Quickie idea: $UWMC squeezing higher post-deSPACing

This post is another in a series I do on an irregular basis. A “quickie” idea is an investment specific idea that I’ve been mulling over and find interesting, but haven’t dove fully into yet. The hope is to provide the jumping off point for a discussion of an idea I find extremely interesting right now, as I suspect the opportunity could be fleeting.

The idea? Buy United Wholesale (UWMC) (formerly Gores Holdings IV, GHIV) before a bunch of index funds are forced to add it and create a possible "index squeeze" driving the stock price higher.

This idea is a little different than the type I normally post or even think about, so keep that in mind. But it's a good and interesting trade in a company I'm tracking, so I figured I'd flag it.

I originally posted the idea to buy-write Gores Holding (GHIV) into their deal close on YAV premium in early December (you can see the case study of the idea here). So I've been following the company pretty closely over the past month. While I've been following it, basically every SPAC has been absolutely ripping higher, driven by a combination of retail speculation, short covering, and other strange dynamics.

As I've watched all of that play out, I had a "eureka" moment: the Gores Holdings / United Wholesale deal was a almost surgically designed to take advantage of technicals like index inclusion and forced buying. There's a chance we see a huge squeeze in it over the next few months (now might be a good time to provide my disclaimer: nothing on here is investing advice. I am long UWMC / GHIV, but in reasonable size. Please do your own diligence and know that betting on a squeeze is speculation, not investing).

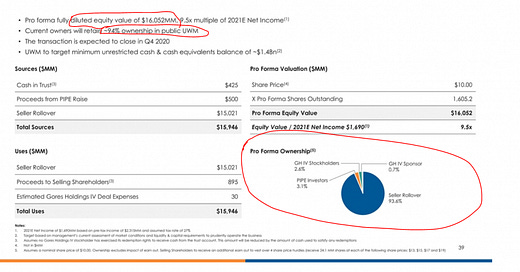

Why do I think a squeeze could happen? Take a look at the slide below (from Gores merger announcement deck); I've gone ahead and circled three things to draw your eyes to them.

United Wholesale is going public through Gores at a $16B+ market cap (actually closer to $20B given where the stock is currently trading) with ~6% of their shares in the free float. This is the largest SPAC deal in history.

Why does that matter?

Because it's the perfect set up to get added to indices. For example, the Russell indices require 5% of a company's stock to be in the free float before it can get added to a Russell / FTSE index (see the free float restrictions PDF).

So UWMC will be eligible for index inclusion in several major indices almost the moment this deal goes through. It will almost certainly get added to the Russell indices (including the Russell 2000). It is already large enough to qualify for the S&P 500; while its free float means that it won't get added in the near term, over the medium term (once some more shares hit the free float) S&P inclusion is certainly a possibility.

On top of having the size for index inclusion, the company has already announced their intention to pay a regular dividend immediately once the deal goes through.

And Gores / United will be coming public with mammoth momentum; the dividend announcement notes Q3'20 was the "best quarter in the company’s 34 year history," and Q4'20 and Q1'21 are likely to be just as strong given continued record low interest rates, the booming housing market ("it has never been this easy to sell homes"), and continued spikes in mortgage refi demand. Despite that momentum, at their current price UWMC is trading for just 11x P/E.

Just to summarize everything above, UWMC is a SPAC coming public in the hottest market for post-SPAC companies we've ever seen (where SPACs routinely rip up 10%+ for no other reason than they are a SPAC or a former SPAC). They're coming public in the best mortgage environment in their company's more than three decades history and at a value multiple (low double digit P/E). In addition, they're coming public with a tight float yet they'll be eligible to get added to a variety of major indices. In fact, given their multiple, their market cap, and their dividend yield (>3% at current prices), I would guess a lot of mutual funds tied to benchmarks are going to be begging the indexes to add Gores / United so that they can buy it.

Put the combination together and you have the potential for a squeeze higher. Again, UWMC is coming public with only ~6% of their float (~$1B) in the free float. Once you factor in the sponsor shares and the PIPE, the actual trading amount of shares available is even lower for the near future (probably closer to $500m shares tradeable). If and when Gores starts getting added to indices, there is going to be a lot of forced buying into a very small amount of available shares. Shares could rocket higher given that dynamic.

Here's where it gets really fun though: even if shares rocket higher, I think investors will be able to talk themselves into the company being reasonably valued. Yes, there's significant concern that the current mortgage / home buying boom is simply pulling forward a lot of future demand, but that's an industry wide concern, not a UWMC specific concern. And UWMC is coming public at a discount to peers. Rocket Financial (RKT) is probably Gores' best peer; Gores would need to trade for ~$15/share to trade at a similar multiple to RKT. If you're a value or dividend fund manager and UWMC gets added to an index and trades up a little bit (say, to $14/share), are you going to sit on your hands waiting for a pullback? Or are you going to see a company with insane operating momentum that still trades at a discount to peers and has an almost 3% dividend yield whose stock will likely have a ton of buying pressure behind it in the near future as the float clears up and it gets added to more and more indices and dividend funds? I'd guess you're going to see the later, and you're going to buy first and ask questions later.

Anyway, UWMC is a little bit of a different idea than I normally write / think about. But it's interesting, and I like the fact that you're able to buy it at a value multiple (~3% dividend yield, low double digit P/E) while getting the upside of it participating in a speculative mania or a bunch of index inclusions. It's a value play on a euphoric environment. I like that combo, and I think it's worth speculating a little.

Chuck Prince famously said that "as long as the music is playing, you've got to get up and dance" right before the housing bubble blew up. Right now, there's a mania in SPAC companies. At some point, that music will stop, and things will get complicated for a lot of SPACs and former SPACs. But while the music's playing, there are probably worse things in the world than "dancing" in UWMC given its value multiple, operating momentum, and near term index inclusion.

PS- I included the chart below in my original GHIV write up, but I figured I'd update it because it's helpful for framing the idea. UWMC / GHIV is actually Gores' 5th SPAC; below is the performance of all five SPACs so far. Performance so far has been excellent; I think you could easily argue that Gores is the best non-Chamath SPAC sponsor. I highlight this just so you know who you're betting on with UWMC; their history shows they are real sponsors that make winning deals. Given everything discussed above, I expect UWMC will fall into that "winning deals" camp.