Premium Post: Can I offer you a combo special sit / asset play / compounder?

There are a lot of different types of investing that can work. I tend to gravitate more towards asset plays (this company owns $100 worth of assets and trades for $50). Some people like compounders more (companies they think can grow their net worth by 15%+ annually for decades, so even if they pay a “fair” price for the company today over time the compounding effects of wealth will prove the price to be cheap). And special situations are always alluring (companies where specific events or actions in the near future will unlock value).

While I don’t think it would be at the top of the list for any one particular of those three traits, the company I want to discuss today has perhaps the best blend of those three traits of any company I know. It’s an asset play: asset value is significantly higher than today’s share price, and I suspect some of those assets are reasonably undervalued. It’s a compounder: management has a fantastic track record and is very aligned with shareholders; I would feel reasonably confident that if you bought the stock today and tucked it away for 15 years, it would be worth a lot more than today’s price and would have an excellent chance at having beat the indices. And it’s got an interesting set of catalysts on the horizon that could unlock value and push NAV reasonably or significantly higher.

The company? Cannae Holdings (CNNE). (Clip below from their 2019 Annual Report).

CNNE is a holding company lead by Bill Foley. As every company associated with Bill Foley (including CNNE) is quick to point out, Bill Foley is a historically good operator / deal-maker. Foley is best known from Fidelity National Financial (FNF), which he founded in 1984 (he was the CEO through 2007 and still serves as the Chairman of the board). In addition to CNNE and FNF, Foley is involved with a bunch of other things, including a several wineries, golf, and the NHL (he owns the Vegas Knights and brought them into the NHL as an expansion team. The Knights made the Stanley Cup Finals in their first year. Having an expansion team make the Finals in year 1 is a real miracle, and every review of the Knights first season discussed how innovative and strong their game day operations and team chemistry were. That culture starts at the top).

CNNE is structured as a holding company externally managed by Foley and crew. The easiest way to think of CNNE is as a publicly traded LP investment into a Foley private equity fund. That’s probably a good bet to make: as we discussed a bit above and we’ll discuss more later, Foley’s track record is extremely good. The man is a money maker; he’s exactly the type of person you want making private equity type bets for you. The fact we get to do it at a discount through CNNE makes it all the sweeter.

Let’s talk a bit more about the track record at CNNE. The chart below (from the company’s proxy) gives some idea of CNNE’s recent track record of value creation. However, I think the best example is CNNE’s recent deal to buy Dun & Bradstreet (DNB). CNNE and partners entered a deal to buy DNB for ~$7B in late 2018. DNB re-IPO’d in early July, and they’re currently sporting a >$15B valuation. I estimate that CNNE’s equity investment into DNB was a >3x return in less than two years. That’s pretty impressive (particularly given the pandemic happened in between!).

Bottom line here: Foley and crew are serious investors with a great track record. As their holding company for private equity like investments, CNNE would be worth a look just to see what they’re buying / selling. Even if it wasn’t selling below asset value today, Foley and crew will almost certainly find a variety of investments to do over the next few years, and those investments should cause intrinsic value to continue to grow.

Ok, that background should check our first box: CNNE is a (potential) compounder. Even if you bought it at fair value today, I think intrinsic value would grow at a pace that would outclip the market going forward.

Let’s turn to asset value: CNNE trades well below a conservative sum of its parts.

CNNE publishes a sum of their book value every quarter. I’ve pasted the one from their Q2’20 earnings below:

As you can see, at quarter end book value was $34/share, with the majority of book value coming from Ceridian and their holding company cash. However, just after quarter end, DNB IPO’d. At DNB today’s price of ~$25, CNNE’s DNB stake is worth just under $2B versus the $382m it was carried on CNNE’s balance sheet at quarter end. That obviously results in a huge increase in DNB’s book value. If we update CNNE’s DNB investment to market prices (as well as updating their Ceridian and CLGX investment to current market prices), we can see that book value is currently above $51/share versus today’s ~$38 price. I’ve pasted a table with updated value below (note: as part of DNB’s IPO, CNNE invested $200m into DNB at the IPO price. I’ve taken that $200m out of their cash balance below).

