Yet another guide to media stocks, Part 2: networks $FOX $CBS

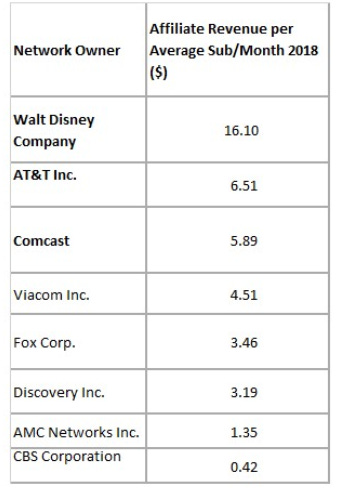

Hi! Welcome to Part 2 of Yet Another Guide to media stocks. This part will cover the networks. Before diving in, I'd highly encourage you to check out the intro section to the guide, which goes over why I'm doing this and dives into the most important thing hitting the media sector today: cord cutting. You can also find links to all of the pieces in this series here. That out the way, on to part 2: the networks. Networks The networks are what you generally think of when you think of TV: the big 4 networks of CBS, FOX, ABC, and NBC. All are interesting, but from an investor's standpoint the most interesting are FOX and CBS. Why? Well, NBC is owned by Comcast and a small-ish piece of Comcast's overall value; similarly, ABC is owned by Disney and is a small piece of its overall value. Fox and CBS are major pieces of their publicly traded companies, and so investors can more or less "bet" on them by buying their stocks. So this article will tilt a bit heavier towards those two. Let's start with a brief overview: the networks provide programming to their broadcast affiliates (who I discussed in part 1). This includes prime-time programming (think NCIS or The Good Place), as well as sports (NFL), national news, and late night shows (The Tonight Show). In most of the major metro markets (NYC, LA, Chicago, etc.), the networks also own their local broadcast affiliate, but that is a seperate business that can be analyzed and valued separately. Networks make their money from two places: advertising and reverse retransmission fees. A reverse retrans fee is the fee that an affiliate pays the network for their affiliation; for example, Nexstar might pay CBS $1/sub for the right to be a CBS affiliate / carry CBS programming. Why would Nexstar pay CBS? Because Nexstar gets $2/sub from the local cable company in retrans fees, and they'd get a heck of a lot less if they weren't a CBS affiliate (note that I'm just using hypothetical numbers to make the math / visualization super easy). I think the easiest reason to be bullish networks is they get way less money on a per eyeball basis than most cable networks. I pulled the chart below from this article (which is worth reading); note that the revenue is every cable channel a parent company owns so you can't really compare across companies (i.e. Disney includes ESPN, ABC, Disney Channel, etc.). The two I want to focus on are AMC and CBS. AMC owns AMC, BBC America, We TV, and one or two other niche channels. CBS is CBS (duh), but also CBS Sports Network. (Note: I'm not convinced the CBS numbers on here are perfect, but it's directionally correct so let's go with it). (post publishing note: I added a clarification post further discussing the sub number below)

Consider the ratings here: even ignoring major sports that CBS offers (and ignoring them is a huge task; CBS has the NFL, Masters, March Madness, SEC college football, etc.), CBS programming does multiples of the ratings of AMC. Below is a comparison of CBS ratings versus AMC (from tvseriesrating CBS and AMC page); impressively, CBS's least watched shows appear to have more viewers than AMC's blockbuster Walking dead, and the viewership numbers get wildly different from there. To be fair, The Walking Dead rivals CBS's shows in terms of viewership in the all important 18-49 demo, but if you're a cable company looking to retain video subs, doesn't having more overall viewers (particularly among older viewer who are paying the bills) matter more than having one show that is popular with the youths?

CBS made the point slightly differently in their CBS / VIacom investor presentations: the combined CBS / Via is responsible for 22% of viewing, but gets just 11% of affiliate / retrans share. That's a huge opportunity going forward, and one that I think could be aided by the increase in D2C services. I'll just show one simple example: CBS All access costs $5.99/month with ads, or $9.99 without ads. No cable company pays CBS even close to that much on a per subscriber basis, but I would guess a substantial minority of cable companies' viewership watches CBS. If someone cuts the cord and signs up for CBS All Access, that's a mammoth boost in revenue for CBS, even before factoring in that an All Access sub gives CBS a direct consumer relationship (tons more data) and allows CBS to increase their advertising inventory (they no longer need to give the cable company ad slots).

