Premium Post: Buying the picks and shovels to the SPAC goldmine

I’ll admit it: I’ve been more than a little obsessed with SPACs recently. Fully half of my predictions for 2021 centered on SPACs, and my January 2021 links and ideas included a “SPACs SPACs SPACs” section. Heck, it’s possible I’m more obsessed with SPACs than cruise lines.

But there’s a reason for that SPAC obsession: I mentioned in my 2021 “State of the Markets” that the exuberance in SPACs is creating significant opportunities in multiple tangential plays.

Currently, I have two favorite ways to play the SPAC craze. Today, I want to introduce my second favorite way to play the SPAC craze: buy a firm that’s selling the picks and shovels for the SPAC goldmine (i.e. the firm that helps SPACs IPO; my first play, CURO, was January’s idea ((substack / blog)).

The idea? Buy Jefferies (JEF).

Jefferies has an interesting operating history, which is worth quickly covering as some points will come up in the thesis. Jefferies is best known as a midtier investment bank; however, the firm today was formed by a merger of long time value investor favorite Leucadia and Jefferies back in 2012 (here’s a WSJ article with a little more on the deal). That merger never really delivered on the benefits that the two firms hoped for, and shares have generally languished since the merger.

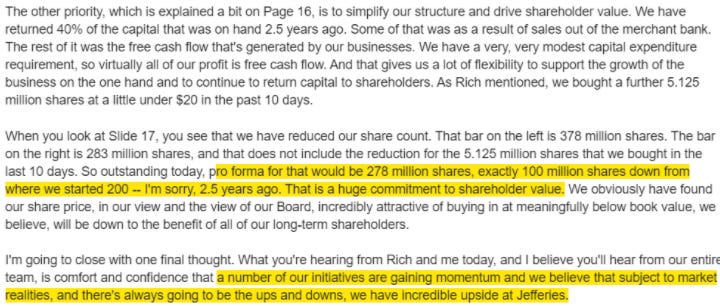

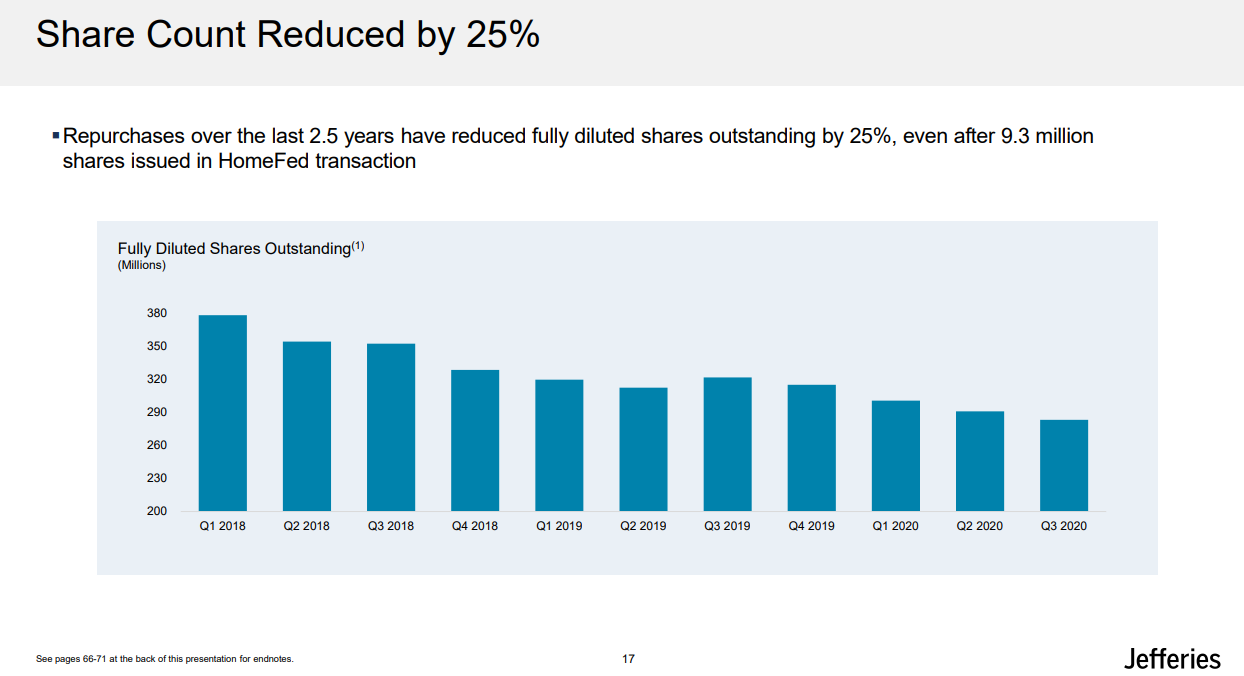

With shares languishing, in early 2018 Leucadia / Jefferies started to pivot. They sold off a bunch of Leucadia’s legacy assets and pledged to focus the company on the Jefferies investment bank while aggressively returning excess capital to shareholders (slide and quote below from their October 2020 investor meeting deck).

