Last week, Pershing Tontine (PSTH) announced late stage discussions to buy 10% of Universal Music (UMG) (just a few days after I called UMG my #3 target for PSTH). On the heels of the announcement, I wrote a piece “breaking down the ridiculously complex PSTH / UMG transaction” where I…. well, you can probably figure out what the piece was about based on its title!

I spent most of the weekend thinking through the PSTH deal dynamics and doing more work on UMG, so I wanted to put out a note with some updated thoughts on all points of the transaction: UMG fundamentals and valuation, the deal dynamics, etc.

Before I get to those, I’ll just skip to the end and give you my bottom line / two biggest takeaways

This deal is not done yet. Vivendi (UMG’s controlling shareholder) is authorizing the approval of the UMG transaction on June 22. PSTH and VIV should sign a definitive agreement right after that approval, so we should see an 8-K with the merger agreement and exact terms right after that. I’d also guess PSTH will give the traditional SPAC deal stuff right after that is signed (a merger presentation with the thesis and future projections very clearly laid out, a management call discussing the deal, etc.). I say all this not because I think this deal will fall through, but because we should learn a lot more once we see a definitive agreement and some deal commentary.

Most SPAC deal decks are ~30 pages. In the past, Ackman has backed has investments up with a >250 slide deck and an Excel model that took ~30 minutes to run. I’m sure the UMG deck will be shorter / won’t involve mammoth excel models, but if you’re at all interested in PSTH / UMG I’d set aside a lot of time on June 22/23 just in case!

At its current share price of ~$22/share, PSTH represents an absolutely unbelievable risk reward regardless of what type of investor you are. I say this mainly because I think Ackman is getting a very good deal on UMG and the market is quickly going to warm up to that stake, but even if you just assume UMG is fairly valued at the deal price I think there’s something for everyone in PSTH (note: this is absolutely not investing advice; please do your own research).

Are you an event investor? PSTH will offer to redeem their shares for trust value ($20/share) in the next 2-3 months. If you buy today, your absolute worst case scenario is the market goes to hell and/or pukes on the UMG deal, and you redeem your shares for $20/share and you lose ~10%. Not ideal, but not the end of the world. Your best case scenario is the market falls in love with the UMG deal, and that enthusiasm spreads to PSTH remainco / SPARC. Suddenly, PSTH could be trading for a big premium, and you could sell for a quick profit. Yes, this trade might sound simplistic, but I would not scoff at it. Ackman is a very good salesman, and stocks tend to spike when he takes a position in them. I realize Ackman unexpectedly buying a major piece of a public company (Domino’s in that link) is materially different than him finalizing a deal that he’d confirmed discussion of weeks earlier (as will be the case when he officially signs UMG), but I would not underestimate how bullish some investors are going to get when Ackman fully walks them through his UMG investment case and they start to understand how good of a business UMG is.

Ackman called UMG one of the greatest businesses in the world when he announced the deal; buying right now gives you the optionality of the market even starting to agree with him after he does a full SPAC roadshow / investor day. That’s a very intriguing bet to me.

Are you a value investor? I’ll walk through the sum of the parts (SOTP) later in this article, but given all the optionality associated with PSTH today I think you could easily make the argument that you are buying PSTH around a conservative SOTP today. If you ascribe any additional value to any of PSTH’s parts (i.e. you think Ackman got a good deal on UMG and it’s worth more, or you think having billions of cash in Ackman’s hands that he can deploy when he finds a good deal is worth some call option premium), than you are buying PSTH below the sum of its parts (and, again, I think people are going to warm

