This is a companion piece to yesterday’s “What am I missing with cyclicals” post. I’d encourage you to read that for full background, but the basic story is my number one prediction for 2022 was deep value retail and cyclical commodity stocks outperform. And the more I’ve looked at the sectors, the more I’ve wondered one thing: what am I missing?

Again, yesterday’s post covered the commodity angle. I’ll admit I put it up first because I’m much less comfortable in commodity land, and I wanted to put that up because I was more looking for feedback / additional sectors I should look into.

Today, I wanted to talk retailers. I think there’s a really interesting opportunity; there are tons of retailers out there that are trading for mid-single digit EBITDA multiples while gushing cash flow and buying back shares like crazy.

Now, the bear pushback to that bull thesis would be three fold.

Bears would argue that you’re looking at trailing results, and for many retailers trailing results include the best environment they’ll ever see; if you adjust out those super normal results, the retailers don’t look as cheap.

The current supply chain issues will wreck havoc on the retailers. Remember that retailers have a large fixed cost base thanks to their operating leases; the supply chain issues mean retailers will struggle to get product on the shelves, so sales will lag and the fixed cost deleveraging will hammer them. Plus, the supply chain crisis means that whatever products do make it on the shelves will be expensive to get there (i.e. increased shipping and handling costs will eat into margins).

A bonus related concern: labor shortages mean rising employee costs, declining service levels, and all around headaches

Somewhat related to the above, physical retail is always fighting a losing battle against online. Yes, obviously 100% of sales won’t move online; there is a place for physical retail…. but every year a little more share will move online, and that’s a headwind!

All of those concerns are real…. but I think they’re overblown, and I think the stocks are just way too cheap. I’ve mentioned BBBY a few times on this blog (including as recently as yesterday); they reported earnings this morning, and the stock was ultra volatile but as I write this it’s up ~10%. Why? Earnings were disappointing, and the company way slashed its outlook (again)….. but the stock is crazy cheap and they keep leaning into share repurchases while suggesting the weak results are mainly the result of supply chain issues, not any long term demand issues or anything. Maybe they’re right, maybe they’re lying…. but when you combine a crazy cheap stock with aggressive buybacks and a non-disastrous medium term outlook, good things tend to happen (and I’ll note my BBBY position is crazy small, so I’m just trying to highlight it as an example / not trying to pound my chest).

Anyway, I’ve generally used BBBY as my example of a cheap retailer…. but I get tons of push back from investors on it. “Sure, it’s cheap and buying back shares…. but it’s only cheap because they’re riding a COVID boom. Longer term, it’s structurally challenged and Amazon is going to eat their lunch.” Ok, I hear that, and those are real risks. But there are plenty of other cheap retail examples out there, and I don’t want to get bogged down by talking about why one specific retailer (BBBY) is so cheap when there’s so many other fish in the sea. So today I wanted to walk through a few other retailers that I think are way too cheap just to highlight why I think the sector is so cheap and how you can find different types of “cheap bets” that have different risk factors than simply “Amazon is going to murder them”.

