Christmas Idea #3: FS KKR Capital Corp $FSK

This is the fourth post in this year's (well, I guess last year's at this point) Christmas Ideas series (other posts include the “honorable mentions,” the first Idea Radisson (RADH; disclosure: long), and the second idea (Telecom Italia Savings; Disclosure: Long). Admittedly, this post is coming a bit late; obviously Christmas and the New Year have already passed, but I had two more ideas in mind for the series and I'm determined to give them away even if they are late! Today, we’re headed back to the U.S.A. (my first two ideas were foreign) for my third idea: FS KKR Capital Corp (FSK; disclosure: long both FSK and KKR). FSK is a weird pick for this series and this blog for two reasons:

FSK is an externally managed BDC. The BDC space has a relatively spotty reputation and its history is littered with blow ups, and many investors avoid the space altogether due to the history + the inherent conflict of interest that comes with externally managed companies.

Traditionally, I’ve tried to focus the Christmas Series on ideas with a firm catalyst for value realization (the idea being that if I don’t write the idea up this Christmas, I won’t have the chance to next Christmas). While FSK has some potential smaller catalysts this year that could help the stock, I don’t think there’s any “mega” catalyst (a merger, a take private, etc.) that could rapidly narrow the gap between FSK’s stock price and intrinsic value.