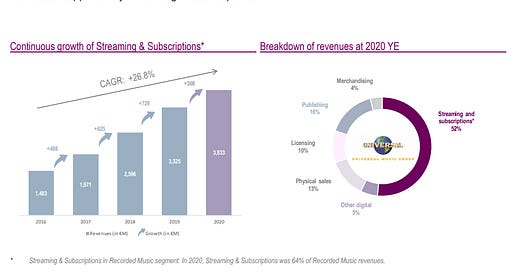

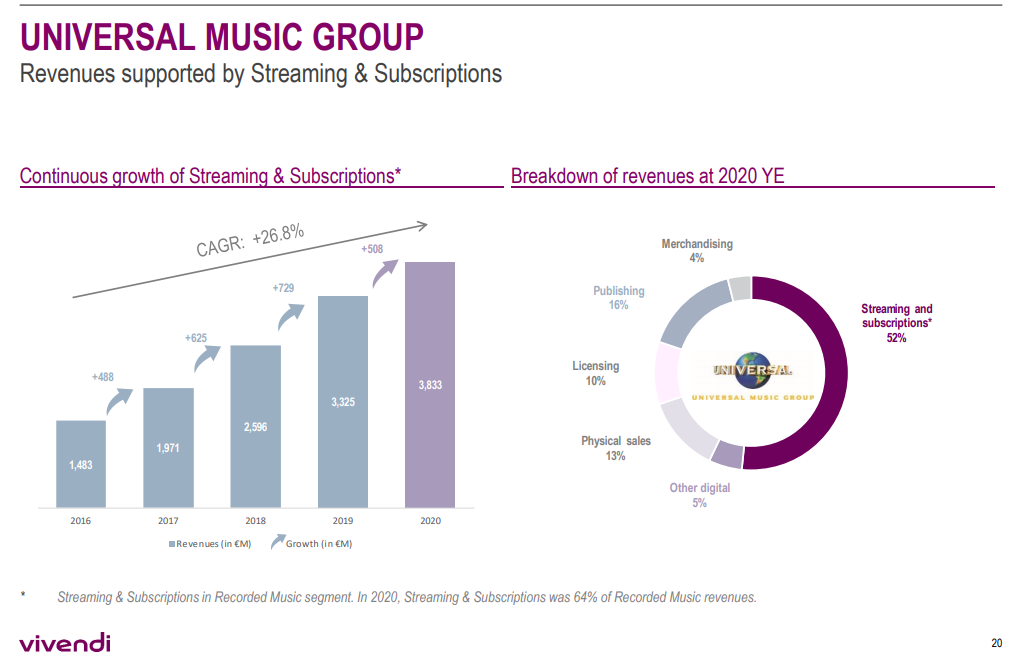

Are you a growth investor? Yes, UMG isn’t a hyper-growth Stripe type business… but I think a lot of investors are going to be very surprised by how quickly this business is growing. Streaming revenues now make up >50% of UMG’s revenues and have grown ~27% over the past five years, and EBITA has grown at a 20%+ clip over the same time frame. In addition, in some ways UMG is a minor tax on the continued rise of digital entertainment; music is a bedrock of tons of online experiences, and UMG gets a piece every time someone puts one of their songs into a game / social interaction / movie (that’s right, UMG gets a piece every time someone uploads a TikTok video with their music in it or you hear one of their songs during a Peloton ride!).

Anyway, that’s my high levels takeaways. I want to spend the rest of this article digging into five different pieces. I’m going to assume that you have read the PSTH deal discussion press release (and maybe my first piece breaking down the transaction) and not go through the hyper-basics of the deal, so please check those out if you have not.

Simplifying the technical complexities / mechanics of the PSTH / UMG deal a little further

Laying out the current parts for PSTH

Diving further into why UMG is a good deal / why I think investors are going to get so excited about this deal

Discussing the longer term implications of this deal for Pershing

Other stuff

Simplifying the technical complexities / mechanics of the PSTH / UMG deal a little further

Unfortunately, we have to start here. With a weekend behind me, I think I understand the deal a little better, and understanding the mechanics is important for discussing PSTH’s post-deal parts later. While I think everything in this section is correct, I anticipate this section will be stale in ~2 weeks, as I’m pretty sure the PSTH / UMG deal announcement will include tons of details on exactly how each step will work.

Let’s start with just a general break down of the timing of the deal, since it’s the thing I’ve gotten the most questions on. The event path for PSTH going forward should look something like this:

June 22/23: Sign definitive agreement with VIV to buy 10% of UMG. Hold deal call / presentation fully laying out thesis.

Late June: File tender documents with the SEC; the tender will offer to redeem common shares for ~$20/share in order to satisfy redemption rights

Late July / Early August: Complete redemption tender offer; file warrant exchange offer for the redeemable warrants (the warrants that currently trade publicly). Set record date for the distribution of tontine warrants (the record date will be before the redeemable warrants can exchange so that the distributable warrants don’t get the tontine warrants).

