The Death of Malls and the Theft of GGP

At the end of last week’s post (Plagiarism and Adding Value), I mentioned I wanted to discuss an idea from this podcast from Modest Proposal.

The idea I wanted to expand on is the “death of malls” thesis. The basic thought here is simple: there’s no doubt a lot of malls are in trouble (class B and C malls are in a lot of distress, though given the amount of distress I’d guess there’s opportunity for investors with a lot of expertise to buy those on the cheap and redevelop them), but when it comes to Class A malls the thesis is way overblown and presents opportunity for investors willing to look through some negative headlines.

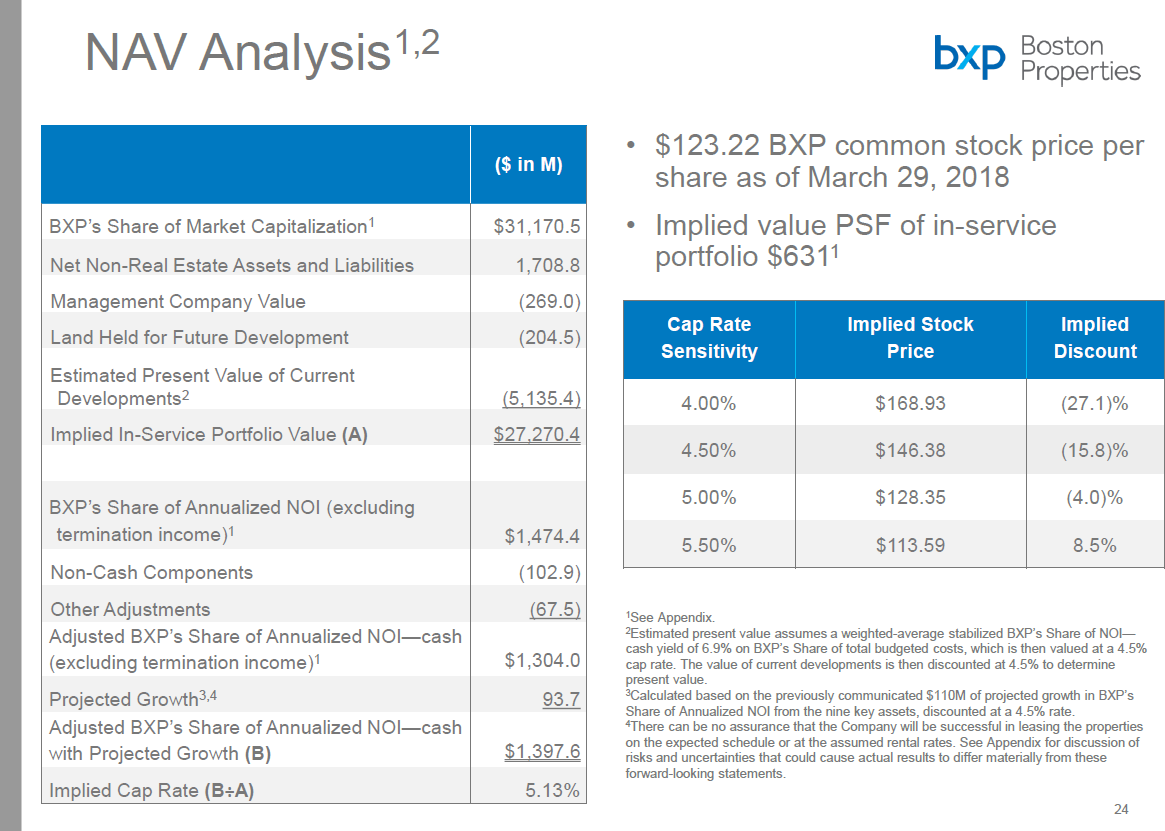

There’s a lot to the “Class A malls are not dying thesis,” but probably the top point is Class A malls are seeing consistent increases in rents (driven by consistent increases in sales per square foot from their tenant base). I think the Macerich slide below does a really nice job of highlighting that point.

Another key point for the thesis is online retailers are increasingly moving into physical retail space (“clicks to bricks”; here’s a nice interview with Warby Parker’s founder discussing it) as they discover opening physical stores can be a cheap form of customer acquisition and boosts online sales. However, they aren’t just moving into any physical space; tenants are picky as they view the stores as part of their brand and need the malls’ traffic to match their target customers, so the online retailers “usually stick with class-A malls in areas with large populations and higher incomes.”

