Could $DISCA be $QRTEA 2.0?

I've really enjoyed doing the Yet Another Value Podcast so far this year (you can find it on YouTube or any of your favorite podcast platforms, and if you like the podcast follows / good ratings / word of mouth recs are always appreciated!). But the podcast can be a bit of a double edged sword: the good side of the sword is the guests are (nearly without exception) smart and extremely compelling, so when they pitch a stock I generally walk away thinking that the stock is interesting and I should, at minimum, do (a lot) more work on it. However, the bad side of that sword is that if and when I pass on something mentioned on the podcast and the stock takes off, I'm going to be kicking myself because I literally had the idea handed to me in significant detail by someone I know and respect and I still passed.

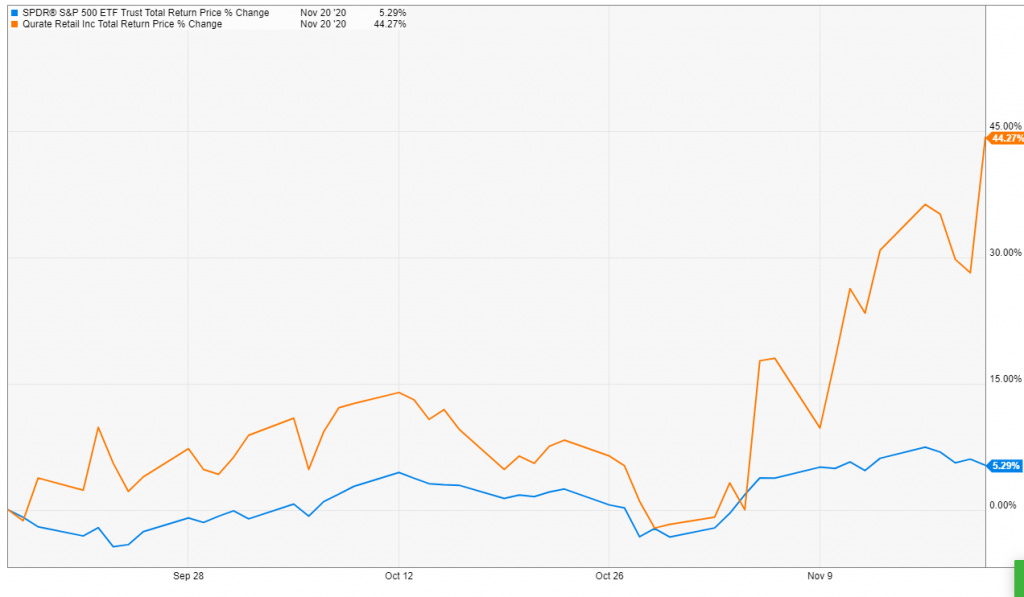

For me, the two stocks / podcasts that hit this "regret" side of the equation the most are my podcast on Uber with Mario Cibelli and my podcast with Bill Brewster on QRTEA (PS- not to pitch my competition, but Bill recently released a new podcast that's worth checking out). Why do those two podcasts in particular stand out as a regret? It's not because other stocks weren't compelling or great returners; for example, Cardlytics is up ~70% since I did the podcast with Cliff Sosin, and while I would have loved to have bought it and thought the thesis was quite compelling, ultimately it just wasn't a company I got comfortable with. Instead, QRTEA / Uber stick with me because of a combination of the pitch for the companies being compelling and the companies having business models and market misperceptions that were right in my wheelhouse. Unfortunately, I passed (well, not fully true; I took a very small position in UBER but it wasn't enough to move any needles), and the stocks have gone almost literally straight up since the podcasts posted.

I wanted to highlight those two examples (and Cardlytics!) for one reason: to stress the fact that you should absolutely be listening to the podcast and going YOLO on whatever stocks are mentioned on there.

No, I'm kidding. That's a complete joke and (of course) absolutely not investing advice.

The reason I highlight those stocks / podcasts is because I was thinking about Liberty Day a lot this weekend. QRTEA took a ton of time up on the second day, and you could tell that overall the QRTEA team was pretty pleased with the recent results and how the market has handled their recent financial engineering moves (moves that I was initially skeptical of and remain a little perplexed by). In fact, I don't think the QRTEA / Liberty team was just pleased by the market's reaction to the initial dividend; I think they were downright surprised and thrilled by the market's reaction. That's why they followed up the first dividend with the second dividend they announced last Friday (which sent the shares up ~13%!).

It seems the market's reaction to the QRTEA dividends has taught Liberty something: when you've got a no or slow growth business where the market is questioning the terminal value, the answer isn't always to pursue a levered share buyback model. The market might prefer a return of capital / dividend story and reward you for making that choice.

Personally, I'd rather a buyback of an undervalued stock than the dividend.... but if the market is going to reward big dividends with these type of moves, I will happily take it and I think Liberty will look to do something similar when they've got other similar assets.

Obviously, not all assets Liberty has would qualify for this model. The levered buyback at Charter is working just fine, thank you very much (and I suspect the team would take serious issues with terms like "slow growth" and "terminal value questions" being applied to Charter!). FWONA and BATRA aren't about to do big dividends. Sirius could be a natural candidate at some point, but Liberty will need to cross the 80% ownership threshold first (for tax purposes), and given they trade at a mid-teens EBITDA multiple it's hard to say the market is really questioning terminal value there.

