Premium post: updates on $IAC and $GTXMQ

Updates on two of my favorite ideas to end the month! IAC and GTX (disclosure: in bankruptcy, buyer beware)

Updates on two of my favorite ideas to end the month!

First update: GTXMQ (remember, GTX is in bankruptcy, which carries extra risk!). I first posted on GTXMQ publicly last Friday. Since then, there are two major updates. First, the judge approved the stalking horse bid from KPS. Second, Honeywell has started buying shares in the open market at prices around the current level. Combined, I think these are two massively bullish pieces for the equity, and they suggest the odds of a large distribution to equity shareholders continue to go up.

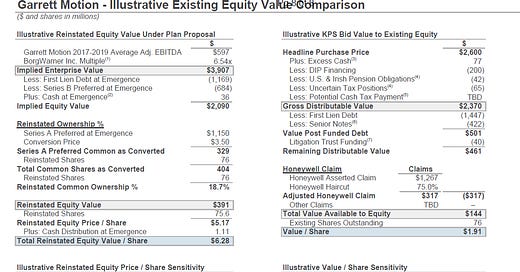

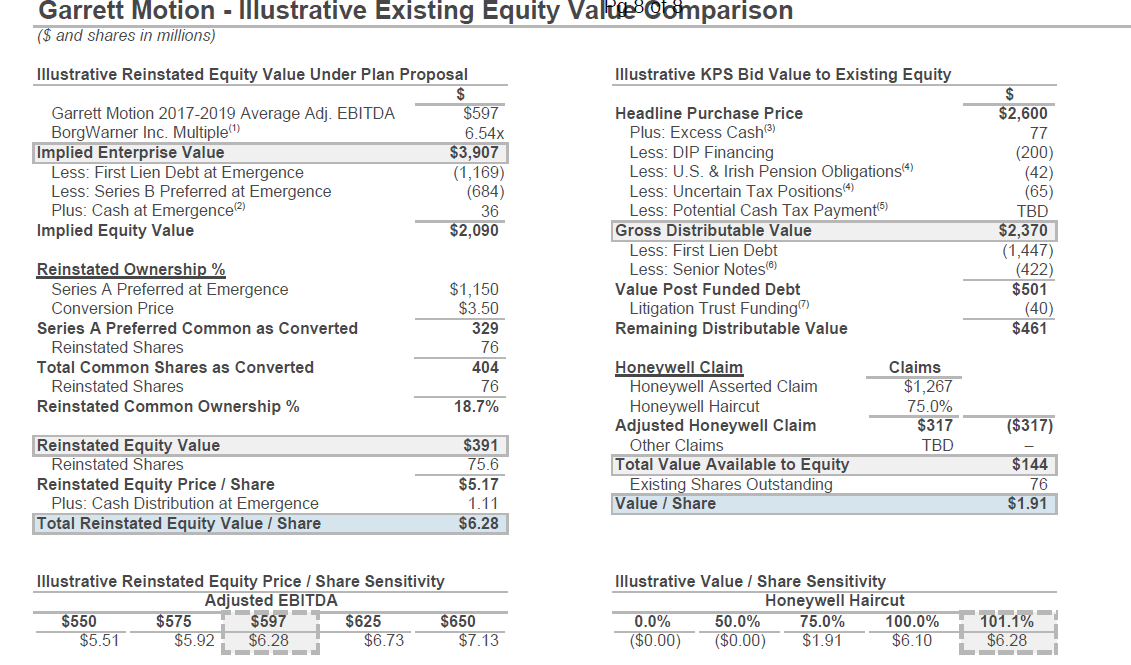

Of particular note to GTX shareholders is docket 273. This is the Centerbridge group’s updated bid to try to avoid GTX going to auction (filed right before the judge approved the KPS bid and GTX going to auction!). It included bumping their bid for GTX by giving a >$1/share distribution to shareholders if the judge agreed to go with the Centerbridge plan. It also included the slide below, which suggested that GTX shareholders would get >$6/share in value under the Centerbridge plan.