I think there are two arguments you could make about the table above: it doesn’t adjust for the management contract, and it doesn’t account for taxes.

Let’s start with the management contract. CNNE is externally managed by Foley and crew, and the external management contract pays 1.5% of invested capital/year plus a share of profits (15% of any profits increasing to 20% once the investment has doubled, subject to an 8% annualized hurdle rate). You probably need to adjust for this contract in two ways:

First, you need to deduct any profit share that will be owed for the big embedded profits in DNB and the other investments; if we ignore the hurdle, I estimate that CNNE currently owes ~$3/share in incentive fees on all their built in gains. The ultimate number will come in a bit lower because we ignored the hurdle rate, but it won’t be much lower. For now, we’ll use a $3/share drag.

Second, you need to adjust for the external management contract. A pile of assets generally deserves to trade at a discount if it has an external management agreement because of those fees. This discount can be adjusted up or down based on the quality of management (i.e. if you had an opportunity to invest in a closed end fund run by Warren Buffett in the 70s, you’d probably pay a premium to asset value just to get your money managed by Warren!). In general, my rule of thumb has been to assign a discount to NAV of ~10x the management fee (i.e. if the annual management fee is 1%, the company deserves to trade at a 10% discount to NAV). There are no perfect publicly traded comps to CNNE (I can’t think of any externally managed holding companies or BDCs that are focused on taking big, concentrated control investments), but if you look across a wide range of BDC’s I think you’ll find that my 10x the annual fee rule is roughly in line with the discount these companies trade at (or maybe even a bit too conservative). Just to chose one example, ARCC has a very similar contract to CNNE; in fact, their contract is probably a bit more generous to the manager than CNNE’s (ARCC gets 1.5% of assets as management fees plus 20% of profits over a 7% hurdle rate). As I write this, ARCC trades for ~90% of NAV, so a slight premium to where my model puts them. Again, just one example, but I think if you look across a wide range you’ll see that my model is a little conservative (and I think CNNE probably deserves less a discount than your average BDC / holdco giving Foley’s track record).

Let’s quickly turn to taxes. CNNE is a holding company, and unfortunately that means they need to pay taxes if they sell shares on the open market. Note that they don’t need to sell shares on the open market to realize value; they could spin off shares they own to shareholders tax free (similar to what IAC did with their low basis MTCH shares), and historically CNNE has done that with some investments. However, recently they’ve been selling Ceridian shares on the open market to generate liquidity, so to be conservative lets assume that’s how they exit investments going forward. If we assume a 21.5% tax rate on their capital gains (similar to what they paid in the first half of 2020), taxes would represent a drag of another ~$3/share.

Anyway, put the two together and CNNE’s NAV currently sits at ~$45 before the management fee discount and we’d target a ~$38 share price after discounting for the management fee, a very slight premium to today’s price.

Note that it’s entirely possible I’m being too conservative hitting CNNE’s net asset value for their management fees, incentive fees, and taxes. I took the slide below from CNNE’s 2019 annual report; note that the share price seemed to closely track CNNE’s intrinsic value ignoring a fee/tax drag. Perhaps the market is just waiting for CNNE to monetize their DNB stake a little more (i.e. prove they can sell some shares around the current levels) before giving the company full credit for their current value, or perhaps even then the market was discounting that DNB was worth a lot more than it was held on CNNE’s books but also that there was a lot of tax / mgmt fee drag.

Bottom line: CNNE trades for a discount to its asset value. Even if we fully hit them for their management contract and taxes owed on their gains, CNNE trades at or slightly below asset value.

Ok, at this point I’ve hit on CNNE’s discount to asset value and why they could be a compounder. Let me now turn to the part of the idea I’m most excited for / I think is the most edgy: the catalysts.

