A flywheel marketplace at <10x EBITDA: $ANGI $IAC

Yesterday, I put up a post on ANGI's emerging flywheel. I'd encourage you to read that for qualitative background on ANGI, because today we're diving deep into the valuation of ANGI.

However, before we go into that, let me start with a little bit of a tease and a question.

First, the question: based on the fundamentals I described in the qualitative ANGI piece, what multiple do you think ANGI would trade at if they successfully completed their flywheel?

I think the answer is "a very high multiple," because if I'm right in the scale and size of what ANGI could build they'd have an enormous moat in a reasonably economic resistant segment of the economy with huge growth and potential "ladder up" opportunities. But it's actually not an easy question to answer, because there wouldn't be any perfect comps for ANGI and many of the loose comps are at wildly different stages of monetization and have wildly differing moats.

Take a look at the slide below, which I'll call the "marketplace take rate slide." It lists some possible peer marketplaces, the total market size they're attacking, and their take rate + market share. Please keep the slide in mind, as I'll be referring to it throughout the article.

I just pulled up Bloomberg and the multiples for these "peers" range from ~10x EBITDA for EBAY to 25-50x for BKNG / GRUB / ETSY to >100x for ZG. Uber is unprofitable and AirBNB isn't public, so tough to put a multiple on those.

Again, all of these companies have wildly differing things that might mess with their multiples (BKNG is dealing with the worst travel environment since the invention of air travel, while Zillow is expanding into iBuying), so I don't think any are perfect comps. But, in general, I think this suggests that if ANGI pulls off their fly wheel, they should trade for a pretty solid multiple. I don't think 30x+ EBITDA would be at all unreasonable.

I mentioned I wanted to start the post off with a question and a tease. You now know the question (what should ANGI trade at if they pull off their flywheel?) and my take on the answer (pretty high!). What's the tease?

The tease is this- what if I told you that I thought ANGI today was trading for 4-6x normalized EBITDA?

You'll never see that multiple on a screen (as I write this, Bloomberg says ANGI trades for ~28x EBITDA), but by the end of this post I hope to show you that ANGI is trading for a low single digit EBITDA multiple of their normalized earnings. If I'm right, based on the multiples above ANGI should be a $60+ stock if things work reasonably well. Again, that valuation assumes that ANGI can successfully complete their flywheel (a big assumption!), but I think it illustrates the huge skew here.

That type of upside may seem crazy. But having an internet marketplace stock explode as they complete their flywheel has happened plenty of times before. Heck, it's happened recently with an IAC company. I first wrote up IAC back in late 2017. At the time, Match traded for ~$26/share. Here we are three years later and Match is trading for well over $100/share (plus some dividends!). Being a dominant internet platform that successfully figures out monetization can have huge and rapid upside; who knew?

Ok, history out the way, let's talk financials.

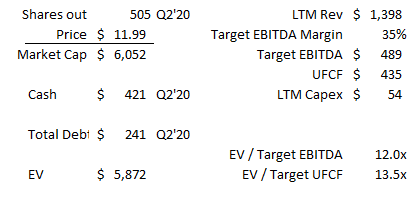

At today's share price of ~$12/share, ANGI trades for an EV of just under $6B. Trailing EBITDA comes in at just over $200m. Unlevered cash flow (EBITDA less capex) comes in at $152m. So, just on trailing financials, ANGI actually trades roughly in line with where the peer marketplaces listed above trade (~30x EBITDA). (Note also that I'm using ANGI's adjusted EBITDA, which ignores $60-70m in stock comp. That's a real expense, but peer valuations generally ignore it and it should get a lot smaller as a % of EBITDA as ANGI scales, so I'm comfortable ignoring it to simplify the math a bit. I'd rather look at the forest and be directionally correct than get caught up in the weeds here!)

I mentioned in the tease that I thought ANGI traded for ~5x normalized EBITDA. How does that make sense given the numbers I just laid out?

Well, the first step is to think about ANGI's margins. ANGI currently does <15% EBITDA margins. ANGI has consistently said they think think they can get their EBITDA margins to 35% over time. I think that number makes sense when you look at other marketplaces. EBAY, for example, is currently doing ~34% EBITDA margins. Uber believes they can get their Mobility EBITDA margins to 45% over time, and they were doing 30% before COVID. Booking was close to 40% in both 2018 and 2019. Grubhub was under 20% as they were fighting a relentless battle with start ups focused more on market share than profitability (thanks Softbank!), but if you looked internationally peers were doing >40% EBITDA margins and I think Grub could have gotten there at some point (GRUB had also approached ~25% EBITDA margins a few times in the past).

Anyway, bottom line: ANGI is currently doing <15% EBITDA margins, but I expect that their normalized EBITDA margins once they fully grow into their business / cost structure / take rate is significantly higher, and peer margins support that conclusion.

