Two Vintage Capital Special Situations Part 1: $TAXA $RRGB

This is the first in a series of two posts (update: you can find the second here) that center on the two most interesting special situations I'm tracking currently, Red Robin (RRGB; disclosure: long) and Liberty Tax (TAXA; disclosure: long). Given how interconnected the two ideas are, I wanted to keep to two posts together, but for a variety of reasons I ended up splitting them. In this post, I'll focus on the driving force behind both ideas, Vintage Capital, and then discuss TAXA. In the second post, I'll discuss Red Robin. Without further adieu, let's start by talking about the private equity firm that connects everything here: Vintage Capital. Long time readers may remember Vintage Capital from the "drama at Rent-A-Center" I mentioned in my December 2018 thoughts and ideas. Vintage had signed a deal to buy RCII for $15/share, but they forgot to deliver notice to RCII that they were extending the merger agreement while waiting on FTC approval. RCII took the opportunity to break the merger contract and argue Vintage owed them a $126.5m break up fee (a hefty breakup fee; more than 10% of the merger value!). The lawsuit was pretty interesting: Vintage argued RCII had "sellers remorse" because RCII had been losing money for years, started to implement the turnaround plan that Vintage had set up, and got sellers remorse when they saw how much money they could make with the turn around plan. Vintage ended up losing that lawsuit, as the judge ruled that they clearly had just forgotten to deliver notice. The lawsuit is instructive to these special situations in a few ways.

First, RCII shares currently trade at ~$26/share. Vintage was going to take them out at ~$15/share. Yes, some of that stock price bump is from the massive breakup fee Vintage had to pay RCII, but most of that increase is from improved fundamental performance from operating the Vintage playbook (as the Vintage / RCII lawsuit makes clear). Maybe that operating turnaround and the stock price increase is just luck (I'm very wary of the N=1 aspect of this piece), but it could also be a sign of both operating skill (successful turnaround) and valuation skill (buying businesses at a discount) on Vintage's part.

Second, RCII is/was a public company before Vintage reached a deal to take them private. Vintage initially offered to take them private at $13/share in November 2017; they raised that offer to $14/share in June 2018 before striking a deal at $15/share a few days later.

So the two key takeaways from the RCII mini-case study (and again, I'll emphasis that this is a sample size of 1!) is that Vintage successfully targeted an underperforming consumer facing business. They had a turnaround plan in place, and they would have made a fortune executing that turnaround plan if they had gotten to buyout the company and execute that plan. In addition, Vintage was willing to make multiple bumps after their first bid in order to get a deal done. That background in mind, let's turn to Liberty Tax. Liberty Tax is the third largest tax prep firm in the country, behind HRB and Jackson Hewitt. For reasons I'll discuss in a second, I think the fundamentals of Liberty Tax itself are not the driving piece of this thesis going forward so I won't dive too far into them (I'd recommend this write up from VIC in November 2018 and this write up from July 2017 for a more in depth look). The high level overview is Liberty Tax was a high flying growth company that ran into a variety of issues (many of which related to a very scandalous sex scandal involving its then-CEO / founder). Vintage stepped in and bought the founder's shares in mid-2018. Then, Liberty Tax received a buyout offer for $13/share from a third party in November 2018; nothing ever really materialized from that offer, but in May 2019 Vintage made an offer to "explore a recapitalization transaction which would allow Liberty Tax stockholders.... to receive $12/share". That offer eventually lead to a July 2019 "Series of Strategic Transactions" announcement that had Vintage merge their "Buddy's" chain (a competitor to RCII that Vintage clearly wanted to merger with RCII when the RCII deal was happening). In addition, the TAXA / Buddy's merger will allow for TAXA shareholders to cash out at $12/share or hold on to their shares, and Liberty Tax will change their name to Franchise Group, Inc. A few weeks later after the strategic transaction announcement, Liberty Tax made their first acquisition, reaching an agreement to buy Vitamin Shoppe (VSI) at a 43% premium it its prior day closing price. Here's what makes this merger so interesting: TAXA's current trailing financials are basically meaningless when it comes to their future financial performance. I think this for three major reasons:

Liberty Tax was undergoing a major turnaround. It's not hard to imagine that the company was in complete disarray after the founder / CEO resigned in a sex scandal, and their FY19 results included "significant one time expenses."