But there is one Liberty adjacent company where the learnings from QRTEA could make a lot of sense. A company with a proven ability to handle a lot more leverage, a history of aggressive repurchases that the market seems to ignore, and a terminal value that the market clearly questions.

That company? Discovery (DISCA).

Now, DISCA isn't a perfect comp here. They aren't enjoying the same "COVID tailwinds" that QRTEA is enjoying, and they're certainly not as cheap as QRTEA.

However, they're probably a better business than QRTEA, and their assets are almost certainly more strategically valuable than QRTEA. Also, Malone has said he "loves" Discovery's stock, and I've never heard him talk that bullishly about QRTEA. So while they may not be a perfect comp, they are a good one and one that I suspect Malone spends more time thinking about / planning for.

Anyway, I'm not trying to do a full write up on Discovery here. I've traditionally been a little bearish for all of the reasons I laid out throughout my "Yet Another Guide to Media Stocks"; DISCA relies on the cable bundle for the vast majority of its revenue / profits, and as the bundle goes away I think DISCA will struggle to compete with their larger competitors who own their customer relationships and distribution (Netflix obviously being the headliner, but others are moving in here (think Disney+ and their NatGeo brand)). I'd been meaning to add a section on DISCA; I may do so in the near future.

So I'm not trying to do a full write up; instead, I just wanted to highlight what I think is an interesting near and medium term opportunity for a "trade" in DISCA. One of the things I missed with QRTEA was how paying out a big dividend really compressed the duration of the equity; I thought that duration compression didn't really matter but clearly the market was thrilled with it. I imagine Malone and company have to be looking at how thrilled the market was with QRTEA's capital allocation and thinking to themselves that DISCA could pull a similar move and see a similar boost to their stock price.

Will they? I don't know. Malone has traditionally had a soft spot for DISCA; he's been expressing his bullishness on it for years and it is one of the few companies he controls where he's actually bought stock on the open market. Maybe Malone is so bullish on DISCA that he can't bring himself to pay out a dividend from the company just to get a short term stock pop; he famously hates paying the tax man (which a dividend forces him to do), and a combination of paying the tax man and forgoing share buybacks to pay a dividend when he's really bullish a company might be a nonstarter for him.

But the man is also a savage capital market allocator, and he knows how to play the markets. If the market wants SPACs, he'll give them SPACs. If they want dividends and will reward his companies for them, I suspect he'll give them dividends. And, it should be noted, Malone is clearly looking to clean up his estate and minimize his tax burden once he passes. If DISCA gets a big pop on a dividend announcement, he could use the "inflated" share price as a mark for future tax maneuvers, potentially letting him further minimize his tax burden.

Anyway, this is a long winded post to get to one simple idea: I think DISCA represents an interesting trade today.

Underlying the trade is one simple fact: DISCA is cheap, and John Malone loves it. Personally, I'm a little more bearish on it because, while they have good assets, they've got a tough pivot to make and the cable bundle is unwinding really, really quickly. Still, Malone is literally the greatest media investor of our generation, so I think we can give him the benefit of the doubt and say Discovery is probably a bit undervalued here.

So value underlines are trade. The big potential catalyst here is that Liberty / Malone have learned from the QRTEA dividend that the market loves big special dividends, and Discovery is perfectly positioned to announce one in the next few months (if they decide to do one!).

However, there is one other short term catalyst I briefly want to touch on. Discovery is hosting a presentation to launch their global streaming service on December 2. I think their global streaming service is launching into a very tough market. However, here's the good news: the market is almost certainly assigning no value to Discovery's streaming service. In fact, given Discovery is currently investing hundreds of millions through their income statement into the streaming service and the company trades for ~7x EBITDA multiple, I think you could credibly argue the market is giving Discovery a negative valuation for their streaming ambitions.

If the streaming service / presentation goes well, you could see the market rerate Discovery pretty quickly. Remember a few years ago when Disney's stock jumped ~12% on their announcement of Disney+'s monthly pricing? Obviously Discovery isn't Disney and we're dealing with a whole different set of expectations here, but I do think Disney's stock movement shows the market is willing to respond positively if they're impressed by your vision for a streaming service. Discovery is a Liberty related / Malone controlled company that's about to do a presentation. Never say never, but I can't think of a single time a Malone company has done a presentation that has disappointed the market / caused the stock to go down (i.e. Liberty stocks often go up on their Liberty day presentations, but I can't remember any going down materially). I suspect the market will, at worst, be neutral to the presentation, and I wouldn't be surprised to see a nice bump from it.

I basically look at Discovery today as a three part free roll

Part #1 is the super short term: buying today gives you a free roll into their streaming presentation in a few weeks and seeing if the market likes that.

Part #2 is the medium term: you get a free look at the potential for a QRTEA like dividend announcement that drives the stock higher. I would think there's the potential for one of these alongside Q4 earnings early next year

Part #3 is the longer term free roll: John Malone, the best media investor of our generation, has bought the stock on the open market, controls the company, and says he loves it. You get a free roll investing alongside him.

That's a free roll I want to buy. I've traditionally been hesistant on Discovery, but the recent success of QRTEA has me thinking there's a lot of financial engineering optionality at DISCA the market is missing.