Assessing $IPOC's options

I've been writing online for years, and "the curious case of PSTH's options" had, by far, the most engagement of any investment idea I've ever posted. Perhaps the idea is just that compelling (and I think it is rather compelling!), perhaps my other ideas have not been as compelling as I like to think (perish the thought!), or perhaps it's a sign of how SPAC crazy the world is right now. The right answer is probably a little bit of all of the above.

Anyway, given the feedback on that idea and the general interest, I wanted to throw another SPAC centric idea out there. Before I get there, I will remind you of the poo-pourri disclosure from the PSTH piece: nothing on this blog is investing advice, and this piece is going to discuss options, which can be particularly risky. So remember, nothing on here is investing advice or a recommendation.

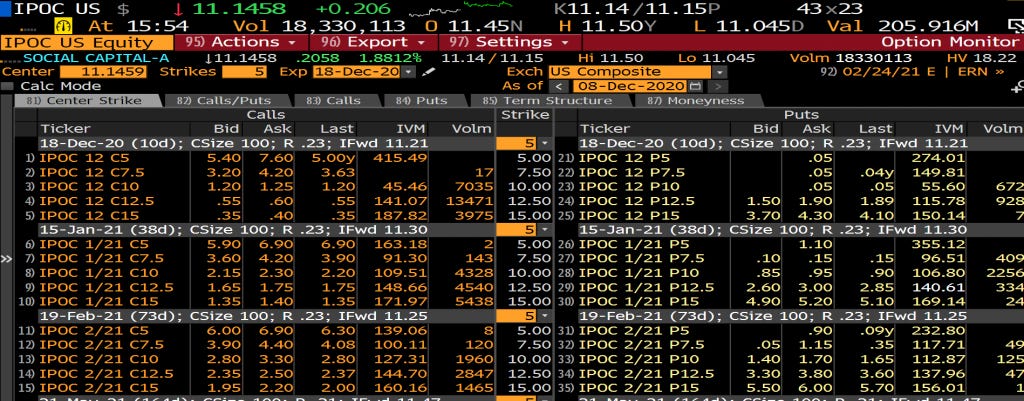

Ok, that out the way, the idea here is pretty simple: take advantage of the insane volatility at IPOC to sell options; in particular, I'm looking at the January options (which expire Jan. 15). I believe it is more likely than not that these will expire before IPOC has had their meeting to approve their merger. If that's right, at worst selling the options will have let you create the stock below cash trust value (at best, the stock follows the prior path of IPO SPACs and goes on a huge run).

Some background will help here. IPOC is the third SPAC from Chamath Palihapitiya. They announced a deal to merge with Clover Healthcare in early October. The deal is "expected to close in the first quarter of 2021."

Now, first quarter of 2021 is a wide range. It could be January 1 or March 31. And, because I'm recommending options, timing matters!

Why does the timing matter? Well, SPACs have a natural put built into them; if you're a shareholder and don't like the deal, you can redeem your shares for "trust" value (generally, ~$10/share) at the time of the shareholder vote. That natural put option provides an effective floor for the stock; as long as the shareholder vote hasn't happened, ~$10/share should be the floor price for the stock because below that arbs can start buying the shares and making a quick buck just by redeeming them.

Because of that "floor" price, any options that creates the stock at or below $10/share before the shareholder vote should be a very good trade. So, as I write this, the stock is trading for ~$11.15/share, and the January $15 calls are trading for ~$1.35/share. Buying the stock and selling the calls would create the stock for ~$9.80/share. Alternatively, simply selling the $10/puts for ~$0.90 is interesting (it creates the stock for $9.10/share), but as I'll discuss in a second I prefer buy writing the calls so that's the trade I'm going to focus on.

So let's focus on the buy stock / sell calls scenario. There are then two scenarios that could happen when the options expire in January.

The shareholder vote hasn't happened yet. This is great for you; there's no way the stock is going to be trading below trust value, so you're in the money / your stock is worth more than the net price you paid (how much more is an open question!)

The shareholder vote has happened. It's unclear what happens here; SPACs are super volatile and the stock could easily be up or down 50% in the next month once that trust value support is removed.

I'll come back to option #2 in a second and why I think it's likely the stock will be higher. But let's focus on option #1 and why I think it's the more likely of the scenarios.

