Some updated thoughts on $AER

I mentioned AER in my markets in semi-panic post last week, and I wanted to revisit the stock this week. The reason is pretty simple. I'm generally rather calm during market sell-offs; in fact, they generally excite me, as I feel like a kid in a candy store getting to buy all my favorite things at a discount. But this sell off was a little more stressful. Part of that may be simple human reasons: I'm married now, and as a professional investor my livelihood at some point depends on the stock market. So maybe this sell off is the first time I've thought "O no, what if everything goes to zero and I can't provide for my family!" But I think major reason this sell off has been more stressful than normal is Aercap. I run a concentrated book, and Aercap is a large holding. The mark to market on Aercap over the past week doesn't bother me so much; in the past, I've had larger holdings down significantly more than Aercap over the last week without a concern. The bigger issue is that it's pretty clear the near term is going to be an absolute disaster for the travel industry, and in some negative tail scenarios that disaster would result in significant and permanent capital impairment for AER (a quick reminder that I wrote up AER pretty extensively last summer, so I'm not going to go over the basics of it here. If you're not familiar with it, I'd encourage you to read that post as I'll be re-referencing some valuation points). So let's discuss those negative scenarios. Remember that AER is a financial lessor. They buy planes and lease them to airlines (hopefully for a nice profit). Planes are a depreciating asset; after ~20-30 years, the plane will no longer be an operating asset and will only be worth scrap value (what they can break it up and sell its different parts for). Because AER's asset base is always depreciating / liquidating, a lost year of earnings could be a disaster for them. Consider AER versus something like Facebook. If Facebook was fined a full year's earnings by the FTC or some other government agency, that would suck for them, but if you fast forwarded a full year the Facebook business would still be there. In fact, it wouldn't just still be there, it would likely have grown in value, as more people will have joined, more connections will have been made, more businesses will be looking to push their wares on facebook, etc. That's the beautiful thing about a business with a moat and growth: assuming no external shock (i.e. another social network supplanting facebook), they should continue to grow in value over time. Compare that to AER: if AER's earnings went to zero for a full year, it would suck doubly for them. Yes, they'd lose a full year in earnings, but even worse is the fact that their assets will have depreciated in value over that year. That's a rough double whammy! Bottom line: AER is a financial asset company. The trick with AER is to buy it for less than the assets are worth (sounds simple when you say that, right? Of course, the trick for all investing is to buy things for less than they're worth!). However, if some external force hits and wipes out a year of earnings, that's harder on a financial asset company than an operating business with a moat, because the financial asset company's value depletes over time. Note that I'm not saying AER's earnings are going to zero or anything; I'm just highlighting why lost earnings are so bad for AER (and other lessors)! Alright, so I've covered why lost earnings for AER are something of a double whammy for them. Let's talk about why a pandemic is so bad for AER. AER owns planes and leases them to airlines. In general, AER will buy a plane and lease it to the airline for ~10-15 years. Once that lease is up, the plane still has15-20 years worth of useful life, so AER is exposed to residual risk on that plane (I.e. if the market value of the plane has dropped by more than AER has depreciated the plane, AER will face a loss. If it has the plane's market value has dropped less than AER has been depreciating it at, as has historically been the case, AER will book a gain). So AER there are two big risks for AER (and I admit this are very connected):

In the near term, AER is exposed to the health of airlines in general. Note that this is the general health of airlines: a few airlines can go bankrupt or even a whole region can face some type of travel correction and AER will be ok: airplanes can be moved quickly to where other airlines / regions have demand / profitable routes. The bigger issue is if every airline is facing financial distress, likely because demand for travel in the short term has dried up.

In the medium to longer term, AER is exposed to the demand for planes because they take on that residual risk of the plane coming off the lease. While the health of airlines is certainly a factor here, a bigger factor is the supply / demand balance for planes. Given supply of planes is somewhat fixed in the near to medium term (it takes a while to build a plane, and because commercial plane industry is controlled by the Boeing / Airbus duopoloy, they try to keep a small plane shortage in order to boost pricing and make an economic profit), so demand for planes is the critical factor here.

