I’ve always known markets could get crazy. Tail risks / black swan events are out there, and unexpected things can happen to markets / companies all the time.

But, if I look back over the past ~18 months, the #1 lesson I’ve learned is that markets can get much, much crazier than you can dream of. I never imagined a downside scenario like COVID (basically causing the economy to halt for several months, with all in-person / live activities out of the question for over a year). And I never imagined an upside scenario like the current meme-stock craze. Yes, I was aware manias and short squeezes could happen. But those are generally short lived things. AMC, GME, and the rest of the memes have now sustained elevated share prices for almost half a year. That’s not how these type of squeezes are supposed to work; they’re supposed to be quick pops followed by a quick drop back to reality.

I’m a big believer that crazy market events generally create asymmetric opportunities for investors willing to think creatively. So, when meme stocks went crazy the first time in late January, I thought you could create a really interesting trade by selling deep, deep out of the money Gamestop puts to take advantage of the insane volatility. When the SPAC market was absolutely on fire, I thought buying the “picks and shovels” that benefitted from the SPAC boom was intriguing (that link is behind a paywall, sorry!). And when the SPAC market busted, I liked buying SPACs with good sponsors or with potentially buzzy targets below trust value.

Anyway, the point I’m trying to drive home is that these manias often have interesting / advantaged trades if you’re willing to think creatively about the structure (and, while nothing on here is investing advice, I will emphasize that selling naked calls on meme stocks is not an advantaged trade. It’s a really good way to get your face ripped off in a squeeze up. Options are extremely risky, and naked calls are exponentially risky. Please be cautious / careful / use common sense).

Over the past week, we’ve seen the return of the meme craze. AMC has 5x’d in less than three weeks, and GME is somehow back over $300. They’ve been joined by all the traditional meme stocks as well as some new ones like Wendy’s (WEN) and Clover (CLOV).

I’ll take a second to one last time remind you that options are very risky and nothing on here is investing advice. That said, I think selling deep out of the money CLOV puts represent a particularly interesting way to take advantage of the current mania.

Just to give some background, I’ve talked about CLOV several times. In late December, I thought buy-writing their stock into their deal meeting was an interesting trade (they were still a SPAC trading as IPOC at the time). And I’ve constantly mentioned how they went public without disclosing a DOJ investigation and I can’t believe no one is getting investigated for that.

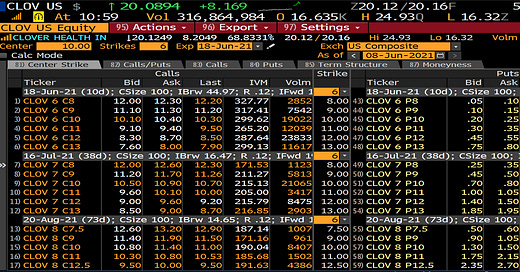

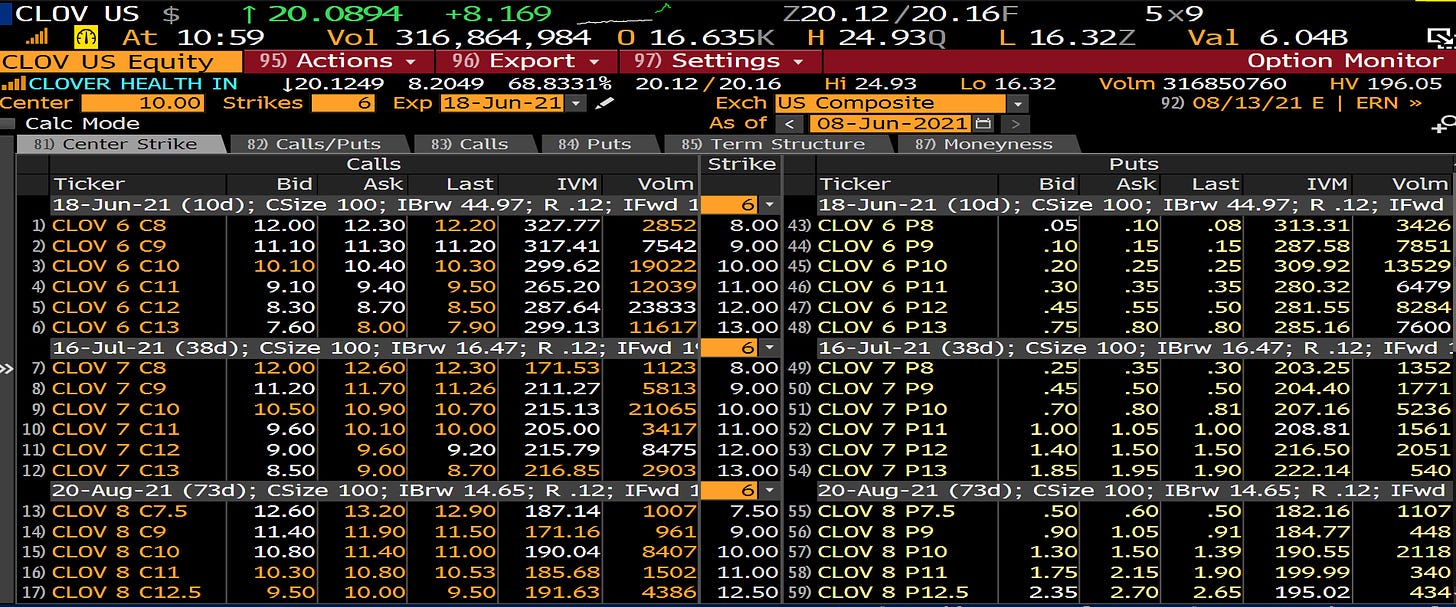

But that background probably isn’t too important at this point. What’s important is CLOV is getting squeezed, and the volatility on this thing is unbelievable. I’ve screenshotted an image of their options chain as I write this below.