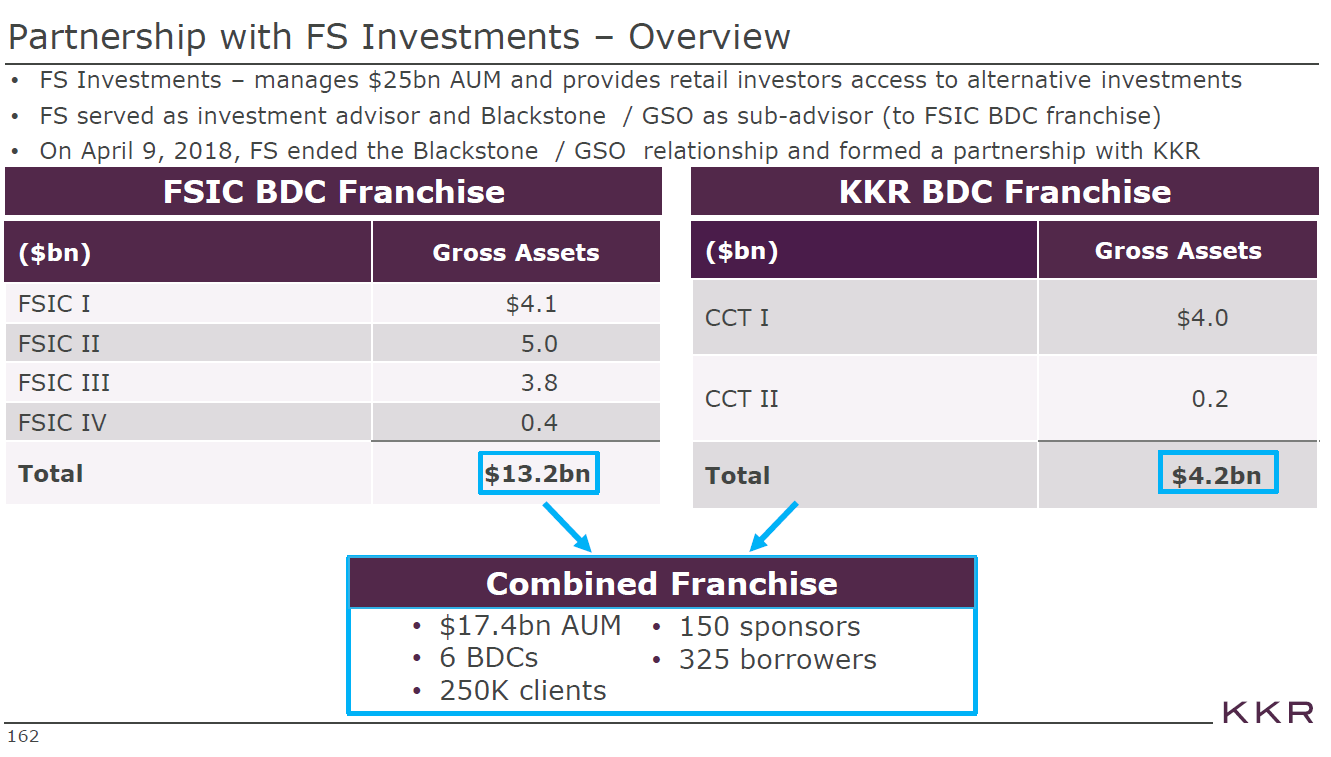

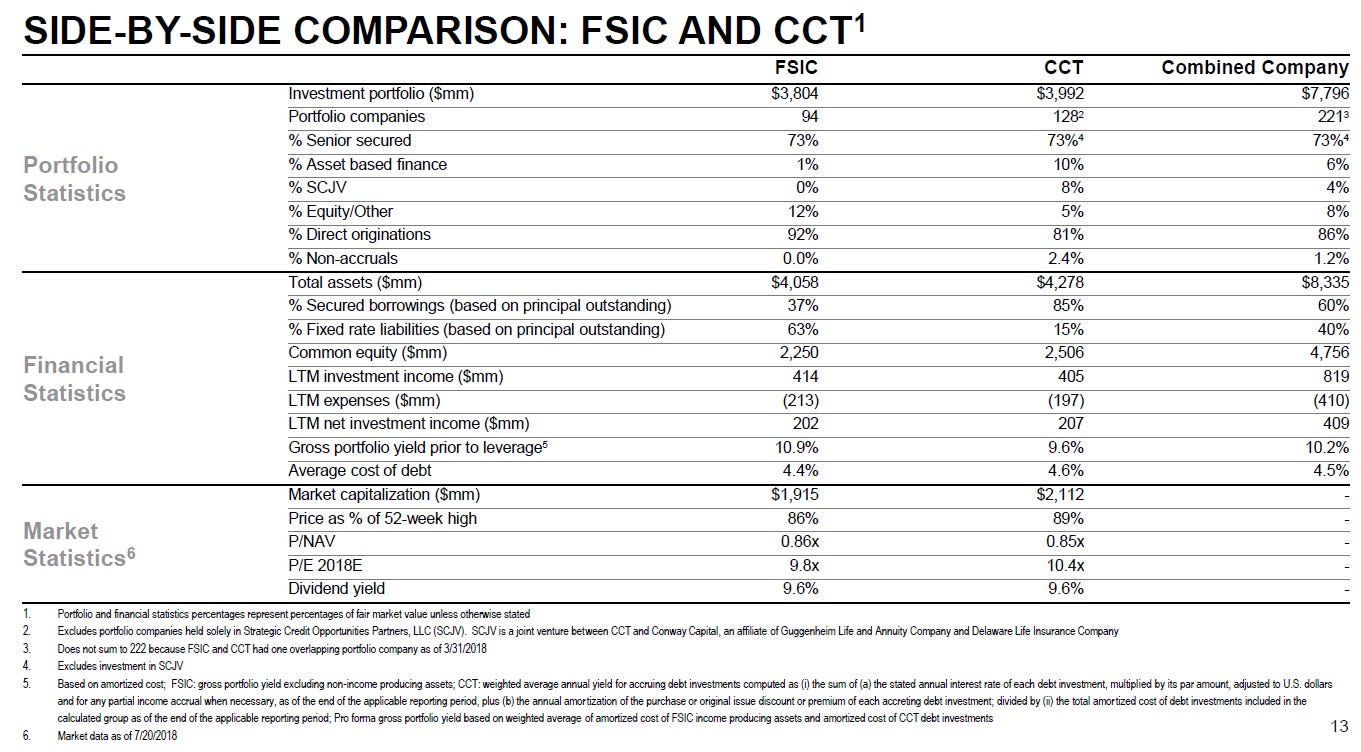

So FSK is a bit of strange pick. But it is very cheap and (I think) misunderstood / neglected / despised (I base "despised" on this FT article which seemed more focused on a falling share price than any underlying fundamentals). While there’s no firm catalyst for the shares today, I’d be surprised if the gap between FSK’s book value and share price hadn’t materially narrowed by year end (due (hopefully) to a rising stock price, not falling book value!). Because of that expectation, FSK is my third pick for my (somewhat late!) Christmas series. Let's start with some background because it's instructive as to what's happening here. FSK is a private debt focused BDC (business development corporation). The company was formed when two BDCs, FSIC and CCT, merged in late 2018. The merger was roughly a year in the making: the stage for the merger was set in late 2017 when FSIC dropped GSO as their sub-advisor in favor of KKR. That deal was structured / called a partnership, but you can basically think of it as KKR serving as the manager / GP for all of KKR and FSIC's BDCs and providing them with access to KKR's lending platform (the slide below, from KKR's July 2018 investor day, illustrates exactly what happened and what each player brought to table). That deal closed in April 2018, creating the "market's largest BDC platform" which managed six BDCs (FSIC, CCT, and some additional non-traded BDCs). Having 6 BDCs focused on the same space is generally pretty inefficient (why pay for six separate audits when you could merge all of them and pay for one?), and it was pretty clear that on the heels of the FS/KKR partnership closing they would look to merge some of the BDCs; in fact, the closing press release included this quote, "Our focus will continue to be on optimizing the platform and enhancing performance as we also evaluate potential mergers of these BDCs to create value."

