I (somewhat facetiously) consider Yet Another Value Blog (YAVB) and its associated products (mainly the podcast (YAVP) and the blog’s premium side, but also my personal twitter and YAVE twitter account) my mini-empire (which I’ve coined Yet Another Value Empire, or YAVE for the rest of this article); I’m always thinking up new articles and series for the empire or ways to improve it.

However, one of my rules for YAVE is “no navel gazing.” While YAVE is a mini-obsession of mine (and might be for a few readers), in general I’d guess 99% of readers could care less about my plans for YAVE or the logistics behind it. They’re just here for that sweet, sweet content.

Still, everyone’s publishing annual letters these days, so once a year I think it’s ok to break that “no navel gazing” rule, sit back, and detail my plans for my empire in the hopes that you, my loyal subjects, might find it interesting (or provide feedback or support that can help improve those plans or take it to the next level).

But before I lay those plans out, let me detail the overarching requirements for everything in YAVE. In order for me to justify the time I put into YAVE, it has to be symbiotic with the rest of my life (mainly my work life, but my personal life is important too!). That requirement means that I have to feel like the time I put into YAVE checks three boxes:

Enjoyable: I have to enjoy the time I spend writing the blog and doing the podcast (and communicating with readers and such)

Helps me improve as an investor: The blog and podcast can’t just be enjoyable; I have to think they somehow contribute to my day job by helping me improve as an investor.

Profitable: whether it’s literally profitable in monetary form from the premium side of the blog, or just profitable in terms of the benefits of exposure / notoriety from having a thinly followed finance blog, the blog has to somewhat pull its own weight.

The combination of all of those is important. My overarching goal in my professional life is to improve as an investor for a long, long time. I’m still “only” 35 (though the grey hairs are building up fast….), so I’ve (hopefully) got literally decades ahead of me to enjoy the compounding fruits of investing improvement. If YAVE is helping me to improve as an investor and it’s enjoyable, then I’ll spend more time working, which means more time improving and “levelling up” as an investor faster than I would without YAVE. And, if YAVE is profitable in some form, then it certainly helps justify the opportunity cost of what else I could be doing with my time. And, look, I get people can hear “YAVE needs to be profitable” and think “Man this guy is just going to try to monetize YAVE like crazy; get prepped for a thousand ads and referral links and everything.” But there are other forms of profitability! In particular, I’d consider the exposure of YAVE is a huge part of the justification for doing it (and thus it’s profitable in that sense); I often joke that YAVB has “dozens of readers”, but if it actually only had a few dozen readers I’m not sure I’d enjoy spending so much time on it (as I’d kind of feel like I was just screaming into the void), nor do I think I could justify spending so much time on YAVE if literally only a few dozen people read it. So viewership / readership is a big part of profitability as well as part of the flywheel that makes it all work. If no one was reading / listening to YAVB and YAVP, then I wouldn’t learn as much from all the writing and particularly the reader responses poking holes in my work / thoughts, the guests wouldn’t get as good of feedback from their appearances, and the whole experience would be less enjoyable and less successful in helping me to improve as an investor. So, yes, I understand it sounds very capitalistic / mercenary to say “I need YAVE to be profitable”, but I do I need the whole of YAVE to be at least somewhat profitable / popular (for a niche financial product) in order for the whole thing to be profitable / enjoyable!.

The good news is that, at least so far, YAVE easily checks all three boxes. I love writing on YAVB and talking stocks on YAVP. And both easily make me a better investor; the inbound idea generation from YAVP has been outstanding, and I firmly subscribe to the line of thinking that writing is the best way to improve as an investor (as I mentioned yesterday, I also find writing a little therapeutic), and I think YAVB has definitely helped in that regard (if I wrote as much as I did without a blog and just kept it all private, my wife would probably have me committed and rightly so!). And the whole of YAVE has been profitable enough that I think it justifies the opportunity cost of other things I could be doing with my time.

I know running YAVE is a weird path for a professional investor (and I suppose I am one, though I frequently have imposter syndrome and think I’m just some grown baby play acting as a business man by moving numbers around a spreadsheet), but as long as YAVE passes those three criteria than I’m going to continue to run it as long as I can.

