Multiplan, Part 1: Short Squeeze Potential $MPLN

This is a little bit of a different thesis than what I normally post, but I think it's an edgy / actionable and I'd love feedback on it, so I figured I'd go ahead and post it.

The idea? Buy Multiplan (MPLN; disclosure: long) because 1) it's cheap + misunderstood and 2) there's a significant possibility of a short squeeze.

Everything I do is generally anchored by point #1 (the stock / company is too cheap and misunderstood), but I would not be attracted to Multiplan if it was simply cheap. There are other companies that I like more that are cheaper. So point #2 (the possibility of a short squeeze) is a big part of the attraction here. I don't think there's anything wrong with that; I've seen enough of them this year to know that this market seems particularly primed for short squeezes, and when they happen they can be vicious.

So again, this isn't my normal type of investment. Take it for what it's worth (and always do your own diligence / remember nothing on here is investing advice!).

Last note- I'm going to split this post into two parts (possibly three). Part #1 (this part) will cover the main reason I'm attracted to the stock: the possibility of a short squeeze. Part #2 will go more into the company's fundamentals and financials and why I don't think the short thesis is a great one / why I think the company is understood. (Update- Part 2, debunking the short thesis, is here)

Ok, some background. Multiplan went public earlier this year through a merger with a SPAC (Churchill Capital III). They closed that merger on October 8; on November 11, Muddy Waters (MW) came out with a short report on Multiplan. That's always a scary term, as Muddy Waters is probably the gold standard of activist short sellers and I've got a lot of respect for them.

That said, the timing of the MW piece is important: when SPACs merge, basically all of the shares held by insiders or anyone who participated in the PIPE cannot be sold immediately. They need to be registered, which requires a prospectus approved by the SEC. That process generally takes about 30 days. After the approval, any non-locked up insiders can sell their shares.

If you've ever seen a SPAC warrant that trades for significantly below the price it seems like it should, this registration process is often the culprit. SPAC warrants are not exercisable until the shares underlying them are registered (which they are as part of this initial registration). It's actually become a pretty common process to have warrants disconnected from the stock while waiting for the registration statement; that disconnect looks something like this: a SPAC announces a merger with an electric vehicle company and sees their shares trade to $25. They have warrants outstanding that let warrant holders buy shares at $11.50/share. At $25, those warrants should be worth $13.50 ($25 stock price less $11.50 exercise price), plus some premium for the time value of money and the value of owning a call option on such a volatile assets. However, the warrants will trade for something like $8/share because they are un-exercisable until the shares are registered. The day the shares are registered and the warrants are exercisable, that spread will collapse as arbs immediately buy and exercise the warrants and sell the stock. In general, the spread collapses because the stock price collapses; the discount in the warrants simply reflected the difficulty of shorting the stock and the market's skepticism that the stock price could hold up as more supply came online.

Market participants know about this process and that it creates selling pressure on the stock. That presents opportunity; similar to how short sellers and investors know that the expiration of the lock-up period for an IPO generally results in a drop in the stock, we're starting to see short reports timed to lock up expiration and registrations for SPACs, as the combination of a short report plus a flood of liquidity from newly registered / unlocked shares create conditions ripe for stock drop.

The Muddy Water report came out November 11, almost exactly one month after the Multiplan merger closed. Multiplan's prospectus went effective November 16th, so the short report was clearly timed to match closely with the prospectus.

Note this is far from an uncommon tactic, and I expect it will become increasingly common over time given the wave of wildly priced and increasingly silly SPACs we are seeing (I've discussed how crazy the current SPAC-mania is a few times). For example, consider Kerrisdale / TTCF. Kerrisdale Capital put out a short report on TTCF on November 19th. This was just over one month after TTCF completed their SPAC merger with FMCI (October 15th) and the same day that TTCF's registration statement was approved (disclosure: we were an investor in Forum's founders' shares, and we continue to hold a small position in TTCF from the founders' shares)

Anyway, bottom line here is that I think Muddy Waters report was clearly designed to benefit from the prospectus going effective and some early investors getting liquidity. And there's absolutely nothing wrong with that!

So why do I think there's a potential for a short squeeze?

The Muddy Waters report has significantly increased the short interest in Multiplan; Bloomberg tells me that there are 16.7m shares short as of 11/13/2020 (the last day BB has data for currently).

Multiplan has ~675m shares outstanding, so normally that wouldn't be a huge short interest. However, ~416m of those shares are owned by "existing MultiPlan shareholders", who are subject to lockups that don't begin to expire until April 2021 at the earliest. Take those shares out of circulation and suddenly you're looking at a free float of ~260m, so the short interest of ~17m shares is already over 6% of the float (table below from slide 64 of MPLN's August 2020 investor day).