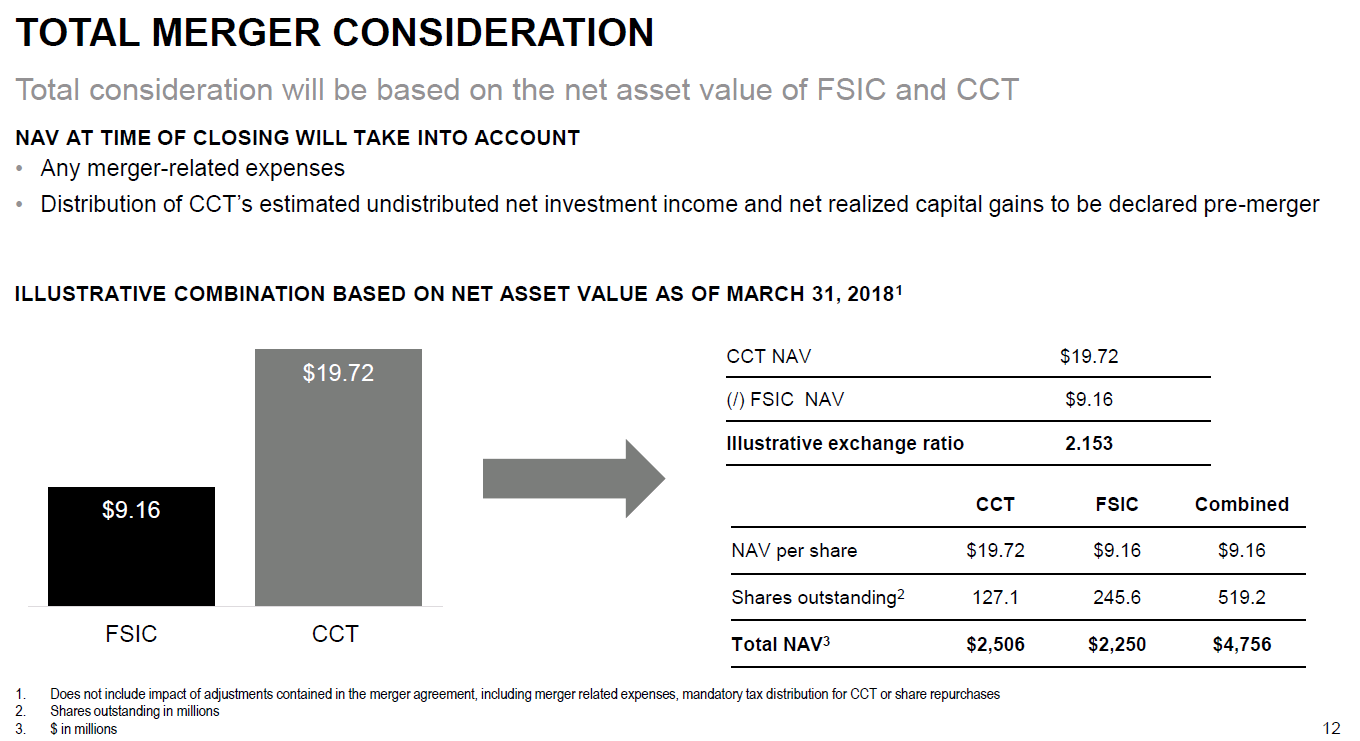

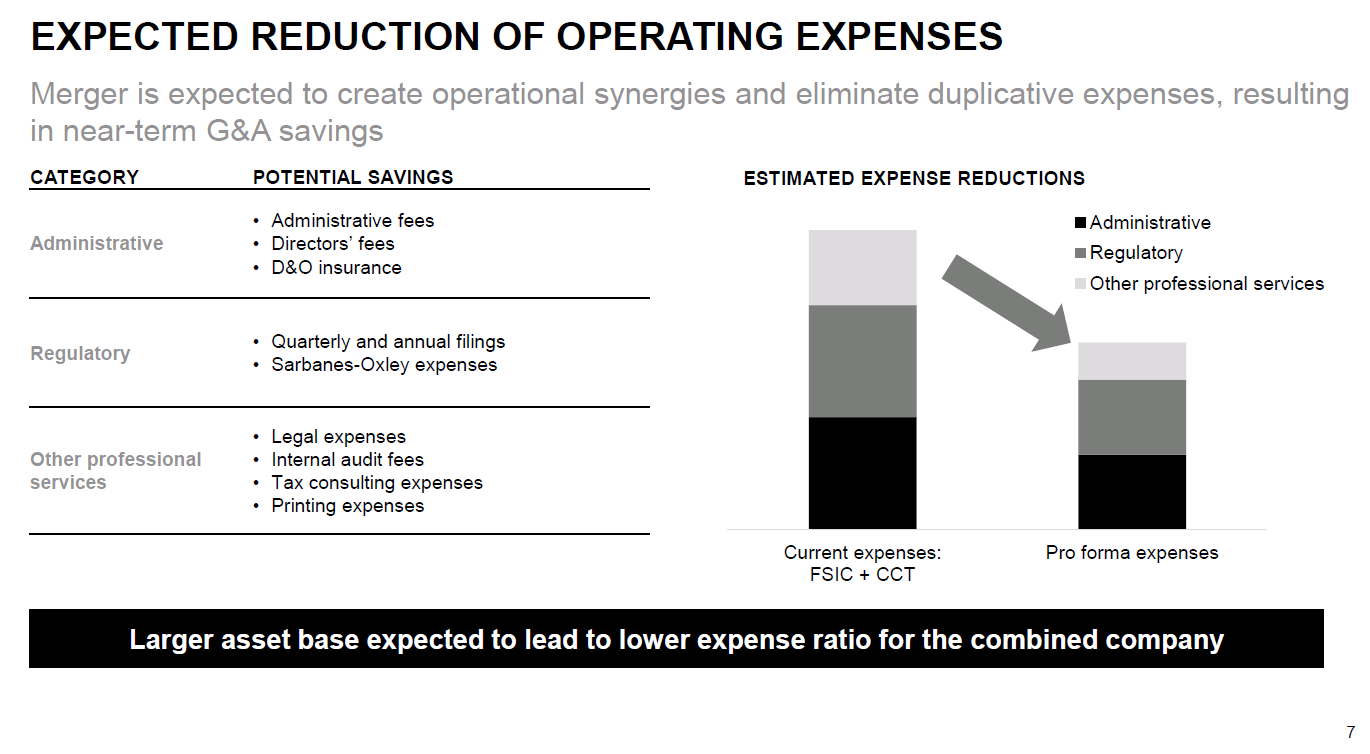

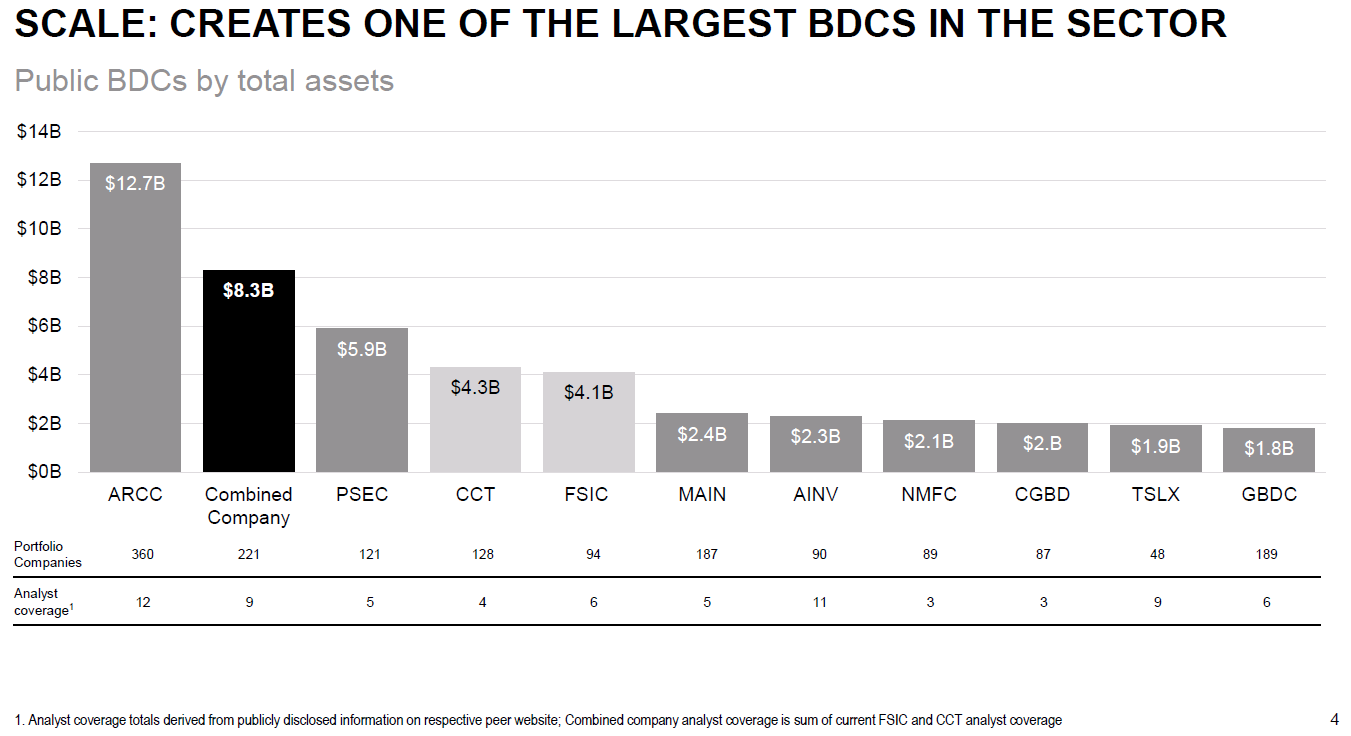

Sure enough, in July 2018, FSIC and CCT announced a stock for stock merger "at NAV" (CCT shareholders would get FSIC shares with each company getting valued at NAV in the merger). You can find all of the rationale behind the merger in the merger transcript, but the overall thought process was merging would create cost synergies (reducing admin and regulatory costs), financing synergies (lower borrowing costs for a larger organization), and what I'll call shareholder synergies (the combined company would be the second largest publicly traded BDC, and the company thought the improved size and liquidity would attract new investors / research coverage and reduce the combined company's NAV discount). This quote (from CCT's Q3'18 call) sums up the deal rationale well, "There'll be lower financing costs over time. I don't think it's any secret that bigger BDCs tend to finance more cheaply. Lower operating expenses, we expect at least $5 million to $7 million of run rate operating expenses across the combined business. And then importantly, given where our stock price is today, better secondary market liquidity, we – average daily trading volume, we expect to go to something like $13-plus-million. We think that's an invitation for more institutional investors, which we think is a big opportunity for our stock." Given those synergies, the company clearly thought the merger would be well received by the market and explicitly stated they planned to follow up this deal by merging the other 4 BDCs into the new company in the year or two after this deal closed (see the first analyst question in the transcript).

