One of the podcasts I got the most feedback / inbounds on was Zack Buckley’s follow up appearance on XPOF in the wake of Fuzzy Panda’s short report. Bulls thought I wasn’t bullish enough / didn’t emphasize how well the business is currently doing; bears thought I didn’t push back hard enough on some of the shadier personal and historical stuff Fuzzy Panda brought up.

Honestly, I agree with both of them; it was a learning lesson for me. I’m not a hard hitting investigative journalist; I find it pretty easy to ask tough questions about financial metrics but once we start getting into more serious stuff that actually impact people’s lives (and some of the Fuzzy Panda allegations are quite serious) it throws me off my game (or, more aptly, it’s not my game to begin with!). And once I got thrown off, I think I just wasn’t quite on my A game asking questions and pulling on different threads (which is unfortunate, because Zack was great and had done great work; luckily podcasting is a team sport so Zack could be the Lebron to my Boobie Gibson).

But that’s neither here nor there for this piece! What I wanted to talk about is XPOF’s recent insider buying.

Since the follow up podcast came out, XPOF reported (strong) Q2 earnings and announced a $50m share buyback… but the real news has been insider buying. Insiders have stepped up and bought >$1m in stock since the earnings report, with the majority of that coming from the CEO.

In general, insider buying is a positive thing…. but the XPOF insider buys are funny to me because they’re something of a Rorschach test.

If you’re a bull, the answer to that test is simple: management thinks the stock is cheap, and they’re showing that by buying with their own money and (to a lesser extent) borrowing an extra $50m to fund the share buyback they announced on their earnings.

If you’re a bear, the answer is also simple: management is desperately trying to prop the stock up with token insider buys.

And that’s where things get really interesting!

The bears would point to two things for why these buys are nothing but a desperate attempt to prop the stock up.

First, they’d say look at management’s history. Insiders have sold over $100m of stock so far this year. Does ~$1m of token buying now that the stock has dropped really signal anything?

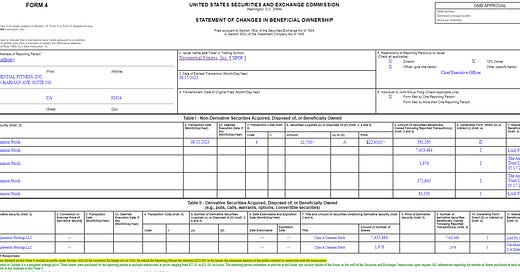

Second, bears would ask you to read the details of the form 4. Insiders at all public companies are subject to the “short swing” rule, which means that you can’t profit from a trade in a stock in a six month period. If you do, you have to give those profits back to the company.

In this case, XPOF’s CEO sold stock in the low $30s within six months of buying stock in the low $20s, so he needs to pay the difference (~$10/share) to XPOF on all of his insider buys. And, if you read the footnotes of his form 4s, that’s exactly what he’s doing.

I’ll be honest: that’s pretty crazy. I’m sure I’m forgetting some, but I follow insider trades pretty closely as part of my sourcing for new ideas and off the top of my head I can’t remember any transactions where an insider pays short swing profits. It simply doesn’t make any sense: if you’re an insider who sold a stock at $40/share and now it trades at $20/share, the short swing rule means you effectively need to pay $40/share to buy the stock. No rational person would do that even if they thought intrinsic value was way higher! After all, you could just wait a few months to buy so you’re not subject to the short swing rule, and if you thought value was so much higher why’d you sell at $40 in the first place?

So the Rorschach test is simple: if you’re a bull, you see a CEO buying his stock and paying short swing profits that effectively take his buy price from ~$23/share to ~$33/share and see a CEO that is so bullish on the company and sees the financials accelerating so quickly that he’s willing to pay up to take advantage because he thinks the stock is going up quickly. It’s worth noting XPOF has an investor day in early September; the bull might think the CEO is so positive the investor day is going to go well that he’s buying now because he’s so positive the stock is going to gap up.

If you’re a bear, you see a CEO making a token buy versus his prior sales in order to prop up the stock, and you see a bunch of bulls who are deluding themselves over $1m in purchases while ignoring over $100m in sales earlier this year.

What’s the right answer?

I certainly have no idea. I’m all over the place on XPOF. How I view the Rorschach test really depends on the day; sometimes I see a cheap, founder-led, rapidly growing franchise business that spews off cash flow and is owned by a bunch of very smart friends, and other days I see a bunch of low moat businesses that could be fads (I mentioned the rise and fall of curves a lot in the first podcast) run by people with some questions about their past I’m not sure I can answer.

There’s an old saying, “Insiders sell for a lot of reasons, but they only buy for one reason (they think the stock is going up).” And it very well might be these small, short-swing insider buys are the exception that prove the rule (or I guess saying in this case).

PS- insider arbitrage had a nice little write up on these buys as well.

$XPOF

Orange County State Court: 30-20-23-01345433-CU-AT-CXC

Central District of California: 8:23-CV-01643