Middle of September: Common shares go ex-tontine warrant distribution. Warrant exchange offer goes through.

~September 22, 2021: Vivendi spins off UMG; UMG becomes a publicly traded standalone company trading in Europe. Vivendi ~immediately files a registration statement for PSTH’s shares.

Sometime in October: PSTH distributes the SPARC rights (“SPARs”) to common shareholders

~November 22, 2021: Vivendi’s registration statement for PSTH’s UMG shares goes effective. PSTH distributes the shares to common shareholders; common shareholders who owned one share of PSTH now own 1 of share of PSTH remainco (with ~$5.25/share in cash) and shares of UMG worth ~$14.75/share at cost.

I could be slightly off on timing in some places, but I’ve talked to several people about the event path and I have a good deal of experience dealing with events and SPACs; I’m confident that directionally the whole event path is correct.

There are two additional complexities with that process that I think are worth discussing quickly.

First, given UMG will trade in Europe once spun to shareholders, will the UMG shares PSTH buys / distributes to shareholders be tradable domestically? There are no guarantees, but I think the answer is unquestionably yes. It’s in everyone’s best interest for PSTH’s UMG to trade domestically. UMG will be a new standalone company; I doubt their board / management team wants the headache of 10% of the company suddenly free floating in the hands of a bunch of domestic U.S. investors who have no desire to own an international stock. For PSTH, they know their investor base is largely domestic, and they don’t want to distribute shares that the investor base can no longer hold. It’s a pretty good bet that PSTH and UMG will figure out a way for the shares PSTH distributes to trade domestically, though the exact mechanic they’ll use to do so (sponsored ADR, dual listing, etc.) is up in the air

Second, I want to break down the distributable warrants exchange offer. PSTH originally had two sets of warrants attached to it: for each PSTH shares, there were ~2/9 of a tontine warrant and ~1/9th of a “distributable redeemable warrant”. The later (the distributable redeemable warrants) are the publicly traded warrants (my broker lists them as PSTH+ and as I write this they’re trading for ~$5.60/warrant); those are what the exchange offer relates to.

The exchangeable offer will let distributable warrant holders exchange their rights for shares of common stock. The exchange offer will be timed so that if you exchange your warrants, you will not be eligible to receive the tontine warrants that current common shareholders get nor will you be able to redeem your shares for cash; however, you will be eligible to receive the shares of UMG / PSTH remainco on the shares you receive in the exchange.

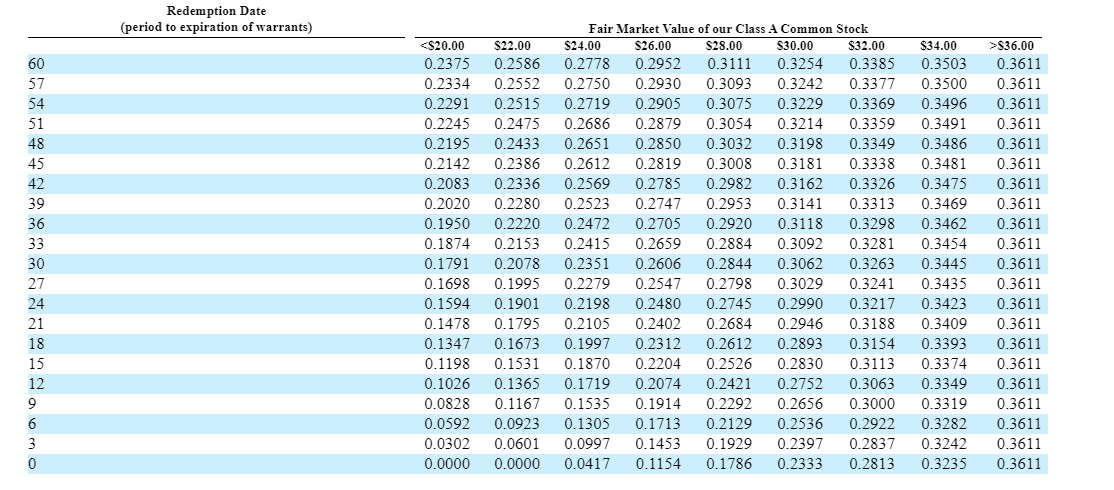

How many shares of PSTH will you receive if you exchange a warrant? The answer depends on where PSTH is trading right before the exchange takes place. You can find a full description on ~p. 166 of PSTH’s prospectus, but the basics are PSTH offers warrant holders an amount of shares based on the VWAP of their stock in the 10 days leading up to the exchange. So, for example, right now PSTH is trading for ~$22/share. When the exchange goes through, there will be ~60 months remaining until the warrants are redeemable, so right now PSTH would offer warrant holders .2586 shares of PSTH for each share of common stock they have. You can do a spot check of that based on current prices; 0.2586 shares times PSTH’s $22/share price is ~$5.69/warrant, which is right around where the warrants are currently trading.

