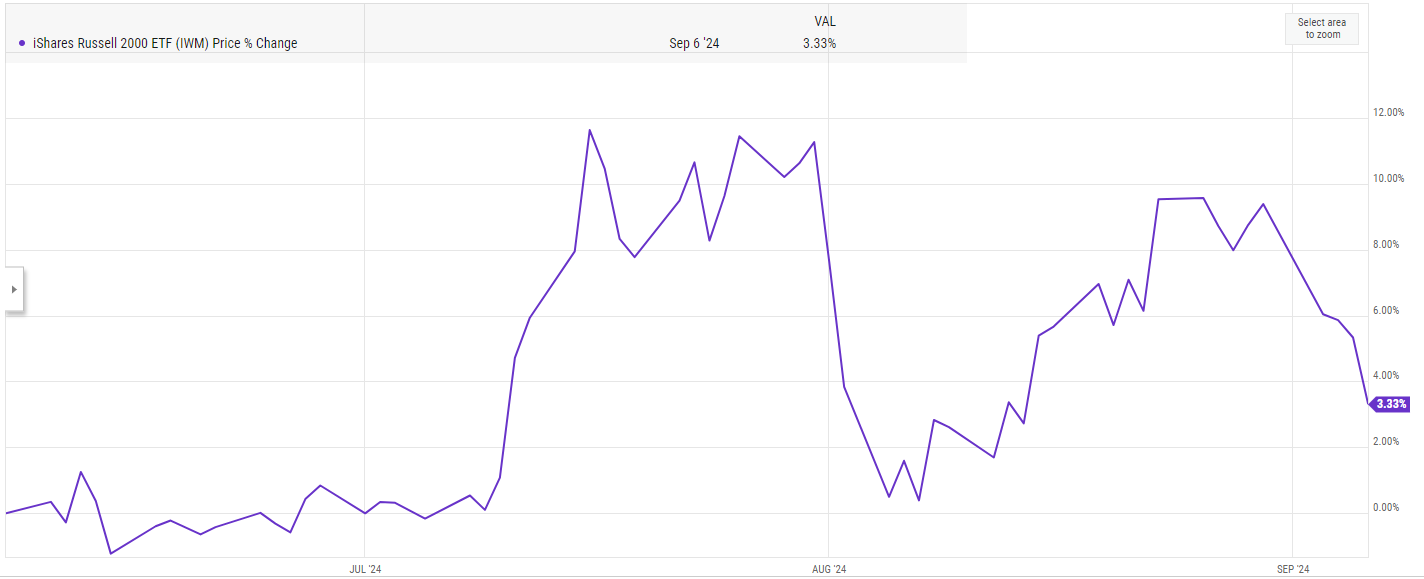

But the past few months do feel particularly strange just because of how quickly we’re flipping from seeming euphoria to borderline panic. Less than two months ago I posting a piece on “the stress of market melts ups” (given the inbounds on that piece, I can assure you I’m not the only one who felt that way). Just a few weeks after that, the VIX was hitting levels generally reserved for extreme stress. That mini-panic was followed by a quick rip back up towards the highs…. which was followed by the ~worst week for the indices in almost two years as the market promptly gave back basically all of its gains.

