Premium Case Study: Worthington $WOR

One of my goals for YAVB in 2021 was posting more case studies: ideas from YAV premium that have played out (whether positively or negatively). There are a lot of reasons for doing so: partly for marketing purposes for the premium site, partly because some people get value in seeing fully written ideas and learning from them, and partly (mostly) because when I write I often like to link to past ideas and thoughts and having them behind paywall makes that writing / linking a little awkward. So today I'm following through on my goal and posting the third in an irregular series of premium case studies.

Why am I posting this particular idea today? Two reasons.

It starts with a line calling Nikola (NKLA) one of this century's greatest speculative / trading stocks. After the absolute insanity of the Gamestop / AMC short squeeze, last year's Nikola bubble seems quant.

There's an idea from this post that I wanted to build on in a future article, so I needed a "public" way to link to this article.

Anyway, below is the write up exactly as it appeared when written up in early July. Enjoy!

The premise of this article is simple: Nikola (NKLA) is one of this century’s greatest speculative / trading stocks. While I find it incredibly unlikely the company will ever be worth today’s share price, there is a backdoor way to play NKLA that will likely outperform the market regardless of how NKLA’s stock performs over the next few years.

That backdoor play? Worthington (WOR). The background is simple: WOR made an incredible venture investment into Nikola a few years ago (a $2m in 2015 which has today become >19m shares currently valued at more than a billion dollars). At today’s prices, the market is basically offering you WOR’s core business for a fair price and throwing in the NKLA investment, currently worth ~$1B (~50% of WOR’s market cap) for free.

Why does this opportunity exist? Any number of reasons could explain the divergence. For example, maybe I’m too optimistic on the WOR core business, and the market is pricing in the WOR business as worth substantially less than I believe it is while valuing the NKLA investment properly. Perhaps the market for WOR is a bit ineffecient: it’s a smaller company with somewhat complicated accounting and a limited float, and the NKLA investment hasn’t hit their balance sheet yet (it will when they report their next quarter). Or perhaps most WOR investors believe that NKLA is a bubble and are assigning little to no value to WOR’s NKLA shares because they believe WOR will be unable to sell their shares at anything close to today’s prices.

My personal belief is a combination of #2 (limited float, inefficient market) and #3 (WOR investors believe that NKLA is a bubble and WOR won’t realize value close to today’s prices). But honestly, it doesn’t much matter for an investment in WOR today. My personal belief is that, even if WOR’s NKLA investment is worth zero, WOR is undervalued at today’s prices. So, in many ways, an investment in WOR today represents the best of all worlds: buy WOR at a good price as a value investment, and get the kicker of a speculative investment in NKLA that could be worth all of today’s share price for free!

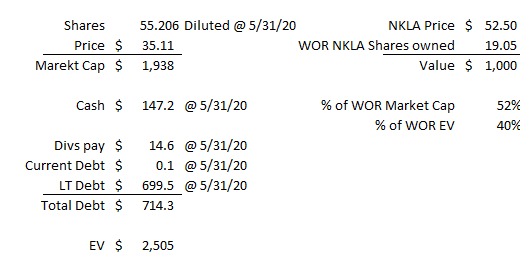

Let’s start with a WOR cap structure overview. I’ve recreated a simplified version of their most recent balance sheet below. Note that the left hand side of the balance sheet includes no value for their shares of NKLA; NKLA went public on June 3 and WOR owns >19m shares, so that value won’t appear until WOR’s next balance sheet comes out. However, as you can see on the right hand side, at today’s price WOR’s NKLA shares are worth $1B, or ~50% of WOR’s market cap and 40% of their EV.

Ok, hopefully that frames how meaningful WOR’s NKLA stake is to WOR’s current valuation. The market is valuing the rest of WOR’s business at just $1.5B, which I think is meaningfully undervalued.

Why?

