Brewing up some March Madness $BREW

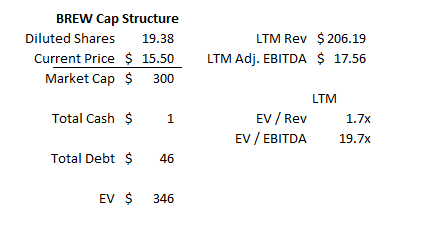

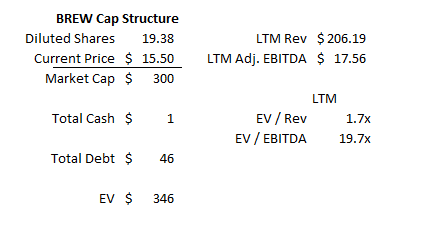

I generally try not to write updates on ideas (except for Charter (CHTR; disclosure: long); there you get an update basically every quarter!), but I figured an update on my March 2017 post on Craft Brew Alliance (BREW; disclosure: long) was topical because 1) it's March Madness, and they'll be airing some nationwide Kona ads, 2) there was a recent short thesis on VIC, and 3) someone on twitter asked nicely. The original thesis on BREW was pretty simple (and this post is going to rely heavily on the background from that post; so I'd encourage you to read that first). Kona was growing quickly, and that growth plus the company's most recent partnership deal with AB created strong incentives for BREW and AB to reach a merger agreement (in fact, their distribution agreement laid out the terms of a potential offer). Even if an offer didn't come, as Kona continued to grow and the company stablized their other brands, Craft Brew would likely prove to be undervalued as a standalone company. Let's fast forward to today. The Kona piece of the thesis has proven relatively accurate- Kona depletions grew ~10% in 2017 & 2018, and shipments grew ~15%+. The rest of the thesis has proven a bit spottier: the non-Kona brands (Widmer and Redhook) have not shown any signs of stabilization, and despite the new AB contract and the increase in Kona shipments, BREW hasn't shown any real signs of operating leverage: EBITDA remains stubbornly in the same $15m/year range it's been at since 2014 and barely covers annual capex (the company's averaged ~$15m/year for the past three years). That's a relatively high level overview, but it does a decent job of bringing us up to today. At today's share price, BREW has an EV of ~$350m and trades for ~20x LTM EBITDA (and an insane free cash flow multiple given EBITDA and capex basically match up. Note that BREW's EBITDA / revenue includes ~$3.4m of revenue recognition of the AB fee that had already been paid(see p. 62); normally I'd say that should be adjusted out be AB is still making annual payments so I think that's a wash).

Still, despite the ostensibly high multiple, I think BREW remains interesting today. As I'll explain in this article, while I think the odds of AB buying out BREW have come down over the past two years, I think BREW's standalone value has likely improved. Let's start with the obvious: a trailing look at the financials fails to capture four important things about BREW.

BREW made three acquisitions in Q4'2018. In total, they spent ~$38m on these acquisitions in Q4 (the actual value was likely a bit higher as BREW owned a piece of the one of the brewers and one of the agreements included an incentive payout based on growing shipments; see p. 52). All of those acquisitions closed in Q4, so when you look at BREW's trailing financials you're getting basically zero value for these three acquisitions which, at cost, make up ~10% of BREW's EV.

If AB doesn't make an offer to buy BREW this year, they will owe BREW a $20m international distribution payment. That payment is pure profit to BREW and is >5% of their EV; it seems silly to exclude that from BREW's EV given it's coming this year.

Spreaking of that international payment, AB is making it because they plan on ramping up Kona international sales. Kona does

BREW is making a significant investment into their brands, particularly Kona. For example (and as mentioned above), they're doing a national ad buy for Kona during March Madness. National ad buys are expensive. This type of brand marketing immediately impacts BREW's income statement, but it's probably better though of as a capitalized asset (if you get someone to try your beer, there's a chance they like it and become a habitual drinker / brand loyal, etc.).

Capex should come down significantly post 2019. Take this one with a grain or three of salt; I've been saying capex should come down since 2017, and management has been hinting at that too and we haven't seen any results so far. Still, management suggests their big growth projects are ending in 2019, and I see no reason why this business should take >$15m/year in capex to support when AB plants are handling a significant amount of production. Management previously guided maintenance capex of ~$3m/year; I'm not sure I believe that number but <$10m/year seems easily reasonable. Combined with "growth" from some of the estimates above, and it's not hard to see this businesses spitting off a decent bit of free cash flow.

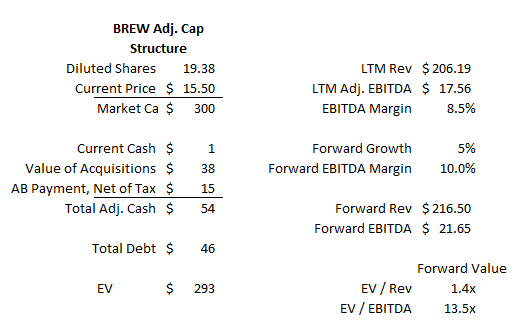

The point I'm trying to drive home is that valuing BREW on a trailing basis probably isn't the right way to look at the company; there are a lot of things that should result in future growth that are getting full credit in Brew's financials. I think once you adjust for all of those points, Brew's valuation today looks, at a minimum, undemanding. For example, if we give them credit for $15m in AB payments in August ($20m less ~$5m in taxes) and the net cost of their acquisitions, their implied EV would drop to a shade under $300m. If we assume they grow by 5% in 2019 while expanding EBITDA margins to 10%, the company would be trading at ~13.5x forward EBITDA (and, with capex about to fall off, a reasonable free cash flow multiple).

