Renting some space in $IWG $IWGFF

This article is quite long. The bottom line is I think IWG (LSE listed: IWG; disclosure: long) is extremely cheap and, while near term results will be poor, they're likely to emerge from the current environment stronger. Below is a three bullet summary of the investment thesis

IWG is a coworking / flex office company (think WeWork). While the near term will be weak (as noted here), IWG's balance sheet and bankruptcy remote subs will allow them to make it through to the other side. The same can't be said for many of their competitors; IWG will likely gain share and make accrettive acquisitions of competitors in distress.

IWG's size gives them a moat when dealing with clients, particularly larger ones. That moat will accelerate coming out of the current crisis.

IWG's franchising strategy should further accelerate that moat. The program is in its early days, but it has the chance to both accelerate IWG's growth and significantly increase their network moat. In a true blue sky bull case, IWG eventually becomes the lead pure play workspace franchisor and is afforded the multiple of leading franchisors (somewhat akin to the hotel franchisors, though IWG's moat would be weaker and they would not have quite the same benefits of a hotel brand, so their multiple / margins would ultimately be lower).

Bonus point: the valuations assigned from the first batch of franchising deals suggest the company's fair value is >4x today's share price even before factoring in the value of the franchise fee stream.

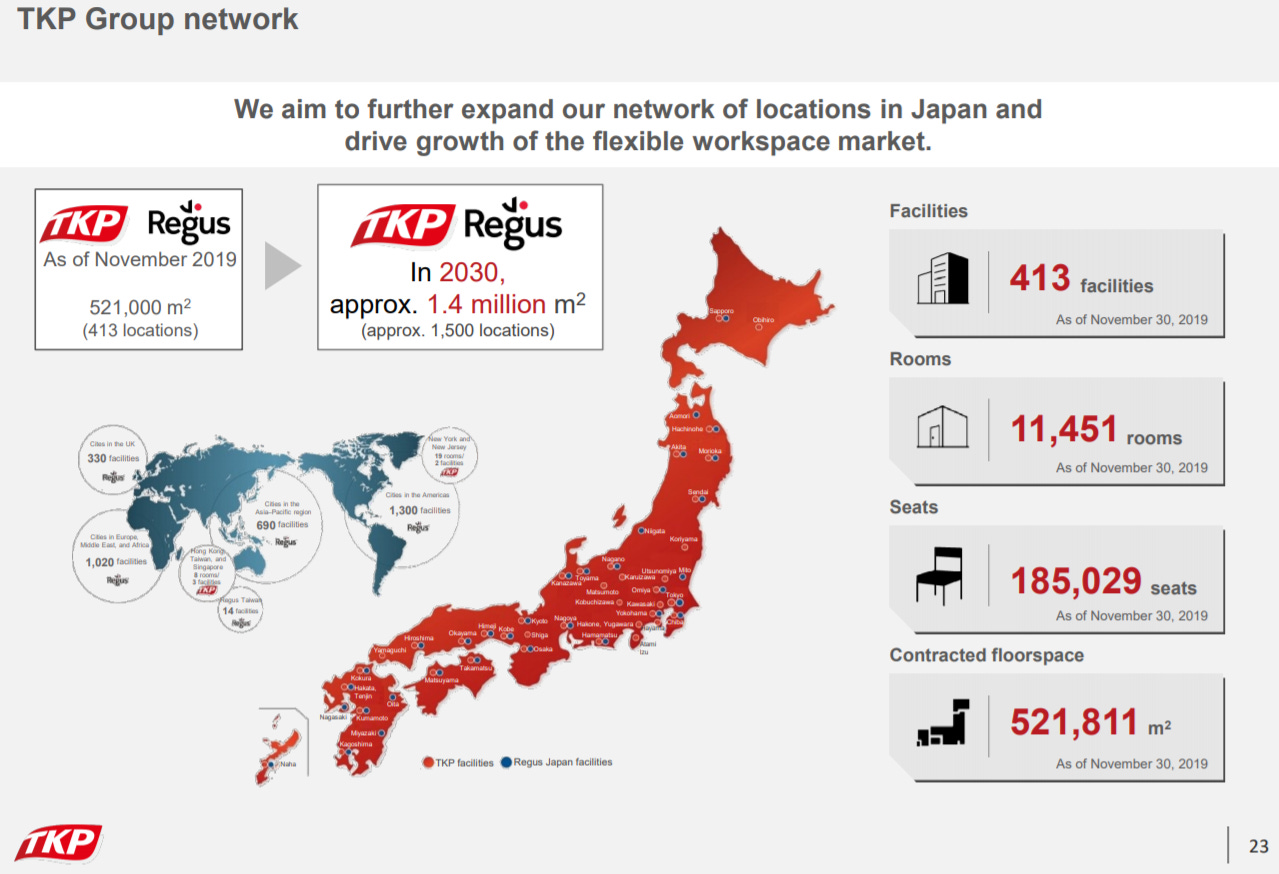

Bonus bonus point: I think a lot of the stuff in here on IWG is unique / differentiated. But the most differentiated / unique / edgy stuff is likely to be all of the work on TKP (mentioned in the franchise segment); this is a publicly traded small cap Japanese company that recently bought an IWG franchise. They've published aggressive growth plans, which would be hugely beneficial for IWG, and I doubt many IWG investors have seen TKP's presentations or growth plans (I certainly haven't seen anyone mention them publicly) despite how bullish they are for IWG.

