Getting the flywheel spinning at $ANGI $IAC

If the past few years have taught investors anything, it's one simple rule: buy pre-deal SPACs, pray that they announce a merger with anything that can vaguely be construed as an electric vehicle company, and profit.

Have there been other lessons to be learned in the past year? Sure, though honestly those other lessons are both more difficult and less profitable than that first lesson.

Among those other lessons has been that buying emerging marketplace companies before their moat becomes clear can be very profitable. Marketplaces realize scale economics very quickly, so these companies can look extremely expensive for years until they finally hit scale. Then, their profitably can inflect upwards massively and all of the sudden the stock looks dramatically cheap (this is basically describing the flywheel effect, made probably most famous by Jeff Bezos' description of Amazon's flywheel in Everything Store). Even when that fails, often a marketplace can prove an interesting strategic acquisition for a larger competitor because they own the top of the funnel / a lot of demand that can be really valuable to another business.

There are plenty of recent success stories in the marketplace business: ETSY (stock up >6x over the past 3 years), GRUB (acquired after a bidding war earlier this year) Zillow (stock an absolute rocketship as iBuying gains legs), and plenty of others. Investors today know that buying a marketplace as it gets its virtuous flywheel going can result in huge gains.

More than any other company, IAC has probably done the most to educate investors on the benefits of these flywheels and how profitable they can be (between their investments / spinoffs of MTCH, TREE, EXPE, etc.), which makes it ironic that IAC's largest asset, ANGI, is almost certainly currently undergoing such a virtuous cycle and investors could not care less.

I've been thinking about writing up ANGI for a while now (I even briefly mentioned them as one of my big losers last year and why I thought they were showing signs of being a real winner despite a rocky start). Long time readers will know that IAC is one of my favorite companies (I've probably written about them more than any company outside of the Liberty complex) and I follow everything they do closely. However, three recent thing pushed me over the edge to write something about ANGI:

ANGI's stock has done really well so far this year and they've almost certainly been a beneficiary of COVID, but the stock's had a big pullback in the past few weeks and I think it's incredibly cheap on a normalized basis.

I mentioned on my podcast with Packy McCormick from Not Boring that I think, because of skew, investing in tech tends to favor people who are optimists. If you're wrong, you strike out and maybe your investment goes to zero, but if you're really right, you hit a grand slam and could easily make 5-10x your money. I think that applies really well to ANGI. Is it guaranteed they complete their flywheel? No, it's not. But, if they do, you're probably going to make multiples of today's share price (ANGI has compared themselves today to AMZN 20 years ago; almost every tech/growth company tries that comparison but I think there's some interesting similarities there and if they're successful and even 1% right in that comparison, the stock is a grand slam). And I think the odds are incredibly skewed in your favor. ANGI continues to show signs that their flywheel is ramping, and ANGI is backed by IAC, who are probably the masters at successfully betting on and building online flywheels and who are showing every indication that they believe ANGI will be successful in getting their flywheel fully spinning.

Remember, one of the great things about flywheels can be the tack-on opportunities represent enormous positive skew / optionality. Amazon uses their scale in AWS to eat every application next to it; ANGI could use their scale in home services to move into tangential markets (like financing and lending) with huge potential profits.

I was listening to this excellent episode of Invest Like the Best and Modest Proposal (of whom I am a total fanboy) briefly mentioned some bullishness on ANGI (around the 39 min mark).

When ANGI gives an overview of their business they describe an experience "radically" better for homeowners + a status quo that is extremely suboptimal + no competitors being close to their scale. That's the trifecta when it comes to talking about the potential for dominant marketplaces with the potential to generate incredible profits / value, which is basically the bull case Modest was pitching.

So the combo of the three encouraged me to put my thoughts on ANGI down. Of course, my thoughts ran rather long, so I've decided to break this post into two pieces: today, I'll cover ANGI's business and the flywheel / moat I think they're building, and tomorrow I'll talk more on valuation and other odds and end (editor's note: that piece is now posted, as well as a follow up piece!).

That out the way... Let's dive a little further into ANGI and their burgeoning flywheel.

