Premium case study: Hanging with Mr. Cooper $COOP

Today's case study is on Mr. Cooper; which I posted in mid-May at <$9/share and has since run to >$18.

This is the second in an irregular series of premium case studies. Today's case study is on Mr. Cooper; which I posted in mid-May at <$9/share and has since run to >$18.

The basic thought for a case study is that once an idea that was posted exclusively to our premium site has largely played out, I'll post the idea publicly as a case study. Partly I'm posting the idea as a plug for the premium site and partly I'm posting it for a historical case study for those who are interested. Note that I'll try to hold my feet to the fire with these case studies when posting in the future; while I hope there are (many) more winners than losers on the premium site and today I'm posting a "winner" (so far! fingers crossed), I'll try to post losing ideas as well both to be honest and to learn from them! (Last note: as announced Monday, prices on the premium site go from $399/year to $499/year; if you've been on the fence about signing up, I'd encourage you to sign up today to lock in the old rate)

(Note: Below is the COOP idea exactly as posted to the premium site mid-May; there was also an extremely prescient update in late May that noted some disclosures that suggested Q2 earnings were going to be (to use the scientific term) bonkers good).

The 90s sitcom "Hanging with Mr. Cooper" had a delightful theme song that included the line "the man you found may be a catastrophe... he may be cute and all but that don't pay this month's rent."

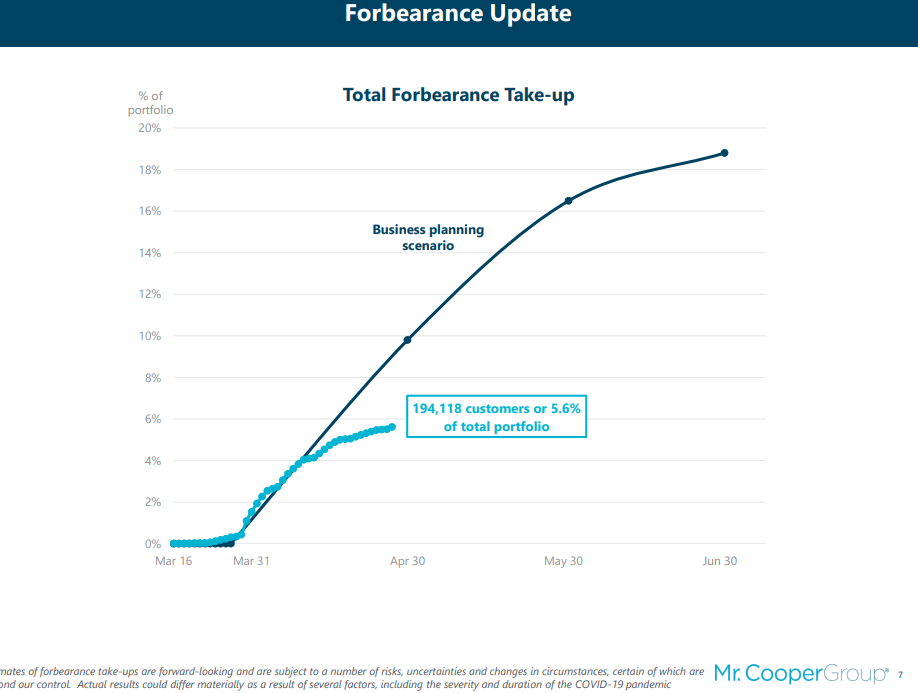

25 years later, Mr. Cooper (COOP) faces a problem similar to anyone trying to date that cute / catastrophic man: homeowners are, en masse, not paying this month's mortgage, and all signs point to homeowners refusing to pay next month's mortgage as well. In fact, the CARES act provides homeowners with the right to up to a year of mortgage forbearance, so it's likely the trend towards homeowners refusing to pay their mortgage is only getting started. Skipped mortgage payments have mammoth negative implications for Mr. Cooper and that mortgage servicing industry in general: as servicer, COOP must cover any mortgage forbearance; while they will get paid by the consumer when the forbearance is over, the delay between COOP covering the payment and the homeowner making the payment creates a mammoth liquidity squeeze that threatens the whole industry.

