I’ve mentioned a few times (most recently here) that I’m a little confused by the price of commodity and cyclical companies. The basics of this confusion are simple: commodity prices have absolutely ripped higher, and while many of the commodity stocks have seen their stocks go up, their stocks have not gone up even close to as much as the underlying input’s increase would imply.

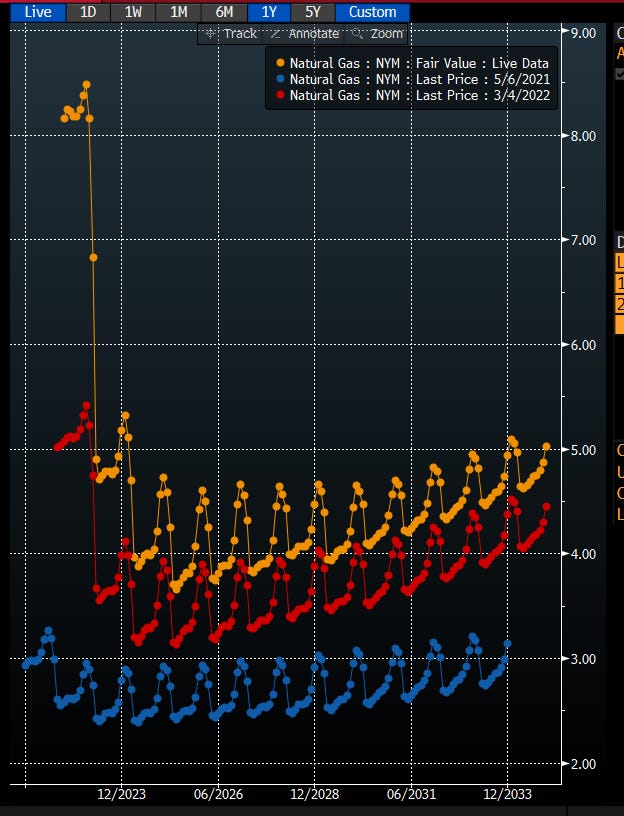

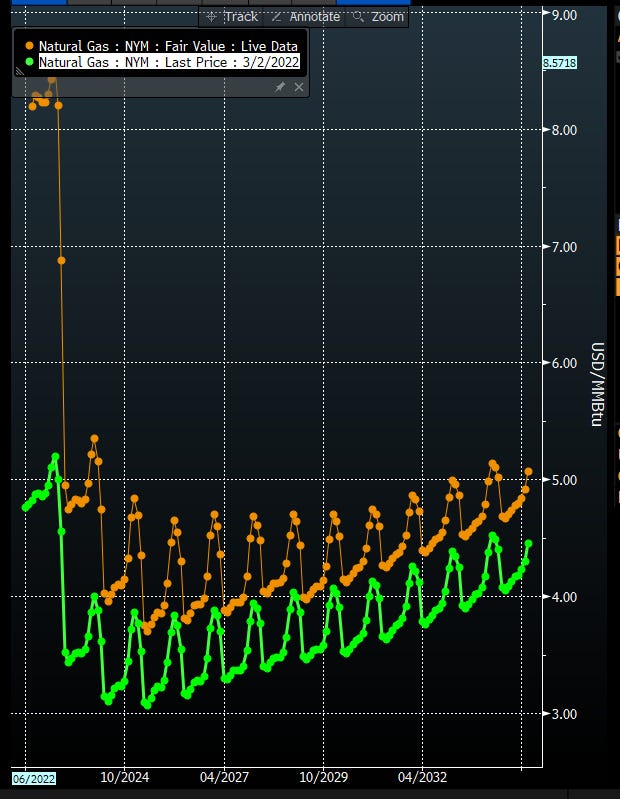

For example, below is the Nat Gas curve today versus in early March (red) and one year ago (blue).

