Markets in (semi)Panic 3: not even a semi-panic yet

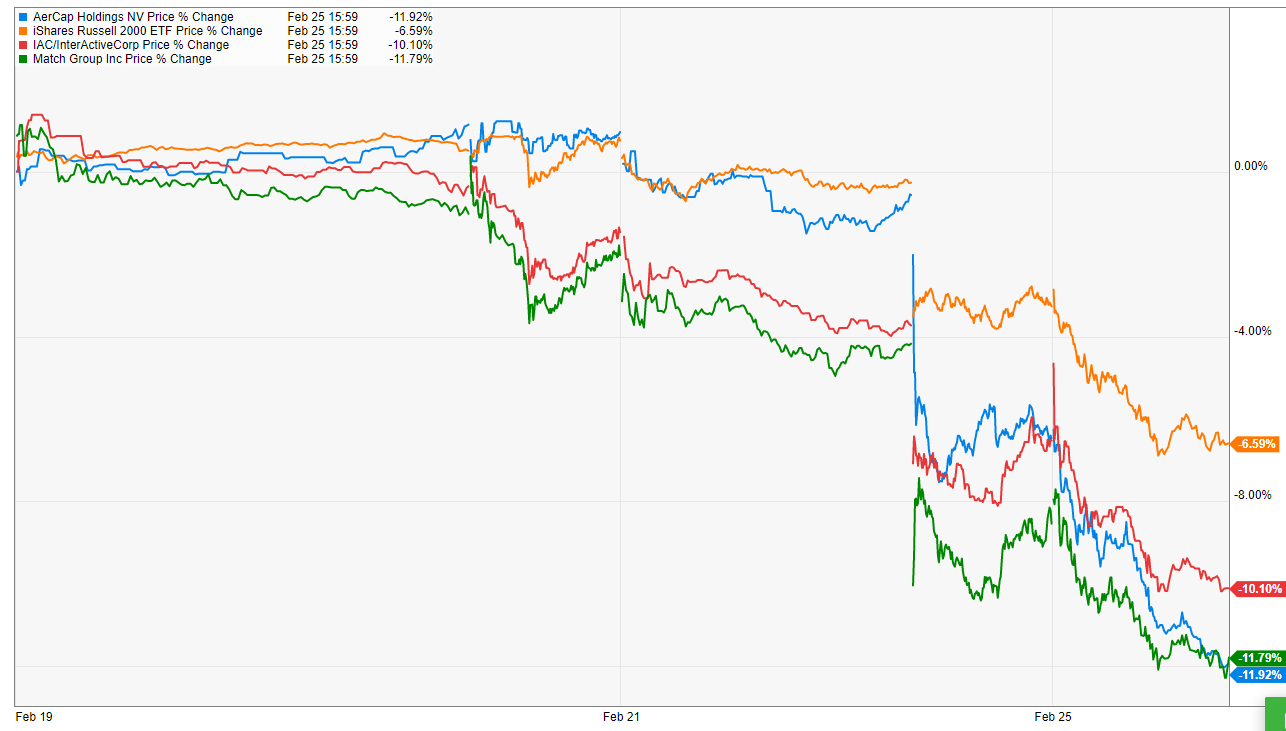

Every now and then, I'll write a "markets in Panic" post. It's generally on the heels of a 10-20% decline when people are freaking out a bit. The last one I did was in December 2018. That post didn't quite mark the bottom; the market would drop another 5-7% over the next week before bottoming on Christmas Eve... but the post was decently close to the bottom. As I said in that last post, writing is a little cathartic for me, so I wanted to put a post up after a rough couple of days over the past few days. Not because I think we're at a bottom or anything. Markets could open up or down 2% (or 5%. or 10%!). I don't know. But because writing helps me think and process. First, let me start with the obvious: while markets are down ~5-7% over the past few days, it's tough to call whatever is going on now a full blown panic. Even after the meltdown of the past two days, stocks are only down ~5% for the year. Given how much they were up last year, markets are basically a rounding error from all time highs. Being within touching distance of all time highs and down just 5% for the year does not exactly describe a panic! As the blog's title suggests, I don't even think this qualifies as a semi-panic yet! (Russell 2000 YTD return below)

