Discovering value in the wake of Archegos $DISCK

We're living in strange times. There's no doubt about that. 18 months ago, who would have believed that March Madness would be cancelled, or we'd go an entire year without fans at concerts / sports, or that the capital would be stormed? I'd guess no one.

And our financial markets seem to have responded to these strange times by becoming equally strange. In the first quarter of 2021 alone, we saw the SPAC bubble both inflate to epic proportions and burst relatively SPACtacularly and we had a bunch of redditors bring the financial system to its knees through short squeezing GameStonk.

I don't think anything's touching Gamestonk for outright financial weirdness.... but the recent rise and fall of Archegos comes close. Somehow, one family office managed to pump VIAC and DISCA, two legacy media companies worth tens of billions of dollars, like they were penny stocks getting manipulated by a boiler room.

I think the craziest thing about the SPAC bubble, the GameStonk squeeze, and the Archegos collapse as that all three of them inflated and deflated within the same quarter. I mean, most bubbles inflate over years and then collapse epically in the span of weeks or months. To see one bubble inflate and deflate in a quarter is incredible. But for three bubbles to inflate and deflate in the same quarter*? Unbelievable.

*Note: I understand that Gamestonk's stonk is still inflated (at $190/share, somehow it's market cap is still ~$13B as I write this!), and that the SPAC bubble really started last summer. But what was crazy about Gamestonk wasn't that one company squeezed; it was that every company with short interest got squeezed. So while Gamestonk and a few select other meme stonks are still high, the rest of the squeeze candidates have come down to earth. And while SPACs were in a mini-bubble in the back half of the year, you can't even begin to compare the SPAC market of 2020 with the SPAC market in February 2021. In 2020, SPACs raised ~$82B. That's an enormous number; ~2x the amount of money SPACs had cumulatively raised over the prior five years. And we basically matched that dollar figure in SPAC IPOs in February 2021. So I get I'm being a little loose with my definitions by saying the rise and fall of both bubbles happened in Q1, but I think I'm directionally very, very right.

I'll say it again: our financial markets seem to be trying to match the weirdness of our real world.

But there is some good news: I've long believed that bubbles can create opportunities for enterprising investors to make really unique risk adjusted bets both on the way up and on the way down. For example, with the SPAC bubble popping, I think investors currently have a really unique opportunity to buy SPACs below trust value or to buy into leading companies whose price have been demolished just because they are in a SPAC form (though, admittedly, the later has a large hill to climb given the fee and incentive structure associated with SPACs!).

Similarly, I think Archegos imploding has created some interesting opportunities in his former positions. In particular, I think Discovery (DISCA or DISCK; I'll use the two interchangeably though I'll focus on DISCK since it's the cheaper share class) is a really attractive bet here.

Let me zoom out a little to lay the overview. Six months ago, DISCK was trading for ~$20/share. In December, they laid out their Discovery+ streaming plans, and in both their Q4'20 earnings call and recent investor presentations, they've given bullish updates on the early trends. As I write this, DISCK is trading for ~$37/share. That's an almost double in six months, and DISCK has significantly outperformed every major peer (VIAC, DIS, NFLX, and the indices) over that time frame. Obviously, a lot of things can drive stock price (especially in the short term, as Archegos has proven!), but I think if you just looked at the starting and ending share prices for DISCA and their peers over the past six months it would be a pretty easy conclusion to say that the market is enthusiastic about Discovery+ and that Discovery's streaming plans have finally started to change the narrative around the company (as I thought it might when I wrote this back in November)!

However, Discovery's stock briefly went parabolic thanks to the Archegos squeeze, and I think people are letting the dramatic rise and fall color their perceptions of what's going on with DISCA. People are thinking that the current share price is still inflated by Archegos's buying, and that the stock is still too expensive / artificially inflated.

I think that's dramatically wrong. Clearly, DISCK's stock was inflated by Archegos's buying. But I think DISCK's stock at ~$37/share today is a better value than it was back in November (when the share price is in the low to mid $20s) because we've gotten a look at Discovery+ and seen that the early launch is going exceedingly well. Yes, it sucks to pay almost twice the price the stock was at four months ago, but honestly I think that's a cheap price to pay for a company that has now proven they have a unique place in the streaming future.