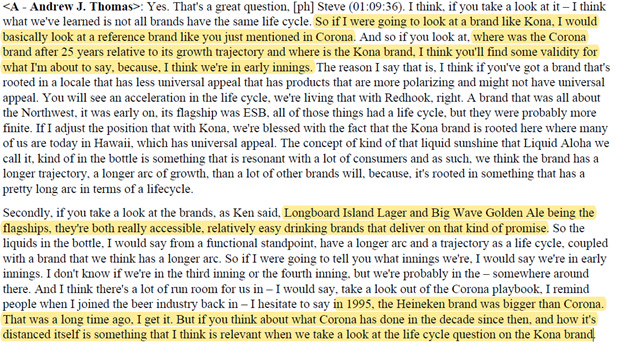

Maybe saying the valuation looks "undemanding" isn't exactly a vote of confidence. But, at its core, an investment in BREW has always been about Kona, and I think if you can buy BREW at an undemanding current valuation while retaining the call option upside from Kona continuing to perform well, than an investment in Kona is interesting. And all signs point to Kona continuing to do well. Depletions and shipments were strong in 2018, and 2019 appears to be off to a good start (they mentioned strong momentum for Kona in Q1 during their Q4'18 call, and their guide implies good momentum as well). The brand should continue to do well domestically, driven by the national ad buys and continued deepening of the AB partnership, and the international opportunity remains relatively untapped (Kona was up 20% internationally in 2018, though off what seems to be a small base)... AB didn't agree to write a $20m check later this year for Kona's international rights out of the goodness of their hears; they did it because they see huge opportunity for Kona worldwide. I've pulled the quote below from BREW's Q4'18 call; I think it's a moonshot for Kona to become the "Hawaiian Corona" but I put it here to emphasize that at an "undemanding" valuation you get any continued growth / operating leverage / moonshot potential for Kona for (effectively) free.

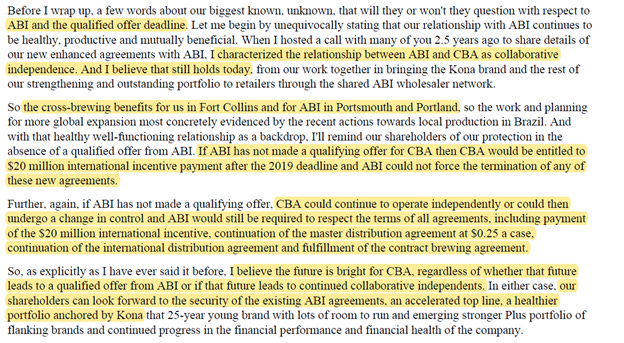

So I think the standalone case for BREW has probably slightly improved over the past two years, mainly driven by continued performance of Kona. Slightly offseting the standalone upside, I think the buyout case has probably gotten slightly worse. The case for a buyout happening is still rather simple. There would be decent synergies if AB bought all of BREW; they could cut out a ton of overhead + public company costs (I would guess synergies run $10-15m/year, a not insignificant amount for a ~$300m EV company!), and tighter integration of Kona would probably allow AB to push the brand a bit harder and keep all of the upside from doing so for themselves. And if AB doesn't buyout BREW, then they'll need to pay BREW $20m for their international rights plus run the risk someone else could buy BREW and possibly leveraging their AB contract in ways AB might not 100% be comfortable with. Here's what BREW's CEO said about the possibility of a buyout on BREW's Q4 call.

So why do I think the odds of a buyout have gone down? Mostly it has to do with BREW's most recent acquisitions. If AB is going to buy BREW, it's for Kona. By buying all of those smaller brands in Q4'18, BREW is diluting their exposure to Kona and thus their value to AB- AB doesn't care about those brands and probably wouldn't give BREW full credit for them; in fact, AB might be forced to divest all non-Kona brands as part of a merger condition if they did attempt a merger, so adding more small brands to BREW's portfolio really only adds to the potential regulatory headache in a merger. Of course, it's possible I'm reading too much into those acquisitions, or that BREW is buying some standalone brands because they're prepping to sell Kona to AB and wanted to have enough brands to spin off into a standalone company as part of a Kona deal. But I can't help but look at those deals and think they're the work of a company looking to remain a standalone company, not a company prepping for a sale to a large strategic buyer. Just to wrap this follow up up: ~two years ago I wrote BREW up. Since then, Kona has continued to perform well, but I think the odds of an acquisition have come down a bit. With the stock up a bit since the last write up and the odds of an acquisition seemingly haven dropped, I think BREW is interesting today but a lot less so than a few years ago. Sorry for the wishy-washy post / conclusion, but I got the idea of an update in my mind and figured it was interesting to go through. Enjoy March Madness (preferably with a Kona).