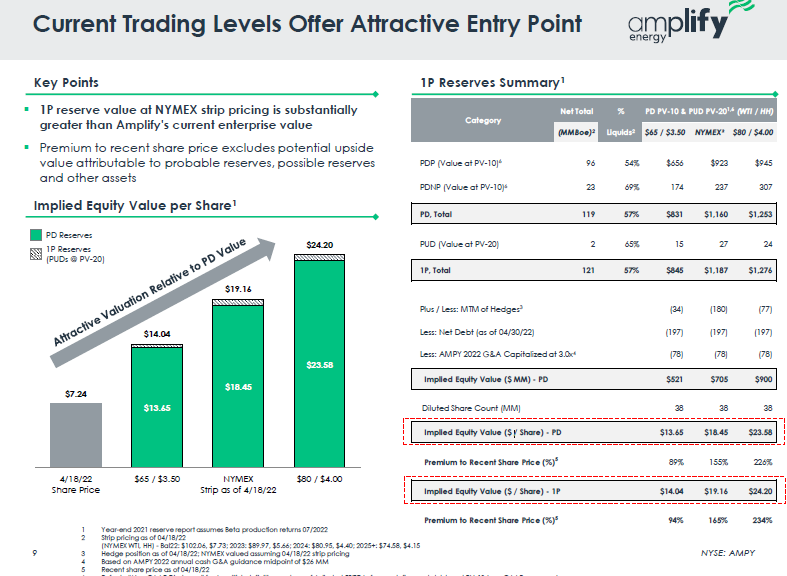

Stocks with nat gas exposure are up, but they’re generally not up close to as much as they should be if you believed in that nat gas curve. It’s tough to compare “stock price move to nat gas move” given leverage (both financial and operating) for these companies, so the best short hand way to do this comp is just to compare price to PV-10. So, to pick a current favorite and one I’ve discussed with my friend Tim Weber quite a bit, AMPY today trades for ~$7.50/share, and their PV-10 was worth >$18/share as of mid-April (and strip is a nice bit higher since then).

I chose AMPY because the Beta spill caused them to remove basically all non-producing assets from their PV-10, so you can look at their PV-10 more as a “this is the present value of cash flows of currently producing wells” versus some other companies where you might need to assume some wells successfully come online or something.