Anyway, that preamble out the way, let’s talk about the four pieces of my empire and my goals and plans for each of them. To rehash, the pieces are:

The public side of the blog (YAVB, what you’re reading right now)

The premium side of the blog

The podcast (YAVP)

Twitter (both my personal twitter and the YAVE twitter account, which I generally just use for tweeting out new YAVE posts)

Let’s start with the simplest goal and plan: the twitter account. I don’t use twitter as much these days for a variety of reasons (including that the new Elon algorithms significantly deemphasize accounts that tweet substacks, meaning my posts get limited engagement / I think I’m somewhat shadow banned). However, I still find great utility from the DMs for twitter, so my goal for the new year is to use twitter to continue to establish some new / interesting DM convos (and maybe pick up a few new followers along the way).

The next most simple to discuss is the podcast (YAVP). My overarching goal for the podcast remains the same: I want to have smart conversations about interesting investment ideas on the podcast. In general, that’s meant the focus of the podcast has been having smart investors on to talk about their best ideas (single stocks). The hope has always been to have the podcast be a mini-flywheel: if the discussions are fun, then it’ll encourage more listeners. More listeners mean each podcast can serve as a catalyst for podcast guests in some way, shape, or form (whether that’s getting more eyeballs on their ideas or getting more eyeballs on their core business; multiple investors have raised money or gotten tons of sign ups to their Substack on the heels of a good appearance), which encourages repeat guests and guests of increasing quality. Increasing guest quality aids in better conversations, which generates more listeners…..

And maintaining that flywheel and focus will remain the overarching goal of the podcast. However, in 2024, I want to experiment with a few new podcast formats.

The idea I’m most excited about is having more “industry experts” from outside of the direct investing area to dive into a topic. The best example of this would be my podcast with Brian Albrecht on the (potential) KR / ACI antitrust case and the stream sponsored podcast on Coinbase’s SEC suit. I think both of those podcasts were hugely informative, and I’d love to do more like them. These types of podcasts obviously lend themselves well to regulatory, legal, or antitrust issues: having a lawyer on to discuss a legal case, have a regulatory expert on to discuss a new law, etc.

The big hold up to these podcasts is honestly sourcing guests. I’m working to improve the sourcing process, but if you have a guest in mind who you think would be perfect for explaining an investing related topic or question, hit me up!

Some of my favorite podcasts have been the ones with management teams coming on; in particular, I’m thinking of the Tidewater and Cable One podcasts. I’d love to do more of those…. but there is a little bit of a “quality” issue at play here. I could have 20 publicly traded CEOs on the podcast in a heart beat…. but the issue is all 20 of them are running companies that I wouldn’t want to associate with / are really just trying to pump their stock. Real CEOs have time constraints, and the overlap between CEOs running a real company that I’d be interested in discussing and CEOs who are willing to come on my silly little podcast is not large. So I’m going to keep working on this one, but I’m not sure how to solve that problem.

I also want to experiment with doing podcasts on companies or investing topics that I think are interesting but may not be actionable. A few examples that I’ve thrown around in my head:

A friend suggested I should start doing a “call for activism” podcast. This would be a podcast where I spend about fifteen minutes discussing a company and why I think they’re interesting…. and then maybe five minutes discussing the corporate governance hang ups that keep me from investing. I’d then sign off by saying something like, “sure would be nice if someone bought up a big position in the company and pushed for some change to those gating factors; I bet that would help close the discount to fair value in a hurry!” I am really tempted to do that podcast…. but for regulatory reasons (I’m not really looking to get deemed part of a group for saying “XYZ company needs some corporate governance overhaul) I don’t think I’m going to touch it.

I mentioned it over the weekend, but I’m really interested in doing more podcasts around investor days. I kind of want the flexibility to talk about investor days and interesting things they say about a company or an industry without the requirement that someone think the stock / company in question is an actionable idea right now (which is generally there for a “normal” YAVP episode; it would be kind of strange if a normal YAVP guest spent an hour of their time talking about a company and then ended by saying “yeah ,i think the stock / company is kind of meh right now; I’m just discussing them to shoot the breeze”). I’m thinking about once a month doing a solo podcast where I take an interesting company that hosted an investor day, review it, and then discuss the key questions and debates in my mind that I’d need to solve before buying the stock.

Similar to the investor day idea, it could be interesting to do a podcast right on the heels of a merger getting announced to discuss the merger, upsides, downsides, risks, etc. I’m probably a little less excited for this one than the investor day idea just because an investor day normally contains much more to discuss, but might keep this one in my back pocket…

This kind of blends idea number 1 (more industry experts from outside finance) and 3B (investor day pods that aren’t necessarily actionable), but I wouldn’t mind ramping up on podcasts just discussing a sector that’s having something interesting happen to it and talking about the changes in real time. I think about an episode like John Maxfield discussing banks right after SIVB failed; something like that any time there’s an industry facing crisis / disruption could be interesting.