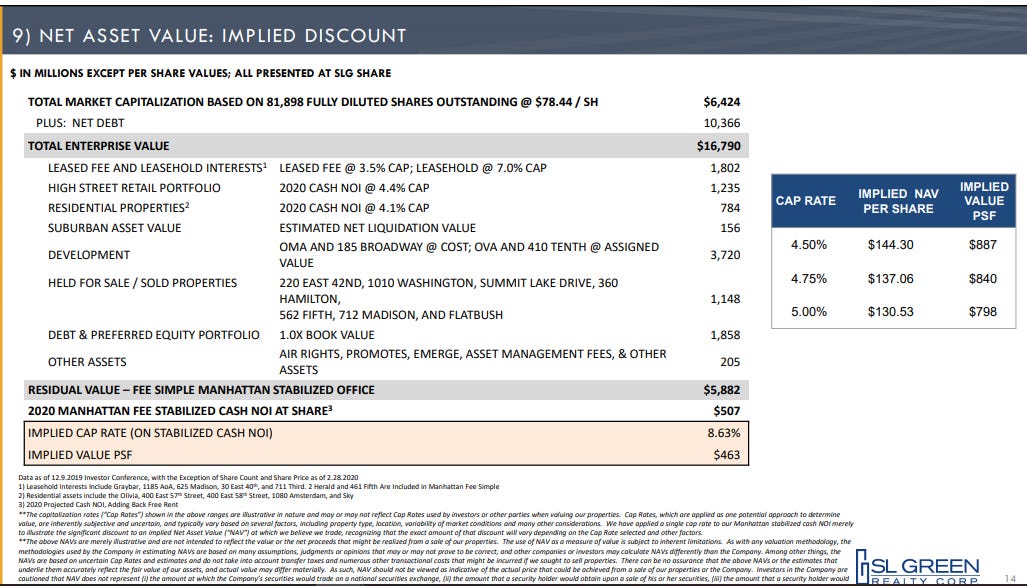

Ok, on to the article. Post Corona, if you were asking me to rank sectors in terms of uncertainty about ultimate demand going forward, I think large urban office space would be at the top of the list. Sure, there are some sectors more impacted (airlines, hotels, etc.), but I doubt the super long term demand for those has changed materially because of Corona (people are still going to want to vacation, travel, etc. once Corona is behind us). But the office space faces some material long term questions: people are going to be working from home for months on the back of Corona. Do companies see that their work force is just as productive working remotely, and begin shifting to less office space / more work remote? Given office space is fixed cost / in space, even a small decline in office space demand could have huge ramifications for office pricing. In addition to the longer term questions around office demand, there are a bunch of short term questions: how many current tenants go bankrupt, how long does it take to replace leases that expire this year, etc. The market clearly isn't blind to these fears; most large office building owners are down ~40% over the past few months and trading for cap rates that imply huge near term earnings issues and/or decently significant asset impairment in the longer term. For example, if you take at face the value of all of the other assets SLG gives in their investor deck slide below (a big if!), today's share price of ~$45 implies a >13% cap rate on their office NOI.

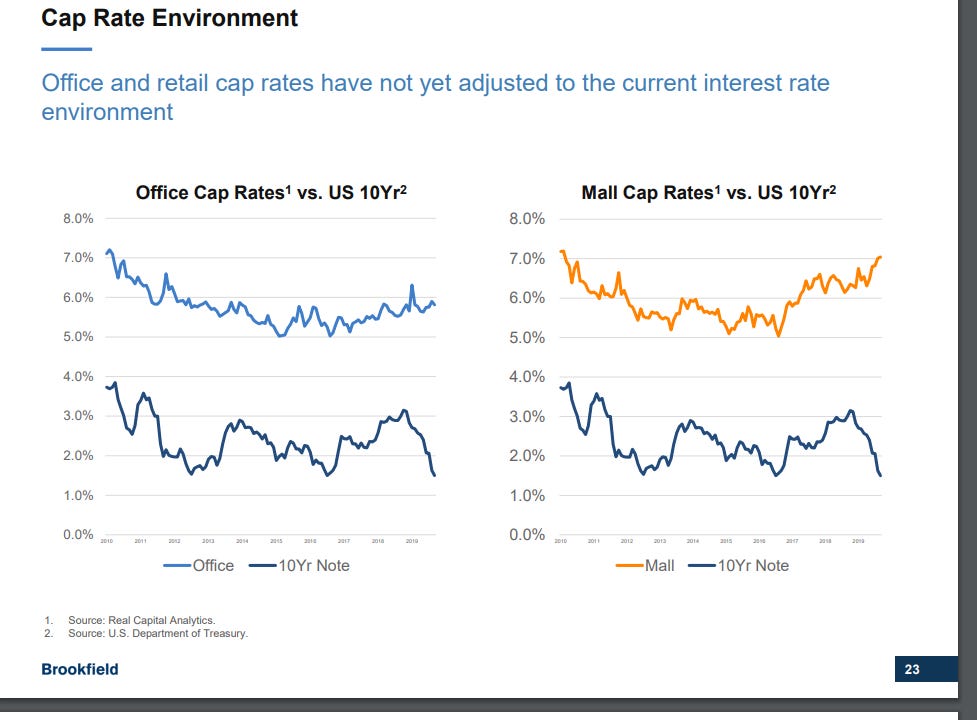

Even with some pretty aggressive haircuts to their other assets, I would have SLG's office buildings trading for a >7% cap rate, a historically large spread to the ten year treasury's <1% rate (office buildings are generally comped to treasury spreads; when treasuries were 1-2% for the past few years, office buildings were going for 5-6% and trophy NYC buildings like SLG own were in the 4-5% range). Below from BPY's 2019 investor day:

Hopefully, that helps set the backdrop for the stock I want to talk about today: IWG (trades on the LSE under IWG). IWG is a co-working company (think WeWork; IWG is basically the original WeWork); they own brands like Regus and Spaces. IWG's stock has been absolutely demolished by the current environment, with shares down >50% YTD.

While I'm sure there will be quite a bit of weakness in IWG's near term numbers, I think the mammoth sell off is dramatically unfair. In fact, I think you could paint a few scenarios where IWG is actually a long term beneficiary from the Corona virus. Consider the following:

As I'll discuss later, IWG has a significantly better balance sheet than their competitors (WeWork is the headliner here, but Industrious, Knotel, and a few others are also competitors). The whole industry is in for pain in the near term: occupancy is dropping as month-to-month leases expire and businesses go bankrupt, some coworking firms have already stopped paying rent, and WeWork is clearly in distress (and employees are nervous). So again.... poor short term picture. But a poor short term picture should present a brighter long term for the firms that can survive, and IWG has by far the best balance sheet and model in the business. The current environment could let them pick up distressed competitors on the cheap.

Note acquisitiosn don't have to mean whole companies / competitors: if a competitor is in distress, IWG could look to cherry pick their best assets / leases.

There is almost certainly going to be a huge increase in vacant office spaces on the heels of this (both from distressed competitors going bankrupt and just from offices that can't find new tenants to replace the current ones whose leases expire / who go bankrupt). That will allow IWG to negotiate for new locations from a position of strength.

While there are plenty of longer term risks to both office demand and coworking demand on the heels of Corona (I'll discuss them further later), the current environment could actually accelerate demand for co-working from larger companies. I'm sure large companies will still want big leases for their core office, but they may reconsider signing large leases for satellite offices or secondary locations and instead look for the flexibility provided by signing with a coworking firm for their secondary / satellite offices.

