Thoughts and notes from #LibertyInvestorDay 2018

It’s not a secret that I’m a Liberty fan-boy, and I’d suspect a decent percentage of my readers are as well. Liberty Investor Day was Wednesday (you can find the morning slides here), and given the wealth of Liberty content (Malone’s interview with Barron’s, Malone’s interview with David Faber, Greg Maffei’s interview), I couldn’t help but post some thoughts on the day. I’ve broken this up into two sections: overall takeaways and thoughts on Liberty Day, and then some notes from Malone’s interview with Faber.

Disclosure: Rather than provide individual disclosures on the stocks, I’ll just note I have “tracking” positions in most of the Liberty stocks (small shareholdings so I can get proxies and notification and such), but I have serious long positions in BATRA, LSXMK, LBRDA, and GLIBA.

Overall takeaways from the day

The thing I like about Liberty Day versus Berkshire is it’s still focused on business. Similar to Berkshire, once you’ve watched a couple of Liberty Days you have an idea of how all of the different beats will go (i.e. between every presentation you get a cheesy video), but the nice thing about Liberty Day is it remains focused on the current business landscape and not finding out if Warren Buffett has a relationship with God, so you can actually get some really interesting insights.

And while all the beats remain similar from year to year, it’s interesting to see how their views change and evolve over time. For example, Liberty has been cautious on the cable bundle / video landscape for years, but this year was by far the most bearish I believe I’ve heard them when they talked about the cable bundle. I’m a bit surprised they haven’t been more aggressive in trying to sell off Discovery and/or Lionsgate (though those are Malone holdings, not Liberty holdings).

I’m talking my own book here, but I thought the two “most bullish” comments of the investor day came on the Braves and the Liberty Sirius tracker. Don’t get me wrong: it’s tough to come away negative on much of their stuff after their presentations (they are all generally good salesmen!), but I thought there was the most incremental new / positive information on these two and the market basically just yawned it away.

Liberty Sirius: The first question of the Q&A session was on the discount at Liberty Sirius, and Malone and Maffei were both very clear they could “eliminate the discount” tomorrow if they wanted to. They also mentioned they thought the Sirius board would be open to paying “full value or more” for Liberty’s shares. That’s a really strong answer; Liberty has said for years that they can close the discount but for them to say they suspected the Sirius board would pay them NAV or more to get out from their control is crazy bullish for a tracker trading at a >30% discount and suggests that the subject has perhaps been broached before. Liberty Sirius continues to trade at a very large discount to its NAV and is buying back shares (at a slower clip than I’d like, but any buyback when you trade for a 30%+ discount is crazy accretive); one day in the future I suspect that discount will collapse and shareholders will be very happy. (Bloomberg actually had a misquote on how Liberty planned to treat their shareholders, but Greg was kind enough to set the record straight).

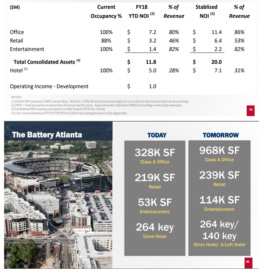

Atlanta Braves: The Braves gave more info on their real estate than I’ve seen from them before. In particular, slide 96 (copied below) showed the NOI they expect to get from their currently developed buildings. These are really high-quality assets (recently built assets in a growing / thriving area anchored by a Major League Baseball Stadium and crazy high quality tenants like Comcast); I’d contend they’d trade much stronger than your average REIT / real estate property (for example, three of their restaurants are in the top 10 grossing restaurants in Atlanta; wouldn’t owning those properties trade much tighter than your average retail / restaurant property?). Slap any type of reasonable cap rate you want on them and these are worth at minimum $300m to the Braves. The Braves market cap is currently ~$1.5B and the Braves would likely sell for at least $2B if they were put up for sale tomorrow. These assets are worth a lot and the market is giving them no credit for them

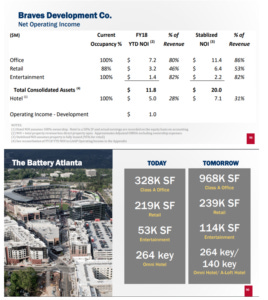

It’s not just the already developed assets that are interesting. The Braves have a lot of development potential in front of them. For example, I’ve pasted slide 90 below as well, which shows they currently have 328k square feet of office space and they’ll have 968k “tomorrow" (I believe tomorrow is ~2020). The IRRs of the new developments should be extremely high. I wouldn’t be surprised if the NPV of the Braves current developed properties plus all of their development potential is well over $500m.

