$PSTH, $PSHZF, and implied vol: another look at SPACsanity

This week, one company has been overwhelmingly dominating my thoughts. Actually, I use the term company, but it's really just a cash shell. That company / cash shell? Pershing Square Tontine (PSTH; disclosure: long, and this article will discuss options, which are extremely risky so I will remind you that nothing on here is investing advice).

Why has PSTH been dominating my thoughts? Three reasons

I mentioned the other day that I went on the Business Brew (that episode is now live); PSTH was a hot topic of conversation during that discussion and I wanted to elaborate on a lot of the points I was making.

I published an article calling CCIV the poster child for SPAC craziness, and as I thought about it the differences between PSH (Ackman's publicly traded hedge fund) and PSTH (Ackman's SPAC) made me think PSTH is actually a better poster child for SPAC mania.

The implied volatility on PSTH's options has gone bonkers; making many of the options plays I discussed in "The Curious Case of PSTH's options" pretty interesting again (and, again, a disclosure that options are very risky and nothing on here is investing advice!).

So I wanted to do a follow up post discussing PSTH and some of the opportunities around the craziness.

Let's start with point #2: how the difference between PSH and PSTH perfectly exemplifies the craziness of SPACs currently.

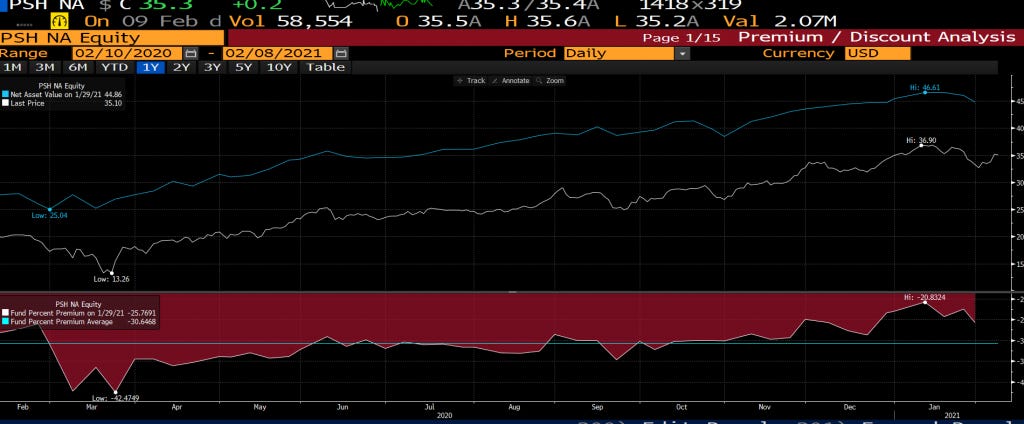

I've previously written up PSH, so you can check out that write up for more background. The high level overview is that PSH is basically an LP investment in Ackman / Pershing Square. PSH trades at a persistent discount to net asset value (NAV) despite Pershing Square's fantastic track record and their stake in PSTH (we'll talk about that in a second).

Remember, PSTH is a SPAC. A SPAC is a cash shell; investors buy into it hoping that the SPAC's management team will find a deal that creates value. When a SPAC trades at a premium to NAV / cash value, it's doing so because investors are betting that the manager will find a deal that creates a ton of value... which makes it strange that PSTH trades at such a big premium while PSH trades at a discount. They are both managed by the same person (Ackman), yet investors are willing to pay a huge premium to invest in one (PSTH) while demand a huge discount to invest in the other (PSH). Effectively, investors are saying that one pool of money managed by Ackman will create enormous value through his capital allocation skills (and thus should trade at a huge premium) while another pool of money he manages will suffer enormous value destruction through his capital allocation incompetence (and thus should trade at a huge discount).

What makes this discrepancy even stranger is that PSH will have a massive investment into PSTH when they announce a deal, as PSH will own sponsor warrants* to buy 5.95% of PSTH at ~$24/share when they announce a deal as well as a forward agreement to invest at least $1B and up to $3B into PSTH units at $20/share as part of the deal. That's an enormous deal; if you mark PSH's forward commitment and sponsor warrants to PSTH's market price, it would add >$1B to PSH's NAV. That's more than $5/share; given NAV currently is <$45/share and the stock trades for ~$35/share, that's a very meaningful NAV boost!

(*Technically, Pershing Sponsor, not PSH, will get the sponsor warrants, but as PSH owns >80% of PSH sponsor I'm ok simplifying here!)

Note that I'm not the only one who thinks the discrepancy between PSH's discount to NAV and PSTH's huge premium is strange; Ackman wrote it up in his 2020 semiannual letter (though the PSTH premium was much smaller at the time), which I have quoted below.

Interestingly, but not surprisingly in our view, PSTH currently trades at 106% of its NAV, which is comprised entirely of cash. PSTH trades at a premium to its cash NAV because the market believes that it is probable that we will fi nd an attractive merger candidate and complete a transaction that creates signifiant shareholder value. We believe that PSTH’s share price reflects the compound probability of our completing a transaction, the potential increase in the stock price at the time of announcement, and the timing of transaction announcement and closure.

