Talking my obsessions #1: Peloton's recall $PTON

I love writing this blog. There are tons of great things about writing a free blog that is read by literally dozens of value investors, but the best thing about writing a blog without any oversight or editor or agenda is that I can write about whatever is obsessing me at the moment (though the legions of groupies are a close second in the "best things about writing a narrowly trafficked value blog"). So, if SPACs or cruise lines are obsessing me, I can mention them in multiple articles every week without fear of repercussions. After all, what's the worst that could happen; my readership goes from dozens to a singular dozen?

Anyway, this week I wanted to take advantage of my writing freedom and write about two of my obsessions: Peloton and Twitter. Today, I'm going to tackle Peloton, and I'll turn to Twitter tomorrow. I'll note that I'm passionate about Peloton, and I stayed up pretty late writing this; that combo tends to lead to a little bit of rambling on my part, so if you're not interested in Peloton feel free to pass on this post!

Anyway, the reason I'm writing about Peloton is obvious: I mentioned in my March links and ideas that I wanted to have a better FTP score than Rory McIlroy, and I finally crossed that barrier.

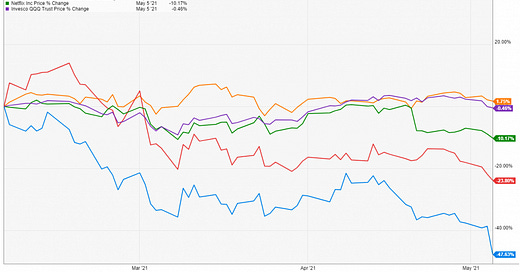

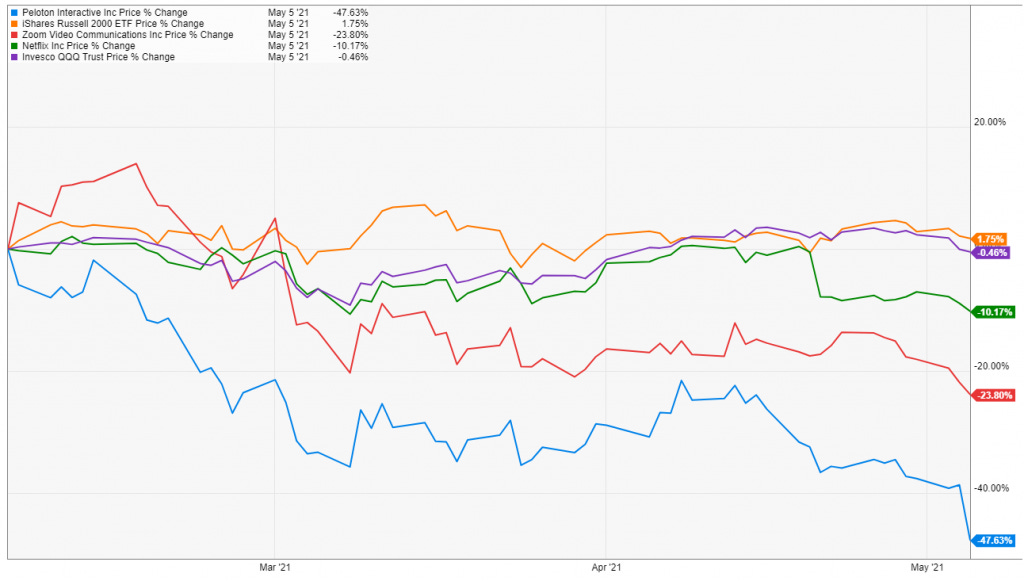

Just kidding (about the reason for this post; I did beat Rory!). The reason I'm writing this post is because yesterday Peloton ended a months long battle with the Consumer Product Safety Commission (CPSC) and recalled their Tread+ product. The stock market has not reacted kindly to the ongoing battle, as PTON's stock has been cut ~in half over the past three months (versus a roughly flat market). It's true that the past three months have not been particularly kind to "Covid winners" like Peloton, Zoom, and Netflix, but even against those loose peers Peloton has performed particularly poorly.