So the plan was simple: merge FSIC and CCT, realize some synergies and reduce the NAV discount, and then merge the new company with the rest of the (non-traded) BDCs to further increase trading liquidity / reduce the NAV discount / cut costs. Unfortunately, the market didn't quite cooperate with those plans. When the merger was announced, both FSIC and CCT traded for ~85% of their most recent NAV (see slide below). By the time the merger closed, both were trading for much larger discounts to NAV: for example, CCT's most recent reported NAV (as of 9/30/18) was ~$19.44/share, but their stock closed at ~$12.35/share the day before the merger closed for a P/NAV of ~0.64x. Sure, some of this increased discount was market driven, but a good deal was FSK specific as shares fell significantly more than peers (see stock price chart from FT article).

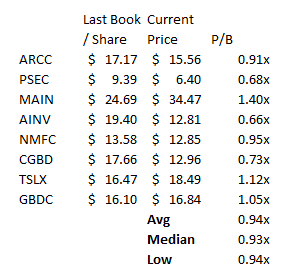

Which brings us to today and the reason I think FSK belongs in the "Christmas Ideas" list: FSK trades for a massive discount to its NAV, and I think that discount is undeserved. Perhaps more importantly, FSK has given us a sneak peak of what their year end NAV will look like, and the company is gearing up to aggressively repurchase shares (which, at today's price, would significantly increase the NAV for the remaining shares). Let's start by discussing how wide FSK's NAV discount is. FSK's merger presentation lists 8 comparable BDCs. I've listed those comps below; you can see the average comp trades for a slight discount to book value though there is obviously a pretty wide range on a limited sample here; still, the range provides some idea of where FSK could / should trade (note that I'm simply pulling the NAV/share for each of these from Bloomberg; most of them have paid dividends out since their last NAV was released so actual NAV/share adjusted for dividends would be a bit lower / Price to book would be a bit higher. I've included MAIN below, they they're internally managed so I don't think they're a perfect comp).

