I spent a ton of time this weekend writing about the DWAC / TMTG deal (part 1 on its impact on the SPAC market, part 2 on the DWAC / TMTG deal itself, and part 3 on 3 winners from the deal).

In the first part, I predicted that DWAC going bonkers on deal announcement could breathe a little life into the SPAC market. I wanted to take a second to highlight and build on that point a little bit, because I’m seeing signs in the market that the SPAC market might be coming back with more than just a little life.

Let me set the stage here: in late January and early February, the SPAC market went absolutely parabolic. SPAC IPOs were literally hundreds of times over subscribed, and a SPAC would IPO at $10/share and the first trade would often be $11/share for a “bleh” sponsor or $12-13/share for buzzy sponsors. Almost every SPAC traded for a significant premium to trust, with the “best” SPACs trading for 50% or more over trust. This was just absolutely insane; remember, a SPAC is just a cash shell in search of a deal, so investors were saying across the board that every SPAC manager was worth a premium to cash. In effect, investors had decided SPAC managers could create huge value from whatever deal they could find despite facing huge value drag from the massive founders’ shares dilution associated with SPACs as well as the “winner’s curse” from being the high bidder in auctions. And, in the short term, investors’ euphoria was getting proven correct: SPACs were routinely soaring to the high teens or $20s/share on deal announcement, and if the deal announcement touched the EV space in any way it was not unheard of for the SPAC to fly over $30-50/share.

The top for the SPAC market came when deal rumors broke that CCIV would merge with Lucid (a Tesla competitor). The stock peaked at ~$60/share, a full 6x over trust, right before the deal was officially announced (I said the stock was crazy at $35/share). CCIV stock dropped precipitously when they announced the Lucid deal, and that basically broke the whole SPAC market. For the past six months, all but the buzziest of SPACs have traded well below trust value, and SPAC deals have near universally been met with a yawn from the market. The days of massive deal pops were over.

That changed last week with the DWAC / TMTG deal. The stock went from ~$10/share on Wednesday (before deal announcement) to $100/share by Friday. Over the weekend I wondered if that movement could be the start of the SPAC market coming back to life.

It’s early, but I’m seeing signs that’s exactly what’s happening. I’ll highlight three different signs of the life coming back: BRPM’s deal with FaZe Clan, AGC’s recent share price, and IPOF / IPOD’s price response to the DWAC deal.

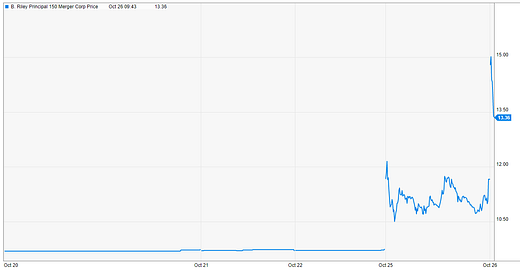

BRPM / FaZe deal: Until the DWAC deal was announced last week, I believe the only SPAC that had popped above $11 on deal announcement since the SPAC market “broke” in March was the MUDS / TOPP deal (humorously, that deal eventually broke). Obviously, DWAC broke that trend, and on Monday BRPM announced a deal with FaZe Clan, a “leading lifestyle, content, and gaming media platform”. The stock instantly shot up, and as I write this it’s currently trading at ~$14/share. Again, we haven’t seen SPAC pops like this since the SPAC market “broke” in March. Now we’ve had two in less than a week.

I’ll pat myself on the back here and note BRPM was one of the SPACs I highlighted on the premium side over the summer. I thought a deal would come a little sooner than it did, but the underlying thesis is the B. Riley is a somewhat under the radar top tier sponsor and any deal they announced would likely be very good, and the early results suggest that thesis was spot on (though, to be candid, I don’t understand the deal or valuation here!).