So the big bull thesis for the networks is pretty simple: they get paid a lot less on a per eyeball basis than anyone else, and if they can correct that over time their payments should go up. You can see lots of different avenues for them getting paid more: going D2C, skinny bundles (bundles of ~10 channels; because the skinny bundles lack legacy distributor's pricing power, they generally pay higher fees), or simply running a blackout or two until distributors pay them more. (Note that this is a very similar argument to what DISCA makes; I'll talk about DISCA in a different post but for a variety of reasons I like the argument more for CBS than DISCA. The main one is that I think a lot of DISCA's programming can be easily replaced for free online (i.e. Food Network can be partly substituted with free YouTube videos, and it doesn't take that much for personalities to launch their own food oriented youtube channels), but the same doesn't hold for CBS). The bear thesis for networks includes a lot of the points I detailed in the local broadcaster post and intro (cord cutting, advertising revenue declines, etc.), so I won't rehash them. However, they include one other major point worth highlighting: sports rights fee escalation. This risk comes in two forms:

The most obvious is what happens when the networks need to renew their sports rights. The NFL is the headliner here; most of networks' NFL rights expire in 2022, and the bidding for those rights is likely to become a bloodbath (CBS has already said they'll do "whatever it takes" to keep them, and it will be a top priority for all the other networks. Fox has said keeping the NFL 21 years from now would be their top concern even if they had just signed a 20 year NFL agreement). Currently there are five different NFL packages: the three "night" packages (Thursday, Sunday, and Monday) and the two Sunday afternoon packages (CBS has the AFC; Fox has the AFC). I would guess everyone who currently has a package wants to keep it, and I would guess ABC would love to get a package. That's five bidders for five packages (CBS + FOX + ABC + ESPN + NBC). All you need is one other bidder coming in for a package, or one bidder deciding they want two packages (like Fox currently has) and prices go ballastic as no one wants to be left without a seat at the table; look no further then how quickly prices escalated when Fox came onto the scene back in 1993. And there are a lot of people who could be that potential extra bidder: AT&T could decide TNT could do with some sports rights. One of the internet giants could use the NFL to drive subs and eyeballs (Amazon looms large here).

The other is what I referred to as the ESPN issue in the intro: the reverse operating leverage that happens when they need to spread the fixed cost of sports rights over a smaller user base because of cord cutting. Say ESPN agreed to by $1B/year for sports rights three years ago. At the time, they had 100m subs, so the rights cost $1/sub/year. What happens if they have 60m subs in three years? Suddenly the cost/sub has nearly doubled!

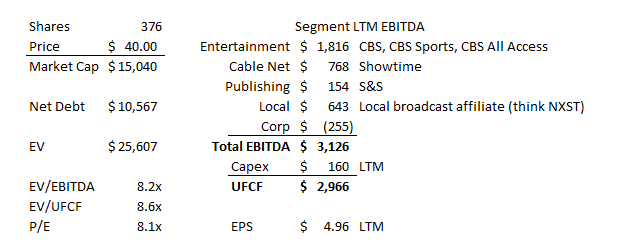

So sports are clearly a risk. However, I'm not sure if the risk is as bad as people think. Say CBS lost the NFL. They currently pay ~$1B/year for the NFL. They can take that money and spend it elsewhere: original programming, more college football, etc. The network would still have March madness (through 2032), the Master and PGA Championship (through 2030), some big live events (Grammys, Tonys), and the SEC (through 2024), along with the most popular original programming on television. Obviously that's weaker slate without the NFL, but honestly it's probably a better slate than ABC currently has. Ok, hopefully I've covered the risks and some sources of upside for the networks. Let's talk valuation. I'm going to show the valuation for CBS here. Fox isn't that different than CBS in terms of valuation; I've got them trading at ~9x EBITDA and ~10x unlevered FCF, and lower if you adjust for some extra goodies (they own their studio lot in LA, which is worth >$1B, they've got a tax shield worth >$2B, and they've got a substantial stake in Roku). So most of what I say here will apply to FOX. There are a few ways to look at CBS's value. The first would be to simply value the whole company; they look pretty cheap on those metrics.