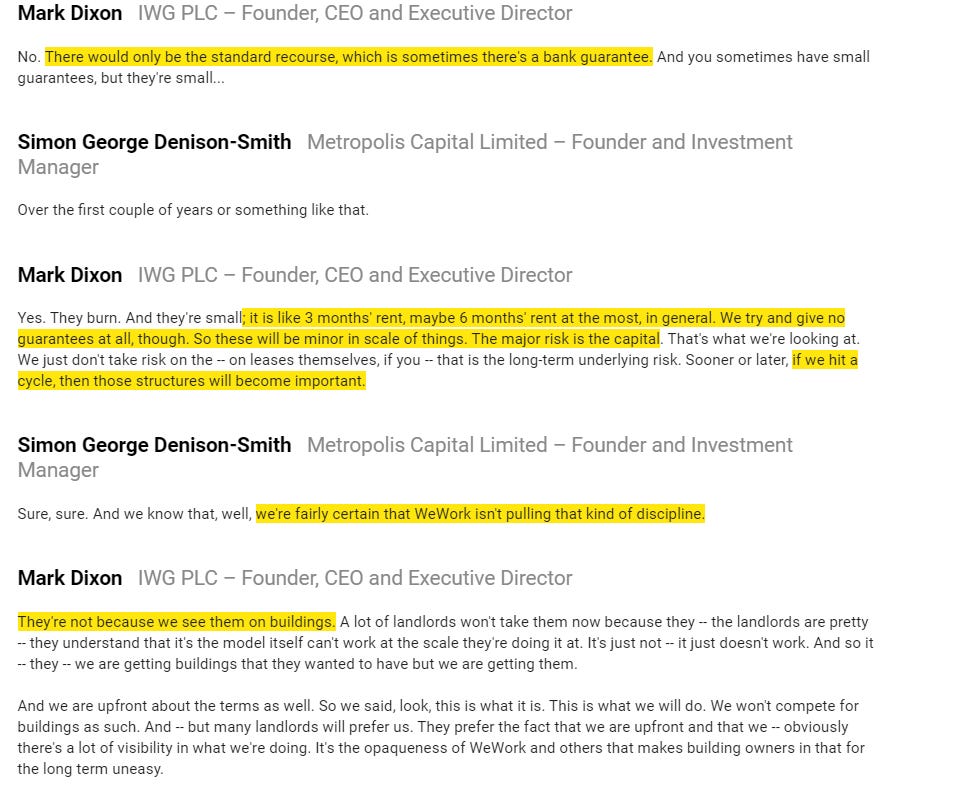

Again, the near term will suck, but IWG will get through it. Some of their competitors will not, and surviving a crisis and coming through on the other side with major competitors either hobbled or destroyed is often the environment for long term value creation. That out the way, let's talk about IWG's business. IWG is the largest outsourced workplace provider (yes, even larger than WeWork). At its core, IWG's business model is simple: they sign long term leases with building owners and then rent that space short term. IWG captures the spread between what they pay the landlord and what their customers pay them. This has the potential to be an attractive model for all parties: IWG makes a spread, the landlord gets a long term lease, and the customer gets access to office space on flexible terms. However, it comes with significant risk for IWG: if a bunch of IWG's tenants cancel their contracts for any reason (like a terrible economy, or a worldwide pandemic making office space temporarily unnecessary), IWG will still be on the hook for those long term leases they owe the building owner, but IWG won't have any revenues coming in to cover those liabilities. That mismatch between IWG's liabilities and their revenue stream has always been the big risk of their business model. However, it's particularly fraught now: many businesses are going to go bankrupt, and a lot of them can't even go into the office right now. It's a perfect environment for massive customer cancellations, which would substantially hit IWG's business (and all coworking businesses). The near term environment is obviously the big risk here. But there is good news for IWG specifically: the company's U.S. arm went bankrupt on the heels of the dotcom bubble, and they learned their lesson from that bankruptcy. IWG now structures their leases in a way that each individual lease has no or very limited recourse to the overall company; as of year end 2019, 95% of their leases were "flexible" (meaning they could be terminated within six months and/or were recourse to a standalone subsidiary that wasn't cross guaranteed by the holdco). In addition, 28% of their leases are variable, so that their rent payments go up and down based on how the individual property is performing (all of these numbers are from p. 49 of their annual report). That lease structure is the most critical risk-alleviating piece to investing in IWG: the company has a solid balance sheet (debt to EBITDA <1x, no near term debt due, plenty of availability on their revolver (which they just extended till 2025)), but if things got truly bad none of that would matter if their leases were recourse to the holding company. Because IWG's leases are carefully structured, they'll be able to close properties down to match any customer cancellations (or, alternatively, they can go to landlords and say "hey, we need a rent cut because customers are cancelling" and the landlord will be forced to work with them or else lose a paying tenant who they'd likely be unable to replace in this environment). Note that competitors like WeWork almost certainly do not operate with the same non-recourse structure. P. 28 of WeWork's S-1 from last year mentions that some of their leases are held by separate entities (which would lead you to believe they are doing the same non-recourse type lease as IWG), but most reporting has suggested that WeWork has generally signed recourse leases, and IWG even said they saw some of WeWork's leases and that they were recourse (quote below from IWG's Q3'17 call). If IWG's competitors have signed recourse leases, the current environment will likely throw all of them into significant distress, which would allow IWG to capitalize on their other side of this (either by buying the competitors for a song or picking up their leases at attractive terms when the competitors go bankrupt). By no means is the thesis dependent on competitor stress, but it's certainly a nice upside possibility!

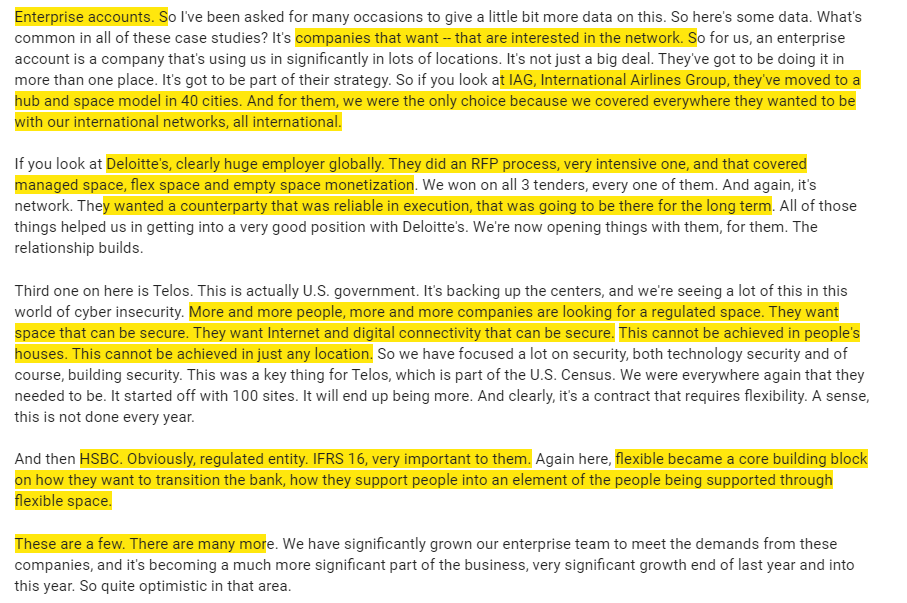

Ok, major risk addressed, let's talk more about IWG's business model and why I think it's attractive. When most people think of outsourced / flexible office space, they generally think of a small startup with 1-5 employees looking for month to month office space. That's certainly a piece of the business, but that's probably the worst / most commoditized piece of the business. IWG's business is increasingly trending towards larger companies looking for flexible office space, and for those companies IWG's size and network is a huge advantage. An example would probably highlight this best: consider a consulting company with employees and offices across the country who travel frequently. The size of IWG's network is a huge advantage here: IWG can offer them nationwide office coverage that a smaller / local competitor simply couldn't, and IWG's network lets the consulting company get offices for their travelling employees nationwide at much lower cost than the company going out and signing a bunch of nationwide leases (to say nothing of the large fixed cost that come with signing a bunch of long term leases). That network advantage should create a sustainable edge over time: IWG's size lets them win a disproportionate amount of enterprise business, which lets them build and maintain a bigger network of offices nationwide, which helps them win more business, etc. Below are two clips of IWG talking about how their scale / network helps them to win enterprise business. The first is from their Q4'18 earnings call; the second is from their 2017 capital markets day. Obviously the source for these quotes is more than a little biased, but I do think they do a nice job laying out how IWG's scale / network is an advantage.