Obviously, that chart is more than a little appealing to me. History suggests that if you find a business that is a category killer beloved by consumers and buy them when there's some controversy that's demolished the stock price, you will do pretty well. Perhaps my favorite person to talk Peloton with is Implied Expectations (his original post / thesis on PTON is unlocked here. I think his service is great; if you're interested in "compounder" tech platforms I would highly encourage you to check it out); we were chatting last night and he roughly said, "this isn't close to as bad as Chipolte during the food poisoning scare; the consumer always comes back." While I'm not sure I fully agree with him there, it definitely got some wheels turning in my head.

I think it's important to note that the wheels in my head are still turning. I say this all the time on the blog, but writing helps me think. So I'm going to stream of thought some bull and the bear thesises for the rest of this post just to try to help me think through what's going on here and to see if there's opportunity (note that I did some of this on Twitter last night). Also, note that this is the second time that I've done a bull/bear on Peloton; in December, I wrote about my love for Peloton and my confusion on the path in "Peloton: Fitbit 2.0 or Netflix 2.0?"

Let's start with the bull thesis, because I think a lot of the bear thesis is rebutting the bull thesis.

The obvious start for any bull thesis has to be that this is a beloved company that users are freaking obsessed with. In Q2'21, the average user did 21.1 workouts per month. That is an insane level of engagement. Is that level boosted by COVID? Of course, but even pre-COVID the average user was doing >10 workout/month. That might be overstating it a little as well; I, for example, like to take a 5 minute cool down stretch class after every ride; my understanding is that doing a ride then a stretch would count as 2 workouts, so you might get a little "workout inflation" from that type of class stacking. But I'm probably splitting hairs here; the bottom line is Peloton has huge user engagement and is generally beloved by its users.

I think the rest of the bull case builds off that consumer love. Peloton has a product people love that they interact with near-daily and pay for with a credit card through a recurring subscription; that gives Peloton incredible stickiness and huge optionality. Peloton is attacking an enormous market (fitness in general). Roll all those together and you have the makings of a potential behemoth. My last article on Peloton asked if they were Netflix 2.0, but really the bull case for Peloton would be that they're Apple 2.0: a premium product consumers love and interact with constantly, vertically integrated hardware and software that just works better than competitors, and people fearing knock-off competitors will undercut them on price while the company just continues to execute and grow until their moat is unassailable. Apple's first "breakout" product post Steve Jobs returning was the iPod; who would have imagined that product would lead to where Apple is today? Peloton is similar in so many ways to Apple; people love them, great brand, huge NPS, premium product, vertically integrated. So while Peloton today might be a "bike" company in the same way Apple was a "portable mp3" company ~15 years ago, who knows where PTON ends up in 15 years?

Let's jump into other pieces of that bull case, starting with stickiness. Peloton's monthly churn is unbelievable (0.62% monthly churn in their most recent quarter; consistently well below 1%). Bears will push back that this is simple customer aging; because consumers pay so much money for a bike and the user base isn't super seasoned, of course the churn will initially be low! But after the bike depreciates and consumers amortize the payments over a couple of years, Peloton would see a spike in churn on the back end. When Peloton IPO'd, that was a big concern I had!

One follower on Twitter noted a similar bear case: we have decades of experience of exercise equipment turning into paperweights. That's a bear case I used to be really concerned with but I'm not as worried about it as much now. Perhaps this is just my love of Peloton (the product) bleeding too much into my view, but I think Peloton's monthly churn numbers are low enough and monthly workouts per member high enough that you can assume these bikes/memberships get used. I think there's a good reason for that: the classic "expensive paperweight" thing is a treadmill that you buy as part of a New Years resolution, use for a month or two, and then stop. Peloton is different for a few reasons: you pay a monthly fee for it (creating commitment bias), the streaming and on-demand nature means there are always new classes (and often actual new exercise types, like when they added barre or pilates) versus a treadmill where you would just get on and run (or, if it came with pre-installed workouts, you would eventually have run through them all), and your "relationship" with the coach plus the gamification nature (the challenges, the awards for hitting milestones, etc) help keep your engagement up and lock your use into a habit.

