For the past 2-3 weeks, most of my time has been spent on two topics:

Researching / writing up / live tweeting / doing spaces on the Twitter / Elon Case.

As I write this, TWTR is trading for ~$39. If you assume the only two outcomes are a flat win for Twitter (they get $54.20 through specific performance) or a loss for Twitter (Elon wins and the stock crashes to ~$15/share), the market is currently pricing Twitter as ~70% to win the case. Based on everything I’ve seen so far, that is materially too low. Elon has absolutely no case here; I’ve been using 90% odds for Twitter to win but honestly the 10% chance relates to negative externalities having nothing to do with the case (the board caves for some reason, the SEC doesn’t approve their proxy, the whole market blows up and Elon can’t fund the purchase, etc.). On the merits of the case I’ve seen, Twitter is over 95% to win (but that’s not investing advice, and you should certainly keep in mind that I am not a lawyer. Plus, I just spent most of my Saturday morning writing a substack post on energy companies; am I really someone you would want to take advice on even if I was offering it?)

I wrote (most of) that paragraph on Thursday (July 21). TWTR reported earnings yesterday (July 22); they weren’t great (to understate it). I don’t think it really matters; Elon can flail all he wants, but TWTR’s case is rock solid. I do have a small worry about the bank funding walking, but it is a very small worry. Bank financing risk is the most likely way Elon wins / TWTR losses, and I think it’s a <5% chance of happening (and TWTR would likely prevail in a suit against the banks for walking and Elon for blowing up his own financing).

Researching energy companies.

I’ve mentioned #2 (researching energy companies) several times on the blog (most recently here), but I continue to remain perplexed by the prices many of these energy companies are selling at.

Anyway, I wasn’t sure I had a ton new to say about energy companies over what I mentioned in my monthly links, so I was just going to sit here and remain confused by myself, but friend of the podcast Alex (aka TSOH) wrote a nice piece on Buffett’s investment in OXY this week that brought a lot of those questions front of mind.

Alex notes that someone asked Buffett why he wasn’t buying OXY on Feb. 20th but started buying it on Feb. 28. Buffett responded that the world changed when Russia invaded Ukraine. Alex also noted that Buffett’s buying was spurred by a presentation Buffett read that “made nothing but sense” (Buffett’s words); Buffett was almost certainly referring to OXY’s Q4’21 earnings release (you can find their slides here and the transcript here).

Alex’s note highlighting what Buffett was saying about OXY and how Buffett came to invest spurred me to go back and look at the presentation Buffett was referring to, so I wanted to throw some thoughts on paper (I also did a long tweet thread on some highlights from the call / slides here).

First, I just wanted to highlight the timing of Buffett’s buying is funny, because WEB starts buying his position right as Carl Icahn is dumping the majority of his. Obviously Icahn and Buffett are different investors with different styles, but I’m not sure I’ve ever seen one “super” investor sell ~5% of a company on the open market at literally the exact time another investor is buying 5% on the open market (it can happen through brokered transactions and such, but for two people to independently buy/sell that much of a company? Crazy!).

Second, I went back and read the OXY Q4’21 call that helped push Buffett to accumulate a massive stake in OXY. Heck, I’m a completion-ist, so I went and read most of the other calls OXY has done this year (Their Q1’22 earnings call and appearance at MS; I was anxious to post this article so I’m saving their low carbon venture call for tmr) as well as all of the calls Chevron has done this year (why CVX? if you compare BRK’s Q1 13-F to their Q4 13-F, you can see BRK bought ~20m shares of CVX in Q1. Not as big as their OXY buying but still a several billion dollar position! You can see my CVX highlights here). My main purpose in doing so was to see what Buffett saw in the companies that made him go so wild buying their stocks.

I think it’s pretty obvious what got Buffett excited: both companies are communicating their capital allocations plans very clearly. Each have incredible balance sheet and can now return significant amounts of capital to shareholders even if we get back to a $40 oil environment. Of course, we’re currently well above that environment, and both companies are communicating that in a “better than $40 oil” environment they can both grow and return huge amounts of capital to shareholders.

