Two Vintage Capital Special Situations Part 2: $TAXA $RRGB

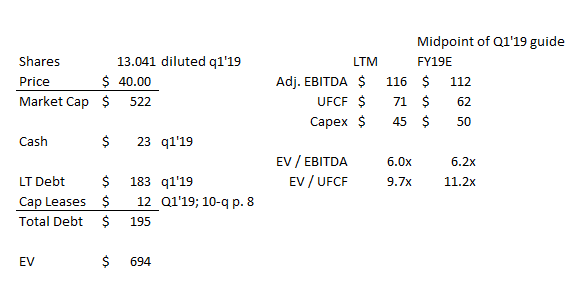

This is the second in a series of two posts (you can find the first here) that center on the two most interesting special situations I'm tracking currently, Red Robin (RRGB; disclosure: long) and Liberty Tax (TAXA; disclosure: long). Given how interconnected the two ideas are, I wanted to keep to two posts together, but for a variety of reasons I ended up splitting them. In this post, I'll on Vintage's offer for Red Robin. I'd encourage you to read the first post for a bit of background on Vintage and their plans for TAXA. Red Robin is a ~600 unit (actually 572, with 483 company owned and 89 franchised) casual burger chain. They're probably most famous for their commercial jingle (Red Robin YUMMMM) and their offer of bottomless fries. The chain will celebrate its 50th anniversary in September. The current financials of Red Robin are.... not great. Same store sales (SSS) were down 3.3% in Q1'19, with guest counts down 5.5%. That's awful, and it comes on the heels of a poor 2018, where SSS were down 2.6% and guest counts were down 1.5%. Margins are compressing as labor costs rise and the company experiences operating deleveraging from the drop in sales. Their CEO resigned April, and RRGB is still operating with an interim CEO. So things aren't exactly going swimmingly at RRGB. Despite those weak fundamentals, Vintage has bought up ~12% of the company of the company this year (their cost basis appears to be ~$30/share) and, in June, lobbed in an offer to buyout the whole company at $40/share (they followed up with a more fully fleshed out offer in July). Red Robin has acknowledged receipt of Vintage's offer, but aside from that and an initial response they've been pretty mum on the deal. My investment thesis here centers on one thing: the most likely outcome from Vintage's offer is Red Robin goes private at a significant premium to the current share price. Most likely, Vintage buys RRGB (and I believe they would buy them through TAXA), but it's possible a different private equity firm or strategic makes the winning bid. Either way, I'd be surprised if RRGB hasn't reached a take private agreement by year end. With shares currently trading for ~$33/share (a significant discount to Vintage's $40/share bid), the market clearly disagrees with me. So what does Vintage see in Red Robin, and why do I think it would be an attractive acquisition target? The most obvious reason is price. Even at $40/share (a huge premium to RRGB's current price of ~$33/share), RRGB would be trading for ~6x EBITDA and ~11x unlevered Free Cash Flow. That's a very low multiple, and it doesn't take too much imagination to picture buying the whole company at that low a multiple working out well for a buyer if they can stabilize the whole company (and I have no doubt that a variety of buyers could easily talk themselves into that!). Note that I'm using total capex here; the company is still opening up a couple of restaurants so you could argue maintenance capex is even lower / unlevered free cash flow is even higher, but I didn't think it was worth splitting hairs over.

I think there's reason to believe Red Robin is even cheaper than it appears in a spreadsheet. There are two reasons for that belief:

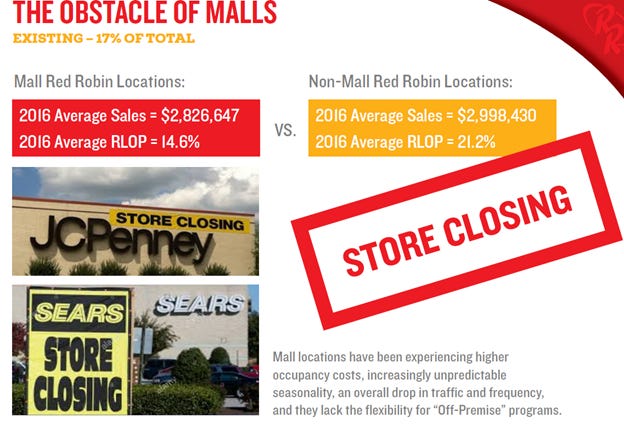

Red Robin has been calling out some under-performing mall locations for years, and through the rest of the year the company will be shutting down ~10 of them. These locations have lost money over the past year, so shutting them down should boost overall profitability. It seems this round of closures are just the tip of the iceberg; on their Q1'19 call, the company mentioned looking to close down or renegotiate the lease for up to 66 other (mainly) mall-based locations.