At this point, I think we even have the numbers to back up that churn/paperweight bear case argument is wrong. I've got a slide from their September 2020 investor day below that shows that, but sometimes stories can be more powerful than pictures so consider me: I probably spend 8 hours a week on a Peloton. At this point, I feel like I have "relationships" with my favorite Peloton coaches. In addition, Peloton has "gamified" working out by giving me badges and rewards for hitting streaks, doing challenges, etc. The combination of a coach relationship and gamification is incredibly power. Right now, I wouldn't leave Peloton because I literally just bought the bike. But in three or four years, the bike will be depreciated and I'll probably look to replace it. Do I care if there's a cheaper competitor that offers similar functionality to Peloton at that point? Absolutely not! If I switched from Peloton, I'd lose my years-long relationships with my coaches. I'd lose my streaks. I'd lose my workout tracking. If I've got any friends I ride with, I'd lose the ability to do that as well.

So those relationships are unbelievably sticky. This is a loose metaphor, but I think if you consider someone like Joe Rogan in podcasting you can see how powerful this type of relationship can be. Rogan went exclusive on Spotify late last year; many of his followers were so passionate that they were willing to switch podcast platforms to hear him when he went exclusive to Spotify. But not all of them were willing to switch (Rogan's viewership is down since the move), and literally all listeners had to do to stay with him was download a new app.

Just keep that in mind and think about a competitor trying to "steal" a customer from Peloton. In the normal course, that's going to be really difficult for a competitor; consumers have literally sunk thousands of dollars into a Peloton, so getting them to switch is a no-go for the most part (why buy another bike when you've got a brand new one?). But there is one time where Peloton is vulnerable to losing a customer to a competitor: when the customer has had the bike for a few years and is thinking about getting a new/replacement one (because they want an upgrade with new features, or maybe just because the bike is getting a little creaky!). That's when a competitor could come and say, "hey, our bike is $500 cheaper, and our streaming service is half the cost per month. Come to us and save money while getting the same workout!" And that's where your relationship with Peloton instructors comes in; if you make that switch, you're going to lose all your workout data and your relationship with your favorite instructors. Are you really going to do that to save $500 up front and $20 a month? My guess is absolutely not; if you're using the Peloton frequently enough that you're thinking of upgrading, that cost is actually a small price to pay on a per hour basis to stay with a product you love and the coaches you've spent years with (i.e. you're probably spending >10 hours/month on the bike, so on a per hour basis switching to a competitor is saving you maybe $2/hour/month, and if you amortize the $500 savings upfront over the useful life of the bike (thousands and thousands of hours)), it's going to be pretty small. And that's only doing the math for one user; if you amortize it all over a family (you only pay for one membership/household, so a husband and wife would count as one membership but they'd get double the benefit discussed here).

(Note I think the above works in the reverse too: the reason it's so important for Peloton to run quickly and grab as many subs as they can now is so that they can have subs form those relationships; if they lose a sub to someone else, the relationship dynamics will work in reverse for Peloton trying to steal the subs in the future. Winning the land grab for customers now should give an enormous long term edge for customer acquisition / retention / scale)

The reverse also works: people always worry about Peloton losing instructors to competitors, and consumers following the the instructors to whatever app poaches them. I think that's pretty low likelihood; if you have a $2k bike or treadmill in your house, are you really going to switch because your favorite instructor left? Probably not; again, people spent dozens of hours a month with Joe Rogan and a lot weren't willing to follow him to a new platform when all they had to do was download a new freaking app. How many are going to go through the headache of throwing down thousands of dollars and getting a new machine installed to follow their favorite instructor? I would guess that rounds to zero in the short term, and in the longer term (i.e. by the time you're ready to switch bikes), you'll have formed a new relationship with new instructors. (Also- I've mentioned this before, but if you were an instructor why the heck would you leave Peloton? How did Mixer taking Ninja from Twitch workout for them? Not well. Joe Rogan lost relevance when he went exclusive, and Ninja lost following too. If you're an instructor, you're a celebrity when you're on Peloton, and that comes with all sorts of side hustles like sponsorship deals. Leave Peloton to make a few bucks more at a competitor, and a lot of that fame and relevance is going to quickly whittle away)