I think that slide is important both because it shows how Centerbridge is valuing GTX and because it suggests a haircut of 75% to the Honeywell claims. Remember, Honeywell is part of the Centerbridge group; for their group to value their claims at such a huge discount shows how poor their claims are!

Bottom line: I’m glad the judge went with the KPS bid, and I expect a robust auction for GTX. I ultimately think GTX will sell for ~$3.2B (versus the current $2.6B KPS bid and the $3.9b implied by the Centerbridge plan) and that Honeywell will take a haircut of ~80% on their claims; assuming both are right, GTX shareholders would get ~$9.50/share in value. I’ve included the math for that and a data table that shows GTX value with different assumptions on auction value and HW discount below. (Note: I posted a piece on GTX to VIC; everything in that piece was covered here, but if you’d like to see that piece as well just let me know and I’m happy to share!).

Second update: below is an excerpt from our September letter on IAC. The basic thought here is pretty simple: IAC today reminds me of IAC when we first discovered it three years ago. Since that time, IAC’s stock has more than tripled; I think it’s possible IAC does even better this time, driven by accelerating strength in ANGI, Vimeo, and some of their smaller properties.

Excerpt below; as always, feel free to reach out to me if you’d like to discuss either of these ideas or anything else more fully!

Almost exactly three years ago, IAC was trading for $100/share. We took a ~5% position in the fund, and it’s been one of our most successful investments. Today, IAC shares trade for ~$125/share; in addition, over the summer IAC spun off ~2.16 shares of MTCH for every shares of IAC; those shares are currently worth ~$244/IAC share. In total, the IAC shares we were buying for $100 three years ago are currently worth $370.

Why do I mention this investment? Because, in many ways, IAC today reminds me of IAC three years ago. But I also mention it because we learned a lot of lessons from that first investment, and we’re applying those lessons to our IAC investment today to make sure our today’s investment is even more successful.

The two most important of those lessons are 1) if you really like one of the underlying pieces of the parent company, don’t be scared to bet directly on that piece and 2) when you see a company / management team this good that’s this undervalued, swing really hard at them.

Let me break down those two pieces. On #1- you can reread our research on IAC at the time of our investment. While I liked the whole business, what I was really bullish on was their ownership of Match, which traded for ~$25/share at the time. Today, those shares trade for ~$115/share and have paid out ~$5/share in dividends alogn the way. So while our investment in IAC was successful, we would have been dramatically more successful if we had just bought Match directly.

On the second point: IAC is one of the best run and most shareholder aligned companies in history. When they’re undervalued, this is the type of company that we should be swinging at hard. I didn’t do that in 2017, and our returns suffered because of it.

We’re correcting both of those mistakes today. IAC is a much larger position, and we may make it bigger over time. In addition, we’ve invested directly in ANGI, IAC’s publicly traded sub that we think is at the same place MTCH was 3 years ago.

IAC today reminds us of IAC when we first invested in them three years ago. That’s exciting…. but what’s more exciting to us is that if we’re right, IAC today is going to drive significantly larger returns today than it did three years ago.

So why are we so bullish on IAC?

First, we think we’re getting IAC relatively cheaply. IAC currently has a market cap of ~$11B. They own just under $5B of ANGI shares, ~$1.3B of MGM shares, and have $2.9B in cash (with no debt). In total, their liquid marketable securities are worth ~$9B, or over $100/share.

For ~$2B, we get everything else IAC owns… and IAC owns a lot of other stuff. This includes a Manhattan skyscraper, a SaaS company growing 30%+ annually (Vimeo), two different businesses generating ~$50m/year in EBITDA, and a bunch of other goodies (including a $250m investment into a car sharing start up and Care.com, which they just bought for $500m). Put it all together, and even with conservative valuations we think IAC’s “other” stuff is conservatively worth at least $5B, or ~$33/IAC share (as I’ll discuss in a second, Vimeo alone is likely worth the “implied stub” price).

