Comcast: buy the cable business, get everything else for (almost) free? $CMCSA

I spend a lot of time looking at and thinking about the cable / telecom / media sectors, and you can't spend any time on either of those without thinking about / looking at Comcast (CMCSA) given their ownership of Xfinity (the largest cable company in the U.S.) and NBC (one of the largest media companies in the U.S.). It's easy to paint a bullish or bearish picture on Comcast. On the bullish side, they're probably the best run cable company in the world, and cable is a great business. Their NBC assets, while currently in more than a bit of flux, obviously have significant value, the stock is quite cheap, and Brian Roberts (their CEO / semi-control shareholder) has a track record of value creation. On the bearish side, the Sky acquisition is looking like a disaster (and plenty of people thought it was a disaster from the moment it started getting floated!), almost all of the NBC assets are undergoing some form of extreme secular headwind and/or Corona disruption, and there are more than a few red flags related to corporate governance that I think bulls tend to overlook. My personal opinion? Comcast is too cheap, but the levered returns from a pure play cable company pursuing a buyback model (like Charter, my largest position) are likely to be significantly better than Comcast's. Still, if you were asking me for the proverbial "one stock I can have my sister put her kid's college fund in and not touch for 20 years" stock (and for some reason we couldn't just do an index fund), that stock would undoubtedly be Comcast. And I think the stock today offers a better value than it ever has. Anyway, the economics and valuation of the NBC / Sky business are much different than the cable business. Most people (myself included) tend to look at Comcast as a Sum of the Parts, and I think most of us have tended to fall into taking conservative valuation for NBC and Sky and then seeing what the current share price implied you were buying the cable business for. An example might show this best: in 2019, NBC earned $9B in EBITDA, Sky did ~$3B, and Cable did ~$23b. Most investors would say "well, Sky and NBC are each worth about ~8x EBITDA; if I assume that valuation at today's share price I'm buying Comcast's cable business for 9x, a discount to cable peers." (Note I'm just throwing multiples around in this example, not suggesting that any of those are how they should actually be valued). That approach will run into some issues this year, as NBC and Sky's earnings will be dramatically impacted by the Corona Virus. NBC's theme parks, for example, did ~$2.5B in EBITDA in 2019 but will generate basically no earnings this year. I doubt anyone thinks the theme park business is worthless, but if you use a SOTP on the NBC business currently that's effectively what you'd be saying. A lot of different NBC / Sky businesses are like that: near term earnings are dramatically impaired, and while their future may be a little less bright, they will almost certainly survive the current environment. None of those are insurmountable problems from a valuation standpoint, but they do make the simple SOTP "how cheap is the cable business" model worthless. So I was thinking about cable the other day and I thought to myself, "Hey, what if you inverted that valuation, assumed the cable business was worth roughly what their pure play peers trade at, and saw how cheaply you were buying Sky / NBC?" A few years ago, there was a ton of noise in all of the cable companies' financials. The headliner here was Charter, which was undergoing a mammoth integration that weighed on its income statement, but all of the cable companies had some idiosyncratic things happening that made a straight apples to apples valuation difficult. Even today, the cable companies are all in different stages on their wireless roll outs (which can be expensive! Comcast burned $400m on wireless in 2019) and other strategic initiatives (in particular I'm thinking of pricing here; if one company is more aggressive in pricing than another they'll perform better in the short term even though in the long term all of the cable companies should have roughly similar pricing power). So, instead of valuing companies on a straight EV / EBITDA basis, I've found the simplest way to value across cable companies is on an EV / homes passed basis. Again, it's not perfect, but I think it's a nice comparative metric. At current levels, Comcast's best peer, Charter, is valued at $3,800/home passed. Other peers are valued more highly: Altice is >$4,200/home passed, and Cable One is >$5,500.

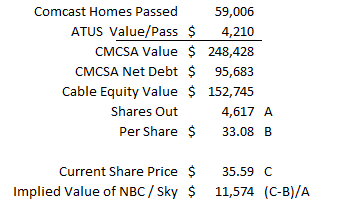

Let's assume that, as a standalone company, Comcast's cable business would be worth what Charter trades for. That's probably too conservative: Comcast's cable business is two to three years ahead of Charter in terms of margins, capital intensity, etc. (Said another way: Comcast has better margins, lower capital intensity, etc. than Charter; Charter will almost certainly get to Comcast's current levels, but it will take them a year or three). Still, let's run with it; under those assumptions, Comcast's cable business would be worth $225B. That would cover all of Comcast's debt plus ~$28/share of equity value. Comcast today trades for <$36/share, so under this math today's share price assumes that NBC and SKY combined are worth <$8/share, or <$35B in total.

To put that $35B into perspective, consider:

Comcast paid $48.6B for Sky in 2018. Today, you're buying Sky and NBC together for ~30% less than Comcast bought Sky alone for 18 months ago.

NBC did $9B in EBITDA in 2019. Disney isn't a perfect peer, but it's the best comp to NBC out there. DIS will do ~$10B in EBITDA this year. That number is obviously depressed by Corona; they did ~$16B last year. DIS's current EV is $250B, so on a pre-Corona valuation they're trading at >15x. Comcast's current price gives you NBC for <4x pre-Corona EBITDA, plus you get Sky thrown in for free.

Comcast / NBC bought Dreamworks for $3.8B in 2016. Dreamworks is a fantastic property, but it's honestly a rounding error compared to the totality of NBC / Sky. Today's share price effectively assumes that Dreamworks is >10% of NBC / Sky's value.

Blackstone bought Merlin Entertainment, which runs Legoland and Madame Tussauds, for $7.5B last year. That value worked out to ~12x EBITDA. NBC's parks are almost certainly better / more valuable than Merlin's, and in a normal environment would get a better valuation to match. Parks did $2.5B in EBITDA last year, and EBITDA was set to increase significantly in the near future as things like Nintendo World at Universal Japan opened in 2020. If you told me in December 2019 that Parks was worth $35B, I wouldn't have batted an eye. It's basically the same valuation as Merlin for a better business!

You can cut it a lot of different ways, but no matter how you do I think there's one conclusion: Comcast is way too cheap at these levels. Can you find stocks with higher prospective returns? Absolutely. But given the safety and stability of the cable business, there aren't many stocks that offer the combination of discount to a (very conservative) sum of the parts and downside protection that Comcast does. PS: I'm a completion-ist, and the title of this post said you could buy Comcast's cable business and get NBC and Sky for (almost) free. The valuation using CHTR's multiple showed that Sky and NBC were screamingly cheap.... but I wouldn't quite say free. So here's Comcast's valuation if you use ATUS's multiple. Sky and NBC combined did ~$12B in EBITDA in 2019; at ATUS's multiple, you're effectively buying them for <1x EBITDA.