Welcome to part two of the “Why the low multiple: rental car companies” series (for more on the “low multiple” series in general, see my intro post here). In part 1, I provided a ton of background on the rental car companies and then dove into the bear case.

If you’ll recall, I ended part 1 on a pretty glum note. To recap, I’ll be honest: the bear case is much more persuasive than I thought it was when I first get interested in the industry.

Given that persuasive bear case, what could possibly be the bull case?

Let’s start with the simplest bull case: these companies are really cheap. As I mentioned in the prior post, at current pricing, Avis is currently trading for ~4x 2023’s net income. Their current market cap also roughly matches the total of what they earned over the past three years. So you’re kind of looking at the commodity bull thesis I laid out in the introductory piece; yes, Avis is probably overearning now…. but pricing isn’t falling off a cliff currently, and every day it doesn’t fall off a cliff is another day that a nice piece of their market cap comes back to investors in cold, hard cash. In fact, Avis is a little better than that; a lot of the commodity companies I mentioned in the original piece were overearning on a ~6 month look back basis; Avis has now been “overearning” for about three years. At what point does that earnings level stop being overearning and start just being the new normal for earnings? (Avis and Hertz certainly would suggest the industry has improved a bit since COVID; for example, Avis’s Q3 earnings call mentioned, “We interpret this as a sign that the industry supply and demand dynamics are well matched and resulting in RPD that's roughly 30% higher than pre-pandemic levels. Is this the new normal? Maybe so, but it's apparent that we are back to a more normalized seasonal trends just at a much higher level.”)

The bull case evolves with two more things I said in that paragraph: “a nice piece of their market cap comes back to investors in cold, hard cash” and “At what point does that start being overearning and start just being the new normal for earnings?”

Starting with the first point (a nice piece of their market cap comes back to investors in cold, hard cash): Avis and Hertz are both aggressive capital returners. Avis did $2.7B in free cash flow in 2022 and bought back $3.3B of stock. Again, their market cap today is roughly $6B. Hertz did $1.5B of free cash flow in 2022; they bought back ~$2.5B of shares. Their market cap today is ~$3B. Both companies have remained reasonably aggressive returning cash to shareholders in 2023, though their cash returns are down a bit simply because earnings are down.

Cash returns to shareholders matter in a few ways. Yes, it’s generally nice for investors to have capital returned from their companies…. but it’s really nice from these low multiple companies. Lots of low multiple companies that are seeing cash flow pour in during a boom like to go and spend it growing their business or on acquisitions (what I like to call empire building risk). That Hertz and Avis are so focused on investors helps limit that empire building risk. Relatedly, a big piece of the current boom comes from the rental car companies not taking up supply (i.e. buying cars) to meet rising demand (or replenish cars sold during COVID). If everyone in the industry is returning all their capital to shareholders, then there’s no capital left to grow industry supply! Finally, the repurchases magnifies the potential upside (and downside). If Hertz and Avis are going to deploy all of their cash flow to capital returns and the market is going to trade them at a low multiple…. well, if the market is wrong and the current boom lasts just a little bit longer than anticipated, that’s generally a recipe for some really wild stock price performance. Look no further than what has happened to DDS stock over the past 20 years to see the power of continuing to pour cash into share repurchases when the market doubts your value and trades you at a low multiple (and notice that the rerating can happen really fast; eventually, all of the free float of your stock starts to dry up and the market is sort of forced to notice your value!)

Let’s turn to the second point (at what point does that start being overearning and start just being the new normal for earnings), which will transition us nicely to addressing some of the bear points on fundamentals. If you’ll recall from the first post, a big piece of the bear piece is that rental car companies are way overearning on two fronts: revenue per day (RPD) has inflated from a consistent ~$40/day early last decade to over $70/day today, and used car pricing has gone ballistic resulting in unsustainable gain on sales.

I think bulls would push back directionally on both arguments; I doubt anyone in the world thinks current profitability level is completely sustainable (particular on the used car prices), but bulls would push back that saying things are instantly going to deteriorate to mid-2015 era profitability ignores a lot of structural changes.