So we think we’re getting IAC at a discount to its asset value. However, if you do the math on everything above, you’d come out to a total asset value for IAC of ~$140/share versus today’s $125/share price. That’s nice, but there are larger discounts out there. Why are we so bullish IAC in particular?

The reason is we are insanely bullish on their three largest subsidiaries / investments: Vimeo, ANGI, and MGM.

Let me start with ANGI, because it’s the simplest to understand. At today’s share price of ~$11/share, IAC’s investment in ANGI is worth ~$55/IAC share, or ~45% of IAC’s overall value. We are hugely bullish ANGI; I think it’s at the same point in its lifecycle as MTCH was when we invested in IAC three years ago. I believe ANGI will be a $60/share stock in the next ~5 years, and as it approaches that value IAC will look to spin ANGI out. If all of that’s right, in 5 years IAC’s investment in ANGI will be worth ~$300/IAC share, and our investment in IAC will be approaching a triple based on the ANGI valuation alone. I know that sounds aggressive, but it would have sounded aggressive if I had told you the same thing about MTCH three years ago and that’s exactly how it played out! I recently posted three pieces on ANGI publicly that covered why we’re so bullish on the company (a qualitative, quantitative, and odds and end piece); I’ll refer you to those pieces if you’d like to learn more about why we’re so bullish IAC.

Let’s talk about Vimeo now. Vimeo is a wholly owned subsidiary of IAC, and they’re “the world’s leading profession video platform.” Basically, Vimeo is a subscription service (SAAS) that provides video management / editing tools. The company is growing quickly; revenue will exceed $300m next year and is growing >30% YoY.

What is Vimeo worth? That’s tough to tell. Most analysts I’ve seen have suggested something in the $1.5B range, or ~5x sales. That certainly makes some sense to me…. but I’d challenge you to find a company with Vimeo’s economics, churn rate, and growth that trades for just 5x sales. I don’t think it’s crazy to think that, if Vimeo was standalone, it would trade for >10x sales in today’s market, or well over $3B. And there’s reason to believe Vimeo will be a standalone company in the next few years; it’s size is approaching the place where IAC generally likes to spin companies out, and IAC’s recently had Vimeo present as a standalone company at a few conference (including at the Goldman’s Communacopia in September). IAC generally has companies present standalone right before they prep to spin them.

Finally, let’s talk IAC’s investment into MGM. MGM is the global entertainment / hotel / casino company, and IAC bought ~12% of the company on the open market. I don’t have anything particularly insightful on MGM, but I’ll just note this: MGM would be a huge beneficiary of the environment “normalizing” (so people can go to casinos again), and IAC’s investment in MGM represents by far their largest investment in recent memory. When a team with IAC’s track record makes an investment of this size, it’s probably going to turn out to be a good one! MGM’s stock was at $35/share pre-COVID versus today ~$22; in addition, we’ve seen online betting plays like DKNG (Draft Kings) see their stock go parabolic. MGM obviously has a large “offline” gambling business that could be used to jumpstart their nescient online betting business; if that happens, MGM’s stock would be a huge winner if the new business was valued anywhere close to DKNG. Again, I don’t have anything particularly edgy here, but MGM is cheap, it’s a winner as we recover from COVID, and it could see a huge boost as it pivots more to online gaming. When a team with IAC’s track record makes this big of a bet into a cheap way to play a potential COVID recovery with a huge potential call option on online betting, I’m happy to be exposed to that bet.

There are other aspects of IAC I am enamored with. For example, I think their Care.com acquisition will be a masterstroke; they bought the company for $500m and I wouldn’t be surprised if it was worth multiples that number in a few years. And IAC’s fortress balance sheet (almost $3B in cash) ensures they’ll be able to pounce on opportunities if the world gets volatile. But while all of them are nice and could be large over time, at this point the three main drivers of IAC are their investments in MGM, ANGI, and Vimeo. As discussed above, I’m bullish all three.

Our first go round with IAC was a huge success, but it could have been better. I expect the second trip will be substantially more profitable.