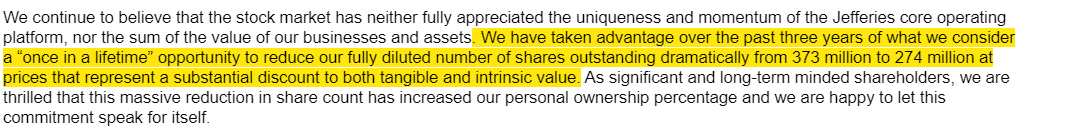

That’s a pretty aggressive buyback, and JEF is clear about exactly why the did that: they looked at their share price and saw a “once in a lifetime” opportunity to buyback shares at a big discount, and they swung hard at that opportunity (quote below from their 2020 shareholder letter; the company bought back ~15% of their shares outstanding in FY20. Not bad for a bank during a pandemic!).

Today, JEF is trading for ~$24.50. Tangible book value was $27.38/share at that end of FY2020 (ended November 2020), so JEF is trading for just under 90%% of tangible book value.

If that was the entirety of the story (Jefferies is trading for below tangible book, and management was aggressively retiring shares), Jefferies would be interesting but I would not be writing it up.

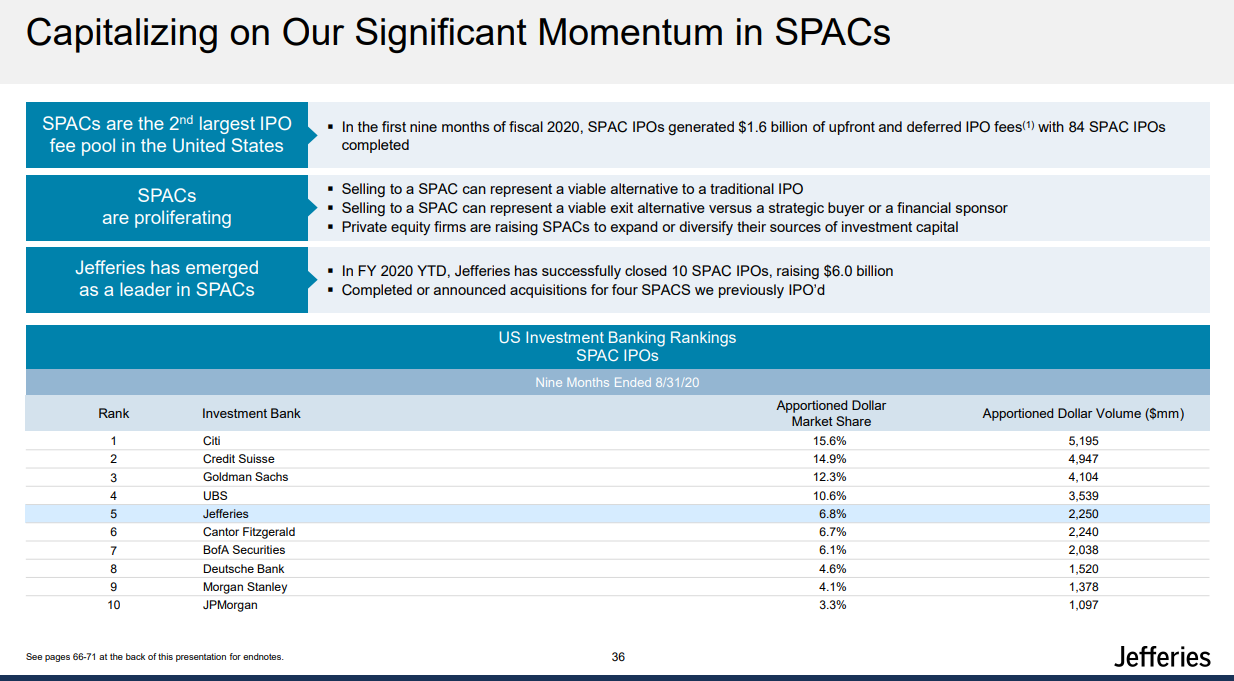

What makes Jefferies so interesting is that they are the bank that will benefit the most from the current SPAC boom. Sure, Citi and GS might do more business than Jefferies, but their SPAC business is a rounding error for them. Jefferies is punching above their size in SPAC IPOs, and their participation in these IPOs is going to drive meaningful economics to their bottom line.