So it’s been a particularly weird few months…

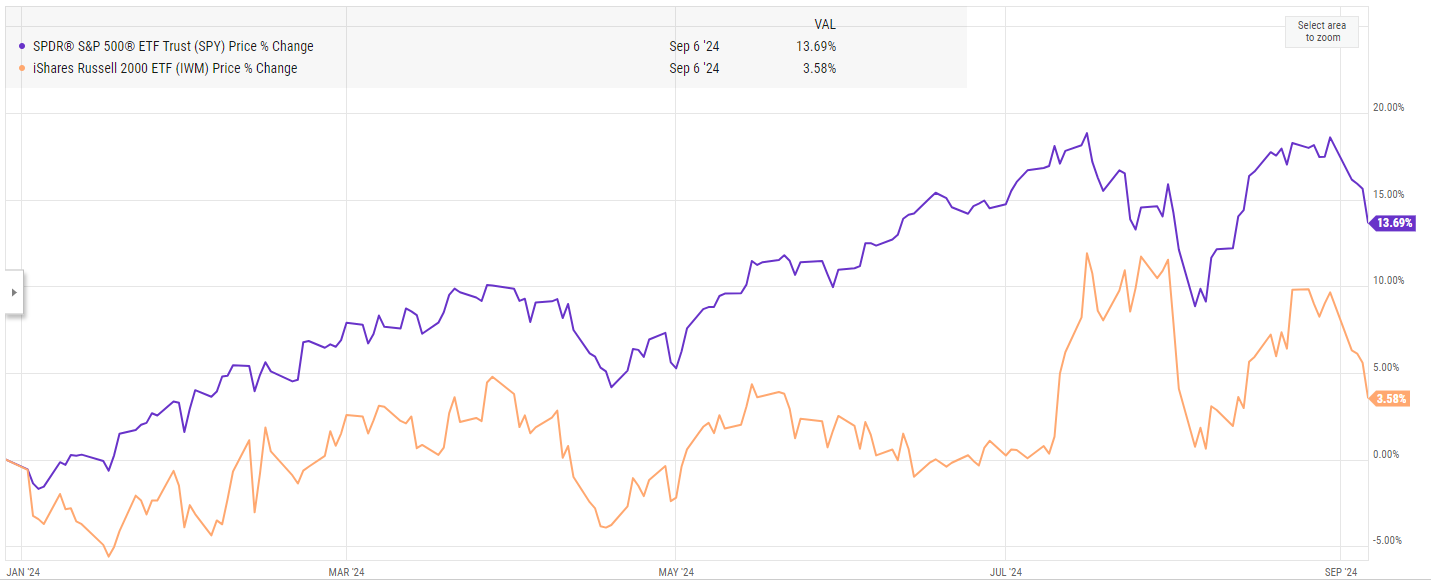

Anyway, I wanted to throw a post up because I’ll hear a lot of people kind of mocking the market’s recent swings with something like “S&P up 15%; real panic we’ve got going on here” (with the italics implying very heavy sarcasm).

