Some $DISCA / $T ramblings

Let me start this post by noting two things: I've been short T for a longtime, and I'm long DISCA (and a few other Malone holdings). I just put that out there for both disclosure stake and so that you know I might be coming at this with a slight bias.

Anyway, this morning I woke up and the first thing that popped up was news that AT&T and Discovery were in talks to combine their content assets (note that I'll flip back and forth between calling T's media assets their content assets and Warner / WB throughout this article).

That's major news; it's a potentially enormous deal. AT&T's content assets come from their $85B acquisition of Time Warner in 2018, and DISCA is a ~$35B EV company (it approached $100B at the height of Archegos just a few months ago!). So we're talking about a potentially >$100B megamerger.

It's tough to talk too much about the deal right now since the news is just breaking (I'm writing this around noon on Sunday, May 16th, so the news broke less than 3 hours ago and I've still only seen the Bloomberg report). There's still so much we don't know about the potential deal; is the deal for all of T's assets (HBO, Turner, CNN, and Warner Bros. studio) or just for T's legacy cable assets (CNN, TNT, TBS, Cartoon Network, etc.)? How will the deal be structured (would T buy DISCA? Is DISCA buying T's assets?)? When (and will!) Discovery+ and HBOMax be merged (they should), or will they be run separately? Who will run the combined company? How quickly can Verizon stop running Discovery+ commercials? My guess is that this deal is for all of T's content assets, it will be structured as a Reverse Morris Trust (almost a given; Malone hates taxes and loves complex deals!, Discovery+ and HBOMax will be merged ASAP, and Jason Kilar (the head of WarnerMedia) will be the CEO with David Zaslav (DISCA's CEO) the chairman, but that's just a gut guess and I could be wrong on any of those.

Still, I was so excited thinking about the deal that I wanted to throw some random thoughts out there so that anyone who is geeking out about a potential mega-media merger on a Sunday (like I am!) knows that they are not alone.

My first thought is, at a high level, that the deal makes sense. Tons of sense. I mentioned last month that I thought Comcast was a natural buyer for Discovery; I think basically all of the same arguments for Comcast buying Discovery apply to Warner and Discovery merging. There should be some synergies in the legacy bundle, as combining DISCA's scale with CNN / TNT / TBS should give some extra negotiating leverage. But the cable bundle is eroding; you can't base an entire deal off of those synergies. This deal is about the future, and I think it makes sense. Remember that streaming is played in two ways: you want to get as many customers in the door as you can (customer acquisition) and then you want to hold on to them as long as you can (reducing churn). The best way to acquire customers is with buzzy new shows or movies; T definitely has that (Warner Brother movies like WW:1984 or all of the upcoming Game of Thrones spin offs; WW1984 was incredible for sign ups). The best way to hold on to customers is with a big library of shows that people can revisit; DISCA absolutely has that (they have consistently noted that the most surprising thing about the Discovery+ launch has how much play their older library gets). I think combining those two strengths makes for something interesting.

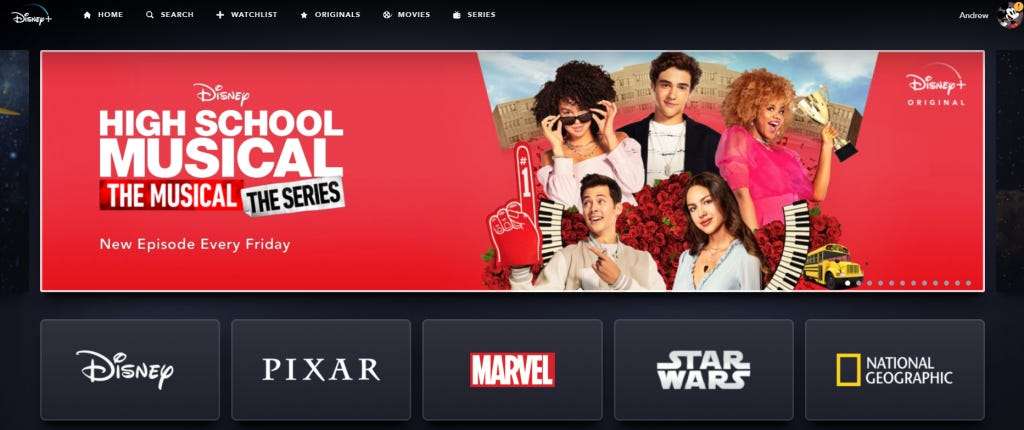

Again, the devil will be in the details and execution. We don't know how the deal is structured, who is running the combined companies, or even what assets T is including. But if they went all out and combined the two, I think that'd be an interesting set of assets. Below is a screenshot of Disney+ when I open their home page. Look at the five brands that they lead with; Disney, Pixar, Marvel, Star Wars, NatGeo.

