A while ago, I used to do a “what am I missing” segment where I’d post on something that seemed obvious and ask…. well, what am I missing? I enjoyed these; sometimes I’d get really interesting responses, and overall writing just helps me clear my head so I always felt I could think through a problem better after posting on it / writing it up.

Anyway, I had a delightful Christmas weekend with family / away from computers and the markets… but, like so many people in investing, my thoughts would inevitably turn back to the markets in my down time. And the thought that kept popping into my head was “what am I missing with the huge AMC / APE spread despite the looming exchange offer?” And given how much I thought about it, I figured I’d throw a quick post out (well, that was the thought. It turned into a very slow, long post!).

To be upfront: I know how wild the discourse around AMC can get. You’ll notice I did not use any AMC or APE “cashtags” in the title of this post; that was intentional to add a little friction to the process of this post getting involved in some crazy debates. I love movies (I was a member of AMC A-List before COVID, and my wife and I go see every Marvel movie the week it comes out at the AMC by us!) and think AMC was dealt an impossible hand by COVID. So I’m not out here hating on AMC; that said, the company’s cap structure was put together in a pre-COVID world. They burnt >$700m in FCF in the first nine months of 2022 on a breakeven EBITDA number. D&A is very, very real in the movie business, so to consistently “breakeven” on EBITDA is an absolute disaster. It takes maybe three minutes of looking at AMC’s income statement / balance sheet to see that this is a company that desperately needs some combination of restructuring and capital raising.

AMC became a meme stock back in 2021, and they took full advantage of their meme stock status to raise some desperately needed capital. However, they eventually ran into an issue: they issued as many shares as their corporate charter would allow, and their (largely retail) shareholder base wouldn’t approve a change in their charter to allow them to issue more stock, so AMC found themselves in a weird place where they desperately needed equity capital and had an obviously overpriced stock that was extremely liquid…. but could not raise capital because of a technicality.

Over the summer, AMC found a clever loophole around this technical limitation by issuing APEs to shareholders. APEs are preferred stock, which AMC has no limitation on issuing, but they are functionally the equivalent of AMC common stock (the AMC FAQ on APEs notes that APEs have the same economic value as common and the same voting rights as common). For more background, Matt Levine had a great piece summarizing the background of AMC issuing the APEs.

With the APEs issued, AMC had access to equity capital, and they proceeded to aggressively tap the equity markets through an APE at-the-money (ATM) equity issuance program, which raised >$150m in ~4 months through mid-December. AMC used this aggressive equity issuance to buyback debt at huge discounts to face value.

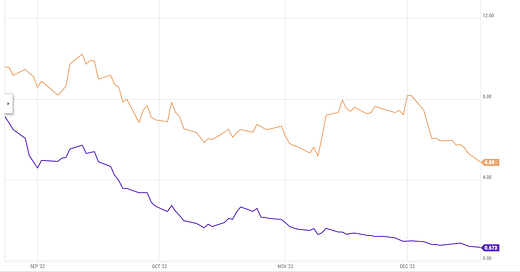

This was almost certainly a good decision for AMC (they were issuing equity capital to buy back debt at 60-70% discounts to face value; that’s almost always a good trade! Almost every company with heavily discounted debt would make that move if their stock was liquid enough to support it!), but the aggressive issuance of APEs created a divergence between APE and AMC stock (which, again, are functionally equivalent). AMC, with its float limited / unaffected by the aggressive issuance, had consistently traded for >$6/share (it closed for just under $5/share early last week). APE, which is economically equivalent to AMC but was getting aggressively hit by the ATM program, opened up trading for ~$7/share but had seen its price drop to under $1/share by early last week.

That is a huge spread for two securities that were, again, basically identical. Go look at investopedia’s arbitrage page; buying two similar securities for different prices and waiting for the price to converge is literally the most basic form of arbitrage (now is a good time to note that arbitrage can be extremely risky, particularly when one side is a meme stock with high short interest. Nothing on this blog is investing advice; I’d generally discourage all but the most sophisticated investors from engaging in arbitrage or any type of shorting!).