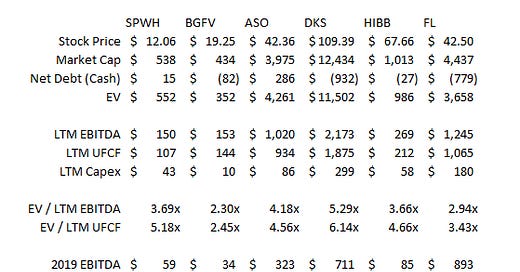

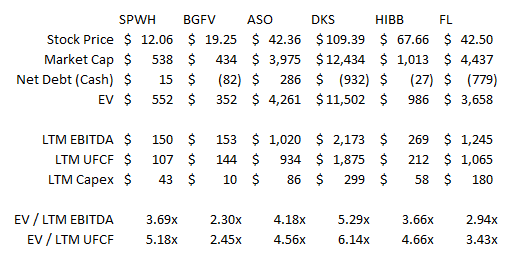

Let me start with my current favorite: the sporting goods companies. This includes Academy (ASO), Dicks (DKS), Hibbett (HIBB), Sportsman’s Warehouse (SPWH, which I mentioned last month when their merger fell through), and Big Five (BGFV). You could even loop Foot Locker (FL) in there if you really wanted to; I will include them just to add another cheap retailer even though the FL dynamics are dramatically different than those other companies. All of these are trading insanely cheap; on a LTM (last twelve months) basis, the most expensive one I see is DKS, which trades for ~5x LTM EBITDA and ~6x LTM UFCF (defined as EBITDA less capex). BGFV and FL are the cheapest, trading for <3x EBITDA. (PS- all of these companies are using Q3’21 balance sheets, which includes inventory build for the holiday selling season. Adjust for that, and they’d all be incrementally cheaper).

Now, the obvious bear argument I’m going to hear is that the LTM earnings numbers are wildly inflated. All of these were mammoth covid winners, and as the environment normalizes earnings are going to fall and the stocks won’t look anywhere near as cheap.

Again, I hear that…. but I’ve got lots of pushback to the bear pushback.

First, I’d note DKS filed an 8-K just this morning pre-announcing Q4’2021 results, and they were gangbusters. The company had guided for full year SSS of 24-25%; they took that up to ~26% in the release. And diluted EPS went from the prior guidance’s ~$14.70 to $15.50. Obviously, all of that increase happened in Q4. So, yes, trailing numbers are inflated by a great environment…. but if DKS is any guide, the current environment hasn’t exactly cooled off!

So the current environment appears to remain really strong, and people are worried that earnings will fall off once we hit more normal times. Cool, I hear you, so let’s look what happens if we just take a pretty negative scenario and instantly run all of these companies back to 2019 earnings levels. Guess what? They’re not that expensive! Most of them are trading for 10-12x 2019 EBITDA. That’s not a number I’d LOVE to pay for physical retailer…. but it’s not astronomically expensive or anything (in fact, it’s about what Cabela’s bought out Bass Pro for a few years ago, see p. 60).

So even if things instantly went back to 2019 / pre-COVID levels, I don’t think you’re paying an insane multiple. Yes, the stocks would trade down, but I just wanted to highlight that we’re not talking “if things went poorly, the stocks are going to zero instantly” here. The earnings boom these guys have generated has been absolutely transformative; their balance sheets are pristine and they can play offense in any market going forward.

But the COVID boom hasn’t just been transformative for their balance sheets; it’s been transformative for their business. I don’t think these businesses are ever going back to 2019 levels because the businesses are just so much better now. I thought Hibbett put it well in their 2021 investor day:

Over the course of the last year, our competitive environment changed considerably. These changes improved our competitive position. Specifically, many points of distribution for our product lines have dramatically reduced. This has been through a combination of bankruptcies, store closures and some reduction in distribution to undifferentiated retail. While unfortunate for others, this puts Hibbett in a relatively advantageous position.

A bunch of competitors have gone bankrupt; those competitors are never coming back and that’s permanent market share that’s up for grabs / the sporting goods stores have gained. And it’s hard to imagine that some of the increased sales from COVID aren’t sustainable (even ignoring the diminished competitive landscape); if you’re someone who picked up a hobby like hunting during the pandemic, you’re probably going to stick with it even once the world normalizes (creating a recurring customer for the sporting goods stores). Plus, the sporting goods stores have seen their customer databases grow by leaps and bounds during the pandemic; that database growth is very valuable and suggests that their current sales level is materially higher than it was prepandemic (i.e. if their customer loyalty base had 10m customers pre-COVID and 15m now, their online sales should be significantly higher going forward just from the incremental sales of 5m new customers opening emails!). And I would guess all of the competitive closures are setting the sporting goods stores up for future store growth and/or a less competitive rent environment.

There’s lots of other stuff to discuss with the sporting goods companies, but I think they’re a little outside of the scope of this post so I’ll leave some of them aside. The one other thing I wanted to hammer home is that it appears insiders believe that COVID has permanently improved their business. You can read any of their earnings calls to find quotes like suggesting that (which generally hammer the reduced competition / new customers becoming repeat customer stuff mentioned above), but I tend to think actions speak louder than words, and we’re definitely seeing actions that say these companies think they’re undervalued.

