Quickie Idea: one more preferred opportunity: $NYMT prefs

I've mentioned a few times that I think there are some interesting opportunities in the preferred space right now. I even gave an example with BPYPP (which is up ~50% since I posted it, and of course I wasn't long!). Today I wanted to highlight another of the opportunities I'm looking at: NYMT's prefs. There are four classes of these (NYMTP, NYMTO (prospectus here), NYMTN, NYMTM). Speaking of four, before I dive in.... four disclosures:

This is very much still a work in progress (I always say I'm going to do more work in progress articles, and I've even tried starting a quickie idea series!), and there are a lot of different moving parts that I'm looking at. A huge reason I wanted to post this is the hope that smart people will check my work and tell me if they see areas I'm off.

Given this is still a work in progress (and the general volatility in the financing markets), these are a bit higher risk / reward than most of the stuff I post.

I have a very small position in some of these prefs

This post is going to get a bit deep into some accounting nuances. The biggest one is that companies often need to consolidate VIEs even if the VIEs liabilities are non-recourse to the holdco. A lot of this post will be trying to look through that consolidation to get a clean glimpse of the holding company. I think I've done a good job explaining all the adjustments to get there, but unfortunately I'm aiming to write an investment post, not an accounting treaty, here, so I'm going to go through these adjustments quickly and trust you can back into them with proper disclosures and references.

Ok, that out the way, let's get to it. NYMT is a REIT focused on mortgage assets. They rely on repo to finance a bit of their book. Similar to just about everyone else with repo agreements, they started getting margin calls earlier this month. On March 23, they announced they wouldn't continue to meet their margin calls, and this morning they announced they were engaged in forbearance agreements relating to their margin calls. Pretty standard stuff for REITs these days. So why am I so interested in them? Three interconnected reasons

NYMT did two equity raises so far this year (~$200m in January and $306m in February).

Obviously they had that money and still couldn't meet margin calls. Still, that money probably puts them in a better place than peers.

The announcement this morning included a line that estimated book value has declined by 33% from YE through March 27th.

The company could be completely lying or using some fancy marks with no basis in reality. But, if they're telling the truth, that would imply common shareholders still have equity here and that there's still a substantial equity cushion for prefs

The prefs are trading for <40% of face valu (all series are trading at or below ~$10/share versus $25/share par value)

That price implies a huge level of distress.... and yes, the company is distressed. But if you believe the company's book value estimates, there'a s pretty big equity cushion here and these prefs should eventually be money good (assuming marks don't get materially worse from here)

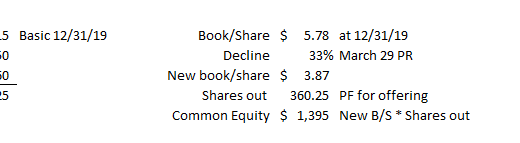

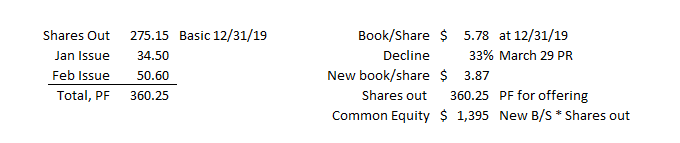

How much of an equity cushion would be behind the prefs? Well, the March 30 release estimated book value had dropped 33% YTD. Book was $5.78/share at 12/31/19; a 33% drop would take it to ~$3.87/share. The company had 275m basic shares outstanding, and they issued~85m shares in the Jan. and Feb. offerings. Post raise, basic shares out would be ~360m, which would imply a total common equity of ~$1.4B (360m shares out * $3.87/share book). That's a pretty large equity cushion versus ~$520m of preferred stock outstanding. You can see the math and stuff in the tables below.