On the revenue front, bulls would likely point out that the industry has consolidated to an oligopoly (Hertz owns Dollar and Thrifty, Avis owns Budget, and privately traded Enterprise owns National and Alamo). This chart from 2018 is a little dated (Hertz is a smaller piece of the pie now; I just can’t find any good updated charts!), but it’s still directionally correct: the big 3 control almost 100% of the industry.

The industry basically hit its consolidation once Hertz bought Dollar Thrifty in 2012. The rental industry is one where scale matters; I’m not saying it’s impossible to start a competitor up, but it would be really difficult. Imagine starting up a rental car company and all the disadvantages you would face. To start, higher prices: Hertz and Avis buy tens of thousands of cars every year, so they’re going to get the best prices on new cars. Good luck matching that price as a new player looking to buy a few cars. And then you’d have network issues: sure, lots of people want to rent a car for a day to drive somewhere and drop it off at the same location….. but a lot of people want to rent a car at point A and drop it off at point B. Hertz, Avis, and Enterprise already have nationwide networks; it would take years for a start up to match that coverage, and in all of those years a huge piece of the rental market would be off limits to them. And that network isn’t important just for people renting cars; cars are a mobile asset, and being able to pull cars into areas when the demand is larger is a big part of running a rental car company (i.e. if demand is off the charts in Denver, HTZ and CAR can start moving cars from elsewhere in the nation into Denver to take advantage of that demand and optimize their network. A start up wouldn’t have that option available). Those are just two barriers to entry, but I could dream up dozens of others both big and small (in particular, getting airport space is very difficult).

Anyway, I think a bull would push back on the bears with an industry structure argument: how many industries where scale matters / potential new entrants face daunting barriers do you know of that have consolidated to three players that haven’t generated some economic profits?

Now, bears would have another push back: Hertz / Dollar merged in the early 2010s. That merger took the industry down to three players. If you recall from my first post, I showed that RPD at Hertz was flat from 2014-2019, so they weren’t really making an economic profit during that time. If the industry is so good, why didn’t you see some economic profit by 2019, almost six years after the merger?

It’s a great question. I’m not an industry expert; I don’t have the answer. However, it is possible the Hertz might have been a little mismanaged.

Let’s take a look at Avis’s RPD over the past decade. Here’s Avis’s 2012 earnings release showing revenue per day way ~$41 in 2011 and $40 in 2012..

Here’s the same table in 2015; again, ~$41/day:

2017 earnings release; new year, same story:

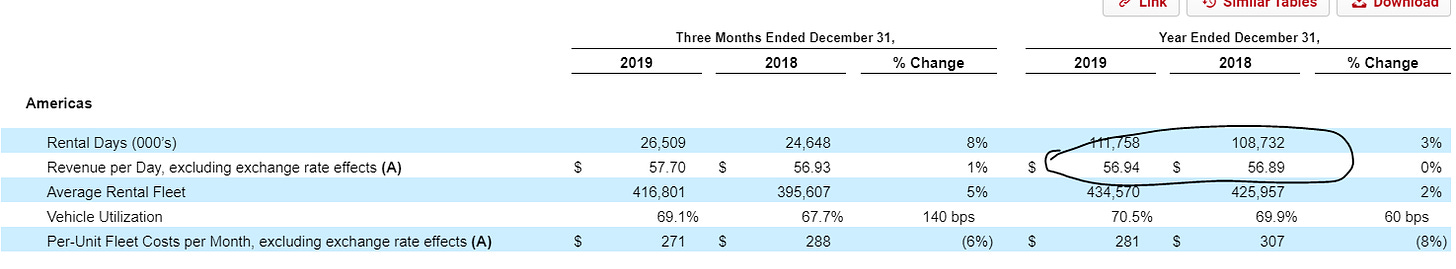

But let’s turn to their 2019 earnings release (i.e. right before COVID). What’s this? RPD is suddenly over $55/day two years in a row?

And today (on the heels of COVID), Avis is doing ~$75 revenue/day right now.

It is interesting that Avis was seeing some RPD acceleration before the pandemic spiked. Maybe it took a few years, but the industry structure improvements were starting to kick in in 2018/2019, and Hertz was just mismanaged and not set to realize them yet?

