Some things and ideas: February 2019

Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month. Monthly value theory ponderings: comparing intrinsic value discounts across levered companies

A new series I'm thinking about doing; every month in my monthly links section I'm going to post thoughts on a "value investing theory" thing that I've been thinking about

This month's theory thing: comparing valuation across two companies with different leverage

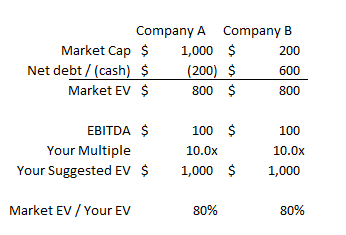

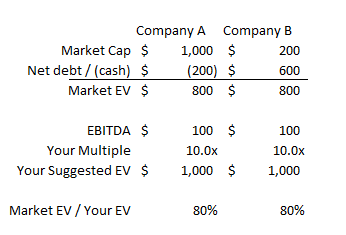

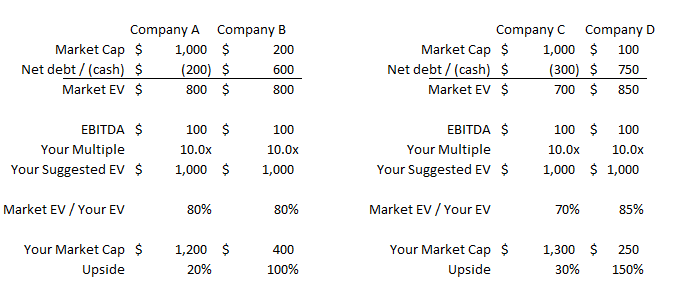

Let's take two companies: company A and company B. The companies are near perfect peers: same industry, same relative size, same management team talent. Both earn $100/year in EBITDA, and you think both are worth ~10x EBITDA. So the EV of each company should be worth $1,000. The companies only have two things different about them:

Company A has $200 in net cash, while company B has $600 in net debt

Company A has a market cap of $1,000, while company B has a market cap of $200.

So, on an EV basis, the market is valuing both companies at ~$800 versus your valuation of ~$1,000. The chart below might help illustrate that:

Despite both companies being undervalued very similarly on an enterprise basis, on a market basis they are undervalued very differently. Based on that math, Company A's market cap should be $1,200, so share have ~20% upside. On the other hand, company B's market cap should be $400, so shares have ~100% upside.

You can make the results even more extreme so that the less levered company (Company A) is more undervalued on an enterprise basis but so that company B still is way more undervalued on a market cap basis given its high leverage. For example, in the right hand side of the chart I've introduced two new companies: company C and company D. Company C is basically company A with more cash on their balance sheet, while company D is company B with more of their equity shifted to debt. The result is company D's stock has way more upside despite being substantially less undervalued on an enterprise basis than Company C.

Everything so far here is very academic (it's basically fun with spreadsheets / investment banking 101), but I do think it presents interesting dilemmas for investors: would it be better to buy Company D because its more undervalued on an equity basis? Or should you buy company C because your margin of safety is so much higher there (if it turns out the companies are only worth 8x EBITDA, company C would still be slightly undervalued while company D would be quite overvalued)?

Is there an argument for using portfolio margin here? Most investors don't want to use portfolio margin for a lot of (rather good) reasons (namely mark to market risk). But if you went 110% long a portfolio consisting of 10 companies identical to company C, wouldn't that be less risky than being 100% long a portfolio consisting of 10 company Ds? Is there a way to structure a portfolio that's net long by going long Company C and short Company D that creates less overall risk? Or would that simply increase the risk given company D's leverage and undervaluation could rip your face off on the upside?

Obviously portfolio margin carries mark to market risk. What about increasing leverage by buying a stake in Company C using an in the money call option? Doing that exposes you to timing risk, but it also increases your upside and allows you to leverage company C a bit / invest in the company that you think is cheaper while increasing your upside. It appears Pershing Square / Ackman structure a lot of their positions by doing something similar (for example, here's their 13-D on CMG; see ex-99.2 for trading data), though part of the reason for him using options could also be a need to quickly buy a lot of shares before his stake becomes public / moves the market.