I did a full thread of all the things that likely appealed to Buffett in that infamous OXY Q4’21 earnings call here, but I want to highlight two quotes below from CVX (from this conference) because I think it so clearly encapsulate what’s attractive about these companies and their capital allocation.

Okay. For those of you that haven't followed Chevron closely, our strategy is straightforward. It's to deliver higher returns and lower carbon, two things that this industry desperately needs to do. And the overarching goal is to sustain strong financial performance into a lower-carbon future.

We're investing in advantaged assets while maintaining a very strong balance sheet and rewarding our shareholders through our growing dividend and steady buybacks of shares. Underpinning this is a commitment to both capital and cost efficiency, which is fundamental in a commodity business, and we can grow our business with less capital today than any time during my career. With a focused portfolio and continued self-help, we expect to drive our unit costs even lower, leading to higher returns and cash flow.

We increased our annual buyback range to $5 billion to $10 billion. We are buying back at the top of that range right now at a $10 billion annual rate. And we advanced several of our lower-carbon initiatives, including launching a joint venture with Bunge on the feedstock side of renewable fuels, and we remain on track to close our acquisition of Renewable Energy Group very shortly, probably later this month.

Higher returns, lower carbon, that is our mission. We've led the industry in doing both, and we intend to continue to do so going forward.

We've also had a very clear and consistent financial framework across many decades. These priorities have not changed. They're up there in the quarter in which we have defined them and continue to guide our business consistent with those.

Maintaining and growing the dividend. We've grown our dividend for 35 consecutive years.

Funding the capital program. We're much more capital efficient than we were not too many years ago. If you go back a decade, we were spending $40 billion a year. This year, our capital budget is $15 billion. And we're growing today. We were not growing a decade ago.

Our balance sheet, I mentioned this was less than 20%. We were at 11% at the end of the first quarter. And in this price environment, that continues to strengthen.

And then returning surplus cash. We've repurchased shares 15 of the last 19 years. $50 billion overall in shares we've repurchased at a cost that has just about matched the average price had we been in the market every single day through that period of time. So we've not only repurchased shares when times are good, and the equity price reflects that.

We also have been very consistent in demonstrating that in a cyclical business, we are prepared for the downside. When we went through 2020 and oil prices went negative, we didn't panic. There was never a question as to whether our dividend would be cut. In fact, we grew our dividend during the pandemic. We've grown our dividend 20% between 2020 and today. That stands out unique amongst our peers.

In a downside price scenario, the $50 oil price, which seems hard to imagine today when it's more than twice that, we continue to have the capacity to increase the dividend and buy back shares for 5-year $50 price. And this is a chart that we shared at our investor in March. At an upside case of $75, which doesn't feel like upside versus today, we've got the capacity to buy back more than 20% of our outstanding shares over just 5 years. So we've got a very strong balance sheet, very strong cash flow and the ability to continue to return cash to shareholders in any environment.

A final slide here. I think we offer a very differentiated value proposition versus others in our sector. We're more efficient, we generate more cash, and we are driving towards a lower-carbon system. The actions we've taken over the past few years make us a stronger company than we've ever been, and they position us to continue to generate strong returns and cash in a lower-carbon future.

To sum, strong balance sheet, consistent and growing dividend, efficient growth at reasonably capex spends, and protection if energy prices are low but huge upside if energy prices remain anywhere close to current levels.

Those quotes from CVX basically mirror what OXY’s saying. Again, you can see all my OXY quotes here, but the key quote is probably right at the start of the Q4’21 earnings call:

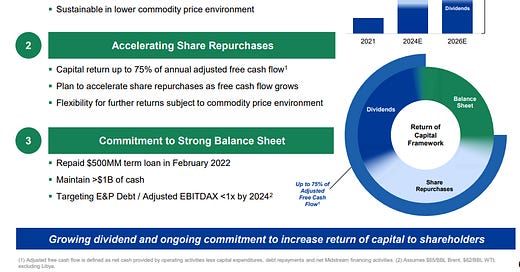

Our focus on consistently delivering outstanding operational results, combined with our steadfast dedication and patience in improving our balance sheet, has positioned us to begin increasing the amount of capital returned to shareholders. Our new shareholder return framework, which we will detail today, includes a dividend that is sustainable in a low-price environment. We are pleased to implement this new framework, beginning with an increase in the quarterly common dividend to $0.13 per share.