In order for a SPAC to complete their merger, they must first have their shareholder vote.... and in order to do that, they must file a definitive proxy that's been approved by the SEC. Getting the proxy approved by the SEC takes time, and you have to have a certain amount of time between filing your definitive proxy and having your shareholder vote.

Let's look at IPOC's older brother, IPOB, for an example. IPOB announced their intended merger with Opendoor September 15, Their proxy went definitive November 30, they've scheduled the shareholder vote for Dec. 17, and the merger should close Dec. 21.

IPOC announced their deal with Clover October 6, exactly 3 weeks after the IPOB / Opendoor merger announcement. They have yet to file their definitive proxy, but if they stick to the same timing as IPOB they'd file the definitive proxy December 21st with a shareholder vote on January 7th.

Think about the calendar for a second. That timing suggests the SEC approves the definitive proxy three days before Christmas, and then IPOC has the same amount of time between their proxy going definitive and shareholder vote as IPOB did despite having Christmas and New Year sandwiched in there.

It's not impossible.... but it feels pretty unlikely. And there's really no huge rush for IPOC; does it really matter if the company gets the merger closed in early January versus late January or early Feb? Probably not for them, so I'm not sure why they'd take on the added stress / rush around the holidays. Of course, it matters a great deal for the options. I like that set up in a vacuum: owning something time sensitive that the company is not time sensitive on.

So, I understand a lot of my timing set up is on feel, but based on precedent deals and the calendar, it just feels to me like having the proxy go definitive in early January with a shareholder vote in late January is what's most likely here. If that's right, the stock isn't t trading below trust value, so this trade is money good.

What happens if I'm wrong though? What if IPOC files their definitive proxy tomorrow and has their shareholder vote on January 4th? Well, then the options will expire after the shareholder vote, so you'll lose the downside protection of the put at trust value.

But I still think the odds suggest this will be a good trade. I say this for two reasons.

First, remember that shareholders are being asked to vote on the merger. For shares to trade below $10/share, in early January shareholders would need to say "you know, I could get $10/share for my stock, but I'd rather keep my stock" and then a week or two later be willing to sell their stock for less than $10/share.

That's certainly not impossible; plenty of SPACs have traded below redemption price after their deal got approved. But I think it's unlikely, particularly for a SPAC with this much visibility. Remember, as I write this, IPOC is trading for >$11/share, so shareholders today are pretty darn excited about the combination. Plenty could happen between now and options expiration that make them less excited (a market crash being the most likely), but it's a pretty tight time frame.

So I don't think shares will trade below $10/share, which means this should be a good trade. In fact, I think it's more likely that the market gets more excited about the stock as we get closer to the merger close date.

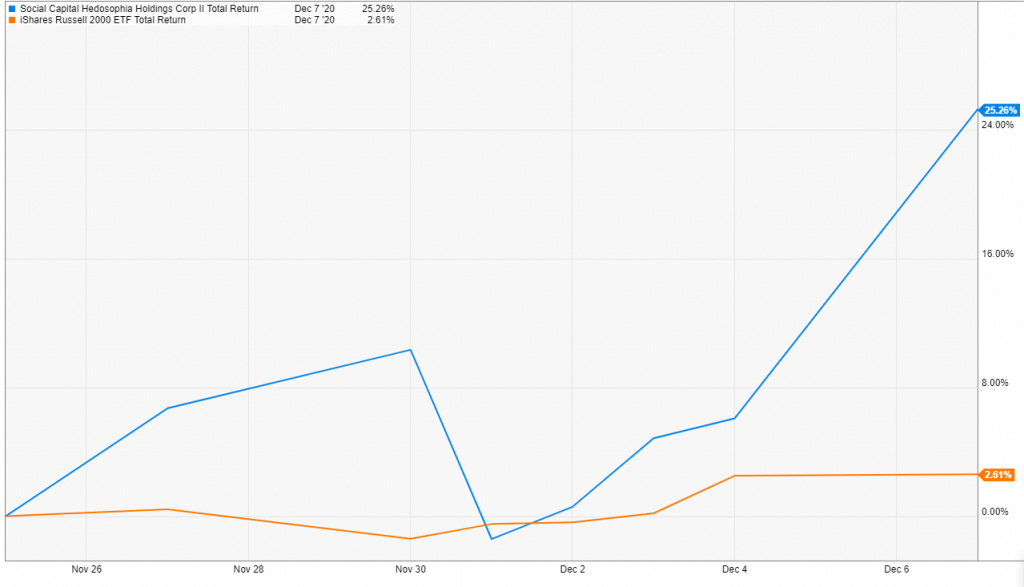

Consider again IPOC's older brother, IPOB. Their proxy went effective November 30th, and on December 7th they put out a PR confirming when they would close the merger and start trading as "OPEN". The combo (and absolutely no other news that I could see) was enough to send their shares up 25% in a week in a roughly flat market