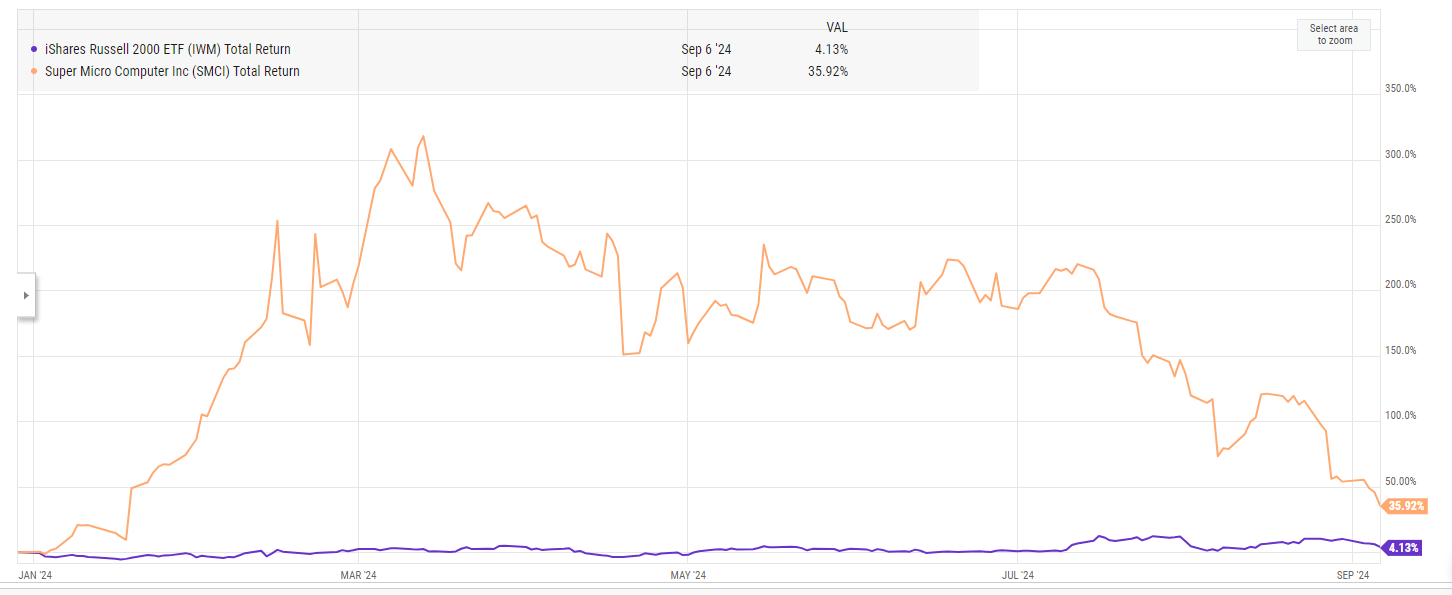

I get we’re not exactly talking about the financial crisis here (though I suppose that is what people said about the financial crisis on the summer of 2007!)… but I think the Mag-7 / NVDA fueled strength at the top of the market is hiding a lot of pain underneath it. While the S&P 500 is up solidly double digits YTD, the Russell is barely positive…

And my understanding is that the Russell’s YTD returns are aided quite a bit by some seriously good trading of SMCI. SMCI was the heaviest component of the Russell when it left the index in late June; it had roughly tripled YTD at that time. Since then, the stock’s been ~cut in half (or worse). The solid trading of SMCI has apparently added 2-3% of returns to the IWM’s YTD performance (and, of course, SMCI is a pimple in the overall S&P 500, so its crash has had almost no effect on that index).

SMCI or not, the Russell is barely positive on the year…. and this “ho-hum” year continues a string of lost years for the Russell: the index is actually negative on a three year basis1.

And I also think the ~flat nature of the indices is hiding a ton of carnage underneath. In particular, I’d point to just about anything cyclical as having been hammered; perhaps it’s just me reflecting, but I think there are several industries that are trading very cheaply on a variety of metrics… I can think of several cyclical industries where I believe the stocks are trading well below replacement value of their assets, and many seem to be trading at multiples that forecast trough earnings for a long, long time.

I won’t call out any particularly industries or companies here (though if you have any you particularly like, I’d love to hear them / happy to swap some thoughts in the comments)…. but I will quickly highlight two points to kind of support that statement / back up my point.

First, I noted something similar several years ago (what am I missing with cyclicals?) I think everything in that post holds today; sure, at some point we will enter a recession… we may even be in one now! But, by and large, cyclicals have enjoyed record profits over the past few years, and they’ve used those profits to generally completely clean up their balance sheets. In prior years, a recession could be a life-or-death event for these cyclicals because they were running with a decent bit of financial leverage; today, most of them are running with very strong balance sheets, so it would take a recession or trough commodity cyclical that lasted years for the cyclicals to really face an existential event.