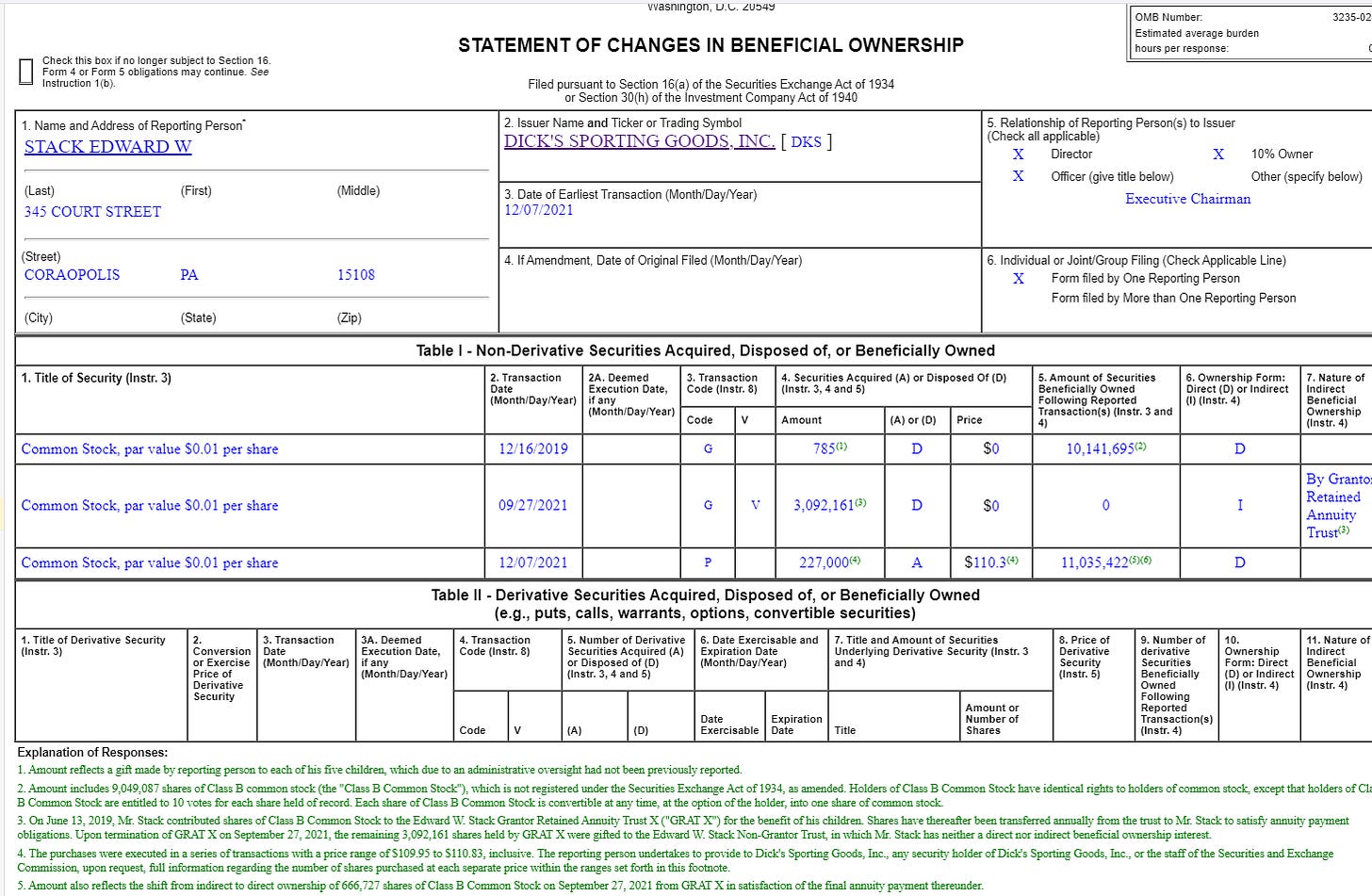

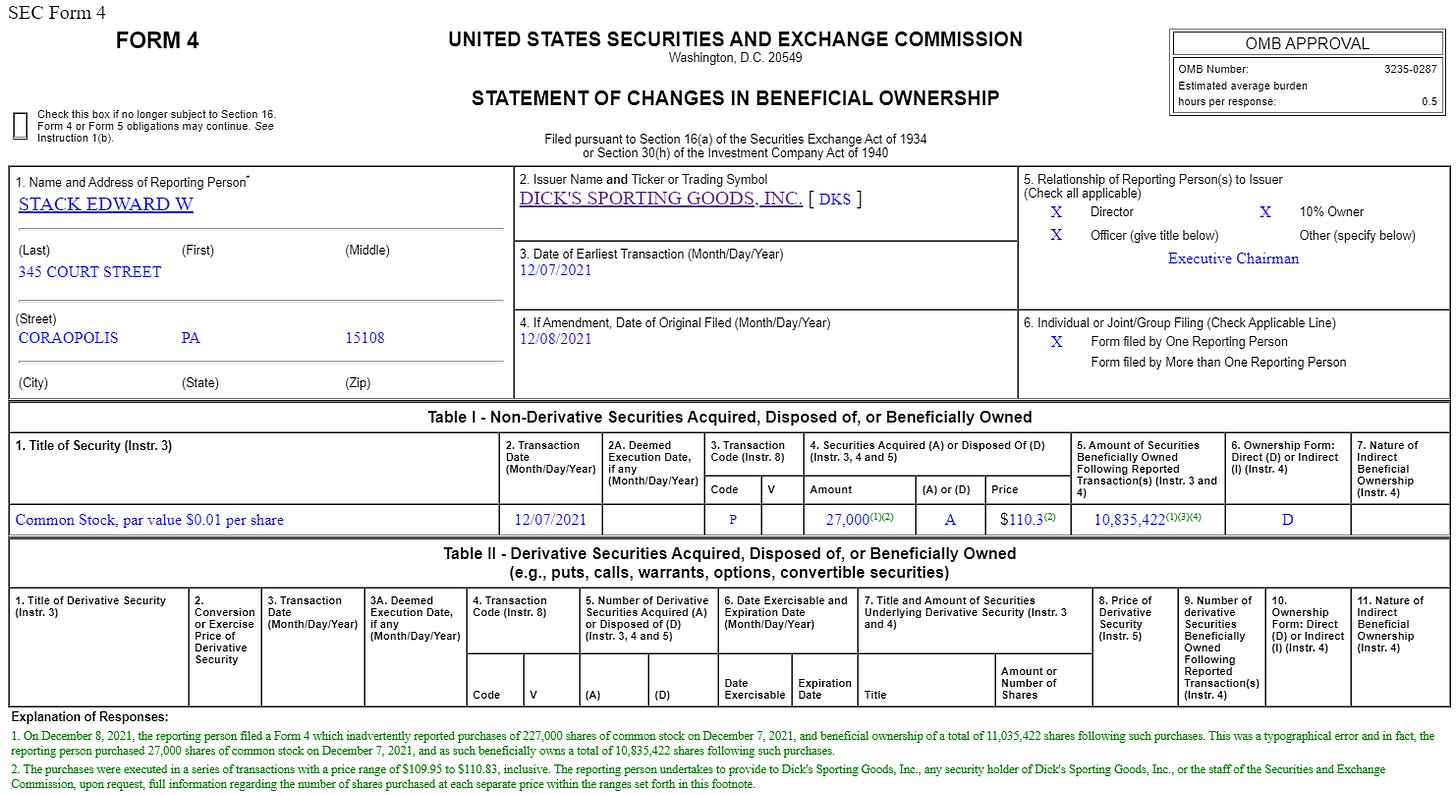

The obvious place we’re seeing that action is in share buybacks / capital returns, and I’ll discuss that in a second. But I first wanted to mention the insider purchases here. We’ve seen multiple insider buys at HIBB, SPWH, and Dicks in the past couple of months. The Dicks one in particular was enormous (and yes I know… phrasing); I’m not saying these are the greatest signals in the world, but it’s certainly interesting that insiders across the sector seem to see value in their stock.

