I mentioned a few times how excited I am for 2022, and between launching my partnership with Tegus, putting out a note on forced selling at NTP, prepping to record a podcast with Chris, and rough drafting my 2022 YAV “empire” post, I’ve tried to really hit the ground running…. but the main thing I’ve spent time on this week is looking at stocks that are really cheap and buying back shares.

I generally found those stocks in three different sectors:

Friend of the podcast Jon Boyar publishes the Forgotten 40 every year, which is a great place for quickly getting up to speed on a bunch of cheap companies with a TMT bent (one of my favorite sectors!).

Retailers trading for low multiples while hammering their share count (BBBY would be a good example; they report earnings tmr so we’ll probably get some fireworks one way or the other. I have a small position just given the valuation / buyback combo).

Cyclical commodities trading for low multiples

#2 & #3 above should come as no surprise to readers, as my number one prediction for 2022 was deep value retail and cyclical commodity stocks outperform. And the more I’ve looked at the sector, the more I’ve wondered one thing: what am I missing? (*** Editor’s note: this post ended up focusing on cyclicals, and I published a companion piece on retailers here).

The overall thing I’m seeing is that these companies are trading for super low multiples to trailing earnings while generating an insane amount of cash flow that they are generally returning to shareholders. Now, a lot of people are going to look at that combination and say “it’s obvious, Andrew. The market is pricing in peak earnings.” For cyclicals, this is generally referring to the risk that their underlying commodity price is about to fall off a cliff (i.e. an oil producer will look really cheap when oil is at $80…. but if oil falls to $50 suddenly they go from massively profitable to underwater / losing money). For retailers, this is generally worries that they are benefitting from a one time cocktail of diminished competition (from all the retailers that went BK during COVID), flush consumers driving a huge spending cycle, and margins buoyed by the current supply chain issues (no need to discount to move goods when no one else has anything to sell!).

And I get that concern. The market is infrequently so inefficient that you can look at a group of stocks, say “they are cheap and buying back shares,” buy them, and expect to make a significant amount of alpha….. but it just seems like that’s what the market is offering currently. These companies are currently printing so much money that if this environment keeps up for even a couple of months more, they’re basically going to have minted so much of their market cap that little things like “terminal value” won’t even matter.

The issue I see isn’t the current multiple per se, but that the stocks haven’t really moved in the face of once in a generation record profits.

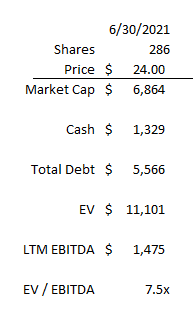

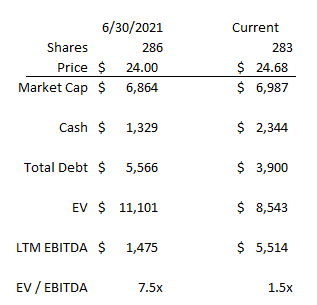

Maybe an example will show what I’m trying to say best. Consider U.S. Steel (X). Go back to July 2021; the company reports an “exceptional” Q2’21, and it’s clear that the environment is great for them (their earnings release mentions “We look forward to setting new records in the third quarter and expect to achieve all-time best adjusted EBITDA for the quarter.”). At the time, their capital structure looks something like this:

Fast forward to today, and those record results continue to play out. X printed $2B in EBITDA in Q3 and another $1.65B in Q4 (for comparison, this is a business that did $711m in EBITDA in all of 2019 and ~$1.8B in the first half of 2021, so these are bonkers quarters for a company with a ~$11B EV heading into them). That EBITDA generation leads to an insane amount of cash flow (cfo less capex in Q3 alone is ~$1.3B, or >10% of X’s EV in one quarter). We don’t have a full balance sheet for Q4’21 yet, but I estimate after the debt paydown and share repos X mentions in their Q4’21 early release that they probably ended 2021 w/ ~$1.5B in net debt (versus >$4B at the half way point of the year).

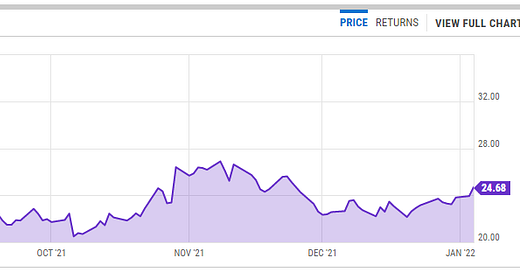

Despite those killer results, X’s stock is roughly flat from the end of June to the end of the year.