Make no mistake, these issues are serious and will impact all servicers. However, in general, the forbearance issue is a liquidity issue. COOP has enough liquidity to survive a forbearance environment dramatically worse than current trends. The same cannot be said for many of their competitors.

So the crux of today's post is this: at today's price of ~$8.50, the market is currently anticipating significant liquidity and earnings challenges for COOP. I think that view is dramatically mistaken; COOP has the liquidity to easily weather the current storm, and as we emerge on the other side, COOP will be positioned to pick up distressed competitors for a song. In addition, the current forbearance cycle is likely to lead to a hugely profitable mortgage modification cycle on the other end, which COOP will benefit from (and may even benefit from in an outsized way if they can take advantage of distressed competitors in the meantime!).

But we'll get to all of that. Let's start with an overview of the company.

Mr. Cooper has three different businesses: servicing, origination, and Xome. The first two (servicing and originations) are far larger and more valuable than Xome; however, Xome does offer substantial upside in some bull scenarios.

Originations is the simplest of the businesses. Here, COOP writes new residential mortgages. The origination side mainly refinances mortgages from the servicing side (i.e. the servicing side has a mortgage with a 6% interest rate that could be refi'd down to 4%; origination would take that client and refi the mortgage for them), but they also acquire mortgages from smaller banks ("correspondent channel") or originate new mortgages through mortgage brokers ("wholesale lending").

Xome is a tech / data platform focused on mortgages and real estate. They have three divisions: exchange (auction of houses, generally foreclosed houses from the servicing side), services (mainly services focused on closing loans: title, escrow, collateral valuation, etc.), and data/tech (mainly Xome analytics, a MLS data and analytics provider). COOP has been building Xome through acquisitions and investment, and, until recently, Xome was mainly an internal use product. However, thanks to that investment, that's started to change: external revenue for Xome increased from 43% in 2018 to 53% in 2019. In more bullish cases, Xome continues to expand and becomes an extremely profitable fintech company; however, given we're buying COOP well below book value, by no means is Xome's upside core to the investment thesis.

Servicing is COOP's main focus. COOP is the largest non-bank mortgage servicer in the U.S. (and third largest overall). A mortgage servicer is the person who handles your mortgage payments every month (collecting the monthly payment, administering tax and insurance escrow, managing foreclosure if necessary, etc.); the right to service a mortgage is known as Mortgage Servicing Rights (MSRs). In return for servicing the mortgage, the mortgage servicer gets a portion of the monthly interest payments. For example, if the interest rate on a mortgage is 4%, ~3.75% of the interest might go to the investor who actually owns the mortgage, while the other 0.25% will go to the loan servicer to cover the costs of servicing a loan (plus, of course, to hopefully turn a profit). MSRs can either be retained by whoever originated the loan or can be sold off to a third party (i.e. JPMorgan might write your loan and then remain the servicer, or a small bank might write you loan and then sell the MSRs to a larger platform like COOP).

The current environment is an absolute disaster for a servicer for three main reasons:

The CARES act allows homeowners to forebear their mortgage payments for up to a year. Servicers are on the hook for those forbearance payments (i.e. even though the homeowner isn't paying their mortgage, the servicer makes the principle and interest payments to the mortgage holder, and the servicer must look to get paid back by the homeowner once the forbearance period is up). Fannie and Freddie recently moved to limit the amount servicers need to cover to four months, but that's still a huge liquidity drag.

An MSR is the right to take a piece of the interest payment each month until the loan is paid off, and its value ends when the loan is paid off or ends (through default or refinancing)). That makes MSRs something of a bet on interest rates and default rates: when you buy a pool of MSRs, you're going to have certain asusmptions on interest rates (which drive mortgage refis) and defaults. If mortgage refis and defaults come in higher than modeled, the MSRs are going to be worth less than you thought. If refis and defaults are lower, the MSRs are going to be worth more. Given the current economy (awful) and interest rate environment (lower than ever), MSR rights are going to be taking an absolute bath. Indeed, COOP's Q1'20 earnings showed a $383m mark-to-market loss on their MSRs.

There is a bit of a counter to this: increased refis should be a boon for COOP's origination business, and increased foreclosures and delinquencies will be a boon for Xome. Still, the negative to their owned MSRs outweighs the positives to the other businesses.