The slide below is from their 2017 investor day presentation; I would guess trends for most of their mall locations have gotten worse sense then.

One of this blog's first posts was on Vonage (VG). Part of the thesis from Vonage was that the company had invested >$2B in advertising the Vonage name since inception, and that gave them a slight name recognition edge against a lot of their competitors (people still recognized them from the "Woo-Hoo" commercials). Red Robin has a lot of similar parallels. The company has a catchy commercial that most people can instantly recognize them from (I don't believe I've ever been to a Red Robin, though I'm planning a diligence trip in the near future, but I could still recognize their jingle), and I think that gives them a bit of an edge versus other restaurant chains. I'm not suggesting that the Red Robin brand deserves a huge premium or anything, but I do think if you offered an informed buyer the opportunity to buy RRGB for 6.5x EBITDA or a similar but nameless burger chain for 6.25x, most firms would probably lean towards buying RRGB just because they see some extra optionality from capitalizing on the name brand / recognition.

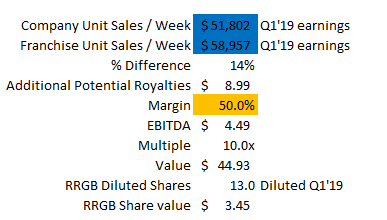

Ok, so Red Robin is cheap and maybe has some "brand upside" optionality or earnings upside as they close underperforming stores. But I think Vintage might see something else when they look at Red Robin: synergies with TAXA from franchising Red Robin's store base. I'll refer you to the first post in this series for more background, but remember that Vintage has become the controlling shareholder of TAXA and is changing the company's name to "Franchise Group, Inc." Red Robin currently has 572 stores, of which 483 are company-owned, and Red Robin has been talking for years about selling company-owned stores to franchisees. I don't think it's a stretch to imagine that part of Vintage's plan for Red Robin includes jump starting Red Robin's nascent franchising efforts and selling off a bunch of stores to franchisees. I also don't think it's a stretch to imagine that, post TAXA / VSI / Buddy's merger, Vintage now plans on having TAXA be the buyer of RRGB, as doing so would help grow TAXA as well as providing some back-office operating synergies with the rest of TAXA's franchising business. Would a potential franchisee want to buy into a Red Robin corporate store? I'm mixed. On the negative side, Red Robin has been trying for several years to franchise company owned stores; I read their 2017 investor day transcript (see slide below), and they make tons of references to selling some corporate owned stores in order to seed some franchise markets. They've made zero progress since then as franchise restaurants are basically flat since YE2016. On the other hand, I think Vintage could come in and sell potential franchisees on a new owner revitalizing the RRGB brand, and that a potential franchisee buying in now is getting in at a low valuation before sales inflect upwards. In addition, they could pitch franchisees that corporate run restaurants underperform franchise Red Robins: in Q1'19, corporate restaurants did <$52k/week in revenue versus franchise restaurants at ~$59k/week in revenue. Obviously that's not a completely apples to apples comparison (corporate restaurants could just be in worse markets), but I think there are certainly the beginnings of an interesting pitch to potential franchisees there. If successful, Vintage / TAXA could buy RRGB and immediately take out a huge chunk of their equity investment by selling company owned restaurants to franchisees, and the result would likely be a grand slam for Vintage.