The only additional complexity I’d add here is that the shares you get for distributable warrants will not be eligible for the tontine warrants still attached to current shares because the record date for the tontine distribution will be before the exchange takes place. However, because the warrant exchange will be based on 10 day VWAP, I’m not sure if the warrant exchange will bake in the value to the tontine warrants or not. For example, if you lined up the exchange record date to be right behind the ex-date for the tontine warrants, the exchange price would include the tontine warrants. If you did the exchange record date a few weeks after, the warrant exchange would exclude the value of the tontine warrants. I’m honestly not sure which one is more likely / how PSTH will handle that.

Laying out the current parts for PSTH

Alright, let’s talk about exactly what each share of PSTH will become after the current deal goes through. If you own one share of PSTH and do no redeem, your share will become four things: 1 share of PSTH remainco (with ~$5.25/share in cash), some shares in UMG (which cost ~$14.75/share), the tontine warrants (which will give you a call option on PSTH remainco), and a SPARC (basically, a five year SPAC right).

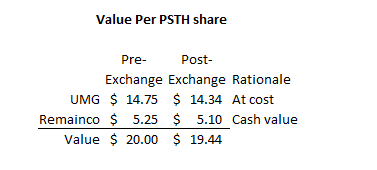

However, there is one complexity here: the cost / cash basis of the shares above are on a pre-warrant exchange share count. PSTH has 200m shares outstanding, at the current price for PSTH, they would have to exchange ~.2586 shares for every distributable warrant. So, with 22.2m warrants out, if all warrants exchange (which is likely), PSTH would issue an additional 5.75m shares. If you adjust for those new shares, it knocks the cash/cost basis per PSTH share down to ~$19.44.

With PSTH currently trading for ~$22/share, if you assume UMG and remainco are worth cost/cash (I’ll discuss in a second why I think that’s likely to be too conservative), the market is valuing SPARC / the tontine warrants for ~$2.56/share. That seems directionally correct.

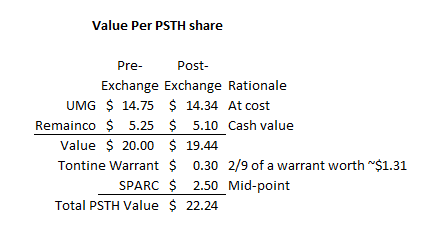

It’s really, really tough to guess exactly what SPARC will be worth. A five year right to buy into a multi-billion dollar acquisition Ackman sources at cost? Structurally, it’s similar to a SPAC, but we’ve literally never seen anything like that before. I would guess this will trade pretty well; PSTH consistently traded for a >25% premium to trust value. Some of that premium was due to the tontine warrants inside of it, so maybe the real number was closer to a 10% premium, but either way PSTH consistently traded at a premium. And, while UMG has been a “disappointment” based on share price, if you had bought PSTH at IPO, your shares + warrants are worth >$22.50 today, a ~12.5% return in less than a year on a reasonably risk-free position. Again, tough to guess, but just given that history I’d guess the SPARC trades for a 10-15% premium to the “call price.” At minimum, that would be $2-$3/SPARC.

On the tontine warrants; again, tough to say what these will be worth. I would guess these will be restruck as a five year warrant on remainco with the stick price adjusted to ~$6/share (versus remainco’s $5.25/share in cash), but I don’t know for sure. Still, we can guess what these are worth. PSTH’s current warrants are trading for ~25% of PSTH’s common price. If we assume remainco’s warrants trade at a similar level (a big assumption, but it also seems reasonable just based on where most pre-deal SPAC warrants are), each warrant would be worth $1.31/warrant. The common shares carry 2/9 of a tontine warrant, so their tontine warrants are worth ~$0.30/share ($1.31 * 2 / 9).