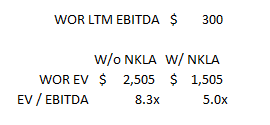

Well, a start is just to apply a simple EV / EBITDA metric for WOR. As I’ll discuss later, WOR owns a bunch of JVs, which distorts their accounting and makes them a bit more difficult to value, but the company is kind enough to provide an EBITDA number that consolidates only their share of the JVs. For FY2020 (WOR’s fiscal year runs through May, so this is the fiscal year ending May 2020), EBITDA was ~$300m. My guess is that on a normalized basis this number is a little low, as their Q4’20 included the bulk of the COVID shutdown. Still, simply using the $300m shows the company is trading at ~8.3x EBITDA if you ignore the NKLA investment and 5x EBITDA if you give them credit for the NKLA investment.

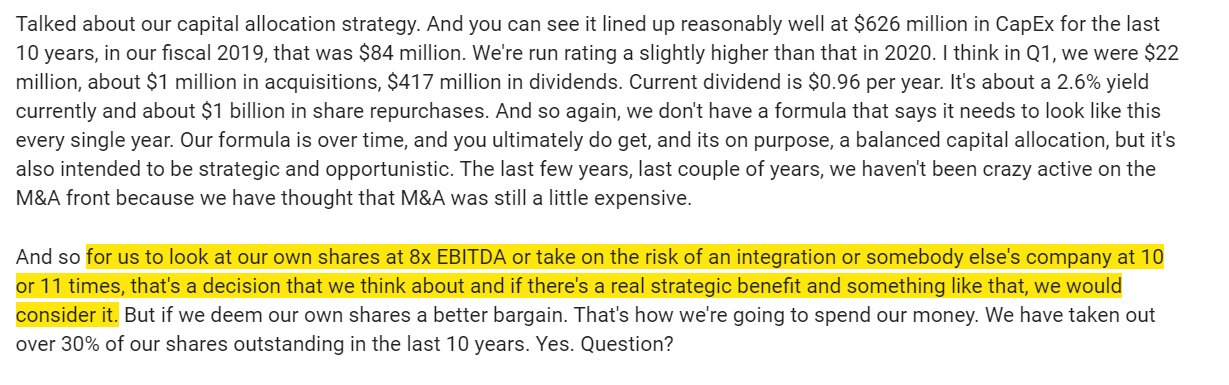

That ~8x standalone multiple (ignoring NKLA, of course!) is interesting. WOR has been a habitual repurchaser of their shares, and when pressed on why they’ve consistently said they would prefer to buy their own stock at 8x versus buy other companies at 10-11x. With the whole company trading for 8x and throwing in Nikola for free, I would not be surprised to see WOR continue to look to retire shares at today’s levels (quote below from WOR’s 2019 analyst day).