That is just an absolute killer line up from Disney; no one else has anything like it. But if you fully merged T's content assets with Discovery, you could imagine opening up the HBONow app and being presented with the option for Cartoon Network, Looney Toons, DC Comics, Game of Thrones, and Discovery. Is that as good a line up as Disney+? Nah, and it's probably not even close. But it is really strong; the HBO/Discovery team would be #2 from a "strength of IP" perspective and I think it'd be a pretty wide gap between them and whoever's #3. Plus, throw in CNN and the sports rights that Turner has (March Madness, Basketball, and some other stuff), and suddenly you've got a little bit of a live angle to that bundle as well.

This deal is going to be complex, and there will be lots of different angles to it. But my bottom line is that I think a deal makes sense; each side brings something to the table the other doesn't have or that complements the other really nicely, and there should be tons of synergies in the long run from both the legacy cable side and on the streaming side (which should be the future of the business). I'm assuming that at some point Discovery and HBOMax would merge if the two businesses came together, so eventually you'd be looking at mammoth synergies from combining tech, reducing marketing spend, eliminating overhead, and improving customer lifetime value. I think the added scale will be really interesting from a targeted advertising perspective as well.

So that's my high level thoughts on a deal. But I wanted to jump into a few other things that have been floating around my mind as I thought about it.

Really the first thing I thought when I heard that DISCA and T were in talks was "Malone's done it again!" Yes, the deal will probably make strategic sense for all of the reasons I laid out above, but I just cannot believe AT&T is back at the table with a Malone company. AT&T has done a lot of deals with Malone over the years, and it's tough to point to a single time they've struck a deal with a Malone company that hasn't transferred billions of wealth from T to Malone and his shareholders. Off the top of my head, I can think of two major and one minor example of T's history with Malone.

The headliner here has to be the DirecTV deal. T bought Directv for ~$67B in 2015 (that includes debt; it was ~$49B on all equity) and spuns DirecTV off for "$16.25B" this year (actual value probably a little lower, it was a really convoluted deal). It's tough to overstate what an awful deal that was, but here's just one example: DirecTV had ~$18B in debt when T bought them and they spun the business out for less than that ~5 years later. Not great!

Another classic is the T / TCI deal from the late 90s. I wasn't around for this one, but based on everything I've seen in the past (including what I remember in cable cowboy) and T's stock price on announcing the deal (dropped ~10% on deal announcement, per this WSJ article) I think it's fair to say AT&T didn't do too well in that negotiation (though they appeared to have managed to unwind a lot of that deal a few years later in selling to CMCSA at a decent price).

T sold their Puerto Rico assets to Liberty Latam in 2019. This is a smaller deal, so it barely moves the needle for T and I tend to think deals for smaller / noncore assets (like PR was to T) can be done in ways that make sense for both parties. So tough to fault T too much here, but I also think it's tough to argue that LILAK didn't get a really nice price on these (the deal call noted these were valued at a "multiple of mid-6 of OCF before synergies and about 1 turn lower if you were to adjust for full run rate synergies. It's a compelling valuation"), and I think LILAK's stock price shows that; the stock was up ~5% in a roughly flat market on the deal news.

Anyway, that's just three deals between T and Malone companies, but T shareholders took a bath in two of them and got the short end of the stick in the third.

So I can understand the strategic rationale of this deal, but I'm honestly impressed that T would even consider a deal with a Malone company at this point. If I was a board member at T, I think I would have a fiduciary duty to my shareholders to at least try to block any incoming phone calls / emails from Malone and co.

I mentioned at the front of the article that I was short T and long DISCA. I think you can look at the above and see why I'm so pumped for this deal: it's a deal that makes strategic sense with lots of synergies, and on one side you have a company with a history of awful acquisitions and getting demolished by Malone, and on the other side you have a company with a history of successful deal making and.... well, Malone. If this deal actually happens, it's tough to see how it's not really good for DISCA shareholders.