If we add it all up, at cost/cash value, the SOTP for PSTH looks something like this:

There are two big assumptions in there that I think are ultimately likely to prove conservative.

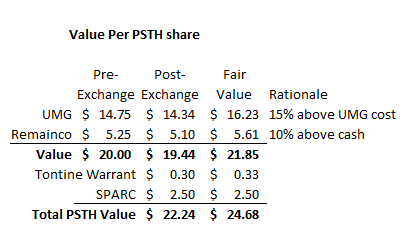

First, we’re valuing UMG at the price Ackman is paying for it. I’ll discuss this in a second, but I think once PSTH signs a definitive agreement and lays out the bull case for UMG / fundamental investors have the chance to do some real work on it, that assumption will prove conservative. PSTH is valuing UMG at ~$42B. Earlier this year, a few banks put out estimates of UMG’s value; several valuations centered on ~$50B and one went as high as $100B. I think the banks are likely to be directionally correct once American investors get a chance to directly invest in UMG as a pureplay.

Second, above I assumed that remainco would be valued at cash. Remainco will basically be a cash shell with $1.5B in trust. In general, cash shells trade for a discount to their cash value until they announce a deal. However, given Ackman’s reputation, I would not be surprised the Remainco trades at a small premium to its trust value (for reasons similar to why I think SPARC will trade with some value).

Just for fun, I put the chart below together to show what would happen if Remainco traded for 10% above cash and UMG trades 15% above PSTH’s cost basis. Again, no guarantee any of the happens, but I would guess this is where things shake out once UMG is a standalone company and Ackman lays out his thesis for UMG.

Why people get excited about UMG

I’ve touched on this above and a little in last week’s post, so I won’t spend too much time here. But I think people are going to get really excited about UMG as they get some chance to focus on it / due diligence it. I’d encourage you to get a head start: UMG’s financials are on their website, and VIV is also public and publishes plenty of info on UMG, so you can learn plenty on your own even before the official PSTH announcement / roadshow comes out!

First, just to frame the story: UMG is the largest music label. It’s ~2x the size as WMG and ~50% bigger than Sony Music; with WMG >2x the size of the largest competitors behind them, people are going to look at this as a semi-oligopoly with big moats. I think that’s a story growth investors are going to love.

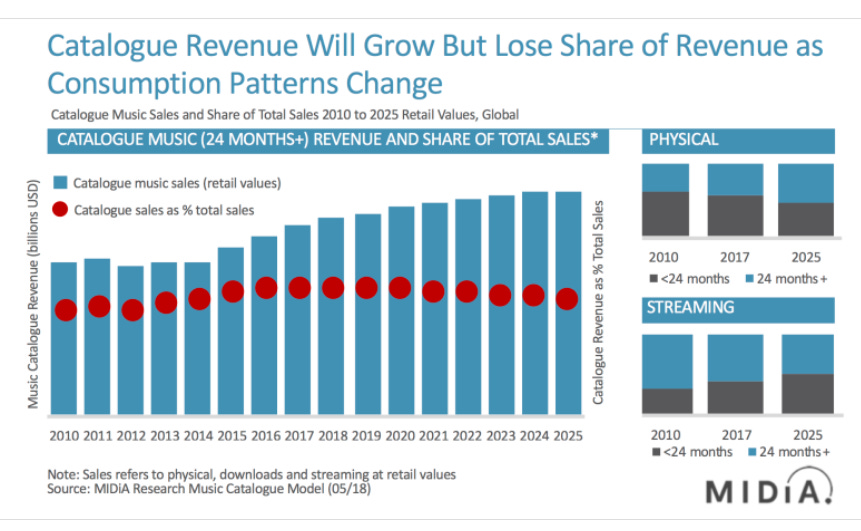

And, if you break down the story even further, I think there’s even more to like. I discussed UMG’s relative valuation versus WMG last week, so I won’t dive into it here (to simplify: PSTH is buying UMG at ~the same multiple WMG trades at despite the fact UMG is a better business and WMG should get a controlled company discount). But I think growth investors are going to love UMG’s exposure to streaming, and I think value investors are going to love the visibility and consistency of UMG’s catalogue.