*** Update: as I was prepping to post, a few people pointed out the Dicks form 4 was mislabeled, and an updated one showed that the buy was for ~$3m, not >$25m. Still a large buy, but not quite as large as it appeared initially. I’m keeping the original text for this article and just updating because I’m a little too lazy to change it this late and because the phrasing jokes just get even better and better with the new smaller size. ***

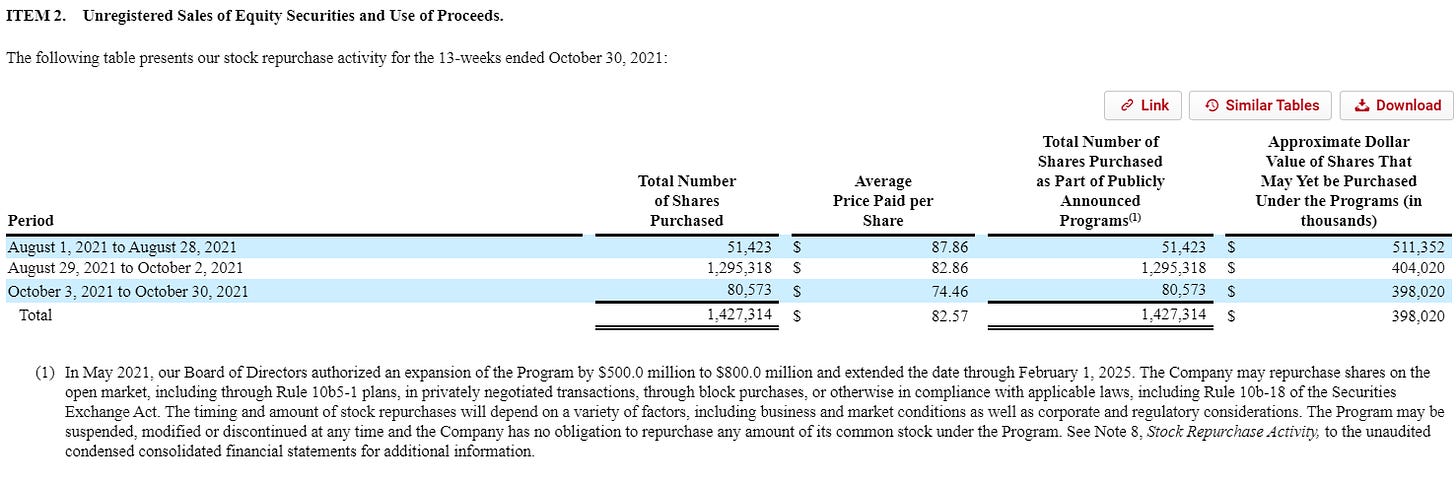

On top of those insider purchases, the companies are being very aggressive with capital returns across the board (the only exception is SPWH, who was precluded from doing capital returns given their failed merger. I expect they will aggressively return capital in the near future). ASO, DKS, and FL have all bought back 5-10% of their stock in the past year (and DKS and FL have paid out a nice dividend), but the headliner here is clearly HIBB. I’ve taken a screenshot from their Q3’21 10-Q below; it shows they bought back ~1.3m shares of stock in the month of September. HIBB had ~15m shares outstanding heading into that month, so in one month HIBB bought back almost 10% of their shares (and note the price is ~20% higher than HIBB’s current price!)!

I’d expect all of the companies to remain aggressive with repurchases going forward. Again, they are gushing cash flow, insiders seem to think they’re cheap, they are telling the market they are going to repurchase share going forward, and (perhaps most importantly) their historical actions suggest that they will follow up on their words. Just to give you an idea of what the companies have said recently on repos:

Hibb Q3 call: “In addition to our capital expenditure plans, we intend to opportunistically allocate capital to share repurchases, and currently have approximately $398 million available under our share repurchase program.”

HIBB June 2021 investor day

CEO “I am a fan of buybacks. I think it's a great way to return value to shareholders.”

CFO “. We said in the first quarter, we were pretty aggressive in buying back shares. We think that we're going to take advantage of the market when we think that there's opportunities to take additional shares off of the table. We did not get an additional $500 million of authorization, so we could just basically sit on our hands in the future. So I think, again, we will kind of look at where the market is trending from a valuation standpoint. We'll obviously try to be very aggressive when we think there's opportunities”

DKS Q3’21 call “Returning capital to shareholders will also continue to be an important component of our capital allocation strategy.”