There's risk to both of those strategies (buying in the money options or using margin), and obviously nothing here is financial advice / I don't recommend any of those strategies (nor do I generally use either of them). But it is interesting to think about those strategies. Perhaps this is just a personal problem, but I'm generally attracted to businesses with strong cash flows and pretty pristine balance sheets, and it can be frustrating that management team's aren't willing to get a bit more aggressive with those balance sheets. Perhaps that's for the best / let's them take advantage of markets when markets are really weak and shakier peers are desperate for financing, but there's a chance it's simply suboptimal and applying some type of external leverage to them could greatly improve overall portfolio returns.

I don't know the right answer to any of these questions. A lot of it seems to come down to gut feel, and obviously no two companies are perfectly alike. But I think the answer and implications to this leverage question are fascinating, and to a large extent it determines what you're interested in and invested in.

For example, I spend a lot of time in the cable industry, and to some extent a lot of the questions between the major three cable players over the past year has come down to your views on leverage. Altice was/is the cheapest if you're simply looking at a free cash flow to equity basis. Charter (disclosure: long through the Liberty structure) is a bit more expensive on an equity basis than Altice, but it was a bit less levered so it was a bit cheaper if you were looking on a enterprise basis (assuming you normalized for their integration costs). Comcast was by far the cheapest on an enterprise basis, but it also had by far the least leverage so it was probably the most expensive on an equity basis (this is all a bit of a simplification, Charter had the integration "issues" and Comcast required a view on NBC's value and the Sky deal, but overall this is directionally correct). I'd see tons of arguments for Altice that basically pointed to free cash flow to equity or for Comcast that pointed to how cheap it was on an EV / EBITDA basis, but it was pretty rare to see anyone attempt to bridge the two.

Or, looking more broadly, I frequently see the argument "Google is cheap because its P/E is 20x if you look through the cash". That's probably right.... but that "look through the cash" is a big argument! 15-20% of Google's market cap consists of that huge cash balance, and it doesn't seem like Google intends to give that cash back to investors at any point in the near future. Is looking straight through that cash to a P/E basis the best way to value Google? Google's still reasonably cheap on an EV / EBITDA basis, but given that huge cash balance if you value it on an EV / EBITDA basis and start looking at the effects of a one turn lift in EBITDA multiple, it doesn't do a ton for the stock (i.e. just pulling numbers from Bloomberg, Google is valued at a bit over 11x forward EBITDA. If you took that to 13x, you're talking about a bit over a 10% move in the share price even though you've boosted their multiple by almost 20%).

Cable follow ups

Speaking of cable, some quick follow ups from my recent post on Charter (CHTR; disclosure: long) in the wake of Q4 earnings.

Comcast and Charter were both at Morgan Stanley's TMT conference recently. Some highlights

On why 5G / fixed wireless broadband isn't a threat / is more of an opportunity for cable (Comcast, Charter, and even Altice)

Charter dunking on AT&T; expects future growth opportunities from cable

Sports media update: A core tenant of the monthly update: continued highlights of the increasing value of sports rights (mainly because of my love of MSG (disclosure: Long)).

Rams Coach McVay- at 33- Fits Easily on the Gridiron or in the C-Suite (and a more in-depth WSJ article on the McVay hiring)

Ok, not quite sports media, and a bit of a puff piece. But I like how the team looked at the data point for young coaches (they either are superstars or flame out and become a joke for a lifetime) and decided to take a shot.

MSG says the Knicks are not for sale. It's a good time to invest in sports either way.

Sealed court documents show Clippers plans for Inglewood arena had discreet beginning

Will sports betting transform how games are watched and even played?

Other things I liked

We didn't see this coming (Gates Foundation Annual Letter)

Hollywood is now irrelevant (Interview with IAC Chairman Barry Diller; disclosure: long)

Cramer interview with Joey Levin (IAC CEO; disclosure: long)

Blackrock's $12B bid to become a private equity giant is behind schedule

Fortnite is the future, but probably not for the reasons you think

HBO made Sunday Night a Showcase. It wants the Same on Monday

Includes this anecdote that shows how quickly our viewing habits are changing; Insane!

Locast, a free App Streaming Network TV, would love to get sued

The World Record Instagram Egg Is Going to Make Someone Very Rich

Gaming goes mainstream (podcast; very interesting interview with $ATVI CEO)

WeightWatchers blames Keto for earnings miss; calls it a meme.