$CHTR earnings were nice.... but it's still way too cheap

I'm happy to do work on (and possibly invest in) just about anything, and I think the stuff I post on this blog reflects that "openness". Microcap pharma company after a failed phase II? Check. Airline loyalty company after it's lost its airline? Why not? Hairy take-unders where the majority controller is screwing / stealing from minorities? Not once, but twice! So I really am willing to look at anything.... but the majority of my time is spent thinking about and looking at two specific (and somewhat connected) sectors / ideas: sports media (mainly driven by my investment in MSG (disclosure: long)) and cable stocks (disclosure: long CHTR through the Liberty complex, and long a much smaller position in Comcast too)). And this blog can at time reflect that focus: my monthly links posts are generally dominated by sports media and telecom links, and I'd guess about one third of my posts are related to sports media or cable in some way. Why do I mention that focus? I tried not to write anything about Charter's Q4 earnings. I really did. But last night I was going back through their Q4 earnings call and I had such a clear vision of a post that I really just couldn't help it... I had to write a post on my thoughts on Charter's earnings. I'm sorry. Charter's Q4 earnings were good. The stock was up ~20%. At this point you're probably thinking that this post is all about me spiking the football on Charter's stock going up and that I'm a complete ass-hat. But you're wrong. Well, you're wrong about the spiking the football part. It's completely possible I am an ass-hat. This post is not about me spiking the football on Charter's stock going up for one day. Far from it. In fact, if you zoom out just one year, you'd note that, despite the recent nice share price performance, Charter's stock is still down a decent bit over the past year.

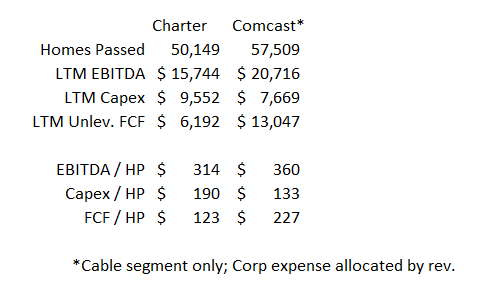

So this post isn't about me spiking the football on Charter's stock price move. Instead, I wanted to use this post to highlight one thing (I can't say it's a fact, but it's my strongly held opinion): Q4'18 marked the turning point in Charter, and the small recent share price recovery is just the beginning. That's a bit more emphatic / sales-y than I generally like to write, but I find people tend to anchor on recent share price moves and the natural feeling from people is to say "o shoot, I missed it!" after a stock has a big post earnings move, so I wanted to use the strong wording and the past year's share price move to try to overcome that natural price anchoring for anyone who might be interested in Charter but feeling some anchoring related inertia. Why do I think Q4'18 marked the turning point for Charter? Simple. For most Charter bulls, the bulk of the Charter thesis has rested on one simple belief: that once Charter put their merger integration behind them, they would largely be able to close the margin and capex gap between them and their closest peer, Comcast. That "close the gap" thesis was the crux of my August update on Charter. In that post, I posted this Charter versus Comcast comparison chart:

Over time, I argued that Charter would be able to close the gap on both their EBITDA and Capex per homes passed, so their free cash flow would go up massively. My guess was that, by 2021, Charter would have been able to close most of the "Comcast gap." Which brings us to their 2018 earnings: Charter is forecasting capex to fall from $8.9B in 2018 to $7B in 2019. In the table below, I've recreated the "Charter versus Comcast" table from my August 2018 post with their updated LTM (FY2018) numbers. In addition, I've added a third column on the right that shows what Charter looks like on their 2019 capex guidance.

(Some small housekeeping notes on the table above: Comcast's capex has increased since my last table because I previously excluded cable software capex from their cable capex but have since started including it. I included Charter's wireless capex numbers in their 2018 capex numbers, but it's not in Comcast's LTM numbers or Charter's 2019 forecast. At $242m in 2018, it's a very small number, so not worth nitpicking)