I’d also note the private market for music rights has been absolutely on fire (this piece on Scooter Braun selling Taylor Swift’s rights includes some really interesting tidbits); there’s a good reason for that. Music rights are asset light and should be a great inflation hedge, and you can model their future cash flows with reasonable certainty. Plus, given the explosion of entertainment that uses music (games, TikTok, etc.), the larger / more classic songs are probably going to see continued demand growth for a long time.

UMG is coming out with the best music library in the business. I think you could paint a story where you’ve got the largest company in the world coming public with a reasonable multiple, the backing of one of the highest profile investors in the world, and a core revenue stream that is incredibly resistant to inflation, reasonably recession resistant (people don’t stop listening to music in a downturn!), and has huge growth optionality. I’d be shocked if that combination didn’t immediately generate a lot of buzz.

Consider something like WD-40 (WDFC). That’s an unsexy, low growth business; revenue in 2018 was ~$408m, and it’ll be around ~$450m this year. So there’s not a lot of value creation happening there, but it’s stable, it’s got a great brand, and investors have really good visibility on it. It trades for >30x EBITDA and 45x P/E.

Yes, that’s a much different business than UMG, but UMG probably has better visibility, definitely has better margins, and has growth optionality that WD-40 couldn’t dream of. Why shouldn’t UMG generate at least an equivalent multiple?

Or consider MGM. Amazon’s buying MGM for $8.5B; that’s approaching 30x MGM’s 2020 EBITDA (thought there’s lots of complexities to the EBITDA number given MGM is a hit driven business). I’d argue music is a much, much better business than movies; the library has a much longer value tail, and it’s much less competitive. Yes, music is probably not as strategic (you can make video exclusive and try to capture subs that way; audio needs to be widely available to max out it’s value for a bunch of reasons), but I still think those numbers speak to UMG being quite undervalued at these level (slide below from MGM’s investor website). (Contrarian edge had a nice piece a few years back that details why music rights are more valuable than movie/tv rights)

Or what about commercial real estate? Trophy properties in large cities like NYC go for low single digit cap rates; again, obviously a very different business than UMG, but I just highlight it to show how high the multiples can get for businesses/assets that have great visibility and are inflation resistant.

Anyway, the point I’m trying to make here is that, as investors get more comfortable with UMG as a standalone business, I think they’re going to look at the multiple Ackman is paying versus similar “high visibility / confidence” assets and realize UMG is much, much too cheap.

One last thing while I’m here: UMG is controlled by Vivendi, and their enterprise value as I write this is ~$40B. VIV currently owns ~80% of UMG; Ackman’s valuing UMG at ~$42B, so the market is saying VIV is worth barely more than the value of their UMG stake. Reasonable people could look at that and say “the market is pricing VIV’s UMG stake at way, way less than Ackman paid for it, so Ackman must be overpaying for UMG.” (my friend Steven Wood has a nice Bol / ODET note that breaks down the SOTP for VIV a little further).

I don’t think that’s right. VIV is effectively a controlled company (BOL owns ~30% of them), and BOL has used that control in the past to pursue some capital allocation that could be considered more favorable for BOL than minority shareholders (see, for example, the taxable nature of the UMG spin, or the deal to buy Havas a few years ago). I think the market applies a pretty big control discount to VIV (plus an adjustment for UMG spin taxes!), and once UMG is a standalone company UMG will get a premium valuation as it sheds that control discount.

What this deal means for PSH

I’ve commented previously how crazy it is PSH (Ackman’s publicly traded fund, which includes the sponsor economics for PSTH) trades at a discount to NAV while PSTH (a simply cash shell / SPAC) traded at a premium. I wanted to briefly touch on that because I would not be surprised if the biggest opportunity to emerge from all of these deals is to simply buy PSH at a discount to NAV.

As I write this, PSH is trading for a ~20% discount to NAV. Now, it’s a closed end fund, so the capital is locked in. Most closed end funds trade at a discount to NAV given the capital is locked up so their fees are relatively perpetual. PSH pays a relatively full / hedge fund expense structure, so you could make an argument PSH should trade for a discount.

Still, I think a 20% discount is too wide for a few reasons.