I can't claim to be an expert on any of the peers (diving into them further is on my to do list), but I don't see any reason why FSK (or AINV, for that matter) should trade at such a wide discount to, say, ARCC. Credit BDC's are effectively a portfolio of loans, so by trading FSK at a discount to a peer you're effectively saying one of the following things:

FSK's booked is mismarked / they haven't accounted properly for some pending losses so the fair value of their book is way lower

FSK's book is marked properly, but management is likely to do something silly with FSK's capital in the future so the company deserves to trade at a discount (i.e. management will make bad loans, or dilute shareholders at under NAV).

Along a similar line of thought, two BDCs could trade for a massively different discounts / premiums to book if one of them had a much more favorable management contract than another, but for the most part all of these companies have similar management contracts so it would be tough to point to that as a reason for a difference.

FSK's book is marked properly and management is fine, but the other BDCs have access to such a great proprietary pipeline that will deliver such incredible risk adjusted returns that you're willing to pay a premium for that access.

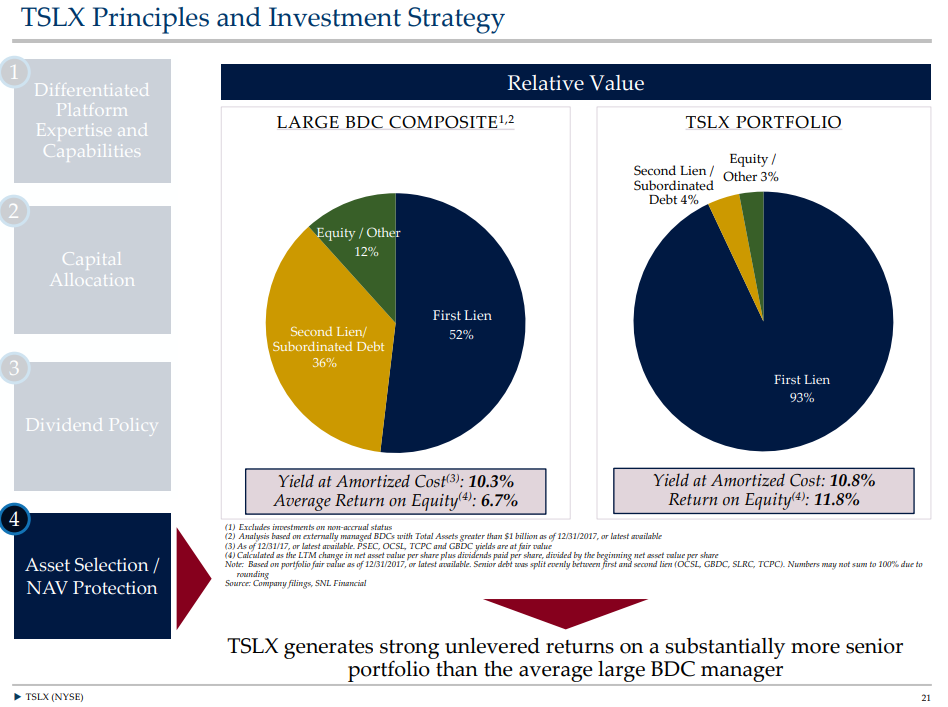

This is an argument that TSLX, which trades for >1.1x book, has consistently made. I haven't looked at them in depth, but given their portfolio stats (from their Wells Fargo presentation earlier this year) I think there could be some truth to it for them.

I can't see any of those potential reasons for a discount applying to FSK.