So it’s really not hard to see why Buffett is seeing in these two companies: they’re producing a critical asset that seems in short supply, they’ve got great balance sheets, they’re committed to returning capital to shareholders, and they’re trading very cheaply (CVX, for example, will easily do in excess of $30B in free cash flow this year. Its market cap is currently under $300B, so you’re buying them at less than 10x. You can argue this year’s cash flow is buoyed by high energy prices, but future prices are pretty juicy. Analyst estimates are for ~$30B in FCF in 2023 and the company thinks they can continue to grow production, so…)

But here’s the thing: what OXY (and CVX) are saying about capital allocation isn’t materially different than what dozens of other energy companies are saying about capital allocation, and many of those companies are trading materially cheaper than the majors.

Consider, for example, EQT. EQT is the largest natural gas producer in the U.S. They have a massive inventory, an investment grade balance sheet, and a commitment to returning capital to shareholders. Here’s two quotes from their Q1’22 earnings call

Our trailing 12-month first quarter '21 net leverage stood at 1.9x. At recent strip pricing, we forecast our year-end 2022 and 2023 net leverage to be approximately 0.8x and 0.1x, respectively. Our forecast assumes we use the full $1.4 billion of dividends and share buybacks. We continue to target a long-term net leverage goal of 1 to 1.5x, assuming a conservative $2.75 per Mcf natural gas price, which should bulletproof our balance sheet through all parts of the commodity cycle.

Looking to 2023, despite the recent appreciation in our share price, our 2023 free cash flow yield is approximately 25% at strip pricing as natural gas prices have rallied alongside our stock. We now expect to generate roughly $17 billion of cumulative free cash flow from 2022 through 2027, representing approximately 115% of our current equity market capitalization.

Beyond 2027, our 15-plus years of core long-lateral inventory has also substantially increased in value due to the rally in prices and the realization by investors and policymakers of the key role that natural gas will play in providing cheap, reliable and low-carbon energy to the world for decades to come. We believe that while many operators' core inventory is being depleted, EQT will remain uniquely positioned amongst peers to continue delivering predictable, robust returns from our deep core inventory. This outlook underscores the compelling value opportunity at EQT and affords us tremendous flexibility to build upon our capital return framework moving forward.

Those quotes from EQT certainly wouldn’t be out of line in the CVX or OXY quotes I posted earlier!

And EQT is far from alone in pursuing a “Buffett approved” strategy similar to OXY / CVX. I highlighted CHK in my monthly links, but that’s another nat gas heavy play so I won’t focus on it here because there are plenty of other energy producers pursuing similar strategies and I’d like to show some diversity in the type of energy company I’m highlighting. To chose just one other example among many, here’s Hess:

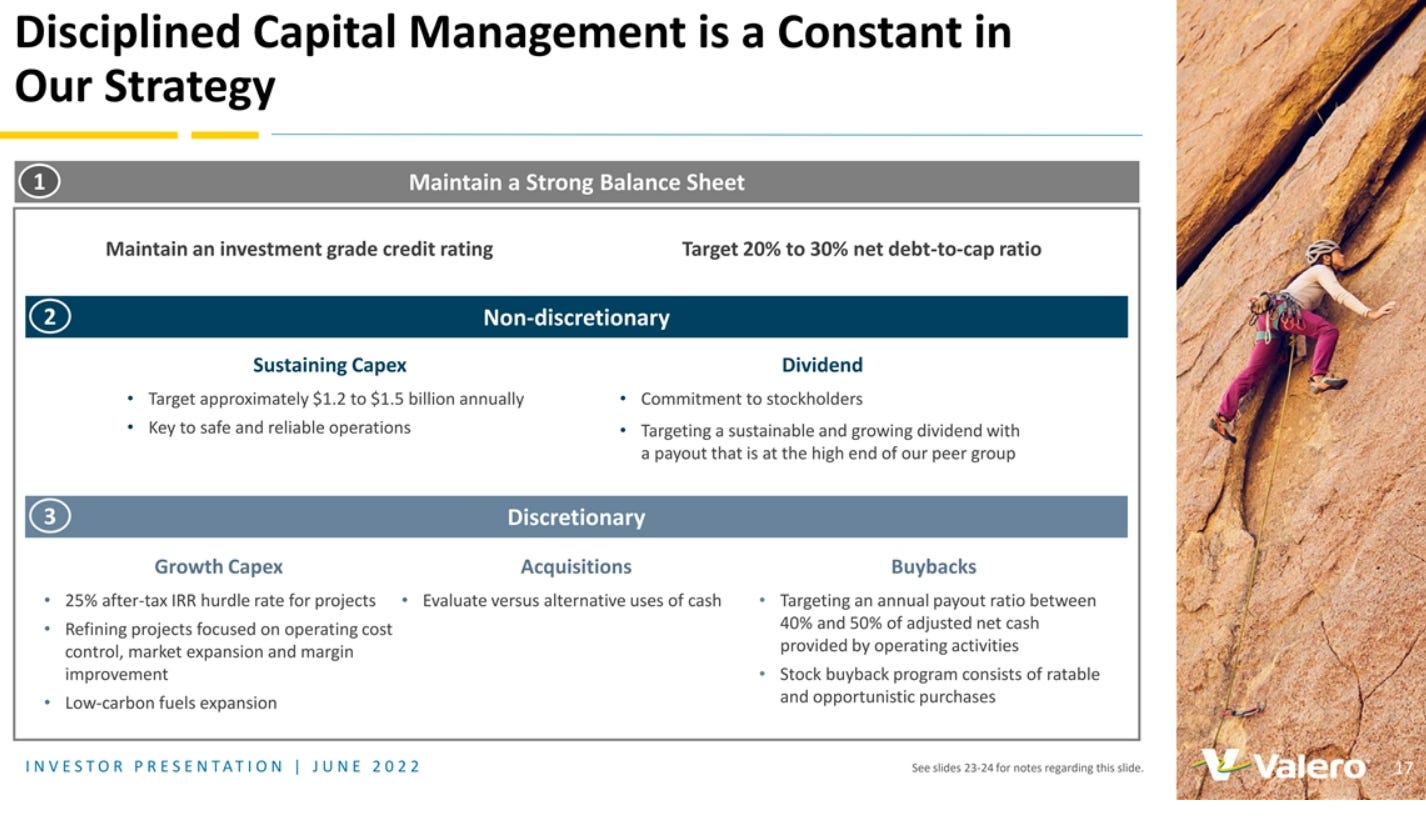

And it’s not just direct energy plays pursuing these strategies; the slide below is from Valero (VLO), a refiner, but you could be forgiven if you thought this slide deck was from OXY because the strategy is so similar. (PS- refining is particularly interesting to me, as margins are great right now and they have several tailwinds that suggests margins could be higher for a lot longer. I pulled out some really positive quotes on refining from the CVX CEO on this thread; I’m doing some expert calls on the renewable diesel space next week if you have any questions I should ask / things I should be focused on).

Now, obviously every company is different. EQT is significantly different than OXY and CVX; on top of being materially smaller, basically all of EQT’s value comes from natural gas from the Appalachian basis. OXY and CVX have material exposure to oil as well as other business lines (midstream, international, chemicals, etc.). But it’s still striking how many companies are pitching these “Buffett-approved” capital allocation strategies across oil and gas.

Maybe the companies are just pitching these strategies because they know it’s what investors want to hear. Maybe they’ll bail as soon as energy prices go down, or they’ll end up following history and doing a ton of value destructive M&A / speculative drilling. Maybe energy prices are way too high now and due to crash, and in a few months we’ll look back on these forward free cash flow estimates and laugh.

