Yet another guide to media stocks, Part 4: Free Radical #1 $AMCX

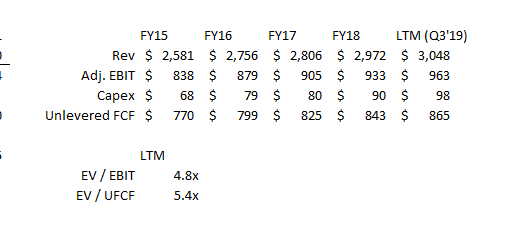

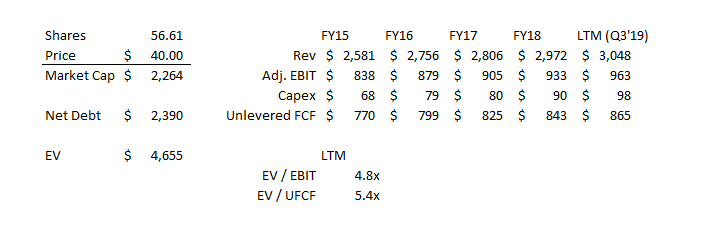

Hi! Welcome to Part 4 of Yet Another Guide to media stocks. Today's post will cover a"free radical:" AMC Networks (AMCX). Before diving in, I’d highly encourage you to check out the intro section to the guide, which goes over why I’m doing this and dives into the most important thing hitting the media sector today: cord cutting. You can also find links to all of the pieces in this series here. The godfather of media investing (John Malone) coined the term free radicals for the smaller media companies that likely need to merge or be acquired long term. Why? Because if they don't, they risk extinction / irrelevancy. A perfect example of a free radical is the company I want to discuss today: AMC Networks (AMCX). Any discussion of AMCX probably has to start with one obvious point: it is cheap. Really cheap. Revenue, earnings, and free cash flow have grown every year for the past five years. From FY15-FY19, the company will have generated >$4b in unlevered FCF. The company's EV is currently ~$4.7B. That's really cheap.