Ok, one more idea that could never work for a variety of reasons (along the lines of the call for activists from #3a). There is a lot of interesting research from activist short firms these days, and I mean that on both the good and bad side. Some of these reports are unbelievably detailed, well thought out, and uncover some truly bad actors, and some of these reports are laughably bad and don’t understand basic accounting. It would be fun to do a podcast right on the heels of a short report, say what works and doesn’t work in the report, and then make a prediction on if the short works or not. I said it’d be fun…. but not that it’d be smart. For a host of regulatory and personal reasons, I need to stay away from that idea!

So that’s my overarching plan for the podcast: mainly more of the same (interviewing great investors about their best ideas), but some room for experimentation in guest type and format (and the type I’ve listed above aren’t the only types I’m thinking about experimenting with! I’m going to feel free to try some one off podcasts that are still finance related but just broader / more adjacent to the single stock pitch type, though obviously those will remain the focus!).

Finally, let’s turn to the last pieces of my empire: the blog on both the public and private (premium) side.

The two sides are somewhat in conflict with each other: any posts I put on the public side can’t go to the premium side, and any posts I do on the premium side can’t go public.

My way of solving this so far has been simple: I generally don’t post individual public stock ideas anymore, preferring to keep them on the premium side. Perhaps it’s something of a commitment bias (i.e. people who’ve paid for the premium side are just more committed to researching those ideas given the investment they’ve made), but I’ve just found it’s better that way; premium write ups have gotten incredible engagement / feedback / due diligence from subs, while I’ll often find publicly writing up an idea up leads to less “I’ve been researching this and have a question on it” engagement and more “the stock is down / up 1% in the past two minutes; what gives?” or “how can I most YOLO this idea?” engagement. With most stock ideas going on the private side, my public posts tend to focus on random musings on investing.

For 2024, I think I’m generally going to keep that separation. But there are two particular series that I think I’m going to try to get going on the public side.