CFO “I would say that we are very, very happy with the fact that we were able to return nearly $1 billion of excess cash to the shareholders this year between the special dividend, the normal dividend as well as the share buyback…. In terms of returning the excess cash to the shareholders, we'll continue to do what we have done always, that we will look to continue to grow our dividends and continue to opportunistically buy shares.”

DKS CFO at MS conference late November “we'll continue to do what we have done. We will continue to look to return the excess cash appropriately to the shareholders, but that is through the normal dividend policy that we have pursued for since we went public, and we'll continue to buy back shares.

FL Q3’21 call “In summary, we are still on track with our capital allocation program, investing in our business first, with a continued focus on returning cash to shareholders through our dividend and opportunistic share repurchase programs.”

CEO “That being said, the Board and our team is really confident about the strength of the business. We pay -- continue to pay the dividend. We've got a share repurchase program that's got value left in it. We continue to look for opportunistic chances to be in the market to buy our shares back.”

Anyway, I think I’m going to wrap it up here. There are a few other retailers I want to talk about / use as examples, but this post is running way long and I think I’ve gotten my point across. I’m spending lots of time looking harder at the sporting goods companies and these are just my prelim thoughts; I want to dive a little deeper into the differences between all of them, but I could definitely see myself taking a position here (in fact, I already have a small position in a few), and the big question to me is if this is better to play as a basket or if I want to swing hard at one of these in particular. Feel free to reach out if you’ve got thoughts on them or think I’m missing anything!

Odds and ends

One thing I didn’t mention: a lot of brands, but particularly Nike, are pulling back a lot on their third party distribution. That’s actually been a huge boon to the sporting goods companies; they sell enough that Nike hasn’t pulled back from them, and when the mom and pop across the street losses Nike and the big player still has it, that drives a lot more sales to the mom and pop. Something I’m still working on / thinking about is how that plays out in the longer term (i.e. could Nike keep culling suppliers and eventually cut off the bigger guys).

I’ve lumped all the sporting goods companies together, but there are definitely big differences between them. Obviously the capital allocation can very (BGFV is more focused on big dividends, while HIBB is aggressive repos and DKS is kind of a blend), but there are big differences in operations and competition too.

For example, I’ve spent a lot of time talking about Hibbett. I like their management team and hyper aggressive repurchase plan quite a bit, but I’m not even sure it’s fair to lump them in with ASO / DKS / BGFV / SPWH. HIBB is mainly apparel / fashion, so it might be closer to FL than the other players.

HIBB would argue their stores are located in much more underserved communities, which increases their moat. I hear that, but one of the things I like about the other players is their gun / firearm business gives them a moat as lots of other retailer won’t or can’t do guns anymore.

So stuff is now going for 10x FY19 EBITDA or for 5x LTM EBITDA -> is this actually cheap on a historical basis? If you look back at historical trading multiples (2019 year end TEV / FY 2019 EBITDA) is today's level really that cheap?

Let's take Dicks (DKS) for example. TEV/LTM EBITDA is like 5x. YE18 TEV/FY18 EBITDA = 4.5x, for 19 it was 4.8x, etc. It doesn't seem particularly cheap to me. I will also say that ROIC has trended down compared to past years and inventory turnover is at a historical low (3x /year), though this isn't surprising given the supply chain issues now. Anyhow, I don't see how DKS is particularly cheap.

I remember reading Einhorn's letter about how various cyclicals / capex heavy old industries trade at disgustingly low multiples. Various fund managers pitch these and they don't move and their fund collapses, further driving selling pressure. Perhaps a dumb question, but what's preventing this from being a value trap?

Also just a curiosity:

How come you look at EV/EBITDA instead of (EV+leases)/EBITDAR? A nitpick I guess so it doesn't really matter to the directionality of your argument.

How about HIBB short and DKS long? That is Brian McGough idea from Hedgeye. Didn't NKE kick HIBB to the curb? Where are they going to get premium sneakers?