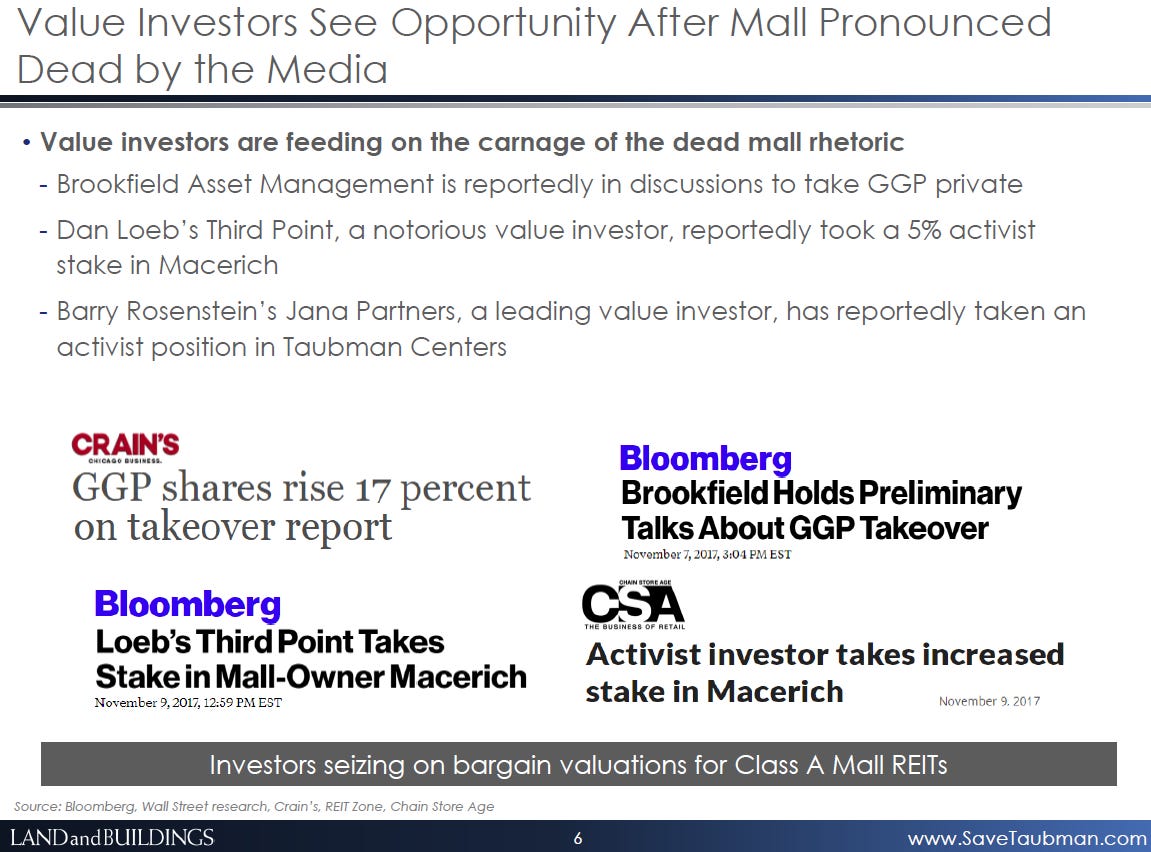

As typically happens with investing, I’m far from the first person to point out that it’s probably unfair to throw Class A malls into the death of malls thesis. Land & Buildings included the slide below in their activist run at Taubman (TCO), and Elliott, Third Point, and Starboard have all explored activist campaigns at Class A mall companies.

So there’s plenty of info out there on Class A malls and the potential for the market to be discounting them right now. I think those links do a good job of covering some of the opportunity, but to dive a bit further in I wanted to look at one specific company / idea / special situation: the pending takeover of GGP by BPY (disclosure: long GGP and long BAM; no position in BPY).

In general, I think BPY is stealing GGP (and to bring this back to the Modest Proposal interview linked earlier, I believe he agrees with me on this). I’ll dive into the reasons I think BPY is stealing GGP in a second (obviously a lot of it has to do with the “death of malls” overhang!), but first let me highlight that there is a serious special situations angle to this investment. This post was running long so I split the special investment piece up to a separate post.

BPY is acquiring the ~66% of GGP they don’t own for a headline price of $23.50/share (as discussed in the special sits post, the market value of the merger consideration is a bit lower). There are two ways to look at the price that BPY is paying for GGP. The first (and the one the market took the day the deal was announced) is to look at the deal and say “Woah, if GGP is taking such a low price, they must know something awful that is a huge negative for the whole sector”. The second (and the way I look at it) is that BPY is simply using some negative sector headlines and their position as the effectively controlling shareholder of GGP to steal the company.