AGC price: AGC announced a deal to merge with Grab, Southeast Asia’s “leading Super app,” back in April. The deal should close by the end of the year. The stock had been reasonably range bound between $10-$11/share for the past three months, which in this market actually spoke to a much better than average SPAC deal. However, in the past three days, AGC stock has spiked (from ~$10.50/share to just under $14 as I write this) on no news I’m aware of.

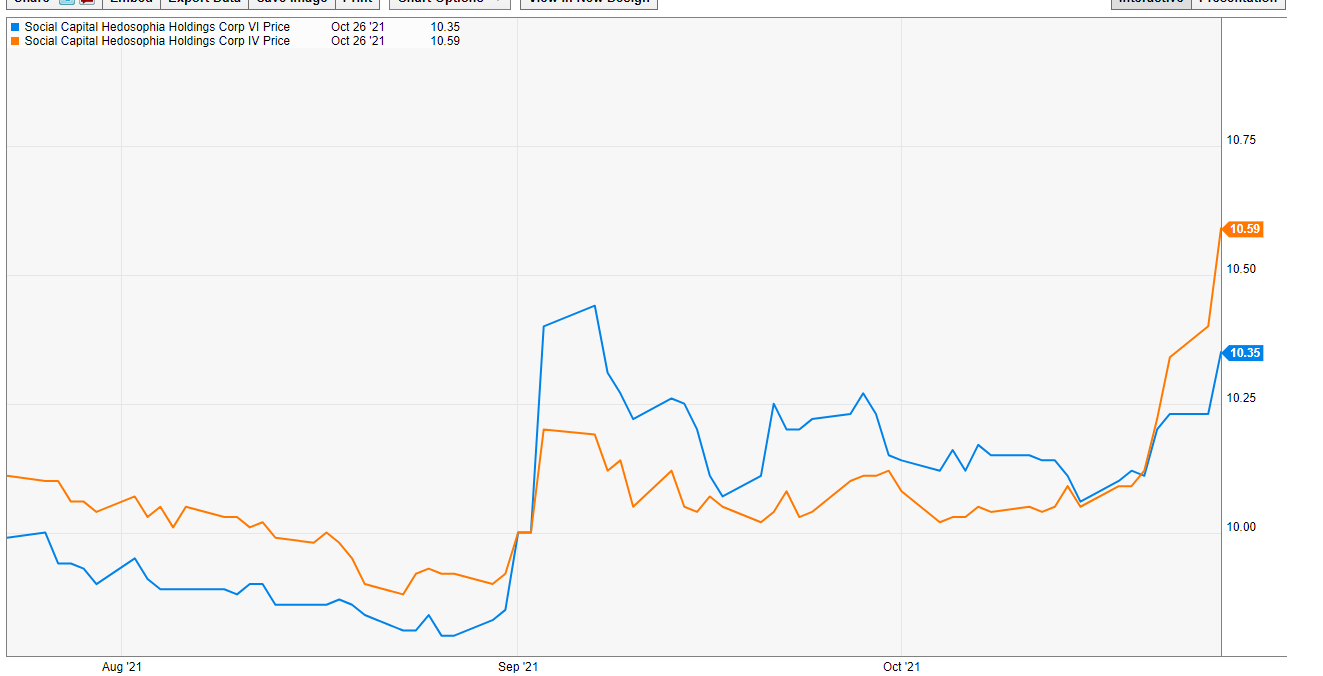

IPOF and IPOD share price: IPOF and IPOD are the two remaining pre-deal tech SPACs from SPAC King Chamath Palihapitiya. Each has languished at or below trust for the past few months… but, on the heels of the DWAC success, each has seen their share price trade up solidly as some buzz returns to the sector. (Note that I use IPOF / IPOD as a stand-in for buzzy pre-deal SPACs, but other buzzy SPACs like BTWN, Thiel Capital’s first SPAC, have seen similar strength).

Taken individually, I wouldn’t read much into any of these movements. But put them all together and have them happen right after DWAC went parabolic, and I think there’s something happening here. Bottom line: I’m seeing signs that the SPAC market is coming back to life. We’ve now seen two companies / SPACs pop on deal announcement, some late stage SPAC deals are seeing strong signs of life, and the buzzy pre-deal SPACs are starting to get some premium again.

