A Lucid look at the SPAC-craziness: $CCIV deep dive

I have spent a lot of my time this year looking and thinking about SPACs. I think there's clearly a SPAC bubble going on right now, and one of my predictions for 2021 is that the bubble will break towards the back half of the year as the pure number of SPACs outstanding overwhelms the speculative capital available and a couple of SPACs start to fail because they simply can't find public ready companies.

It's easy to say, "O that's a speculative bubble," but it can be hard to point to any one company or stock that actually exemplifies the bubble. So today I wanted to dive a little into Churchill Capital Corp IV (CCIV), because I don't think there's ever been a stock that so clearly exemplifies a bubble and, while some people have discussed how wild it is that CCIV is trading at a premium, I don't think people fully realize just how crazy it is for CCIV in particular to trade at this big a prmium.

Note that I am writing this on Sunday, Feb. 7 with the aim to post this Monday, Feb. 8. It's entirely possible Churchill announces a merger tomorrow morning, which would make this post slightly stale. However, the stock exemplifies the bubble so well currently that I wanted to risk a little bit of dating and put this post together now.

Ok, that out the way, let's talk CCIV.

CCIV is a pre-deal SPAC. Like most SPACs, it has $10/share in trust (cash in the bank shareholders can redeem if they don't like CCIV's deal). CCIV is currently trading at ~$35/share, so shareholders are valuing it at 3.5x trust.

Now, there's nothing completely insane about a SPAC trading for a huge premium to trust. It doesn't happen all the time, but if a SPAC announces a particularly good deal in a particularly buzzy sector, the stock will generally race. For example, DKNG completed their deSPACing merger last year and currently trades for ~$60/share.

But it is pretty insane for a SPAC to trade at this large a premium without a deal announced. Pershing Square's SPAC (PSTH) and two of Chamath's SPACs (IPOD and IPOF) trade at the largest premiums to trust for pre-deal SPACs I know of outside of CCIV; each of those trade at ~50% premium to trust. That pales in comparison to CCIV's ~250% premium.

Of course, there's a reason CCIV trades at such a premium. And the reason is that CCIV is rumored to be in talks to merge with Lucid Motors. The market is clearly excited about that merger, perhaps for good reason. There's lots of buzz that Lucid is a "Tesla-killer;" with Tesla (TSLA) currently supporting a ~$800B EV, there's a lot of value to be captured is Lucid is really a Tesla killer.

At this point, you're probably thinking, "Ok, cool. CCIV trades for a huge premium because investors are excited about a Lucid deal; why does Andrew think this particular case show how crazy SPACs are right now?"

Great question! Let's dive in.

First, remember that the Lucid deal is just a rumor. It's not guaranteed to happen, and even if it does we know absolutely nothing about the Lucid deal in terms of financials or how the merger is structured. Bloomberg reported that the transaction could be valued at $15B, but even if that's true, we have no idea what that means for the SPAC. Will current SPAC shareholders own 10% of the company or 40% of the company? That's a big difference. What type of financials is Lucid projecting? Do they think they breakeven next year, in 2025, or in 2030? And what if Bloomberg was off on the valuation? What if the value talks started at $15B, but now that Lucid has seen how enthusiastic the market is for their stock they've taken talks up to $30 or even $50B?

Again, we don't know the answer to any of these questions, and we can't know them until a merger is actually announced. Yet the market is willing to ignore all of those details and just value CCIV at 3.5x trust simply on the rumors of a Lucid merger.

I've ranted before about how wild SPAC valuations are. Because SPACs have no operating synergies with their target companies, they generally strike deals to go public by paying the highest price for a company. Reaching a deal by being the highest bidder is, of course, prone to the "winner's curse." For regular SPAC shareholders, it's even worse, as they pay a 20-25% premium to the agreed upon price because of dilution from the founders shares / sponsor promote and all of the banking fees involved in a deal. But CCIV is even crazier; if you adjust for the likely sponsor promote, buying CCIV at 3.5x trust value is equivalent to investors saying the Lucid is worth >4x whatever they agree to sell to CCIV at.... and investors are saying that without having a single look at Lucid's valuation or any of their projected financials.

So just the valuation alone is insane.... but the valuation grows more insane when you dive into the numbers even further.