There’s lots of ways to look at what GGP’s worth and how big a steal BPY is getting for them. All those articles quote analysts with price / NAV targets in the mid to high $20s/share, and I generally agree with them. But rather than showing the math to get there, I think the most interesting thing to show how big a steal BPY is getting GGP for is to look at BPY and GGP’s own words.

The best place to start is probably BPY, since they’re the buyer. BPY follows IFRS accounting, which means they treat real estate investments (including GGP) at fair value. At the end of Q1’18, BPY valued their GGP shares at $26.61/share. That valuation includes $1.71/share of goodwill, so on the low end you could say BPY valued their GGP investment at $24.90/share.

Both BPY and its manager, BAM, like to argue that, if you look at the history of their IFRS marks, they’ve been fair to slightly conservative in their valuations, so I think BPY’s IFRS valuations should probably have been the starting point for taking GGP private. There probably should have been a debate over whether the right price started with or without the goodwill included and if BPY needed to pay a control premium on top of the fair value, but at minimum I think ~$25/share is around the starting point of a fair value.

Of course, BPY’s offer for GGP isn’t worth $25/share. The headline price is $23.50, but (as discussed in the special situations article) given the cash and stock mix the current market value of their offer is closer to $22/share. Whether you use the headline value or the market price, BPY is capturing a significant amount of value by taking GGP out at a discount from the internal valuations (if we assume BPY is capturing $2/share of value from GGP, BPY is capturing ~$1.25B in value from the ~630m GGP shares they don’t own).

But I’m not sure $25/share would represent fair value if we really looked at GGP’s asset base. BPY’s fair valuation trend for GGP over the last four quarters has been very curious. In Q2’17, their fair valuation on GGP was “about $29/share”. On November 2nd, they reported their Q3’17 valuation for GGP went from $29/share to “about $30/share”, with the increase driven by a continued pick up in earnings. Less than two weeks later, BPY launched their first bid for GGP at $23/share. When BPY reported their Q4’17 valuation in early February, they stepped their GGP value down to $27.33/share. In March, BPY reached the deal to buy GGP for “$23.50/share”, and then when they reported Q1’18 earnings in early May they reported GGP fair value was down to $26.61/share.

So the quarter before the take private, BPY is taking their GGP valuation up, but once BPY needed to convince shareholders to sell GGP they start taking an ax to their valuation. Perhaps BPY simply started looking closer at the GGP assets / started to market some of them and realized that their internal valuations were too optimistic. Perhaps… but color me skeptical. A more cynical person would look at that trend and say BPY was playing games with their valuations to reduce the chances of GGP shareholder pushback.

Keeping that trend in valuation in mind, it’s very interesting to go back to BPY’s 2017 Investor Day and see what they were saying about GGP (here’s the transcript, and here are their slides). Their investor day was held in September 2017, so it’s right when they boosted their mark on GGP from $29 to $30 and mere weeks before they started the take private process. I’ll let you flip through the slides and transcript at your leisure, but some quotes probably do a nice job of showing how BPY is thinking about the opportunity in GGP:

“We think there's a real opportunity right now in the U.S., in retail in particular, given a dislocation that's happening there. Obviously, everybody here has read headlines about the challenges that retailers are facing. We think this is one of these classic Brookfield moments where others are fearful and there are opportunities if you have a long-term focus and the right operating capability to take advantage of these situations”

“Over the course of 2017, we've actually acquired three shopping centres, three enclosed malls here in the U.S. The plan for all three of them is an extensive renovation repositioning. In fact, all of them are going to be converted from enclosed malls into something else - open-air lifestyle centres with a substantial amount of multifamily and other alternate uses on them, and we think we'll be earning well north of 20% returns overall on these investments. We do think this is a very unique moment because not many people are looking at this particular situation and really having a creative approach. In all three of these cases there was no auction; there is no broker involved. It was a one-off negotiated situation. For those of you in the business of investing, you know how rare that is today in the U.S. with all of the capital that's floating around.”

“I think GGP, the management team has been very vocal in their view that the $20 is clearly below what they think the underlying value of their real estate is and I think there's a few transactions but not a lot you can point to, frankly, to show exactly where cap rates are. But to your question about buying back stock, much like we have been doing at BPY, the company has become much more active in buying back their own shares. As you probably know, we own warrants in the company which we'll be exercising in about a month to increase, take our ownership interest from 29% up to 35%, so we do certainly think where it's trading today is below the intrinsic value of those assets.”