Yes, most closed end funds trade at a discount to NAV…. but most closed end funds aren’t run by Bill Ackman. A closed end fund run by a rando should trade at a discount; Ackman’s track record is fantastic. At a minimum, it shouldn’t trade at a discount similar to a fly by night closed end fund manager.

PSH will have major exposure to UMG and to the PSTH remainco / SPARC. If you believe any of those are an opportunity / undervalued, PSH’s NAV is understated. In particular, PSH’s NAV is understated because it has not captured the SPARC sponsor economics yet.

Perhaps most importantly, Ackman clearly wants SPARC to be the first in a chain of SPARCs. If he’s successful, than not only does PSH’s current NAV not reflect their sponsor economics for the first SPARC, but PSH will be the sponsor in a chain of SPARCs that they are getting no value / credit for. Over time, the sponsorship of a chain of SPARCs could easily add hundreds of millions of dollars/year to PSH’s NAV, and that’s currently getting valued at nothing.

Anyway, I’m going to wrap it up here. I might do a deeper dive on UMG once we see a full presentation, but I feel like I’ve hit a variety of the high points here. I’m looking forward to staying on top of this going forward, and particularly to seeing how remainco / SPARC trade once they emerge!

Odds and ends

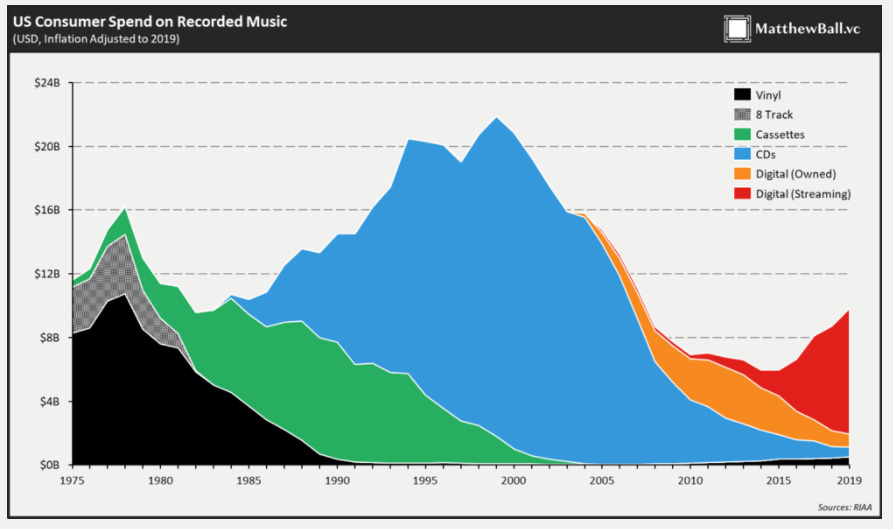

If you’re interested in UMG, I can’t recommend Matthew Ball’s piece on audio’s opportunity highly enough. I’ve stolen the two charts below from him because I think they frame the audio upside opportunity so well.

Despite a huge growth in streaming revenues over the past few years, U.S. spend on music is way, way down from where it was in the 90/early 2000s. Compare that to video, which has continued to grow relatively relentlessly despite the rise of streaming and everything. I’m not saying music will ever get back to its peak, but that it’s so far below it’s peak despite the fact music is probably more ubiquitous / listened to today than it was in the 90s (thanks to all of us having all the world’s music on in our pockets at all times!), I would be pretty surprised if there weren’t tons of continued upside to music’s monetization.

I will be really looking forward to the PSTH / UMG deal show. In particular, I’ll be interested if they address some of the risks from Taylor Swift re-recording Fearless. I’ll also be interested on how they discuss opportunities for NFTs and digital concerts going forward. (Stratechery had a nice post discussing all of those a few months back).

I’ll also be interested how they frame the Spotify risk going forward. Right now, I think the labels and Spotify have a very symbiotic relationship. I tend to fall on the side that Spotify owns the consumer, and over time that consumer ownership will let them chip away at the labels margins. I know a lot of people who think that belief is wrong, and that given the degree of competition Spotify faces (Amazon Music, Apple Music, etc.), labels will always hold the upper hand in negotiations. Given the valuation, either could be true and this deal could work, but for it to be a real homerun you really need to believe UMG maintains the upper hand or at least a symbiotic relationship with Spotify.