2017 cap markets day (head of enterprise sales speaking)

The other critical aspect of IWG's moat is that they aren't just an office provider; a significant portion of their revenues comes from "ancillary" services. Some of this can be little things like selling coffee or snacks in their office, but the majority of this revenue is from "subscription" like services like business continuity / workplace recovery or IT services.

Again, the ancillary services are another critical part of IWG's moat. The barriers to entry to this business are extremely low: anyone can go sign a lease with an office building and try to start subleasing out parts of it. But no startup can go to a large company and offer nationwide office coverage and a business recovery space in the event of a disaster. Those things may seem small, but they mean that 1) each property IWG adds increases the value of the rest of their network and 2) the extra service revenue IWG has allows them to be profitable at lease levels that a start up competitor would lose money at. One other note here: IWG's exposure to enterprise and ancillary services should be particularly beneficial during Corona. Start ups are much more likely to be on month to month contracts and quickly cancel in the current environment; they're already forced to work from home, so why bother paying for their office space? In contrast, enterprises generally sign longer term contracts, enterprises are generally better credits than start ups, and enterprises are much less likely to cancel their contracts (particularly for something like their business recovery offering). The quotes below are from IWG's 2019 earnings call in early March; obviously the world has changed a bunch since then, but IWG could see how China was impacted by the virus and them seemed confident that the demand for their spaces was still there and coming back quickly as the country reopened.

