$ANGI: odds and ends

Last week, I posted the qualitative and quantitative bull thesis for ANGI. Today, I want to dive into some other odds and ends that didn't make their way into the piece, as well as answer some questions / concerns / bear thesis that have been sent to me since posting.

One question that's always worth asking- why does this opportunity exist? I think there are two major reasons. The first is simply that ANGI screens poorly. Again, this is a company early in hitting their flywheel, so their financials are messy and they look expensive on a trailing basis. However, if I'm right, one day the flywheel will be really spinning and ANGI will be able to start to nudge their take rate up while realizing huge operating leverage. When that happens, what today looks like a company trading for ~30x EBITDA is all the sudden going to morph into a company growing >20% annually with huge pricing power and trading for ~10x EBITDA. I'd expect the stock to rocket if and when that happens.

So that's the fundamental reason. Still, I think enough companies have successfully completed their flywheel and seen their stocks get massively bid up that investors would be on the lookout for a potential flywheel at ANGI. That brings me to the other reason I think this opportunity exists: illiquidity. ANGI is a $5-6B market cap company. However, IAC owns ~85% of them, so the free float is well under $1B and shares are relatively illiquid. That small float / illiquidity precludes a huge portion of the investing universe from getting involved with ANGI, and I think it's a major reason ANGI trades at such a discount.

There's good news on both of these fronts. On the "screening poorly" point, at some point if ANGI is successful their margins will explode higher, and the screening problem will fall away. On the float issue, IAC has frequently referred to themselves as the anti-conglomerate, and when ANGI is ready to stand on its own IAC will almost certainly spin them off (they've already done so once before, as they considered spinning ANGI along with their Match stake).

I linked to mindsetvalue's bear piece in my first post, and he was kind enough to publish a follow up piece (in addition, I thought Keith Smith laid out a bear point well). I respect all of his points, but I think his fundamental bear thesis boils down to: right now, service professionals have plenty of demand and don't need ANGI (this point + "google risk" were the two most common questions I got asked about). I think that's short sighted. Demand on ANGI is exploding; eventually, SPs are going to get pulled onto ANGI whether they like it or not. Say you were a NYC car driver 10 years ago. You had all the business you needed, Uber be damned. And it was fine to live the "Uber be damned" life for a long time.... until one day all of the demand was on Uber, and you either got onto Uber or you had no business. I suspect most service providers will see something similar, though probably on a (much) more gradual scale. If you're a plumber with a full book of business and a loyal customer base today, you don't need ANGI for incremental business and you won't need it tomorrow or even next year. However, at some point in the future, some of your customers are going to churn (maybe they move, maybe they die, maybe a competitor steals them). When that happens and you want to replace them, eventually the most cost effective channel, by far, will be to go on ANGI.

I guess I'd sum it up like this: mindsetvalue looks at demand (service requests) exploding higher and growing faster than SPs can keep up and sees a bear case. I look at service requests exploding higher and see the bull case; in marketing, money eventually follows eyeballs. I think something similar happens here; eventually, the supply will go to wear the demand is. And the demand is on ANGI.

The other piece of the mindset's bear thesis centers on an SP shortage (in particular, for plumbers). Again, I think that's short sighed. Plumbing is a frequently mentioned service, but ANGI is trying to own every service in the home (painting, roofs, heating, etc.). I doubt that every single provider category is going to have a shortage. And, even if that were the case, it doesn't mean ANGI can't carve out a great business for themselves. Remember, if you're a plumber, time is money. If you had a project scheduled for Friday and it cancels, that's lost money. Even if you've got a loyal book of business, you may not be able to instantly fill that project on your own.... but if you turn to ANGI you probably can! And once ANGI has you (as a provider) and fifty other plumbers on the platform to fill up random dead time in your schedule, that should be enough to keep that flywheel building. (I also like how Elliot Turner touched on this point)

And just to address Keith's point a little more: I do think over time ANGI's platform will let SPs do value add services that will help justify the take rate / pull and keep people on their platform. There are a ton of things I could dream up here; your simplest would be some form of smart scheduling so SPs could spend more time doing revenue generating work and less time on their schedules / doing customer relationship stuff / travelling (a part of the smart scheduling should be putting jobs next to each other to minimize "dead" time travelling from jobs), but you can start dreaming some really big stuff depending on how creative you get and how large a piece of the market you think ANGI takes.

Just to drive this home / combine this with the SP shortage point: even if SPs are in dramatic shortage and command super premium pricing with huge books of business, that doesn't mean ANGI has no place in the world. Lost / deadtime is still a huge risk for SPs (perhaps even more so if there's a huge shortage and the SPs are charging huge amounts!), and if ANGI pulls off their platform successfully, it will be the most effective and easiest place for SPs to fill in their books of business / acquire new customers / replace cancelled jobs.

Just one more thing ANGI could do: if you hire a contractor, one of your worst fears is they do shoddy work or take whatever you give them for materials and just never show up for the job. ANGI could use their database / knowledge to avoid that problem. They could guarantee a contractor's work, and they could hold payments in escrow until the job is completed. Both would solve a major consumer pain / worry point and make customers want to transact over ANGI instead of going around ANGI and directly with a SP (even if the SP were willing to offer a discount for going direct!).

The other big risk here is google risk: why doesn't google just do this themselves? That's a question that looms large over just about any online business, but I think ANGI is reasonably well insualted. If you think of ANGI as "yellow pages for plumbers / painters," then yeah, ANGI is exposed to Google. But if ANGI is actually matching customers to vetted providers, showing them availability, handling payment, etc.... then ANGI has built a moat that is extremely difficult to recreate / automate.