In addition, dealing with distressed mortgages simply costs more. In good times with a performing loan, a mortgage servicer simply auto-collects the monthly mortgage payment from your bank account and forwards the money to whoever owns the mortgage. The marginal cost of collecting on performing mortgages is basically nothing. Distressed mortgages are different. Dealing with mortgages is heavily regulated, and borrowers who are late on payments must be contacted, lots of hoops must be jumped through, etc. It's all quite costly, and it all falls on the servicer to do. So the current distress environment not only results in lower MSR value for COOP, but it also results in higher expenses!

So the near term for mortgage servicing is likely to be poor. And, again, that's largely been reflected in the results to date, as COOP took a mammoth charge on their MSR assets in their Q1'20 earnings.

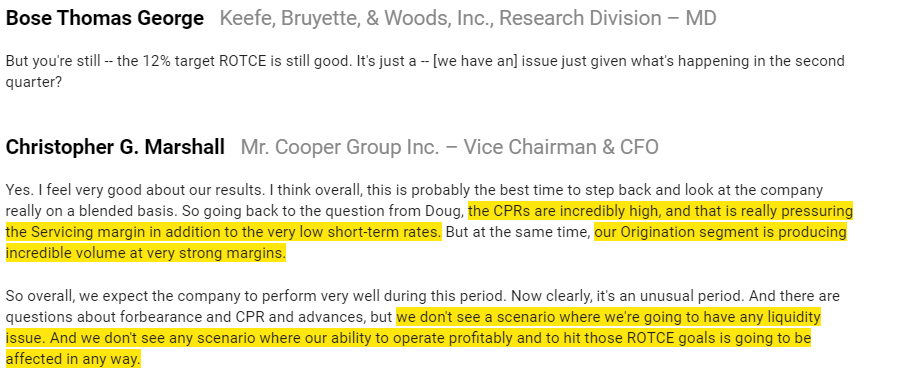

But what excites me most about COOP is what happens on the other side of the current environment. COOP has plenty of liquidity to get through this environment. They refi'd the majority of their debt in January, and they are running their business to a base case that has forbearance increasing to a substantially higher level than it's currently tracking to, and even in that environment COOP has enough liquidity to get through without raising capital.

The same cannot be said for many of COOP's competitors. Just to name one example, Ocwen (OCN) has been in trouble for years, but, judging from their Q1'20 preannounce, the current environment may be enough to push them from "troubled" to "full blown distress" (though they still seem bullish!). Peers like NRZ and PMSI have also run into some issues with margin and financing. And these are the larger players: there are a significant number of smaller players in the market, and I would guess all of them are having substantial liquidity issues.

That could set up a bonanza on the other side for COOP. At a minimum, in the near to medium future their competitors will have less capital available to bid for new MSRs, so COOP should be able to take market share at attractive rates as we emerge. Even better, competitors in distress or facing liquidity issues may need to sell assets; given COOP will be in a better position than any of their competitors (and already enjoys more scale benefits and a better platform than comps), COOP should be the natural buyer of any distressed assets that come for sale, and any deals should be extremely accrettive (COOP confirmed on their Q1'20 call that, with their liquidity "locked down", they were looking to "play offense in this environment."),

There could also be a big benefit on the back end of this cycle from modifying all of the mortgages in distress / forbearance. Remember, dealing with distressed mortgages is costly. However, investors and the government know that it's costly, and they also know that all parties benefit if they can find a way to bring a distressed mortgage back into performing territory (homeowners benefit because they don't get kicked out of their homes, investors and servicers benefit because they don't have to go through costly foreclosure proceedings). Because everyone is better off if distressed loans can be brought back performing instead of foreclosing, servicers are often given bonuses and fees if they modify a distressed loan to make it performing again.