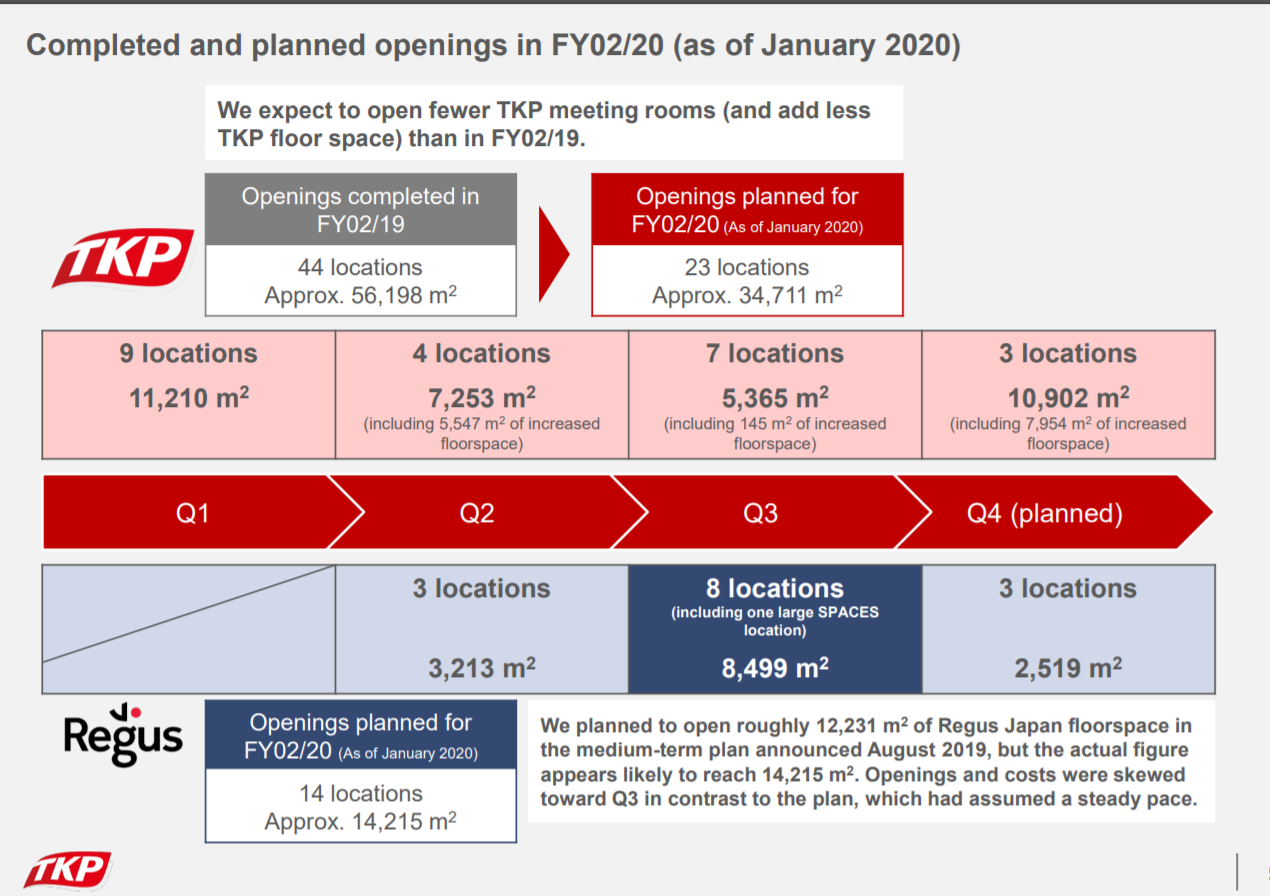

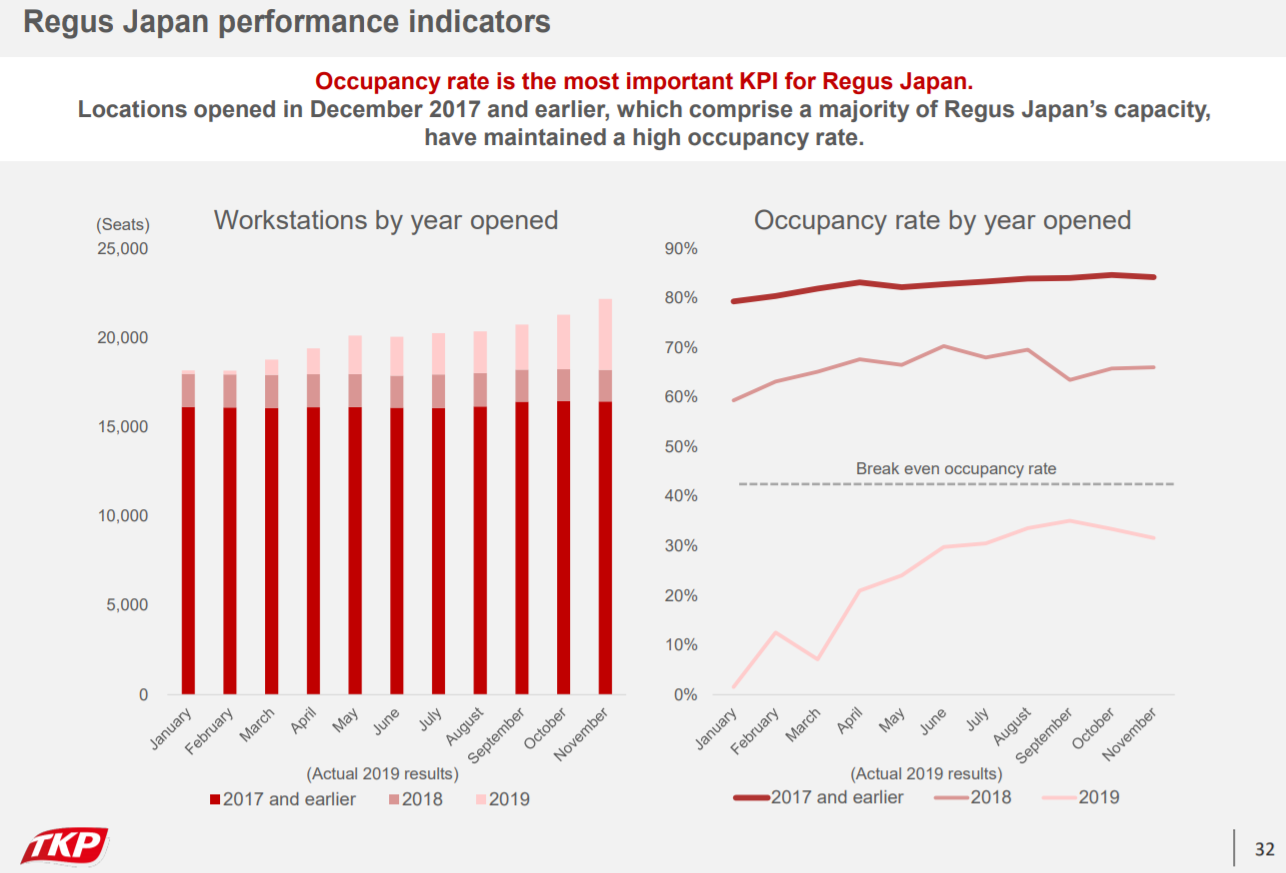

At this point, hopefully I've convinced you that 1) IWG's balance sheet and lease structure is much better than their peers and 2) IWG has a scale moat / network that competitors can't match. Let's now turn to the piece of IWG I'm most excited about: franchising. Starting in 2019, IWG began shifting into a franchisor. They struck several deals across the world to sell their local operations to local franchisees, who generally promised to aggressively expand the network locally. The headliner deal here was the sale of their Japanese assets to TKP for £320m, but they also sold their Taiwan assets (to the same group who bought their Japan assets) and their Swiss assets. IWG has indicated they're working on more franchising deals; I'm sure those are on pause in the current environment, but over time IWG will continue to transition to a "predominantly franchised model" (p. 41 of their annual report) and doing so will create significant value. The value comes in a few ways: first, there's obviously the big upfront payments as they sell the assets to partners (as I'll discuss later, valuing the rest of IWG's business at the same multiple their Japan assets got would result in a 4-5x increase in share price before even factoring in the ongoing franchise fee stream). Second, there's the continued high margin franchise fee stream that the company will get from their franchisees. Third, and perhaps most importantly, the franchisees have indicated they plan to grow their local territories significantly after taking over from IWG. This is greatly benefit IWG both from the increase in franchise fees and because the added properties will continue to increase the value of IWG's network. Let me highlight the TKP deals (Japan in April followed by Taiwan in August) because I think it's super instructive here. TKP is a Japanese company focused on rental spaces; importantly, they are publicly traded (3479) and have an English IR site, so if you're willing to dig you can get some extra info on the franchisee side and what their plans for franchising are. And those plans are wildly bullish for IWG: TKP wants to grow their Regus network to 1,500 locations by 2030 (up almost 4x from 2019's levels). That (potential) growth will fortify IWG's local network, enhance the global network, and drive significant franchise fees for IWG. And TKP wasn't waiting to get that growth going; their Q3'20 deck (quarter ending November 2019) notes that they immediately started opening up Regus spaces in Japan and were trying to accelerate their opening as quickly as they could (see slides below).

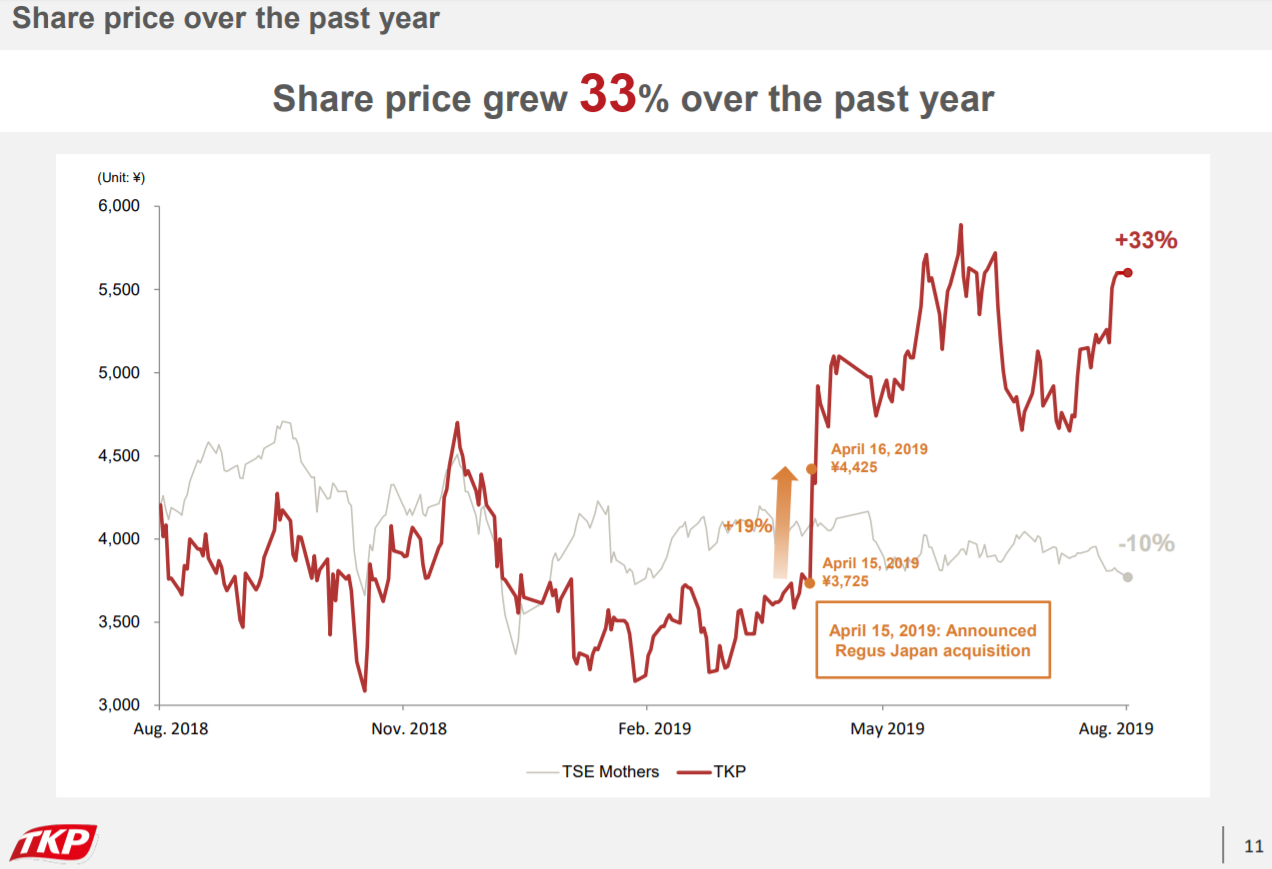

There are lots of other interesting things in the TKP decks. But I think the most important is this: they announced the agreement to acquire IWG's Japan business in April. The market loved the deal for all sides; IWG's shares were up ~20%, and TKP's shares were up similarly (see slide below). TKP bought the Japanese business, saw the initial results and the market reaction.... and almost immediately decided to buy IWG's Taiwan business (announced August 2019). That's a wildly bullish combo to me: the market loved TKP buying the franchise, and TKP saw the initial results and decided to lean into the move. Now, you could argue that the transactions were done in a different (pre-COVID) world, but I think that's why understanding IWG's network benefits is so important. If you believe that office space demand returns to normal at some point in the next few years and IWG can survive till then, IWG's network benefits will still be there when the world returns, and they'll still have the offer of a premium franchise deal that was so good that the first companies to try it were seeing their share prices skyrocket and immediately doubling down on the franchise strategy. That's a huge pitch.