As part of the "series of strategic transactions," Liberty merged with Buddy's, a rent to own retailer (similar to RCII) that Vintage owned. Buddy's trailing financials are obviously not reflected in TAXA's financials, and there should be some synergies between the two companies that won't get captured in trailing financials (i.e. Buddy's could put a TAXA store within a store in all their stores, and there should be some overhead synergies). In addition, TAXA is buying VSI. As discussed later, the combined TAXA / Buddy's has done ~$35m in LTM EBITDA. VSI has done ~$55m. While VSI probably deserves a lower multiple than Liberty Tax / Buddy's, it will quickly become a large piece of TAXA's value and that won't be captured in TAXA's trailing financings.

Liberty is changing its name to "Franchise Group, Inc." VSI has basically no franchises currently (they operate all ~765 of their domestic stores; they do franchise ~10 international stores but obviously that's a rounding error). Liberty Tax also still owns ~100 stores. As I'll discuss in a second (particular with VSI), I would guess any and all corporate owned stores are on sale block.

So Liberty's trailing financials are borderline meaningless when it comes to assessing future value.... but I think there are some hints that today's share price of ~$12/share is cheap. The major clue is the actions of Vintage. Vintage is, by far, the most informed party here. They contributed Buddy's to TAXA as part of the merger. They are clearly the driving force behind the TAXA / VSI merger (Vintage had originally invested in VSI in December 2017). Vintage will be controlling the combined company going forward (tough to peg share ownership until everything shakes out, but Vintage and their partner, B. Riley, should control well in excess of 50% of TAXA's shares). And all of Vintage's actions suggest that they see significant upside in TAXA. Consider:

As part of the TAXA / Buddy's deal, TAXA agreed to buyout any minority shareholder at $12/share. This offer was backstopped by Vintage, who would buy any shares above a baseline amount (i.e. if more than a token amount of shares were tendered, Vintage would be buying the shares at $12/share).

A major piece of the VSI deal is being funded by Vintage, who will buy $70m of TAXA shares at.... $12/share.

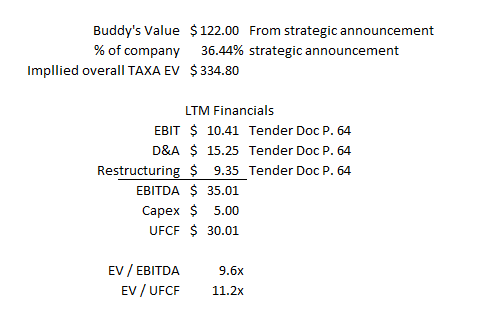

Alright, hopefully at this point I've driven in two points: 1) it's exceedingly difficult to value TAXA given just how many moving parts there are and 2) the most informed insider here (Vintage) appears to have a near unlimited appetite to buy shares at $12/share. Still, just because it's tough to value TAXA doesn't mean we can't try to get a rough estimate. If we look at the Series of Strategic Transactions announcement, we can see that Vintage contributed Buddy's to TAXA in exchange for 36.44% of TAXA's equity, and Buddy's was valued at $122m in that transaction. That implies the whole company was valued at ~$335m; that's the EV I will use going forward as it's difficult to pin down TAXA's exact EV until the tender is complete and the VSI deal is finished. As a simple spot check to ensure that EV is in the ballpark of right, if you look at the PF balance sheet on p. 66 of the tender doc and the shares outstanding on p. 76, I get a similar EV (~$315m in this method) for the company assuming a $12/share price (and before all the VSI stuff happens). Ok, so we now know what TAXA is trading for. How much does it earn? If go to p. 64 of the tender docs, we can see the PF Buddy's plus Liberty company earned $10.4m in EBIT in FY19. Adding back restructuring charges of $9.3m and D&A charges of $15.3m, and I get a PF EBITDA number of $35m. EBITDA should convert very well to FCF: I believe the merger is structured in a way that it will preserve some tax assets the Liberty had as well as reduce the combined company's taxable earnings (so taxes should be low), and capex needs should be minimal. We don't have a PF cash flow statement, so it's tough to estimate, but TAXA averaged less than $5m/year in capex over the past three years, and Buddy's had just $1m in PP&E at the time of the merger, so I would guess PP&E needs will be extremely limited. Bottom line: I wouldn't be surprised if TAXA was generating $25-30m in unlevered free cash flow/year going forward. Compared to a ~$330m enterprise value, that makes TAXA seem pretty cheap given that a significant chunk of those earnings will be coming from franchise royalties, which should be pretty steady / recurring. That valuation also factors in no upside from things like potential merger synergies, upside from Liberty Tax stabilizing (Liberty did ~$40m in EBITDA just two years ago; if they could get even close to that level of earnings, that business alone would be worth more than the current valuation. I'm not saying they well, just saying the business has clearly fallen off and there's certainly upside there), etc.