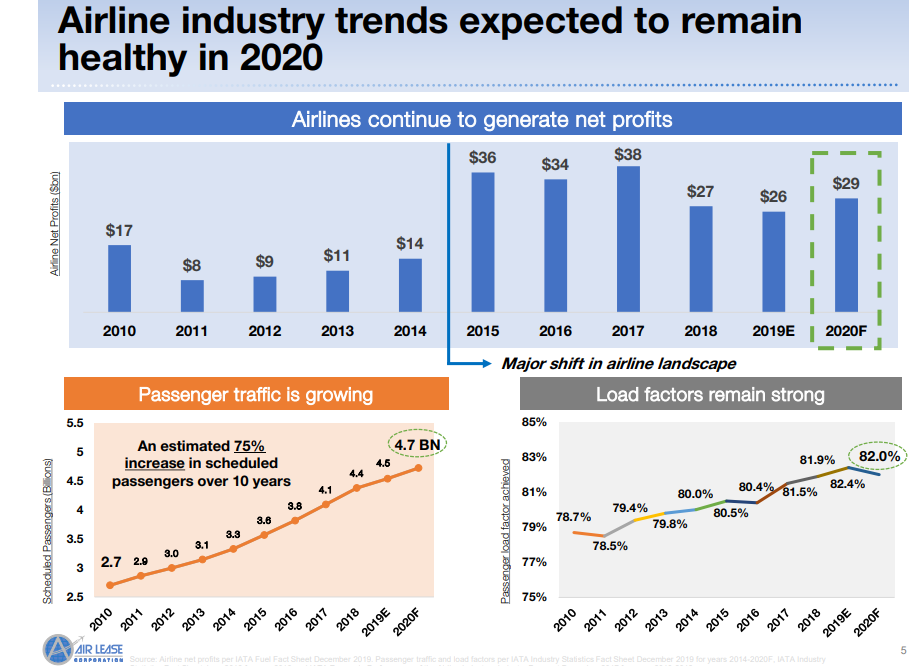

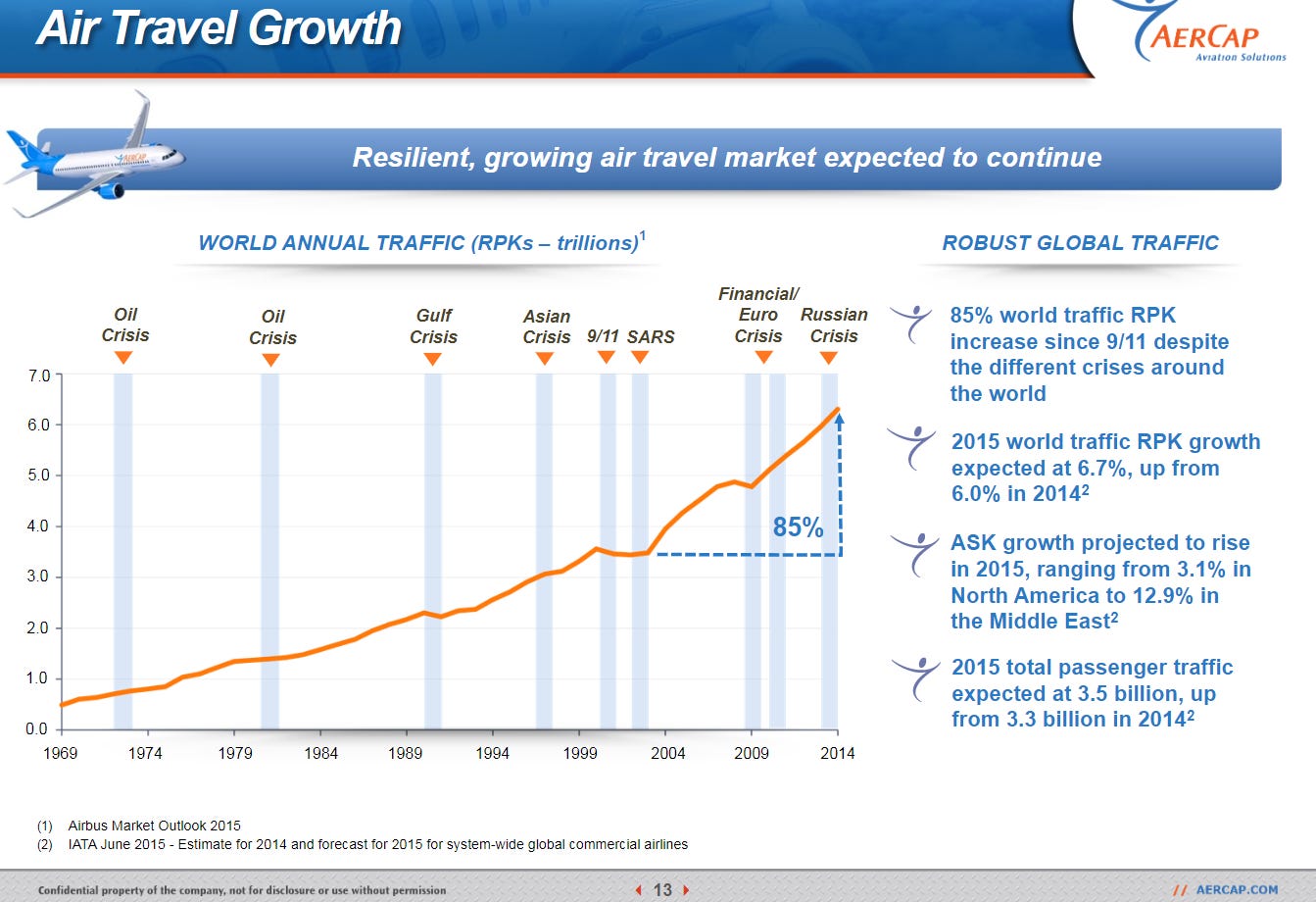

On both of those factors, AER has had general favorable factors over recent memory. Airlines have been reasonably profitable since the financial crisis. More importantly, demand for air travel has been really strong, boosted in large part by the growing demand from emerging markets. And those trends seemed destined to continue for the reasonable future: as the world got richer, more and more people would want to travel (either for pleasure or for work), which would continue to boost the demand for planes (slide below from an Air Lease Jan. 2020 presentation).