One more note on TKP: they bought Taiwan with a clear expectation that they were going to massively grow the IWG business in the near future. They also obviously had ambitions beyond Japan / Taiwan; I would not be surprised to see them buying more IWG franchises in the near future (see slides below).

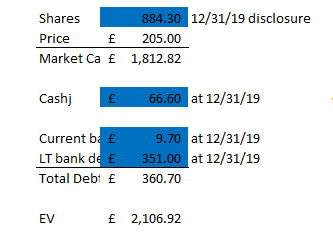

The franchise expansion is early. We don't know what IWG's franchise fees look like, nor have we seen it really proven out. We don't know what the demand for it looks like on the heels of Corona. But the early signs were good, and I believe both the demand for office spaces and IWG's network will be there as the world starts to normalize. Global franchisors (like HLT) traded for >20x EBITDA before the crisis (heck, they still trade for 15x+ despite how bad the near term environment is); if IWG continues to successfully shift towards franchising, they could unlock a huge amount of cash and transform themselves into a high multiple franchise company. Speaking of multiple, let's talk valuation. It's important to remember that the companies franchise efforts are still pretty nascent, so their trailing numbers (and current numbers) mainly reflect their current operations with very little in franchise revenues or fees. That said, the bottom line here is IWG is cheap. At today's share price of £210, IWG trades for a market cap of <£2B and an EV barely above £2.1B. EBITDA was £428m in 2019, so they trade for ~5x EBITDA. Maintaince capex runs ~ £150m/year; that would put unlevered FCF (EBITDA less MCX) at ~ £280m; suggesting a EV / unlevered free cash flow of ~8x.

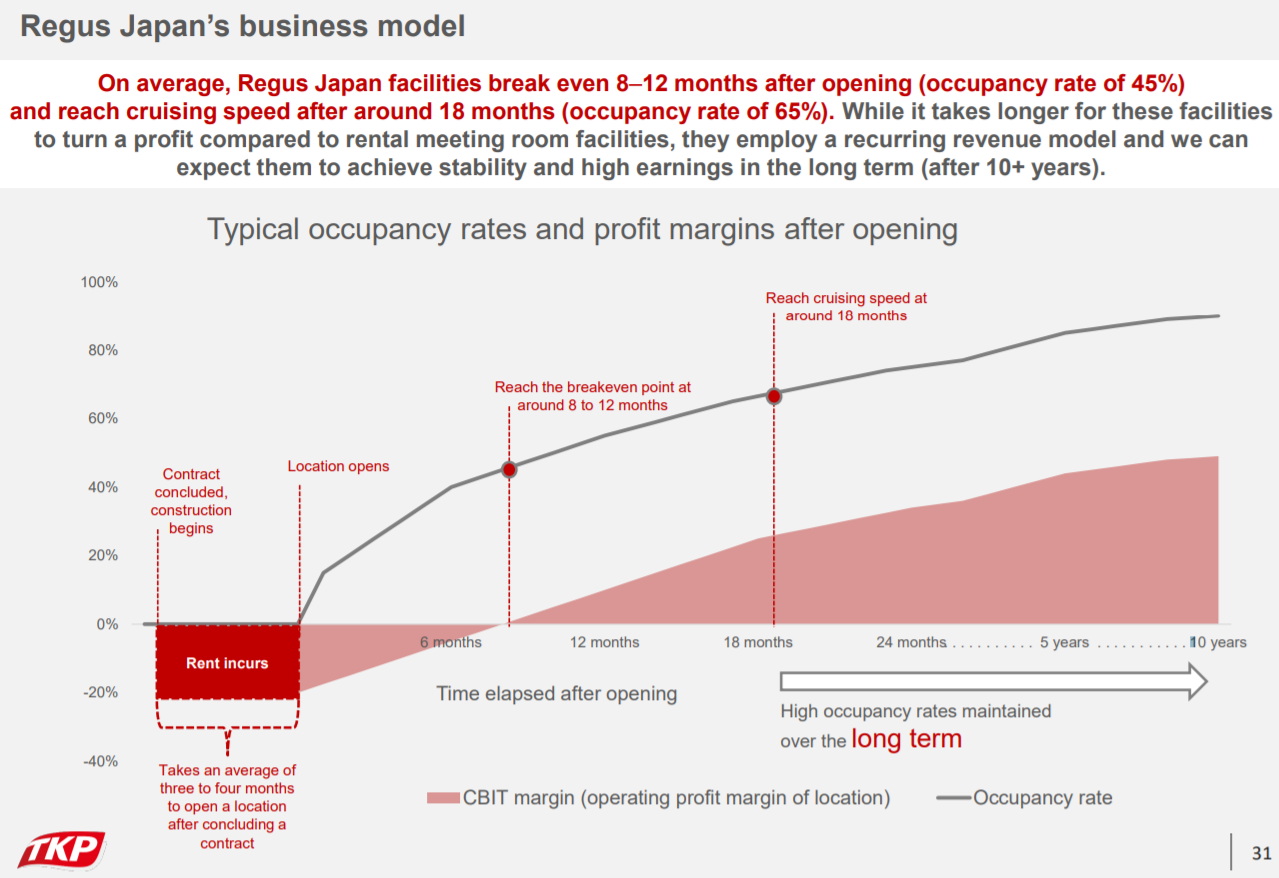

(Note: the company had been buying back shares through the first quarter; actual share count is closer to 870m. Of course, they spent some cash on the shares, so cash balance would be a bit lower. I decided to ignore for simplicity, but if you want to get really into modeling it specifically you can adjust for those two). Obviously there are puts and takes here. The big put (and it is a big one) is that COVID weakness probably means 2020 EBITDA is well below 2019 as cancellations / defaults increase. However, there are some pieces of upside that suggest the company's long term earnings power is substantially higher than their 2019 EBITDA. The largest upside is that it takes time for the company's centers to ramp up. The slide below is from TKP's (the Japanese franchisee) deck. It nicely highlight that new centers are money losing in the short term, break even after ~a year, and then start generating substantial profits. IWG has been substantially expanding their network recently; they actually disclose a "pre-2018" EBITDA number that ignores the losses from those start up locations. Pre-2018 EBITDA in 2019 was £472m; on that number, we're buying the company for well under 5x EBITDA and under 7x unlevered FCF.