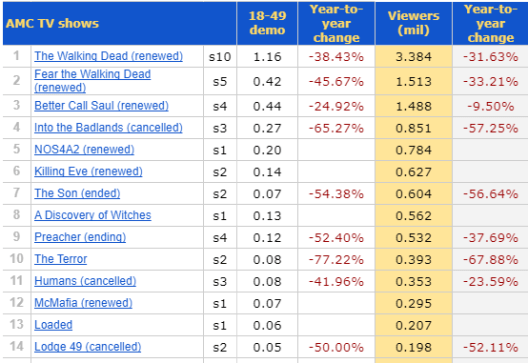

(PS: a great example of why I don't think blind valuation games are that worthwhile; I'd guess most people would look at these financials blind and trip over themselves to pay ~12x EBIT for this company, particularly once you factor in how asset light the company is. 5x EBIT may be too cheap for this company, but I can near guarantee 12x would be too expensive.) Ok, so AMCX is statistically cheap. But I think it actually might be overpriced at these levels. Let's dive a bit more into the fundamentals. AMCX owns ~5 cable channels (AMC, WE tv, BBC America, IFC, and SundanceTV), but the highlight is obviously AMC. AMC has a storied recent history: Breaking Bad, Mad Men, and The Walking Dead were all AMC shows and all have had a mammoth impact on the television landscape. In 2018, AMC had three of the top 6 dramas on basic cable (Walking Dead, Fear the Walking Dead, Better Call Saul), plus AMCX has the American rights to Killing Eve (a sleeper hit that I need to get around to watching). Despite all of those strengths, it's hard to think of a company in a worse strategic position that AMC. Because I want to talk about their place in the world strategically, I'm going to ignore just how dependent that are on the Walking Dead franchise for most of this conversation (seriously, has there ever been a channel so dependent on one show?), but that's obviously a huge concern as well. Basically all of AMC's value comes from monetizing the legacy cable bundle (getting paid a per sub fee by the cable companies). I'm just pulling some numbers from their 2018 10-K, but in 2018 their national networks segment (which holds the US cable channels you're familiar with) did $2.4B in revenue (~$1.5B in distribution (mainly cable fees, but also licensing of shows) and ~$900m in advertising). That's a lot of money, and I think a huge chunk of it is at risk. Say the cable bundle went away completely tomorrow. Could AMC come close to recreating that much revenue by launching a direct to consumer app? No chance in heck. Their most popular show, by far, is The Walking Dead, and the rights to that are locked up on Netflix. So they wouldn't be able to use Walking Dead as a lure to launch an app (nor can they use Mad Men or Breaking Bad; the rights to both of those are owned by other studios, and while those shows are loved I don't think they're near popular enough / they're too old to be a tent-pole in launching service. they're more just nice to haves)... but let's ignore that little fact for a second. To recreate $2.4B in revenue, AMC would need to sign up 20m people at $10/month. You can play around with that number (maybe they do $5/month fee and get the rest in advertising), but there's simply no way that AMC has enough content to drive that many people to sign up for their standalone app. Who's paying $10/month to AMC when they can get way more from Disney for a lot less? And we've ignored the fact that if AMC wanted to launch a standalone app, they'd need to make a mammoth investment to do so. Remember, DIS has signed up tens of millions of people for Disney plus, and they don't forecast breaking even on that service for ~5 years. Launching a standalone app that millions of people will sign up requires hundreds of millions of dollars of investment into marketing, content, etc. AMC simply doesn't have the resources or scale to do that. (Note: AMC has laid out a lot of their D2C plans, and they know they can't compete with NFLX / DIS. Instead, AMC's doing a variety of niche services, and they think they can get to ~7m subs / $500m in revenue (~$6/month/sub) in 5 years. That's fine, and if the current business doesn't melt away it would be a nice cherry on top. But once you start thinking of the marketing costs, programming expenses, etc., it becomes clear that $500m of revenue from D2C isn't really going to budge the needle versus their current economics if the current system is melting away. I'm talking a bit apples to oranges here since I was assuming the cable bundle had gone away and that's obviously not happening near term, but I just wanted to highlight how big the gap between AMC's current monetization and their D2C plans are) So if the bundle went away tomorrow, AMC would be demolished. Fortunately for them, the bundle isn't going away tomorrow. But I still think today's earnings are at huge risk. First, remember that AMC gets paid per sub from all of their cable partners. The cable bundle is shrinking, which means that there are less and less subs every year for AMC to get paid on. At some point that's going to bleed into AMC's financials. Second, I think AMC is a prime candidate to get blacked out at some point. AMC is getting ~$1.50/year/sub from cable companies. Below are AMC's rating from a recent night (from this AMC page; remember, AMC is getting paid for >80m subs). Sure, Walking Dead is pretty popular, but it's ratings are way down over the past few years. A few years ago, AMC could go to cable companies and say "8-10m people watch the Walking Dead every week; drop us and they're going to be pissed... and o by the way people are going to riot if you black out the Breaking Bad finale." Today, AMC goes in and says "4m people watch Walking Dead every week.... and o by a few people might watch one or two of our other shows." AMC could get paid a lot more from the former argument than the current argument; that suggests that their current affiliate deals are over-earning and they'll probably have to take a cut in the future. Speaking of over earning, I also think AMC will be in an increasingly tough spot in negotiations going forward. Think back to my post on sports rights: the big argument for sports rights holders is that if a cable company drops them, fans will be switching to a different provider in droves because they can't afford to miss a game (games must be watched live). AMC's programs certainly aren't that; combine that lack of "live" with their ratings declines and that their shows available on Netflix, and people are a lot less likely to drop their cable service for a different provider simply because AMC is blacked out.