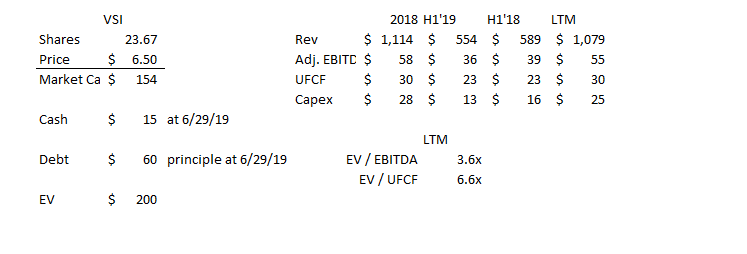

The valuation also factors in no upside from their VSI merger (in fact, it factors in nothing from the VSI merger!). I'm hesitant to give them any credit for value for a merger they just did at a big premium (>40%!), but I do think there are seeds of something interesting here. VSI has 765 stores, and aside from a couple of franchised international units, basically all of the stores are company operated. Liberty Tax is changing their name to "Franchise Group, Inc." It doesn't take a genius to guess what TAXA's plan for VSI is: buy the company, sell the stores to franchisees, and turn it into a royalty stream. Are they going to be able to? Who knows!!! I can't imagine the demand for becoming a vitamin store franchisee is crazy high right now, but I also can't imagine TAXA / Vintage bought VSI without having some due diligence that suggested there were some potential franchisees for the business. The price also looks pretty solid; at ~$6.50/share, TAXA is buying VSI for ~$200m EV. VSI did ~$55m in EBITDA in the LTM and spent ~$25m in capex (in Q1'19, they guided to ~$63m in EBITDA and $33m in capex in 2019, though they didn't update guidance in Q2'19 so I'm just using LTM numbers), so TAXA is buying them for <4x EBITDA and <7x UFCF.

Yes, it's a vitamin business, the outlook for vitamin stores in a digital future isn't exactly spectacular, and it's near impossible to count how many times someone has said "Hey, Legacy Retailer X looks really cheap at 5x EBITDA," right before EBITDA went to zero and the equity was wiped out, but the bottom line to me is TAXA is acquiring VSI really cheap and there appears to be multiple near term opportunities for TAXA to get a significant chunk of the cash they're putting into VSI back (either from franchising the store base and dividending the cash back to the holdco, or simply from running a levered equity model that strips any cash out of VSI immediately). If you wanted to wear really rose colored glasses, you could paint a picture where VSI actually grows earnings and cash flow over the next few years by ceasing all new store openings (per their Q1'19 call, they'll open 10 stores in 2019) and closing unprofitable locations (their Q1'19 call mentioned closing 60-80 poor performing stores over the next three years), but that's certainly not necessary for the VSI investment to workout well given the prices TAXA's paying. I'll also note that I heard plenty of people shorting RCII when Vintage bought them on a pretty simple thesis: rent to own is going away, Vintage is paying a full multiple, and if the deal breaks RCII will get demolished. Well, turns out Vintage had a clear idea about how to significantly improve that business and would have made a fortune if the deal had gone through (just based on RCII's current price and recent results); instead, RCII made a fortune at Vintage's expense by implementing Vintage's playbook. So sure, I doubt the long term viability of VSI, but I'm very willing to bet that Vintage has a solid playbook that they plan on implementing that can significantly improve the company's results. Anyway, I'm rambling a bit so I'll wrap up the VSI section and then the overall article here. My bottom line with VSI is that TAXA is buying them cheaply and getting a lot of interesting upside optionality. I would guess that the investment works out decently well as a base case just given the low multiple, with the potential for it to work out really well if they can quickly franchise the business. With TAXA, I think you're getting the opportunity to buy into a company that's about to become a cash flow machine at a low multiple because of extraneous factors (Liberty Tax's recent struggles, complex trailing financials from the merger, forced selling from TAXA getting kicked off the exchanges, etc). The company has multiple avenues of optionality that could accelerate that cash flow (some synergies, potential from Liberty Tax stabilizing and selling off their company owned stores, closing the VSI merger and franchising that business), and executing on any of them could quickly rerate the company. Other odds and ends

