Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month.

My monthly overview

I'm going to start putting this piece in at the start of every month. I just want to highlight two things

I do four things publicly: this blog / substack (the free side), the premium side of this blog, my podcast (Spotify, iTunes, or YouTube), and my twitter account. You can see my vision for the podcast here, and my vision for the blog and premium site here. If you like the blog / free site, I'd encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

I try to be as helpful as humanly possible to anyone whose research / writing I enjoy. In almost every post I do, you'll notice I link to other subscription services or investors who I like. I don't get referral fees or anything for that; these are almost always organic links and highlights that I do not because I was asked to but because one of my goals with the (very small) platform I have is to shine light on other people who are doing good work.

If you're launching a subscription service, or a new blog, or you're an investor who has done some really good research and wants to get some more eyeballs on it, please drop me a line and let me know. If the quality is there, I would love to link to your blog post or subscription service or research (and if the quality isn't there, I'm happy to provide feedback! I have done so with several services and I think my advice is good/appreciated/helpful!), and I'd love to have you on the podcast to talk about all of it. I can't promise anything, but most podcast guests / people I've linked to have been very happy about the reception / feedback they've gotten (I've even been called the king of the sub bumps, and I've generally heard from investors with LPs who come on the podcast that they're delighted by the response). My DMs are always open, so feel free to slide into them if I can be helpful!

SPACs SPACs SPACs

The SPAC market continues to evolve in really interesting ways. I’d say it’s pretty clear we’re in a SPAC bear market right now; the vast majority of SPACs are trading below trust, and ~9 out of 10 SPACs continue to trade below trust even after they announce deals and as they approach their deal dates (I’m saying that based on my gut, not hard data; if someone has hard data to share on that I’d be happy to see it!). I’ve been saying for months that there would be a few babies thrown out with the bathwater in SPACs, and I’m starting to see some signs of interesting opportunities given just how shelled out the market is. In particular, deSPACings (when the SPAC successfully completes their merger) have been leading to big pops for what I would consider some of the more real / better SPACs recently. That is a pretty weird trend; I think it exists because people are waiting till the business combination happens to buy the stock / waiting for the stock to trade under the “right” ticker (or maybe because they’re size limited until the deal closes), but it’s really weird because the stock loses its put once the deal goes through and that put has a lot of value. In a perfectly rational world, it seems like the deal going through should lead to the stock dropping a percent or two just because you lose that put option that could be really valuable in a tail scenario (i.e. if you’re deSPACing with a company that owns a ton of Hawaiian real estate, even if it’s an incredible deal done at a great valuation that put option would be really valuable if a volcano exploded and destroyed Hawaii! Same for an earthquake and a California company, or even just an unexpected pandemic that shuts the world down while you’re waiting for the deal to close!) Anyway, a few examples of SPACs jumping post deSPACing this month:

OWL traded below trust for months heading into their deal. The deal completed earlier this month, and suddenly shares were a rocket ship.

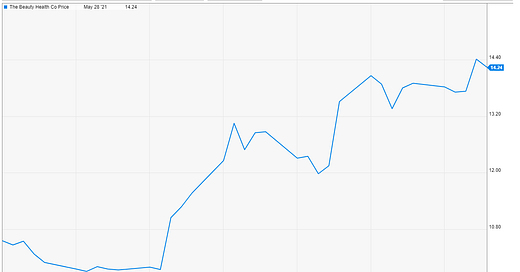

Similarly, SKIN was trading well below trust for several weeks before completing their deSPAC in early May; the stock is up ~40% since.

One company that could be setting up similarly? FRX. Last week, they announced their proxy was effective and they’ll hold their meeting to merge with Beachbody on June 24. In response, shares traded above trust for the first time in weeks. I could see Beachbody becoming a buzzy name on a bunch of fronts (fun ticker! P90X! Shaq is on the board!), so I wouldn’t be surprised to see this one run a little as the deal closes.

SPAC King Chamath Palihapitiya is Doing fine, even as the bubble begins to burst

For startup leaders, SPACs have lost their allure

The buzz has died down a little now, but at the SPAC market peak you would hear tons of rumors that sponsors were just searching for basically any company they could merge with and didn't really care about valuation or doing due diligence on the company (for example, I mentioned how insane the Lucid / CCIV deal timeline was, and the typos in their deck didn't do them any favors!).