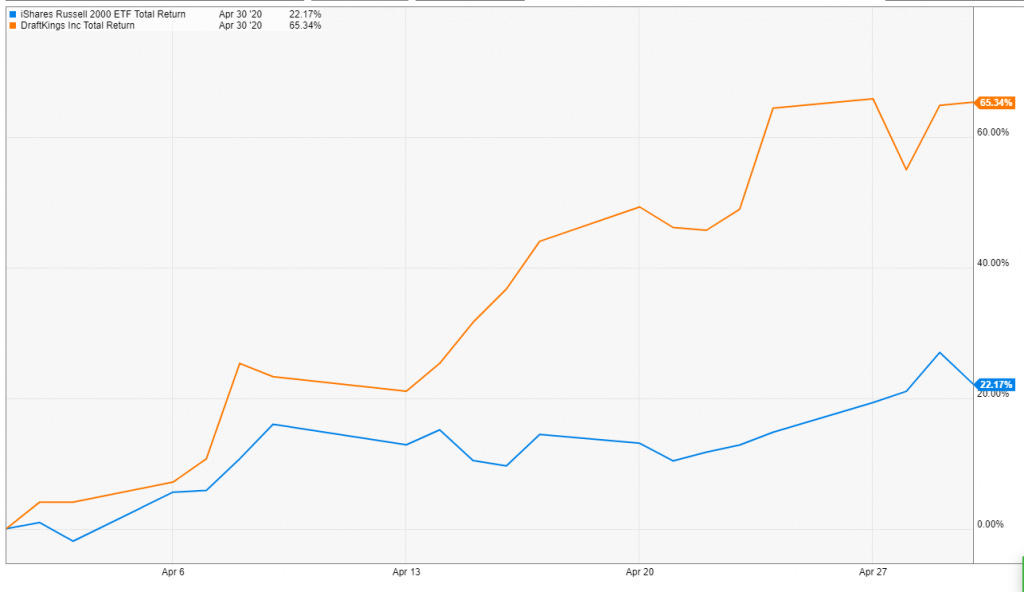

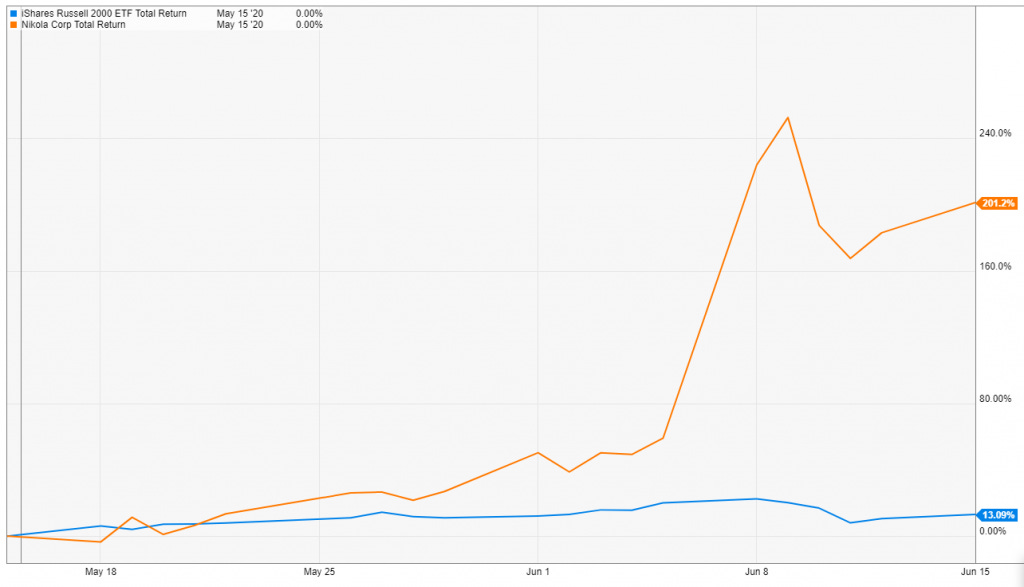

That's not unique to IPOB. It's tough to define "buzzy SPAC", but I honestly can't think of many that haven't seen their share price increase significantly into their merger completing. Is that silly? Yes. But it's happening, and given the pedigree behind IPOC I'd be surprised if it didn't happen here. A few examples to hammer this point home:

April 23, 2020: DKNG completes merger

June 3, 2020: NKLA completes merger

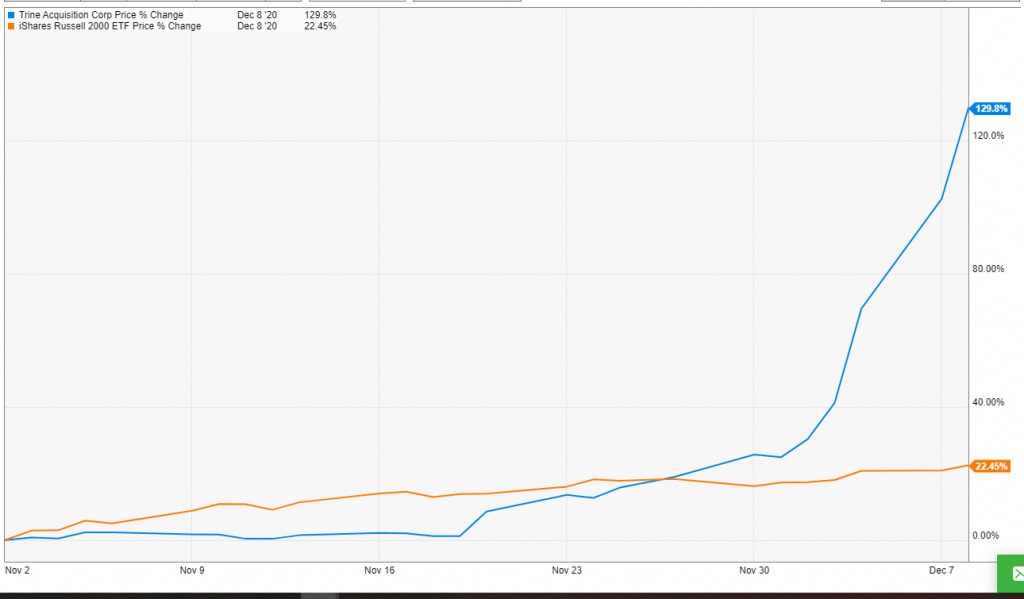

TRNE: announced merger in August 2020. Proxy went effective November 10th, successful shareholder vote December 8 (yes, yesterday!). Stock has more than doubled since the start of November; this is a particularly interesting comparison as Chamath has backed this one.

I understand this is N=4 (IPOB, NKLA, DKNG, TRNE), so this is a small sample set. But I just think the evidence says that buzzy SPACs run up into their merger close date. You could make a bunch of arguments for why this happens: technicals (borrow becomes tighter as redeem shares get taken out and people start trying to arb the warrants), Robinhood (they like to trade the cool ticker, not the SPAC ticker), or media/visibility (the company really tries to get out and tell the story around deal close, and banks start to pick up coverage). I don't know, but (again) IPOC is about the buzziest management team out there, and while Clover might not be the sexiest / buzziest story, I would be pretty surprised if IPOC didn't enjoy a similar boost to that peers have seen.

That's why I like buying the stock and writing the calls so much here: you get to participate in a lot of upside if the stock goes on a similar run to what peers have done as we get close to merger close.

Anyway, I think I've laid out the trade rationale pretty clearly, so I'll wrap it up here. There are obvious risks: the most glaringly obvious is that if the deal closes before the options expire, you're exposed to market movements on the stock. Again, I think history suggests those movements are more likely to be positive than negative, but a lot can change quickly. I personally think we're in a bit of a SPAC bubble, and bubbles can pop very, very quickly. If that happens here, IPOC's deal could close and the stock could be down significantly before the options expire.

It's a risk. But it's a risk I'm willing to take as I think you're very well compensated for it.

(PS- I said this in the PSTH post, but feedback on this idea is always welcome. I'd particularly appreciate if you have line of sight into the most likely timing of the proxy going effective and the shareholder vote date; however, I'm also loving the set up of these trades, so if you know of other SPACs trading near trust with options trading on them, I'd love to be alerted to them as well!)