At the end of the forbearance period, I would guess there's going to be a ton of mortgages that are quickly going to flip to distressed or need some type of modification to avoid distress. As servicer, COOP will need to make those modifications, and they'll be in line for healthy fees as they do so. We saw something similar with the servicers in the wake of the GFC; the government created the Home Affordable Modification Program(HAMP) to encourage servicers to work with homeowners. The HAMP fees proved a bonanza for the servicers, and it sent their stocks near parabolic. For example, here's OCN, which saw its share price ~3x as the HAMP program really kicked in in 2012/2013. You can find more in their 2013 10-k, (particularly p. 39) but the basics of the program is the government had HAMP incentives that could earn several thousand dollars per mortgage, and OCN collected >$200m in HAMP fees from 2011-2013. Those fees drove OCN's profitability through the roof. The big profits, plus a big roll up strategy, sent OCN’s shares through the roof, While it's early, I think there's a serious chance that we see a similar program coming on the heels of Corona, and COOP would be a major beneficiary of that program, as well as to benefit from rolling up the industry.

So, in an upside scenario (and I actually think it's rather likely / possible), a bunch of COOP's competitors are in distress coming out of the crisis. At minimum, that allows COOP to pick up market share in new deals at attractive returns/pricing going forward, but it likely allows for some accrettive M&A as well. Longer term, a bunch of loans will likely need modification coming out of the crisis, and COOP could make a significant amount of money in modification fees on the back end. A similar modification cycle happened after the GFC, and it sent the shares of servicers flying.

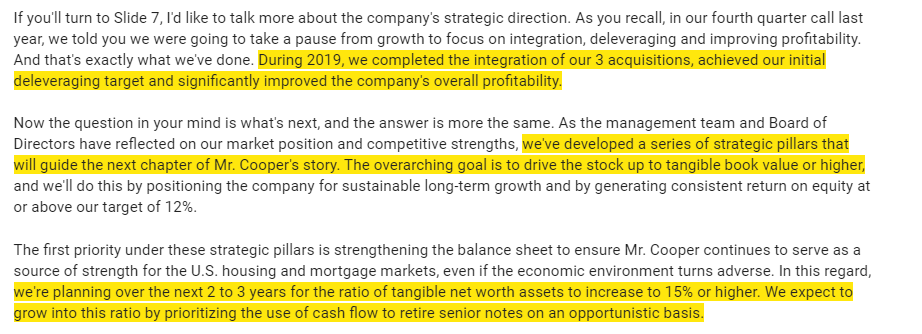

But here's the great thing about COOP: at current pricing, you don't need any of that upside to play out to make money. COOP's tangible book value per share is $20.50. The company targets a >$12% return on tangible equity (excluding mark to market earnings or losses on their MSRs), though they've pretty consistently been higher than that number. If you assume they can hit their 12% target, they should be able to earn ~$2.50/share in earnings. Today's share price of $8.50 is good for a P/B of ~0.4x and a P/E of <4x those hypothetical earnings.

Now, there are some issues you can easily take with that valuation:

Book value includes a mammoth deferred tax asset (~$15/share), most of which is an NOL that only has value to the extent COOP has earnings.

COOP's ROE targets include substantial addbacks (in particular, add backs of mark to market of MSRs).

Both the servicing and origination business run with substantial leverage, so even "bleh" ROAs can result in attractive ROEs.

And all of those concerns are certainly valid.... but I think today's valuation more than overcomes those concerns.

Yes, COOP is levered, but leverage is common in this industry and given the underlying mortgages are government backed mortgages, some leverage is absolutely appropriate here.

Yes, COOP's ROE targets include a lot of addbacks, but a huge piece of them are the MSR rights decreasing in value. COOP has managed to make money even while their core asset is seeing interest rates go against them; if interest rates ever held flat or moved their way, the underlying results could be incredible.

Yes, book value includes a big tax asset.... but that asset is getting used, as COOP is profitable! It's a real asset! You can haircut it if you want, but even with a haircut COOP still trades below tangible book value.

These concerns are also not lost on the management team. Pre-crisis, they consistently discussed how their plans for COOP were to get it to trade up to tangible book value (or higher!) by delevering and improving asset returns.

I'll go through a bunch more points in the odds and ends section, but I'm going to call it for the main write up here. The three major points I hope you take away from this piece are

COOP has sold off on near term fears, particularly around liquidity, but COOP's balance sheet is positioned to survive even a much worse scenario than we are currently seeing while peers are in significant distress.