From a "special sits" perspective, I think the most interesting piece of an investment is TAXA is you get a "free look" at their near term financials and their VSI valuation. Remember, as part of the Buddy's merger, TAXA agreed to offer shareholders the option to cash out in a tender at $12/share (with the tender backstopped by Vintage). The company had to delay that tender when they announced the VSI deal (completing the tender while the VSI offer was out without offering any info on that merger would probably invite a securities investigation or three); they plan on restarting the tender once they provide additional info on VSI. So buying shares of TAXA today is a free look at what they say about VSI (in addition to any earnings releases TAXA puts out between now and restarting the tender): if you see something you don't like in the financials, you can basically tender into TAXA at $12/share and breakeven from today's prices. If you like what you see (or if the market likes what it sees), you can hold on to your shares (or the market will have priced shares well through $12 and you can sell at a profit).

This should be a completely free look as, based on my reading of the tender docs and merger agreement, there's no way for TAXA / Vintage to back out of doing the tender, and given Vintage already contributed Buddy's to TAXA, if they did try to back out of their backstop TAXA would probably just get to keep Buddy's as collateral for a very easy to win breach of contract lawsuit.

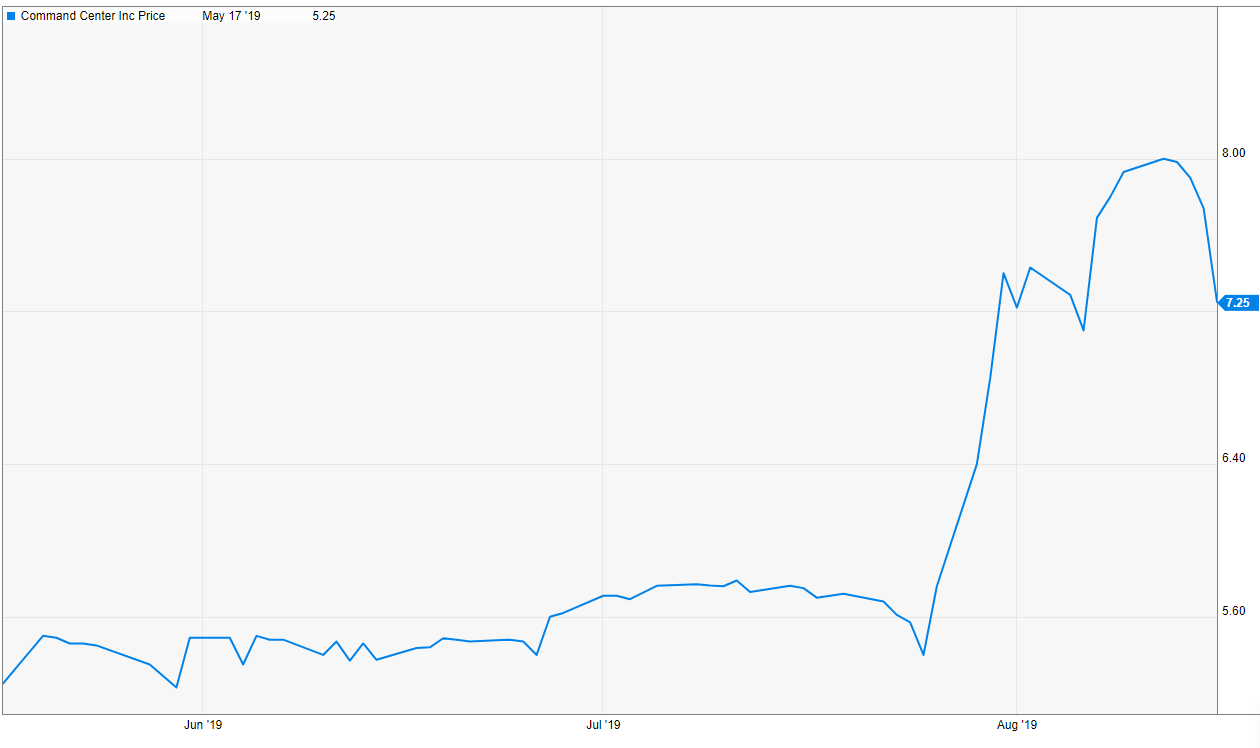

Another thought: what if the TAXA set up is the same as CCNI post tender? I won't go through the full background here, but basically over the summer CCNI did a deal very similar to TAXA / Buddy's. A private company merged into CCNI and, as part of the merger, offered to buyout a huge chunk of minority shareholders in a tender at $6/share. The offer was undersubscribed, and basically the moment the offer expired CCNI shares jumped way through the offer price.