Still, something about the past few days in particular is irksome / worrisome. For me, it's some combination of the following three things:

The market drop has been pretty sudden (what market drop isn't?). Back to back down 3% days are rough. I've taken to posting this clip on twitter any time the market is down more than 2.5% on a day. The reason is pretty simple: I try not to spend my life staring at stock prices, but I find once the overall market goes down more than 2.5% it requires more of an effort to stop staring at screens filled with one half dread (O MY GOD! Stocks are going down and never going to go back up again! Global depression imminent!) and one part greed (O MY GOD! Company X is down 5% today; I already thought they were cheap and they're going to be buying back a boat load of shares at these prices! I need to buy more right now!). Putting that tweet up is a soft little reminder for me to stop staring at stock prices and get back to normal work.

It's also funny that my triggering point is markets down 2.5% on a day. Again, in the grand scheme of things, a down 2.5% day is nothing. Black Monday saw the stock market drop >20%. 2008 (and 1929) saw multiple down >8% days. Still, I know that ~2.5% down days are when my basic instincts start to kick in and say "we should panic. this is the end. run!", and recognizing that is the level my animal brain kicks in helps me keep my composure / stay rational / keep a longer term view.

Most market drops are caused by some fear about the economy (Are we entering a recession? Did the Fed tighten too much? etc.). Honestly, I could care less about that stuff.... but there's something different about a health panic. A health panic is out of human control. If markets tank because we raised interest rates too much or everyone lost their minds and gave $1m loans to people without jobs, we as a society can recover from that. New banks will form (eventually), new companies will take the place of the bankrupt ones (eventually), and the inexorable march of human progress will go on and the economy will recover... but all of that changes with a true pandemic that wipes out some percentage of the world population. Yes, eventually human kind will recover, but if some fast moving disease wipes out 1% of the world's population, that's how whole economies shut down or whole nations start panicking. Are any of those outcomes even remotely likely? No, of course not! But a pandemic really encourages the mind to wander into big panic type things. I love movies and fiction books, and the current story around Corona is how basically every good zombie / "virus wipes out mankind" book starts. That type of similarity is enough to encourage people to day dream big panics and scare themselves.

Funny thing I thought about today: almost every company has included a health epidemic risk factor in their 10-k for years. Logically, I knew scares like this could and would happen. But real time there's something so different about reading the risk and living through the market start to worry about one.

Two of my largest positions are Match (through IAC) and Aercap (AER), and both are probably more exposed than your average company to pandemics. For match, if people are terrified of going out of the house to meet people, they're going to cancel their dating app subscriptions real quick since they won't be doing any dating (or, at the very least, not feel the urge to pay for a la cart features to make matches instantly!). For AER, the first stop in trying to halt a pandemic is to shut down travel, and travel restrictions demolishes the demand (and thus the value!) of airplanes. You can probably see that fear in the two companies stock charts over the past few days, as both are down ~2x the overall market.

Again, I try not to focus too much on day to day market moves, even for my largest stocks. But one of the things I'm finding toughest about a health "panic" is that Match / IAC and AER are two of my highest conviction stocks (and thus why they're two of my largest positions), and my general response to market weakness would be to buy more of my favorite stocks / companies that I have the most conviction in. But it's a little harder to buy more that when the market is probably correctly interpreting that your favorite stocks are more than likely more exposed to a pandemic than your typical stock!