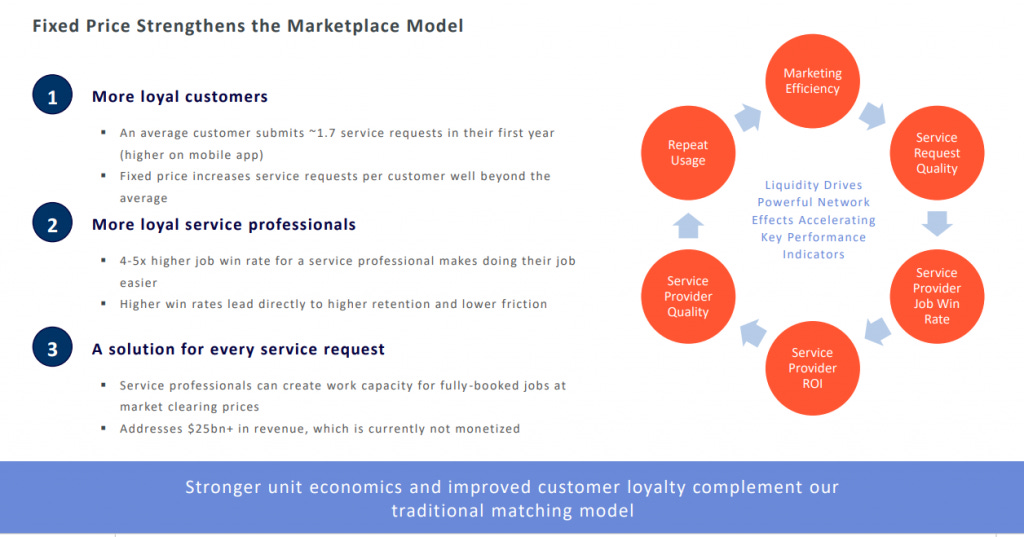

ANGI was formed by the merger of IAC's wholly owned HomeAdvisor with publicly traded Angie's List back in 2017. The logic of the merger was pretty simple: ANGI had a great brand name and tons of consumer traffic, while HomeAdvisor had the largest network of Service Providers (SPs; think plumbers, contractors, etc.). By marrying the two, ANGI would combine the demand side (consumers) with the supply side (SPs), which would go a long way to getting the market place flywheel going. The flywheel would look something like this: the combined ANGI had a bunch of consumers in local markets. Because they had the most consumers, SPs across a bunch of categories would be attracted to the ANGI platform. That gave consumers access to the broadest category of SPs, but also over time would let ANGI offer services that smaller providers couldn't match. The dream here is a fixed price / fixed time solution. Say you need a plumber to come tomorrow at 2 PM; if your platform only has one plumber on it, it's unlikely you can offer that. However, if you're ANGI and you have 30 plumbers on your platform, that's a service that your scale allows you to offer. Have the majority of SPs across a bunch of different categories on your platform, and your scale is going to let you offer products no competitor can match as well as have customers open up your app (forming a habit!) way more frequently than any competitor / any app that only focuses on one niche could get. The end goal here would be to have consumers open up every time they need something done to their house.

Anyway, that's the flywheel ANGI hoped to kickstart when they did the merger. And while I think the logic behind the merger was solid, the results have probably been a bit rockier than expected. At the time of the merger, ANGI thought the combined company could do $270m in EBITDA in 2018 while achieving long term revenue growth of 20-25% with 35% EBITDA margins. The company has dramatically underperformed those projections: EBITDA in 2019 was ~$202m, and revenue growth has generally topped out at ~mid-teens versus the 20%+ that was talked about at the time of the merger.

I don't think those numbers quite drive home just how disappointing ANGI's performance post merger has been. If you go back to the merger proxy, you can see that the HomeAdvisor business alone was projecting >$1.5B in revenue and $434m in EBITDA for 2020. That's significantly more than the combined businesses will actually end up doing this year (despite some acquisitions and a lot of cost synergies!).

