Yet Another Look at a Reopening Play: $SIX

One of my predictions for 2021 was that cruise line stocks would perform poorly as the year went along (see #7). My thinking was pretty simple: on an EV basis, cruise lines were already trading at valuations in line with their pre-pandemic levels. They were still going to be burning hundreds of millions a month while they waited for the pandemic to ramp down in the front half of the year, and I thought there was a chance that longer term they would face higher cost structure as governments and consumers demanded improved hygiene measures. I also thought there was a decent chance that "reopening falters" trade would apply not just to cruises but also to airlines, theme parks, movie theaters, etc.

Two months into the year, that prediction is not aging well. Reopening stocks are absolutely heading to the moon. Here's a quick basket I threw together this morning; normally I'd include AMC in there but that stock is such a rocketship that I actually had to take it out to make the chart readable!

So, to date, the market has laughed in the face of my valuations and cost concerns.... given that, I wanted to spend a second diving a little deeper into a reopening play I've followed for a long time: Six Flags (SIX)

I've actually got a long history with Six Flags.

As a consumer, I absolutely love theme parks. I have a slight fear of heights.... which makes the thrill of going on a roller coaster even more enticing. And I could eat overpriced chicken tenders, french fries, and Dippin' Dots every day for the rest of my life and be a reasonably happy (if extremely overweight) man. So I love the product.

As an investor, I also love to follow theme parks for three reasons. First, I really enjoy following the media and cable stocks, and Disney and Comcast are two of the major companies in those sectors and each have significant theme park exposure. Second, the theme park business is just really interesting. There's enormous upfront costs to build one and fixed costs to maintain one, but those costs also act as regional moat: once you've built a theme park in an area, it's extremely unlikely anyone else will try to build one in your region because there are almost no regions that can support two major theme parks. Third, theme parks had historically done a nice job of pushing pricing and membership upgrades, but I always thought there was a chance that improvements in technology could eventually create huge improvements in both NPS and profitability for theme parks (for example, as tech got better, people could plan their entire day through a smart phone app, which could reduce wait times for rides while also increasing park capacity).

I looked at SIX early last year right before the pandemic and almost pulled the trigger on taking a position. The thesis at the time was simple: SIX traded in the mid-$30s, an activist was making noise, their 10-k suggested they traded below replacement value, and a business I thought was (slightly) inferior (MERL / Legoland) had just sold for ~12x EBITDA, which would imply SIX was worth at least $50/share.

That $50/share price point is funny: as I write this, SIX is trading for ~$50/share. That's right: SIX basically shut down and didn't have a 2020 season. They burned >$400m last year (~$5/share), and had to raise some very expensive financing right at the height of the pandemic. Despite all of that, in the past year the stock price has gone from ~$38/share in January 2020 to my "MERL / Legoland" pre-pandemic price target of $50/share.

Wild.

What makes the SIX flags example so interesting to me is that this is a business that was not performing well heading into the pandemic. A longtime shareholder and activist had just joined the board, the CEO had just turned over, the company had badly missed on their $750m EBITDA target for 2020, and even prepandemic EBITDA was shrinking (2019 EBITDA was down from 2018, and the midpoint of 2020 pre-pandemic EBITDA guidance was $450m, down almost 15% YoY).

Make no mistake: SIX flags was struggling before the pandemic (the CEO said it well on their Q4'20 earnings call, "over the past few years, we did not evolve at the same pace as our guests' expectations. As a result, we underperformed the industry from both a top line and bottom line perspective."). Yet, with the stock price increasing >30% from its pre-pandemic price, the market is saying SIX is more valuable today than it was before the pandemic despite having burned hundreds of millions of dollars. SIX commenced a "transformation" plan in March 2020 that they elaborated on a little bit more in their Q3'20 earnings; at the current price, the stock market is effectively giving SIX full credit for that plan being successful despite the company not having operated one full season with the plan in place! And it's worth noting the fruits of that big transformation plan will bring EBITDA all the way back to 2019 levels.

So SIX is basically saying, "hey, we're burning millions of dollars, but we've got this great vision. It's going to be hard, but we think that, at some point, the vision is going to get our earnings back to where they were in 2019, and then maybe we can grow from there!" Not exactly a hyper-growth company.... but the market is just absolutely lapping that vision up.

Obviously, I'm a little skeptical here.

Why?

Well, first, the valuation is certainly full. Again, their baseline transformation plan is to get earnings back to where they were in 2019, and a theme park business requires a significant amount of capex to keep the parks up to date and safe (9-10% of revenue has generally gone to capex). So this isn't an SaaS company where you just slap a revenue multiple on it and the multiple screams higher as they grow faster; this is an old, somewhat moat-y business but low growth business that is generally run for cash flow plus a little bit of pricing power.

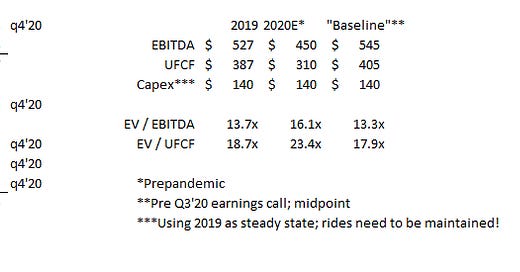

Valuing SIX is a little difficult because it's tough to know what earnings number to use. Obviously you don't want to use 2020 numbers since their parks were basically shut down. But should you use the pre-pandemic 2020 EBITDA projection? The 2019 EBITDA number? Or the baseline EBITDA number they're trying to hit in the future?