It's also worth remembering that, as the cable bundle unwinds, it increasingly becomes a "live" product: people (mainly older) subscribe to it for live programming like news and sports. AMC's entertainment offering doesn't fit super well in there; increasingly, I think cable companies are going to look at blacking out AMC simply because the majority of cable's audience isn't getting cable for dramas (they get that from Netflix / Disney / HBO); the customers are only there for the sports so the cable company might as well spend all of their money on sports. Anyway, my big takeaway here: yes, AMC looks cheap, but I think that quantitative cheapness is misleading. Their key franchise ratings are declining, and I suspect they are significantly over-earning versus the value their channel currently delivers. Incremental margins are pretty high for a media company; I wouldn't be surprised to see their fees cut as their next rounds of deals are negotiated, and if that happens AMC could go from looking really cheap to pretty expensive in a hurry. So what makes AMCX a free radical? It's that they're too small to survive that cable bundle breaking on their own.... but they could be a valuable part of a larger company. If a larger media company acquired AMC, the synergies would be enormous. First, they could protect AMC: currently, when a cable company negotiates with AMC, if they black AMC out they only lose the Walking Dead super-fans. But if a larger company with a bunch of other properties bought them, they could increase AMC's negotiating power (for example, if CBS bought AMC, then a cable company would have to blackout not just the walking dead but the NFL, college football, etc.). That protection is huge. Second, the investment in D2C is way too big for AMC to make on their own, but by merging with another company, the combined company might have the scale to make the investment, and AMC's properties could be a crown jewel to help lure people to the service. The crux of Disney buying Fox was getting enough scale to launch a D2C service; things like Nat Geo and The Simpsons have been huge pieces of Disney's marketing strategy, and without them (particularly the Simpsons) Disney probably didn't have enough content to launch a standalone service last year. AMC is no FOX, but it would certainly help fill out a D2C service for any acquirer. To me, if you're buying AMC, you're buying it for one of two reason. One, you think it's going to melt slower than the market is forecasting. That's certainly possible; in fact, I think it's likely that they will end up generating more in after tax cash flow over the next ~10 years than there current market cap / Enterprise value. Still, I think AMC's earnings are in a very precarious state and could fall off a cliff pretty quickly, so there is significant tail risk there. Two, you think AMC is going to get acquired (and quickly, before their value melts further). That's a better bet to me. The synergies with bigger players would be pretty large; the new CBS / VIA in particular would make a lot of sense. As discussed above, they could lend a lot of leverage to AMC in future negotiations, and AMC's library would help CBS hit scale on CBS All Access sooner. In addition, there would be some corporate synergies. I think a VIAC (disclosure: long) deal for AMCX would make a ton of sense.... but unfortunately for AMC, it doesn't appear VIAC is in any rush to make that deal, and I suspect AMCX's hand in negotiating will get weaker by the day as the cable bundle continues to shrink and the Walking Dead continues to age (and, again, we're ignoring the rather huge issue that AMCX's most popular franchises are already tied up in deals with Netflix, which limits AMCX's strategic value to an acquirer). Another natural acquirer would probably be the company I'm going to mention tomorrow, Discovery (DISCA) (though AMCX is a little of a strange fit with DISCA's focus on nonfiction content, but the synergies would still be pretty large and it would be an interesting move). PS- One other quick note on AMCX: capital allocation is always important, but it's perhaps most important in a melting ice cube story. Is management going to return cash to shareholders, or are they going to try to "save" the business by investing all of that capital either back into the business or into new businesses (often at poor rates of return)? I'm a little bit worried about AMC's plans with capital allocation. From FY16-18, AMC's invested just shy of $1b into a huge amount of share repurchases (~25% of their shares out) at an average price in the low $50/share. Today, shares are way cheaper (below $40 on a lower share count and with higher earnings), yet the company is choosing to preserve cash and invest into building out a niche D2C product instead of continuing to retire shares at these low prices / valuation. That company says building out D2C products will have a better rate of return that buying shares; I'm skeptical and if it's true that building out a D2C product will have a better return than buying the business at like 5x unlevered FCF, then that doesn't speak very highly to the future of the business of the sustainability of their earnings (Note: VIAC has pursued a similar capital allocation path, which frustrates me but given they trades for almost twice the multiple of AMC I think it's a bit more defensible).