Anyway, I'm writing this post because writing's cathartic, and I wanted to put down some thoughts that are swirling in my head. Let me build a bit off those thoughts with one other thing: how is the current "panic" (and, again, I use that term loosely) affecting how I invest? Honestly, not much. I'm still trying to keep my nose to the grindstone and read new 10-ks or learn more about the businesses I already know about and follow. I spend a little more time looking at stock prices than I normally do, but I try to consciously catch myself when I do so and get back to work. And I've been a bit more active putting "dry powder" to work than I normally am (i.e. buying). What am I buying??? Mainly IAC / MTCH / AER, but also a few smaller names (names that I mainly haven't disclosed yet; perhaps I will mention them some other time!). Why am I buying IAC / AER if I think the market is right that their business is probably more sensitive than most to a pandemic? Two keys reasons:

I already thought these stocks were cheap... and a 10% decline is a pretty big whack on businesses I already think were cheap. If you run the math on a10% decline, the market is implying that the Corona virus is extremely likely to impact those businesses and extremely likely to have result in some impairment of their longer term results. Consider AER: the stock's down ~$8/share over the past few days. That's roughly how much I expected the company to do in EPS this year before Corona fears got real (actually, given the strength of their contracts, I still expect them to do something similar!), so the market has basically shaved a full year of earnings off the company. If you had told me last week that AER was going to have some type of company specific disaster that resulted in them losing all of this year's earnings but then returning to normal after, I wouldn't have loved it but honestly I would have still thought they were too cheap. That's basically what the market has done with AER after the recent sell off, and I think that's wrong.

IAC / MTCH / AER are in businesses more likely than most to be impacted by Corona / some type of pandemic.... but their managers are much better than most. I have huge confidence that they'll make moves that will boost (or preserve) value more than your typical manager. If the market sells their stock too hard, they'll get (even more) aggressive buying back shares. If financing locks up, they'll figure out some type of creative financing while all of their peers are left in the lurch. Or they'll take advantage of competitor weakness to buy them on the cheap. Anyway, I don't know how this will play out, but the great thing about buying leading companies with shareholder friendly / astute management is that when the market throws their whole industry lemons, they're likely to make lemonade while the rest of their competitors have an allergic reaction to lemons.

PS- one more thought while I'm here. I've mentioned countless times on this blog that Charter (through the Liberty complex) is my largest position. I can't think of a safer stock for some type of global health scare (well, maybe some type of pharma company that produced a treatment for the scare, but you get the idea!). Why? Two reasons. First, if people are scared to leave their house, they're going to want something to do.... and that something is surf the internet. Broadband usage goes up, creating some pricing power for cable and further widening the cable / wireless moat (you can't cut your broadband cord because your wireless provider could never handle the amount of data you stream at home). And in a real pandemic, people are probably moving less, which will lower churn (people moving is the largest source of churn for broadband). Yes, household formation goes down, which lowers a key source of growth, but the most important point here is that the core cable / broadband business is really resilient versus some type of pandemic. Second, interest rates continue to decline, which is good for cable in two ways: a lower interest rate should raise the terminal value of the business, and lower interest rates means the company can continue to refi their debt at cheaper and cheaper rates. Last week, Charter issued ten year debt at 4.5%. Since then, the US 10 year has dropped from a ~1.5% yield to a ~1.3% yield as investors flee to safety and bet the Fed will cut rates to combat Corona economic weakness. If / when rates continue to drop, Charter will continue to have a little bit of a refinancing tail wind. And the nice thing about Charter is its a pure play on cable! True, that's always been the nice thing for Charter against its largest peer, Comcast, but it's particularly so in a health scare. Remember, Comcast owns NBC, which owns Universal Studios (theme parks). That's a fantastic business.... but theme parks are obviously super exposed to health scares (one of the first thing to go in health scares is tourism!). Will Comcast be fine no matter what happens in a potential health scare? Almost certainly! But the fact remains some pieces of their business will certainly take a dramatic hit if things got a little scary, while Charter is likely to be firing on all cylinders no matter what. Anyway, I'll wrap this post up here. Hopefully, two years from now we look back at this post and laugh at how silly markets were to panic about Corona. I'm optimistic that's the case... but, again, something about big losses + health scares causes the animal brain in me to say "Panic and don't look back!", and I wanted to put some real time thoughts to paper on that.