Trailing Revenue is ~$1.4B. If you believe that this model will get to 35% margins at scale, than "normalized margin EBITDA" on that revenue is ~$490m. At today's share price, the company would be trading for ~12x EBITDA.

Still, I don't think that tells the whole story. A big piece of ANGI getting their EBITDA margins to 35% will come from increasing their take rate (the % of every dollar spent that ANGI keeps). I think ANGI is currently depressing their take rates in order to get their flywheel spinning. An example might show this best: think about what Uber did to get drivers on to their system. Driver's net take for trips could go over 100% (i.e. some drivers might make $11 on a trip a customer paid $10 for) because Uber was giving drivers huge incentives to complete rides. Getting a flywheel started is expensive and faces a huge chicken / egg problem; the way to solve that problem is often to subsidize every side of the platform and keep take rates extremely low to incentivize activity on the marketplace. Once the flywheel is fully spinning and customers / suppliers are somewhat locked in, then you can start raising take rates and worry about making a profit. ANGI right now is keeping their take rates low in order to lure more SPs on their platform. Once ANGI fully has their flywheel spinning, I expect that they'll be able to significantly increase their take rate. Doing so will not just boost their EBITDA margin, it will also increase their revenue!

This increase is not a secret. Think back to the marketplace take rate slide I posted; ANGI has consistently pointed out that their take rates are well under peers / what they could charge at maturity. Heck, as far back as the ANGI / HomeAdvisor merger back in 2017 ANGI was saying that there was huge potential upside to their take rate.

So where could take rates eventually end up? ANGI has hinted that they already get something close to 20% (or maybe more!) in some of their more mature fixed price businesses. That's probably a nice starting point for thinking about take rates. Personally, I think 20% is doable, but it might end up being a little aggressive. Take rate is going to be a push and pull between a lot of different factors. Again, I'll refer you to the take rate marketplace slide, but just eyeballing it lower dollar value things (like food delivery for Grub Hub) tend to have slightly higher take rates than high dollar value things (like renting a room on AirBNB). Something more fragmented (again, like restaurants and food delivery) is going to have higher take rates than something more concentrated (like hotels / airlines with Booking).

When you think about ANGI, I think they play into a pretty highly fragmented market, which is good for take rates, but also one with higher dollar values (having a plumber come to your house is a bigger ticket than ordering a pizza, and getting a new deck built is multiples of both of those, which suggests slightly lower take rates). Remember that ANGI also has to worry about people trying to go around their marketplace much more than something like Uber; every 1% ANGI nudges up their take rate is going to increase the incentive for a provider to try to contract with repeat customers directly and get off the ANGI platform (say you get your house cleaned for $100 once a month. If ANGI's take rate is 1%, the cleaner probably doesn't try to go around ANGI. If ANGI's take rate is 20%, the cleaner might offer you $10 off to just pay them directly and both of you are better off!).

Anyway, while I think ANGI might be able to get take rate up to 20% at some point, I feel more comfortable underwriting them at 15%. That would be at the lowest end of the take rates from the take rate slide above, so anything above that will be pure gravy.

So I think the right way to think about ANGI's valuation is this: trailing revenue is $1.4B. Let's say that, over the next three years, total service requests / marketplace transactions on the platform grow 10%/year. That would be well below what I think they can do; Service requests grew 17% in FY19 and will likely grow mid-teens this year despite some COVID headwinds (and seem to be accelerating!), but bear with me.

Ok, so service requests are growing 10% YoY for the next three years. We know ANGI's take rate is currently <10% (per the marketplace take rate slide), but we don't know exactly what it is, so let's just say it's currently 10% and over the next three years they'll increase it to 15%. Finally, let's assume that between the increased take rate and some operating leverage, ANGI gets their EBITDA margins to 35% by the end of the period.

Throw that all together and we can estimate a 2023 financial statement for ANGI.... and the results look pretty darn good. Revenue increases to ~$2.8B. With 35% EBITDA margins, EBITDA comes in just shy of $1B. And, assuming capex equals 2019 levels, unlevered free cash flow is well over $900m. Put it all together and the company looks screamingly cheap on forward numbers a few years out (and that's ignoring that they should be generating well in excess of $100m/year in free cash flow between now and then).

Again, I think this business is worth at least 30x EBITDA if they successful complete the flywheel / hit those metrics. 30x EBITDA on those numbers is a $60+ stock.

Now, there's plenty to quibble with those numbers. In particular, I doubt the company is going to be able to get take rates up quite that quickly. And the headline numbers are likely to remain messy / depressed for a while; maybe they can get take rates up to 15-20% in a few categories by then, but ANGI will likely still be in investment mode and running a bunch of markets / verticals at low take rates to keep accelerating growth and moving into new categories.