So the thesis for DISCK going forward / as an investment is pretty simple. I tend to break it into four parts, though all of them are somewhat interconnected:

It's cheap, and probably cheaper than a headline valuation would have you believe

We have early results for Discovery+ and they look very good

It's a reasonably unique asset among the remaining free radicals

There's reasonable continued upside from narrative shift and continued Discovery+ execution.

I'm going to spend the rest of the post diving into each of those points.

Point #1: It's cheap, and probably cheaper than a headline valuation would have you believe

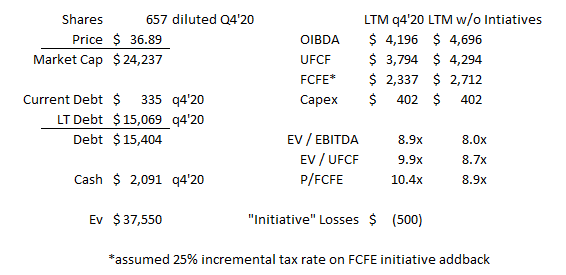

Let's start with the headliner: as always, Discovery remains cheap. Adjusted OIBDA was ~$4.2B in 2020. At today's share price, their EV is ~$37.5B, so you're paying around 9x OIBDA.

However, I think that headline number does Discovery an injustice in three ways. From smallest to largest:

2020 results were obviously impacted by the pandemic. Remember, Discovery has a lot of European sports rights, including the rights to the Olympics, and they didn't get any real payoff from those in 2020. In addition, advertising rates, while strong, were obviously impacted by the pandemic. So valuing them off 2020 numbers is a pretty harsh comp.

Discovery is not a normal company. As John Malone once said, they're a free cash flow machine that converts 50% (or more) of OIBDA into cash flow to equity (56% in 2020; guiding to at least 50% in 2021). Comparing them to your typical asset heavy company that trades for 9x should qualify as investing malpractice.

Discovery made a mammoth investment into direct to consumer initiatives in 2020. The screenshot below is from their streaming day in December 2020; they said they were going to burn $500m investing into their "next-gen initiatives". I think it's fair to say that if you were valuing Discovery just as a melting ice cube / declining business, you could add almost all of those losses back. It's also fair to say that those losses are an important part of Discovery's future going forward, so you can't fully add them back if you believe in Discovery+ / the company as a going concern deep into the future. The truth is somewhere in between, but I think the bottom line is the headline valuation on trailing numbers is held back by next gen investments that will either bear fruit / create value or go away over time.

A related and underdiscussed angle to this cheapness: Discovery doesn't license any of their shows to other streaming platforms (as far as I know of; maybe there's some one offs but their big hits like 90 Day Fiancé, Naked and Afraid, Mythbusters, etc. are exclusive to Discovery). That's a lot of foregone very high margin licensing revenue, and given how high margin licensing revenue is it's really hard to give up once you start getting it (check out this article on Comcast / NBC weighing what to do with their movies). If you were truly valuing Discovery as a melting ice cube, I think the right thing to do would be not just to addback their next-gen losses but also to give them credit for tens of millions in licensing revenue that they currently forgo to build out their streaming service.

Anyway, put those three together and DISCK is probably cheaper than it looks on the headline trailing numbers... and it's already pretty cheap on those!

Point #2: We have early results for Discovery+ and they look very good

This is probably the most important part of the thesis currently. It's why I think Discovery at ~$37 today is cheaper than it was at ~$20 in November. In November, you didn't know what Discovery+ would look like or how it would be received. Maybe they'd launch it and people would just yawn and say, "Nah, I'd rather watch Netflix." Maybe they'd launch it with a ton of technical bugs. Or maybe they wouldn't really commit to it and would launch it with half-assed programming (as many legacy media companies have done when moving into the streaming world).

But those fears are behind us. Discovery still needs to execute, but the early results and returns from Discovery+ look good. Today, you can buy Discovery and confidently say, "Look at those early results. This is a company who has a place in the streaming future. Customers will pay to get access to their content, and they'll do it in a way that makes economic sense for Discovery."

Why do I think the early results for Discovery+ look good? The quote below is from their Q4'20 earnings call.