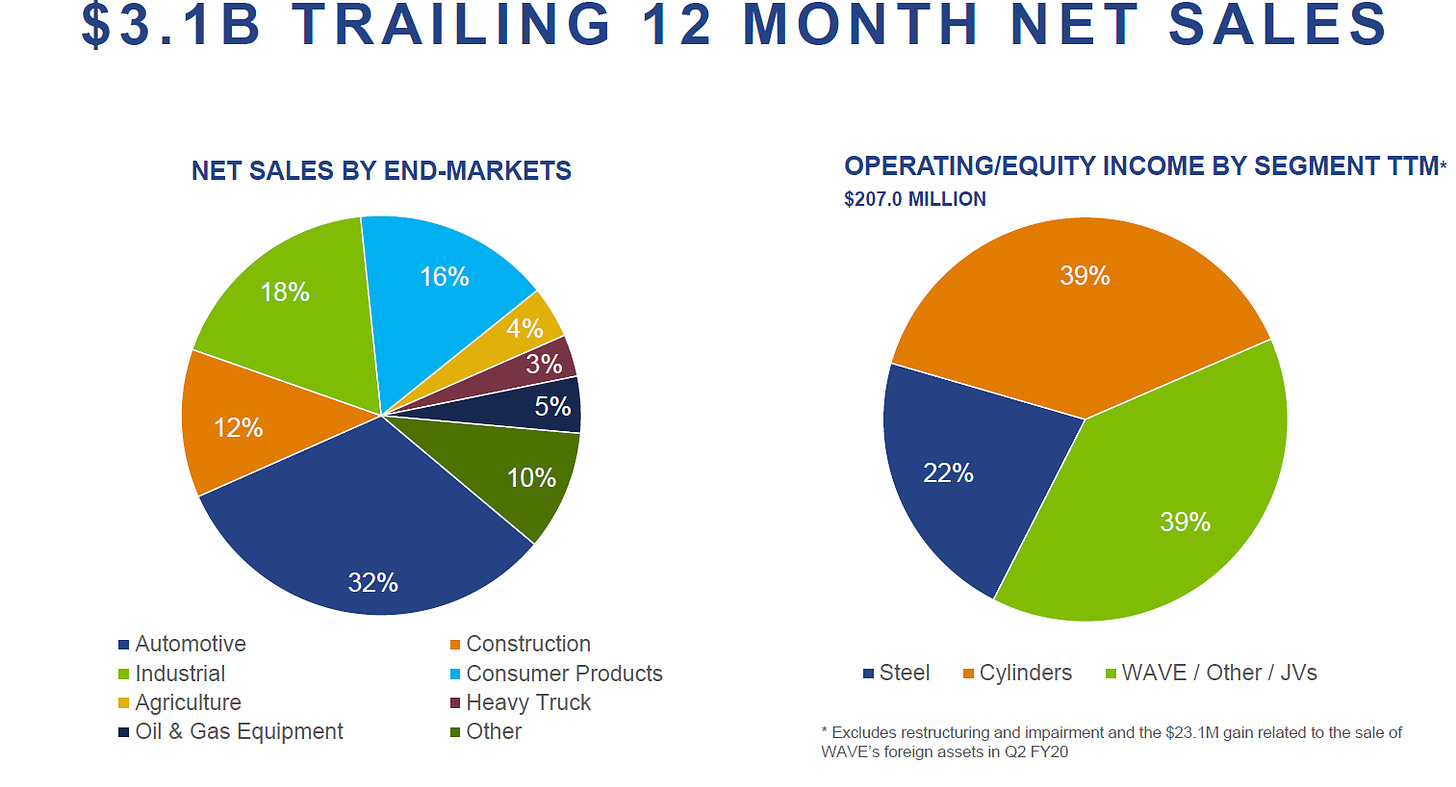

Ok, that’s a high level valuation. Let’s dive a bit deeper into where WOR gets its value. WOR can effectively be broken up into three different pieces of value, with each contributing roughly the same amount of earnings: joint ventures (JVs), Steel, and Cylinders (slide below from Q4’20 earnings).

I’ll discuss steel and pressure cylinders in a second, but let’s focus on the JVs for now, as (outside of the NKLA investment) the JVs are the key driving force behind WOR’s valuation and drive a huge amount of accounting complexity that I think contributes to WOR’s undervaluation.