A bear would note that the above only applies to people who have bought a Peloton bike or tread; if people are just downloading the app and subscribing to the streaming service (for the non-product related workouts like their HIIT classes, strength classes, yoga, etc.) Peloton doesn't get those great lock-in effects and they are vulnerable to losing customers. The bull case for Peloton is they are the dominant streaming service for working out, not just for people who buy their products but also for people who just want to download the app and get at home workout. I think the bears are right on that particular point, though the library scale, the gamification, and the coach relationships definitely still give Peloton some lock in here and I think that should grow over time.

The above loosely relates to another bull point: At some point (and they may have already hit it), you'll start to get a library scale advantage at Peloton too. I love their cycling classes, but I also really like their Yoga and outdoor running classes. And both my wife and I have been known to hit a barre class together (yes, I'll do barre every now and then!). We get all of those classes from Peloton. Is that impossible to recreate? No. But it would be difficult for a startup to launch with enough classes upfront to satisfy my wife and I (remember, we don't just want spinning classes. We want a big choice of length (15 mins, 30 mins, etc.) and types (tabata, hill, low impact, etc.)). That's tough for a competitor to launch, and every incremental vertical Peloton launches into is one more thing a subscale competitor needs to add before we could even consider switching. Over time, that library and workout mix moat will grow and grow. (this library scale moat relates to another moat I tweeted out: Spotify has a deal with labels, and now artists view their platform as a great place for discovery / fan engagement. How does a start up match that? They need to go get a deal with a label, and then they need to get a giant user base so that artists want to use them for discovery. That's a tough chicken/egg problem for a start up to crack!)

I mentioned Apple earlier, and I think that's instructive for another thing that you get with Peloton: optionality. Remember, Apple started with iPod, then iPhone, and then they've moved into tons of other areas that all build off the success of the iPhone franchise. I mean, look at the success of airpods; how successful are those without the Apple brand and tight integration into the Apple ecosystem? Peloton should have similar optionality over time. I think apparel is an obvious one; Peloton has a great brand and their instructors are literally in your face (and looking good!) for hours a day. Peloton is just starting to drop hints in their class to buy their stuff (things like instructors saying, "check out my new Peloton socks; they're awesome!). With that type of marketing and brand, I'd think it's obvious Peloton will have a large athleisure apparel business at some point. But there are plenty of other possibilities; why wouldn't Peloton have a wellness line at some point? Partnerships with health insurers (insurer subsidizes your membership and gives you a discount on your insurance if you do 10 classes a month)? What about coaching opportunities; if you love a particular Peloton coach, why wouldn't Peloton have a premium offering that gave you more access to them (for $100, your favorite coach will spend thirty minutes on a zoom with you reviewing your diet, lifestyle, etc. and making suggestions? For $250/month, your favorite coach will review your workouts once a month and give you a personalized plan.)? What about live events; CrossFit sells out stadiums and has ESPN cover the crossfit games. Doesn't Peloton sell out a stadium with a "Peloton games" at some point? Who knows; the possibilities are endless as a brand this good gives you near unlimited optionality. Look at some of the stuff RH is doing (mentioned on my RH podcast); could PTON open a luxury hotel wellness brand in Aspen? A fitness / wellness studio in every large city?