But it’s not just the SPAC IPOs that Jefferies will benefit from. Remember, after a SPAC IPOs, they still need to find a merger partner. After a SPAC finds a merger partner and deSPAC, there’s generally secondary offerings, future M&A, and a whole other host of things that the SPAC will need to hire a bank to do. And guess who they’re most likely to hire? That’s right: the same bank that IPO’d them. The quote below (from Jefferies 2020 investor day) helps illustrate this.

Bottom line: Jefferies isn’t just benefitting from the current SPAC boom. Their leadership in SPAC IPOs will set them up with juicy revenue and fee streams for years to come.

The best way to show how much Jefferies is going to benefit from the SPAC mania is by taking a look at the Golden Nugget Online’s (GNOG) merger with Landcadia II. Jefferies was actually part of the sponsor group for Landcadia (they had ~48% of the founders shares); which is great because it means that the company’s proxy for the merger had to disclose all of the fees that went to Jefferies as part of the process. And the fees are awfully rich! Jefferies will capture $15m in fees from this one deal ($11.1m in deferred IPO fees now that the deal has closed, plus $3.75m in financial / capital market fees). Of course, the real prize in this deal is Jefferies founders share stake; they forfeited 2/3 of their founder shares to get the deal done (see p. f-41), but even with that their GNOG stake is worth ~$25m and they own another ~2.8m private placement warrants that are probably worth another $25m. So the real prize for Jefferies here was in the founders shares, but the fees associated with the deal are instructive for the rest of the business. In total, Jefferies captured ~$15m in fees from this one deal; in addition, they probably got countless fees from hedge funds trading the stock (remember, as sole underwriter, Jefferies chooses who they give stock to, which means they likely give it to their best clients who then trade the stock with them) and of course have follow on fee potential.

By my count, Jefferies has been sole underwriter on ~13 SPAC deals in the past ~3 weeks (they were also joint on a couple of more). Most of these SPACs were in the ~$200-$275m range, so the fees associated with them should be roughly similar to Landcadia II (that was a $275m SPAC). If those deals carry a similar fee structure as the GNOG deal, Jefferies in the past 3 weeks has underwritten >$175m in future fees.

Obviously, fees are not profits (after all, the bankers need to pay for their Hamptons houses!), but they should have pretty decent flow through to the bottom line. Incremental revenue tends to come with a ~33% profit margin (two thirds to the bankers, the government, and just general overhead; one third to the bottom line. That’s probably a little conservative but directionally correct), so this big boost should have a pretty nice impact on Jefferies bottom line.

My rough math here suggests that, at the current run rate, each month Jefferies SPAC business is underwriting deals at a pace that would add ~$0.20/share in EPS. Again, they are doing that every month at the current rate; it’s entirely possible that the SPAC business alone generates >$2/share in FY21 if the SPAC market stays this hot this year (a big if, but also a big earnings number versus the current share price!). And don’t forget that IPOing these SPACs tends to come with plenty of follow on revenue opportunities: fees for trading with the hedge funds who you give allocations, follow on fees for the inevitable secondary offerings, fees for advising the company on future mergers, etc.

Jefferies should continue to benefit from their own SPAC sponsorship as well. LCY, the third Landcadia SPAC, just announced a deal to merge with Hillman. The proxy isn’t out yet, so it’s tough to estimate JEF’s exact returns (and the returns won’t be as good as the GNOG deal given that it doesn’t look like LCY is a rocketship)…. but the returns will still be nice, as JEF got to serve as advisor on all sides of the deal in addition to their founders’ shares stake. (Update: as I went to post this, LCY filed their prelim proxy. LCY is a bigger SPAC than GNOG (~$500m), and the fees to JEF are commensurately bigger. This is all laid out on p. 242, but JEF will get $17.5m in deferred underwriting fees; $21.9m in placement and capital markets fees, $25.2m in advisory and financing fees from Hillman, and up to $22.7m in fees for raising the first lien TL. In total, it looks like JEF will get just shy of $100m in fees from this deal, plus some very valuable founders shares! I laid out earlier that JEF likely gets ~30% margin on incremental SPAC revenue; if that's right, LCY alone will result in >$0.10/share in earnings for JEF. LCY is unique as JEF advised both buyer and seller and is handling every piece of the financing, but that is still a lot of money in one deal!)