Again, the Braves today probably trade for below the value of just the baseball team, and they just gave a lot of disclosure of a substantially valuable real estate portfolio that just hit profitability. Yes, there’s some debt in there, but the bottom line is the Braves asset value today is a decent bit higher than they are trading for in the market and it will continue to compound over the next few years. I think the market’s sleeping on the Braves. (As mentioned in my Malone interview section below, there’s also the chance that the FOX RSN sale results in the Braves buying their RSN, which could be interesting).

PS- The MLB and Fox just extended their broadcast agreement through 2028. The deal includes some expanded streaming rights and jumps the annual payment to the MLB by ~36%. That’s good for the values of the Braves (and all baseball teams; national revenue isn’t as big a driver for baseball as it is for other sports but the 36% bump is pretty solid!) and sports teams in general (further proof that the next round of sports rights will be well bid even though the cable TV bundle is under some pressure).

Netflix- It’s tough to host an event centered around media without touching on Netflix. I thought the divergence in thoughts between Maffei and Malone on Netflix was interesting. Maffei challenged the audience to “name more than 10 hits in the Netflix catalog”; Malone basically told David Faber Netflix was uncatchable unless Reed Hastings did something crazy (I hit on this a bit more later on in my Malone / Faber notes section). Maffei admitted Netflix “is king” but he also questioned their financial model and consistent cash burn (he even quoted Buffett when talking about Netflix’s cash burn, “Warren Buffett noted in his 2007 shareholder letter, the worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and earns little or no money. So we'll see.” I put his full comments here if you’re interested)

Both of them understand the power of Netflix, but interesting to see that Maffei seems decidedly more bearish on Netflix while Malone thinks their consumer relationship ownership and pricing power sets them up well.

Notes and thoughts Malone’s interview w/ Faber (here’s a transcript of some of it)

Disney has great brands, but they don’t have “consumer credit cards” (direct consumer relationships) and they may struggle with technology

This is a point I’ve tried to make before (see the paragraph on Mr. Mercedes versus The OA), but of course Malone can do in one sentence what I struggled to do in three paragraphs.

There are plenty of doomsayers who say Disney+ along with expanded video offerings from Apple and Amazon will really hit Netflix. Malone thinks Netflix’s customer relationships, scale, and technology means they will be “very successful” unless Reed Hastings does something “really nuts”; I agree with him.

That’s not to say Disney won’t do well. Disney’s brands are unlike anything else in the world. One way or another, Disney will probably do well in the future (Malone thinks Amazon, Netflix, and Disney will end up being the three streaming services of the future. I agree with him, but even in in the unlikely event Disney+ fails I think they could figure out a reasonably profitable future monetizing their brands by building them through movies and theme parks and selling content to Netflix / Apple / Amazon (or just eventually selling the whole company to Apple).

PS- Part of the reason Malone is bullish on Netflix is direct consumer relationships and better technology. You know who else that could describe? Spotify. I don't have a position in Spotify, but every time I think about it I think they have "Netflix" like potential and that I'll be kicking myself in five years for passing on them.

Malone seems very bearish HBO

Doesn’t think AT&T will be willing to write the checks needed to compete with Netflix and the other video players

That’s interesting, as the moment AT&T closed on HBO they started talking about dramatically increasing the content budget.

AT&T’s WarnerMedia has reportedly held talks with NBC about licensing films or TV shows for WarnerMedia’s planned Tv service (which seems like it will involve HBO content in some way). (PS- that article notes that Universal’s collection of characters is better than Warner’s. That seems crazy to me! Universal has Jurassic Park and Fast and Furious, but Warner has Harry Potter and DC Comics. Neither is Disney, but Warner seems way better than Universal to me).

Malone’s comments and WarnerMedia looking to work with NBC show how crazy quickly the industry is evolving. Ten years ago HBO’s content budget was considered huge; today they’re massively subscale versus what Netflix is doing.