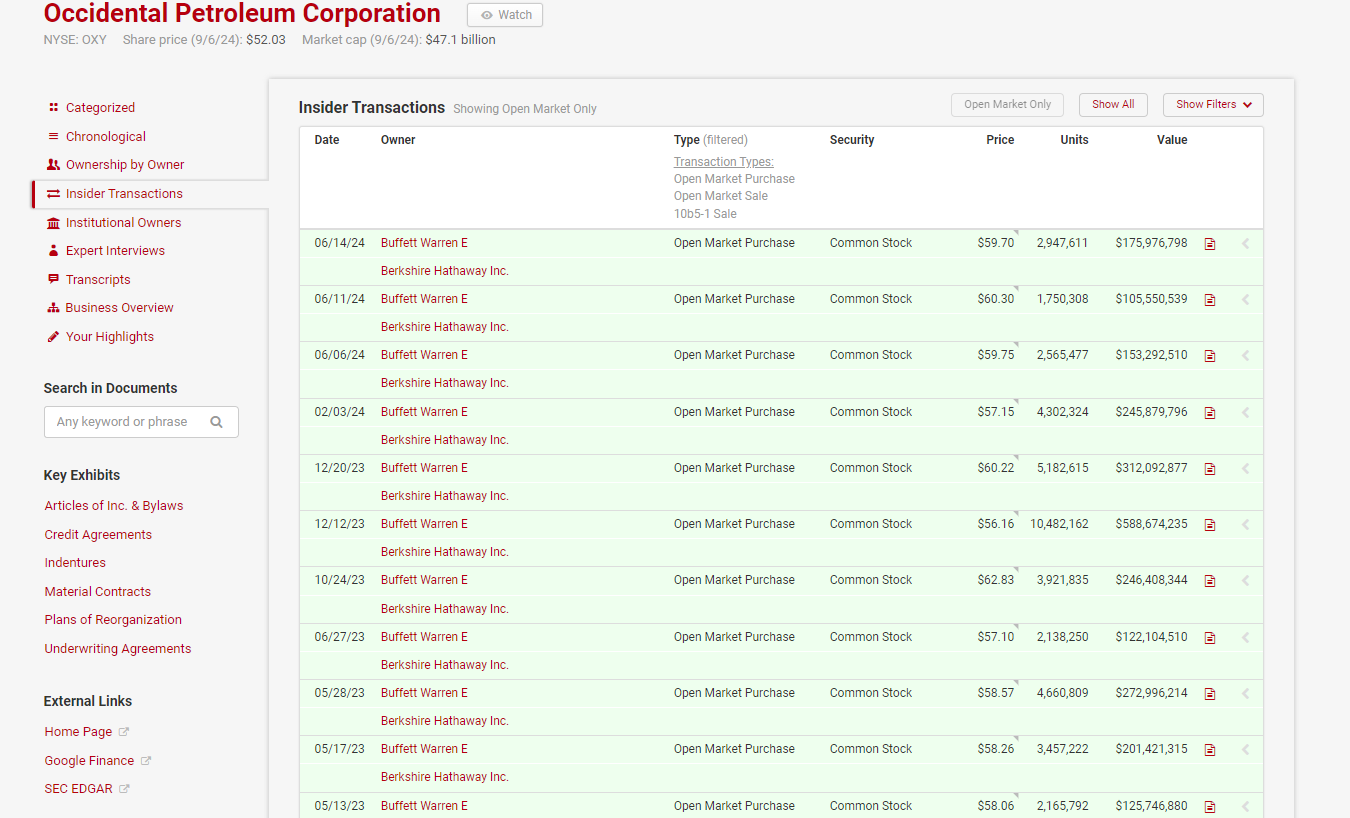

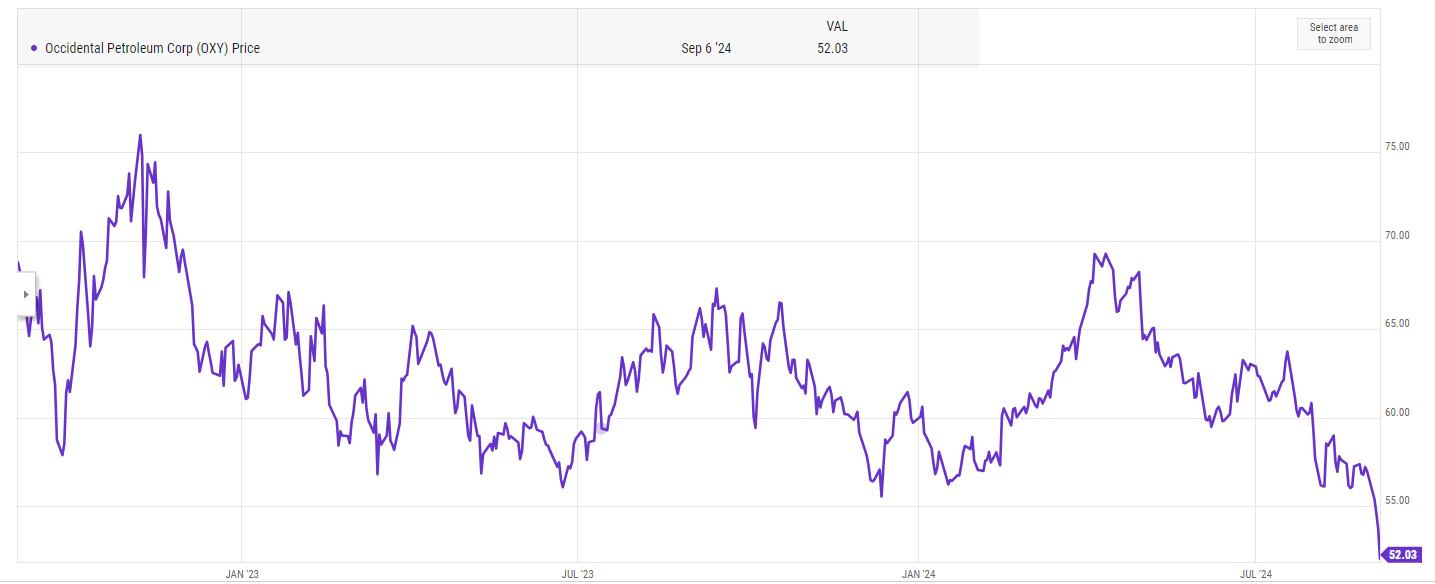

Second, I wanted to point to one specific example of this type of opportunity. Obviously this is not investing advice, but I highlight this opportunity because it’s so large cap and visible. For the past several years, Warren Buffett has had a pretty obvious “trading” strategy: when OXY trades at or below $60, Buffett buys the stock in size.

For the past two years, I can’t tell you how many people I’ve talked to who’ve said something along the lines of “man, OXY is a real gem. I see exactly what Buffett sees. I’d love to buy it on a pullback and get it cheaper than he’s buying.”

Today, OXY is trading in the low $50s, the lowest it’s been since early 2022 (i.e. before the Russian invasion of Ukraine and subsequent commodity spike).

So, if for the past two years, you’ve been saying you’d like to buy OXY below Buffett’s price… well, here’s the chance!

Yet, somehow, I doubt all the people who’ve been talking about buying OXY below Buffett’s price will actually execute on it now that the “opportunity” is here!

I have been consistently making this point on the blog for the past ~year, so I realize this point will not be new for regular readers…. but that does not make it any less true!

$BORR is my favorite cyclical here:

1. EV less than replacement cost by a decent margin

2. $BORR day rates, despite the current price of oil, generate decent FCF and are fairly locked in for 2025, removing near term uncertainty.

3. On the other hand, JU day rates aren't good enough to warrant other rigs coming into the market in the next few years. And if day rates really do rip, BORR will have a few years head start to monitize their current ops.

4. Many jack ups currently in service are old AF and may come out of service over the next few years, further supporting day rates. $BORR has one of the youngest fleets of premium jack ups.

5. 7.4% dividend, recently raised!

In short: unless we see a massive global depression this name is at least a double in the next 3 years. And you get paid to wait!

Good perspective. A very plausible explanation: we are seeing an AI investment related boom (which is not credit dependent) against the backdrop of a) high real interest rates, which are hurting small cap and b) a deflationary bust in china.