Now turning to discovery+, which is off to a very impressive start. And though it's early in our launch and global rollout, we are very pleased with all of the early metrics. First, we have now surpassed 11 million total global paying direct-to-consumer subscribers after less than 60 days since the launch in the U.S., the majority of which are attributed to discovery+ and more than half of the subscriber additions were in the U.S. And as David mentioned, we will hit 12 million global paying subscribers by the end of the month.

Second, importantly, both roll to pay and churn have been better than planned, and while early, these represent critical variables in our modeling. Third, engagement as measured by average watch time per active viewer has been robust and already significantly ahead of linear.

Fourth, this engagement, along with advertisers and brands eager to embrace our subscriber base, is driving higher CPMs. It is worth pointing out the value our advertisers see and the portion of our subscriber base that are not currently pay-TV subscribers, delivering much needed incremental reach to the video advertising ecosystem. This as well has contributed to very healthy ad monetization that is already well ahead of plan.

Number five, this has led to ARPU for our AdLite product that has already surpassed average linear ARPU, and we see further upside as we drive scale and subscribers, a key tenet we laid out for you in early December. Number six, early signs of churn are within our expectations, if not better, which, taken together with the monetization framework I provided, are contributing to a higher implied customer lifetime value than our initial modeling.

Number seven, finally, subscriber acquisition costs have so far come in very favorably, especially compared with the evolving customer lifetime value. Consequently, taking these early data points together, we see both a very strong start to next-gen revenue growth in 2021, with Q1 poised to grow around 50% with meaningful acceleration in the quarters thereafter and a much more attractive investment opportunity around subscriber growth.

For those keeping track, in that quote alone Discovery highlighted that Discovery+ is off to an impressive start, which includes rapid subscriber growth, better than expected churn, robust engagement "significantly ahead" of linear, higher CPMs, and better than expected customer acquisition costs.

