Here’s an actual conversation I’ve had with several friends this week

Fly to New York for the long weekend. Download all of the sports betting apps and take advantage of the sign up promos; the free money they’re showering down on people will more than cover the entire cost of your trip. So you’ll make money + get a free trip to New York (and get to hang out with me, which might be a negative point).

Seriously, the betting promos are absolutely bonkers. The headline craziness is Caesar’s / William Hill, which is giving away $300 in a free bet plus a deposit match up to $3k for a total of $3.3k in “free” money. FanDuel will give you $50 free plus a risk free $1,000 bet. DraftKings is doing a 20% deposit match plus a free bet that varies in size. (Note: I believe I get a small referral fee (~$50) if you use any of those links; I highlight that both to be upfront and because I want you to keep that in mind when discussing customer acquisition costs later).

Obviously Caesar’s is the outlier, but all of these offers are pretty bonkers. Total it up and you’re talking about a lot of sign up promo money. I’ll pause here and note that you should spend a little time getting comfortable with the fine print on those terms, and the bonuses are only for first time customers. So please, be careful. But it is a lot of money literally just being given away for signing up.

I wanted to highlight all of those for a few reasons.

First, I wanted to encourage all of you to take advantage of them. If you live in NY, you should definitely be looking into them…. but you should also be signing up your significant other to take advantage of them, as well as your parents, your grandparents, and even your dog (assuming your dog somehow has a social security number and bank account). If you don’t live in NY, you should fly to New York, download all the apps, stay a night or two (many of the bonuses don’t fund for 24-48 hours), and then leave with the bonuses having paid for your trip.

But the other reason I wanted to highlight them is because I have no clue how the hell any of these companies are going to realize a positive return on the deals.

I understand how customer acquisition cost and lifetime value works. I get that bringing an avid sports fan / bettor onto your app right when gambling goes live in NY can create a lot of value over time.

But I don’t understand how businesses can create positive value from the amount of free money that’s being given away.

Consider Caesar’s, since they’re the outlier in terms of over quality. They’re givign away free bets; if you assume those bets are ~50/50, they’re effectively giving away $1.65k for a $3k deposit. Now, it’s not quite that bad, since you do need to do some betting to unlock all of that money, so Caesar’s will pick a little bit back in spread fees and everything…. but I just having trouble believing that the average customer Caesar’s is grabbing has a life time value of more than $1.65k. And that’s even ignoring all of the people who are going to be gaming the system to take advantage of the free money; I signed my wife up for the promo, and I can guarantee you she is going to have a lifetime value of zero after this promotion. And anyone who takes me up on my suggestion to fly to NY and download the app for the promos is going to have a pretty low lifetime value as well!

I can’t claim to be an expert in the industry, but DKNG has a quote that they acquire customers expecting a 2 to 3 year gross margin payback. Again, I’m not an expert, but it seems there’s no chance in hell even the least generous offers ever break even here. I’ll use the simplest offer to highlight this: Bet River’s $250 deposit match (I believe that’s the lowest EV offer out there). NY has a 51% tax rate on gambling, which is astronomical (NJ has a 13% tax for comparison; NY also raked operators for a $25m license fee and $5/m year to host servers). That tax comes out of gross gaming revenue (what the casino makes after they payout wins/losses), but if you assume the average person is losing 10% of everything they bet (i.e. for every $1000 I bet I’ll end up with $900 and the casino will keep $100 in the long term), then Bet River’s is going to need the average person to bet $5k to break even on just that $250 deposit match (w/ a 10% loss rate, $5k in bets turns into $500 in revenue w/ for the casino, of which ~50% is taxed so they keep $250).

Again, I’m not an expert, so you can play around with those numbers. Maybe my lose / keep rate is too low for the casino. But however you play around with the numbers, I just don’t get to any reasonable number that suggests what the sportsbooks are offering comes close to generating value for them. And remember- Bet River’s matching offer is probably the most conservative of any of the sportsbooks!

BTW, that analysis is just the breakeven on the bonus payouts. I haven’t even started talking about all of the other costs (the referral fees I mentioned at the start of the post, the $25m in licensing fees to the state of NY just to operate, the astronomical amount they must be spending on advertising given literally every ad I’m getting hit with right now is a sportsbook ad, etc.). Nor have I factored in how many people are doing what I’m suggesting my friends do and just download the apps / take advantage of the bonuses and cash out (I am far from the only person to suggest taking advantage of these offers; there’s a super active reddit post advertising the exact same thing).