I don’t know, but I think bulls might argue that bears see the current cyclical boom as purely COVID driven, and they are missing that the industry has markedly improved over the past decade (thanks to consolidation).

Let’s turn to used car pricing. I doubt anyone thinks the current used car pricing boom is sustainable…. but I think bulls would push back on bears to define the downside to used car pricing.

Using some numbers might show this best. In 2019, before gains and losses on used car sales, Avis reported ~$270/vehicle/month in depreciation (they mentioned on their Q3’23 call that their sustainable D&A is probably ~$300/vehicle/month, but let’s use that 2019 number just for consistency between posts). After gains and everything, Avis reported ~$105/vehicle/month in depreciation in 2022. Avis’s worldwide fleet was ~650k cars in 2022; if we just applied the difference between 2022 and 2019’s depreciation/month to that fleet, Avis would report an extra ~$1B in depreciation expense in 2022. AVIS generated ~$4.1B in EBITDA in 2022, so adding that extra depreciation expense would take them down to ~$3.1B in EBITDA (note: Avis and Hertz both report EBITDA after depreciating their cars given that’s a normal operating expense). Avis’s EV is currently ~$10B, so you’re talking about a just over ~3x EBITDA multiple on those numbers. Not exactly a disaster if pricing normalizes!

Anyway, I realize I just threw a wild amount of math at you; here’s an excel table that shows the math I was working off (and apologies for formatting; I’m still working largely with one hand due to my pec injury and too lazy to properly format. Also, I ignored some currency effects and used year end fleet numbers instead of average fleet numbers so my numbers may slightly defer from the company’s if you recreate them yourself, but they are close enough it’s not worth splitting hairs over).

And here’s what I look like after writing all that:

But what I’m trying to hit you with is this: yes, used car pricing has been a huge tailwind, but I think you can normalize for used car pricing and these companies still look cheap.

There’s also a tie between used car pricing and industry profits that I think is worth pulling on. Used car pricing is inexorably tied to new car pricing; used car pricing went ballistic post COVID in large part because there was a new car shortage. In my first post, I mentioned the saying “the cure for high prices is high prices”; people say this because an industry flush with profits generally spends that cash increasing supply, which eventually sends prices back down. Well, rental car companies would generally increase supply by ordering more new cars…. but, either through luck (a forced new car shortage) or skill (being disciplined about new supply and instead returning the capital to shareholders; as mentioned above, cash that you return to shareholders can’t go to growing supply!), you haven’t really seen the rental car industry respond to the increase in RPD with a huge increase in supply; in fact, industry supply today may be lower than it was pre-COVID. At the end of Q3’23, Avis and Hertz had ~950k vehicles in their combined domestic fleets, down from ~970k at the end of 2019.

Why? Hertz had to liquidate a ton of cars during their bankruptcy and while they’ve been trying to ramp back up they’re still way below where they were pre-COVID.

Maybe that discipline crumbles going forward…. but it’s worth remembering that ICE vehicles could be viewed as a sunset industry, and new car production has been on a downward trend for decades. Perhaps Avis and Hertz keep disciplined when it comes to growing their fleets. Perhaps their suppliers (the car companies) force discipline on them by continuing to underproduce. Or perhaps used car prices stay just a bit elevated thanks to the car companies slightly underproducing cars. Any which way, I could easily paint a picture where profits come down from the current record levels but still stay way above pre-COVID trend lines.

Anyway, I’m running wildly long on this piece (and series). There’s a few more bull points I want to address that I’ll hit in the odds and ends.

But I guess I’ll wrap up by giving you my take: I’m not hugely swayed by either side in this argument (and, since I wrote both sides, perhaps that means I was either incredibly unpersuasive in writing both sides or I was so incredibly persuasive that it’s impossible to chose one). I think both sides have really good points and debates…. and having good points on both sides is kind of what makes a market.

If you held a gun to my head and asked me which side I’d favor…. well, I have to ask you if you were asking for batting average or slugging percentage on my prediction.

If you were asking for batting average (meaning we only cared about being chance of correct and didn’t care about magnitude), I’d probably lean towards the bear side. The rental car company profitability today is just so far above pre-COVID level that I can’t imagine they don’t have some regression.

