What the fudge is happening to legacy media stocks? $VIAC $DISCA $NFLX $T

Something weird is happening in media stocks.

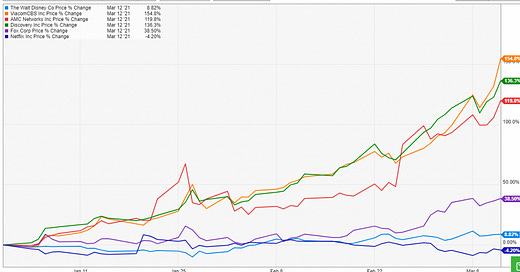

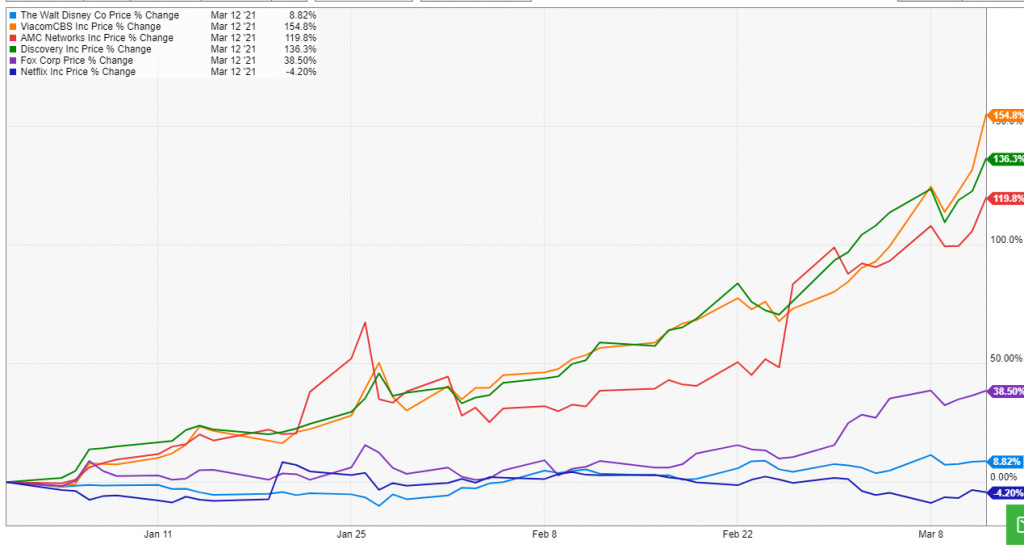

Legacy cable channel / media stocks have seen their stocks go on an absolute tear so far this year, while streaming "winners" have been left behind. Year to date, AMC Networks, ViacomCBS, and Discovery have all more than doubled, while DIS is up slightly and NFLX is actually down.

Yes, it's a little aggressive to judge stocks on a couple of month's movement, but the big move has had a meaningful impact on long term performance too. Netflix now trails basically all of those legacy media companies on a three year basis.

Stock price, of course, isn't business performance. In 2018 (the starting point for that 3 year performance), Netflix was still running around EBITDA breakeven, while DISCA was trading for a ~high single digit EBITDA multiple. Even after the big stock move, DISCA's only trading for like a 15x EBITDA multiple, while Netflix is at like 30-40x. So the big move could, in part, be attributed to a little bit of financial gravity. In 2018, Discovery was priced like a dying business, while Netflix was priced like it would dominate streaming forever. Some of the share price movement could be attributed to the market giving Discovery credit for "terminal value" (i.e. the market is now saying that Discovery will have a place in the future streaming world, while a few years ago the market was forecasting Discovery would die as the cable bundle died) and acknowledging that Netflix wouldn't forever own the streaming market.

It's not hard to point to what changed the narrative. The legacy media players have all started rolling out their full out streaming plays (Discovery+ for Discovery, Paramount+ for VIAC, etc.), and the market is loving the early returns (I wrote last November I thought DISCA could be QRTEA 2.0 as they rolled out their streaming service, and the market has whole heartedly agreed. Unfortunately, I sold way too soon).

Still, it's hard to look at the results without thinking the market might be a little too optimistic here.