The first catalyst is a looser one: Dun and Bradstreet. A super soft catalyst could be CNNE reporting their Q3’20 NAV with a clean DNB post-IPO NAV. Remember, DNB IPO’d after CNNE’s quarter closed, and marking up their DNB shares to the new value is going to take NAV to ~$50/share (as shown above). Perhaps that number alone represents a catalyst; computer and quant models that currently see CNNE as a $38/share stock versus a $34/share last reported NAV might be buyers once a $50 NAV comes out.

So that’s your soft catalyst. But I think there’s reason to believe that CNNE’s asset value is likely to go up significantly in the short to medium term. This increase in value will most likely be driven by stock price appreciation at DNB, but there are two other call options in the form of successful SPAC deals and a successful CLGX deal that I’ll hit on in a second.

Let’s start with the biggest possible driver of asset value: DNB’s stock going up.

What is that history? I’m particularly thinking of CNNE’s history with Ceridian (CDAY) and its IPO. Let me give some basics:

At March 31, 2018, CNNE’s investment in Ceridian is held at $391m.

On April 26, Ceridian IPOs at $22/share. Cannae doesn’t sell any shares in the IPO; instead, concurrently with the IPO Cannae invests $33.4m into a private placement in Ceridian at the IPO price.

Based on the post-IPO price, Cannae’s stake is now worth $1.22B. Obviously the mark pre-IPO was too conservative!

CDAY’s stock opens around $30/share post IPO. Shares continue to climb through the end of the year. CNNE sells shares for the first time in November 2018 at $36/share; around 4x the price they were marking the stock at in March.

Keep that history in mind as we discuss DNB going public.

As shown above, CNNE holds DNB on their books for $382m at the end of June 2020.

DNB IPOs in early July for $22/share. Concurrently with the IPO, Cannae invests $200m into DNB at ~the IPO price.

Based on the current shares price, CNNE’s DNB stake is now worth almost $2B. Obviously the pre-IPO mark was too conservative.

DNB shares today trade for ~$25. Everything about the DNB IPO mirrors the CDAY IPO a few years ago. If the “mirroring” continues, DNB’s stock is about to go on a big run, and that big run will drive CNNE’s NAV materially higher.

What could cause such a big run? I think the most likely driver is some type of accrettive M&A. Reading DNB’s calls, they’ve been clear that they see a very attractive M&A landscape, and their leverage has been holding them back from getting really aggressive. The IPO puts cash onto their balance sheet and lets them pay down some high cost debt earlier than they otherwise could have. I would not be surprised to see DNB announce an acquisition in the near future, and obviously a very accrettive acquisition could drive shares higher.

Make no mistake- I’m not making any type of call on DNB. I’m just pointing out CNNE’s history with IPO’s suggest DNB is likely to go up in the near to medium term, and given DNB is a major piece of CNNE’s NAV, DNB increasing will drive CNNE higher as well. I view this as a completely free option: as is, we’re buying CNNE at a discount to NAV, and DNB is a major piece of that NAV. I think DNB is reasonably valued at current levels, but I am happy to get the free upside if I’m wrong and the stock races higher.

There are two other catalysts I could see on the horizon for CNNE. Both would likely be much smaller than the upside from DNB’s stock moving higher, but they’re still worth highlighting.

The first is at CoreLogic (CLGX). Cannae and Senator partnered to take an activist position in CoreLogic and make a bid for the whole company over the summer. So far, CoreLogic has been stonewalling the activists. Who knows how this plays out, but in general when a potential acquirer goes activist with a 10%+ position (as Cannae/Senator have), something has to give. Perhaps CoreLogic sells to someone other than CNNE, which would drive CNNE’s asset value higher through appreciation on the CLGX shares. Perhaps CNNE buys CLGX, and in a few months it becomes clear CLGX is DNB 2.0 and their investment is going to be a homerun. Some parts of CLGX would have synergies with DNB, so perhaps the real endgame is using the activist position to get an accrettive acquisition for DNB. Who knows? Either way, something is likely to happen here, and it probably drives CLGX’s share price higher and takes CNNE’s NAV higher too.