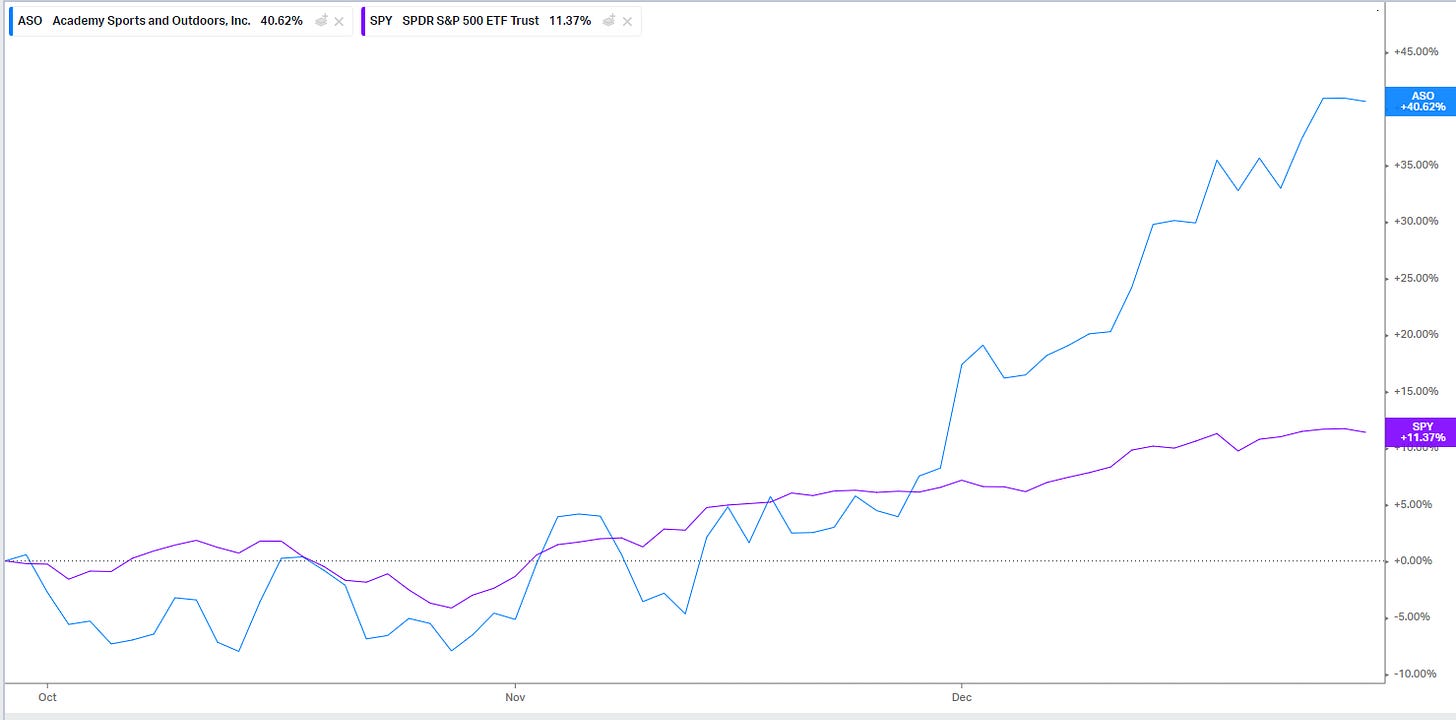

First, the reception to the “inevitable retail” series was really good. Now, that might be because the stock I mentioned as a possible inevitable (ASO) has been on a face melting rally up since that series…..

But I prefer to believe the positive reception was because people found the series and idea thoughtful.

So I want to try to do more series and posts like that one. Perhaps not quite as in depth, but taking a historical pattern or investing thought, applying it to a current (potential) stock idea, and discussing why it could fit an “alpha” pattern or why it doesn’t.

Along a similar line to that piece (and the investor day podcast I mentioned earlier), the other series I’ve been thinking about doing is a “why could the market be wrong to give this sector a low multiple” series. An example stock / post will probably show the thought behind this series best. Avis (CAR) currently trades for ~4x P/E. Obviously, that’s an insanely low multiple, and there are a host of reasons why the market would give a stock that low a multiple. The purpose of the series would be to break down all the reasons the market is discounting the earnings. It wouldn’t be a stock pitch, and it probably wouldn’t reach any conclusions….. it would more just be a “this is interesting” post with the hope of kicking off some conversation from people more knowledgeable.

So that’s the public side. On the premium side, it’s going to be more of the same: my goal is to post one actionable investing idea every month, as well as follow ups to previous ideas. The response to the premium side has generally been pretty positive, so I don’t think there’s need for huge changes there. However, as I mentioned in my start of the year premium post, I’m real bulled up for 2024. I have a particular focus on some quirky securities and special situations right now, and I suspect we are going to see a lot of really interesting situations this year. Why? To quote from my post,

I think the year is going to be a fantastic set up for event driven and value investing. In general, I just think the increase in interest rates over the past few years caused some companies to put some M&A or special situations (like spins) on hold, and I suspect we see the floodgates start to unleash this year (particularly with the back drop of companies looking to get things done this year before a potential change in the administration / regulatory regime).

I understand all of that is pretty broad and high level, but my gut is just telling me that this year is going to present some really interesting situations and set ups, and that there will be a lot of alpha for people willing to dig deep into some quirky securities (though I guess that’s always the case, I just feel like this year is particularly set up for that)….. so, bottom line, I’m pretty excited to ramp up into the year.

Anyway, those are my plans for all the pieces of my empire… but, because it’s the new years and everyone is making goals, I want to leave you with my goals for the empire as well.

The average YAVP episode gets just under 10k listeners, and the average YAVB post gets just under 20k views.

My goal for the new year is to double those numbers: 20k listeners per pod, and over 40k views per post. On top of stroking my ego, doubling those numbers would be enormous for the YAVE flywheel I mentioned earlier (particularly on the podcast side).

So my ask is this: if you like the YAVE experiment, please don’t hesitate to share it (simply press the “share” button below) with someone you think would similarly enjoy it! The value and event driven community is a small one, but it’s a passionate one and I honestly would be surprised if there’s someone who’s interested in value/event driven investing who isn’t interested in at least some of the podcast episodes and blog posts.

Alright, there you have it. Now you know my plans and goals for the empire this year; if you have thoughts on improving the blog or increasing my chances of hitting my goals, the comment section is open (as is my email).

Thanks for reading my silly little blog (and listening to my slightly less silly podcast), and I’m looking forward to chatting a lot in the year to come.

Happy new year, Andrew 💚 🥃

Had me scared at the start that this was a ' end of YAVB post ' phew! Looking forward to an exciting year and i think the podcast idea about why certain sectors are given the mutliples they have is an amazing idea. I for one would enjoy that a lot.