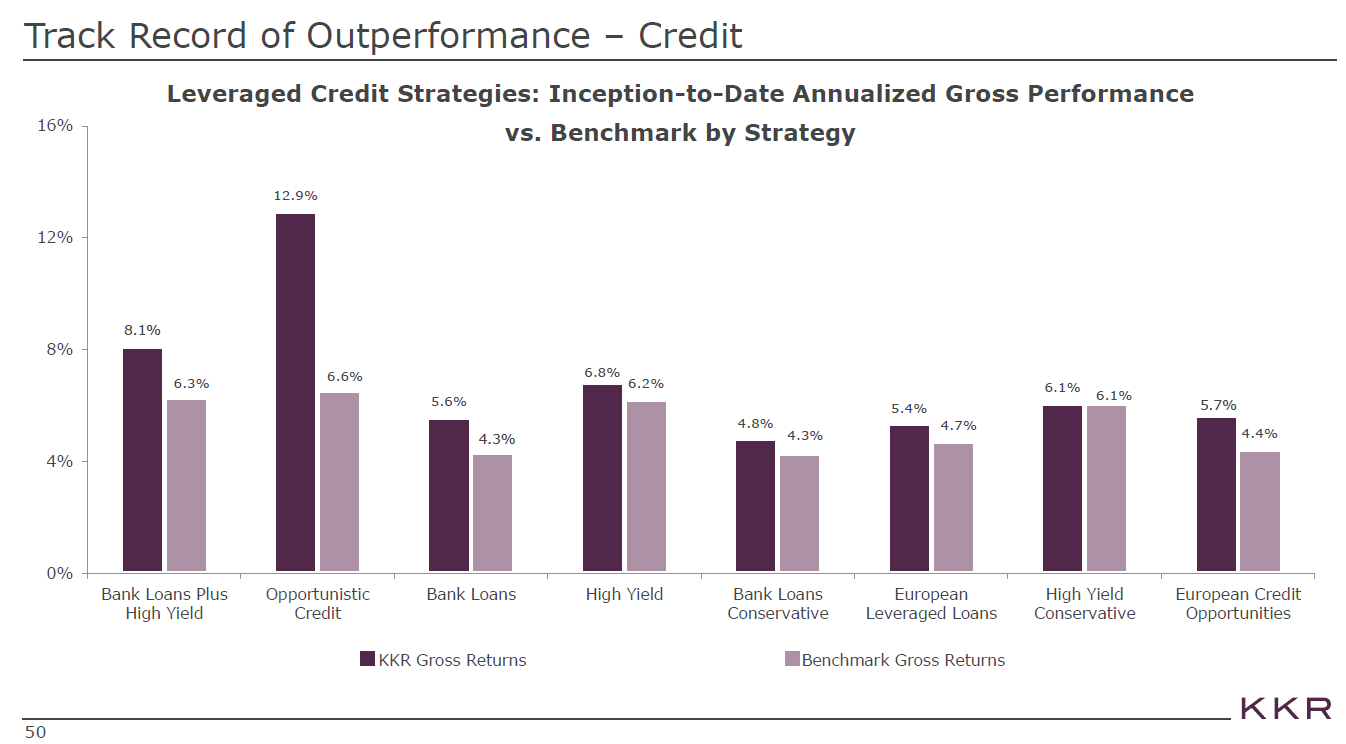

FSK is managed by KKR and gets access to KKR's credit pipeline. At worst, I'd say this is a neutral factor for FSK. KKR is a giant asset manager with huge scale across the globe; I doubt there are a ton of loans that get made that KKR doesn't get a look at. And KKR's track record in credit (see slide below from KKR's investor day) is pretty good. Put those two together and I see no reason for FSK to deserve a "pipeline discount" versus peers.

FSK could trade at a discount because management is going to do something silly to dilute shareholders and ruin returns. Always possible, but I feel pretty good that FSK will treat shareholders well here. I've included some quotes below, but I think management has been very clear that they want to repurchase shares when they trade at a discount and they were frustrated that the pending FSIC / CCT merger kept them from doing so. As part of the the merger closing, FSK announced a $200m repurchase program, which would let them retire ~7% of shares outstanding at today's prices; in addition, the company said they'd release preliminary financial results in mid-January 2019 to allow them to start repurchases earlier. To me, the quotes below + FSK's actions suggests they are serious about taking advantage of their share price when it trades below NAV.

On buybacks from the FSIC / CCT merger call: "We think we showed our commitment at each FS and KKR to the buyback programs and we’ve been in the market executing on those buyback programs. We are focused on continuing to drive the share price and to deliver performance to the investors and we’ll have more on that during our calls"

On the Q3'18 CCT call: "Let's now turn to share repurchases. Since listing last November, CCT's total share count has been reduced by roughly 9% through a combination of repurchases and a tender program. To be clear, we believe the current share price presents an attractive opportunity to repurchase more of our common stock and that share buybacks would be accretive. As such, we've been investigating the viability from a regulatory perspective of share repurchases during this proxy solicitation period. We've been advised by counsel that it would be imprudent to announce or execute share buybacks until after the merger with FSIC has closed. I'll note that historically we announced a share repurchase program when

our shares were trading in a meaningful discount to NAV and when we announce the program we aggressively fulfill the entire amount. Our philosophy has not changed. Finally, we, the FS/KKR Advisor have historically discussed the strategy to consolidate the non-traded funds on the platform into one publicly traded entity as a means to create value for both our public and non-traded shareholders. Given recent trading performance of both FSIC and CCT, we do not believe current conditions support such a consolidation. And even when these conditions improve, let me be clear by saying that consolidation of these non-traded BDCs with our listed BDC will need to be accreted to CCT shareholders, position the public traded vehicle for success, and be in the interest of all shareholders."

This quote covers another piece of the potential "management shenanigans discount." Given FSK had previously telegraphed intentions to merge the non-publicly traded BDCs, it's possible the current discount reflected fear of the mergers. I think that quote puts those fears to bed (for the most part) until the discount is much smaller.

As part of the merger closing / buyback announcement, "We believe buying shares of FSK is a compelling opportunity. Given current trading and dividend levels, investors are able to earn a 13% annual dividend yield with the potential for significant market price appreciation through convergence to fundamental book value. Our board has authorized a $200 million share repurchase program, which reflects our perspective on this buying opportunity and confidence in our investment portfolio and broader franchise"

Finally, FSK could trade at a discount because their book is mismarked. Given how rocky markets have been since September 30th (the last date most BDCs reported NAV), it's very possible one or two big loans have gone bust since the last mark and driven FSK's NAV down significantly. However, as part of the merger, FSK provided a NAV updated through the Determination Date (~December 15th), so we have a very up to date NAV number for FSK showing an NAV of $7.92/share (down from $8.64/share at 9/30/18, with ~$0.19/share of the drop coming from their dividend and the rest coming mainly from losses on their investments).