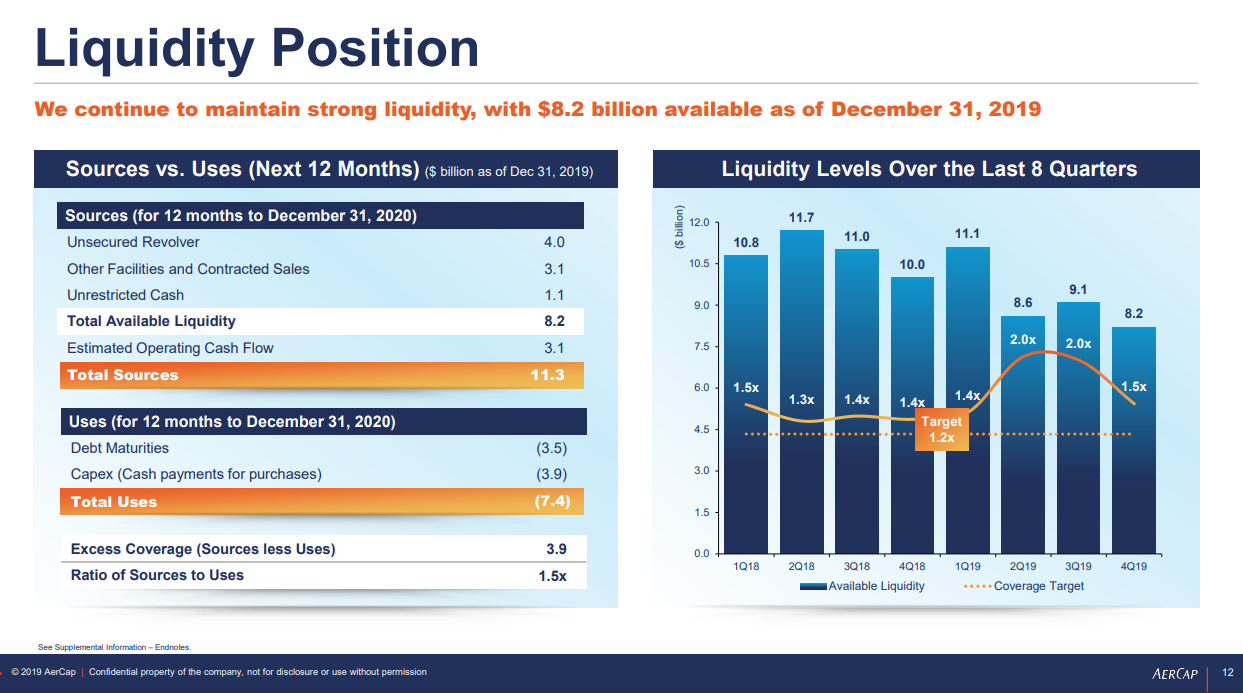

Corona, however, has changed all that. Suddenly no one wants to travel. Businesses are cancelling non-essential work trips. Consumers don't want to go on vacations. Governments are cancelling international flights to slow the spread of disease. That's an absolute disaster for the airline industry. The airline industry has huge fixed costs in the form of their airplanes (both from the depreciation of the airplane and from the financing cost of the plane, either from taking out debt to buy the plane or from the cost of leasing the plane). So there's no demand for travel and high fixed costs. I It's tough to say how long the current corona disruption will last. But given that fixed cost dynamic, the costs of any drop in demand is going to rapidly hit the airlines. This isn't some recession causing air travel demand to drop; this is a health scare that's basically dropped demand for travel to zero. That's a rough, rough combo for AER. A big piece of the investment thesis is that AER trades below book and they've consistently sold planes for well above book value. If AER tried to sell a plane today, I seriously doubt the demand would be there for them to get book value for a plane (in fact, I wonder if there would be demand at all right now...). The good news for AER is that their planes have, in general, long lease lives. So, as long as AER's customers aren't going bankrupt, AER won't be a forced seller of planes. That is something of a big if; as mentioned a second ago, demand for travel is way down and fixed costs are high. I'd be surprised if we didn't see a lot of trouble in the airline industry if Corona doesn't miraculously solve itself in the near future. Ok, so the near term for AER looks bad. The question is how bad could things get? And that's where I think I come out a little more positive! First, let's look at AER's liquidity. The slide below is from AER's Q4'19 earnings release. It shows their liquidity versus their capex and debt maturities. Even if you assumed operating cash flow of $3.1B went to zero because every airline defaulted on their lease, AER would have enough cash / liquidity for the next twelve months. Yes, that's probably too simplistic for a few reasons (if every airline defaulted and AER didn't do any new leases, cash flow would be negative given interest costs, corporate overhead, etc. at the same time, we're two months into the year already, so assuming cash flow goes to zero when they've already booked two months of it is kind of wild), but the bottom line is AER's balance sheet is strong enough to handle a short term shock of pretty dramatic magnitude.