Of course, that assumes that all of the shares held outside of the existing Multiplan Shareholders are in the free float. If you swing down to p. 138 of the prospectus, you can see the beneficial ownership of MultiPlan directors, you can see they own or control another 115m shares. By my count, that 115m number includes 24.5m warrants, which were not included in the shares outstanding number above, so directors might own closer to 90m shares of float. That's still meaningful, as it would pull free float down from the 260m we estimated above to ~170m. With 17m shares short, that would imply 10% of the float is short.

I think you can paint cases were the free float is even lower than that. Garden State, TBG, and Oak Hill took down the majority of the PIPE and all of those funds have connections to MultiPlan / Chruchill directors (see p. 135 of prospectus); Oak Hill's shares are accounted for in the table above (by Glenn August), but I don't believe either Garden State or TBG's shares are accounted for, which would another 10m+ shares out of the free float.

Anyway, it's tough for me to say exactly how much of MPLN's free float is currently sold short, but it appears to be a pretty significant percentage. That creates the environment for a short squeeze. All it would take to ignite one is 1) some unexpected positive news or 2) incremental buying that takes shares out of the float.

I'll save #1 for the post on fundamentals tomorrow. Instead, let's talk #2- incremental buying that would take shares out of the float. I see two main places that could drive incremental buying and create a short squeeze.

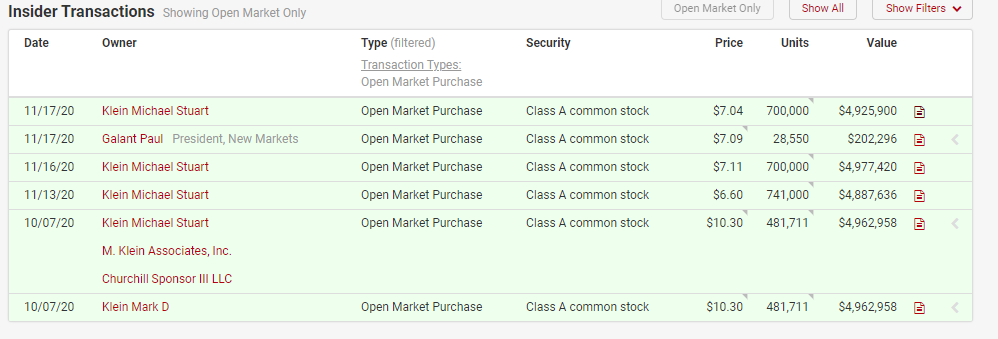

The first is obvious: insider buying. When Multiplan completed the SPAC merger, the sponsor (Klein) announced that they thought shares were undervalued and would buy $50m on the open market. Shares were at ~$10/share at the time; they've since fallen to ~$7 on the heels of the short report. In response, Klein has picked up their buying. Based on their press release and the table below, they have another ~$25m of shares to buy, or >3m shares. Nothing huge, but add those 3m shares to the ~2.5m they've already bought, and you have 5.5m shares (in total) coming out of an already tight float.

However, the real game changer that could drive a squeeze on the insider end is from Hellman & Friedman (H&F). H&F was the driving sponsor behind Multiplan's last buyout in 2016, and they remain the largest shareholder today with 32% of shares outstanding. In response to MPLN's price drop, they filed this 13-d which stated that Multiplan's shares were "undervalued" and that they intended "to acquire additional shares" on the open market.

Given H&F's size and ownership, if they were to start buying shares, their purchases could easily dwarf Klein's. Combine their (potential) purchases with Klein's, and MPLN's free float could shrink rather rapidly in the near future.

So that's the insider buying angle. The other angle here is the potential for index buying / flow. At today's share price of ~$7/share, MPLN's market cap is just under $5B. I pulled the below from Bloomberg; as you can see, MPLN is currently a part of basically no relevant indices.

There's simply no way that continues; as MPLN's stock "matures," they're going to get added to a boat load of indices. Heck, at some point inclusion in the S&P 500 isn't out of the question; MPLN's free float is too small / tight for inclusion right now, but they already have a bigger market cap than SLG and XRX (both S&P components). At a minimum, inclusion in things like the Russell 2000 and a bunch of other smaller indicees is a given within the next year; all of those indices represent incremental buying that will soak up a little bit more of the float.

Note that MPLN's index inclusion could become something of a self-fulfilling prophecy. Remember, as a former SPAC, MPLN has a variety of warrants and founders' shares that kick in at different price in the low double digits. In addition, they have $1.3B of debt that converts at $13/share. If MPLN stock starts to rise, suddenly those warrants / founders shares can kick in and significantly increase MPLN's market cap and free float.... which could drive additional index inclusion / demand.... which could further increase the stock price, leading to more warrants going in the money / converting.... (Of course, the counter here is that if warrants kicked in, the free float would increase, which should alleviate a potential short squeeze, but given the warrants are struck at $11.50/share and the stock is sub-$7 right now, there's a long way to go before that happens!).

Anyway, that's part one on MPLN and the dynamics for a potential short squeeze. Stay tuned for part two tomorrow, where I'll be breaking down MPLN's business model and where I think the short report falls short (pun intended).