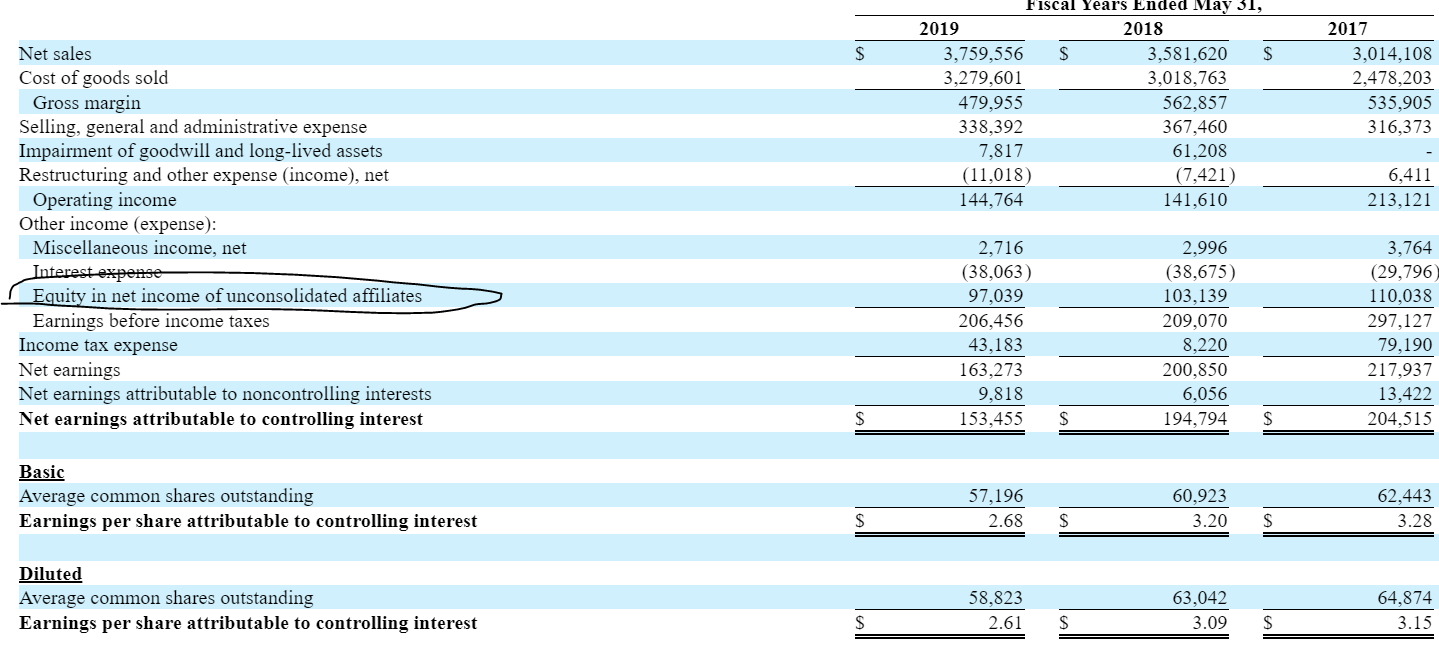

WOR has built themselves through a variety of acquisitions and mergers over the years. Sometimes that has meant buying whole companies, but often that has meant merging their operations with a competitors in a JV. The accounting for a JV can be complex: if WOR owns more than 50% of the JV, they simply consolidate the JV on their income statement. However, if they own 50% or less of the JV, WOR will report their share of the JV’s earnings in a special line on their income statement (“equity in net income of unconsolidated affiliates”). I’ve pasted a copy of WOR’s income statement from their 2019 10-K below to show this line:

That line item can create some opportunity for mispricing. Computer models might miss it because it’s below the operating line, and because that number represents the consolidation of all the different JVs a company invests in, it can result in a huge valuation swing if there’s some complexity in the underlying numbers (an extreme example might show this best: in 2019, WOR reportd $97m in JV income. What if they had two JVs with one earning $1B and one losing $900m? Obviously the first JV would be worth an enormous amount of money, but the consolidation would make the JV segment look like it was worth a lot less).

WOR has an absolute gem of a JV, Worthington Armstrong Venture (WAVE). This is a near 30 year old 50/50 joint venture with Armstrong World Industries. WAVE is one of the two largest manufacturers of ceiling suspension systems (just look up at your ceiling and there’s a decent chance WAVE touched or made something in there). WAVE is insanely profitable: EBITDA margins are ~45% with fantastic returns on invested capital. In fact, the JV is so profitable that, over its lifetime, it has dividended out more to its investors than they put into the company. Because WAVE’s dividends exceed its contributed capital, WOR is required to hold WAVE on their balance sheet as a liability (worth negative $95.3m at Q3’20) despite the fact their stake in WAVE is easily and obviously worth hundreds of millions of dollars (again, a potential mispricing: computers see a liability when in reality it’s worth a huge amount!)