So there's plenty of juicy stories in there. But I thought the really interesting thing was startups avoiding SPACs that are >6 months old. There were ~300 SPACs that IPO'd in Q1'21 (compared to 248 SPAC IPOs in all of 2020 and just 59 in 2019!), and that wave of SPACs is rapidly approaching the 6 month mark. If the word gets around that the "best" companies and start ups are avoiding older SPACs, we could see some pretty fierce bidding wars or strange deals announced as we approach the 6 month mark. I continue to think a lot of the SPACs that don't have deals announced right now are going to be forced to liquidate unless the SPAC environment heats up again; sponsors are going to be very aware of the liquidation odds and desperate to announce (and close!) a deal while their window is still open.

ALTU, Aerion, and the deal that almost was

I highlight that deal because I think it speaks to tons of things about the SPAC space. At the height of the SPAC mania back in February, SPACs were just desperate to announce buzzy deals, and they were taking tons of companies public that barely qualified as operating companies. Aerion would have qualified; if the SPAC window had remained open a few more weeks, that deal probably would have gotten announced and it would be public with a multi-billion dollar market cap right now. Instead, the mania died, and now Aerion's shut down. There are plenty of similar businesses that did get their deal through before the SPAC window closed, and I suspect over the next few years we'll see those companies burn tons of cash and eventually fold (or be sold for scraps) when it becomes clear that the businesses were more sizzle than steak.

I enjoyed how listeners with Diamond Hands responded to Ackman's pleas not to buy short term options

Speaking of PSTH, if you listen to that interview and what Ackman said at their annual meeting, there’s a decent chance we see a PSTH deal in the very near future. I’m finishing this post up on Memorial Day, and the day after long weekends is a popular time for deal announcements, so it’s possible that we have a deal announced before the digital ink on this article is even dry.

I’ve written up PSTH quite a bit, but I continue to follow them closely because I think the options are dramatically mispriced (not investing advice! options are incredibly risky!). Given that, I’ve been thinking a lot about what companies PSTH might be targeting. I might do an article in the next day or three on this, but I think the key topic in that WSJ interview is that they’re trying to solve some type of problem for the seller. That leads me to believe they are either pursuing a corporate carve out (i.e. buying JNJ’s consumer health division) or buying a big partnership (i.e. buying McKinsey, which is currently a partnership owned by all of its partners). In either scenario, the structuring of the deal would be hugely important to minimize the tax burden on the sellers, and that structuring issue could be what’s holding up the deal.

The list of companies that could fit that “difficult structuring” requirement are enormous, though it does rule out some of the more obvious / popular candidates for PSTH’s targets (Chick-Fil-A, Subway, Bloomberg, Starlink all would not qualify). The three targets that I’ve never heard anyone mention that could all fit that bill and would make some sense are Bain Capital (remember, Bill said he was buying some of the publicly traded private equity players at the height of the pandemic crisis last year), Cox Cable (controlled by the Cox family, and they have tons of other assets; there would be interesting tax and split off considerations to consider if he was only getting the cable side), or one of the major consulting firms (McKinsey, Bain Consulting, BCG; you could use similar logic on some of the major accounting firms). I think the consulting / tax firms are significantly less likely than the Cox / Bain Capital, but just thought it was interesting and worth mentioning! (And, by the way, all are probably wrong; again, the list of targets is enormous!)

If you listen to the interview, Bill reveals his new stake in Domino’s and mentions that he’s never had a bad investment in the food space. Given his first SPAC took Burger King public, a deal in the food space could make sense…. but given the issues that have created >6 months of talks on structure, it couldn’t be a typical deal. Perhaps some type of carve out that lets a food company split into a brand and operator would make sense? Just to use an easy example, Chipotle currently owns and operates all of their stores; PSTH could provide a huge amount of capital to let Chipotle split into a franchisor / franchisee model and split the operations from the brands. I don’t think Chipotle would do that, but you could get pretty creative with that type of idea. Could he buy the international operations of some major food chain? Buy a huge real estate portfolio from a restaurant chain that still owns a bunch of real estate? IDK, just spitballing, but the idea has occurred to me.

Speaking of real estate, one other deal type that would fit the “complicated structuring” criteria: Bill has done a lot in real estate over the years (the GGP bankruptcy, HHC, etc.). Maybe he’s looking into buying a stake in a major real estate empire, and there are significant tax considerations and change in control provisions on the property level debt to consider and work through?

One other note while I’m here: given that there seem to be some type of complications on the seller’s end, there have to be a boatload of lawyers, tax advisors, and bankers involved with whatever deal PSTH is working on. If they’ve been working on this since November, I am shocked the deal hasn’t leaked given that combo. I will be very, very interested to see what the target is and how they kept the deal talks quiet!