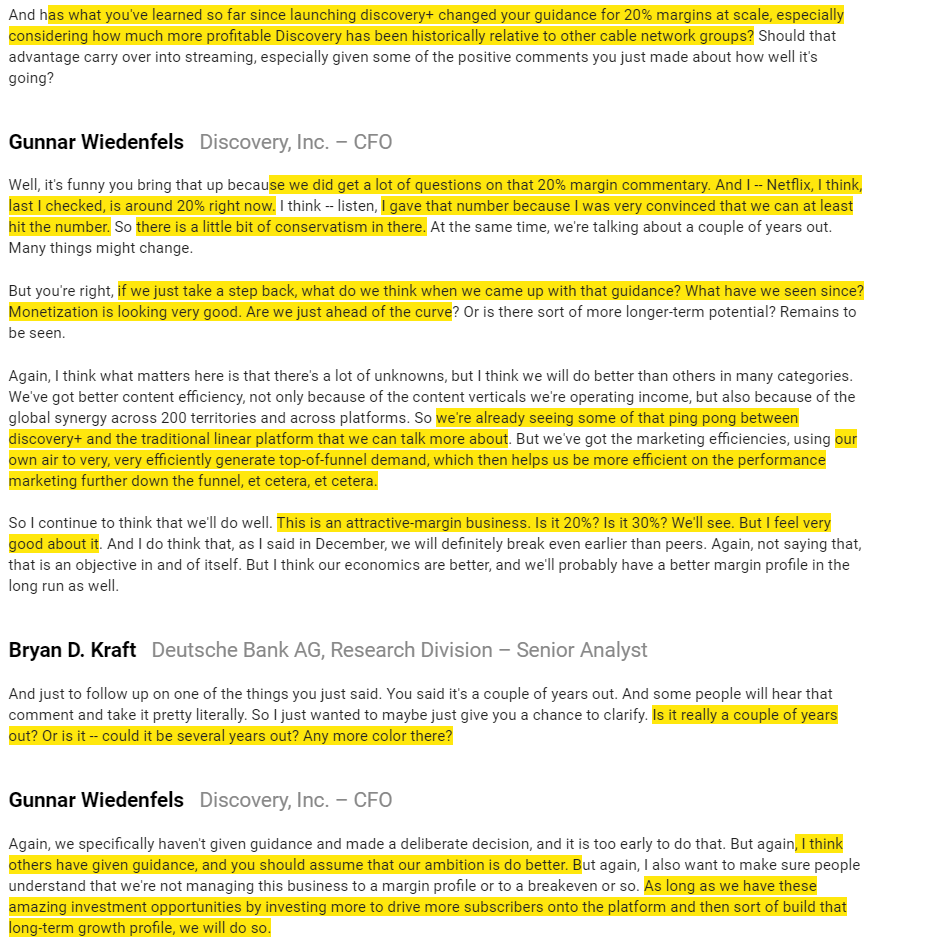

That's.... pretty good. The CFO summed it up more succinctly later in the call (when discussing the long term guidance for 20% margins in the streaming business), "I gave that at least 20% number because I was very, very confident that we'd be able to hit it. If you look at what we've learned since then, every metric has come in better. So I think it's safe to say that that's even more conservative from today's perspective. At the same time, there may be some sort of pulling impact forward, so I'm not in a position to give a new estimate now. We're focused on building this product out and optimizing this now, but I feel very, very good about the margin potential in the long run."

One more quote while I'm here; the screenshot below is from an interview the CFO did at a conference in early March.

Remember, this conference is three months after they held an investor day to lay out their vision for Discovery+, and the CFO is already admitting that the margin targets they laid out for the streaming business has "conservatism" in there and casually saying "Is this a 20% or 30%? margin business? We'll see." I can promise you the CFO is not casually saying their 20% margin target was conservative and throwing around a 30% target just 3 months after their investor day. He's dropping those because he's seeing the early numbers for Discovery+ and they are continuing to blow away his projections; he knew the initial projections were conservative and gave him a lot of levers to pull to make them, but the early results are so good he can admit just three months later they are going to smash their initial targets.

And while those quotes were the headliners to me, there are plenty of other bullish quotes in their presentations / earnings calls. Casual mentions of getting close to announcing 2 more key deals (a la the Verizon partnership), discussions of pricing potential on both the subscription and advertising side, continued emphasis that Discovery+'s ARPU is a "multiple of the linear ARPU," and plenty of other goodies.

Bottom line: the early results from the Discovery+ roll out appear to be going spectacularly. Sure, Discovery is more expensive on a headline number today than it was at $20-25 six months ago.... but today you know that the $500m/year they're investing in Discovery+ is money well spent. Six months ago that was no guarantee.

Point #3: Discovery is a reasonably unique asset among the remaining free radicals

I'll keep this simple: Discovery is attacking the market from a much different angle than every other player. Viacom, Netflix, Disney, Hulu, HBO, Starz, etc.... all of them are trying to win new subscribers with buzzy new scripted shows and movies. Yes, they all attack it somewhat differently (for example, Starz is targeting women and minorities while Viacom has a sports and late night angle that the other services don't currently), but the core building blocks are the same.

Discovery is different. Because they're eschewing the more buzzy scripted shows, their price point can be a lot lower and they can engage with consumers in a much different way. They can also serve as your "service #2" in a way that a lot of other channels can't (i.e. you can have Discovery as your #2 service alongside any of the scripted streamers like Netflix, Starz, or HBO and it's a really nice complement. The other channels don't complement each other nearly as well; you have to be a pretty devoted TV fan to want both Starz and HBO!)

So I just like that Discovery has a somewhat unique angle.... but I also like it because it's uniqueness means it is an interesting strategic block somewhere down the line. Discovery is alone among the major media assets in that it would fit perfectly into almost any acquirer's portfolio, or DISCK could go the other way and be a buyer of whoever is left behind in the streaming wars as they evolve.

Again, an example might show this best: let's say Starz wanted to sell themselves tomorrow (either as a standalone, or in a whole company deal with Lionsgate / LGF). Do I think there would be buyers? Yes, absolutely. But it's not a really clean fit into any one portfolio. Starz is kind of duplicative with most other media services; if HBO bought Starz, would Starz really bring something new to the HBO bundle? Yeah, they'd get some more movies and libraries, but there's just so much overlap. HBO already has Game of Thrones in their library; do they need American Gods? HBO already has access to the Warner Movie library; do they need Lionsgate's?

But Discovery is different; they have a ton of programming that is reasonably unique and would add a much different angle to most of the catalogues out there. Discovery, Food Network, and HGTV would all bring a library of content much different than what most of the major streaming players have / focus on.