But there's more! While the pre-2018 EBITDA numbers exclude the losses from those start up centers, it doesn't include the profits as those centers mature. Those centers did >£300m in revenue in 2019. Obviously revenue should increase substantially as they continue to ramp up, but if we just assume revenue was flat and they eventually hit the rest of the company's EBITDA margins, those centers ramping up would add another ~£60m in EBITDA, which would take another half turn of their EBITDA multiple (and significantly more to the cash flow multiple given it should fall pretty cleanly through to free cash flow). Personally, in a normal environment I think the core business would be worth 10-12x EBITDA (would imply ~15x unlevered FCF). That would imply a share price of >£500, or significantly more than a double. There's evidence the company agrees with me: they've been a consistent share repurchasers and have habitually argued they are undervalued. Perhaps more importantly, recent franchise deals suggest that valuation may be conservative. Remember that IWG did a significant bit of franchising in 2018. As part of those deals, they disclosed the 2018 revenue and EBITDA numbers for the assets they were selling. For example, they sold the Japan assets for £320m, and they disclosed those assets did £94m in sales and £21m in EBITDA in 2018 (implied multiples= 3.4x revenues; >15x EBITDA). Those numbers are probably a bit misleading; several of IWG's Japan assets were newer and still ramping up, but directionally they still suggest the private market multiples for IWG's assets are significantly higher than where the market is trading. My estimate is IWG would need to trade for ~£900-1000/share for their valuation to match up with the private market value from the Japan sale; or a 4-5x increase from today's price. Obviously such a huge increase seems laughable against today's price. The biggest pushback is likely that those deals were pre-Corona, and that pushback makes some sense (though, again, I think the business survives this and comes out the other side stronger). The other pushback is that the TKP deal was a onetime deal and they overpaid. That's a possibility, but I think the evidence is against that. Again, TKP's stock rocketed higher on the announcement of the deal, and TKP liked the deal so much that they did the Taiwan deal a few months later at a similar revenue multiple (and higher EBITDA multiple!). It seems to me that they were happy with the deal, though again it's one company and one set of their assets so it might not be the right mark for the whole company. Still, I think those transactions suggest IWG's private market value is significantly in excess of today's share price. And remember that when IWG sells their assets to franchisees, it comes with an ongoing franchise fee that will have significant value to IWG, so IWG's ultimate value would be in excess of these private market franchise deals, and that value should increase as their franchise deals often come with commitments from their partners to significantly grow the business (and thus the franchise fee) in the near future. There are lots of risks here obviously. The near term demand picture is pretty bleak, and given a lot of the business is short term leases (month to month), people will be cancelling leases left and right (either because they are not going to the office or because their business has gone under). As mentioned above, the majority of IWG's leases are non-recourse to the company, so if a center loses enough business to be unprofitable, IWG should be able to renegotiate the lease with the landlord or simply break the lease and close that shop without much issue. So the near term picture is bleak but IWG will survive. The bigger longer term risk is that Corona results in a mammoth change in office demand (this article covered a lot of these risks). There are a variety of ways this could play out: for example, you could just see people and companies moving more towards remote work and overall office demand going down. I tend to think the effects of overall office demand dropping would be mixed for co-working companies; office demand going down would leave a lot of vacant spaces (cheaper rents for the coworkers), and people might actually accelerate to signing up with co-working spaces because they want increased flexibility to start/stop leases and still need a common / shared space to handle in-person meetings every now and then. There is a longer term risk that Corona puts a huge damper on either office demand in general or shared office space in particular, and demand for co-working in general takes a hit as a result of this. I don't think that's likely; Asia has dealt with pandemics before (SARS, H1N1, etc.) and demand for co-working has always come back. I don't see why this time should be any different; ultimately, people want an office space to get out of the house / meet in person with co-workers. IWG also mentioned on their March 2020 call that people were already returning to their office spaced in China, so early signs internationally suggest that people will come back eventually. Still, I think those risks are manageable, and that IWG will emerge from the other side stronger (particularly given the devastation their competitors are likely to see). Over the next decade, I expect IWG will pursue more deals like the Japan / TKP deal. They'll sell their owned assets to franchisees who promise to invest significant capital into growing the business, and I expect they'll do so at multiples far in excess where the market is valuing them today. IWG will return the bulk of that cash to shareholders through dividends and share repurchases, and over time I expect the market will reward their new franchise fee stream with a premium multiple. It sounds silly in today's environment, but between ramping up their franchise fees and recycling the proceeds from asset sales into share buybacks, I wouldn't be surprised if IWG's a ten bagger over the next few years. WeWork Obviously the dynamics of WeWork have loomed large over IWG for the past few years, so I wanted to address them a bit. While IWG and WeWork have a lot in common, there are some key differences. The most important is that IWG is well run and actually profitable (and has been so for years), while WeWork is an unprofitable mess. For years, IWG has been quick to point out that WeWork was taking all the same steps / mistakes that IWG had made in their early days, and that the end result was likely to be tears. For example, the quote below is from IWG's 2017 capital markets day.

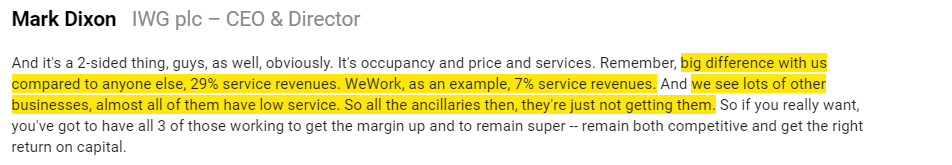

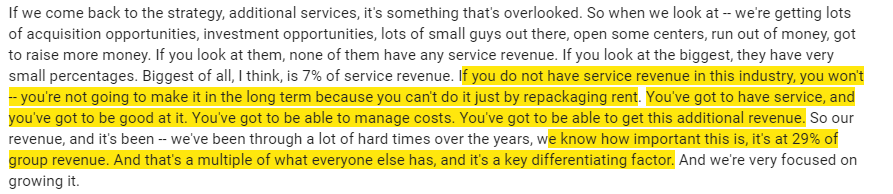

Aside from being profitable / well run / structured so that leases are bankruptcy remote, another huge difference between WeWork and IWG is that IWG derives a significant amount of revenue from services, not rent. As mentioned above, service revenues are critical to making this a profitable business. I think the quotes below help illustrate that difference best (from their Q1'19 and Q4'18 earnings calls, respectively)

WeWork's meteoric rise and fall loomed large over the sector for the last few years. That was a bit of a negative for IWG; when a competitor is given nearly unlimited free money at fantasy valuations, they can use that cheap money to try to price out their competitors. However, WeWork's fall is likely to be a huge positive for IWG going forward. For the industry as a whole, WeWork likely significantly raised awareness of coworking / flex office, which could accelerate the trend to flex office space. For IWG in particular, WeWork's reorganizing will likely present them the opportunity to buy distressed asset on the cheap; in addition, all of the negative press around WeWork should give IWG a huge leg up in sales going forward (to say nothing of churn from clients who signed in the last few years at well below market rates driven by WeWork's growth at all costs mantra who are going to get hit with mammoth rent increases when their contracts lapse). An anecdote might make sense; imagine you're a giant company looking to outsource office space nationwide. Can you trust a bid from WeWork? You've heard all of the stories about disarray and distress over there; are you going to risk a bunch of nationwide locations being blacked out because you outsourced to a company everyone knew was in distress? Probably not. I'm not saying that WeWorks distress or IWG's scale gives IWG infinite pricing power or anything, but it is certainly a huge leg up in enterprise sales (as is the fact that their network is better / larger!). The quote below is from IWG's Q3'19 earnings call; I think it sums up the upside from WeWork's distress nicely.