With X’s stock price flatlining while they continue to print record profits and gobs of cash, X’s EV shrinks rapidly, going from ~$11.1B to ~$8.5B (note that I’m estimating the Q4 ending share count / balance sheet as they haven’t released it yet; I could be slightly off but directionally this should be correct).

So the point I’m trying to make is this: last summer, you could have told me “O, X is trading at a low forward multiple because the market is forecasting lower prices after the near term super normal prices.” But, here we are, six months later, and X has printed ~25% of their EV in cash flow, and the near term environment looks basically the same as it did heading into the current cycle (below is a chart of HRC (hot rolled coil), which is a short hand for steel pricing).

What surprises me isn’t that the market is saying that the super normal profits can’t last forever; I’m surprised that the market doesn’t appear to be giving these companies any credit for the cash flows they’re generating in the short term from the super normal cycle.

FWIW, asking an industry exec about the cycle is generally like asking a barber if you need a haircut, but X sure seems confident that the industry isn’t heading back to the doldrums anytime soon. I’d point you to three places that show how bullish X is:

The company began an capital return program focused on share repurchases at the end of October

I’d encourage you to read all of their Q3’21 earnings call, but it includes quotes like

“We believe the market is not rewarding us for the strong performance we expect in 2022 and is not yet recognizing the long-term value creation potential of our Best for All strategy,”

“Our strong financial performance and the significant returns we believe we can generate by buying our own stock is the reason we are accelerating direct returns to stockholders. Reinstating a $0.05 per share quarterly dividend and moving quickly on a $300 million stock buyback demonstrates our commitment to ensuring our strategy is indeed best for all. Our goal is to ensure direct returns become an enduring part of our capital allocation strategy, and we believe there are catalysts that could drive additional buybacks in the future.”

“Aside from additional free cash flow generation, we believe there are near-term opportunities to divest noncore assets, primarily real estate, which could further accelerate or increase further authorizations. In addition, the option for Stelco to acquire 25% of Minntac remains in place through January of 2027 and presents an opportunity to return up to $500 million of incremental capital to stockholders.”

“We're entering 2022 in a great position to both create value for our stockholders and deliver value to our customers. We are executing a robust contract process with customers, in most instances, having begun discussions 90 days sooner than we have historically. Our strategy is paying dividends. Assuming the forward curve, which we believe to be a pessimistic view of spot prices, we fully expect average selling prices to be higher in 2022 than 2021 for our Flat-rolled segment.

We've also listened to our customers and in some instances, have signed agreements beyond 12 months. This creates longer uplifts and supply continuity while fostering collaborative product development opportunities to solve their most difficult challenges.”

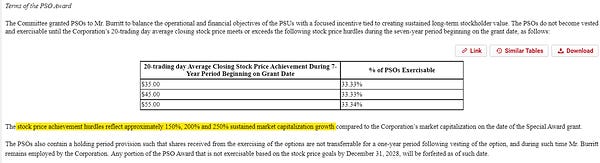

They granted the CEO special stock awards that don’t vest unless the stock hits certain price targets by 12/31/28. Companies generally like to grant CEOs options that they have some confidence in obtaining; the high end of those target would require the stock to hit $55/share (a ~12% IRR over the next ~7 years).

Again, industry execs are almost always going to be the most bullish on their industry, so take that with a grain or three of salt…. but those don’t seem like the quotes and actions of a management team who is seeing a near term drop off in demand. In fact, it sounds like a management team who is really bullish on their company and is using the current super cycle to drive longer term deals that give them extra visibility into their medium term earnings while exposing themselves to increased upside through stock awards.