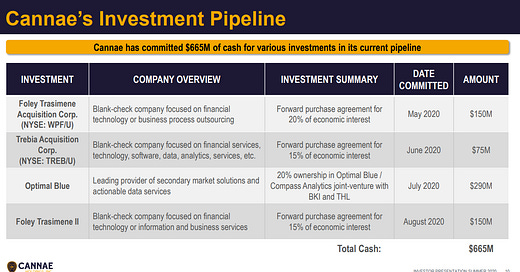

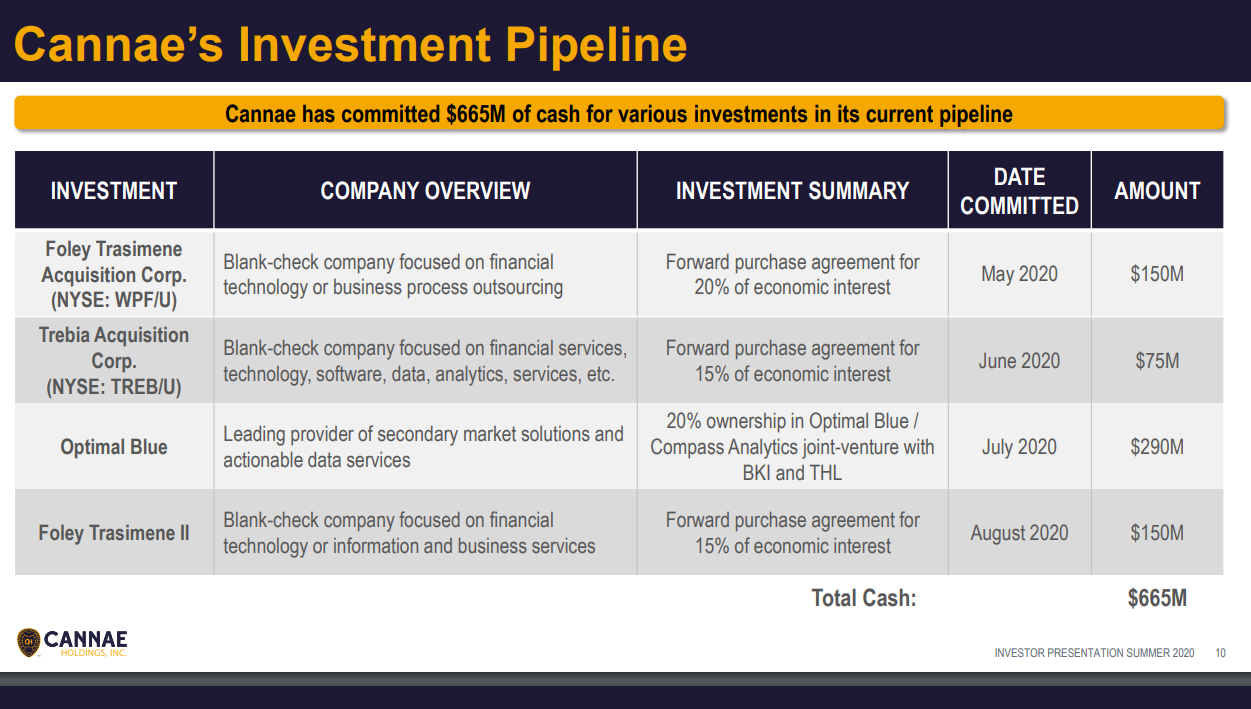

The second is CNNE’s recent investment into SPACs. Foley has done three SPACs recently (WPF, TREB, and BFT; see slide below). CNNE has committed to a forward purchase agreement with each of them when they announce a deal; in addition, CNNE owns a small piece of the founder’s shares for each SPAC. I’ve mentioned a few times how ludicrous the current SPAC bubble is, but I love having a piece of the founder shares through CNNE. By my math, if each of these SPACs announces a successful deal and their stock trades ~flat, CNNE’s founders shares across all three deals will be worth a bit over $50m combined, or less than $1/CNNE share. The real money would get made if any of the SPACs announced a deal and saw their share prices go crazy a la NKLA / SPCE / DKNG. If one of the SPACs announced a deal and saw their share price go to $15/share (which has happened multiple times in the current SPAC market), it would easily create >$100m in value for CNNE’s forward purchase and founders shares.

I’m not saying a SPAC deal that turns into a rocket ship or an accretive CLGX deal is likely. But either is plausible, and if they happen they will increase CNNE’s NAV. Most likely they’ll just be an incremental boost, but the right deal or move could result in a meaningful boost in NAV. Either way, you’ve not paying anything for that call option at today’s prices.

Are there risks? Of course! I think your two biggest risks are portfolio concentration and external management.

Portfolio concentration: About 2/3 of CNNE’s NAV comes from their investment in DNB and CDAY, so obviously any big issues at either of those companies would be a negative.

External management: CNNE is externally managed, and external management creates some strange incentives. The management contract calls for fees of 1.5%/year of invested capital and a profit share once investments reach an 8% hurdle rate. That contract creates the incentive for the manager to grow CNNE as large as possible, even if it’s not in shareholders best interest, and to only go for investments that will exceed 8%/year, even if there are better / less risky investments to be made (i.e. an external manager would prefer an extremely risk investment that could return 9% to a riskless investment that would return 7%).

The former point (portfolio concentration) is a more pressing concern in the short term and will likely always be there in some form (as I expect CNNE will always be taking big, concentrated bets), but the later point (External management) is the bigger concern over the long run. "Show me the incentives and I’ll show you the outcomes,” and the incentives of an externally managed firm are to grow as big as possible to maximize the management fee stream.