In the medium term, COOP is likely to benefit from the current environment. Assets should be available at attractive pricing, and COOP should be a major beneficiary of potential modification fees. In the last cycle, modification fees sent COOP's peer stocks (and their earnings) soaring.

You're not paying anything for that upside potential. COOP is trading below tangible book value. Management is focused on deleveraging, and doing so should allow the stock to trade closer to book value over time.

Odds and end

This deck (from May 2019) did a really nice job covering the industry in general and COOP specifically; while it's a little out of date, it's a very good overview.

The CFO / Vice-Chair bought some stock on the open market in the middle of March. I'm always a little hesitant to put stock in insider purchases, and I'm particularly hesitant in insider purchases done as COVID really accelerated (just because so many insider purchases were XAN like; buying all the way down as the business imploded). Still, I do think there is a little info here: the CFO's purchases were around the time most of his peers started getting margin calls; he probably had some idea how bad things were getting and still bought a decent bit on the open market.

On their earnings call, NRZ disclosed that Fannie / Freddie were talking about a $500 incentive fee for forbearances. We'll see where everything shakes out; I was hoping it would be a little higher, but even at $500 this would be a massive cash inflow for the servicers.

This is a highly regulated business, and regulators can inflict harm in a variety of ways. Some of these can be earned (i.e. the NY Fed stopping an Ocwen / Wells Fargo deal) and some of these can be because the regulator woke up on the wrong side of the bed.

KKR owns ~20% of COOP's shares. The shares are held at the KKR level, not in a fund or anything, so there's no set timeline for realizing the value of this stake. I'm of a mixed mind of private equity controlled public companies: on the one hand, they're generally less likely to do stupid deals as the PE firm asserts some capital discipline on the management team. On the other hand, the PE firms often are willing to play games with minority shareholders to try to take the company over for a song.

A decent bit of KKR's stake is through prefs that convert to COOP stock at $13.20/share, so KKR has serious incentive to get COOP's share price higher than that eventually.

I mentioned the upside from Xome a few times. I don't think it's hugely relevant to the base case thesis, but the upside could be pretty significant. In Q1'20, Xome's revenue were up organically 10% YoY, and revenues from third parties increased from 43% in 2018 to 53% in 2019. On their Q1'20 call, COOP tempered near term expectations for Xome but suggested that the sales piepline and outlook were gaining significant traction (quotes below).

Again, COOP trades well below tangible book. You don't need XOME to be crazy profitable or gain market share for this idea to work, but if it does the upside could be very large. Xome did $38m in earnings before taxes in 2019; that doesn't include any corporate overhead allocation (though G&A is baked in), and XOME is still only gets ~half their revenues from third parties, so the $38m number isn't completely clean..... but I don't think it's a huge stretch to say this business could do $20m in earnings as a standalone business with a full corporate overhead allocation in a semi-normal environment. At a reasonable 10x multiple, Xome would be worth $200m, or >$2/share. In a real bull case, Xome could be worth COOP's entire market cap in a few years. I don't think it's crazy likely, but I also don't thin you're paying much for Xome at today's prices.

A lot of COOP's book value comes in the form of NOLs. Your mileage on those may vary. Would I rather the book value be 100% in cash? Of course. But I do like the NOL value here: I think near term earnings have the chance to be much higher from the forbearance and modification fee income, which would allow them to quickly convert the NOLs to cash, and I think there is a chance that we come out of today's environment with higher corporate tax rates, which again would increase the NPV of those NOLs (though somewhat countered by all businesses being worth less in a higher tax environment).

Another nice thing about COOP? If we did somehow find our way into a higher interest rate environment, the value of their MSRs would go much higher.

There's been a ton of press spilled on Fannie / Freddie deregulation. I don't think it's in the cards near or medium term for a variety of reasons (the politics of trying to privatize home mortgage financing while a government guarantee is the only thing that kept the system functioning the past few months are not fantastic), but if it did happen I actually think it would be a net benefit for COOP as focused players like COOP would probably pick up shares versus more inefficient bank platforms.

Just for some industry color, below are some highlights from NRZ and OCN (two COOP servicing / origination competitors) Q1'20 callson how profitable the current environment is for underwriting and the potential for subservicing going forward

NRZ

OCN