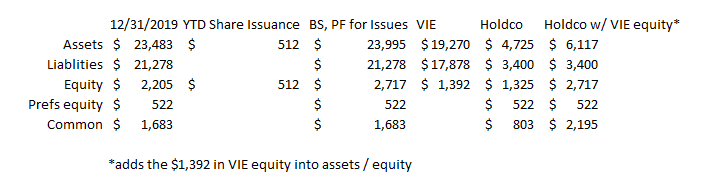

That's the simplest way to think about it. But let's dig a bit deeper. NYMT's financials are pretty complicated because they consolidate some VIE's even though the liabilities of the VIE's are non-recourse to the holding company. In addition, the balance sheet is more than a bit stale, as it doesn't include all of the equity capital the company has raised so far this year (and, of course, doesn't incorporate the negative marks for any of their assets, though we'll need to ignore that for now). Below, I've tried to update the company's balance sheet to just get down to what the holding company looks like. I've done this by adding $512m in assets/equity from the YTD equity raises, and then substracting the VIE assets and liabilities that are consolidated on their balance sheet (see the footnote on F-5 of their 10-k). That leaves us with $4.7B of assets and $3.4B in liabilities at the holdco; however, the $1.4B of VIE equity is an asset of the holdco'ing company, so the last column adds that VIE equity back to the holdco's asset / equity balance. Either way, you can see there's a decent equity cushion at the holding company level.

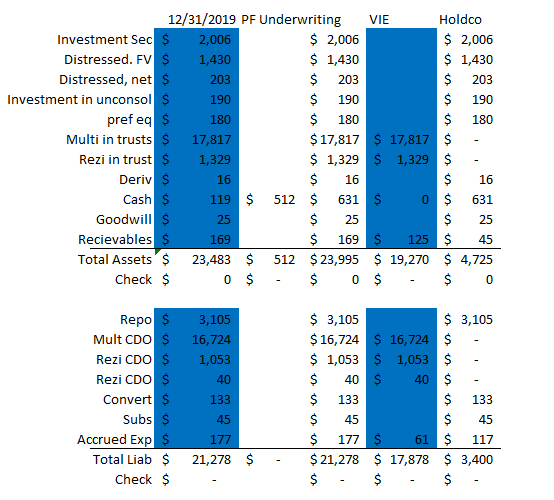

Ok, I know that was a lot of math / accounting. Hopefully you followed along. The bottom line is that the holding company isn't as levered as the consolidated balance would make it look, and there appears to be a substantial equity cushion here using 12/31/19 marks. Of course, the marks are the issue: obviously just about everything has been demolished. The question is what the marks look like. Let's try to figure it out. Below I've created a bit more of a detailed balance sheet for the holding company. For now, I'm only looking at the holding company ignoring any equity in the VIEs. All of the numbers I've gotten are from the 10-k; I'm sure you can recreate them if you spend some time in there (actually, there's a table on p. 51 of the 10-k that tracks very closely to this one, but because it includes equity in the VIEs and because I wanted a table to build off of as I haircut things later, I chose to use my own rather than use theirs).

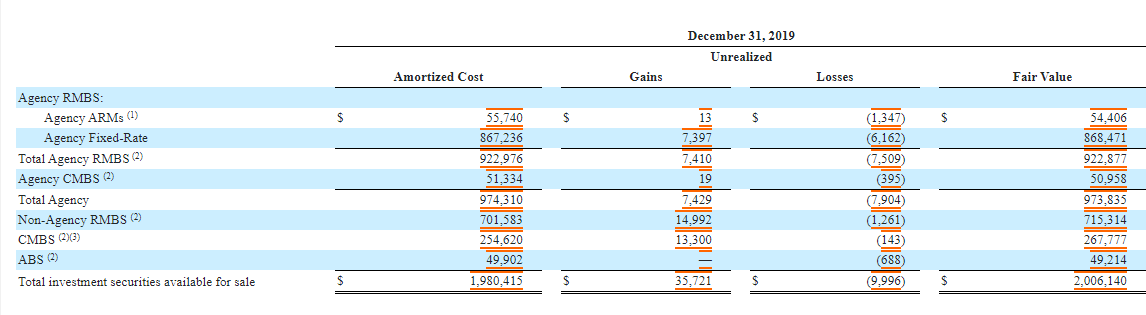

It looks like the major assets at the holdco are $2B of investment securities and ~$1.6B of distressed assets, as well as cash (mainly from the equity raises). So what are those assets. Well, p. F-26 of the 10-k walks us through the investment securities... and the news there is pretty positive! I've included the table below.