On Comcast’s Sky deal: “Roberts needed to get global, and this was the best asset out there” (this is around the 27 min mark)

Malone is the chairman of Liberty Global (a major European cable company) and a major shareholder / on the board of Discovery (a global content business). I don’t disagree with him, but it’s interesting he thinks Sky is better than either of those assets (Discovery if you’re looking to scale up global content; Global if you’re looking to scale up European distribution).

His commentary on Global is interesting as well; I’ll probably have more to say on it at some point in the future. But in both this interview and in the Barron’s interview, Malone says something along the line of “Global is cheap if their current deal closes.” That’s really interesting, as it’s in direct contract to the line their CEO has been pitching for the past several years (something along the line of “our stock is way too cheap and trades below private market value”) and the capital allocation strategy Global has been pursuing (selling assets to buyback shares at a furious clip). Malone is the chairman of Global, and the company has been saying / pursuing that strategy for the past several years (i.e. at higher stock prices and before the current VOD deal was announced), so it almost seems like he’s talking in opposition to his company / strategy here.

On Charter passing up all the mergers last year

The deals seem to have passed “for now”

Some of the board members (including John, it seems) think they should have pursued the merger opportunities more aggressively, but none of the deals were acceptable as offered

The Sprint overture required Charter to believe Sprint could be fixed quickly; Charter thought it would take at least 3 years and $18B to fix out Sprint’s network. It would have been a huge distraction.

Sprint’s overture wasn’t deemed equal for all shareholders; doubted it could get support of independent board members.

Look forward a few years- if 5G is an attractive fixed solution, Charter will have a maturing high speed powered local network that will have a lot of incremental optionality to add 5G. The vision Verizon saw to put Charter and Verizon together will still be there a few years from now and will be enhanced.

Charter is trading at 9.1x EBITDA, Comcast cable is getting attributed about 7x.

Charter is getting rewarded for being a pure play

Love that Malone can quote the EBITDA multiples of Charter and Comcast’s cable (what it’s attributed to) off the top of his head.

Around the 42 min mark, Malone talks about the old studies where 4 year olds are offered a cookie now or two cookies if they can hold off on the cookie and how kids who are able to hold off are much more successful

“Spending all your money supporting your stock and buying it back is eating that cookie”

I tweeted this out, but isn’t that a crazy rebuke of Charter management?

Malone seems to think once the integration is done in a year or two, Tom will be much more open to a sale. But the comedy of the quote plus the potential internal board chaos it reveals is off the charts.

Once the integration of Charter is done and they have a ton of cash flow, “are we going to have the opportunity to steal someone like Brian Roberts did with NBC?”

Potentially interesting. Does he mean use Charter try to steal a content player? I doubt it based on earlier in the interview (and also this interview, where he calls putting Discovery together with Charter “apples and oranges”). I think he means use Charter’s cash flow to buy a new strategic asset on the cheap but obviously interesting that he specifically mentioned NBC example.

I would still guess the end game is buying a wireless operator of some form (or more cable players, though that’s tough); it’s really the only thing that fits the “strategic asset” plus “something that doesn’t crazy overlap with something else in his portfolio” criteria. Still, the more likely option seems to be a sale of Charter to a wireless company (as he said in the Liberty global piece, when you have a cable operator that cover ~35% of the country and a wireless operator that covers 100%, it’s normally the wireless company who should be the buyer) as he mentioned both in this interview and Liberty day some regret over not selling to Verizon and that the synergies from a Verizon deal will still be there / be even bigger in a few years.

Fox RSNs for sale

Atlanta Braves automatically have an interest in if they should own the distribution of their content to consumers

Charter may have interest in RSNs in regions they have overlap

Again, this in interesting. Charter’s management has frequently said they are not interested in RSNs; John says they should be interested here.

When pressed on the discrepancy on what he’s saying and what Charter has said in past, John walks his comments back pretty quickly.

Any business based on sports rights contracts are vulnerable… when the sports rights contract comes up, the sports team is going to get a much more aggressive / pricey contract.

Distributors are starting to hit the limit of what they can pay for RSNs (what they can pay for sports in their pay-tv bundles)

The best buyer for RSNs is someone who has other market power. Potentially Fox.

Around the 54 minute mark, he mentions how two of his companies wanted Formula 1.

Liberty Media ended up buying F1, but he mentions “Mike and David” wanted it too. Guessing that would have been a partnership between Liberty Global (where Mike Fries is CEO) and Discovery (where David Zaslav is CEO)? Very interesting!