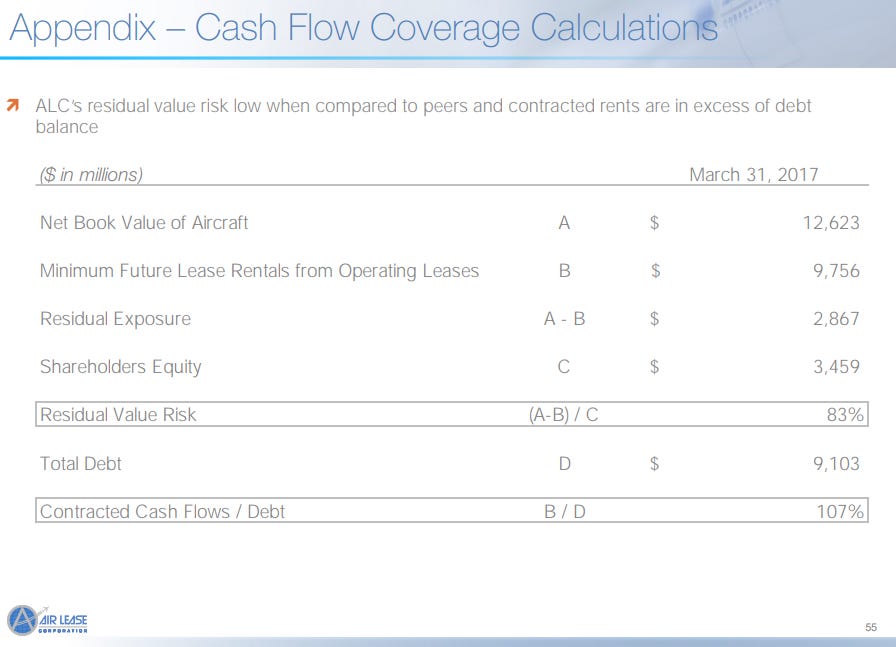

So AER's got enough liquidity that they won't be forced to do anything uneconomic in the near term. That's really good news: in two or three years, I doubt markets think much about Corona. The world economy should be back to relative normal, and people should want to travel again (just as they did after SARS, or 9/11, or numerous other events that depressed demand for travel in the short term). If AER can make it to the medium term, then all of those favorable trends should kick back in their favor. Liquidity out the way, let's talk about how much capital impairment AER is likely to face. I think there are two ways to do this. First, you could look at how much capital impairment the market has already put into AER's stock. Second, you could make different assumptions around lost earnings and then see what that does to the stock. Let's start with the first method: what has the market priced into AER's stock. AER was trading for ~$62.50 before Corona fears really went rampant in late February. As I write this, it trades for $52.50, so the market's dinged it ~$10/share. With ~130m shares out, that's about $1.3B of value lost. If you go back to my original AER post, you can see an analysis I did of the residual value of AER's planes. It was based a lot on the slide below (from ALC). The basics of it were that you take the book value of a lessors planes, subtract out the minimum future lease payments owed, and the remainder is the residual plane value risk the company's shareholders face.

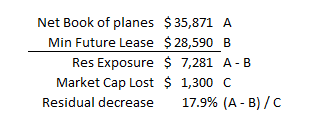

At the end of 2019, AER had ~$35.9B in book value of planes and ~$28.6b in minimum future lease payments (that number is actually from Q3'19, not Q4'19, but I doubt it's changed much), for a residual exposure of ~$7.3B. So, by wiping out $1.3B of market cap, the market is basically saying that residual risk for AER is worth 15-20% less than it was before the Corona scare (see math below).