That transitions nicely into the second point I wanted to make. This is a little broader than just AT&T, but I think the deal history / background between T and Malone shows why it's so important to have a management team that actually is aligned with / cares about shareholder value in some form.

Below is a stock chart for the past 15 years of T versus Verizon, Comcast, the SPY, and the IWM. T underperforms all of them pretty impressively. Step back for a second and think of the past fifteen years. AT&T had a mammoth tailwind from declining interest rates, the iPhone launched and they had an exclusive on it for years, the wireless industry consolidated to an oligopoly, and there was a financial crisis that rocked the financial system but left AT&T relatively unscathed. Yes, there were some headwinds (the death of the landline), but on the whole I'd say the deck was reasonably stacked in T's favor. Yet they underperformed pretty significantly.

Why?

My guess is it's the same reason that other legacy "blue-chip" companies like Exxon, IBM, and GE have struggled over the same time period. The management teams had grown up in companies with mammoth competitive advantages, and they rose to the top of those companies through some combination of business and political savvy. Once they were there, they had pay packages that set them up for multi-generational wealth regardless of how the stock performed. Between those managers and the board, insider ownership was often minimal (versus how large their comp was) and they were often more interested in playing politics and empire building than actually creating value. That's how you get Randall Stephenson hanging around in the top spot at AT&T for over a decade despite an abysmal track record of value creation.

Anyway, for years, people have pitched AT&T to me as a long idea. "It's cheap. The wireless industry has consolidated. The old CEO is gone. Where else can you get a >6% dividend yield?" That's all fine, but when I look at AT&T I see a company that's been on the wrong side of every transaction for over two decades (how could I forget T selling their stake in Hulu for a ~$15B valuation less than two months before Comcast and Disney reached an agreement that valued Hulu at $27.5b!) . I see a company that, despite all of their advantages, somehow gave up the top spot in wireless and appears to be bleeding market share because their network is falling behind. I see a company unwilling to consider cutting their dividend even when maintaining it means fireselling assets to paydown leverage or not making the investments needed to maintain their current position and/or grow into the future.

To me, that's a company that's a perfect short. A company with a proven history of making uneconomical decisions because they're easier (like maintaining their dividend when they need to deleverage) or destroying value on headscratching transactions. Yeah, they might look cheap on a trailing basis, but you know that a year from now their assets will probably be worse off because they're not willing to invest enough into them, and at any time they might announce a deal that lights billions of shareholder's money on fire. It's a company too large to be bought out or "Gamestopped"; borrow is super easily available. So yes, the stock could go up, but it's probably not going to rip your face off and if, as a stock picker, you can't find something that's going to outperform AT&T then... I love that set up.

It's Sunday, and this article got a little longer and more winding/rambling than I meant it to. But I'm pumped. I think DISCA / T makes tons of sense. I've been long DISCA and short T for a while, and everything about what seems to be happening here suggests that I'm going to wish I had been a lot larger on both sides of that transaction in the near future.

PS- There aren't a lot of global media assets left out there that budge the needle for major players. Given that scarcity, I would not be surprised if this deal resulted in another round of media consolidation; I've been saying that for a long time (so has John Malone!), but if you're another media company and you look at the assets Disney, Netflix, and HBOMax will be able to roll out on the heels of this deal, you have to be a little worried about scale and getting left behind. I think both Comcast and ViacomCBS, in particular, would need to think about bulking up on the heels of this deal. It's tough to pinpoint a specific target that fills what those guys need, but I can't imagine they could look at their assets and think they could compete with any of the big three after this. By the way, Discovery would fit in really nicely to both Viacom and Comcast's portfolio, the "legacy" side synergies would be way higher for DISCA w/ Viacom or Comcast over Warner, and both of the last major "strategic" media mergers saw pretty intense bidding competition (Comcast/Disney bidding war for Fox; Discovery / Viacom bidding war for Scripps). Bottom line: I think Discovery remains the cleanest and most synergistic asset a major media player could buy right now. This is obviously a long shot, but I would not at all be shocked if Comcast or Viacom lobbed in a topping bid for Discovery (though I might be a little surprised; Malone is a master negotiator, and as detailed above I bet the price he gets for Discovery is really rich (or the price he pays for Warner is really attractive), so it might be tough for a competitor come in over the top for Discovery just because Malone has already driven the price up so high).