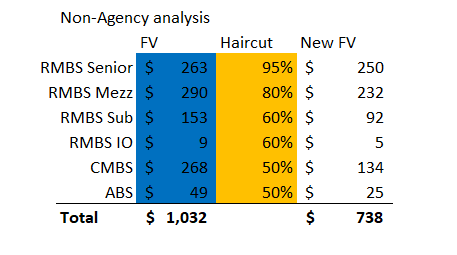

Almost $1B of the value comes from agency backed securities. That's really good. Agency securities are guaranteed by the U.S. government; that should retain their value really, really well. I'm going to assume those are still worth roughly par. The other half of the portfolio (the Non-agency RMBS, CMBS, and ABS) are much more difficult to value. If you look at p. 69 of the 10-k, you can see these run on the riskier end of the spectrum: about 55% of the fair value here are at the mezz level, with ~30% at senior (higher) level and ~20% at the subordinated (lower) level. I've recreated the values from p. 69 in the blue shaded cells of the table below; in orange, I've made some assumptions on the mark to market for where they would be trading right now. It's entirely possible these value are off; I've based them on my best guess but again, there's not tons of info on the market or what the specifically own. I would guess the bast majority of these end up being worth far more than I'm marking them at, but that's a discussion for another day.

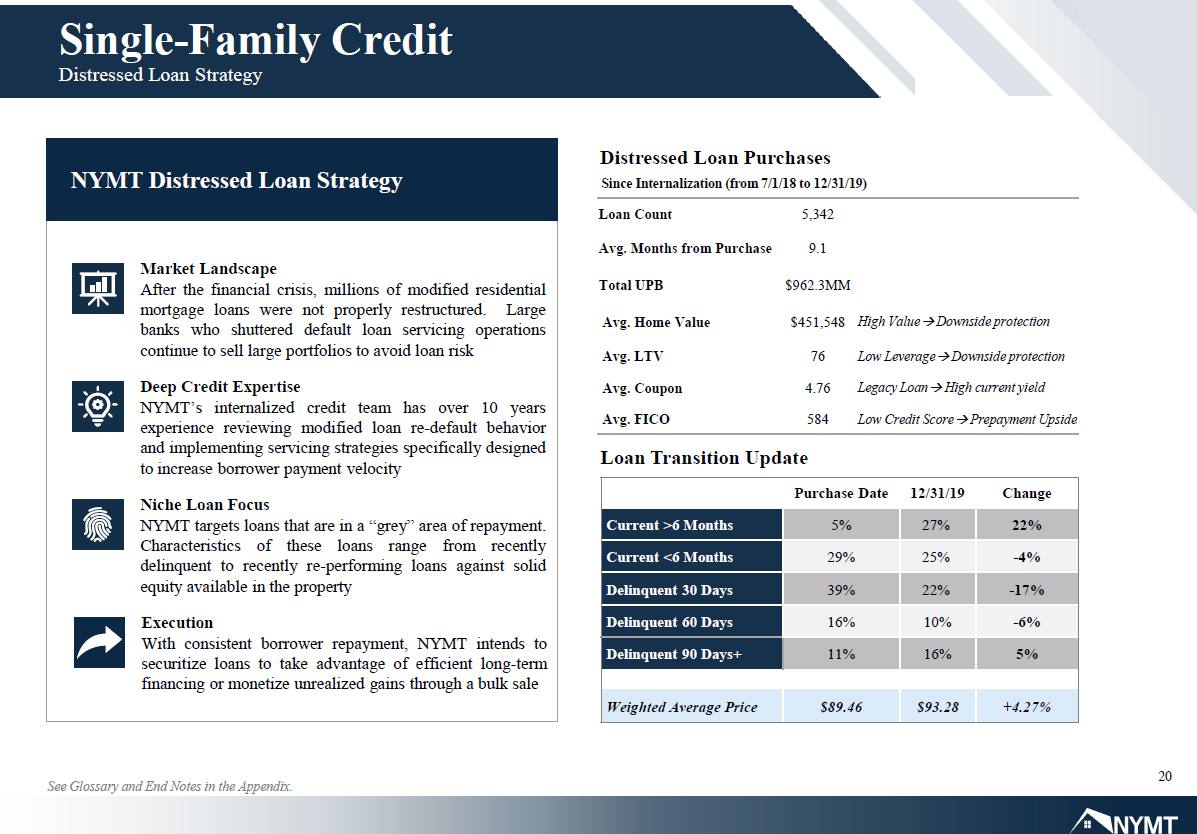

It's worth noting that the majority of these issues are pretty recent; p. 42 of the 10-k notes ~2/3 of the non-agency RMBS, ~1/3 of the CMBS, and 100% of the ABS were purchased in 2019. While that does mean the marks are fresher, that's probably a slight net negative (they were acquired in a much better environment than today, and they've had less time to season). Anyway, using those marks, the investments category