But if companies stick to their capital allocation frame works and energy prices don’t drop materially from the current curve (and I mean materially; even if the curve is 10-15% too high all of these companies are going to mint a wild amount of money versus current stock prices), all of these stocks seem way too cheap and investors will almost certainly do very well from these levels.

I’ll use EQT as an example for this. As I write this, their market cap is ~$17B on a ~$42/share price. If you look at the quotes I used above, you’ll see that in their Q1 earnings call EQT said they’d generate ~$17B of free cash flow from 2022 to 2027 with plenty of terminal value after that given their inventory. So EQT is trading for right around what they were projecting in FCF over the next five years. That alone seems attractive…. but the natural gas curve is up materially since they gave that quote. I’ve got the curve through 2023 below (note: this is the curve as of July 23 per my Bloomberg pull), but pay particular attention to 2023-2026, since those are nearer term and the curve is up well over 10% in those years.

I’d suggest that, given the increase in gas prices, EQT’s free cash flow should be materially higher than what they were talking about in April. Combine that higher cash flow with another quarter of repurchases and free cash flow at EQT (they were certainly generating tons of cash flow and repurchasing shares in Q2!), and…… well, things start to get pretty crazy. Again, if the gas strip was to drop ~10%, EQT’s free cash flow over the next few years would equal their current market cap just based on what we heard from them a few months ago. You could look at it like this: at current prices, you are buying EQT for a few years worth of free cash flow if energy prices drop by ~10% and getting all of their out year cash flow for free. That seems nutty.

I’ve said several times that I don’t understand what’s going on with energy companies currently. The market is clearly expressing enormous skepticism about the sustainability of these companies’ free cash flow and the sustainability of the current energy strip.

Buffett is seeing value in oil majors trading for <10x free cash flow. If you’re willing to look at smaller companies, you can find them trading for even cheaper levels. EQT and CHK are by no means microcaps; each have $15-$20B market caps. And each of them are trading for mid-single digits multiples of this year’s free cash flow and below the amount of free cash flow they’ll generate over the next 3-5 years if energy prices are anywhere close to the current strip.

It seems like a massive opportunity to me… but, as I’ve said frequently, the history of generalists plowing into oil and gas names is really, really bad, so I’m always looking for what I’m missing / what anvil is going to drop on me!

I think it's simple what's going on: many of the co's on a look back basis are absolute train wrecks. Share issuance is through the roof, losses are material and in many cases consistent or at least lumpy - to me, most of them look like a text book example of what should be avoided under normal circumstances, especially with half the worlds governments painting them as Satan himself.

Now, the difference is that circumstances are certainly not normal and many of these co's will earn substantial amounts of money, certainly in the short term and likely in the medium term (perhaps even longer term) - but what does management do - do they s**t the bed like many have done consistently for the last decade or have they suddenly seen the light? - I'm sure some will be the latter but it's hard to argue that many will be the former.

Can they hold it together for long enough that investors net a substantial return?

Again - I bet some can - maybe many can - but it's still a ballsy proposition to throw any material amount of capital at these guys - at least that's the case for a generalist like myself.

Not legal or investing advice. On TWTR, the scenario that worries me is: a few days before trial, Musk offers say $5bn to terminate the merger agreement and settle the litigation. As I understand, the board has a duty to act not only in the best interests of shareholders (for whom litigation would be by far the better choice -- I have the prospects of getting an order for specific performance a bit below you but not materially; and I don't think Musk can realistically do anything other than comply with a Delaware Court order) but also the company itself and they are free to consider the interests of other constituencies as part of that assessment. I can see the board deciding that the company and its employees would be better off remaining independent with the benefit of the hypothetical $5bn to support the strategy and (potentially - as above, not legal advice) getting advice that the balancing of conflicting interests of the company itself and the shareholders is a matter for the board's judgement. If this is wrong, please let me know (I currently don't hold, but would if I got myself comfortable (not relying on anyone's comments here) that this scenario wouldn't arise).