Podcasts

I launched the Yet Another Value Podcast in August 2020 and provided a longer piece on my vision for the podcast at the start of 2021. They've been a blast so far. You can follow on Spotify, iTunes, or YouTube (and please be sure to subscribe and rate them if you enjoy them!). This month's pods:

I said it last month and I’ll say it again this month: I went a little podcast crazy this month! I don’t have any new podcasts lined up for the near future; I’m working on reaching out to get some new names, but in the meantime if you have a company / guest you’d like to hear on the podcast, I’d love some suggestions!

The Business Brew: Jeremy Raper and Aaron Edelheit

I’m very much biased because I consider all three friends, but I really enjoyed Bill’s recent podcasts with Jeremy Raper and Aaron Edelheit. Seriously, if you had to list my “online friends” who I have man crushes on, all three of them would be right at the top of my list (Mike from Nongaap would be up there too; I mention this because I think Jeremy sometimes gets jealous of Mike when I mention him in conversations!).

Let me give you a little pitch on all three of them.

Starting with Bill: I've been on his podcast and he's been on mine. I think he's got a real skill as an interviewer; I've mentioned this before, but one of the reasons I evolved my podcast to focus only on discussing stocks is because I listened to Bill's pod and realized I couldn't compete with him at interviewing guests. So anytime he interviews someone I like, it's a must listen for me. Plus, he's a great guy. I met him in person at a conference recently, and it was just a real delight all around. So, right off the bat, you know you’re in good hands with your host for these interviews!

Let's turn to Jeremy. While we disagree on the seriousness of getting attacked by people who can shut lasers out of their eyes (Jeremy is absolutely wrong here), Jeremy is absolutely one of the smartest investors I know so I can forgive him for his flaws (though I am still working on uncancelling him for the time he proposed launching "Raper as a service"). Seriously though, Jeremy is incredible; you probably know that given I’ve had him on my podcast four times! Just to drive that point home a little harder: him and I had a call last month and I felt awful because he was just pitching one quirky / off the wall idea after another at me and I felt like everything I was pitching / looking at was much more vanilla and plain by comparison. I don't say that lightly; there are maybe three investors in the world who I talk to consistently and say, "damn, they are just on another level than me when it comes to quirky idea generation" and Jeremy is at the absolute top of that list. And the man will absolutely never pay for a drink anytime I’m around him again; some of the best investments I’ve ever made have come from Jeremy or from digging into a rabbit hole that Jeremy pushed me to check out.

Finally, let me turn to Aaron. He just came on my podcast, so you can listen to me gush about him there, but I really respect and admire him (and it will very much show in that podcast!). Again, my interactions with him have been limited, but I feel like I know him given how open he can be in interviews / his writing and how much I enjoyed his book (The Hard Break).

Want to know how much I enjoyed the book? I’ve started taking a Hard Break on Saturdays! I set my phone to “brick” all day Saturday (the only things that work are the phone, text, and map functions) and I turn my computer off; I’ve only done it twice so far. It is a little difficult to do since my default for downtime is generally to work and I constantly find myself reaching to check Twitter or something, but so far I’ve really enjoyed it and I’ve found the extra time to think and mellow out has gotten the creative juices flowing and I’ve come back Sunday with just tons of stuff to research and/or write about.

Anyway, I’m clearly biased, but I enjoy all three of them and I thought both interviews were great. Recommend!

Other things I liked

Barry Diller's System of Discovery

Both of the past two links are from Neckar's notes. It's a reasonably new substack but it has some of the best writing I've read this year. Highly recommend!

No particular link here. But if you're into quirky smallcaps and off the run international champions, Alluvial is obviously a must follow!

Roblox Queen MeganPlays is making millions with a blocky digital empire

Ochtahedron Capital on Peloton

Peloton: the antidote to laziness (seriously, Blind Squirreel is unbelievable. I recommend it with the most effusive of praise! Know who else recommends it effusively? Peloton's founder/CEO!)

Full Faber / Malone interview (focused on Discovery / Warner)

DISCA has been a disaster since deal announcement, but I think it's a huge opportunity. Malone sounds just as bullish as I am.

Want an example of how subscale NBC is? Look no further than Comcast's own advertisements for Xfinity!

Who is David Zaslav (WaPo profile of DISCA's CEO)

I'll tell you who he is. A man with an unreal pay package; I'd guess he's a billionaire off this pay package alone.

Exxon (XOM) wasting money showing me ads to vote for their board in the NYT

Thanks for sharing that man :)

Hi Andrew! You say that PSTH options are dramatically mispriced. You mean underpriced or overpriced? (ofc not investing advice, just your thoughts)