What will Ophthotech do with all that cash? $OPHT

This week, the blog’s focusing on companies trading below net cash value.

Net cash investing sounds boring and safe, but I’ve generally found it to be highly volatile.

Ophthotech (OPHT) trades below net cash; the question is what management is going to do with the money.

Last week, the blog’s focus was on companies with a subscription model (SHOR, VG, and FC; all of which I’m long in various sizes), particularly ones that are undergoing a switch to a subscription model.

This week, the blog’s focus will be on 3 companies that are trading below the value of the net cash (cash less all debt) on their balance sheet.

Before I go to the first company I want to talk about, a quick note. I’ve always felt buying companies for less than cash is the most pure form of value investing there is. However, these days, markets are pretty efficient (activists have generally “picked over” the good companies that trade below cash and forced them to do something), and in general when a company today is selling below net cash it’s for a reason (generally investors are concerned by some combo of management incompetence, management greed, inaction, fraud, or high cash burn). So while it may seem like buying companies below cash is relatively safe, I’ve actually found it to be a pretty high volatility strategy. For every 10 companies trading below net cash, I would guess that ~5-6 of them tread water, 2-3 of them end up taking serious capital impairments, and 1-2 of them double or more. I don’t have scientific evidence to back that up; that’s just been my general experience w/ companies trading below cash. You could probably skew the stats by only taking specific subsets of the net cash market; for example, some family controlled companies have small floats and pristine / cash rich balance sheets built up over years. Your risk of permanent capital impairment in those family controlled companies is pretty low; in general, those trade below cash because the cash on the balance sheet is worth so much more than what the actual underlying business is worth that the market is just time discounting back the value of whenever the cash will actually be returned.