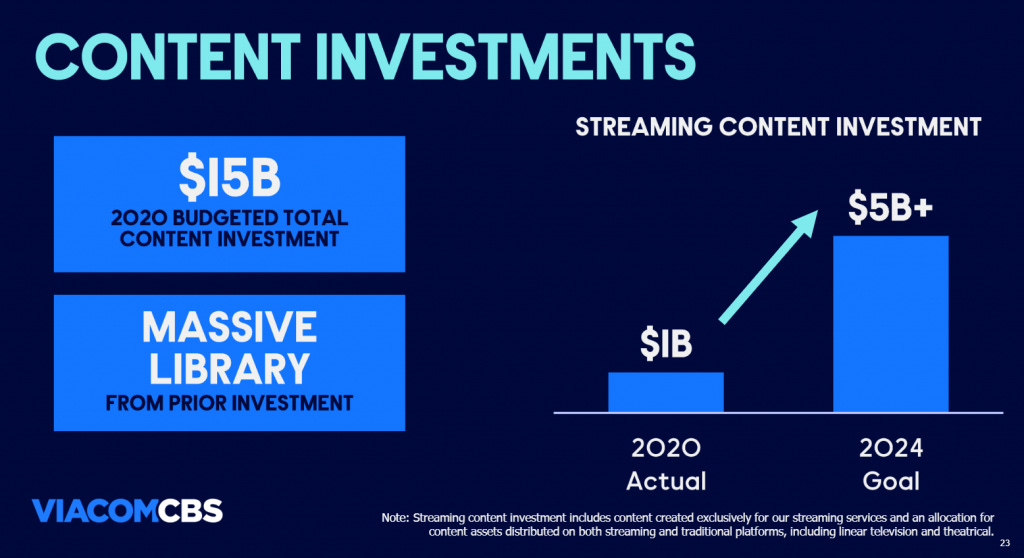

Consider Viacom. Bulls would say that they've got brand, huge reach, great franchises (Star Trek, South Park, etc.), a huge library, and they're going to be pursuing a huge ramp in streaming investment (from $1B in 2020 to >$5B by 2024; slide below from their Q4'20 earnings).

No doubt there's something interesting there.

But VIAC is competing with some giants. Netflix already spends >$12B/year on content, and Viacom's brands and franchises can't touch Disney's. Take a look at the top streaming series in the U.S.; not a single one of them is a VIAC series. Almost all of them are Netflix or Disney. Yes, that's just a one week snapshot, but I think you'd be hard-pressed to find a show CBS has released in the past ~5 years that has really made a dent as a must watch streaming show (Star Trek Picard perhaps being the exception that proves the rule)

And, yes, VIAC's library has value, but the real value for a streamer is buzzy new shows that can get people to sign up for the service. That's why Netflix has discussed licensing their older shows to TV networks; you need a library to retain subs but subs don't particularly care what's in your library (with The Office reruns being a noticeable exception!). What really matters for streaming is releasing new shows that can attract new subs and keep older subs engaged.

Again, none of this is to to say VIAC can't be successful in streaming. But, after the massive runs, the market is starting to price in a real future for the streaming services of AMCX, DISCA, and VIAC. I'm just a little skeptical that all of them can live up to what the market is implying. Starting a streaming service and committing a big investment to it is easy. But the execution of that plan is much harder; sticking to that investment as you burn billions of dollars, getting people to sign up for that service when they already have a Netflix and Disney subscription service and those two services release more media than any consumer could ever watch, etc. VIAC, DISCA, etc. are not just trying to lure away subs who already have Disney and Netflix subscriptions, but they'll be competing for those subs with each other and with a bunch of other new streaming services (HBO Max, Peacock, and a variety of others).

Bottom line: I'm surprised how enthusiastic the market is for these subscale / legacy D2C services, and I'm skeptical that the services will be able to grow into the value the market is putting on them.

But that skepticism is not why I wanted to write this article. I think the market's enthusiasm for the legacy media stocks currently has created some very interesting opportunities both from a stock picking standpoint and from a corporate standpoint.

It's probably obvious what I mean by "opportunity from a stock picking standpoint;" I think the current multiple disparity presents opportunity to buy stocks at very interesting implied valuations (or short some stocks that are priced too richly for the streaming future if that's your thing). But what do I mean about opportunity from a corporate standpoint?

Well, valuation can become your destiny. Consider Netflix over the past decade. There's no doubt that they created tons of value from their switch to a streaming service. However, that value can become a little reflexive: Netflix needed access to the capital markets at reasonable rates in order to fund their business. If Netflix had laid out their streaming plans and the market had hated them to the point where Netflix couldn't raise capital at reasonable rates, then Netflix would never have been able to fund their streaming domination. An example might show this best: in 2017, Netflix issued ~$3.1B of bonds with an interest rate of ~5% (see p. 51). If the market hadn't been convinced that Netflix's streaming plans were viable and had instead charged them 15%, then Netflix wouldn't have been able to pursue the same growth plans. The economics simply wouldn't have been viable at that cost of capital!