That’s pretty wild. The stock is at ~$20 and someone is willing to pay $0.50/share to buy the August $7.50 puts.

I don’t love CLOV’s business, but I think selling that put an interesting trade for a few reasons.

Before CLOV turned into a meme stock, it was trading for ~$7/share; the lowest it had traded since coming public. Buy-writing the $7.50 for that price basically means your cost basis if the put is exercised to you is at those lows. Obviously, stocks can trade far, far through their lows, but I just highlight that to show that selling this puts takes you to the price before the stock got meme’d.

CLOV literally just deSPAC’d earlier this year. Their balance sheet is pristine right now; almost $700m in cash (a bit under $2/share) against basically no debt and limited liabilities (see balance sheet screenshot below). AMC and GME are both meme stocks, and they’ve used their share price to raise a boatload of cash to survive….. but without that, they were quite distressed. CLOV is not distressed; even without raising money, they’ve got a long, long runway before their financial position would be a concern.

(Most important point) Any meme stock can turn their deep out of the money puts effectively worthless by just taking advantage of their high share price and raising a ton of cash. If a company has limited debt and their stock is at $20, you sell a put at $5, and the next day the company doubles their share count by issuing stock at $15….. well, in order to trade down to your put price, the company would have to trade for less than their net cash balance post equity raise. Can that happen? Sure, anything can happen in these markets!!!…. but it’s really, really unlikely a company is going to go from a meme darling to trading for less than net cash. And, while the Pied Piper of SPACs is certainly controversial, he knows how to use euphoria in the stock markets to his companies’ advantage (remember, CLOV came public through IPOC, so Chamath is very involved here). I think it’s highly, highly likely CLOV will take advantage of their elevated share price in some way to raise cash, which would instantly make these puts worth dramatically less / dramatically less likely to be in the money. How could they do that?

The easiest way would be to do a secondary offering of CLOV right now.

Alternatively, CLOV could take advantage of the insane volatility on their stock and sell convertible preferreds; the extra cash on the balance sheet would cushion the downside for the whole company, while convertible players trying to hedge their notes could create some short interest that creates further short squeeze / meme opportunities for CLOV.

However, the most likely and probably most logical way to do this would be for CLOV to call their warrants. CLOV has ~27.6m public warrants outstanding. They can call the warrants if their share price holds >$18/share for ~20 days. Alternatively, they can call them at any time by offering to redeem them according to the table below (from ~p. 130 of IPOC’s prospectus). Why does this matter? If CLOV’s stock is >$18/share and they call their warrants, warrant holders are better off exercising their warrants and then selling the stock (i.e. paying $11.50/share to buy a share of stock from CLOV and then selling that share in the open market). An example might show this best: the warrants are struck at $11.50. If the stock is at $21.50 and the company calls it, the warrants would be worth ~$7.77/warrant in an exchange (0.361 * $21.50); alternatively, if you exercised the warrant and immediately sold, a warrant holder would make $10/warrant. So Chamath / CLOV could announce a warrant exchange tonight, and assuming all warrantholders are rational and redeem instead of exchange, the company would instantly raise >$300m from their warrant holders. Note that the timing of calling CLOV’s warrants now would somewhat match up with Chamath’s history; SPCE called their warrants in March 2020, ~6 months after they completed their merger.

Just to wrap this up, I’m not saying this is the great trade in history, but it is an interesting / eventy trade. In small size, I think selling deep out of the money CLOV puts is a great risk reward (but I’m emphasizing small size, not investing advice, and options are risky). With CLOV’s share price screaming higher and so volatile, it behooves them to raise some capital, and any capital raise would likely crush the vol on the stock / make it very unlikely the stock trades below the put strike (and I like that CLOV has warrants outstanding they can convert, a quick capital raise option other meme stocks don’t have). Even without raising capital, given CLOV’s reasonably strong balance sheet thanks to the cash from deSPACing and Chamath’s charm, I doubt the stock is trading below the put strikes before expiration.

Buyer / seller beware, but it’s an interesting set up. I look forward to following up on it in a few months!

Any concern that, instead of the company raising cash, they just let the insiders sell after the July 5th unlock, and you end up getting dumped on?

Pursuant to the Amended and Restated Registration Rights Agreement dated as of January 7, 2021 by and among SCH, Clover Health, the Sponsor, certain former stockholders of Clover and other parties thereto (the “Registration Rights Agreement”) and our amended and restated bylaws, subject to certain exceptions, the Sponsor and the former stockholders of Clover, including our directors, executive officers, principal stockholders and their affiliates, are contractually restricted from selling or transferring any shares of common stock (not including the shares of Clover Health Class A common stock issued in the PIPE Investment pursuant to the terms of the Subscription Agreements) (the “Lock-up Shares”). Such restrictions began at the closing of the Business Combination and will end on the earlier of (i) July 5, 2021 and (ii)(a) for 33.33% of the Lock-up Shares, the date on which the last reported sale price of our Class A common stock equals or exceeds $12.50 per share for any 20 trading days within any 30-trading day period commencing at least 31 days after the closing and (b) for an additional 50% of the Lock-up Shares, the date on which the last reported sale price of Class A common stock equals or exceeds $15.00 per share for any 20 trading days within any 30-trading day period commencing at least 31 days after the closing.

https://www.sec.gov/Archives/edgar/data/1801170/000119312521007853/d91397ds1.htm

If the company called the warrants based on the FMV table do warrant holders have the option to exercise for cash or are they forced into cashless exercise?