It's a good question.... I'll let you decide for yourself what the answer is. Below, I've laid out the valuation based on today's share price and each of the different EBITDA levels. I also included a UFCF (unlevered free cash flow, EBITDA less capex) number to give you an idea of the pre-tax cash flow metric on SIX.

No matter which earnings number you use, SIX looks pricey. We know what an informed buyer would pay for assets like these from the MERL / Legoland sale (~12x EBITDA). SIX is probably a better asset than MERL, but it's already trading several terms above that take out multiple. And remember: SIX will burn cash in 2021, so if you adjust their capital structure for what it'll look like by the end of the year they're actually more expensive.

There are other complexities to the SIX story, but I'm not sure any of them are positive.

Consider, for example, SIX's active member base. This is a critical base for SIX; these are the easiest customers for SIX to market to, get to come to the parks during slow seasons, etc. At the end of 2019, they had 2.6m members. By the end of 2020, that was down to 1.9m. No one can fault SIX for losing members when all of their parks were shut down, but re-acquiring those members is going to be a real cost to SIX and that's not really in their financial numbers.

Maybe I'm being too skeptical here. We've all seen the stories of how much demand there is to return to normal life. Maybe the market is right to be thinking that people will be desperate to return to normal life in 2022, and SIX's parks will be overflowing with customers who are stuffing their faces with high margin fried foods and that demand + operating leverage will create a boom in earnings in 2022/2023.

Certainly possible. But it seems like the market has already priced that in.

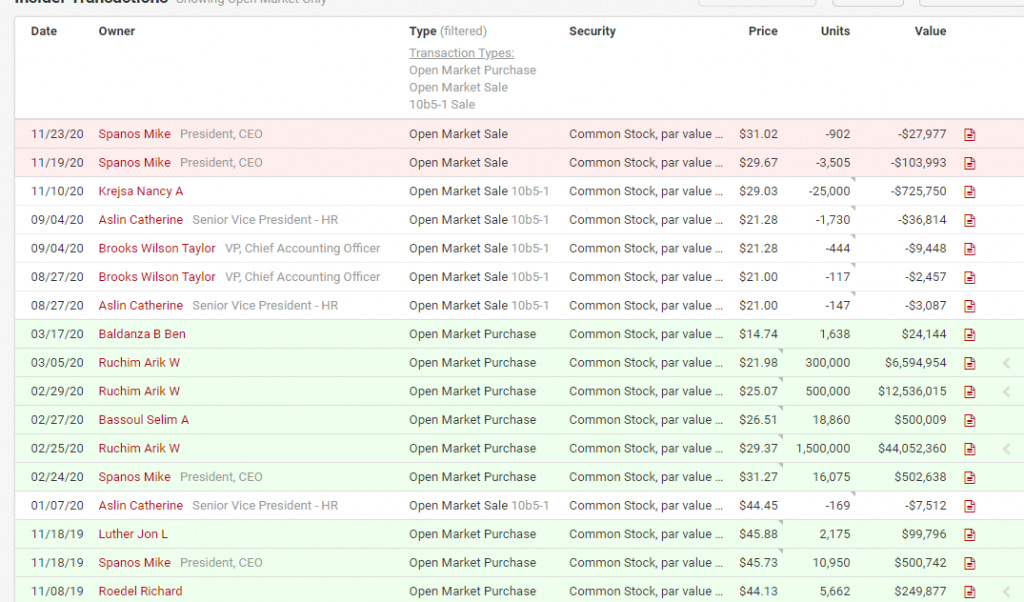

BTW- it appears I'm not the only one who is skeptical. I pulled a chart of SIX insider transactions below; I don't put too much stock in the insiders' sales (the CEO November 2020 sales, for example, seem to be more based around taxes), but I do think it's interesting that insiders were buying relatively aggressively in late February 2020 (before the impact of the pandemic became completely apparent) but were tilting more towards selling at the same or lower prices a few months later as the effects of the pandemic became apparent. Again, nothing wild or to put too much stock in here, but I do think it speaks to insiders not seeing a lot of value at prices a lot lower than today's!

A few weeks ago, CCIV dropped ~50% when they announced their Lucid deal. It was a classic case of "buy the rumor, sell the news," and while the deal was an objective success if you looked at it from a 30k foot view, the narrative and big drop was shocking and I think partly to blame for the current SPAC bubble unwind we've seen.

I can't help but wonder if we'll see something similar with reopening trades. Airlines, cruise stocks, and restaurants are all trading at or above their pre-pandemic levels despite a much murkier outlook IMO. As the economy actually reopens, I think the market might look at the valuation and multiples these things are trading at and say, "o boy, maybe we got a little ahead of ourselves." And I think SIX is a great case for showing that; the business was struggling even before the pandemic, and their current valuation seems to imply not only that the pandemic didn't affect them, but that the pandemic has actually solved a lot of the operational issues they were having.

Again, I'm eagerly awaiting a glorious return to riding roller coasters, but I suspect that SIX and other reopening trades are currently firmly at the peak of their respective roller coaster tracks..... and, as anyone who's been on a roller coaster knows, the ride to the bottom is much, much faster than the ride to the top!