So the markets can be a little reflexive: if you're given a high multiple and reasonably cheap capital, it's a sign from the market to press ahead with growth. M&A and investments you might not have otherwise considered become possible. If you're given a low multiple, a lot of growth plans become out of reach because you can't fund them on an economic basis.

From a corporate standpoint, I think the current stock moves are very interesting because they allow for a much wider range of possibilities.

Consider, for example, DISCA. Last year, the market was pricing them at ~7x EBITDA and a ~10% free cash flow to equity yield. At that valuation, M&A was kind of off the table for them. How could they justify going and paying a premium to buy another business when their own business was priced so cheaply? The opportunity cost versus buying back their own stock and/or investing into their own streaming service was simply too high.

Now, however, DISCA is trading at ~15x EBITDA. At that level, it's possible that the opportunity cost for buying back stock is too high, and taking incremental dollars out of share buybacks and instead plowing them into growing Discovery+ (through investments in content, investments in customer acquisition, etc) or into M&A is the right move.

Ok, all that out the way, given where media stocks are trading, here are the three most interesting thought bubbles on my mind:

Is Netflix a value stock now?

Do we finally see free radical consolidation?

How do T and CMCSA handle Warner / NBC

Thought #1: Is Netflix a value stock now?

I would guess the majority of investors would laugh at Netflix being a value stock. They trade at ~10x revenue!

But consider this: VIAC is targeting 65-75m streaming subs by 2024. Their EV is ~$80B; at the midpoint, the market is valuing VIAC at ~$1,115/2024 streaming sub. NFLX today has ~200m global subs; in fact, NFLX right now has as many subs in North America (~75m) as the high end of VIAC's global 2024 target. NFLX's EV is ~225B; that's ~$1,125/ current Netflix sub. So the market is valuing VIAC's hypothetical 2024 subscriber number at the same value they're currently giving Netflix.

Obviously, that valuation is a little bit of an exaggeration. VIAC is more than just their future streaming service; they own PlutoTV and they'll make billions in cash flow off their legacy TV channels between now and 2024. It's not like the market is valuing VIAC only for their future streaming subs.

But there is some truth there. Pre-pandemic, VIAC traded for ~$45B versus ~$80B right now. They owned all of the same assets then (PlutoTV, the billions in cash flow from their legacy channels, etc.). The major change between now and then is the market has gotten a lot more excited about Paramount+.

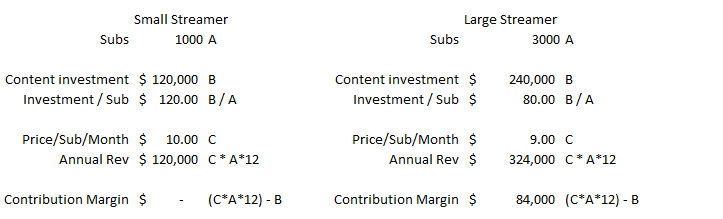

Streaming is a scale game. Consider two hypothetical streamers: small streamer has 1k subs, and large streamer has 3k subs (3x more subs). The large streamer has a huge advantage; their scale means they can invest more in content on a total dollar basis but their content cost per sub will be dramatically lower. In addition, because the incremental cost to serve a new sub is effectively zero, streamer B could price their service lower while still getting more incremental profit.

I've laid out a very simple hypothetical streamer model that shows this below. You can see the smaller streamer charges $10/month and invest $120,000 into content. Their content cost neatly meets their annual revenue, meaning there's no money leftover to cover marketing, customer acquisition, overhead, etc. In contrast, the large streamer invests 2x as much into content and charges only $9/month; however, because their user base is so much larger, their annual revenue more than covers their content investment, leaving plenty of money leftover to cover marketing and the like.

So the large streamer has an enormous advantage. They're offering consumers twice as much content at a 10% discount to the smaller streamer. Over time, that advantage should only grow; their larger content investment means they'll grow a bigger library over time, customers should be tempted to switch to the lower streamer given the bigger library and lower prices, and the large streamer should grab new customers quicker given the bigger marketing budget. So their size gives them an advantage that starts large and should grow larger over time.