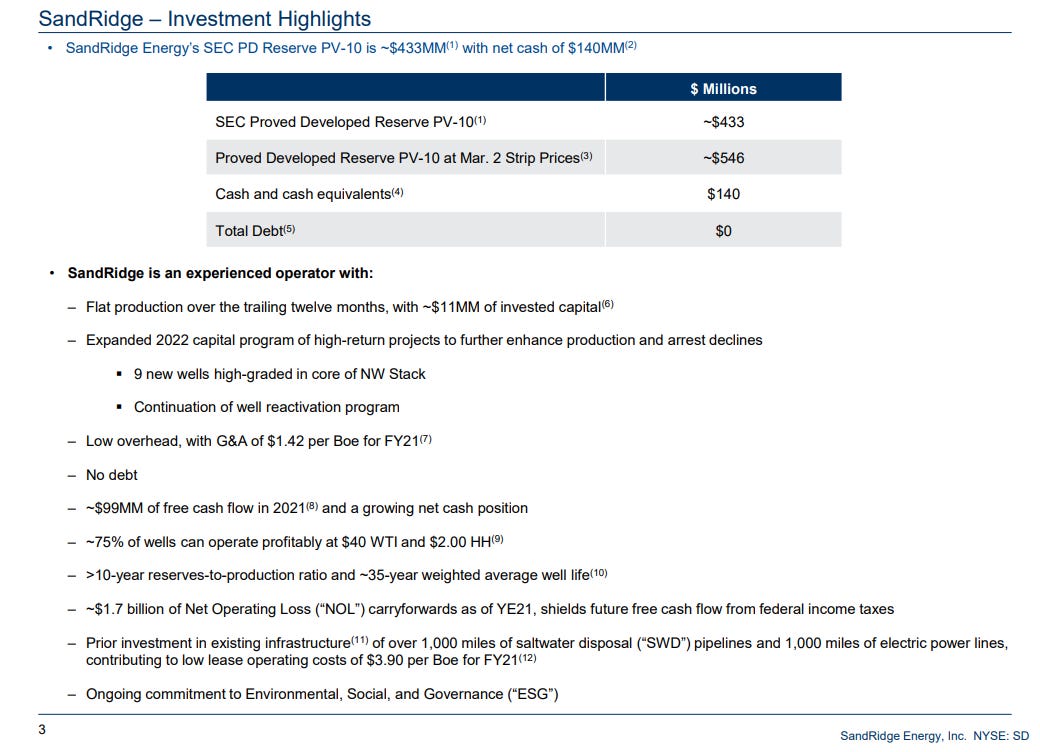

Of course, AMPY has Beta risk (though I’d argue the current share price is more than covered by the value of their non-Beta assets), but this “share price isn’t reflecting the curve” argument applies to plenty of other companies. For example, my friend Josh Young recently wrote up SD. Today, shares trade for ~$20/share, which gives them a market cap of ~$750m. At the end of Q1’22, SD had $166m in cash on their balance sheet, so their EV is just under $600m.

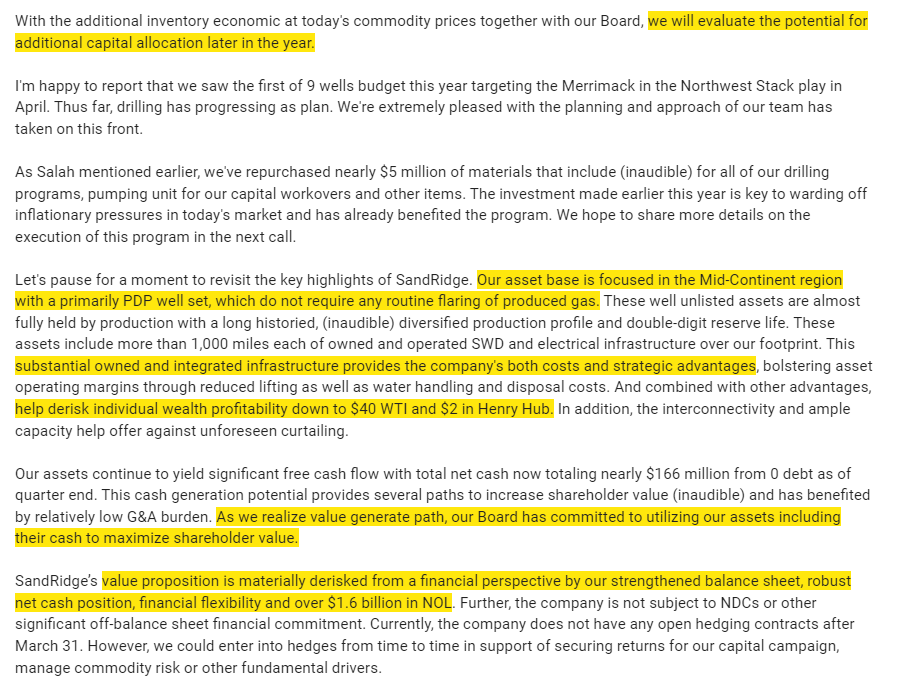

In March, SD published an investor deck that noted at the then current strip their PV-10 was ~$550m.

Here’s the nat gas curve today versus March 2nd (SD has oil exposure too, but that’s up too!):

So, in effect, at current prices you could say you’re paying March strip prices for SD even though prices have skyrocketed higher.

I get there are way more complexities to investing in an energy company than just looking at their PV-10 and saying “the stock is trading for less than PV-10!” But it seems to me the market is selling a bunch of energy companies at prices that show extreme skepticism of the current energy curves.

You can think of a variety of reasons why the market would discount these equities. Maybe the market doesn’t believe the PV-10 for an individual company or there are company specific issues (like with AMPY / Beta). That’s fine…. but this discounting is happening sector wide.

The two most likely reasons for the sector wide discount are:

The market is worried management teams are going to look at current prices and plow all of their cash flow into M&A and drilling new, high cost wells….. and then the companies will blow up when the cycle turns (this is what I like to call “going wildcatter”).

The market flat doesn’t believe the commodity curve.

But #1 is solvable with shareholder oversight, and #2 is solvable with financial engineering.

Which brings me to the question I’ve been thinking about recently (and the purpose of this article): when are we going to see activist funds and private equity step into the energy space?