It's still entirely possible that "determination date NAV" is off. BDCs are filled with horror stories of companies trading for fractions of NAV because the underlying asset is marked at cost or a fair value that is obviously well in excess of where the asset's real market price is (for example, MCC currently trades for ~$2.62 despite a NAV of $5.90/share; I can't claim to be an expert on it but it appears at least part of the discount is driven by the market seriously questioning the marks on their assets given high default rates), and almost all of FSK's portfolio is level 3 assets (assets where the manager marks based on their own valuation), so it's possible FSK is just way overstating their asset value. I doubt that's the case here though. (Private equity companies are also filled with stories of firms marking portfolio companies at stale values way higher than their current fair value.)

Consider that KKR is a mammoth asset manager, and the loans that FSK invests in (through the KKR lending platform) are the same that KKR's other private debt funds invest in. It's possible that FSK's marks are a bit rosy... but if you're arguing that FSK is massively mismarked, you're either arguing KKR is systematically mismarking all of their credit funds (which seems a bit crazy to me) or you're arguing KKR is marking their credit funds properly but purposely mismarking FSK / giving them different marks (which also seems crazy to me, and I would argue the reputation risk to KKR is way higher than whatever they would get from slightly mismarking FSK). (Here's what CCT said about the NAV valuation what asked on their Q3'18 call, "As a reminder it's a NAV for NAV deal, right. And what that means is that we'll actually strike the NAV two days before closing, once we complete shareholder approval that NAV will go through the same rigorous process as each quarter-end NAV goes through, the third-party valuation firm on nearly 100% of Level 3 assets, KKR valuation committees, and of course our board.") (Note: some of this argument doesn't apply perfectly to legacy FSIC, which had a lot of loans remaining from their GSO days, but given KKR had been in charge of the portfolio for >6 months before marking fair value at the merger, FSIC represents <50% of the combined companies' NAV, and GSO is a credible underwriter / lender, I think the section is close enough for that side of the deal as well).

~80% of FSK's debt is senior secured or asset based (per the FSK / CCT merger doc; yes a chunk of this is second lien debt but bear with me), and almost everything in FSK's portfolio is current on their interest payments (FSK has ~$7B in investments proforma for the merger, and I counted only ~$150m in fair value of assets on accrual). It's of course possible that some of these loans are complete disasters that are about to go on non-accrual, but between lending secured + most of the assets being current + KKR's underwriting, it's tough to believe these assets are marked at crazy high / unrealistic marks.

That section ran a bit long; to sum it up: there are a lot of reasons FSK could deserve to trade at a big discount to peers, but I don't think any of them are applicable. In fact, between KKR's track record and management's commitment to repurchasing shares (albeit so far their "commitment" is weighted heavier to words than actual actions), I think you could make an argument that FSK deserves to trade at a premium (or at least in line) with most peers. Yet FSK does trade at a mammoth discount to NAV. I want to circle back the the determination date NAV for a second, because I haven't seen it mentioned anywhere (albeit FSK isn't exactly a widely followed stock) and it's a critical reason I like FSK at these levels. When comparing FSK to at peer NAVs, the peer NAVs we're looking at are from the end of September. Since then, the S&P posted it's 14th worst quarter since WWII, loan spreads have blown out, and most of FSK's peers have paid out a dividend. In other words, most peers' current NAVs are likely substantially lower than they marked at quarter end (with the potential for one or two big losses to have completely blown up their NAV), while we have a relatively updated mark for FSK. FSK's determination date NAV was $7.92 and their current price is ~$5.45, so they trade for ~70% of their relatively updated NAV. That discount level would put FSK at the lowest end of peer discounts despite FSK having the most updated NAV. I think that's obviously wrong. Over the next few weeks, I expect FSK to announce a prelim NAV for year end relatively in line with their determination date NAV. The company should begin aggressively buying shares soon after that, and assuming they're reasonably aggressive in share repurchases they should prove significantly accretive for remaining shareholders. Assuming NAV doesn't fall off a cliff over the next few months, I'd expect FSK's discount to NAV to shrink materially by year end as investors warm up to the KKR underwriting story and management's shareholder friendliness. Other odds and ends

I wanted to get this post out before FSK announced their prelim 2018 NAV (at deal close, they said they'd announce prelim results in mid- January) and started their share buyback program, as I wouldn't be surprised if that served as a mini-catalyst to shrink the discount. Because of that somewhat self-imposed time limit, I didn't get to dive as deeply into FSK's peers as I would have liked. If you've done some work on the space and have some thoughts on them or FSK, I'd love to hear them (in particular, I'm interested in why AINV trades at almost as wide a discount as FSK (I think Apollo, who manages AINV, is good and they seem to be pretty shareholder friendly)).