You might be noticing that I did the larger streamer 3x as large as the smaller streamer; that was intentional because it's roughly the same size difference as Netflix's sub count today versus VIAC's target sub count three years from now. So, even if you assume VIAC can hit their targets and Netflix doesn't grow at all from now till then, you're still talking about a mammoth advantage for Netflix just given their size and scale.

I'm not saying that there will only be one streaming service; there will probably be several winners in the end. But you know Netflix will be one of them; they have 200m subs, almost double the next closest (Disney+ w/ ~100m). And the market seems to be giving Netflix the same per sub value that it's subscribing to a lot of their sub-scale peers while assuming that all of their sub-scale peers will definitely be successful in their ambitions despite huge structural disadvantages.

Seems wrong.

Thought #2: Do we finally see free radical consolidation?

Years ago, John Malone famously said that the "free radicals" needed to get together in order to compete with Netflix. For a while, it seemed like he was right and we'd see a wave of consolidation. Discovery bought Scripps, Lions Gate bought Starz, and it seemed like the dominoes would keep falling. But then the market kind of froze as the major players got caught up in mega-M&A (AT&T bought Time Warner, Disney bought Fox, Comcast bought Sky, and Viacom and CBS merged at last) and the subscale players saw their multiples too depressed for M&A to be a reality on their own (for example, CBS offered $5B for Starz ~2 years ago; Lionsgate's EV was <$5B for almost all of last year. How could LGF consider any form of M&A when the market was pricing them below what Starz alone was likely worth?).

But now we're in a new world. The major companies have finally digested their acquisitions to the point where M&A is back on the table for them, and the minor companies have seen their multiples expand to the point where they could reasonably consider using their stock to fund M&A.

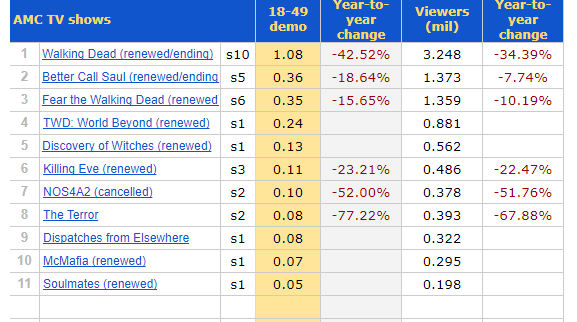

Consider someone like AMC Networks (AMCX; I wrote about them a little bit last year).

The bear thesis on AMC has always been, "this is a subscale cable network, and their core shows are getting very long in the tooth." While the stock has run a lot recently, I don't think the run has really changed that reality. Ratings for their key shows continue to go down, and they haven't they haven't released a new hit franchise in years.

At the end of FY20, AMCX had 6m D2C subs; their goal is to hit >9m by the end of FY21 and 20-25m by FY25. With an inability to release new franchises and a long term subscriber goal that is only a fraction of what peers currently have (remember, CBS has 30m subs currently and I'm calling them subscale versus NFLX; AMC doesn't think they can get to CBS's current numbers in four years!), I think it's pretty clear that AMC will have to consider some type of M&A in the near future. Otherwise, they're simply going to be outgunned by their competitors.

That's where the huge stock price run comes in. When every legacy media company was trading at 6x EBITDA, M&A possibilities looked pretty bleak. They were too small and their cost of capital was too high for them to act as a buyer, and their multiple was too low for them to reasonably consider selling. At ~6x EBITDA and with basically no capex requirements, AMC could reasonably look at their stock price and say, "even in a melting ice cube scenario, we can milk this business for more cash flow than our market cap right now. The market is clearly forecasting us doing something stupid with our money; why not prove them wrong and realize the upside for ourselves? Why would we sell to someone at anywhere close to these prices?" And consider AMC from a buyer perspective; if you're VIAC last year and your stock is trading at 7x EBITDA, are you really thrilled to pay the same multiple to go buyout AMC? I doubt anyone is out there saying AMC's assets are anywhere close to VIAC's in terms of quality, so why would VIAC pay the same or higher multiple to buy them out.

So, in many ways, the depressed stock prices acted as a barrier to M&A. AMC couldn't bring themselves to sell low, buyers couldn't buy AMC's assets for the same multiples that their own (better) assets traded for, and AMC's cost of capital was too high to pursue M&A.

But now AMC is trading for ~9x EBITDA. It's not an aggressive multiple, but the market is valuing them at more than melting ice cube value. VIAC and DISCA are trading for low to mid double digit multiples. There's no doubt that there would be synergies in a merger; perhaps the higher multiples allow AMC to sell with their heads held high, and a buyer to use their higher priced stock to fund an accrettive transaction that doubles as fuel for enhancing their D2C growth prospects that the market is clearly excited for.