You could also do a SOTP if you wanted. NXST trades for 7-8x EBITDA, so you'd probably value local at around that. Entertainment and Cable Net are tough cookies; there's no perfect pure play comp for either, and historical transaction multiples are pretty high (T / TWX was 12-14x and is probably the best comp, but CBS itself is a much better asset than TNT / TBS / CNN, while HBO is a way better asset than showtime). Publishing (Simon and Schuster book publishing) probably deserves a pretty low multiple, though you could talk yourself into it having some strategic importance (publishing books gets you a foot in the door / first look at potential future IP). Anyway, I'm not going to put a SOTP here, as I don't think any of the parts are so different that it materially changes the overall multiple / valuation. I just wanted to point that out. There has been some buzz that the new CBS will sell off some noncore assets, so a SOTP might be more meaningful than normal... There are three other complications to CBS's valuation. These are more company specific than sector specific, but I wanted to touch on all of them. First, political spend. CBS's LTM earnings capture the tail end of 2018 political spend. To account for the cycles in political revenue, it's probably more accurate to look at local and maybe even entertainment on 2 year average earnings. As I've noted before, 2020 is probably going to be a blockbuster year for political advertising, so earnings should have some natural tailwinds in the near future. Second, investment into D2C. CBS and most content companies are making huge investments their D2C apps. This investment comes in three forms: first, the actual investment needed to launch a D2C app. Think tech spend, marketing, customer acquisition costs, etc. Second, they are mammothly stepping up their investment into content to make their consumer apps viable. The company is making a bunch of new originals shows for both CBS and Showtime (Why Women Kill, tons of Star Trek shows, etc.). Those shows cost money (on their Q3'19 earnings call, CBS noted that content spend was up ~20% YoY ), but they probably will represent a good investment long term as they continue to build the CBS All Access App / Showtime D2C business. Third, they are forgoing licensing revenue to get more content onto their apps. Think of NBC pulling Parks and Rec and The Office from Netflix to bring it onto their new app. I believe Netflix was set to pay ~$100m/year for each of those shows. That's $200m in very high margin revenue that NBC is forgoing in order to build out their own app. CBS owns a bunch of classics (Cheers, Star Trek, Twin Peaks, CSI) and some of the most popular shows currently on TV (NCIS). Are any of those as valuable as The Office? No, probably not. But a lot of them would have a lot of value, and CBS is forgoing that value to build out their D2C app. If I wanted to absolutely maximize CBS's near term cash flow, I think you'd be shocked how high I could get it by shutting down All Access and selling off / licensing the back catalog to the highest bidder. Is that the right move for long term shareholder value creation? I doubt it. But I point it out because I wanted to highlight that CBS is trading at a very low multiple and their earnings are significantly depressed by several expenses / forgone revenue streams that are currently running through the income statement but should create long term value. Third, CBS in this form won't last for long. The company is merging with Viacom (they will finish the merger tonight; I wrote a decent bit of this around Thanksgiving). I think a lot of people are questioning the merger. I'm surprised by that; yes, Viacom has some headwinds facing it, but there are clear synergies between the two companies and the scale of the two will be important going forward (I believe both Greg Maffei and John Malone said they were surprised by how negative the market was since the merger's announcement.). You can find the CBS / Via proxy here; it includes lots of forward projections. I won't go through them here, but I'll note if you give them credit for some of the synergies they think they'll achieve and simply take the lowest projection for each of the two companies, the new company stock is even cheaper than standalone CBS. More importantly than the combined companies being cheap, I think there are real near term and long term synergies to having CBS and Viacom together. Viacom owns Nick, MTV, and Comedy Central; that's a lot of potential content that CBS will be able to bring onto CBS All Access. I believe The Simpsons has been the most popular thing on Disney+ so far, and Family Guy is really popular on Hulu. Viacom already licensed South Park to HBO Max and has sold a lot of Nick shows to Netflix in its "arm dealer" strategy, so there's unfortunately no near term upside to putting all of their stuff onto All Access, but there's still a really deep library over at VIA that CBS can use to deepen out All Access. For example, I don't think Chapelle Show or Key and Peele have been licensed yet, and I believe there are plenty of Nick shows yet to be licensed (just last week CBS and Nick announced a bunch of children's programming heading to All Access). Add all of those to All Access the the depth of the inventory starts to look really interesting.. You could also see lots of potential to mine classic Nick shows for future IP in a variety of forms, and while the Paramount movie studio has been mismanaged for quite sometime, it contains a bunch of iconic properties (Titanic, Godfather, Forrest Gump, as well as more commercial stuff like Mission Impossible, Star Trek, and Transformers) that can eventually go on the All Access service (again, adding depth to the inventory) or even be relaunched / remade in the future. Scale is the name of the game in streaming, and you can see how a combined CBS + VIA gets you a lot closer to the scale they'll need to be a viable standalone streaming service. CBS vs Fox So far this post has focused on CBS. The most direct investing alternative to CBS is FOX, so I think it's a fair question to ask why not invest in Fox versus CBS? The first thing to point out is that Fox owns two main assets: Fox the network and then Fox News, and the value of Fox News drastically overwhelms the value of Fox, so much so that an investment in Fox is more a bet on the future of Fox News than it is anything else. Fox's cable segment, which mainly contains Fox news, delivers ~5x the EBITDA of the TV segment, which includes the Fox network and fox affiliates. I don't think this is a completely fair comparison, as Fox recently paid up to get Thursday night football, and they haven't fully reset all their affiliate fees to cover that (so TV earnings are arguably depressed in the near term), but still, Fox news is the big driver here. See breakout of earnings below:

In the present, having the majority of value come from Fox News is a good thing. For a significant minority of America, Fox News is the must have channel and the only source of news they'll trust, but I'm not sure how durable the Fox News moat is. Consider:

The most obvious worry is Fox getting attacked on the right. When (if?) Trump leaves office, what happens if he launches a Trump news channel? You can already see Trump criticize Fox whenever they host a "non-Trump" voice, and he's tried to boost non-Fox news outlets several times. What if Sinclair gets serious about launching a nationwide cable network to the right of Fox? Or, as people cut the cord, do they start getting more of their news from some conservative voices directly and not need as much Fox News?

This is somewhat related, but in two or six years Trump is going to leave office (probably) and is (probably) going to be replaced by a much more "normal" politician. Does a normal politician generate the type of daily fighting and content that Trump generates? Goes a somewhat more normalized political environment lead to ratings and viewer engagement slowly declining over time?

The other worry is that Fox News isn't durable programming that builds up lifetime library value. No one is clamoring to rewatch Hannity episodes from last week; they really only have value in the moment. That's great when negotiating with cable distributors, but I'm not sure how good it is in a D2C world. It's going to cause a lot of churn at some point: if you're not really interested in the politics of the day or whatever the argument du jour is, there's nothing to keep you from churning your Fox News account. In contrast, if you're not interested in the current batch of new Netflix shows, there's about 5k other shows on their that they've released in the past and own that can keep you entertained.

The last thing I'll mention is that I view "news" as much more personality than platform driven. This (again) relates to point number 1 above, but ten years ago if a personality left Fox News most viewers would stick with Fox. They simply didn't have any other options. Today I'm not so sure: if Hannity left Fox, I think he could pull a ton of viewers with him. Heck, he might go out arguing that the deep state got to Fox and pushed him out. News seems really easy to fragment and hyper target your audience, and it doesn't take much for a personality to launch a new news channel and reach people directly. Over time I can see that eroding Fox's reach. Fifty years ago, everyone got their news from the newspaper and the Big 3 Networks news programming. Today, there are tons of places but like 8-12 major ones, all smaller than the outlets fifty years ago. I wouldnt be surprised if fifteen years from now there like twenty five major outlets, all smaller than today's outlets, and hundreds of big personalities who have gone direct to consumers.

I'll discuss this more when I get around to talking about DISCA, but my general worry about news and more lifestyle networks is that they are really based around personalities, and in today's world I'm not convinced the personalities need the Fox News / DISCA platform as much as the platforms need them. Over time, I wouldn't be surprised to see the personalities try to launch their own things. They might not monetize quite as well as being on Fox News or an established big platform, but because the personalities own the equity they will realize much more money (i.e. maybe the overall revenue a personality drives would be $10m versus $7m on their own platform, but the personality gets to keep all $7m if they own the platform while Fox would probably only pay them $1m). Contrast that to something like Netflix: yes, stars can get big paydays, but Netflix controls the customer, and Netflix certainly can create new stars. If someone like Ryan Murphy left Netflix, the platform would barely notice.