For investors, that begs one question: how do you take advantage of the SPAC market if it’s coming back to life?

The answer is simple: buy pre-deal SPACs, preferably below trust value.

I’ll pause here to note that this is certainly not investing advice (nothing on this site is! Please check out our disclaimer).

But the asymmetry of this trade is why I love the SPAC market so much; if I’m right and the SPAC market is coming back to life, it’s very possible that you’re going to see a ton of pre-deal SPACs announce deals and see their stocks pop significantly.

But if I’m wrong, no big deal! The SPACs will eventually announce a deal or liquidate, and you’ll be able to redeem your shares for trust value.

Heads, you win (you get a big deal pop). Tails, you do a little better than breakeven.

SPACresearch.com, my favorite site for SPAC stuff, says there are currently just under 500 SPACs searching for a deal, so there are plenty of SPACs for you to search through. I’d encourage you to flip through a few S-1s; read the management background and the terms of the SPAC and use those to find teams you want to bet on yourself (though, I will note with some irony that the buzziest SPAC deals tend to get announced by lower quality teams who are willing to….. let’s put it nicely and say overlook some red flags in order to announce the buzziest / most newsworthy deals, so in some ways you might be better of flipping through SPAC S-1 and then pulling a Costanza and doing the exact opposite of what you think you should do).

So I’d encourage you to explore on your own…. but, since you took the time to read all the way through this post plus three DWAC posts over the weekend, I’ll give you three of my favorite pre-deal SPACs right now:

DNAA / DNAB / DNAC / DNAD: Ok, I’m already cheating. That’s four SPAC in one number! But these are all related; these are Chamath’s four healthcare / biotech SPACs. Each will target a different vertical (DNAA is CNS and PNS, DNAB is oncology, DNAC is the “organ space” (intrinsic diseases of the heart, kidney, etc.), and DNAC is immunology). Chamath is very controversial, but I think he’s a great marketer and he has a knack for spotting big trend. I tend to view him as a levered call option; buying into a levered call option with the downside protection of the trust / redeem structure in a SPAC is about the best trade I can think of, and with all of them trading under trust you’re not paying up to get that call option.

SVFA / SVFB / SVFC: Cheating again, another three SPACs. But, again, these are all related. These are Softbank’s three SPACs. I view Softbank similar to Chamath: they’re a levered call option. When they swing, they swing big. Maybe it leads to a disaster, or maybe it leads to a grand slam. But they have a big following and deep pockets; any deal they announce is going to get a ton of buzz and I’d be surprised if at least one of them doesn’t get a big pop. Again, you’re buying below trust, so you’re not paying up to get access to that potential pop / call option.

OACB: I’ve mentioned OACB before, and I suspect this will be the most popular among my readers given my readers value bent. OACB is Oaktree’s second SPAC; it’s run by their value equities team.. What I like about this SPAC is it’s “well seasoned” (it IPO’d in September 2020 and has until September 2022 to find a deal), it’s below trust, and the team has proven they can caputre the market’s attention (their first deal, HIMS, peaked at ~$25/share at the height of the growth / SPAC trade). Who knows what OACB does, but I’d expect a deal sooner than later and I wouldn’t be surprised if a deal was well received by the market.

Anyway, those are “three” of my favorites (and I’ll disclose have a position in all of them), but there are plenty of others. Again, there are ~500 pre-deal SPACs out there, and almost all of them are trading below trust.

If there’s a SPAC you particularly like (whether it’s because of the team, the structure, or whatever), I’d love to hear from you (and why!).

Overunder on SPARC becoming a thing? I think Gensler wants to improve the SPAC structure, but may have to say no / have his hands tied if it seems like SPARC approval is just to benefit bailing out PSTH

Great stuff. In your SPAC resarch, did you come across management that seemed to have no business to have a SPAC or even shady?