There are other free radicals lurking out there that could probably be consolidated. MGM studios is openly for sale, but the company that really interests me here is Lionsgate (LGF). Lionsgate's current EV is ~$6B; we know that CBS offered $5B for Lionsgate less than two years ago. Starz has 28m global subs, and the Lionsgate studios owns the rights to some great library titles (Mad Men, Weeds) as well as some great movie rights (John Wick's the headliner, but they own Hunger Games and Twilight, which are ripe for remakes or world expansions at some point). I think a variety of players could see a Lionsgate acquisition as the piece that would take their D2C ambitions to the next level. Discovery, for example, would make a lot of sense; adding Starz and Lionsgate would give Discovery content capabilities that they currently lack (though admittedly it would be a change from their "let everyone else fight for scripted dramas" strategy). Apple or Amazon could do it to accelerate their content plans, or VIAC could do it just to beef up their streaming library.

Any one acquisition seems unlikely. But there are now at least 10 players with major worldwide streaming ambitions, and I don't think people are going to end up subscribing to 10 streaming services. Streaming is a game of scale; I think a lot of the second tier players are quickly going to hit the point where they either need to go buy someone to beef up and try to catch up to the first tier players / separate themselves a bit from the other second tier players. Buying Lionsgate would be an easy and very quick way to do so, and it would have a double bonus as taking them off the board would remove one of the last assets of scale that a competitor could use to get larger quickly.

Thought #3: How do AT&T and Comcast handle Warner / NBC

When investors were slapping mid-single digit EBITDA multiples on legacy media assets, it wasn't worth spending that much time thinking about the valuation of Warner Media inside AT&T or NBCU inside of Comcast. They simply didn't budge the needle against the much larger, much more valuable core telecom businesses.

But with legacy media stocks racing, that SOTP math gets much more interesting.

Consider AT&T. They bought TWX (the basis for Warner media) for ~$85B in 2018, which is ~what VIAC is worth currently. There is no doubt that Warner media is worth a lot more than VIAC; HBO is just a much, much better business than anything VIAC currently owns. It's tough to do the exact math because of all of the moving parts, but if you just tracked TWX's value to VIAC over the past few years, TWX's implied market cap would be somewhere around $130-$150B. Perhaps more or even much more. Let's just say Warner is worth $150B.

AT&T as a whole did ~$52B in EBITDA in FY20. ~$10B of the came from Warner Media, so the Non-Warner Media pieces of T did ~$42B. Bloomberg has T's EV at ~$425B. There's some moving parts to that (C-Band spend, DTV transaction, etc.) and you can quibble with corporate allocations and the like, but let's go with thoose numbers. If you think TWX is worth $150B, then the "remainco" T is worth ~$275B, and the remainco is trading at 6.6x EBITDA.

Again, you can quibble with numbers here and there, but directionally I think those numbers are close enough. And 6.6x EBITDA seems too cheap for a business as steady as T's core telecom business. As I write this, VZ is trading for ~7.5x EBITDA; not a huge discrepancy, but given T's leverage closing that implied gap would add ~$5/share to their share price. Not bad against a $30 stock! And, given how far ahead of VIAC Warner/HBO's streaming plans are, I think you could easily argue we undersold the value of Warner in this.

You could do some similar math for Comcast with NBC (I did an analysis last year that showed CMCSA was probably trading for the value of its cable franchise and giving you everything else for free; I'm not going to rehash it here) that would say you're buying the core Comcast business quite cheap if you give NBC credit for anything approaching a VIAC multiple (though the story is a little more complex as both Comcast and NBC have some extra moving parts).

So one way to think about the current run up in legacy media stocks is that they present opportunity; the implied SOTP math for conglomerates with big media segments starts to look really attractive.

But I think what's even more interesting is to think about what moves the companies could make to realize value for their segments. It has to irk T and CMCSA that they own streaming assets that are better than VIAC / DISCA and that are growing faster, but they don't appear to be getting any credit for those assets. Do T and CMCSA start to explore steps they can take to unlock that value? Could Comcast do a tracking stock on NBC? Would T and CMCSA consider a mega-merger / JV of NBC + Warner assets?

Who knows? But, for those two conglomerates, the value discrepancy creates interesting opportunities on both the stock picking and the corporate actions side.