Personally, I think the ideal fit for Discovery would be Comcast. There'd be big synergies between NBC's cable channels and Discovery's, Discovery would really boost Peacock's library, Discovery's European assets would go well with Sky's, and there would probably be synergies between merging the Olympic rights (Discovery owns the European rights to the Olympics; Comcast/NBC owns America). But Comcast shareholders probably wouldn't love more diversification away from the cable assets, and I'm not sure how regulators across the globe would feel about it.

But just because Comcast is probably the best fit doesn't mean they're the only potential acquirers. You could paint some type of case that Discovery would fit with just about every major media / telecom / streaming player. So both from an ongoing strategic angle (this asset is unique and it fits in well alongside most other subscription services) and from an acquisition angle, I like that Discovery is unique among the streaming players.

(A bonus point here: Discovery pays their execs an absolute insane amount. Their CEO has tried to defend his pay by saying it's all stock based, but it's pretty nutty to see a CEO make >$200m from FY2017-2019 (see p. 59) while the stock and financials completely flatline. The cost synergies in a merger would be pretty large as all that exec compensation got cut; obviously there would be plenty of other synergies too!).

Point #4: There's reasonable continued upside from narrative shift and continued Discovery+ execution.

The previous three points have largely covered the execution / valuation, but I want to build on the narrative shift angle for a second.

I think narrative and stories can be a little bit like the Overton window: once it shifts one way, it's tough to get it back to where it used to be.

For years, the story on legacy media assets was the market would never give them credit for their streaming services and that they were melting ice cubes. But then we spent the past month with PMs and analyst looking at a bunch of legacy media stock prices and saying, "Dang.... can't believe they ripped this quickly, and the valuation seems a little rich..... but I always knew that they could make the streaming shift!"

And I don't think that window is fully going back to where it was. The days of legacy media stocks with good assets and a future trading for 7x EBITDA are gone. Analysts and PMs are going to start placing value on these asset's streaming opportunities and stop valuing them like they'll decline into perpetuity.

The narrative around legacy media stocks has shifted, and PMs and analysts are going to be more willing to give them some credit for the future going forward. And they should! Again, this narrative piece just builds on the work above; the early returns from Discovery+ are great, and with the Overton window for legacy media stocks shifted, I think the market is much more likely to continue to give them credit as they deliver.

Some odds and ends

Just some quick hits on points and thoughts dancing around the edges of this piece

Posting date: I'm posting this on April 1st (April Fools' Day for my non-U.S. readers). Is this post a joke? Obviously not. Will I claim it was a joke if the stock is trading in the teens a year or three from now? Obviously yes.

Both DISCA and VIAC got hit in the liquidation; why DISCA over VIAC? I actually think they're both attractive here; I just like DISCA more. DISCA is a more unique asset with a larger range of strategic moves / sales possibilities. DISCA's IP ownership is much cleaner than VIAC's, and I think their path to rollout both domestically and internationally is much cleaner (both thanks to their cleaner IP ownership and not having to deal with domestic affiliates). DISCA is a little cheaper than VIAC, particularly if you adjust for the foregone licensing revenue I mentioned above. And, while I really like Bob Bakish (VIAC's CEO), I don't really trust Shari Redstone (VIAC's controlling shareholder). I do trust John (DISCA's controlling shareholder). Also, I actually like that DISCA has less reliance on sports than VIAC does; I'm a little nervous about how legacy sports rights contracts play out as the bundle continues to unwind and our attention becomes more and more fragmented. DISCA is one of the few companies that can reasonably look at how much they earned from the legacy bundle and say, "We'll actually make more in a D2C world!

That's not to say VIAC isn't interesting. Nickelodeon is an incredible asset in a D2C world, they've got some great brands, and I think people really underestimate the strength of CBS and a lot of the library there (probably because most investors / wall street analysts aren't exactly the target audience for something like Young Sheldon). But when I think about Paramount+ and compare it to Disney+.... well, maybe it's just my taste in content, but it's tough for me to imagine Paramount ever catching up there. DISCA is just fighting a different ballgame!