So while the near term for Fox News looks good, I think there are a lot of tailrisks to them longer term. Given how big a driver of Fox's earnings they are and how quickly I think the wheels could come off in the tail scenarios, that's a tough bet to make. Also, if I compared the Fox network to CBS, I simply like CBS's strategy more. Fox is all in on live: news, sports, etc. That's great in the near term, but sports rights will continue to be bid higher and higher until the sports teams take all the economics for themselves (or simply go direct). I prefer a combination of sports and live in the near term with some programming that builds longer term value that can help transition you to a D2c world (like what CBS is doing): major sports rights which force distributors to carry you / viewers to turn in, but then lots of scripted content as well which helps to build up long term portfolio value (i.e. CBS airs How I Met Your Mother or NCIS; those programs go for ten years and gather a following, in part because they're advertised during the NFL. Eventually those programs have a lot of library value). Look at Fox's schedule currently: Thursdays they air Thursday Night Football. Fridays are WWE. Saturdays are college football. Sundays are NFL and their animation domination block (Simpsons, Family Guy, etc.). All of that drives great near term viewing, but none of it drives longer term library rights (Fox doesn't own the rights to the animation block anymore; Disney does); in fact, I believe Fox doesn't own the long term rights to any of the shows on air for them anymore. Contrast that with CBS: basically every day of the week they're airing original programming. That's a whole lot of shots on goal to build up hits / library value. CBS doesn't own all of the content they air, and obviously some of the shows will be duds, but I like that they have some sports rights to force carriage, and then lots of shots on goal to build up library value and potentially release a hit. Before wrapping this up, I wanted to quickly touch a bit more on advertising. It's easy to focus on things like retrans and reverse retrans, but advertising still makes up a really big piece of network's revenue. Below is a breakdown of CBS's LTM revenue just to give you an idea of how big advertising revenue is.

You can see a bull thesis and bear thesis to the advertising pretty easily. I've basically covered them both already, but to quickly recap: the bull thesis is that advertising demand remains really strong. You can't listen to an earnings call without media CEO's talking about how strong the advertising market is, with both upfront and spot rates growing massively as advertisers are desperate to reach consumers in brand safe ways. In addition, next year's political advertising market is going to be bonkers. The bear thesis is that ratings continue to decline, and eventually advertisers aren't going to pay up to reach a declining audience (right now price increases are more than making up for eyeball decreases, but eventually that can't hold. If price stays flat, we're going to see mid-single digit declines (or more!) given the drop in eyeballs / ratings, and if we ever see a recession and pricing declines, look out below...). I'm much more worried about the later than the former, but I do think there's some interesting upside to advertising as we move more and more into a D2C world. AT&T highlighted this when they bought Time Warner, but the ability to use cable channels for targeted advertising has the possibility to dramatically increase advertising rates. Again, I'm more worried about advertising revenues declining than I am excited about advertising increasing, but I figured it was worth highlighting because there's pretty large upside there. Odds and ends

I don't think I explicitly said it in the write up, so I'll put it here: one thing I like about the networks versus the broadcasters is that more of their revenue comes from subscription like sources (retrans and reverse retrans) than the broadcasters. I also like that I think you can build a D2C app around a network's programming / content; I can't say the same for a broadcasters.

Just to build on that last point: I like that they (the networks) get more optionality as we move to an unbundled / streaming world. Consider a world where everyone signs up for every app / channel they want individually (Eventually they all probably get rebundled and sold by Amazon or someone, but bear with me). What does Nexstar have to offer to that bundle outside of their network programming? Local news and that's pretty much it. I'm not saying local news isn't valuable, but in just about every market there are four to five good local news teams; I doubt people are itching to sign up for 5 local news broadcasts. I tend to think that gets competed away or a large player ads it as part of their content. In contrast, CBS has all of their shows, sports rights, etc. That's enough to drive people to sign up for CBS, and I'm not sure long term why CBS would let NXST take a cut of that.

One thing that I think is overlooked when considering the major networks: they could easily take leverage way up. Consider this: NXST runs at 4-5x leverage. CBS is running ~3x. CBS is undoubtedly a better business (after all, they get the reverse retrans fees from NXST). That leverage discrepancy creates a lot of upside from financial engineering at some point in the future if they ever wanted to pull that lever (increase leverage by 2-3x, pay out the proceeds as dividends or do a huge share buyback, and then continuing running a levered equity model into the future).

Imagine the return of capital if CBS combined running a leveraged equity model with maximizing near term cash flow (as mentioned in write up, shutting down All Access, selling the rights to all programming, etc.). Earnings would rocket upwards, and the return of capital would be mammoth. Is that the right decision for long term shareholders? I don't know, but I suspect not. Still, it's interesting to think about that lever.