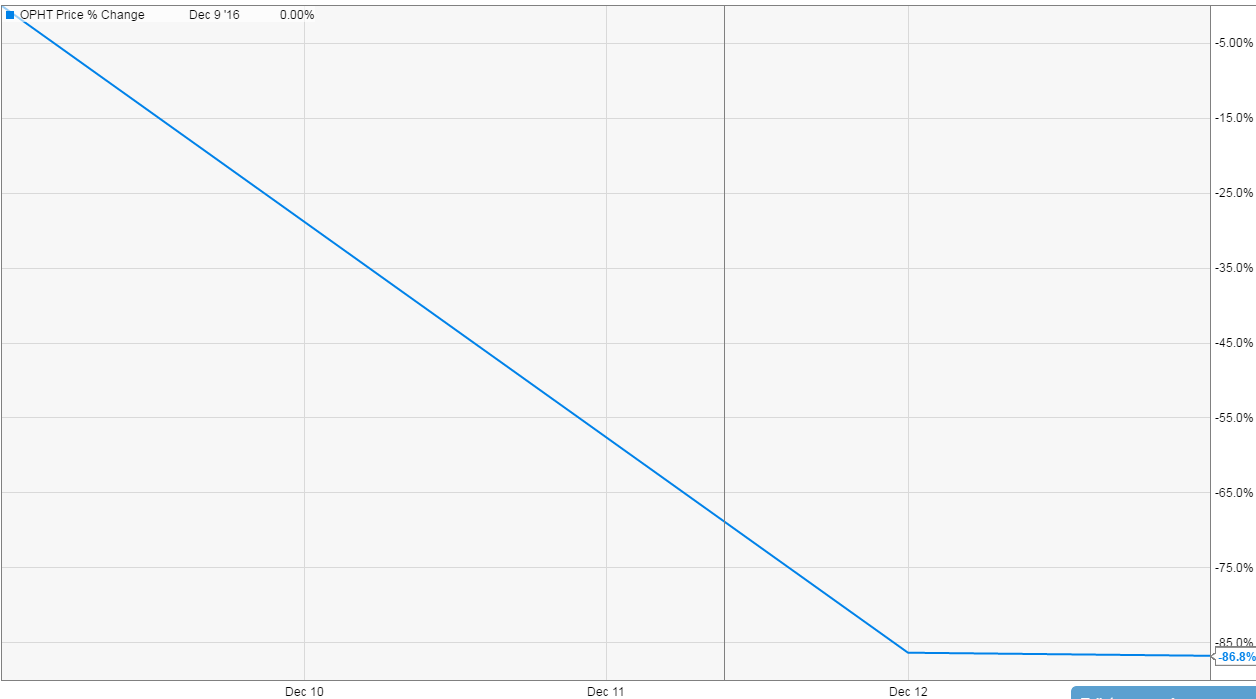

Ok, with that out the way, the first company I wanted to focus on is Ophthotech (OPHT; disclosure long in very small size). OPHT is a completely busted biopharma company. People had high hopes for their Fovista drug, but on December 12th the company announced the drug had not achieved either of its endpoints in phase 3 trials. The poor trial resulted in a complete stock price meltdown, one of the most depressing conference calls I’ve ever listened to, and a wave of hilarious analyst downgrades (“Morgan Stanley cuts Ophthotech to equal-weight from overweigh; Price Target lowered to $7 from $99”.)

However, I think shares have gotten pretty interesting in the wake of the massive sell off. At September 30th, OPHT had $320m in cash + available for sale securities; they also have an income tax receivable of ~$24m. They had no debt and minimal liabilities (if you look at their 10-q, they have $200m+ in deferred revenue and a $125m royalty liability, but both of those liabilities are related to Fovista and are non-recourse / basically worthless now).

So, even ignoring the $24m income tax receivable, OPHT has ~$9/share in cash on their balance sheet versus today’s stock price <$5. Yes, the company is burning money, so the cash balance will probably be a lot lower by year end- Q4’16 cash burn will probably be pretty bad as they were completing the failed trial and running a few more, but the company is also doing a lot of things that you want to see from a company trading way below cash value (firing the bulk of their work force and shutting down trials on the failed drugs, letting go of some of the senior management you no longer need, etc.). They did pay some of their remaining top brass a retention bonus this year, which I find both hilarious and awfully depressing (what do you think the board said to themselves to justify giving these out? The mgmt. team had just overseen a failed trial that evaporated hundreds of millions of shareholder value; are other companies really going to be fighting over themselves to poach them if OPHT didn’t give them an extra bonus?).

Anyway, there’s no doubt that the cash on OPHT’s balance sheet has value. The question is really just what OPHT does with the cash and how much of it they’ll burn.

Cash burn- OPHT was burning ~$25m/quarter for the first three quarters this year. They’ll probably burn a decent bit in Q4 as well, but I would guess cash burn drops significantly in 2017 given all of the Fovista trials are behind them and they’ve fired most of their work force. We already know they’ll burn ~$15m in their restructuring; if we assume they burnt another $25m in Q4’16 and will burn an additional $30m in 2017 on top of the restructuring cash (puts their cash burn for 2017 around in line w/ where it was in 2015), the company would exit 2017 w/ ~$250m in cash (excluding anything they get from that tax receivable), or ~$6.33/share. That feels like a pretty decent (maybe even conservative guess) to me, but I’d be interested if someone else has insight into a more accurate guess.

What do they do with all that cash? The $250m question. I have no idea. I’d prefer if they just called it a day and gave the bulk of that cash back to investors, but that’s probably not happening. Insider ownership is nonexistent, there’s no controlling shareholder, and the board is staggered. Management is probably going to do something with that cash, and shareholders just have to hope it makes sense.

Is there any other value here? Actually, yes. The company also has Zimura, a development drug in phase 2/3 trials. Honestly, I don’t have a real view here: it’s pretty clear the potential for Zimura is way below Fovista, but that doesn’t mean Zimura wouldn’t have some value if approved. At today’s prices, investors clearly aren’t paying anything for Zimura, so as long as management isn’t completely lighting money on fire developing it (not an impossibility by any stretch), it’s probably a nice source of upside.

Ultimately, the range of outcomes with OPHT is pretty wide. Maybe an activist fund comes in and forces them to return cash to shareholders and sell Zimura to someone better suited to develop it. Maybe they use the cash to buy up some new developmental drugs that work and shareholders make a fortunate. Maybe they buy some drugs that don’t work and shareholders are left holding a bag.

But, trading at ~75% of my estimate of their cash balance of year end 2017, and with at least one drug with some potential value, I think OPHT represents an interesting speculative bet at these prices.