(PS- Jefferies was involved in PSTH’s SPAC IPO; I only mention it because it’s the largest SPAC in history and any deal they do will likely be enormous. Maybe Jefferies gets a piece of the advisory business on that; maybe not. But the fees associated with that deal could actually be a decent needle mover for a company JEF’s size)

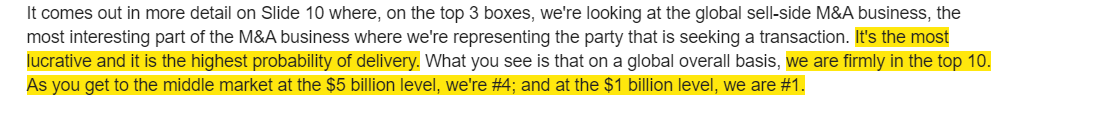

The actual SPAC IPO (and JEF’s SPAC ownership) isn’t the only way the company is benefitting from the SPAC boom. The “most lucrative” part of an investment banking business is M&A advisory. What’s interesting here is that Jefferies business here skews to the smaller side; they’re #7 overall, but #4 in <$5B M&A and #1 in <$1B. Guess what that’s perfect for? You guessed it… SPAC M&A. Most of these businesses are in the ~$1B range, so Jefferies is winning a huge share of their business even on deals that they didn’t lead the IPO for.

Given that massively positive near term pipeline, it’s interesting to note that in early December Jefferies top management got $12.5m in equity tied to stock price appreciation. As far as I can tell, the timing and type of this grant was unique for Jefferies. Maybe that’s driven by COVID funkiness (you couldn’t exactly pay top execs big bonuses in April!), but it looks to me like Jefferies saw their near term prospects and the stock price and granted themselves a nonGaap style “spring load” of equity. It’s interesting to note that stock grant came just ~1.5 months after Jefferies said the below at their investor meeting in October 2020.

So far, this article has focused on one thing: that the SPAC business is on fire and going to drive a huge earnings number for Jefferies. And I think that makes sense, as the SPAC business is the hook / catalyst that could drive earnings and shares higher in the very near term.

But I don’t want to lose site of the big picture here: Jefferies is trading below tangible book value, and simply way too cheap both because Jefferies can earn above average returns on equity (even without a SPAC boom) and because Jefferies book value is understated.

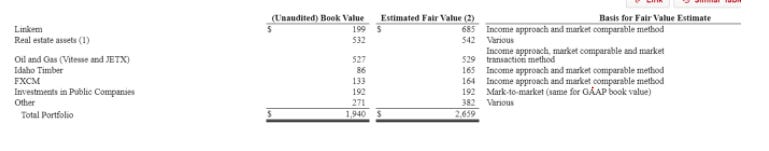

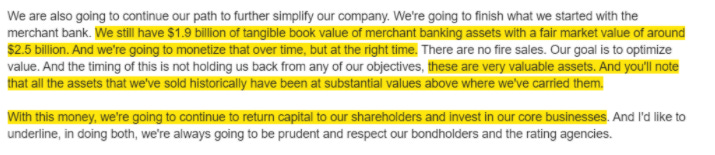

Let’s start with the later point: Jefferies book value is understated. I mentioned in the start that Jefferies today was formed from a merger with Leucadia, and until 2018 they carried a significant amount of merchant banking assets. They’ve made significant progress selling off those assets, but Jefferies still has $1.9B of those assets sitting on their books. That’s probably good news for shareholders: on average, Jefferies has sold merchant banking assets for 122% above where their merchant banking assets were market on their books (source). Jefferies provides a supplement that estimates the fair value of their remaining merchant banking assets; you can see it below. If Jefferies is right and we mark the merchant bank assets to fair value, that would add another ~$2.50/share to tangible book value.

Let’s turn to the other point: Jefferies can sustainably earn above average returns on equity even without the SPAC boom. I took the slide below from JEF’s 2020 proxy; you can see that over the past six years ROTDE (return on tangible equity deployed) has averaged ~7.7%. That’s probably slightly below JEF’s cost of equity capital; if they were going to earn that rate forever, I’d expect them to trade just below tangible book value.

