Some things and ideas: November 2018

Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month.

“Facebook’s got a big job cleaning it up”: Former board member Donald Graham

Really enjoyed this interview with Donald Graham on Facebook.

Around the five-minute mark, he makes an interesting point. I’m paraphrasing a bit here, but he says something along the lines of “any regulation will slow Facebook / Google down dramatically and probably impair their future significantly. Facebook / Amazon / Google have been doing well for a while and there’s a tendency to view them as permeant, but business changes (mentions IBM example). Washington D.C. is the city where nothing happens; maybe politicians can pull themselves together to regulate the companies but I would bet against it.”

I’m in agreement with most of his points there.

In general, I think the major tech companies are pretty cheap right now, but I think buying them now (and for the past few years) is to some extent a bet against regulation. It’s interesting to view the tech stocks in that light; it explains a lot about their share prices. For example, it’s tough to argue Facebook isn’t cheap right now: it trades at maybe 10-11x EBITDA and is growing >20% annually with continued upside as they monetize some of the “untapped” parts of their empire (Whatsapp, Messenger, etc.). But the stock price today isn’t reflecting some fear of a near term slow down; the reason it’s so cheap is every incremental news story seems to increase the chance Facebook is subject to dramatic regulation that demolishes their future.

The counter is (as Don Graham says) that Washington is the city where nothing happen, and the tech lobby would likely band together to fight any regulation against Facebook (if they can come for Facebook, they can come for Google, Apple, etc.). Today’s Facebook share price seems to be pricing in a pretty high chance that the company faces onerous regulation; it seems the market may be too pessimistic.

PS- Don Graham seemed really sharp in this interview. He retired as CEO from Graham Holdings a few years ago to let his son-in-law takeover; the move seemed a bit premature (though he was ~70 so maybe it was normal succession planning). Anyone know why he retired when he still seems so sharp?

Follow up from Liberty Day / “world of John malone” interview

A quick follow up from the world of John Malone interview / Liberty Day (you can find my initial thoughts here)

One thing that jumped out at me was Malone’s line on Liberty Global (LBTYA; disclosure: Long). The article quotes Malone saying “Would I buy the stock here? Probably not.” That’s a borderline shocking quote, as over the past several years Liberty Global has pursued a very aggressive share repurchase plan, and the company continues to tout the line that their stock is very cheap and they want to retire as many shares as they can at these prices. Given Malone is the controlling shareholder and chairman at Liberty Global, it’s really strange to hear him say something that runs counter to the major crux of their capital allocation strategy of furiously buying back shares.

Maybe you can explain this away by saying Malone thinks the stock is cheap if the Vodafone deal closes, so he meant he wouldn’t buy without that deal closing. But I’d still say that runs very counter to the strategy Global has been running: they’ve bought back shares at (much) higher prices in 2017 (i.e. not too distant of the past, but before the VOD deal was announced).

Just to show how counter Malone’s quote runs to Liberty Global’s “party line”, here are some quotes from LBTYA’s Q3’18 investor call. You can find similar quotes from nearly every earnings call / company presentation over the past several years.

“I think it's fair to say that, given where we are today and given the implied fundamental value we see in our stock, clearly, we would look at that. I mean, when we do the sum of the parts, folks, when we look at the implied multiples based on the close, these are screening buys.”

“Like many of you perhaps, we are puzzled, certainly not pleased, with our stock price today. By our estimate, we're trading somewhere in the mid-single digits, if you assume completion of the Vodafone transaction.”

More Liberty while we’re on the subject

Retail foot traffic / Death of Malls / Amazon’s holiday sales

I’ve mentioned “the death of Malls” a few times on this blog.

This article contained some interesting stuff to think about with that. It noted mall foot traffic was up 4.1% YoY, but there was a real divergence between high end A-malls (up 6.1%) versus lower end malls (up 1.9%).