It just seems like the opportunity is too big to ignore.

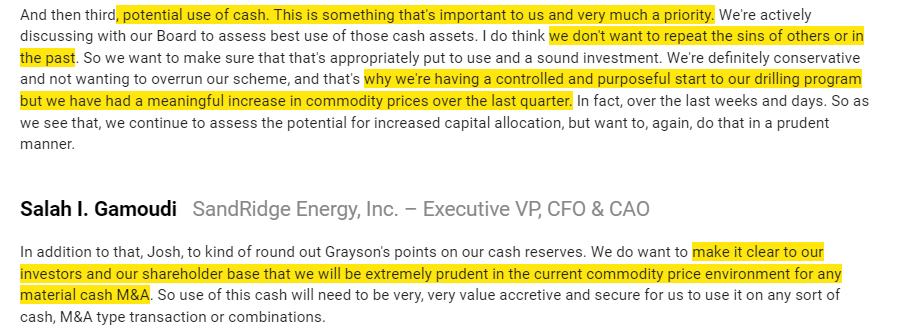

If the market is worried about #1 (management teams pursuing awful capital allocation)…. that’s what activist funds were made for. Buy a ton of the company, put someone on the board, and ensure that the huge cash flows the energy companies are generating get returned to shareholders and not spent on speculative projects or overpriced M&A. Note that I chose SD for one of my examples; that was not a random coincidence. Carl Icahn is the largest shareholder and I think they’ve been pretty clear they’ll follow a path similar to what I’m discussing here (quote below from their Q1’22 earnings call).

One more SD quote for good measure; they could be lying, but it seems pretty clear SD isn’t going to “go wildcatter” on you.

If the market is worried about #2 (not trusting the commodity curve)…. that’s solvable by either activists or private equity. Buy the company, slap a ton of leverage on it, hedge out the whole curve, and use your now completely hedged cash flow to generate a ton of cash, pay the debt down, and return cash to shareholders.

There’s a reason I focused on energy for this post. I think you could make a similar claim (that a company trades for way under the commodity curve / current prices) for a variety of commodity / cyclical companies. But lots of those commodities aren’t easily hedgable; for example, lumber companies should be printing money right now, but I think it’s very difficult to hedge lumber in any reasonable size, so you face the risk that prices collapse. But oil / energy markets are insanely liquid and hedgable, so you could easily pursue the “hedge the curve and pay out cash flow” model; in fact, there are several companies (like CNX) that already do exactly that!

Arbitrage opportunities don’t last forever. Eventually, someone comes along and takes advantage of them. As a generalist, I keep looking at energy curves versus where the equities are trading and saying “what am I missing?”, and I keep coming back to people just don’t believe the curve and/or don’t trust management teams. That’s an arbitrage opportunity, and eventually some activists and/or private equity firms are going to come along and take advantage of them and make a fortune while doing so).

(PS- think I missed something, or have an energy company that looks particularly appealing? I’m always open to being told I’m wrong or for now ideas; feel free to slide into my DMs!).

(PPS- we have seen private equity do the type of “buy the company, hedge the curve, milk the cash flows” trade before. This was exactly what the plan was for TXU, which ended up becoming the largest bankruptcy in history. However, it’s been a long time since that trade failed, but if I remember correctly the issue there was PE paid a really high multiple and only hedged nat gas for a few years. Also, they were doing a bit of a bank shot by buying coal plants when nat gas was the marginal producer. For the trade I’m recommending, the energy players are trading at much lower prices, so you’d only need to hedge a few years of prices to be able to cash flow your whole equity check, and these are direct plays on energy prices (unlike TXU, which was a bank shot)).

Its a good article and I lean more to 2 than 1. Mgmt teams nowadays are hyper sensitive to the external environment. However it is impractical to hedge out the curve. Many products are illiquid after a few months. Hedging the benchmark means taking on basis risk. Physical hedges maybe but that too is complicated in size longer dated.

In theory: Energy producers owned first and foremost a physical call option on futures. So it's logical that as this option moves deeper into the money, that the extrinsic value premium in the p/pv 10 ratio should go down.

Now I agree with your argument in practice in terms of magnitude of the delta :)