However, if you asked me for slugging percentage (i.e. you don’t have to be right more than you’re wrong because when you’re right you make significantly more money than you lose when you’re wrong), I’d way, way, way lean towards the bull case. The rental car companies are trading at a low multiple and returning capital aggressively. If this works in any way, shape, or form, it’s going to work huge. When something “works huge”, it doesn’t take a huge percent chance of payoff to turn it into a positive EV bet (i.e. if you have a 10x on the upside, even if it only has a 15% chance of happening that’s a very positive EV bet and that assumes a complete 0 the other 85% of the time). I think there’s a good chance the rental cars work and work big.

And, if that happens, shareholders are likely looking at multiples from today’s prices.

So the bear case may be more likely, but I’d rather be betting with the bulls here.

Odds and ends

As I was getting ready to post this (morning of January 11th), Hertz filed an 8-K noting they were selling and writing down about a third of their EV fleet. There’s a lot of interesting stuff in there; Hertz mentioned they will be reinvesting some of the proceeds into ICE vehicles (which makes one wonder if the industry will be as disciplined on supply as the new car shortage lifts), and if you look through the write off at their EBITDA number it seems clear that windfall profits rapidly disappeared in Q4.

A big part of the bull thesis would be industry improvement, and part of industry improvement would be some ability to raise prices and have that drop through to the bottom line. This line from HTZ’s Q3 call would be music to any bulls ears, “it was at the JPMorgan conference quite publicly in the summer, we were at that point, orchestrating a price increase on Hertz. And we were able to do that in a way where we saw very little in the way of degradation of volume but bringing price up. And remember, price runs about 80% to the EBITDA line.”

Part of an industry consolidating to an oligopoly is scale / network benefits that preclude new entrants. I think rental cars check that box today, but I certainly could be wrong! SIXT and Europcar (through fox rent a car) have both been trying to expand domestically; I’ve never really seen either so perhaps I’m letter my own worldview bias me on ease of entrants!

As I was finishing these articles up, I saw a CNBC article on used car price outlook for this year. Let’s be honest: no one knows what used car prices are going to do. But if the articles right an used car prices are roughly flat after two years of dropping (from the pandemic unsustainable highs!), I’d guess that’s probably a small positive for the industry.

I can’t tell you how many times I’ve seen companies plow money into buybacks when times are good and then are left desperate when times are bad. Bed Bath and Beyond has to be the best example of this; they spent $900m on buybacks in FY20+21 only to wind up dead in FY22/23. So just because a company is plowing back capital into stock buybacks doesn’t mean they have a great read on the value of their stock or sustainability of their business…. but it is probably worth noting that the rental car companies are very cognizant that their current results are unsustainable and they’re still choosing to direct free cash flow towards buybacks (and this is with management teams and major shareholders who I’d suggest are focused on / incentivized by long term value creation).

I’d encourage you to read Avis’s Q3’23 call. They’re very wide eyed about the industry; they think they can protect RPD, but they’re very clear that the gain on used car pricing bonanza is about to end, (“We have said that we expected our gains to continue to normalize and our monthly depreciation cost to continue towards our gross depreciation of roughly $300 per vehicle. This will happen by next quarter, and we're seeing it reflected in the October results.”). Despite knowing the bonanza will end, they are buying back shares aggressively (“We also deployed nearly $500 million into repurchasing 2.2 million of our shares outstanding this quarter. Given that we strongly believe that our current share price does not reflect the fair value of our transformed company, we will continue to aggressively buyback shares until that gap closes, and this will be reflected in the cash flow usage of our fourth quarter.”)

The rental car companies are very interest rate sensitive in two ways. First, when interest rates go down, the interest costs for the monthly payments on car notes (whether new or used) goes down. So lower interest rates can support used car prices simply by lowering the monthly payment. Second, rental car companies are huge borrowers (both at the corporate level and particularly at the ABS level when borrowing on their fleets). The ABS borrowings are generally done on floating rates, so lower interest rates lowers the ABS borrowing costs and ultimately increases free cash flow.