The fact that PSTH trades at 106% of NAV is particularly notable when it is compared with the 33% discount to NAV (comprised of cash and marketable securities) at which PSH trades, as PSH is managed by the same investment team, owns 91% of the PSTH Sponsor Warrants, and is a minimum $1 billion forward purchaser, alongside the two Pershing Square private funds, of PSTH common stock and shareholder warrants, with the right to increase its forward purchase investment by up to an additional $2 billion.

While the Sponsor Warrants are valued at $84 million today, in the event PSTH completes a successful merger, the Sponsor Warrants would be worth 1.5% to 2% of the equity market capitalization of the merged company at the time of completion of

the merger (based on a Black Scholes valuation) depending on its stock price volatility. As PSTH is targeting a company with a post-merger market cap of $15 billion to as much as $30 billion or more, the Sponsor Warrants could become a material asset to PSH. This becomes even more likely if, as we expect, the merged company stock price increases above the initial transaction value, as the warrants, in that event, will become much more valuable.At PSH’s current 33% discount to NAV, PSH shareholders are getting all of PSH’s $1.7 billion of net free cash, the Sponsor Warrants, the Forward Purchase commitment, the option to increase the Forward Purchase commitment, plus hundreds of millions of additional value for free. PSH’s undervaluation has enhanced the benefits of our ongoing buyback program that endeavors each day to purchase the maximum number of shares permitted under the buyback regulatory regime.

It is important to note that all of the economics of PSTH are going to PSH shareholders and our private fund investors. This is an unusual approach as nearly every other SPAC sponsor has chosen to keep all or substantially all of the founder economics of launching a SPAC for the individuals that control the sponsor, rather than for the other funds they manage on behalf of their investors.

To sum up section one: PSTH trades at a mammoth premium to trust value. PSH trades at a large discount. Given PSH will own a bunch of PSTH (and, in fact, has a hidden asset from their forward purchase agreement for PSTH at a large discount to the current market price) and that PSH and PSTH are both controlled by the same capital allocator, it seems strange that one would trade for a premium while the other traded for a large discount

Let's turn to section 2: the options chain on PSTH is absolutely bonkers (and, for the last time, I'll disclose that "absolutely bonkers" is a highly sophisticated finance term and also that options are risky / nothing in here is investing advice).

I've pasted a screenshot of the current PSTH option chain from May through September below (note: current = as of 8 PM EST Feb. 9). You can see that implied volatility (the "IVM" column) is running at ~100.

That is a wild level of volatility. Remember, PSTH is a cash shell searching for a deal.... yet their implied volatility (at 100) is higher than Tesla (at 70). Remember, Tesla is a battleground EV stock that now owns freaking Bitcoin. Outside of meme stocks and maybe biotechs awaiting FDA approval, I can't think of a company that should be more volatile than Tesla, yet somehow the cash shell of PSTH has significantly higher volatility. Insane!

So PSTH's volatility is insane.... but I think that volatility presents opportunities. I will highlight two of those opportunties in a second, but before I do let me just walk through one more thing that interests me about PSTH.

Remember, PSTH is a tontine structure. I'd encourage you to read their S-1 for full details on how the structure works, but basically if you're a PSTH shareholder and you vote for their deal, you are given at least 2/9 of a warrant as a reward. That number could actually increase, as the shares that vote not to redeem are given the warrants from the shares that vote to redeem (so if you own shares and vote to redeem, your 2/9 of a warrant are given to all of the shareholders who do not redeem. Thus, the tontine structure).

That structure interests me for three reasons.

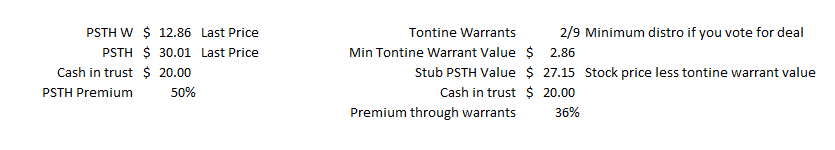

First, the Tontine is completely unique; I'm not aware of any other company or SPAC that is structured similarly. In my experience, things that are completely unique in financial markets can often be significantly mispriced.

Second, PSTH might be cheaper than it appears. Remember, each share today will get at least 2/9 of a warrant if they don't redeem when PSTH announces a deal. PSTH warrants are currently publicly traded and going for just under $13/warrant, so each PSTH share will be given $2.86/share in warrants if they vote for the deal ($13 * 2 / 9). So, while PSTH trades at a ~50% premium to trust value if you just look at the share price, if you look through the tontine warrants that will be attached to the shares the shares are actually trading for $27.15/share, a somewhat more reasonable 36% premium to trust value. This does get somewhat circular, as a higher share price creates a higher warrant value and a lower share price creates a lower warrant value, but I do think that directionally this method is correct in saying that PSTH trades for less of a headline premium than a quick glance would have you believe. So, yes, ~36% is still a large premium, but it's reasonable to cheap in comparison to most other high quality sponsors with pre-deal SPACs. For example, IPOD and IPOF are both pre-deal and trade for >50% premiums, Softbank's SPAC (SVFA) trades for a ~32% premium to trust, and a Peter Theil backed SPAC (BTWN) trades for a >50% premium. So, looking through the tontine warrants, PSTH might be a little cheaper than your average high quality SPAC. Interesting!