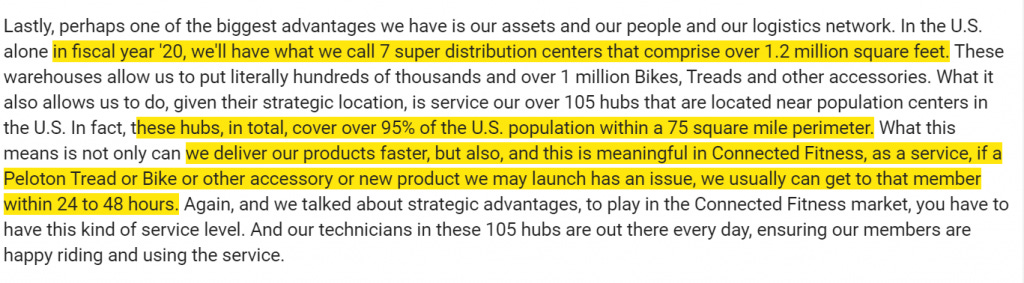

One last qualitative bull point: I think people underestimate the service moat here. Peloton delivers the bike to you; their team will actually come in the house, install and set it up for you, and make sure you know how to use it. If you have problems, PTON will send someone next day-ish to fix the bike for you. Setting up that distribution and service business is very expensive, and competitors don't have that and don't have the size to match it / fund that investment. Maybe all of that seems silly, but I promise you the investment dramatically improves NPS. That service is going to give them a sustainable NPS advantage, result in a huge improvement in churn versus competitors, and give them a significant word of mouth / referral advantage. You could probably make a similar argument about Peloton's growing retail footprint; this is basic "clicks to bricks" stuff. A lot of consumers are going to want to interact with a bike before they buy / having a retail presence will lower customer acquisition cost and increase lifetime value. Peloton is already building that out; any start up competitor will need to spend years building out a footprint to match Peloton there. (quote below from their investor day in September)

Alright, those are all the qualitatify bull points. Let's hit two quantitative bull points, and then turn to bear stuff.

The first qualitative bull point is that the stock's current reaction is much, much larger than the near term impact from the recall. The recall notice says it impacts ~125k tread plus products. It's up to consumer if they want to return / recall the bike or not. If you go onto Peloton message boards, it does.... not seem like many people want to return their treat (this FT article has some incredible quotes as well!). But, even if you ran the just absolute worse case scenario and said that every single person returned their tread, we're talking pretty small numbers for Peloton. Peloton would be looking at ~$250m in all out refunds at that point, plus the loss of 125k subs (that's ~5% of where their sub base will be when they report earnings tonight). Peloton's lost ~25% of their market cap (~$10B) on these issues, so if you isolated just the impact of this recall I'd say the market has already priced in an absolute worst case scenario. Again, that's way too draconian; I doubt 10% of treads are returned, and many of the treads that are returned will stay in the Peloton ecosystem in some form (switching to a bike, getting the normal tread product, or just becoming a digital sub). (PS- large portions of this section were spurred by the discussion Implied Expectations had on the recall, so hat tip to him and again I encourage you to check his stuff out! I don't get a referral fee or anything for saying that; I just enjoy his service)

The other quantitative bull point is that, while Peloton looks expensive on a headline number, they're actually reasonably cheap if you run rate them and/or comp them to peers.

I think the easiest way to look at that would just be to do a simple comp. The slide below is from Beachbody's SPAC deck. Peloton is currently trading for <$30B EV and will do >$4B in revenue this year, so you're buying them for <8x revenue. Just on its face, that seems too cheap for a brand that is just finding its legs and scaling versus some of the peers below. You could also look a little more broadly; Lululemon, Nike, Yeti- take your pick of premium consumer brands, most of them are trading for ~8x revenue. I think Peloton has a chance to be a better business than all of those (their brand is really strong, and PTON's relationship with their consumers is much more direct / recurring given their monthly subscription and daily interaction with those products). It just seems like a reasonable valuation to me versus peers given the potential of the business model.