With that in mind, it’s interesting that Cannae has done two equity offerings in the past year: one for ~$210m in December in the low $30s/share and one for ~$400m in June in the mid to high $30s. Pessimists could look at those two deals and point to them as proof that CNNE is looking to grow their equity base. That’s certainly possible; however, I do see some promising signs in the offering. In particular, the insider participation in the offerings is interesting. In the December offering, insiders bought 84.2k of the 6.5m shares offered (~1% of the offering; total price <$3m). In the June offering, insiders bought 500k of the 11m shares offered (~4.5% of shares offered; total price ~$18m). That’s a huge increase in participation in the June offering. My guess is that insiders stepped up their participation in the June offering because they saw the stock as undervalued and wanted to buy more to participate in capital appreciation, not because they were most concerned with maximizing management fees. (Note also that the CEO bought another 5k shares on the open market a few days ago).

So yes, the external contract is a concern. But insiders seem to be signaling that they think the stock is undervalued and that they want to make their money through share price appreciation, not management fees. Insider ownership is also pretty strong here: insider own ~7% of the company, and FNF (which Foley founded and still chairs) owns another ~7%. Again, that’s not to say that they won’t abuse the external contract, but so far they seem to favor making money through CNNE’s stock appreciating and collecting incentive fees on good deals, not management fees. And if that were to change, I doubt they would be investing tens of millions of dollars into participating in CNNE share offerings as they did in June.

Just to wrap this up, CNNE is an absolutely unique blend of an asset play inside of a compounder with some special situation components. If someone told me they were buying it because they thought the next six months would see positive news on the DNB front + some accrettive deals in their SPACs, that would make sense to me. If someone told me they were buying shares and throwing them in a coffee can for the next 10-20 years based on Foley’s track record, that would make sense to me too. To have that combination inside of the same company / stock is special.