There’s also some really interesting data on the value of Prime member to Amazon and Amazon’s sales trends

Prime members spending on Amazon increases 16% annually in the first four years after enrollment

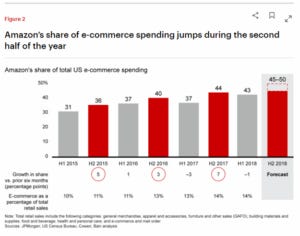

Amazon's share of e-commerce tends to remain flat in the first half of the year; they tend to make all their share gains in the second half of the year. (I’m not sure how to think about that stat: does Amazon’s convenience lead people to try them more in the holidays and then stick with them throughout the year? Or is something else at play here?

Sports media update: A core tenant of the monthly update: continued highlights of the increasing value of sports rights (mainly because of my love of MSG (disclosure: Long)).

Interview with MLB Commissioner Manfred

Includes some really interesting nuggets: MLB looking at buying the Fox RSNs, expects local contract value to continue to increase,

MLB and Fox agreed to broadcast agreement through ~2028.

Deal jumps annual payment ~36%; includes expanded streaming rights for Fox and new streaming rights for DAZN.

The tactics behind the Athletic’s breakout success in sports subscription

Liberty (disclosure: long lots of Liberty trackers!) could buy Fox RSNs

Altice mentions RSNs as a differentiating factor for video subs (note that MSGN (disclosure: long) is one the RSNs they’re referring to; helps illustrate how the market dynamics for MSGN are much better than most other RSN markets / one reason why I think MSGN deserves a premium multiple versus other RSNs).

Semi-related: here’s DISH on what happened when they dropped Univision. I’ve talked about broadcasters and drops a ton on here; the dynamics DISH talks about are really interesting.

MSGN (disclosure: long) and William Hill enter integrated sponsorship for Devils Broadcasts

Amazon reports H1 numbers for Thursday night football stream

A retiree discovers the joy of being a sports fan

I think an open question for sports teams going forward is if today’s kids have the same passion for sports going forward (both in terms of “depth of passion” and in terms of the percent of kids who are sports fans) given how many alternative things they have pulling for their attention (video games and e-sports the prime competition, but plenty of others). An interesting counter to this is that as a big piece of our population ages / retires, it’s possible that we see their sports passion (and, importantly, sports spend!) increase.

I also wonder if we see sports passion actually increase as people increasingly search for an “identifiers” they can hold on to in a world where what is real and fake increasingly blurs, but that’s probably a bit too meta and deep for this blog!

AT&T’s pay-per-view golf gaffe exposes weakness of online sports

NYT on new TV season ratings (Reboots and Reality sinking; Football up)

Earnings season gold- I love ridiculous questions on earnings calls, and I try to share them whenever I see them. Please feel free to share if you see any and I will include them here.

“The CEO of Canada’s biggest newspaper company getting into a public argument with an American hedge-fund billionaire (Leon Cooperman)”

“FSNN’s stock is down >50% YTD, and analysts at Craig-Hallum are asking them the real hard hitting questions”

Two questions about midterms- with midterms having taken place this month, here are two questions that have been floating in my mind. If you know the answer I would be interested.

Democrats “won” the national vote by ~8% and ended up with ~235 house seats. If the Republicans had won by a similar margin, how many house seats would they be expected to have?

In the ~month leading up to the election, the stock market was down ~5%. Not a crazy huge move but not insignificant. Is there any evidence that short term moves in the stock market leading up to an election impact election results? (Note: I’m talking more about short term moves leading into the election than performance over a year or two. For example, I’d be more interested if a market crash on October 31st would have an impact on an election than the impact of a stock market down 40% over the two years leading up to an election).

Other things I like

How a new breed of media companies is convincing people to pay for news again

How a former Canadian Spy Helps Wall Streets Mavens Think Smarter

Related: Altice CEO: 5G won’t be a threat to cable for an extremely long time.

While we’re talking Alitce… Altice on the potential for the MVNO; why they think their MVNO is better than peers.

Chip and Joanna Gains of “Fixer Upper” to come back with Discovery Deal

T-Swift signs new UMG deal (Wall Street Journal; Billboard)

Popular streaming playlists can boost a song’s revenue by up to $163k

Fictional Hologram Band Tops Real-World Charts After stunning League of Legends Show

Amazon Studios Pacts with Blumhouse for 8 Thematically-Connected Movies