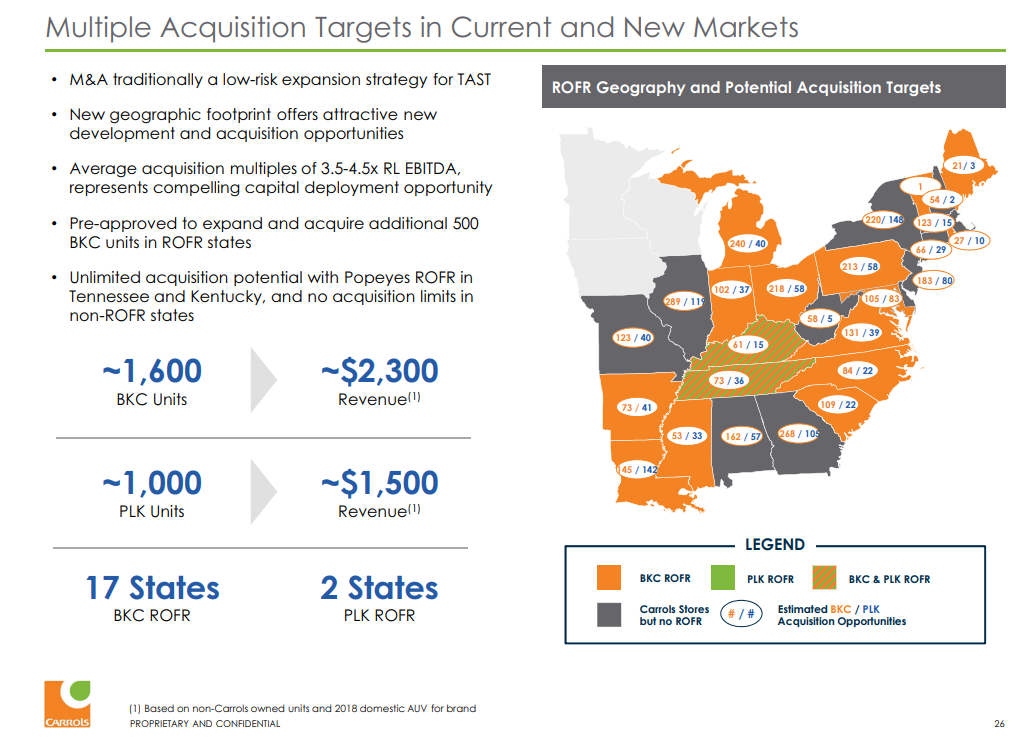

What would RRGB's financials / SOTP look like if they could successful convert to a franchisee model? Let's start by looking at how much cash RRGB could get from franchising units. This is not purely apples to apples, but TAST is a publicly traded franchisor of QSR restaurants (Burger Kings and Popeye's). They target buying franchises at ~4x restaurant level EBITDA (see slide below from their June 2019 investor pres), and their restaurant level EBITDA margins run about ~14%, so at the revenue level it looks like they pay ~0.55x sales (4x EBITDA * 14% margins). Obviously Burger Kings and Popeyes have a bit different economics than Red Robins, but I think those multiples would make sense as a baseline for RRGB. RRGB's restaurant level operating profits have run ~20% over the past two years; throw in a 5% franchise royalty rate (because RRGB's restaurant margins are corporate and don't include a franchise fee while TASTS's targets already have that baked in; I use 5% because that's the high end of RRGB's royalty rate from p. 48 of their 10-k) and a Red Robin store's margin profile would look similar to what TAST is buying (probably a bit better given a Red Robin does ~$1m/year more in sales than a Burger King / Popeye's, so my gut tells me you get a little bit more operating leverage on capex and overhead).

That valuation is actually consistent with what RRGB has talked about getting for their stores in the past. In their 2017 investor day, RRGB put up the slide below, which suggested selling some restaurants to seed some franchise markets would result in a loss of $200m in revenue but proceeds of $90-120ms.

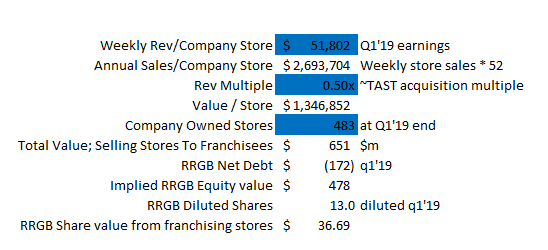

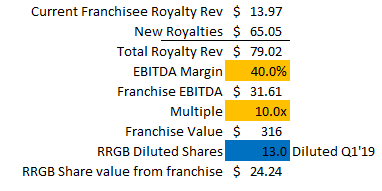

Run with me for a second and say that a franchisee would be willing to pay 0.5x annual sales for RRGB's company owned stores (so a bit below what TAST pays when they buy franchises and towards the low end of what RRGB thought they could get in their 2017 deck). If that's right, and given RRGB stores did $51,802/week in sales in Q1'19 and RRGB owns 483 stores, that would imply that RRGB's entire company owned store base is worth ~$36.69/share (net of RRGB's debt). See my math below:

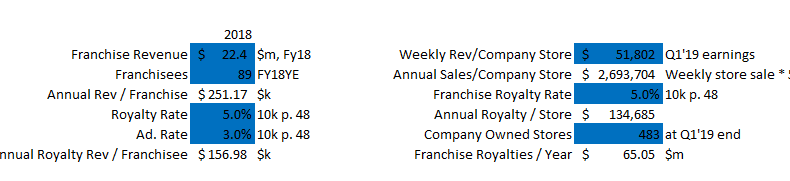

On top of that value, you'd get the value of RRGB's franchise fee stream. This would obviously be a high margin fee stream that would likely be worth a very high multiple; for example, QSR trades for ~20x EBITDA and WING trades for 75x EBITDA. Neither of those are great comps for RRGB as they are growing units significantly faster than RRGB is (though maybe Vintage could change that as they implement a turnaround plan), but I show that to highlight how high of a multiple these things can generate. I would guess the right multiple for a hypothetical RRGB franchise fee stream would be ~15x, though you could make a credible argument that it could be as low as 10x (DIN, for example, owns Applebees and iHop and is almost 100% franchised, so you could consider them a really solid comp, and they trade at ~11-12x EBITDA, while WH trades at ~10-11x EBITDA, though they have a lot more cyclical fears embedded in them than a casual burger chain like RRGB would get). Anyway, we need to figure out how much revenue and earnings RRGB would get from hypothetically franchising their restaurants. We already know that the average RRGB company owned store does ~$52k in sales/week. Let's assume that RRGB would charge a 5% royalty rate (the high end of what's mentioned in their 10-k); that means the annual franchise royalty stream per store would be ~$135k ($52k * 52 weeks * 5%). We can spot check that number against what revenue RRGB currently reports from their 89 franchisees. In FY18, they reported $22.4m in franchise revenue. That number includes both advertising revenue (a franchiser charges franchisees an advertising fee but is required to spend that money; they have to report this as both revenue and expenses so it nets out as a zero but dilutes margins, though hopefully it builds brand value over time!) and royalty revenue. If we assume they are charging franchisees 5% royalty rates and 3% advertising rates (~consistent with p. 48 of their 10-k), then RRGB would be getting ~$157k/year in royalty revenue from franchisees. That roughly matches up with the math I just did above to get to $135k in royalty revenue / year from franchising a corporate store (a big piece of the $157k versus $135k discrepancy can be explained by the current franchise stores doing ~$7k/week more in sales than corporate stores).

With 483 corporate stores getting franchised, that would be $65m/year in royalty revenues. Add that to the current ~$14m/year in royalty stream from the existing franchisees (last year's $22.4m in franchise revenue with the advertising piece taken out), and the new business would do ~$79m/year in royalty revenues. This royalty revenue should be a very high margin as there are basically no costs except for some overhead associated with it; for example, Wingstop (WING; disclosure: short a tracking position) reports ~30% adjusted EBITDA margin, but if you adjust for advertising fees (as mentioned above, pass through revenue worth $0 in income so it dilutes margins, though it does build brand value) and a few company owned stores, I estimate Wingstop's franchise business does ~60% adjusted EBITDA margins with even higher incremental margins. DIN actually presents EBITDA margins without advertising expense; they do 45% EBITDA margins ex-advertising though that includes low margin rental revenue and company operated stores; again, I would guess they're ~60% EBITDA margins if you exclude those really low margin streams. RRGB won't have quite the same scale as Wingstop and obviously doesn't have DIN's scale, so let's conservatively assume that the RRGB franchise business would do 40% EBITDA margins; that would generate ~$32m/year in franchise EBITDA. Assume a conservative 10x multiple, and the franchise business would be worth ~$316m, or ~$24/ RRGB share (FWIW, I actually think the business would be worth a ~15x multiple if they could pull this off, and I would guess margins would be closer to 50%, but if the economics are even close to what I laid out this idea will work out so well there's no need to get aggressive).

Put the value from the franchise stream together with the value from selling off the company owned stores before, and you would get a total SOTP value of ~$61/share. A huge premium from today's price, and significant upside from Vintage's bid if they can buy RRGB and successfully pull off this model. Note that none of this assumes improvements at the company owned stores that got franchised. Again, I think a big selling point the company will make is "our franchised stores do >10% more sales than our company owned stores; as a potential franchisee, there's tons of upside from improving operations". I'm not sure if that upside really exists, but if the franchisees managed to close that gap across all 483 company owned stores it would create an additional ~$9m in annual franchise royalty revenue for RRGB. Assume 50% incremental margins (again, I would guess higher given incremental royalty revenue should flow directly to the bottom line) and a 10x multiple, and that would be an additional ~$3.45/share.