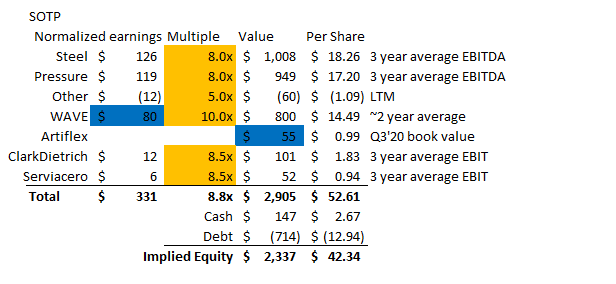

So what exactly is WAVE worth? WOR’s share of WAVE’s earnings have come to ~$80m in each of the last two years (it was actually greater than >$100m in FY20, but that includes a $23m one time gain from the sale of WAVE’s international operation). UMG is a decent comp that got bought out for a mid-double digit EBITDA multiple last year, and their deal proxy contains a whole host of peer valuation info (note that UMG’s 10-k listed WAVE as a competitor). It’s tough to find a precedent deal or trading comp that isn’t trading for ~10x; given WAVE’s superior economics I wouldn’t be surprised if it was worth a premium to peers. Still, for now let’s stick with a conservative multiple. At 10x, WOR’s share of the WAVE JV would be worth ~$800m.

Moving on from WAV, let’s quickly discuss the rest of their unconsolidated JVs. There are three headliners here: Serviacero, ClarkDietrich, and Artiflex, though WOR does have stakes in several other businesses through their JVs. Valuing any of these JVs is difficult as they’re cyclical. For example, WOR’s share of Serviacero’s earnings was $9m in FY18 and down to just $1m in FY20. Still, there’s undoubtedly significant value here (slide below from Q4’20 earnings).

The easiest JV to value is probably Artiflex. In Q2’20, WOR began a strategic review for Artiflex. As part of that process, they had to determine if they should write down Artiflex’s book value or not and they determined there was no need (see p. 8 of their Q3’20 10-Q). WOR also chose not to write down the Artiflex investment when they reported full year results in May. My guess is that WOR has very good line of sight into a disposal / exit opportunity at or above book value given that fact pattern, as WOR’s history suggests they are pretty conservative with writing investments down the moment they evaluate them for impairment / selling them (WOR has had several write downs that subsequently lead to small gains on disposals in their recent past). Based on that, Artiflex is likely worth at least book value.

The other two JVs (Serviacero and Clark) are tough to value given cyclicality, but don’t budge the needle too much. For simplicity, I just take their average earnings over the past three years and value them at 8.5x. This is likely too conservative: as noted above, peer M&A takes place at low double digit EBITDA multiples, and WOR’s JVs are generally structured so that JV earnings roughly matches distributable cash flow. An 8.5x multiple on the JV earnings equates to maybe 7x EBITDA for a peer company. Bottom line: these are likely conservative multiples.

Ok, JVs out the way, let’s turn to WOR’s owned business: steel and pressure cylinder.

Neither of these are fantastic businesses. They are cyclical and reasonably capital intensive. WOR’s goal is to earn a 10% return on invested capital through the cycle in these business; that ROIC target creates value but is also nothing to write home about.

Still, that’s not to say these businesses aren’t valuable. They do have some competitive advantages, and through the cycle they should earn greater than their cost of capital. While neither has perfect pure-play publicly traded peers, they do have loose publicly traded peers that they likely should trade for a slight premium to.