So the performance since the merger has been disappointing, to say the least. ANGI would be quick to point out that a lot of that disappointment can be explained by the company investing into the business to get the flywheel spinning a little faster; for example, if ANGI really wanted to juice their near term metrics, they could probably increase their take rate (how much of each dollar the company keeps versus giving to the SP) right now and show a big boost in profitability today at the expense of their long term growth rates (I'll talk about increasing take rates more in tomorrow's post on valuation). ANGI is probably 100% right that they're sacrificing some financials today for a lot of growth tomorrow, but I still don't think that changes the point that at the time of the merger most investors thought ANGI would be a lot more profitable / further along their flywheel than they actually are.

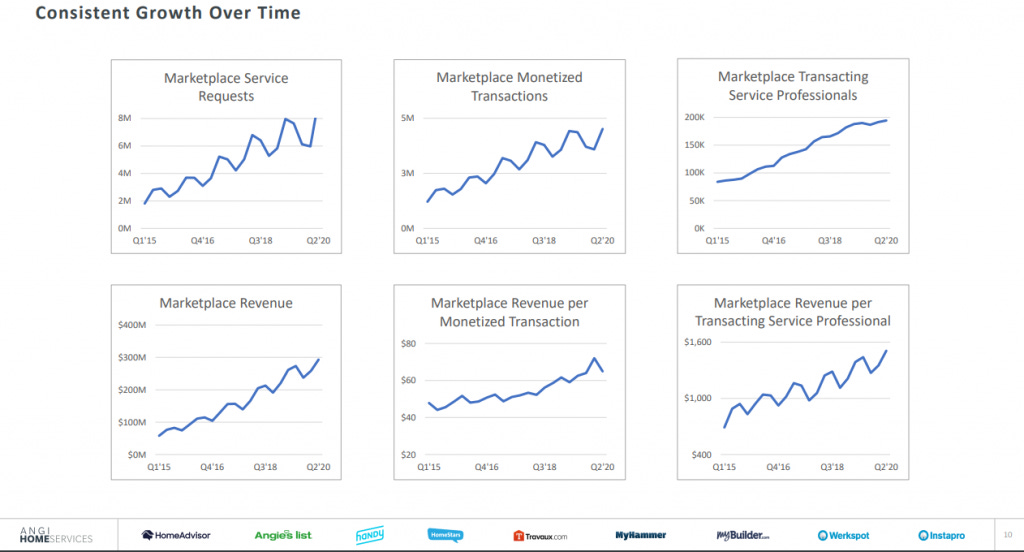

Even though ANGI is further behind than many (including the company!) thought they'd be at this point, I don't think that changes that ANGI is slowly getting their flywheel going and that, once they've done so, they'll have an incredible moat. And while a lot of their financial metrics have lagged behind where they were hoping to be, I do think a lot of their underlying KPIs are moving in the right direction.

Remember, ANGI is trying to dominate local services. Think about hiring a plumber. Right now, if you need a plumber, you probably ask for a friend's recommendation or, if it's an emergency, you just google "local plumber." You then call them and try to schedule a time that works for the two of you. That's just an incredible inefficient process.

At its best, ANGI offers a solution that is significantly better. You go on into an app, click on "plumber", and find a plumber who is available at a time that works for you. Combine that efficiency with the ability to review / read reviews and the ANGI process should dominate the old way to doing business.