Another interesting way to look at PTON is to just isolate the streaming side of the business. At the end of their fiscal year 2021, Peloton is projecting ~2.3m subs. Streaming ARPU is just a hair under $40/month, so on that sub run rate Peloton will exit the year with over $1B in annualized subscription revenue. Margins on subscription revenue are obviously off the chart (LTM subscription gross margin is ~60%, and incremental margins on new subs should be >90%); with Peloton's current EV of <$30B, today you're buying their streaming business for <30x current run rate subscription revenue. That seems expensive-ish, but with a monthly churn of under 1% and the company having quadrupled their subscriber base inside of two years, it honestly doesn't seem ridiculous (less than 1% monthly churn, multiple family members on one service, and continued expansion in their offerings (adding yoga, barre, pilates, etc.) suggests there should be some latent pricing power over time!). I think you could make a straight faced argument that today's PTON stock price roughly fairly values just their streaming business and gives you all of their upside optionality and the money they make from actually selling the bike (they'll do >$1B in gross profit from product sales) for free.

Ok, let's turn to the bear points.

In the near term, the bear point is the crisis response. I mean, this is a disaster. A kid died from the Tread+, the video of the yoga ball getting sucked under the Tread is viral, and the company's first response in April was a PR attacking the CPSC. Now the company is backpedaling. Bears will argue it's way too late; the brand damage is done. The trail here is awful for Peloton, regulators are going to have an easy case for a massive fine and class action lawyers have to licking their chops.

But the damage goes beyond that immediate financial impact. For the next few months, management's days are going to be subsumed by dealing with regulators and this recall. And the brand could suffer long term damage; yesterday, the front page of CNBC and CNN were both discussing the Peloton recall. Maybe that doesn't impact current Peloton subscribers, but for new potential subs, the first thing that is going to come to mind when considering the product is going to be, "o, isn't that the company that killed a kid and then lied about it?" Not good!

And think of the competitor field day here! A few years ago, dollar shave club had a viral marketing video that took them to a >$1B brand. Obviously the company had to execute and everything, but that video was a big part of getting them there. Who's going to be the first start up competitor to launch a video that says "our product will get you ripped and won't kill you?" How's that going to look for Peloton? Maybe that's extreme, but what about mirror or soulcycle or some other competitor running a campaign, "hey, turning in your peloton? We'll give you half off our product and a 30 day free trial?". Does that encroach Peloton on the margin?

That all builds into the bear's most pressing point: even after the drop, Peloton is still trading at pretty lofty absolute multiples. Roughly $12k/connected sub, ~7x revenue, approaching 100x EBITDA. Maybe those numbers look reasonable if you think this is a category killing dominant brand platform, but you need to be right on that bet. Anything that distracts from that possibility means this investment is an overpriced disaster. And you have to remember that Peloton is a reverse reopening play: the pandemic demolished all of their competitors and likely pulled forward years of growth. So not only are you paying a multiple that implies the company is a brand dominant category killer, but you're doing it off peak earnings in literally the best environment the company will ever have.

Just roll everything forward a year. Say the country is open again, COVID's controlled, and everyone can go to gyms and fitness classes and the like. What are Peloton's sales going to look like then? If you didn't buy a bike during the pandemic when you were locked inside, are you really going to buy a bike when you can go do "normal" fitness stuff? Particularly when you've been seeing headlines about the product killing puppies and babies?

Or consider me: I love gyms. I never would have gotten a Peloton pre-COVID. Now I love my Peloton, but are there a few people like me who see their gyms reopen in six months, all the instagram photos of their friends hanging out at a gym post workout, etc. and think to themselves "you know what, maybe I go ahead and sell this peloton and go back to my old life?" Maybe!

So the bear argument is you are paying a rich multiple on absolute peak earnings, and in order for that to workout you need everything to align for you and this company to be the dominant fitness platform going forward. The recall, the expense, the headache, etc. simply increases the odds that Peloton is not dominant going forward, which increase the odds that this investment is a failure.