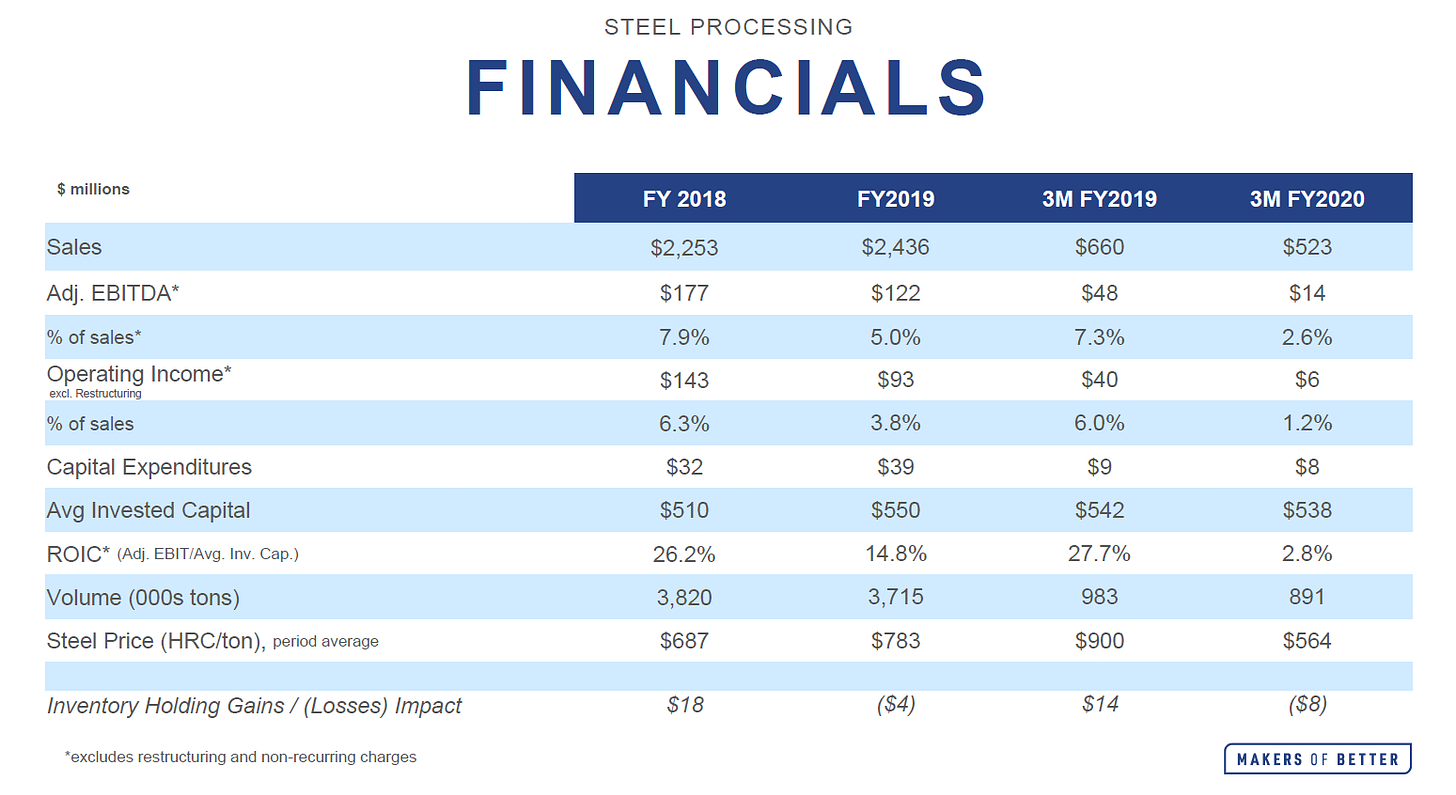

Let’s start with steel. WOR’s steel segment isn’t a traditional steel company. WOR is more into niche markets where they take steel from integrated steel mills and then process the steel to meet customer specifications (for example, “cutting-to-length” the steel into sheets of exact length, or laser welding the steel). Much of the business functions as something as a pass through: they buy metal from a steel company, make some improvement to it, and then sell it to their end customer for cost plus a mark up.

Again, this isn’t a great business, but it is a decent one for WOR given some competitive advantages. Outside of the automakers, WOR is the largest purchaser of flat roll steel, which should give them some small purchasing power (to give a sense of size, WOR’s steel is in 50% of cars in the U.S.).