Odds and ends

It's extremely difficult to guess what happens to IWG's occupancy in the near term. However, there's almost certainly a significant amount of headroom before they need to think about shutting down a bunch of locations (and, again, those locations are generally non-recourse, so they shouldn't impact the whole company if they do need to start shutting locations down). The slide below is from TKP's deck and suggests breakeven is around 40%; I think IWG's breakeven is a little higher but given that their average occupancy for mature centers is 70-75%, IWG has significant headroom for clients to cancel leases before they need to start worrying about shutting locations down. That breakeven occupancy is also on a the current rent schedule; I would guess IWG could negotiate pretty hard for rent relief (which would drive the break even rate down) before they actual had to close locations. Plus, in a scenario where IWG did need to shut locations down, they'd likely be able to move some current clients to nearby locations that remain open, boosting the remaining locations occupancy. Obviously none of this would be ideal, but I highlight it to show how much headroom IWG's current model has.

I mentioned the network effects benefit is a huge piece of the investment thesis for IWG. A few other points on their size benefits

There are a variety of benefits from having multiple office locations that IWG's scale lets you access. Obviously someone who travels a lot will got a lot of benefits from being able to drop into different offices. Companies see significant improvement in worker satisfaction when they give them access to offices closer from home (i.e. if someone from New Jersey commutes into the main office in NYC; having an office in New Jersey that they can work from every now and then is a huge lifestyle improvement).

IWG's scale gives them some purchasing power versus start up competitors. A super small benefit but it's there.

Scale also gives a little bit more data / operational knowledge. As mentioned in the WeWork piece, you can't operate a cowork / flex box profitability simply by arbing rent. You need to have significant services revenue. IWG's operational history gives them an advantage in generating service revenue that newer competitors won't have.

The CEO was buying pretty aggressively in Mid-March (another director did as well). I tend to discount insider buys made during March: the scope how bad Corona was going to get wasn't really known, so you had lots of situations where executives were buying hand over fist as their equities were rapidly careening towards the brink of insolvency. Plus, mid-march was the (current) height of the crisis, and the share price was materially lower than today's. Still, I think the buys were a little instructive simply because IWG has lots of offices all over the world (including in China), so the probably had a bit better view than the average company on how Corona was likely to impact their business.

Speaking of the CEO, your mileage may very on him. I tend to think he's quite good: a former hotdog salesman, he founded the business 30 years ago. Yes, he almost blew up in the aftermath of the dotcom bubble, but I think he learned the lessons from then and overall I think he's a value creator. He's been pretty prescient predicting what would happen with WeWork, and I'm generally impressed with his interviews and such (one more from right when WeWork was blowing up). As a founder with ~30% ownership in the business, I feel pretty good that he'll be focused on value creation.

I've given them no value or credit for it, but IWG has £150m in property investments on their balance sheet (per their annual report p. 34). That's a little bit of incremental potential value (~£15-20/share), and also a source of potential liquidity if the environment remains poor for longer than expected. IWG has stated before that they do plan to resell these properties at some point in the future (quote below from Q4'17 call), but again I haven't given them any credit for them so these would be pure upside.

Update: as I finished this up, there was a Times London story suggesting IWG was exploring a sale leaseback of those properties.

I'm obviously quite bullish on the franchising opportunity. It will take a long time for it to fully ramp up, but there is some early momentum. And that momentum is encouraging; potential franchisees are going to do a decent bit of due diligence before making a multi-million dollar commitment, and the momentum suggests that early diligence is positive. In addition to the Japan / Taiwan deals mentioned extensively in the article, IWG sold their Swiss operations for >£100m, and their annual report notes franchise agreements in Spain, the Netherlands, the UK, Germany, Thailand, and the Philipinnes (see p. 27).

Again, one of the great things about the financing strategy is not just that it gets IWG a ton of cash and a high margin franchise fee stream (though those are great!); it's also that the partner will invest their own capital into rapidly building out the country and increasing IWG's network. The quote below is from their Q1'19 earnings call; I don't love the comparison to the mobile phone industry but I think the general point is spot on.

Recent accounting changes require both domestic and international companies to put operating leases onto their balance sheet (they were allowed to keep them off balance sheet before). Lots of people have suggested this could be a catalyst to accelerate the move to co-working / flexible. I'm dubious an accounting change alone is enough to significantly accelerate the move, but it is possible and you're obviously not paying for that possibility at these prices.

It's entirely possible I am too naive here. AMC once hosted a call just to yell about how the data services treated them after the accounting changes, and it included slides to walk everyone through the changes in great detail. I could 100% see companies like them deciding to go the flex offices just to improve their financial optics, though I would note AMC's CEO was particularly next level when it came to obsession with street number and optics.

I do think that, overall, the move to flexible office space makes a bunch of space, and the sector is likely to continue to grow going forward. Tech companies in particular, which can see mammoth hiring on the way up or rapid cuts on the way down, are particularly good candidates for flex space.

There are a lot of moving pieces here, but the company's tax rate should be reasonably low. P. 117 of their annual report suggests it should be <15%, and they have pretty significant tax loss assets.

A risk I've heard thrown around is why don't the property owners do this themselves (for example, Vornado mentioned this on p. 21 of their 2019 chairman letter). I think it's pretty simple: even the largest property owners don't have the scale needed (a secondary reason: dealing with hundreds of clients, short term leases, and the service revenue side of things is a much different skill than dealing with a few clients on long term leases).

The below is from IWG's 2017 investor day; it's ILG interviewing the CFO of "Norway's largest company" (a property company that partnered with IWG). Again, consider the source, but I think it highlights the barrier for property owners well. (Also note that Entra is a public company; they don't specifically mention IWG too much but, in general, they seem to be very pleased with the partnership and, as recently as Q1'20, were publicly mentioning continue to grow it).

IWG has a bunch of different brands: Spaces, Regus, HQ, etc. I thought this was kind of strange at first; after all, WeWork only has one brand. The quote below helps highlight why IWG's strategy might make more sense (better customer segmentation).

Brookfield and Onex were in serious talks to buy IWG in 2017/2018, but the deal couldn't get over the finish line because none of the parties came up with a "recommendable price." I doubt a buyout is in the cards, but it's certainly possible.

There were some rumors IWG would try to float Regus when WeWork was discussing an IPO; obviously I don't think that's happening, but it's an interesting thought and there are some arguments in there that pieces of IWG are worth significantly more than all of IWG's current market cap. That article also mentions how focused IWG is on unlocking shareholder value, which is always nice.