The rental car companies have taken a lot of cost out post-COVID. To use just one anecdata, post-COVID people have been trained to need less interaction with a desk when renting a car (i.e. before COVID they might have gone to a desk to get their keys when checking in; post COVID they might be comfy going straight to the rental car and using a QR code to unlock it), which means HTZ / CAR need less people staffing their locations (and thus lower costs). Lower costs / increased productivity are interesting: in a perfectly competitive industry, the improvement will get passed through to consumers. In a monopoly, the improvement would tend to stick with the company as increased profits. I think you can make a very coherent case the rental car companies are an oligopoly…. but it’s an open question how much of the improvement sticks with the company versus gets passed on to consumers.

This is a little bit of a wonky one…. but a rental car company is about the most complex business I can think of to manage from a pricing / optimization standpoint (I saw one expert interview where they said airline pricing and optimization is child’s play compared to rental car). Your fleet is completely mobile, so every day you face trade offs between getting cars from one market to the next, locking them up for more days at lower rates versus higher rates for fewer days (i.e. a weekend trip versus a full week), you’ve got tons of different units you need to manage (SUVs versus minivans versus sedans), you have to account for no shows and cancellations, and just a kajillion other variables to factor in….. and you have to do it all in basically real time. Just given that amount of data and complexity, I could imagine a world where rental car companies are one of the real winners from an AI boom; they get higher pricing / better utilization and can fire a bunch of human analysts to boot!

Again, part of this would come down to industry structure. If you believe the oligopoly thesis, productivity from AI gains would accrue to the firm (or at least some of it what). If you think this is pure commodity, it all goes to the consumer!

When considering “normalized” earnings and the pre-covid environment, I think it’s worth thinking about the ride share businesses as well. Remember, ride share is a substitute for rental cars in a lot of cases, and pre-covid rental car companies may have been suffering because Uber and Lyft were REALLY subsidizing rides. This is anecdata, but there are some personal trips I took in 2018 that I chose to uber instead of renting a car because it was way cheaper and more convenient. If I took the same trip today, I think I would probably rent a car because it would prove way cheaper. So I think the environment today is probably a bit better on the ride share front as well; the ride shares are no longer subdizing unprofitable rides, and in fact they’ve opened up a new market for rental cars in a lot of ways (both uber and lyft have partnerships with Hertz for rental cars to open the driver market to people who don’t own cars).

Volkswagon bought Europcar (international rental company) back in 2021, and at their last analyst day they discussed how Europcar was a key piece of “an exciting opportunity for us as Volkswagen Group to change the mobility of the future.” I’m more than a little skeptical that you need a car rental business to be a leader in the mobility business….. but mobility is a huge prize and HTZ and CAR are pretty small in the grand scheme of things. It only takes one giant to think a rental car company is a key piece of the future of mobility to turn these into enormous strategic plays / buyout candidates.

To be explicit about this, the argument for rental car companies would be that any autonomous vehicle or mobility play needs tons of data and lots of logistical capacity for managing a fleet. A rental car company gives you that instantly in one swoop. I am a little skeptical the buy versus build math there (particularly given how much retrofitting for an EV autonomous fleet I’d suspect the rental cars largely ICE and consumer rental based logistics focus around), but I am also not an expert and need to learn more on that angle!

The peak of the bull market for used cars has definitely passed, but there is far too much certainty from the consensus that a return to 2019 prices is imminent. Probabilistically, a new normal that sits somewhere between the two is most likely. Like nat gas rig counts, used car prices are a lagging indicator, since you can't have used cars without new cars. That takes time. The utter dearth of new vehicle production from the height of factory closures has yet to really materialize in the market; the single largest steady supply of used vehicles is returned leased/rental vehicles after 3 years. Where exactly is the glut of supply of used cars that will supposedly crash the entire market going to come from? Manufacturers have only been able to start ramping up production since H1 2023, so those effects won't be seen for even longer downstream. A Tegus expert call with a car industry insider would really be necessary to flesh out the details. Now... if only we knew of a blogger who is sponsored by that company! *wink wink nudge nudge*

Nice article. I haven’t read through any of the filings on either company but CAR and to a lesser extent HTZ have had meaningful capex increases over the past year. In the case of CAR it’s more than double pre-covid levels. Is that lack of discipline, a dramatic upturn in business or something else?