You can quibble with the math a bit. Perhaps, for example, the market is factoring in a 10% residual decrease plus some losses in the minimum future lease category as airlines go bankrupt and AER can't release the planes (or has to release them at cheaper rates). But I think the math holds, and I think that's a really big drop in residual value for an issue that should be somewhat temporary. The other way to think about AER is to make an assumption around lost earnings and see what the market has priced in from that angle. AER has five major expense categories: depreciation, asset impairment, interest expense, leasing expense, and SG&A. The two major expenses are depreciation and interest expense. Remember, even though depreciation is a non-cash expense, it is a real expense as assets need to be replaced over time, and in AER's case it is very real as planes last for a finite amount of time and get less valuable every year.In 2019, AER had ~$1.7B in D&A expense; let's just say that's their run rate for 2020. They also had $29.5B in debt at year end and an average interest cost of ~4.2%, so annual interest expense runs $1.24B/year. Put it together and AER's two major fixed costs run ~$3B/year. In addition, in 2019 they had ~$270m in SG&A and ~$288m in leasing expenses. I would guess those costs prove to be quiet variable if the travel world does shut down completely. For now, let's just say those expenses could get cut in half in a really draconian scenario. That would mean AER's fixed cost base runs ~$3.3B/year, or ~$275m/month, We know the market has cut $1.3B off of AER's market cap since the Corona fears really began. That's just shy of five months of operating expenses with no associated revenue. So another way to look at the recent market drop is that the market is assuming Corona will cause AER to forgo five full months of revenues while eating all of those costs before things return to normal. You could change the numbers up a bit if you wanted to: you could say the market is implying AER will need to forgo half of their revenues for ten months or something. Yes, all of that was a simplification. Obviously if air travel shut down completely for five full months, there would be plenty of issues on the back end for AER (plane resale values would be decimated, leasing costs for finding new airlines to take their unused planes would be high, new plane lease rates would be awful as people were desperate to get money in the door, etc.). But I wanted to highlight it just to show how big a bath the market is currently implying AER will be taking. Again, the right answer is probably something more complex than all of this. The market is probably factoring in like 3 months of half earnings, a residual decrease of 8%, and some lost minimum future leasing. But, no matter how I cut it, I think the current drop is a bit overblown when you step back and really think about how long Corona is likely to impact the travel industry. If you think Corona will be a multi-year long event that causes countries to shut their borders down and travel to completely cease, then the market is obviously severely underestimating the damage to AER's asset base. Plane values are going to be destroyed on a permanent basis, and a ton of airlines will be bankrupt. But that's probably way too draconian. The chart below is from AER's 2015 investor day. You can see even the dual combo of 9/11 and SARS within a couple of years barely dented the annual demand for air travel. Perhaps Corona has a slightly more dramatic near term drop than those two combined, but I kind of doubt it and even if it did the effects would almost certainly be short lived (you could also argue that air travel had a much larger global emerging market growth tailwind 15 years ago, and without that air travel is more susceptible to dipping).

Rather than thinking Corona marks the end of air travel for the world for years, if you believe (like I do!) that any impact from Corona is likely to be both severe and temporary, then my guess is that the market is way overshooting with AER. Sure, a few airlines will go bankrupt and AER will have some credit losses, but the market is currently implying that AER gets zero revenue from any of their customers for almost five months. That seems... extreme. And, in a six months or a year from now, the travel market will start to return to normal and AER will be back to selling planes at a premium to book value. That combo will make the market current implication that AER's plane's residual values are worth 18% less than they were ~two weeks ago look downright silly. One more thing while I'm here: as I mentioned in my first piece on AER, I have a lot of respect for AER's management (I think they check a lot of the boxes for being an Outsider CEO). And, as I showed above, AER has a significant amount of liquidity even if you assume their cash flows for this year go completely to zero. A savvy management team with a lot of liquidity in a market undergoing a temporary panic is a powerful combination. At a minimum, I would expect AER to take advantage of the current share price by buying back a lot of shares. However, I wouldn't be shocked if the dislocation gave them the opportunity to pursue some really accrettive deals like sale / leasebacks at really attractive rates from an airline desperate for liquidity or taking over some smaller, overlevered competitors. Ok, one last note (for real this time!): I'm still thinking through the implications of all this. If you've done work on it and have different views or ideas, I would love to hear them!