Remember, CCIV is Churchill's fourth SPAC. While we don't have tons of long-term data on repeat SPAC sponsor performance given how new the category is, I think it's fair to think that there's likely to be some persistence to performance (similar to how there's persistence in the top tier for both venture capital and private equity).

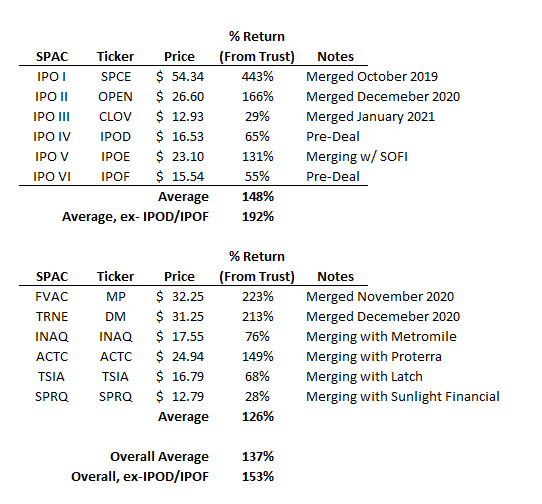

So, to some extent, it makes sense that investors would price SPACs lead by past winners at a premium. Chamath, for example, has two pre-deal SPACs that are trading for 55-65% premiums (IPOD and IPOF); while that's a big premium, it makes some sense given that he's now been involved in 10 other SPAC deals and all of them have been successful with several of them being massive home runs.

So one argument for CCIV to trade at such a large premium could be, "Yes, we don't have numbers and value for a Lucid deal yet, but the Churchill team has such a history of value creation you should give them the benefit of the doubt."

But I don't think that argument holds up to scrutiny. If anything, Churchill's prior SPAC deal track record is below average for a multi-time sponsor (note that I am using track record as stock price above or below trust value; I actually like Churchill's average deal significantly more than the average SPAC deal, but the market's judgement is the one I'll defer to here).

CCIV is the fourth SPAC from Churchill, and the performance of their prior three SPACs is decidedly mixed. Churchill I became Clarivate (now trading under CLVT; it was CCC until earlier this month); with shares currently trading for ~$30, that deal is unabashedly a homerun. Churchill II (CCX) is under contract to merge with Skillsoft; that merger should close in the next month or so. However, CCX shares are stuck right at trust value, which is generally not a great sign for a SPAC. Churchill III became Multiplan (MPLN); MPLN has been the target of a short thesis (one I disagree with) and shares are trading well below trust value. You'd have to call the a failed SPAC merger (so far; it's still early!). Sum it up, and Churchill has done three deals so far. One was a homerun, one is yet to close but early signs aren't promising in terms of market acceptance, and one has closed and has been a bust so far.

Again, it's early, but the early signs are the market doesn't love Churchill's past deals, so it seems more than a little aggressive to give them the benefit of the doubt in evaluating a potential Lucid merger in the dark. Heck, we even saw signs of this doubt with CCIV's first rumored deal; in December, the WSJ reported that Churchill had made a bid for DirecTV through CCIV. Investors yawned at that deal, and shares traded basically at trust value for over a month. That's really curious; CCIV still has the same management team as from that first rumor. When the first DirecTV rumor came with limited disclosure, investors ignored it. When a Lucid rumor came, investors bid the SPAC up to a huge premium.

Same management team. Same SPAC. Same limited disclosures. But the second deal was in a buzzier sector, and now investors are willing to pay a huge premium sight unseen.

Anyway, perhaps this all boils down to "investors will buy anything SPAC + electric vehicle" right now. That's certainly possible.

And I'm not the first person to point out that the current CCIV set up (with the stock trading at a huge premium to trust on simply a deal rumor with no details) is insane.

But I hadn't seen anyone lay out just how insane the set up was. CCIV isn't just trading at a huge premium because of a rumor; it's trading at a huge premium despite a sponsor with a mixed track record. It was almost involved in a different deal that the market was ready to ignore. Same sponsor, same vehicle, but simply switching the rumor from one sector to another resulted in a speculative frenzy.

I'm not sure we'll ever see a better example of the current SPAC mania than CCIV trading at 3.5x trust pre-deal. Buyer beware.