Alright, with BPY’s side of the story out the way, let’s turn to how the seller, GGP, talked about their value historically. The best place to start is probably on their Q1’17 earnings call, when their stock was trading at $22.66/share. Here’s how GGP’s CEO talked about their capital allocation decisions at the time,

“Our capital allocation decisions reflect the value we see in the portfolio. We view our own stock to be attractive at this level, and we were active buying it during the first quarter. There is a wide discount between public and private markets. The sum of the parts is far greater than GGP's current stock price. We are reviewing all strategic alternatives to bridge the gap.”

An analyst picked up on that line and asked what they meant about strategic options, and the CEO responded pretty forcefully,

“80% of my NOI comes from the A assets that are growing at 4%. A assets trade from mid-3s to low-4s. You do the math. The break-up value is far in excess of where we trade today. We're evaluating all alternatives, and we will pick a path in the near term by looking at assets on both ends of the quality spectrum. There is no sacred cow. We could sell assets and dividend cash. We could sell asset and buy back our shares. We will get value to our shareholders. The break-up value is more than the current market capitalization. The business is strong. We will pick a path soon.”

Fast forward to the Q2’17 call in August and the stock is trading just a tick below $22, and the CEO still has pretty strong thoughts on the stock price. Here’s how he opens up the earnings call

“First off, I would like to give you an update on our review of options to create long-term value in our business. Given the significant and inappropriate gap between private and public market values, we thought it was prudent to undergo a strategic analysis in our efforts to maximize shareholder value. The first thing to report is that we have concluded that this franchise has best in class retail. There is also a tremendous amount of embedded value within our portfolio residing in these incredibly well-located urban and suburban infill locations with the ability for greater amount of apartments, condominiums, office, hotels, data centers, co-working gyms, tailors and the like. In that regard, we looked at all options available to us and actively engaged our board in numerous discussions. Given the market conditions and results of our outstanding portfolio, we and the board believe proceeding with our current strategy under the direction of our deep and experienced team will produce the best long-term results for the shareholders. And should a larger opportunity arise, we will, of course, consider in light of our ongoing efforts to maximize shareholder value.”

Later, when asked why they’d publicly announce a strategic process and then not do anything, the CEO responds,

“we felt there was a tremendous disconnect between public and private markets. We felt it was good for us to go out and do a strategic analysis with the board. We did the analysis and we came to the conclusion of, where the stock price is trading today, the best course of action for us is to stay the course. We've also determined that the inherent embedded value in the real estate is so high that you actually do the best for the shareholders. This is not the right time.”

Finally, we come to their Q3’17 earnings call at the end of October, just two weeks before BPY launches their first bid at $23/share. Here’s some select quotes from GGP’s CEO,

“During the quarter, we've remained an active acquirer of our common stock. We acquired 9.3 million shares in an average price of about $21.19, investing a $197 million. We firmly believe that our stock at this price level represents an accretive investment opportunity for our capital allocation activities. We have a 188 million remaining under our Board authorized share repurchased plan.

Anyway, this post is running long, but the trend here is pretty obvious: with their shares trading right around the price BPY eventually agrees to buy GGP out at, GGP has consistently been shouting about how undervalued their shares are.

To sum up: in Brookfield, you have a sophisticated controlling shareholder with a history of successfully buying in industries in distress who is talking about how the see opportunity in retail. In GGP, you have a seller who is constantly shouting about how their intrinsic value is way higher than their share price when their share price is right around the price their controlling shareholder ultimately takes them out for.

I know which side of the trade I’d rather be on. BPY is stealing GGP.

Other odds and ends

If both BPY and GGP agreed that GGP was worth more than the BPY bid, why would GGP’s special committee agree to vote for the BPY “$23.50” offer? In BAM, GGP’s special committee is against some of the sharpest negotiators in the world who also control the company. The industry is flooded with “death of retail” articles, and every day it seems another GGP tenant goes bankrupt. The special committee has almost no financial incentive to push for a higher price (two of the five committee members own less than $75k worth of stock, and the five of them combined own $3m of stock), but if they walk away from the offer and the stock collapses they could be facing a string of fiduciary lawsuits. Yikes. With all of that going on, can you blame the special committee for “settling” for a small bump?