There was, of course, one catch to this arbitrage: while APEs were functionally equivalent to AMC shares and would almost certainly one day be converted into AMC shares, they were not immediately convertible (the AMC / APE FAQ makes this point quite clear!). That meant the spread could stay extremely wide due to limitations on borrowing AMC stock. I know of several funds that had the “short AMC / long APE” trade on over the past few months, and I know they were all extremely frustrated as that divergence continued to widen. AMC is also a very high short interest stock with tight borrow costs; add those borrow cost to a widening spread and this proved to be a very costly trade.

So the AMC / APE spread remained stubbornly wide…. but AMC is a company with a reasonably complex cap structure and a bunch of securities trading in distress. If one part of the complex trades at a dramatic premium to the rest (as AMC did to APE, and as one could argue the equity was trading at versus the equity value implied by the distressed debt), there are arbitrage profits to be unlocked and the profits eventually get big enough that the company can take a cut of them (perhaps a major cut) by facilitating an unlock on that arbitrage.

That is exactly what AMC agreed to do last week. The company agreed to sell $75m of APEs to Antara. In addition, Antara will exchange $100m of AMC debt they own for more APEs. In exchange, AMC has promised to hold a vote on collapsing APEs into AMC (i.e. APE shares will become AMC shares). The vote is almost guaranteed to pass, as APE and AMC shares can both vote on the exchange; given there are now more APE shares than AMC shares and APE shares are economically incentivized to vote yes (as doing so collapses the spread!), the vote is almost certain to pass. (Matt Levine, of course, detailed the trade nicely here).

Ok, that’s a rather long set up. At this point, you’re probably wondering, “Wasn’t the article titled ‘What am I missing?’ What exactly is the author missing? Am I, the reader, the one who is actually missing something?”

So here’s what I’m missing: with the exchange agreement on the table, why is the arbitrage spread between APE and AMC still so wide?

APE closed yesterday at $1.91/share. AMC closed at $4.03/share. That is an enormous spread for two securities who are economically identical and whose spread should collapse sometime in the ~next 90 days.

Big spreads general reflect some type of risk or uncertainty, so your first thought is probably “O, the spread just reflects risk the vote will fail (or won’t happen) and the collapse won’t happen.” I don’t see why that’s a massive risk: the company is contractually obligated by the Antara deal to hold a vote within 90 days, so there shouldn’t be a large “vote doesn’t happen” risk. And, when the vote does happen, it should easily pass: there are more APEs outstanding than AMC shares, and the APEs are economically incentivized to vote for this deal, so the vote should pass (the APEs are also likely held more by institutional investors, while the AMC shares are more retail focused. Retail tends to turn out less than institutions in voting, so the APE shares likely represent an even higher percentage of “turnout adjusted” shares outstanding).

There are other risks along the lines of “the vote fails” issues, but given the company controls the process and is incentivized to get this deal done (not only are they contractually obligated to, but they are economically incentivized to as it brings much needed cash into the company as well as a nice chunk of debt relief), I think the vote should absolutely happen and pass in the near future.

People more familiar with risk arb might point to another risk: borrow risk. AMC is a meme stock with high borrow costs and limited short availability, so the huge spread could just reflect the difficulty of putting on the arbitrage. Investors could also be scared that AMC stock could have a meme squeeze in the middle of the process that could make the borrow costs really weird (what happens if the deal closes and the spread collapses, but AMC stock has a weird squeeze and somehow touches $100/share while APEs continue to trade at $2/share in between now and close? You’d have gotten margin called out of this trade before the collapse! PS- that’s why shorting and arbitrage are quite risky and this isn’t financial advice!).

There could be something to that risk (the brokerages I’ve checked have had little or no AMC stock borrow)…. but the spread is so high that risk rings a little hollow to me. As I write this, the AMC $4 March puts are trading for ~$2. The deal will almost certainly have closed by then (if not, it will be days away from closing; again, the Antara contract says AMC will hold the vote within 90 calendar days of December 22. 90 days puts the absolute latest the vote can happen at March 22. These puts expire March 17, so we’re talking about a very small timing difference at the absolute latest). Investors could buy 1 March $4 put for $2 and buy 1 APE for ~$1.90. That would create the “unit” for ~$3.90. When the deal closes, that unit will be worth at least $4 (if AMC is trading below $4, the put is in the money and can be exercised to sell AMC for $4), creating a downside scenario that yields a ~2.5% gross spread in ~3 months. Not bad for an arbitrage…. but the real upside would come if AMC’s stock somehow squeezed higher and the deal closed. In that case, your “unit” would be worth whatever AMC closed at. I suspect that a squeeze higher is very unlikely…. but I also didn’t think AMC could sustain a meme squeeze for this long. Bottom line: there’s a non-zero chance AMC closes at >$4 when the collapse happens. So (again, assuming the deal closes) your downside is a really attractive gross return in a tight timeframe, and your upside is you benefit from a random meme squeeze? Not bad at all!