But I don't see any reason that ANGI can't hit any of those metrics longer term. In fact, I think a lot of them may be conservative. ANGI's take rate is certainly under 10% now, so we're likely talking about a much bigger boost as they approach 15%. And I think ANGI should be able to grow service requests and transactions at significantly greater than 10%/year.

The most important thing is this: we live in a world of zero interest rates. I believe ANGI has a flywheel and can hit the economics I'm projecting. And I think they can hit them this decade. Maybe it doesn't happen in 2023, but I would guess by 2026 those numbers are shining through, and probably better than I've projected. I'm not saying that you should buy ANGI as a play on man terraforming Mars and ANGI expanding into interplanetary home service domination in 2070, but as long as ANGI is approaching the numbers I think they can hit, given a world with zero interest rates it doesn't make a huge difference if they hit full scale in 2023 or 2026. The stock will be a literal grand slam.

Maybe I'm being too bullish on ANGI. But there's another person who thinks ANGI is too cheap today: ANGI insiders.

Remember, ANGI is controlled by IAC, and IAC has a long history of investing successfully into marketplace companies. So while it's always nice to see insiders bullish on a company, the fact that ANGI's insiders (who largely are a part of IAC or have some connection to it) are bullish on ANGI is particularly instructive here.

There are two ways to see how bullish insiders are. The first is to look at the proxy statement. My friend nongaap has already done that for you/me, so I'm just going to refer you to his write up. I'll just highlight one thing here: the midpoint of ANGI's 2022 revenue and EBITDA hurdles for management comp are $2.35B and $427.5m (respectively). That's a fair bit lower than the 2023 numbers I put out in my "full take rate" scenario.... but it's not materially lower, particularly if you think 2023 is the year they really start to turn up the take rate (i.e. growth from now till 2022 is mainly service request and transaction increases, and then in 2023 they really start the march towards a normalized take rate). Remember, increasing take rate is basically 100% margin; at the ~$2.35B in 2022E revenue for the management target, it wouldn't take much of a move in take rate to send EBITDA screaming higher in 2023. Note also that the management 2022 targets imply an EBITDA margin approaching 20%; higher than their current margins, but still significantly below both management's projections at deal time and where I showed marketplaces tend to settle out. Again, while the management targets are probably higher than the market is expecting, I think they remain significantly below the long term potential of what this business can do.

The second way to see how bullish insiders are is is to look at ANGI's share repurchases. Remember, IAC already controls ANGI and owns ~85% of them. Most controlling shareholders with stakes that large don't like to do buybacks when the free float is that small. It's just a tough combo: you can't buyback enough shares to really move the needle, and doing so creates an even thinner free float which makes it more difficult for your stock to catch a bid.

Plus, ANGI's stock isn't just illiquid. ANGI is trying to fully kickstart their flywheel. Acquisitions can be extremely accrettive in flywheel type companies; not only are there cost synergies, but growing larger often spins the flywheel faster so you end up in a situation where 1+1 doesn't just equal 2 or 3, it equals ten. I'm sure there are better examples than this, but think of something like Ebay + PayPal twenty years ago. Merging the two created huge value for each (eBay because it helped them cut down on fraud / increased buyer trust / lowered friction to buying, which increased transactions; PayPal because it got them a core customer to launch their flywheel). ANGI is trying to jumpstart their flywheel, and acquisitions are a great way to accelerate that flywheel. ANGI has to weigh buying back their own stock against the huge potential accretion from a successful merger.

Given both ANGI's illiqudity and the potential from mergers, I think it's instructive that ANGI has bought back ~15m shares over the past year. Again, this isn't the largest buyback of all time, but when you think about who's driving capital allocation here and some of the alternatives they may be giving up, I think it's instructive to just how cheap the stock is. Also, consider this: over the past year, ANGI's free cash flow to equity (cash from operations less capex) comes in around $185m. ANGI spent a bit over $100m on share repurchases over the same time. ANGI isn't just buying back shares despite an illiquid stock and the opportunity for potentially accrettive acquisitions.... ANGI is directing the majority of their cash flow to buying back stock! Again, considering IAC's history with marketplaces, the fact they're directing the majority of cash flow at ANGI to buying back ANGI stock is pretty telling.

Ok, that covers valuation. I know I said I was going to make this a two part post, but there's still a lot of stuff I want to talk about and I want to be fully prepped for my podcast with Minion Capital tonight (which I'm very excited for!), so I'm going to end this post here. Monday I'll wrap up with an odds and ends post where I'll address some lingering risks, reader questions, and a few other things (editor's note: posted the update here). If you have anything you're curious about or you'd like to see addressed in there, feel free to reach out in the mean time.