Finally, the tontine structure creates some weird complexity for the options chain. Remember, a PSTH share today represents one share plus however many tontine warrants it receives (assuming the share votes for the deal). If you're selling options against PSTH, how do you know how many warrants will be attached to that PSTH stock you just sold options against? And how do you know what type of busienss PSTH will buy? Surely those warrants will be worth a lot more if PSTH buys a high growth tech company than if PSTH buys something boring like a restaurant chain. That uncertainty could create opportunities for mispricing in the options line; in particular, the options around trust value could be interesting because if the stock trades towards trust value it becomes much more likely that some shares vote to redeem and the remaining shares get a significant increase in tontine warrants.

Anyway, some of this is a little looser, but I think it's all directionally correct. Bottom line, given the uniqueness of the tontine structure, the open questions of how many warrants are attached to a share (and how valuable / volatile those warrants will be post deal), and how the embedded warrant value inside a PSTH share today means shares are a little cheaper than they appear at first glance, I think that PSTH presents an interesting case for mispricing, particularly once the high volatility from the options is factored in.

That out the way, let me wrap this up by highlighting two different opportunities to take advantage of PSTH's high implied volatility (though, again, risky and not investing advice!).

The first opportunity would be to sell puts at the $20 or $22.50 strike price. I covered lots of details on that in my first piece, including an interest angle around the tontine structure with the company, so I'd encourage you to read that piece for a little more. But the basic thought here is that PSTH has $20/share in trust. Investors are currently so excited by the prospect of a PSTH merger that they're willing to pay $30/share before even seeing PSTH's deal. After Ackman / PSTH announces a deal and then goes and pitches it on CNBC / Bloomberg / every news outlet that will have him, are investors really going to sour on the deal so much that PSTH trades to trust value? Probably not. So, by selling the PSTH puts, you're basically betting the deal isn't a complete disaster that investors just outright hate... and even if they do hate it, as long as you sell puts in the ~May/June timeline, you should have protection from the $20/share in trust value (remember, it takes a few months between deal announcement and deal close, and until the deal close investors are protected by the trust value because they can always look to redeem their shares for cash). Personally, I like selling the June $22.50 puts (currently trading for ~$1.80/share); if you get put the stock, you've basically created the stock for $20.70/share (the $22.50 strike less the $1.80 premium), so you're creating the stock for just above trust in the event you're put the stock, and PSTH probably wouldn't be able to close a transaction before those options expire so you're reasonably protected by the trust value. Selling those for $1.80/share creates a ~8% gross return ($1.80 premium / $22.50 strike price) and a >26% IRR until expiration. Not bad!

The other interesting option play would be to buy the stock and sell some out of the money calls against the stock in order to reduce your cost basis. Given the massive volatility, you can sell some pretty deep out of the money call options against your stock and still get paid a significant amount.

For example, I think my personal favorite would be buying the stock and selling the May $40 calls against it. Those calls last traded for ~$4.80/share, so with the stock currently at $30/share buying the stock and writing those calls would cost you $25.20/share net.

Why do I like the May $40s in particular?

First, because the company is unlikely to close a deal before those options expire, you still have some protection from the trust value here.

Second, even if the stock runs up massively on a deal, this trade provides you with huge upside. If the stock trades through $40/share, you'll have made ~37% gross on this trade. Given that's 37% gross through May, the IRR on the trade is so insane I cannot bring myself to write it down.

Third, I think this trade set up really trades into the Tontine structure for PSTH. I covered the tontine structure earlier, so I won't dive into it further here, but the warrants inside of PSTH have real value. But if you follow my math and mark the tontine warrants attached to a share with the premium from writing the call options, this buywrite would be creating the pure stock for ~$22.35/share. You can see my math below (the $2.86 tontine warrant value is the current market price of the warrants times the 2/9 of a warrant attached to a PSTH share; see the table from earlier in this post for more), but $22.35/share is just a 12% premium to trust. Again, somewhat circular looking through the warrant value given that its value rises and falls with the stocks, but I just thought this was an interesting way of looking at it and thinking about creating the stock for closer to trust value.

Anyway, this has been long, so I'll wrap it up here. The SPAC market is crazy right now; Ackman controls two major assets in the market and the market is giving one a mammoth discount and the other a huge premium even though the former will benefit from the later. While the market is crazy, there's plenty of ways to take advantage of that craziness. PSH's stock looks interesting given the discount and the hidden asset value of the PSTH forward commitment, and taking advantage of the huge volatility associated with PSTH looks interesting as well.

Just goes to show even crazy markets and potential bubbles can present opportunities for investors willing to think creatively!