There are some pieces of this analysis that have clear holes: for example, I've assumed the company franchises all of their stores, but they'll probably close down some unprofitable mall units and need to keep a couple of stores as owned corporate stores (every franchiser I'm aware of holds on to one or two stores to experiment with operations with). Still, I think the overall direction of the piece is accurate: if you can successfully franchise the bulk of the Red Robin Stores, you could probably get pay down roughly all of Red Robin's debt and current equity value while getting the remaining high margin, high multiple franchise business for free. Turning back to the special situations piece of this, the interesting thing about that SOTP / franchisor franchisee split is that we already know Vintage is interested in pursuing exactly that strategy. As mentioned in part one of this series, TAXA is changing its name to Franchise Group, and it's pretty obvious that they're buying VSI with the express purpose of selling their corporate owned stores to franchisees. Vintage has already bid $40/share for RRGB; as mentioned above, my guess is that Vintage's end game is to have TAXA buy RRGB and franchise all of their corporate units. Doing so could be a win/win for Vintage: Vintage appears to have a big appetite for TAXA shares, so they could provide TAXA financing for an RRGB transaction (either by buying new TAXA shares, rolling their RRGB shares into TAXA, or perhaps both), they could capture the majority of the upside from pursuing a franchising strategy at RRGB for themselves (since they own the bulk of TAXA), and successfully pulling that refranchising strategy off would be proof of concept for TAXA that might boost the company's multiple to a level where they can accrettively raise equity (if you go back to my first post, TAXA currently trades for a mid-single digit EBITDA multiple, while most franchise concepts I follow trade for solidly double digit multiples. If TAXA can grow into a similar multiple, it would let Vintage start to take some of their investment off the table at huge gains as well as start to use TAXA's equity to accelerate growth). Anyway, let's wrap this up with a quick summary. I think Vintage has shown both some skill with picking undermanaged / undervalued small cap consumer stocks, and I think they are likely very willing to pay a premium to buy RRGB and pursue a franchising strategy. Even if a buyout doesn't come to pass, RRGB's quite cheap, and I think investors would probably do well from here investing in RRGB provided the company can somewhat stabilize their operating performance. If they can't stabilize, between Vintage's offer and ownership, I'd expect management to be forced to run a sales process, and given the low multiple and the brand equity here, I'd be surprised if they couldn't find a buyer willing to pay a higher price than the current market price. Other odds and ends

Just to throw back to the first post in this series, in it I discussed how Vintage bought a stake in RCII and then lobbed in multiple increasing bids until they reached a deal (a deal that ultimately fell through when Vintage thought to extend). Do I think Vintage will raise their bid here if RRGB indicates they're open to selling? Maybe! But it is nice to know that they have a history of their first bid representing more of an opening bid than a best and final offer.

Notice I said if RRGB is open to selling. That's a major question here. I tend to think they'll have to: Vintage owns 12%, RRGB's recent performance has been awful, and the company doesn't have a full time CEO. But the stock price is way below all time highs, and insider ownership is borderline non-existent. That combination tends to create a company that's hesitant to sell and would prefer to hold on and hope for a turnaround / higher price. I think Vintage would easily be able to replace the board and force a sale if it came to that, but those processes take time and RRGB's fundamentals could continue to deteriorate while the process is ongoing.

Red Robin reports earnings Friday. I generally think the market overreacts to earnings, but this report will actually be pretty critical both because it will likely be awful and make this idea quickly blow up in my face and because it will probably baseline how the company responds to Vintage. A really weak set of earnings (particularly same store sales), and Red Robin is going to face a shareholder revolt if they try to turn down Vintage's offer (at a large premium!) and remain a standalone company (of course, a weak set of earnings might set Vintage up to lower their offer price). A strong set of earnings might give Red Robin a bit more breathing room in fighting off a buyout offer and remaining a standalone company.... or it might pressure Vintage or other would be buyers to bump their bids.

Red Robin owns the real estate under 37 of their stores. I estimate that there's $30-50m of hidden value (net of rent costs if they sold those stores and kept operating them) in that real estate, that it's tough to have great confidence in that number without having more details on exactly what stores Red Robin owns. Still, that's ~$3/share of real estate value, and I would guess Vintage would be quick to monetize that if they did buyout RRGB (as would most financial buyers, and I would guess the presence of that hidden value would be a nice part of the appeal for potential bidders).

As I mentioned in the first post of this series, it's entirely possible I'm a dumb dumb. Red Robin is a casual burger chain. It's tough to imagine a more competitive space, or one with lower barriers to entry. I think the valuation and potential catalysts here are more than low enough to make up for just how bad of a business this is, but buyer beware!

Speaking of being a dumb dumb, I'm going to copy a bullet from part 1: "I feel like this goes without saying in a post that includes the line "I'm just a dumb dumb," but TAXA is an OTC stock and somewhat illiquid. Do your own work!"