So, if history suggests middling returns on equity, why do I think they can sustainably earn above average returns even without the SPAC boom?

Simple; over time, they’ve shifted their book dramatically from their merchant banking business to the investment bank, and I think the investment bank can earn above average returns.

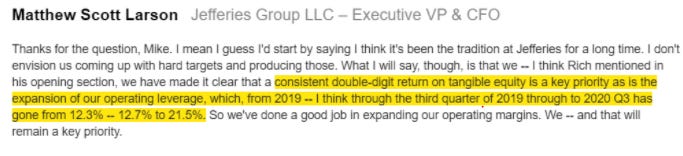

Recent history suggests that’s reasonable. Return on equity over the past few years has been expanding, and Jefferies has consistently discussed targeting a double digit return on equity.

That return on equity is probably a little unfair; it’s the return on equity from Jefferies overall (which includes gains at the merchant bank); over time, the company’s ROE should track what the investment bank does. That’s still fine; the investment bank did ~11.7% ROE in FY20, and that should continue to accelerate as the company gains operating leverage (and of course, if the SPAC boom continues). Jefferies has been on an aggressive hiring spree over the past few years. Similar to an SaaS company, a hiring spree at an investment bank is something of an investment: you put up a bunch of costs upfront (a hiring bonus, increased fixed costs), and it takes a year or two for those new employees to payoff in the form of increased business. In a lot of ways, the current ROE boom Jefferies is experiencing is the fruits of a bunch of investments over the past few years.

A little more on operating leverage and ROTE (from their 2020 annual letter).

Today, you’re paying below book value for Jefferies. I think book value is understated, and I think the company can consistently earn above average returns on equity (and thus should trade for at least tangible book value, if not a premium). The company is committed to aggressively buying back shares as long as they trade below book value. The real kicker here is the SPAC business; it’s currently running super hot, and it has the chance to supercharge earnings (which will then be redeployed into buying back discounted shares).

Odds and ends

Your big risk when you invest in a bank or financial company of any form is that liquidity dries up and/or their marks prove wrong and it goes to zero a la Lehman. That’s always a possibility, but I tend to think these business have been super stress tested over the past decade. Between the financial crisis, whatever the heck happened to the eurozone in the 2010s, and the pandemic, I think banks have faced three of the toughest environments they’ll ever see. I guess never say never; a black swan can come at anytime. But at this point I think the Jefferies business is reasonably stress tested, liquidity is very high, and I feel comfortable with this risk.

The mania is dying down, but I know there are people out there who think the whole GME / AMC mania will blow up the financial system. For a split second last week (when GME was roaring 100%+ while the market was down more than 2% on deleveraging and it seemed like the markets plumbing was on the verge of breaking), it certainly seemed like that was possible though extremely unlikely; today, it seems like those fears are behind us. I actually think the whole GME saga will be a boost to JEF’s earnings in the long run; maybe WSB moves heavy into SPACs, or maybe JEF just benefits from increased trading or volatility. I doubt this concern is around two weeks from now, but I figured I’d mention it since there are some loose lingering questions there.

One last thing on SPACs; I have heard that there’s been discussions of underwriters taking small pieces of founder shares as part of the IPO process. I have not seen any SPACs that have actually done this yet (or, if they have, they simply haven’t highlighted it), but if Jefferies were to do that it would be a small cherry on top, as the founders’ economics are generally very good.

If you trust JEF’s fair value marks, the largest piece of their merchant banking arm is Linkem. I won’t go too deep into this business, because it doesn’t really make or break the thesis, but I’ve included JEF’s overview of the business below. I will note that 3.5 GHz spectrum it controls is extremely interesting. It borders on the C-band spectrum. If you’re a wireless aficionado, you know that C-Band is likely to be the most important spectrum for 5G. The auction for C-Band in Italy went parabolic back in 2018, and the U.S. C-band is set to wrap up this month and also went parabolic. There is a decent chance that the strategic value of Linkem’s spectrum is far, far higher than where it’s marked on JEF’s books.

Jefferies has been very clear that their goal, over time, is to dispose of their merchant banking arm, either by selling the assets or by placing them into an asset management vehicle where they’ll earn fees. The later is really interesting; between Jefferies SPAC sponsorship and the merchant banking arm, there is a chance Jefferies could back into some type of interesting asset management business

Jefferies has also been very clear that, as long as the shares trade below fair value, they will be very aggressive in share repurchases. Given their share ownership, the equity incentive 8k linked earlier, and their history, I believe them.