I think there are two ways to value WOR. If you believe this is a completely commodity business, you would probably value them as worth roughly their invested capital (~$512m per slide above). I think that’s too conservative, as they do have some scale economies and they’ve earned significant in excess of their cost of capital over the past few years. I prefer to value them at 8x their average EBITDA for the past three years. That valuation is roughly in line with their loose peers and, again, below where WOR was seeing M&A valuations towards the end of last year.

The last business we need to value is WOR’s pressure segment. This business makes pressure cylinders (there are a variety of products here, but hand torches like their Bernzomatic brand are probably the best and coolest example).

I find this segment to be one of the most interesting for WOR. There should be some competitive advantages here: pressurized cylinders are obviously a regulated industry, and regulated industries tend to result in economies of scale for their largest players (which WOR is!); however, historical ROIC for this segment has been middling. That could change at some point; the segment has been investing into some interesting growth initiatives (including a cannabis extraction cylinder) that could result in significant operating leverage if they play out. For now, however, we’ll value pressure as the middling business it is.

Average EBITDA for pressure over the past three years is ~$119m. At an 8x multiple, that’s $950m of value for the pressure segment. That’s just a bit higher than the ~$870m in invested capital WOR has in the pressure segment (which makes sense; ROIC is middling so an earnings based multiple should yield roughly book value).

The slide below puts it all together: pressure and steel at 8x average three year earnings, a slight charge for their “other” segment (which is mainly corporate overhead), WAVE at 10x earnings, Artiflex at book, and Clark + Serviacero at 8.5x. The result would yield a share price for WOR of ~$42.34, or in excess of today’s share price with no value assigned for the NKLA windfall.

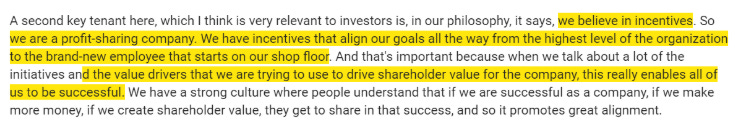

For those who’ve studied WOR’s history, I don’t think the results should be a surprise. WOR is a shareholder focused company: the executive chairman owns ~35% of shares outstanding, and the whole company is incentivized to maximize value (see quote below).

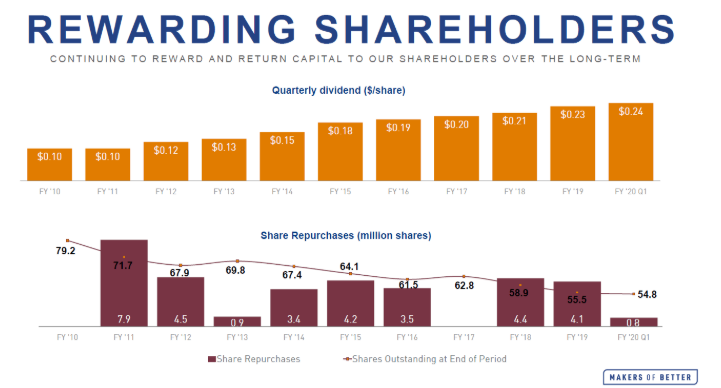

Over the past few years, WOR has been a consistent repurchaser of shares, retiring >30% of shares over the past decade. When a company with a shareholder focus and a key executive doubling as a major shareholder decides to consistently repurchase shares, they generally do so because their shares are significantly undervalued. WOR has pursued just that route, and remember that they chose to do so before they struck a $1B windfall with Nikola.

Ok, we’ve covered a lot here. So a quick summary before signing off. WOR made the venture investment of a lifetime a few years ago when they put start up money into NKLA. That investment has turned into a ~$1B windfall, yet the market is giving them no credit for that investment. WOR is run by a very shareholder focused and stock price incentivized team, and at today’s prices WOR’s core business is somewhere between fairly valued to undervalued with the Nikola investment (worth ~half of their market cap) getting thrown in for free.