This post is running way long, so I’ll save a discussion of retailers for another day. But I want to wrap this up by emphasizing that, while I used X as an example, X is by no means unique in the commodity space. Near across the board, I’m seeing commodity companies that have been minting cash flow for the past ~6 months but are trading at insanely low valuations / haven’t seen their stocks budge despite the record cash flow. For example,

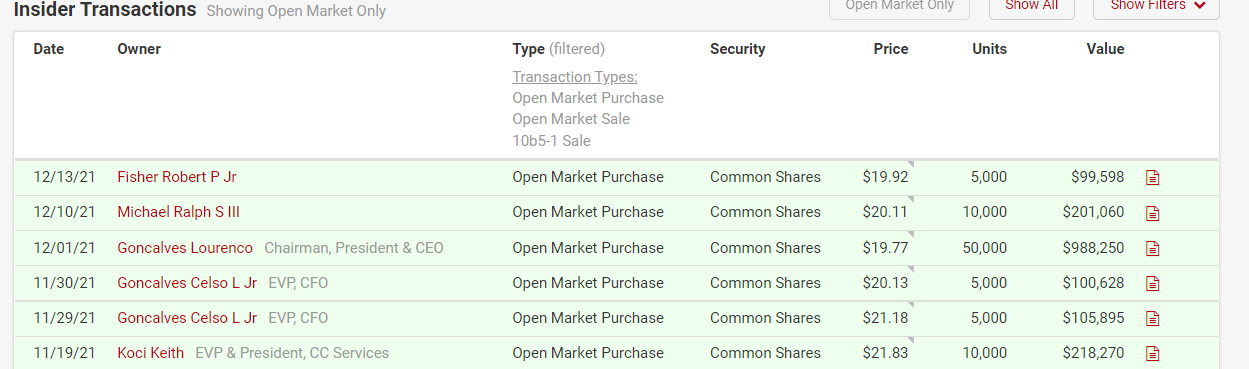

X’s peer CLF might have a little baggage, but you’ve seen multiple insiders buying on the open market in Q3, the stock is trading for a low single digit EBITDA multiple, and they have long term contracts that give them visibility into a great 2022.

From their Q3’21 call, “Wrapping up, the financial position of the company is on stronger footing today than it has been during my entire time here at Cliffs and the trend should continue into Q4 and 2022. The fixed price contract business we have with high-end clients, such as the automotive OEMs, gives us significant downside protection if spot prices trend lower. Therefore, even under the current bearish futures curve for HRC, our average selling price should be much higher next year than it has been this year, leading to the expectation of another year of outstanding EBITDA, cash flow generation and debt reduction in 2022.”

Andrew Carreon made a great pitch for BSM in June. Recall that BSM gets paid royalties for oil / Nat Gas found on their land, so they’re a double beneficiary of rising prices (they get paid directly from more royalty dollars, but higher prices also encourages more drilling on their land). Since that pitch, oil and nat gas are both up ~15%., and BSM’s Q3 earnings call included quotes like “we have a lot of positive momentum around the asset base” as well as tons of discussion of all the new production that’s set to come online. Despite that, the stock has barely budged.

RFP currently trades for ~$14/share. They probably earned >$6/share in 2021, they have a reasonably aggressive share repurchase program (they bought back 7% of shares over the twelve months ending Q3’21) in addition to paying out nice sized special dividends, and I believe they would earn their entire market cap if lumber stays around current levels for an entire year.

UAN will likely earn and pay out 50% of its market cap in the next three quarters.

Look, I can’t claim to be experts on any of these. All I’m trying to point out is that these stocks have not budged after six months of producing record results, and the cash flow to remaining enterprise value dynamics are getting pretty wonky. Each has idiosyncratic risks, but it sure seems like a basket of them will do well absent an immanent and deep recession. Personally, I’ve looked at a variety and I tend to lean towards the steel plays (as you can probably see above) because I’m a little more comfortable with the outlook there (and the management teams are a little more reliable than some of the wildcats I’ve seen in smaller companies), but I’m a generalist without a ton of sector knowledge so I’m always open to being pointed to other interesting cyclicals (I generally want a low multiple and an aggressive capital return program, preferably through buybacks) or to someone telling me what I’m missing with the current cycle / valuation.

On $X specifically my guess is the market is worried about cooling demand for steel in China due to their property sector cooling off. China accounts for almost half of the world's steel demand. Steel prices have been in pretty rapid descent in the past few months and even though $X trades at a value multiple and mgmt pulling the right levers, it doesn't usually decouple its correlation with steel prices. Maybe the answer on $X is that simple (steel prices need to stabilize)?