I think lots of the feedback from yesterday's broadcaster post said was "yeah, but the broadcasters are cheaper than the networks." I think if you look at them on an unlevered basis, the multiples are pretty close across the board. Would I rather the networks ran more leverage? Yes, of course. But I'd rather buy the better business at a similar unlevered multiple than a worse business just because it's been levered up a bit.

I mentioned in yesterday's piece how ad spend is going to be enormous in 2020 because of political spend; interestingly, streaming TV ad spend may also be a big tailwind.

Probably the biggest issue with CBS / Viacom? Capital allocation / control. I actually like VIA's CEO (who will lead the new Via / CBS) and think he's done a really nice job. But, for better or worse, the Redstone's control CBS / Viacom, and I think it's mostly for worse. VIA was mismanged for years, I think they bungled the Monves situation, and they're letting everyone get paid in the CBS / Via merger (see: The ugly deatails in CBS's and Viacom's latest merger filing). That's some combination of poor management and poor negotiating. I'm not 100% sure that they're ready to make the moves necessary to maximize long term shareholder value.

Some stuff VIA CEO has done that I've looked: turned around Paramount (it was burning money for years; in made over $100m last year. Perhaps even more impressively, they released a Transformers movie with good reviews), seemingly turned around the core networks (MTV, Comedy Central, Nick, etc. all were losing distribution and had weakening content slates when he stepped in; that seems to have been fixed), bought PlutoTV for $340m (this is a bit of a moonshot, but in Q4'19 Pluto had 20M domestic MAUs, up 70% YoY. I'm not sure what Pluto's worth, but with active user numbers like that, if Pluto works out it will be worth huge multiples of what they paid for it).

I don't mean to undersell the issue here. I don't think CBS / Viacom is the last step. CBS probably needs to get even bigger; either inorganically (buying LGF?) or organically (continuing to dramatically ramp content spend). The combined company is also going to face some tough choices (does it really make sense to have seperate CBS and Showtime apps?); it would be nice to feel really confident the controlling shareholder had a really clear view of how to best navigate that landscape. I don't.... but I think the valuation and potential upside / strategic value of CBS / VIA makes up for it.

And that's not to say FOX's capital allocation is much better. I think people look at Fox a bit rosier currently because the huge premium DIS paid for them is fresh in their minds, but FOX has had its fair share of empire building over the years. And don't forget: Murdoch tried to sell Fox to DIS for a much lower price before CMCSA came over the top and forced a much improved bid from DIS. All in, I think FOX's capital allocation is likely to be a bit savvier than CBS's, but neither of them get top marks from me!

Speaking of CBS / VIA and this not being the last step, I think it's pretty clear there's more M&A in the company's future. Verizon tried to buy CBS before; if T / TWX proves to be a huge success (I've yet to see any evidence of synergies between the two) I'm sure they could revisit that deal. Or, if it's a success, T could double down and buy CBS itself; given they won the T/TWX litigation and FOX/DIS were allowed to merge, it'd be tough to argue T + CBS is an antitrust issue. Or, instead of being a seller, CBS could be a buyer and get bigger by buying all the "free radicals" (LGF, AMC) and combining with DICSA. A string of some of those acquisitions would create a company with a ton of scale and a mammoth library. If regulation ever rolled back, you could see some synergy from CBS acquiring all of their affiliates (I.e. NXST's CBS channels), though I'm not sure they really need to do that longer term. There always looms the possibility of an internet player deciding they need to get into the content game and buying out CBS, though for a variety of reasons I think that ship has sailed

CBS / VIA sold off pretty hard when the merger S-4 came out. While earnings projections were generally inline with what analysts were projecting, free cash flow was much lower. The reason free cash flow is lower is simple: working capital is exploding as the company amps up new show production. This is not a CBS specific issue; it's something every legacy media company who is launching a D2C platform and increasing new show spending is dealing with. Personally, I'm ok with this. I'd rather CBS lower near term cash flow to invest in new Star Trek's or take swings at big new shows. Eventually, working capital will normalize (either they'll hit scale with All Access and be able to flatten out spending), or they'll realize all access was a failure and they'll be able to recover a lot of that investment from working capital wind down + selling the rights to the shows. As long as you think investing in new shows is not a money losing business long term (it doesn't have to create value; it just needs to be reasonable value neutral), than the working capital build isn't ideal but it's not a crazy huge issue. I actually think the news shows will create value, possibly significant value, and provides a lot of upside potential for All Access, so I'm cool with it.