Other odds and ends

Most investors big worry here is going to be WOR monetizing the Nikola investment, as their NKLA shares are currently subject to a lockup. A common line of thinking is “who cares what NKLA is worth now? WOR will never get out at today’s price; as soon as NKLA’s lockup expires, the shares will crash.” I certainly understand that worry; I believe NKLA is a speculative bubble (though, as an indirect shareholder through WOR, I’d love to be proven wrong!). Still, speculative bubbles can go on for a lot longer than pessimists generally think they can, and lockup expirations often aren’t the thing that causes them to pop. Take a look at Beyond Meat (BYND). People thought that stock’s massive surge post IPO was driven by a limited float, and once the lockup period ended a lot of people expected the stock would get crushed. While the stock did drop a little when the lockup expired late last year (going from ~$105 to ~$90), it was a far cry from the IPO price of $25/share and with the stock currently at ~$140/share it’s clear that the stock was able to handle the lock up expiration. Could NKLA’s stock drop a bit as the float increases and lockups expire? Sure! But my guess is that the massive speculation in NKLA’s stock will provide continued support for the stock through the lockups. Either way, I’m happy to bet on NKLA by getting it for free through WOR.

Per the terms of WOR’s lockup, 5m shares should have become freely tradable in the past week so it’s entirely possible that as this article posts WOR has already monetized >25% of their stake.

WOR will face taxes if they flat out sell their NKLA shares on the open market. Given their cost basis is effectively zero, the tax burden here could be meaningful. I think there are ways to avoid this tax (for example, I believe WOR could do an exchange offer where they give NKLA shares to shareholders in exchange for WOR shares, effectively doing a big share buyback), but for conservatism it might be right to bake in some tax drag here.

Given I believe the market is assigning WOR no value for their NKLA shares, I’d be bummed to pay a big tax bill but I suspect the market would be thrilled to “have” to pay a big tax bill.

I mentioned WOR is a shareholder focused company, with historical share buybacks and the executive chairman owning ~35% of shares outstanding. One other semi-important note on this front: both the new CEO (just promoted from president) and the COO have a massive incentive to get the stock price higher. Each has an enormous slug of restricted stock that only vests if WOR’s share price exceeds $65/share for 90 days before September 2023 (see p. 46). The CEO’s RSUs would be worth ~$12m if he can get the stock price to $65 by then and nothing if he can’t. That provides a big motive for the CEO to do whatever he needs to do to get the stock price over the next few years; the easiest way to push the stock price higher would be to find a tax efficient way to dispose of the NKLA shares and then buyback a boatload of shares with the proceeds, but there are other levers he can pull as well (continued share buybacks; finding ways to make the JV value more clear, etc.). Bottom line: there’s going to be a ton of motivation to get WOR’s stock price higher in the near future.

FWIW there was a small insider purchase by the CFO towards the end of March. The executive chairman (who doubles as a 35%+ shareholder) will also buy shares on the open market every now and then (his last was last summer); again, nothing crazy huge but I do think it’s interesting both to highlight his view of intrinsic value and that the company is focused on shareholders. Put it this way: the exec chair already has huge exposure to the company’s stock given he owns 35% of it. Despite that, he was using cash to buy more on the open market last summer at higher prices than today’s without any idea his company was going to get a >$1B windfall from their NKLA investment. Plenty has changed over the last year, but I would guess he bought because he thought intrinsic value was way higher than the price last summer and, given the lower price and NKLA windfall, it’s hard for me to imagine he wouldn’t continue to see intrinsic value far above today’s price.

WOR’s recently faced a lot of headwinds from steel tarriffs. Going forward, I’d expect that noise to be behind them one way or the other (either because tariffs get overturned, or because at this point the tarriffs effects are baked into their numbers).

Remember that WOR’s Q4’20 included the (likely) peak Covid months (March, April, May). The company chose to raise their quarterly dividend in June; given that they’ve already reported the likely trough quarter and still chose to raise their dividend, I would ventur