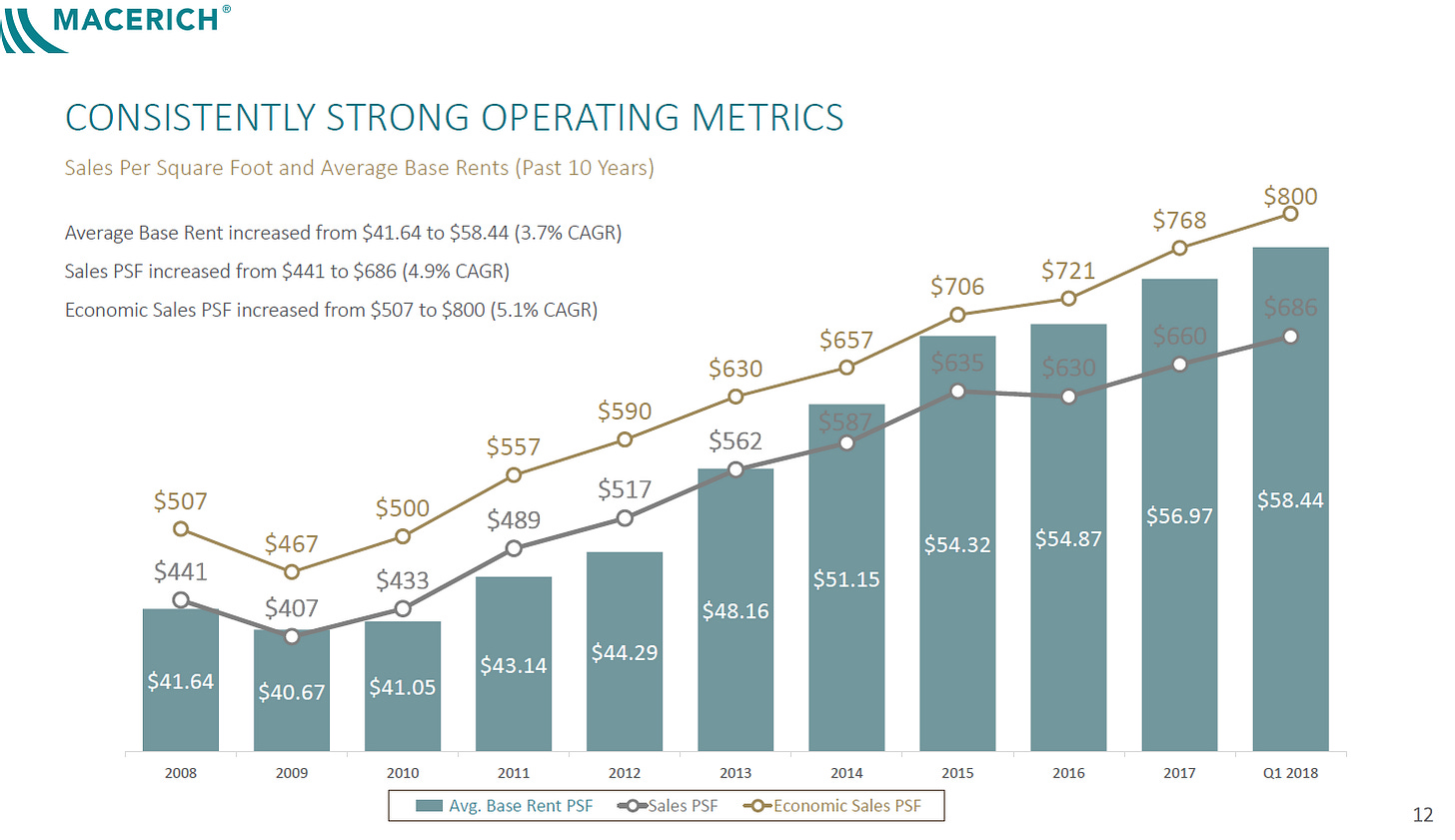

While I focused on Class A Malls and GGP in this write up, I think the whole “publicly traded real estate” space is interesting right now. The market seems to be pricing most publicly traded real estate companies / REITs at a discount to their NAV. I’ve got some examples of this below, but in general I think this is a pretty interesting opportunity for activists to step in and force companies to realize NAV (either through liquidating or selling) and for buyers to pick off companies at a discount.

In my April links, I mentioned VNO’s shareholder letter that they thought their shares were “stupid, stupid cheap” trading at a 29% discount to NAV

Over on Twitter I highlighted SL Green’s (SLG) Q2 call and how they thought they were buying their shares at a large discount it NAV

BXP included the slide below in their Q1 earnings call while noting that repurchasing shares was among the best uses of their capital given “their material discount to NAV” (they also highlighted buildings in the core markets were trading with cap rates “generally in the 4s” to give you an idea of where they think they should trade).