would have lost ~$300m in value since their last quarter ($1,032 less $738m from table above). The next things we'd need to look at are the company's distressed residential mortgage loans (the $1,430 and $203 asset lines on the balance sheet above; similar to the non-agency stuff, ~half of these were acquired in 2019 so the marks are reasonably fresh on these). I've included a slide from the company's Q4'19 earnings slides below which shows some info on what the company does on the distressed side, but basically they're buying loans on single family homes that are exhibiting some credit issues at a discount to par and trying to make a profit. They do that by trying to acquire the loans at reasonable LTVs (creating a significant equity cushion) and a few other things (for example, their Q4'19 call mentioned that a lot of these loans are pre-financial crisis, and that deferring / capitalizing a few payments can often make a huge difference for the borrower and given the low LTV makes a lot of sense for them as lenders too).

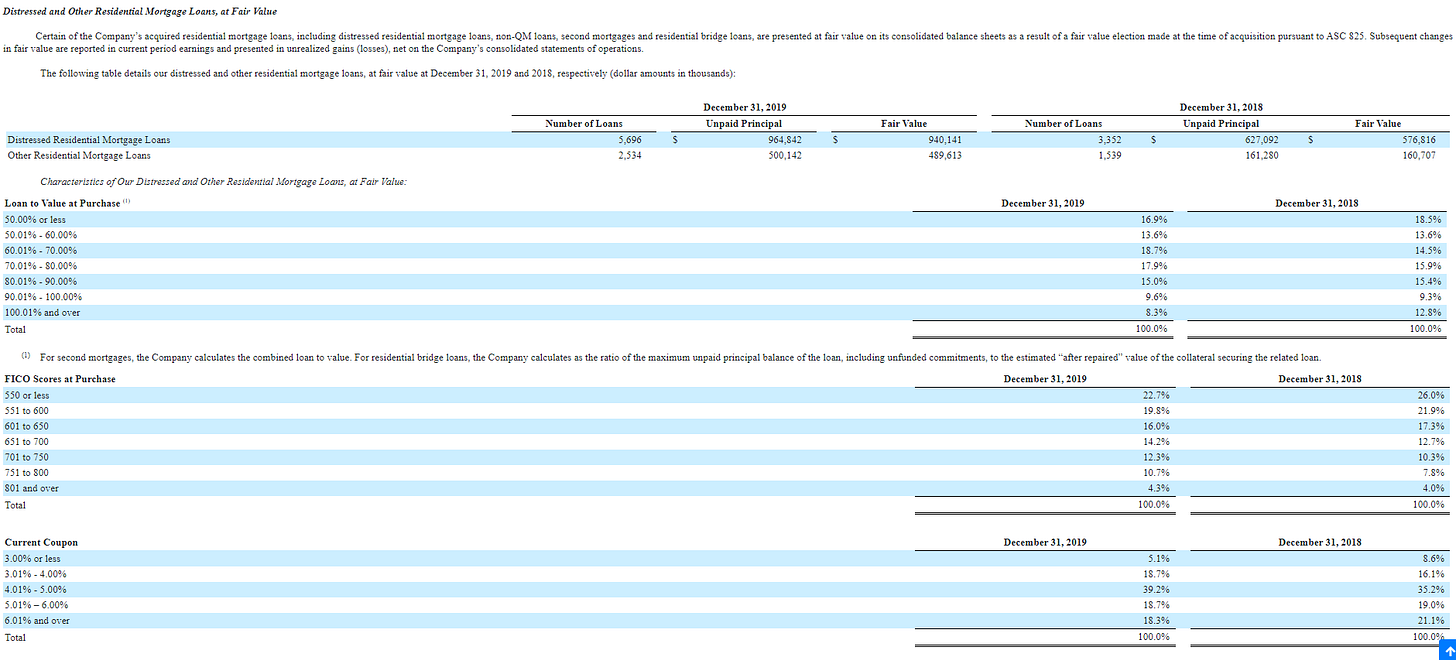

P. 77 of their 10-k gives more info on the distressed loan line item. I've pasted the table below (and note that it's probably a little misleading to call this whole bucket distressed loans; a decent chunk falls into the "other" category, which encompasses a wide variety of loans but I believe includes a large amount of "scratch and dent / GSE kick-out loans (loans that were made intending to get government backs but got rejected because of a loan origination dent).