That’s a pretty simple trade. People more creative / more experienced with options than me can finally find some trades that create even more interesting structures / payoffs. For example, I’ve probably been too conservative with the timing of the transaction; while the deal is required to close within 90 days of the forward purchase agreement, I’m really not sure why it couldn’t close by the February options expiration (“not sure why it couldn’t close” might be underselling it; I think AMC is incentivized to get this closed as quickly as possible), so you could possibly create the “unit” cheaper by buying shorter term options.

Again, I’ll emphasize that arbitrage / shorting / options carries serious risk. But the overall trade is pretty simple in the grand scheme of arbitrage, and the spread here is enormous.

So what am I missing?

PS- I just wanted to pause and tip my cap to Antara for this trade. Some people might wonder why they’re willing to take debt, which trades higher in the cap structure, and exchange it dollar for dollar for APEs, which are lower in the cap structure / clearly distressed. The answer is simple: AMC’s debt trades for a deep discount. The second lien that Antara is exchanging has traded below 40 for the past month. So Antara is taking debt that they almost certainly bought relatively recently for a massive discount and exchanging it at par into APEs. Antara is doing the swap in a few different tranches, but I believe the all-in average price of the APEs is well under $0.80/share, and those APEs will quickly get converted into AMC stock (which is trading much higher). If the APEs close the gap to AMC's current price, Antara will make out like bandits on this trade (if you assume they bought the debt for 50% of face value and swap it into APEs at an implied ~$0.80/APE share, and that $0.80 becomes $3 when the AMC / APE gap collapses, Antara would have an almost 8 bagger on their hands in the space of a few months). But the critical piece is Antara bought the AMC debt at a huge discount; even if the APE price trades down pretty seriously, Antara will still do well on this trade given they are swapping deeply discounted paper into the APEs at par. I believe the APEs / AMC stock would need to trade well below $0.40/share for Antara to lose money on this trade…. and that assumes that Antara hasn’t already hedged any of their AMC stock price risk already (while the contract precludes Antara from hedging after the deal is done, I don’t believe it precludes them from having established hedges before the contract was signed! I could be off on that though).

Two points on what you migh tbe missing - 2nd one more relevant.

1) The "turnout adjusted number of shares" you`re writing about are misleading since as far as I understand, a failure to show up i scounted as a "no". That`s the reason AMC can`t get even simply things approved any more - too many retail investors that don`t turn out to vote, irrespective of the topic. But this shouldn`t change the expected outcome of an approval.

2) ...and this might get weird now. A key part of your thesis is that you somehow can short AMC with reasonable risk, and you described how to do that via put options. However, this makes the assumption that the strike price does not get adjusted. But: Some significant corporate event can lead the OCC to adjust the option contract in order to guarantee smooth trading, e.g. through adjusting the strike price. One of the coporate actions that can lead to that sort of adjustments are stock splits (see e.g. https://www.fidelity.com/learning-center/investment-products/options/contract-adjustments) Yes, I know, technically the split has already happened through the introduction of APEs. But to be sure, I think one would have to wait until AMC officialyl declares the date of the vote (then they need to inform the OCC), and close to the annoucnement of that date. the OCC would publish a memo (https://infomemo.theocc.com/infomemo/search) on changes in the options contract, if there are any.

Obviously, I might be totally off with this point, let`s see what you think.

what we missed is that Antara can hedge their position on swap (they only have to keep the voting rights). Your post nicely points out how cheap they got their shares, and thus, how incentivized they are to just lock in their multi-bagger.

today's price action basically proves (to me, at least) that they're hedging. I had thought the overhang of the ATM was lifted, but no - this works like the opposite of an Accelerated Share Repurchase. Call it an ASS - Accelerated Share Sale. AMC sells the APE shares to Antara, who then sells them into the market (on swap, via their counterparty).

i mean, nothing really changes in the whole story to your points, except that there's still APE overhang, and, potentially, lots of it... .