The CCNI parallels are interesting because CCNI's plan was similar to TAXA: CCNI's new majority owner was buying CCNI with the explicit plan to take CCNI's company owned stores and franchise all of them out.

A huge risk with this investment would look like this: what if Vintage is stuffing TAXA with Buddy's at a super inflated valuation? So, in this scenario, Buddy's was valued at $122m in the merger deal; what if Buddy's was really only worth $60m and Vintage's real edge comes from trading overvalued Buddy's equity for the newco? It's certainly possible that Buddy's is overvalued at the valuation Vintage swapped it into TAXA at, but overall I think the thesis that the "wholeco is way undervalued" stands here for two reasons. First, and most importantly, Vintage appears to have enormous appetite for newco shares at $12/share (as evidenced by backstopping the tender offer and financing the VSI merger), which suggests they think the whole company is undervalued. Second, p. 64 of the tender docs show that Budy's made $12.4m in EBITDA in the LTM, so the $122m Vintage contributed Buddy's at valued the company at <10x EBITDA. With extremely limited capex requirements given basically no PPE, <10x EBITDA is basically 10x unlevered cash flow, which seems fair-ish. RCII trades for ~6.5x EBITDA, so maybe you could say I'm overvaluing Buddy's at 10x EBITDA; however, RCII is basically all company owned stores (their 10-k has them at 2,158 company stores and 281 franchised) while Buddy's is basically all franchised stores (p. 51 of the tender docs has Buddy's at 35 owned stores and 235 franchised stores), so Buddy's almost certainly deserves a higher multiple given it's franchised / capital light nature.

Here's another risk: I'm just a dumb dumb. TAXA is about to be a combination of a vitamin shop, the third largest tax prep company in the nation, and a small rent to own franchise business. None of those exactly scream "good business" or "long term growth prospects." I think that's more than offset by the multiple here (low, and probably lower after you adjust for all that optionality), but (to somewhat paraphrase Charlie Munger) maybe what's happening here is you're just rolling three mini-turds together and the result isn't a raisin; it's a giant turd. I've been a dumb dumb before and it's entirely possible I'm one here as well.

Capital allocation is going to be critical here. Between VSI (particularly if they manage to franchise the business), Buddy's, and Liberty Tax, the new company will be a collection of asset light companies that spit off free cash flow (a bear might say a collection of melting cash flow companies; someone more bullish might see some avenues for growth or at least hope the company can maintain their current earnings for a few years). Given the low multiple and the high cash flow, what the company does with that cash flow is probably going to be the determining factor with how this investment works out. I'm pretty comfy with that risk: Vintage and B. Riley are going to own over 50% of the company, so they'll be the driving force behind capital allocation, and I'm pretty positively inclined to Vintage / B. Riley (as you might have guessed from the upfront of the article). My understanding is Vintage has a very good track record in their private funds, and I've generally been impressed with Vintage and B. Riley's (who has partnered with Vintage for a bunch of recent investments) recent investments (RCII would have been a home run, RILY (disclosure: long a tracking position) has done a bunch of really interesting microcap investments (particularly on the "take control" side), the two partnered on an interesting recap of BW, etc.).

I have not given any valuation detraction for a bunch of ongoing shareholder lawsuits. I tend to think shareholder lawsuits are pretty silly (as a shareholder, you're an owner of the company, so by suing them you're just moving money from one pocket to the other less a ton of legal fees and taxes), but there are still a couple of outstanding lawsuits from the former CEOs scandal days. If TAXA is on the hook for any of those liabilities, it'll obviously detract somewhat from TAXA's value, though I think you'r ebuying cheaply enough that as long ast the liabilities aren't too crazy you'd be ok.

Speaking of the former CEO, here's an interesting interview with him and how he plans to launch a new tax franchise business; this will be his third!

I feel like this goes without saying in a post that includes the line "I'm just a dumb dumb," but TAXA is an OTC stock and somewhat illiquid. Do your own work!