I would not be surprised if PSTH remainco announces a deal very, very quickly on the heels of this transaction (say, by year end). Ackman had been canvassing the market for almost a year since launching the first PSTH. There are only a few hundred companies that could take a ~$5B check, but there are thousands that could take a ~$1.5B check (which remainco will have on their balance sheet). I wouldn’t be surprised if Ackman could circle up to a few targets he talked to before and say “hey, we loved your business, but our check size previously was just too big. Now that we’ve got a lower check vehicle, let’s strike a mutually beneficial deal.”

Don’t forget that Kanye offered to buy UMG for $33B. Ackman’s valuing it at $42B, so if the deal goes bad he could always put it to Kanye!

Because sarcasm doesn’t travel well: to be clear, this is a joke and not investing advice!

When I tweeted out my initial post breaking down the PSTH / UMG deal last week, I said I wondered if the deal’s complexity hid some form of value. Right after I wrote that, it clicked that this deal reminded me a little of some of the Malone rights offering in You Can Be a Stock Market Genius. That’s not fully apples to apples (Malone was hiding value of actual operating businesses inside of super complex structures, where most of PSTH remainco / SPARC’s future value will come down to a bet on Ackman finding more good deals and creating value with his cash), but I do think that we’ll see similar PSTH case studies a few years down the line where some funds took big, concentrated bets on SPARC or remainco and made a ton of money because people didn’t quite understand the go forward dynamics (I hope to be one of them!).

In the deal breakdown piece last week, I mentioned how the SEC turned down a “Spinning Eagle” SPAC, and, given the PSTH structure has some similarities, I asked Bill on Twitter if the SEC would be cool with this set up. Several people reached out to me and told me they’d talked to their firm’s lawyers / advisors, and universally they all suggested the structure was unique but that ultimately the SEC would be cool with it.

The music industry blog had a somewhat bearish take on catalogue a few years ago. I don’t agree with a lot in there, but it was a well thought out piece and I thought the chart below was pretty interesting! (They also had a quick piece on the PSTH / UMG deal if you’re interested!).

One of the cool things about PSTH is how wide the investor interest in it is. I’ve talked to “serious” investors who run hundreds of millions of dollars interested in PSTH, and I’ve also talked to “retail” investors who bought five shares of PSTH on the “Big Daddy SPACkman gonna take us to the moon” thesis (which, honestly, is not far off from why many of the professional investors were interested!). With an interest that broad, I’ve run into three pretty interesting theories around PSTH. I feel very comfortable rebutting two of those theses, while I think one of the thesis is worth mulling over a little.

Bill Ackman is running a burner twitter account with some mild profanity in the username and he’s secretly dropping hints about what’s next for PSTH in my DMs. Obviously, this is the theory that is most interesting; the more offensive and profane the Twitter username, the more likely it’s an Ackman burner giving you inside information.

UMG is just a smokescreen; the real deal is Stripe / Starlink / insert buzzy company here, and the real deal is going to get announced instead of UMG on June 22: PSTH remainco or SPARC might merge with one of those buzzy companies. I doubt it, but the future is unknowable and there are a lot of event paths out there! But I feel very confident saying Ackman / Pershing wouldn’t burn their reputation putting out a press release saying they’re about to sign a deal for UMG if that wasn’t the case, and I also feel very confident Ackman / Pershing are very, very happy with the UMG deal given he called it one of the greatest businesses in the world in the PR!

The PR announcing the deal discussion is weird; lots of details are left out or TBD (for example, the treatment of the sponsor and director warrants isn’t finalized): Pretty interesting. I noted on Twitter that an original version of an FT article said Ackman had increased his UMG bid a day before the discussion leaked, and a later version of the article pulled that quote. Combine the changing reporting, the details left out in the press release, and that Ackman was staying up late the night before the announcement…. I just wonder if this news broke a little earlier than some of the parties thought it would. Did one of the parties strategically leak it? And, if so, why? No answers for me, but catches my eye as curious!

Is there large potential dilution here in an upside? With up to $3bn of forward purchase agreements at $20/share (with 1/3rd warrants attached), 44M outstanding redeemable warrants at $23/share, and $65M of sponsor warrants at $24/share... would that not create enormous dilution in the upside? I am still trying to wrap my head around the impact of each of these securities.

Do we have enough details to quantify the exposure PSH will have to the different pieces of PSTH?