You can see how the ANGI process should be better than what exists currently; however, getting that flywheel going is a much longer slog than for a lot of other marketplaces for a variety of reasons. Think of Uber: if you're an Uber customer, you're almost certainly taking a couple of car trips a month. If Uber can simply jumpstart their flywheel around two variables (enough drivers and enough customers), they can get enough repeat business going that they have a successful local market. ANGI is different: a person is only likely to use a plumber once every few months. It'd be tough to really have a flywheel going by dominating an individual category like a plumber for a bunch of reasons (plumbers would eventually go around your platform and work with your customer to avoid your take, you'd need to reacquire lost customers frequently, etc.). So for ANGI to really get their flywheel going, they'll need to get a lot more customers than Uber (so that they can keep all of their SPs occupied) and get SPs going across a ton of different categories (so that they drive frequency for their consumers). Some (made up) numbers might show this best: say you need 1000/transaction/month in any category to achieve local scale. An Uber customer might take 10 trips/month and a driver might do 100 trips/month, so in this scenario Uber could get a flywheel going with 100 customers and 10 drivers. But because an ANGI customer only needs 1 plumber trip every 3 months, to get scale in the plumber domain ANGI would need to get ~3,000 customers (so that they have 1,000 plumber requests every month). And if someone is only using your app once every three months, they're incredibly likely to churn the next time they need a plumber (or just contract with the SP directly). For ANGI to really scale and "lock in" a customer, they need to offer not just plumbers but painters, carpenters, house cleaners, etc. The more types of SPs they can offer, the more frequently they can attract customers, which makes them more attractive for SPs, etc. On top of that, ANGI probably needs to offer something that makes the process more effecient so the consumer / SP don't go around them. Again, an example might show this best: ANGI is going to take ~5% of any project they connect with. Say you're a painter and you go paint someone's living room. All in, the cost is ~$250. ANGI is keeping ~$12.50 of that. Maybe you tell the customer, "Hey, when you want your bedroom painted, just call me directly and I'll knock $10 off the price." To really dominate the local market, ANGI needs to find ways to make consumers / SPs not want to leave the platform over time. The more they can do that, the more business they can capture on the app and the stickier / more dominant it becomes.

Anyway, the bottom line is that getting the ANGI flywheel going is a longer grind than for a lot of other marketplaces. And that's probably made even more difficult by the nature of ANGI's SPs. If you're a 55 year old plumber who already has a full book of loyal customers, you probably don't feel any need to learn an entirely new platform like ANGI. Compare that to a cab driver whose seeing all his business evaporate to Uber; he's probably going to get on board with an online market place much faster.

Still, I think that slow process works both ways. Right now, ANGI is going through the grind of building up their flywheel in each local market. They're adding local SPs and customers one by one until they hit scale. But, once they hit scale, that means any competitor is going to have to go through the exact same grind if they ever want to build out a network similar to ANGI's list, except when ANGI went through that grind they were competing with a much more inefficient offline process while any competitor going through the grind will be competing against an already built out ANGI. I'm not sure if that's doable. Think of it this way: an Uber competitor like Lyft only needed to crack one flywheel (getting enough drivers to meet passenger demand). You can do that by flooding the market with cash (give riders tons of free rides and drivers tons of driving incentives). An ANGI competitor is going to be in a much tougher spot: to steal a customer, they need to have enough plumbers, carpenters, house cleaners, etc. to keep people coming back into the app. Given how long it's taking ANGI to scale every market, it's tough to imagine a competitor coming along and burning enough money to jumpstart scale in each one of those SP categories. So, while it's a grind for ANGI to build out their flywheel now, I think that points to a huge potential moat once ANGI has effectively done so: no one else is going to look at the grind it took ANGI to start a flywheel and think it makes sense to create a competitor. Even if for some reason someone did want to try to recreate ANGI, I'm not sure if they could: again, you need consumers logging on to your platform for a bunch of different services to start to form some customer habits, and the logistics for a competitor to build out multiple categories and try to steal consumers when ANGI has already done so are really complex.

Alright, hopefully at this point I've illustrated ANGI's evolving flywheel and the moat they'll have if/when they successfully get the wheel fully spinning. I'm going to break here; in tomorrow's post, I'll discuss why I think ANGI is so cheap (and show that IAC agrees with me!).

PS- there are a few bear cases for ANGI. Here's one that I think hits on one of the biggest / most likely worries: the company simply isn't going to be able to get enough SPs to really get the flywheel going. I think that's wrong / short sighted: history suggests that, if the company controls enough demand, the suppliers will eventually need to work with them. There are basically four global music companies, and any of them could have blocked Spotify if they really wanted to be irrational. Yet all of them eventually got on the platform. If those multinational companies chose to eventually work with Spotify, I feel pretty confident that ANGI will be able to get one of the dozens of plumbers/carpenters/handy men in every market to get on to their platform!