Look at the capex / HP for Charter's 2019 estimate. What makes Charter's 2018 earnings / 2019 capex guidance so good is that they're forecasting closing the entire capex gap with Comcast in one year.... that's insane! I was pretty bullish on Charter and I thought it would take them another ~two years to close that gap. Charter's also noting that their 2019 capex number continues to include significant integration investments, so it's possible capex could drop even further going forward (driving even high FCF). With the Comcast capex gap closed, Charter's free cash flow generation is going to be insane. EBITDA will almost certainly grow in 2019 (we'll address that in a second), but the capex boost alone will take Charter's unlevered free cash flow from 2018's <$7B to >$9B in 2019. Charter doesn't pay taxes currently, and annual cash interest expense currently runs at ~$3.9B. So free cash flow to equity for 2019 will be over $5B in 2019 before any growth in EBITDA. That's a big "before". Growth in EBITDA drops straight through to growth in FCF to equity, and Charter is forecasting EBITDA growth accelerating from 2018's ~6.5% growth. If Charter simply grows EBITDA at 2018's levels, EBITDA would grow from ~$16b to $17.1B, and equity free cash flow would be over $6.2B (that's ~$27/share, just to give you an idea of per share numbers). In addition, Charter has committed to maintaining 4.0-4.5x leverage, so growing their EBITDA by more than $1B will result in >$4B in incremental debt raise that they can return to equity; in total, Charter could easily return more than $10B in capital ($6B in FCF to equity plus $4B in incremental debt) to shareholders in 2019. Charter's history suggests all of that capital will be returned to shareholders through share repurchases. At today's share price of ~$337, Charter's current market cap is ~$78B; with >$10B to return to shareholders, it's almost a given that Charter will repurchase more than 10% of their shares in 2019. That's the simple argument for Charter. At today's share price, the company is trading for ~12.5x free cash flow to equity, and that free cash flow per share should be growing rapidly given aggressive share repurchases and continued EBITDA growth. Yes, at some point in the future they'll have to pay taxes, so maybe it's not completely fair to judge them on today's free cash flow, but still.... however you cut it, Charter is a high quality, non-cyclical company trading for a pretty cheap multiple. But I actually think there's more to the story. Remember, the argument for Charter was that they'd close the gap with Comcast on both their capex spend and their EBITDA. And everything we've talked about so far only factors in what happens with "normal" EBITDA growth now that Charter's capex gap has closed. Charter's management expects EBITDA growth to accelerate now that the integration is behind them / that there's no reason margins can't approach peers over time. I agree. And that's why I think the recent share price recovery is just the beginning for Charter. The market seems to have (partly) adjusted for Charter closing the capex gap with Comcast. It doesn't seem to have given them any credit for closing the EBITDA gap. As 2019 progresses, it will become increasingly clear that the EBITDA gap is starting to close as well. The EBITDA growth will drive free cash flow even higher than the numbers presented above, as well as even more incremental debt capacity. Most likely, all of that incremental cash flow / borrowing capacity will be applied to share repurchases, which will drive free cash flow per share even higher. By the end of 2019, I think the market will have woken up to the EBITDA gap starting close. Charter's share count will be way lower than today's, and the remaining shares will be worth much more. I'm not in the prediction business, but my guess is shares start with a "$4" before the end of the year and at some point in 2020 they'll start with a "$5". Again, that's bolder than I normally write. But it's fun to be bold, and when the market gives you something as mispriced as Charter is currently it's both fun to be bold and potentially lucrative (I'll take a second to remind you that nothing on this blog is investment advice and I am very long Charter). Yes, maybe I'm wrong and the market doesn't recognize Charter's value in the time frame I laid out above. But here's the great thing about Charter: if the market doesn't recognize that value, the cash flow is still there, and a lower share price just means Charter can buy back more shares. So maybe I'm wrong and shares never start with a "$4" this year.... but the lower price means more share repurchases, which means a higher free cash flow per share in later years / makes my prediction of a price starting with a "$5" in 2020 even more likely. So, yes, the recent share price move was nice. But it's just the beginning for Charter. Cash flow per share is about to explode, and, one way or the other, shares are going higher over time. PS- I didn't mention Charter's wireless venture much in here. I remain a huge cable / wireless bull and think it will create substantial value, but it's kind of a sideshow to the free cash flow dynamics I laid out above. PPS- I've long been skeptical of fixed wireless (particularly Verizon's current effort), so I generally agree with everything in this article. Worth reading to catch up on fixed broadband (or you can just catch this quote from Charter's earnings call).