Another fun reason to like VIAC: they have a history of share repurchases, and they just top ticked the market offering $3B in equity. Their current market cap is ~$30B; how epic would it be if they top ticked the market by raising cash at $85 and then used all of that cash to buy back almost 2x as many shares at $45 a week or two later?

Just one more add on to the "DISCA might make more in a D2C world than the legacy bundle" thesis. Almost every cable channel has argued that their monetization inside of the cable bundle is lower than their viewership numbers (i.e. Viacom once argued Viacom + CBS accounted for ~20% of cable eyeballs but only got ~10% of cable fees). The reason for that is sports channels like ESPN had huge cost from their rights fees and could use that cost plus the hardcore fan demands to get much more from the cable companies than their pure ratings would suggest. I think there's a reason non-sports content gets less than sports content, but I do think there's interesting upside for a company with brands like Discovery to slightly increase their payment in a D2C world. What's probably more interesting is Discovery's ability to increase advertising rates in D2C; for years, Discovery has complained they get ~1/3 of the CPM of major broadcasters. I think that's because advertising alongside 90 Day Fiancé is a lot less valuable for a brand or for a movie coming out over the weekend than advertising on Monday Night Football, but given the degree of data Discovery will have in a D2C world I think you could reasonably argue there's a lot more upside to the Discovery advertising rates given how much lower they currently are and how targeted they'll be able to get.

DISCA and VIAC have been rumored to be interested in merging with each other before, so it's possible they end up together anyway!

I tweeted this out, but I still don't understand how these stocks got squeezed this much. Honestly, when VIAC was approaching $100, I checked the short availability at my prime, and it was general collateral (meaning it was very easy to borrow). And I get Archegos bought up 10% of the stock inside a quarter, but honestly plenty of companies have bought back 5-10% of their stocks within a quarter without causing the craziness that happened here. Heck, Altice is a reasonably low float stock and they did a tender offer for >10% of the company last December and that stock barely budged! I just feel like I'm missing something; I really don't know how multi-billion dollar market cap companies got squeezed to the point of tripling in a quarter while their shares were still easily borrowable (it is possible I'm off on the borrow; this article suggested borrow was a little tight so maybe my broker just had a little better / different access since they weren't part of the Archegos swap. Still, I'm pretty sure I'm directionally correct and I'm surprised Archegos buying 10% in a quarter can make this big a difference but we have indices buy 10% of companies or companies buy back 10% of their stock inside of a month pretty frequently without causing this big a squeeze. Seems off).

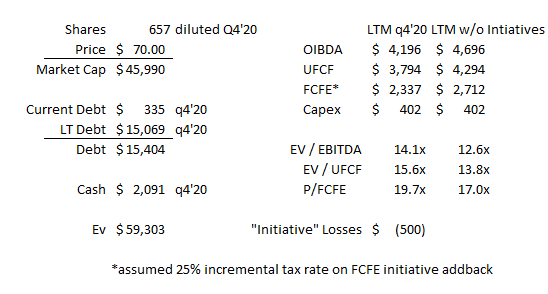

Here's a hot take.... were VIAC and DISCA that overvalued at their peak prices? I mean, on a relative basis versus larger players like NFLX, I think the obvious answer is yes (and I said so in real time). But on an absolute basis, maybe not? Tons of people were surprised by the moves in VIAC and DISCA, and lots of people struggled to justify the valuations, but I didn't really see anyone who said "these valuations are complete bubbles and clearly the result of a squeeze." As far as I can tell, most people just accepted that the market was giving being too generous in giving them full credit for a successful shift for streaming and way overestimating the number of people who could survive / thrive in a streaming world.

To dive on that a little more: below is DISCK's cap structure with a $70 share price. Yeah, it looks expensive against what we discussed above.... but is 17x FCFE really so crazy for a company that's undergoing a successful shift to streaming? Yes, you have to really believe the company can successfully pivot and that their economics in a fully streaming / post-bundle world look similar to what they are today, but that's not that crazy an assumption. Check out what VIAC was saying in early March when their stock was at $60; they were saying the market was just starting to give them value for the streaming shift and more was to come. Yes, maybe that was a little aggressive, and clearly the company thought the share price at ~$85 was aggressive as they raised equity for the first time since... I don't know when! But everything about the situation seems weird / hasn't been fully explained to me, and it doesn't seem like I'm alone in that.