Maybe this is a better way to put it: Google is really, really good at recreating your business if they can automate it. Booking and Expedia were always a little vulnerable because Google could just scrape airline / hotel sites to find pricing / availability and offer to customers that way. ANGI, at scale, is different. If you search for a plumber who can come to you tomorrow at 5 PM, how would Google know who could / couldn't? That's not an easy web scrape. It takes going out to a ton of local plumbers and having access to their calendar / book of business to do that. That's ANGI's end game, and it's a huge moat.

In my qualitative post, I mentioned ANGI's moat and how I thought buying online / fixed price is where I thought the future was. I forgot to link to some ANGI quotes on that subject, so figured I'd throw them in here. Here's ANGI talking about how a smaller start up will have problems with loyalty, and here's them talking about how this is likely the dominant way people by 10 years from now.

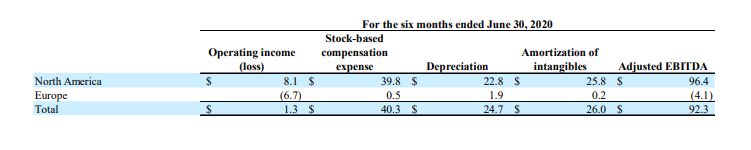

One valuation thing I didn't mention: ANGI's consolidated results includes their European operations, which are burning ~$10m in EBITDA annually. Adjust for that and ANGI would be a little cheaper on a headline / trailing basis. Obviously the European operations offer huge upside; it's one thing to dominate the North American home services market. Dominating the North American and European market obviously offers more rewards and probably some interesting scale / size benefits (leveraging tech / SG&A the most obvious, but I can dream up a few others).

There are acquisitions to be done out there. On the public company side, I think there'd be varying degrees of synergies with GRPN, YELP, FTDR, and I'm sure a few I'm forgetting. There are several private market companies that I think would have synergies with ANGI too. Obviously betting on any particular acquisition is a fool's game, but I do think M&A is inevitable and likely to be extremely accrettive for ANGI. That's one of the great things about flywheels: if you have a successful flywheel up and running and there's an acquisition target that will make the flywheel spin a little faster, almost by definition that business is going to be worth more to you than the business is worth as a standalone and so just about any acquisition should create a decent bit of value as long as you don't massively overpay.

As I was finishing this up, someone shared this interview / article saying ANGI should buy YELP. I agree (though I won't fight you if you'd rather IAC acquired YELP).

Personally, I think FTDR would be the most interesting acquisition. FTDR sells home service plans; think of it like a warrant for fixing electrical, plumbing, etc. If something breaks in your home, FTDR will pay for a repairman to come out and fix it. I think the synergies with ANGI would be incredible; buying FTDR increases ANGI's demand amount and would let them start planning SPs routes more / become a more integral piece of their SPs business, and the scale of the combined ANGI + FTDR spend would let them negotiate preferential pricing with SPs. FTDR spun out of ServiceMaster in October 2018, so we're just entering the timeframe where they could get acquired without tax consequences....

Kind of related to the acquisition optionality; the market is fully willing to price some growth-ier names like IPOB at levels that imply a much better chance of market domination. I think that's curious: ANGI is already profitable and is building (IMO) a much more defensible moat with just as many (if not more) opportunities to level into new optionality. At some point, I think they get recognition for that.

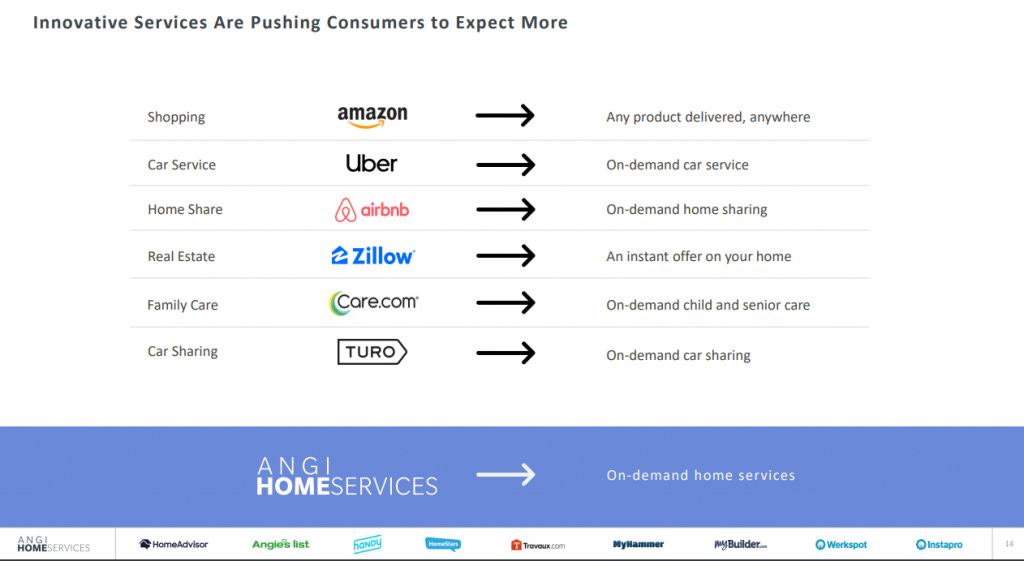

The slide below intrigued me. For two reasons

Take a look at Zillow's stock price since they pivoted to iBuying. I think it kind of highlights the point I've been driving home this whole series: if ANGI's flywheel starts to look like it's paying off, the stock is a rocket.

IAC has investments in Care, Turo, and ANGI. Are they juicing the slide a bit? Yeah, probably. But marketplaces have a lot of optionality if they pay off; I think the slide illustrated the positive skew in a lot of IAC's investments!