Anyway, it's tough to estimate exactly how far the value of the distressed loan bucket has fallen. Again, I'm sure the mark to market if pretty poor, but it'd be surprising if they took mamoth haircuts on huge pieces of these. ~65% of the have LTVs <80%; for those to take losses, you'd be implying primary homes have fallen in value by 20%. So I'm not 100% sure how to mark these. I'm guessing anything with an LTV <70% is pretty solid. 70-80% is more questionable, and over 80% is likely to get whacked. I put in the numbers from the 10-k with some different assumptions below. It's a little bit fun with numbers, and it doesn't adjust for any mark to market issues they have in meeting repo / margin issues, but I do think the haircuts will likely prove way too conservative on my part. Anyway, the analysis assumes that the distressed portfolio is worth ~64% of face value today, knocking another ~$600m off of NYMT's equity value.

The last major area we need to look at is the company's cash. Cash is cash, so it should normally be valued at par. However, the company was aiming to deploy this pretty quickly (their Q4'19 call mentioned within 3-4 months), and any investments they made between year end and now have probably lost a decent bit of value. I assume that they'd deployed ~$150m of cash before they started preserving liquidity, and those investments have lost ~20% of their value. So I'm haircutting their cash by $30m. Not a huge move, but figure it helps be a little more conservative. There are two others smaller items that probably need to be adjusted: the investment in unconsolidated entities and the preferred equity lines (the $190m and $180m lines from my table). You can find more info on both of these on ~p. F-35 of NYMT's 10-k, but basically the unconsolidated lines are minority equity pieces of multifamily buildings. There's not a lot of info on the preferred line, but p. 75 of the 10-k notes its mainly preferred equity in multifamily buildings representing the ~70-90% tranches of the value stack. I'm not sure how to mark either of these: the multifamily buildings in the unconolidated piece appear to be up and running pretty successfully (a summary income statement is on p. F-38). I'm just placeholder haircutting them at 50% of their last mark; tough to say if that's too conservative or not enough, but these are smaller in the grand scheme of thing so I'm fine with it. Ok, putting all those investments together, I've got an updated holdco balance sheet below.

That's pretty interesting, as it leaves ~$230m in equity left over ($3.63B in equity less $3.4B in liabilites). Yes, this was a little bit garbage in / garbage out as I made a lot of assumptions in building out the balance sheet, but I feel like I erred on the conservative side with the asusmptions. Note that this model also ignores the equity that the holdco owns in the VIEs (basically, assumes all the VIEs are zero), which again is probably too conservative (the VIEs are mainly their consolidated K-Series (government sponsored multi-family loans) and SLST (government sponsored residential loans); I'm still trying to figure these out, but it seems likely there's some equity value there). NYMT has ~$522m in face value of preferreds outstanding. If the above balance sheet is right (again, it's not, but bear with me), the common would be a zero but there would be $230m of equity for the preferreds, which would put their recovery at.... ~43% ($230 / $522), a bit higher than the market is currently trading them at. Anyway, I think I'm going to wrap it up here with a quick summary. I think there's the potential for opportunity here: the preferred markets are in panic, and in ~a month the company went from raising equity at a premium to book value to getting margin called and cutting their dividends (which likely results in forced sellers of the preferreds). I'm still working on the different line items, but even haircutting the VIEs to zero (super aggressive) and applying some pretty aggressive marks to the rest of the book results in recovery for the prefs higher than the current trading price. And the company just put out a press release implying the common equity / book value is way, way higher than I estimated above. If they're even close to right, the prefs are covered in full and then some. Are there risks here? Absolutely. The prefs are perpetual, so you're counting on dividends getting turned back on at some point (or the company getting acquired and force redeeming the prefs). The pref docs are pretty wide, so the company could lever up as a hail mary to get value back for the common. It could turn out my marks on the books weren't conservative enough, or that the company's margin calls were worse than I thought and they fire sold all of their assets at the absolute bottom. All are possible (I think your biggest risk is the super fire sale risk, as I think my marks are likely to be too conservative if you can hold all these assets through the crisis / to maturity). But as a spec position with a lot of upside, I think this is pretty interesting. I'd love to hear if you've done work on the company and have a different view.