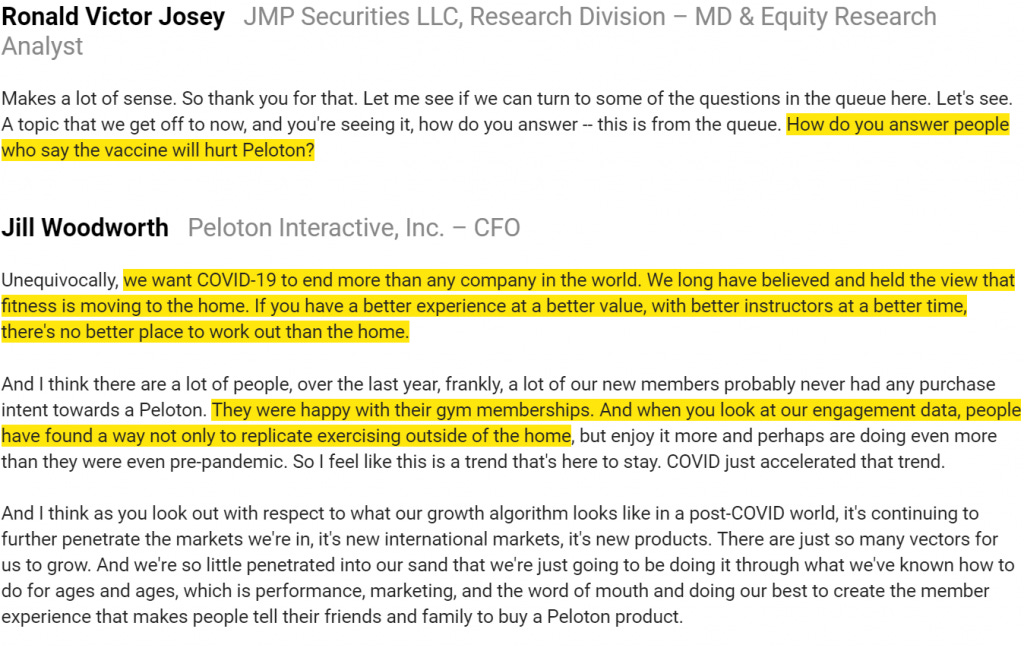

I'd note none of these arguments are lost on Peloton; here's a quote from them at a recent conference and I do think it's kind of interesting (plus they obviously had me in mind when they gave their "happy with gym membership" consumer example!)

Anyway, my bottom line answer here is "I don't know." So I guess I'm sorry for rambling on so long to come out to a wishy-wash answer. But I thought it was important to do some work and put some thought into it. The opportunity to buy leading brands down 50% is pretty rare, and history suggests that the opportunity can be very profitable (Buffett and AmEx after the salad oil scandal; CMG after the food poisoning scare).

I suspect that the current recall issues will be a blip in Peloton's future in the very long term.... but, even after the drop, the valuation is still pretty rich in an absolute sense, and combine that valuation with my fears that the company has pulled forward years of subscriber growth and this recall will only add to their issues in growing in a post-COVID world, and I'm just not "there" on Peloton yet. I also worry that my obvious love the Peloton the brand can influence my interest in Peloton the stock, and I'm cognizant that could lead me to get a little bullish more bullish on the stock than I normally would be (particularly after a big drop caused by an issue I don't think will impact them longer term).

Peloton reports earnings tonight. I'll be curious to see how they frame their current recall issues and the demand they're seeing as the country reopens.

PS- one last thing. I couldn't stop thinking about this quote from Peloton's investor day on "Peloton addiction." Obviously I'm being a little facetious comparing Peloton addiction to nicotine, but I do think there is some interesting kernel to dig into there.

PPS- I wrote the bulk of this pretty late last night, and I was doing pretty quick model building / updates to frame the opportunity. I feel pretty good in everything I wrote here, but it's entirely possible I'm off. If you think I'm wrong on something, there's every chance I am. Please feel free to let me know!

PPS- how good was Peloton's timing on their convert issuances in Febuary? 0% coupon, and after the capped call transaction they convert at way over $300/share versus $80/share right now. My lord!