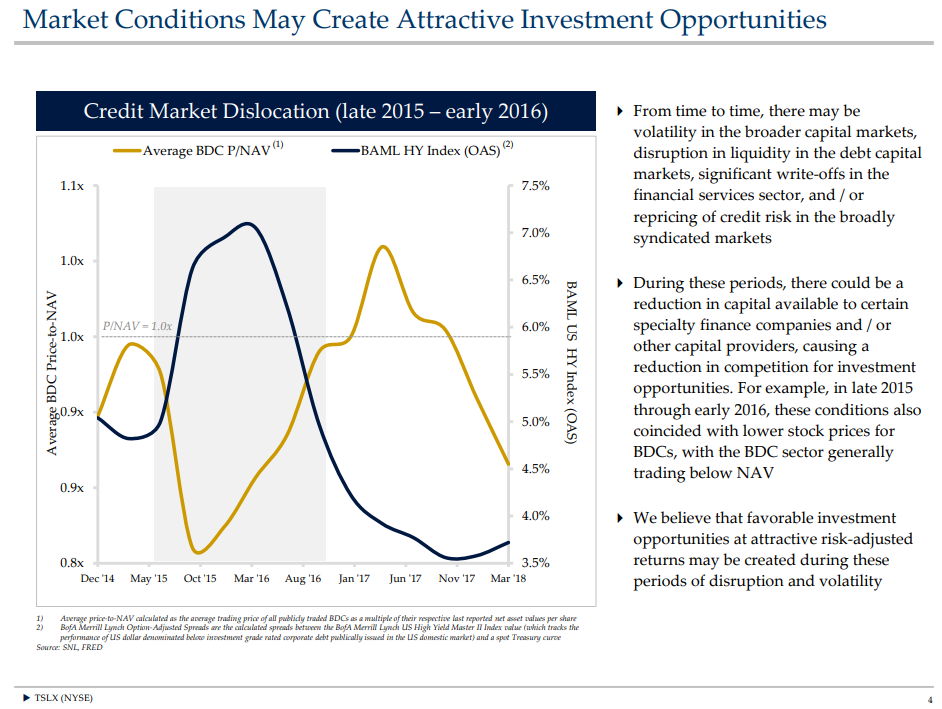

FSK has been hit way harder than most of their peers, but to some extent this idea is simply a "markets have been hammered and BDCs get hit when markets get hit" call. When markets are rocky, BDCs tend to trade for really large discounts to NAV, and when markets are good they trade around or even above NAV. The slide below (from TSLX's deck) does a nice job of illustrating the cyclicality of BDC's P / NAV.

FSK's portfolio is pretty diversified, but it consists primarily of private loans to middle market companies. Is this the place you want to be if you're forecasting a depression? Probably not. But given these are generally secured loans with some equity cushion behind them and you're buying at ~70% of a very recently marked NAV, I think shares have more than priced in a recession at these levels.

One interesting thing about FSK's NAV discount- if you really believe the discount exists because FSK's manager (KKR) sucks (either because they won't have shareholder's interests in mind or because their credit lending platform / underwriting skills are subpar), that is a very solvable problem. Some peers have gone hostile on under performing peers before; in particular, I recall several BDCs trading above book making stock offers for peers trading below book value over the past few years (for example, TSLX offered to buy TICC in 2015). Deals where a company trading at a premium to NAV offers stock for a company trading at a discount to NAV can make a lot of sense for both sides, and I'd note that activism in the BDC is relatively frequent and FSK's contract allows them to terminate their manager with no penalty payments on 60 days notice if shareholders vote to do so (see page B-7). I think FSK's discount will shrink long before it comes to any of that (and I think KKR's lending platform is good), but just pointing out that if the company trades for <70% of NAV for a long period of time there are pretty easy avenues for shareholders to try to boost value (assuming that the NAV mark is good).

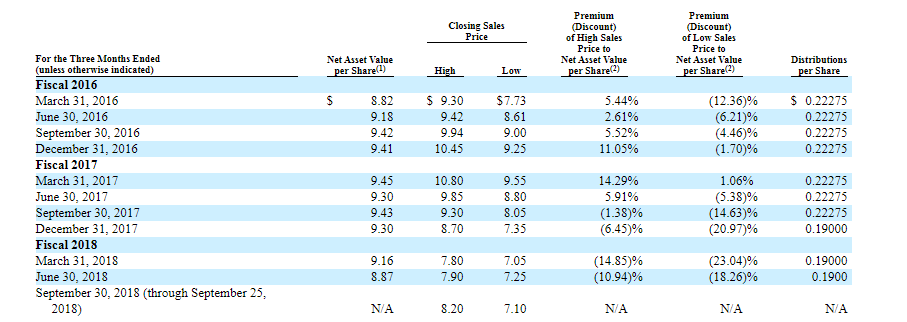

Somewhat related to the "BDC's trade at a discount when markets get rocky" point above, the table below (from the deal proxy) shows FSIC's premium / discount to NAV over the past few years. I'd note FSIC has traded at a premium to NAV a few times in the recent past. Of course, that was before KKR took over the book, so maybe it's not relevant, but I just wanted to point out that it's not impossible for these to eventually trade at a premium to NAV.

Speaking of the deal proxy, FWIW you can find the fairness opinion for the company on p. 178. Nothing groundbreaking (there rarely is in a fairness opinion!), but it is somewhat notable that none of the fairness opinion's suggest the combined company should trade for a steeper NAV discount than any of their peers (consistent with my thesis that the discount at these levels is way too high).

Two potentially interesting catalyst from the regulations front.

As part of the tax cut, BDC's maximum leverage moved from 1:1 debt to equity to 2:1. As of the determination date, I have FSK at ~0.85:1 debt to equity, so they're levered way under their theoretical max. That gives them a lot of dry powder to play with, either to make new loans or to increase leverage by buying back shares. Will they? Who knows, but the optionality is there.

BDC's are subject to the Acquired Fund Fees and Expenses rule, which means that any mutual fund that buys them must consolidate the BDC's expenses on to their income statement. Because of this, BDC's were kicked out of most indices in 2014. I've heard BDC's are lobbying to get exempted from this rule, which could open them up to more institutional ownership / index inclusion. I wouldn't be surprised if this happened sometime this year: it seems pretty business friendly to do so, and (as this article points out) most major credit / private equity firms have a toe in the BDC space now, and they tend to be very connected / savvy at lobbying.