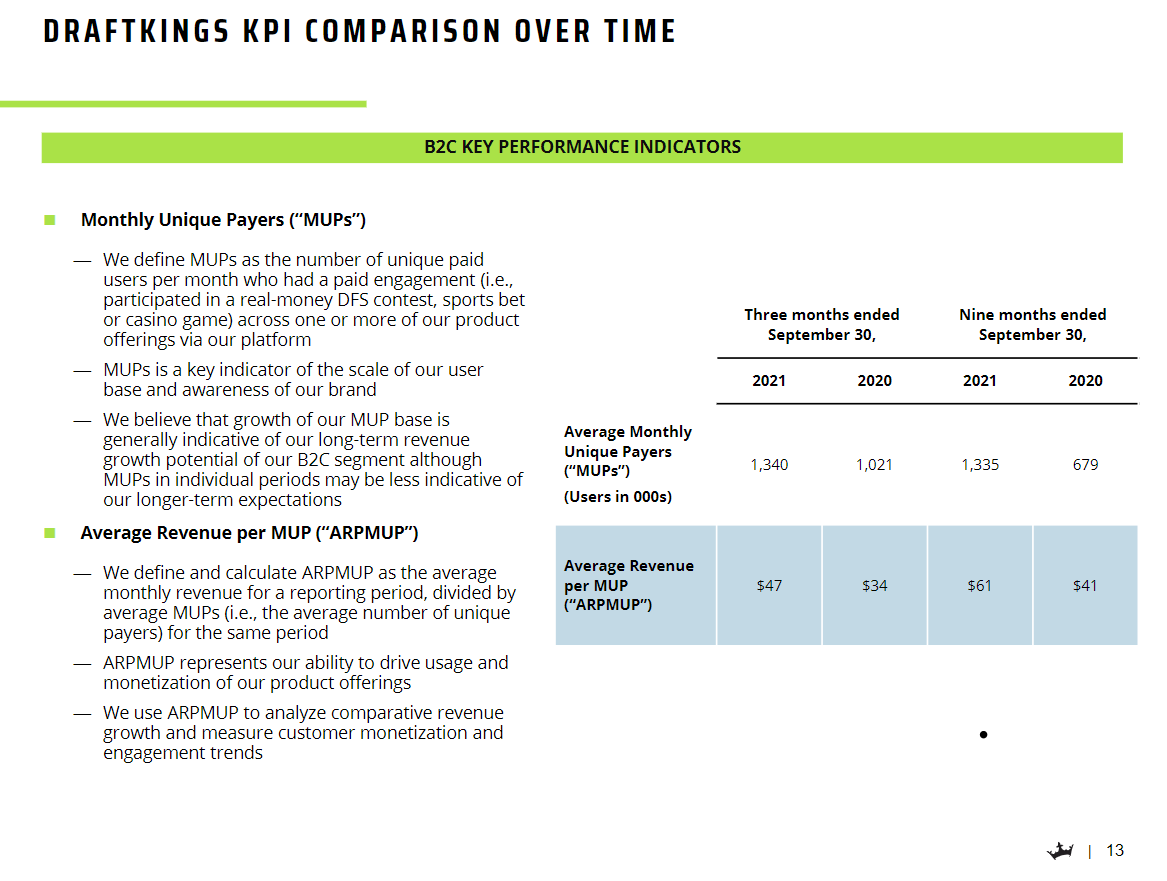

My first way of looking at the economics of a customer (showing a $5k in annual bets w/ 10% loss above) was a “fun with numbers way” that was reliant on assumptions (particularly the amount of each bet the casino wins / keeps), so let’s try another maybe less assumption driven method. DraftKing’s Q3’21 earnings had ARPMUP (Average Revenue per Monthly Active Player) at $47 in Q3’21 and $61 for YTD’Q3. Let’s just use the higher $61 number; that would suggest the average customer does $732/year in revenue ($61 * 12).

DKNG’s gross margin for the first nine months of 2021 was ~35%. If you used that number on DKNG’s ARPMUP, the average user is doing ~$250/year in gross profit. Bet Rivers was paying $250 in deposit matching promos, so that simple math would suggest they are within the Draft Kings “2 year gross margin payback number”…. except that NY’s tax rate is materially higher than pretty much any other state (again, NJ is the low teens and NY is 51%). Adjust for the tax rate…. and I just don’t know how any of these companies (particularly the ones with the more generous terms) are acquiring customers profitably at these levels (and that’s ignoring the massive marketing ramp, the people who are just going to sign up for the bonus and then leave, etc.).

Bottom line: no matter how I cut it, I don’t see how the operators make money from the business. It just seems like they’re lighting money on fire. I understand that in a “land grab” business you can spend a little bit upfront to crate value on the back end, but you have to model it properly so that you’re spending less than each customer is worth. I’d love to see the math that shows Caesar’s is acquiring customers profitably with ~$3.3k in free / matched promo money (particularly once you factor in the people like my wife who are only going to sign up for the free money); I’d also love to know what drugs the people who are running the models that suggest $3.3k in matched / free money can create profitable customers are taking (I’m pretty sure those drugs are not legal in New York!).

Anyway, the original (and main) reason I wrote this article was to encourage all of my friends to come visit me for free. But I also wrote it because I’d noticed that all of the companies that seem to be leading the charge in grabbing market share in NY have way, way underperformed the market over the past three months. DKNG’s been cut in half. Caesar’s is down 20%. Rush Street (which owns Bet Rivers) is down >30%. The market is basically flat over that time, and someone like WYNN or MGM is pretty much inline with the market. Both WYNN and MGM have online plays, but I believe neither is in the New York market yet (I certainly haven’t seen ads for them, and I just checked the BetMGM app and it doesn’t appear live in NY).

So I’ve been wondering if the market has pre-emptively been penalizing these companies for lighting money on fire to “win” the NY market.

It’s kind of funny; all of these companies were high multiple / growth stories that were trying to please Wall Street with tremendous growth and winning land grabs. But it seems they took that strategy too far literally in Wall Street’s back yard, where it was beyond obvious to anyone that they were making offers that could never be economical, and Wall Street has punished them for it.

I don't know the specifics of the fine print on these offers and they may be different, but historically, it is very difficult (you have to be on a major heater) to cash out any bonus bets. In other words, even if you win a bet using the bonus money, they won't let you cash out the bonus or the winnings until you've reached some ridiculous (nearly unattainable) threshold.

For free bets, the best way is to put it all on a longshot in the 4/6-1 range, and spread that around the different books. You win less, but your payout is much better than, say, betting opposite sides at different books. The math looks like a X^(1/2) chart, but if you do 95-1 longshots your will run out of sportsbooks before you win.